The Digital Health 50 is CB Insights’ annual list of the most promising digital health startups in the world.

CB Insights has unveiled the winners of the 2024 Digital Health 50 — a list of the world’s 50 most promising private digital health companies, selected based on a combination of data signals and proprietary scoring.

For health system CIOs, digital health investors, and life sciences executives, this list spotlights companies to explore for technology adoption, investment opportunities, and strategic partnerships as healthcare shifts toward AI-driven infrastructure, advanced diagnostics, and specialized care platforms.

Four key themes emerged from this year’s cohort:

-

- AI will become foundational to infrastructure across healthcare, as evidenced by 36 of the 50 companies building AI products, from insurance claim copilots (Alaffia Health) to specialized healthcare LLMs (Hippocratic AI). These startups reflect the start of a broader shift for AI from powering point solutions to becoming an essential part of healthcare delivery for patients.

- Diagnostic innovations continue to dominate, representing the most crowded category on last year’s list and tying for the largest category this year, with 11 companies developing tools across imaging (Airs Medical), pathology (Proscia), and non-invasive diagnostics (Alimetry). These next-generation diagnostics look to make testing more accessible and non-invasive while prioritizing early detection.

- Virtual and hybrid care companies more than doubled in this year’s cohort, with 11 companies in this category, up from 5 last year. The increase reflects the growing number of specialized platforms in areas including mental health (Talkiatry) and cancer care (Resilience), signaling the shift from general telemedicine toward condition-specific virtual care models.

- Workflow efficiency emerges as a key priority heading into 2025, with 19 companies streamlining administrative and clinical tasks, from medical document processing (Tennr) to ambient documentation (Abridge). The surge of automation solutions here signals that healthcare organizations will prioritize efficiency amid staffing shortages to help shift provider time from paperwork to patient care.

Our selection of winning companies followed a rigorous three-step process.

From a pool of 10,000+ digital health startups, we analyzed companies using CB Insights’ proprietary metrics — Commercial Maturity and Mosaic scores — along with additional data on partnerships, funding, patents, leadership, and headcount.

Companies with high Mosaic scores (> 500) and recent market activity advanced to our shortlist of 1,500 candidates. We supplemented this analysis with direct company submissions via Analyst Briefings.

Our analysts then evaluated strategic partnerships, market adoption, and growth metrics to identify the 50 most promising digital health companies.

2024 DIGITAL HEALTH 50 COHORT HIGHLIGHTS

Funding and deals

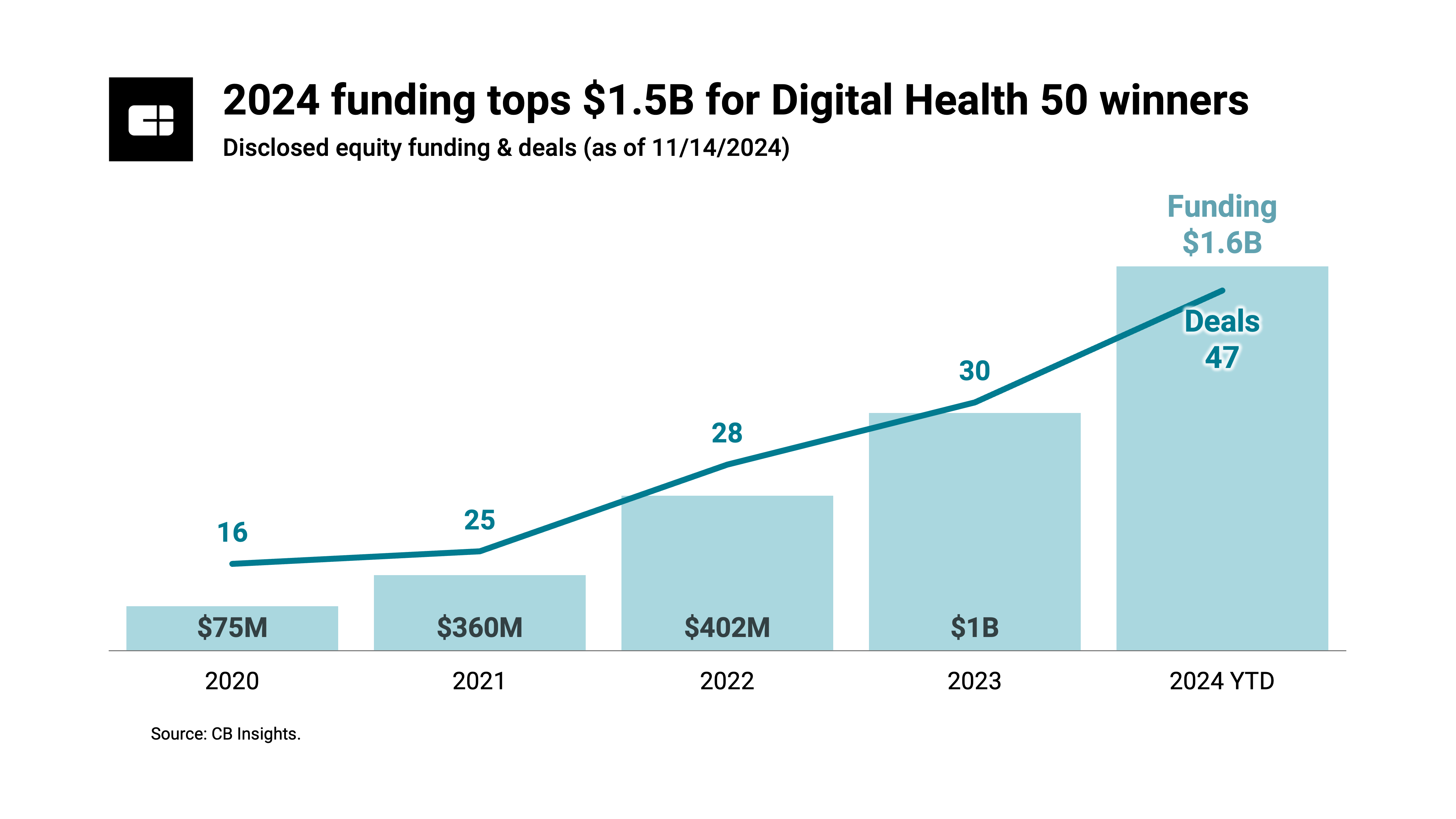

The 2024 Digital Health 50 companies have raised $3.5B across 171 disclosed equity deals (as of 11/14/2024). Monogram Health and Abridge lead the cohort in disclosed equity funding, with $555M and $208M, respectively.

In 2024 so far, the cohort has raised $1.6B across 47 disclosed equity deals. The largest deals include:

- Abridge — $150M Series C

- Superluminal Medicines — $120M Series A

- Grow Therapy — $88M Series C

- CytoReason — $80M Series A

- Ambience — $70M Series B

The recipients of these top deals are largely focused on 2 AI applications: streamlining clinical documentation (Abridge and Ambience) and accelerating drug discovery (Superluminal Medicines and CytoReason).

Stage breakdown

Fifty-six percent of the 2024 Digital Health 50 companies are early-stage (seed or Series A). In comparison, 44% of winners are mid-stage (primarily Series B or C) companies.

Top investors

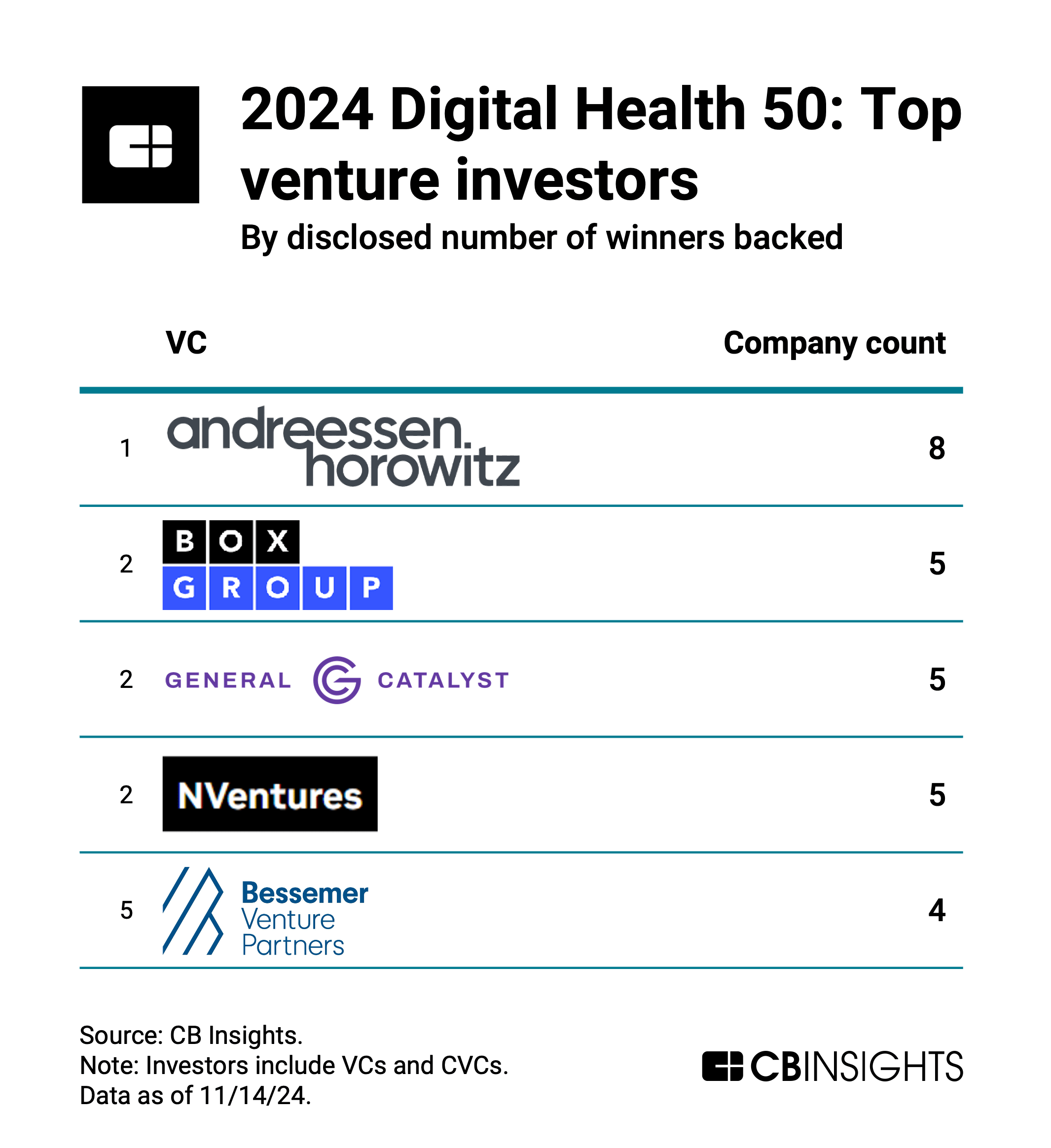

Andreessen Horowitz leads VC investors (including CVCs) in the number of 2024 Digital Health 50 winners backed (8). Its investments span various areas within digital health, including:

- D2C health testing — Function Health

- Clinical intelligence — Ambience, Hippocratic AI, Scribenote

- Virtual & hybrid care — Talkiatry, Pomelo Care

- Price transparency — Turquoise Health

- Administrative workflow optimization — Tennr

Andreessen Horowitz is followed by BoxGroup, General Catalyst, and NVentures (Nvidia’s venture arm), each with 5 winners backed.

All 5 of NVentures’ portfolio companies are building AI products. They are split between clinical intelligence (Hippocratic AI, Abridge, Artisight) and drug discovery (Iambic Therapeutics, Superluminal Medicines).

Healthcare systems and other big tech players are also active investors in the 2024 Digital Health 50. Mayo Clinic, Memorial Hermann, and Google Ventures have each invested in 3 companies on this year’s list.

Geographic distribution

This year’s Digital Health 50 companies are headquartered across 9 countries. Most companies (36) are based in the United States.

Germany has the largest representation outside of the US — 3 companies are headquartered in the country. It is followed by Canada, Israel, South Korea, and the United Kingdom, each with 2 companies.

Additional countries represented include New Zealand, Belgium, and France, each with 1 company.

Headcount growth

The 2024 Digital Health 50 companies collectively employ more than 7,500 people, with 4 companies employing about 40% of the cohort’s workers: Grow Therapy, Nourish, Monogram Health, and Octave.

Three companies — Tennr, Nourish, and Pomelo Care — have demonstrated the strongest headcount growth over the past year, with 12-month (September 2023–2024) headcount increases of 320%, 250%, and 244%, respectively.

This year’s winners collectively created more than 2,900 jobs over the period, with Grow Therapy creating the most jobs (800).

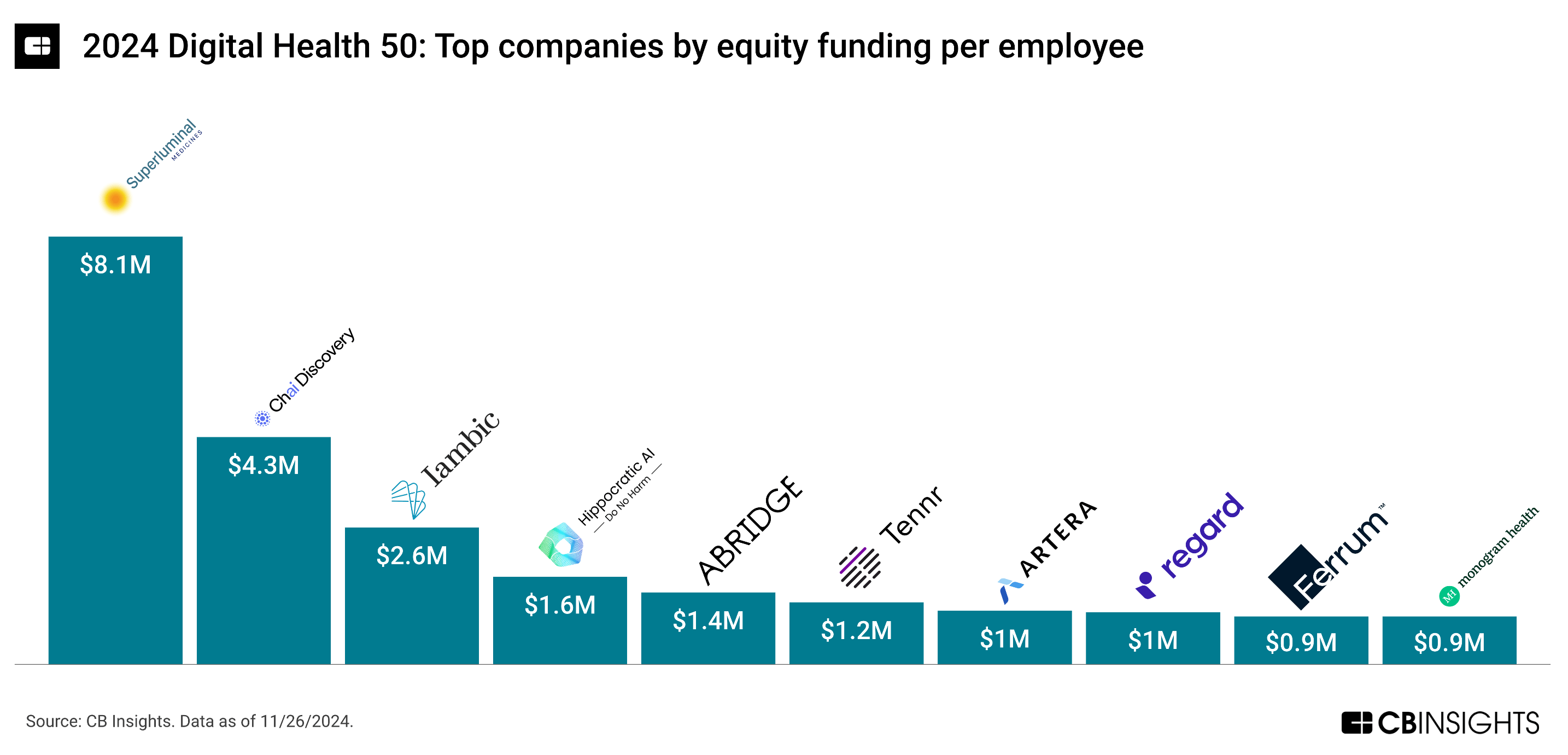

The median 2024 Digital Health 50 winner has raised $487K in equity funding per employee. Superluminal Medicines leads the pack, raising $8.1M per employee, followed by Chai Discovery ($4.3M) and Iambic Therapeutics ($2.6M).

Company health

The average Mosaic score — a proprietary measure of private company health and growth potential — for the 2024 Digital Health 50 is 771 out of 1,000 (as of 11/14/2024).

Forty companies in this year’s cohort have a Mosaic score of 700 or higher, placing them among the top 4% of private companies tracked by CB Insights.

Midi and Nourish lead the cohort with the highest scores — 932 and 887, respectively.

If you aren’t already a client, sign up for a free trial to learn more about our platform.