The post AI GI Joe: Defense tech goes on the offensive appeared first on CB Insights Research.

]]>Military technology is entering its AI era.

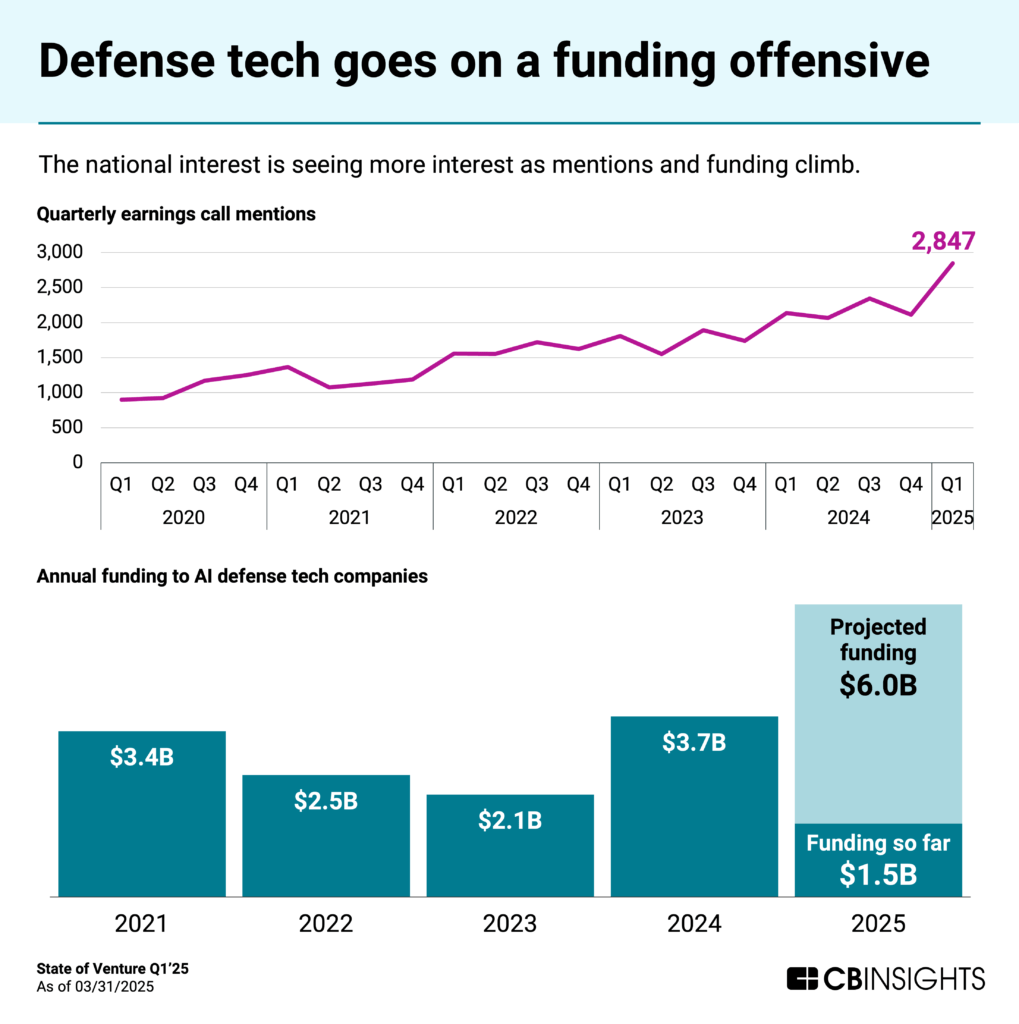

Funding to AI companies targeting defense applications has reached $1.5B this year. At the current rate, this year will set a new record for the sector.

Public-company execs also have defense on the brain.

Last quarter saw earnings call mentions of “defense” reach an all-time high, according to CB Insights’ Earnings Transcript Analytics.

Growing geopolitical tensions combined with AI advances are fueling the investment surge.

Much of the activity centers on multidomain operations (MDO) technologies — integrating systems across land, sea, air, space, and cyber — where AI is accelerating mission planning, threat detection, and battlefield connectivity.

Below, we look at:

- Recent partnerships and the year’s biggest deals

- Anduril’s UUV announcement

- Top investors in 2025

1. Recent partnerships and the year’s biggest deals

Major defense contractors are forming partnerships with AI startups to pilot more autonomous capabilities.

For instance, defense contractor L3Harris partnered with Shield AI in February to combine L3Harris’ electronic warfare capabilities with Shield AI’s autonomous flight tech.

The next month, L3Harris invested in Shield AI’s $240M Series F alongside a16z, Booz Allen Hamilton, and others.

That round is the 3rd-largest AI defense deal we’ve seen in 2025 so far, surpassed only by:

- Saronic’s $600M Series C. Saronic develops autonomous surface vessels for naval defense.

- Epirus’ $250M Series D. Epirus creates high-power microwave systems for counter-drone and electronic warfare applications.

Meanwhile, last week, SandboxAQ (an Alphabet spinout) raised a $150M extension to its $300M Series E from December. Its AQNav product is a real-time navigation system that combines AI and quantum sensing, with the aim of operating in areas where GPS is jammed or otherwise unavailable.

SandboxAQ is a leader in the quantum sensing market, alongside players like Q-Ctrl and Aosense — both of which partnered with Lockheed Martin last month on quantum-led navigation for GPS-denied environments.

2. Anduril’s UUV announcement

AI defense leaders are also making gains in commercializing more advanced autonomous systems.

This week, Anduril unveiled an unmanned underwater drone equipped with torpedo-like capabilities. Anduril was last valued at $14B in August, making it the most highly valued private AI defense firm.

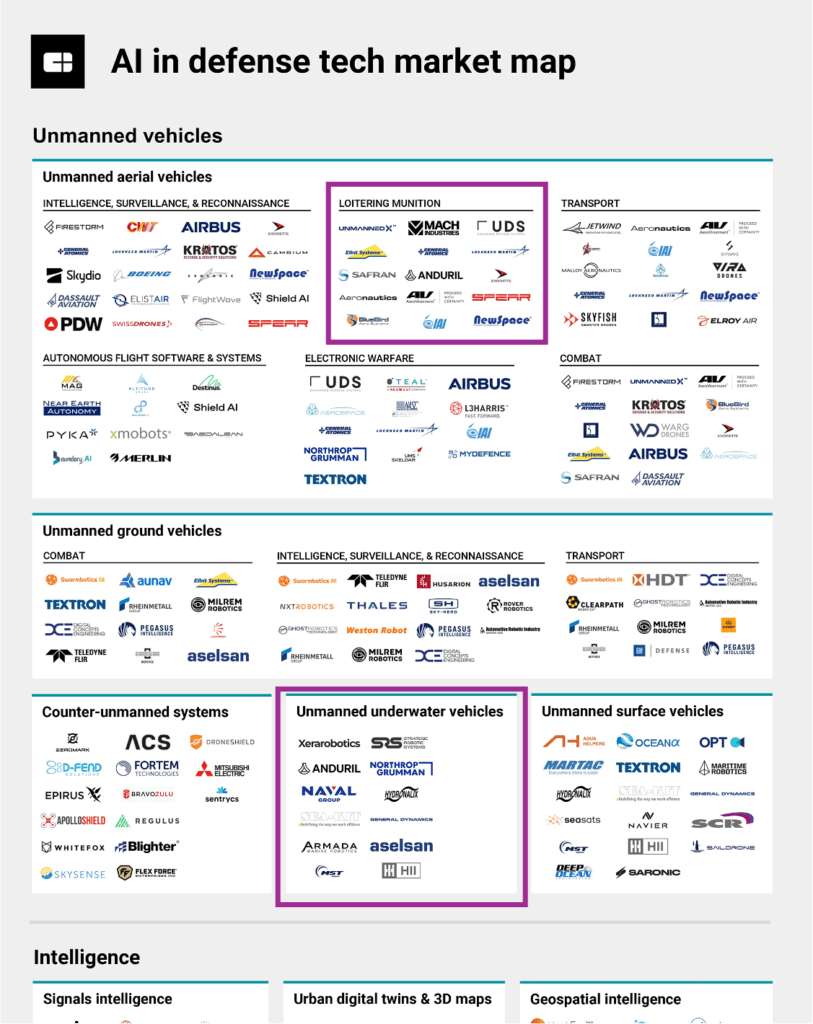

We featured Anduril in several areas of our recent AI in defense tech market map. Customers can use the below links to see how Anduril stacks up against competitors in these markets:

- Loitering munition unmanned aerial vehicles (UAVs): Drones that loiter over an area for extended periods of time, providing intelligence before engaging targets with a precision strike

- Tactical unmanned underwater vehicles (UUVs): Autonomous or remotely operated submersibles that carry out a range of military and strategic tasks below the water’s surface

CBI customers can unlock the full map here.

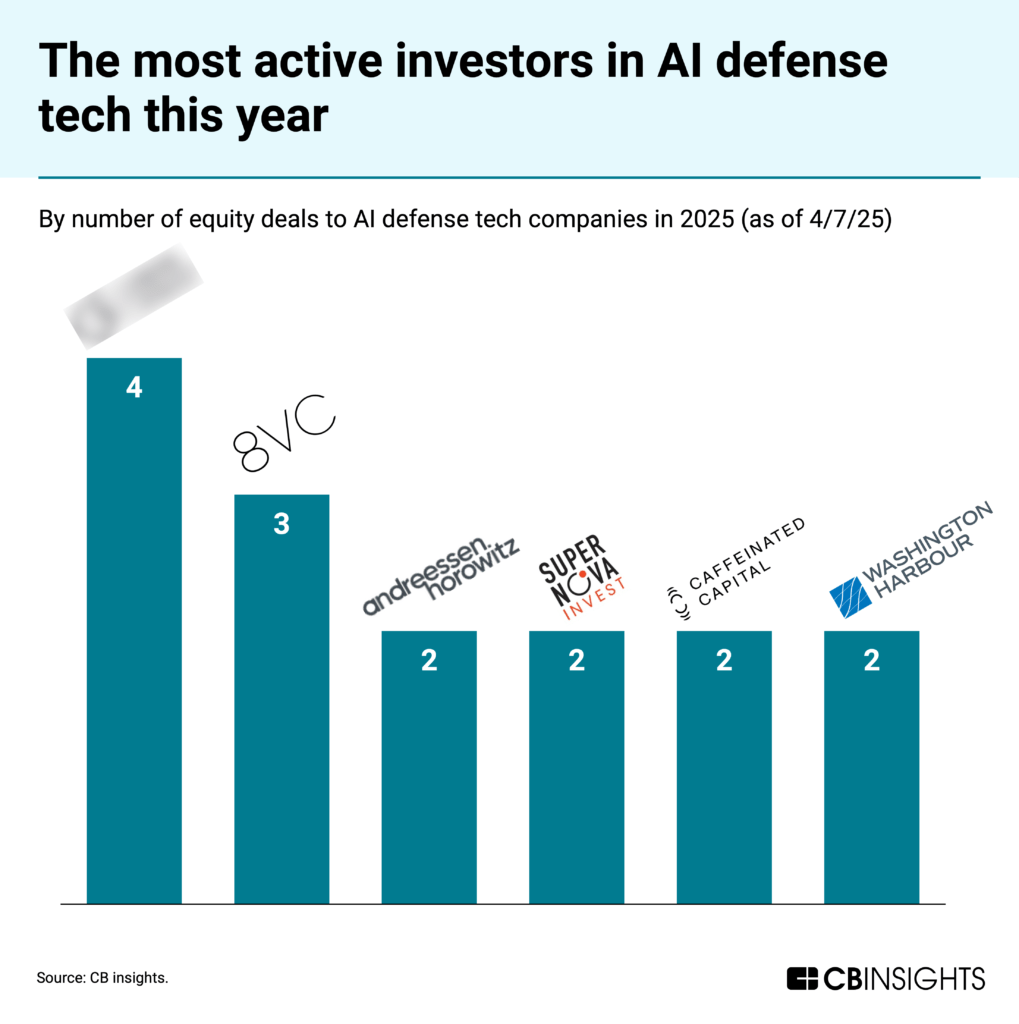

3. Top investors in AI defense tech in 2025

8VC and a16z rank among the top investors in AI defense tech this year — but they’re outpaced by one peer who has already backed 4 AI defense tech companies in 2025.

CB Insights customers can see who it is using this platform search.

Related CB Insights research:

- The AI in defense tech market map

- State of Venture Q1’25 Report

- The quantum information market map: The companies working on quantum computing, post-quantum cryptography, and more

- Analyzing a16z’s AI investment strategy: How the VC is funding the AI global takeover

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

The post AI GI Joe: Defense tech goes on the offensive appeared first on CB Insights Research.

]]>The post State of Venture Q1’25 Report appeared first on CB Insights Research.

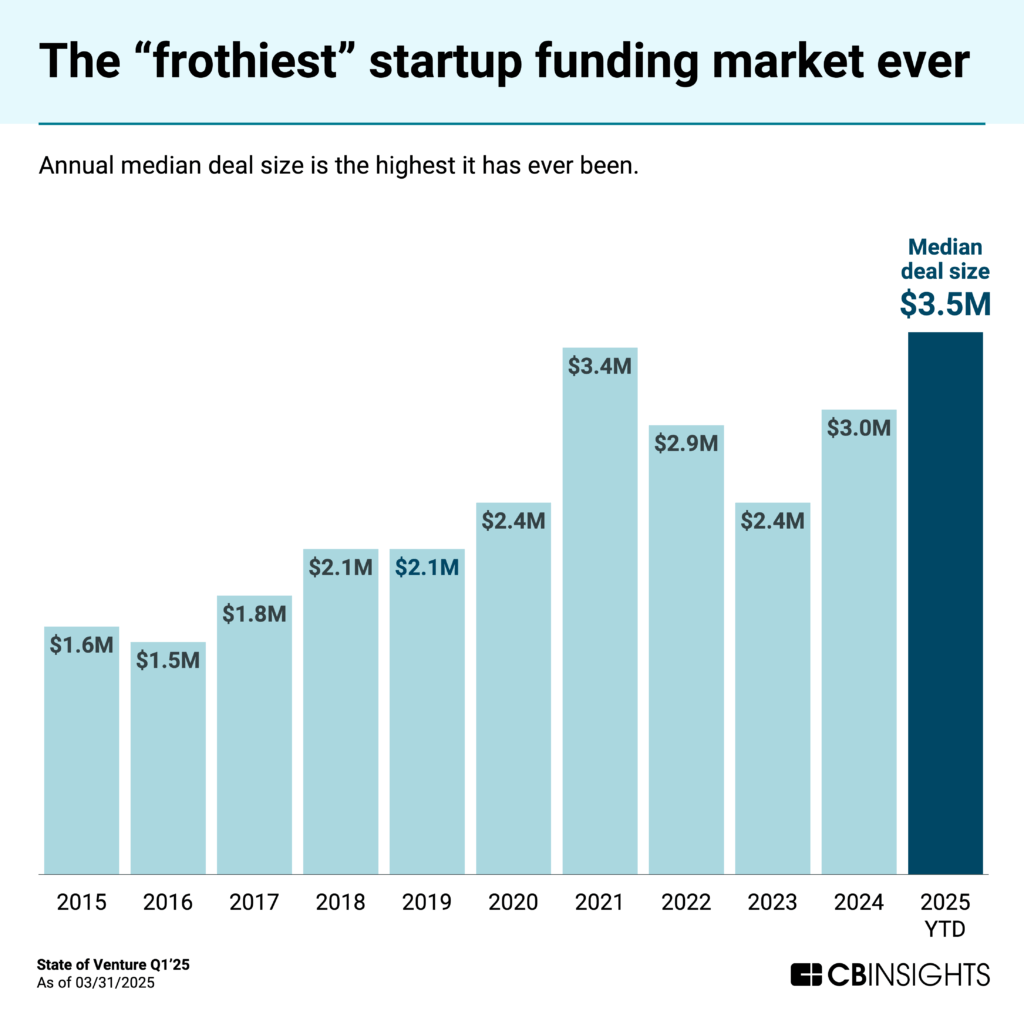

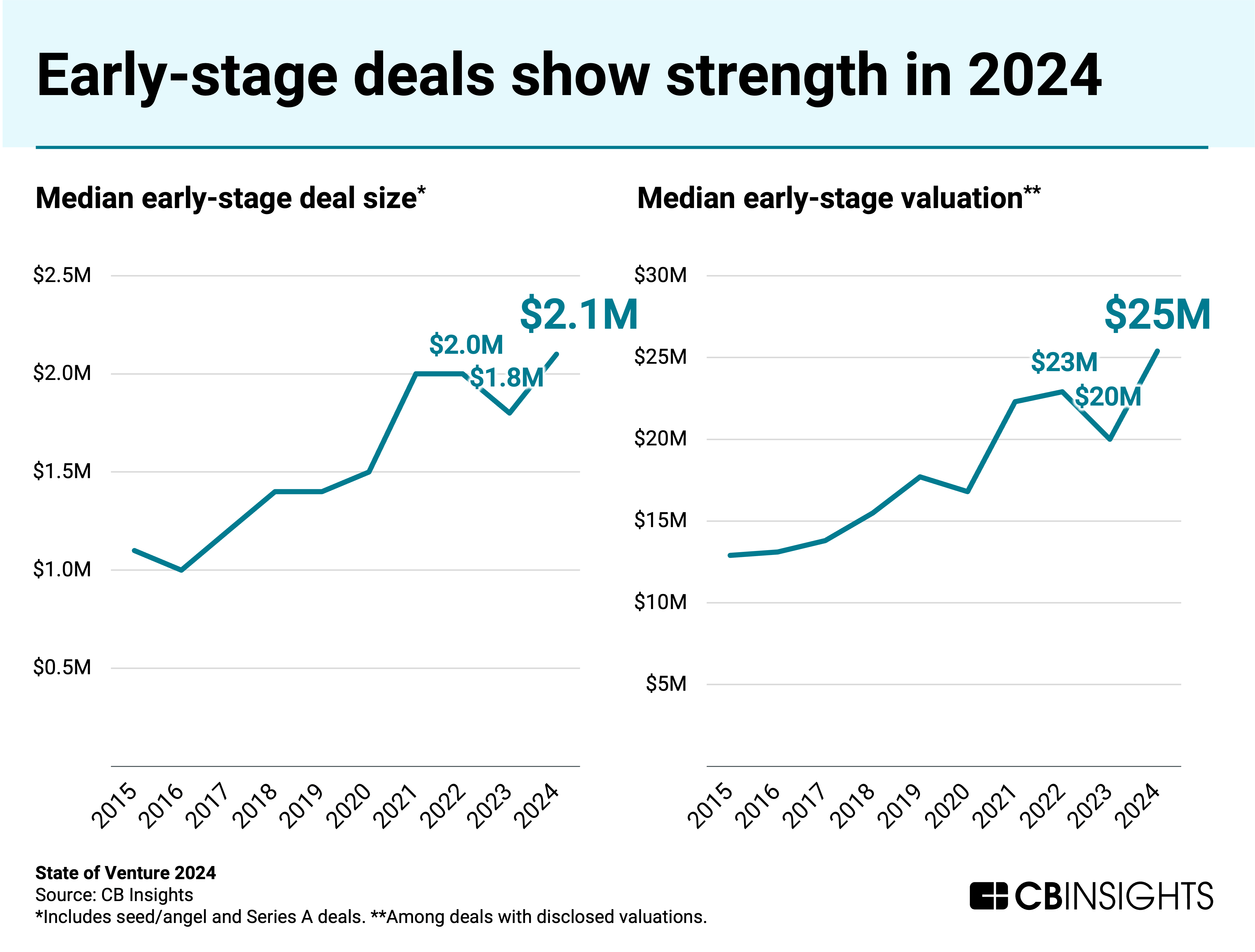

]]>Opportunities across stages and geographies have fueled growth in deal sizes globally. So far in 2025, the median deal size sits at a record $3.5M.

While AI continues to dominate headlines and venture activity, sectors like fintech, digital health, and retail tech all recorded quarterly funding increases as investors diversify beyond core AI infrastructure plays.

Download the full report to access comprehensive data and charts on the evolving state of venture across sectors, geographies, and more.

Below, we break down the top stories from this quarter’s report, including:

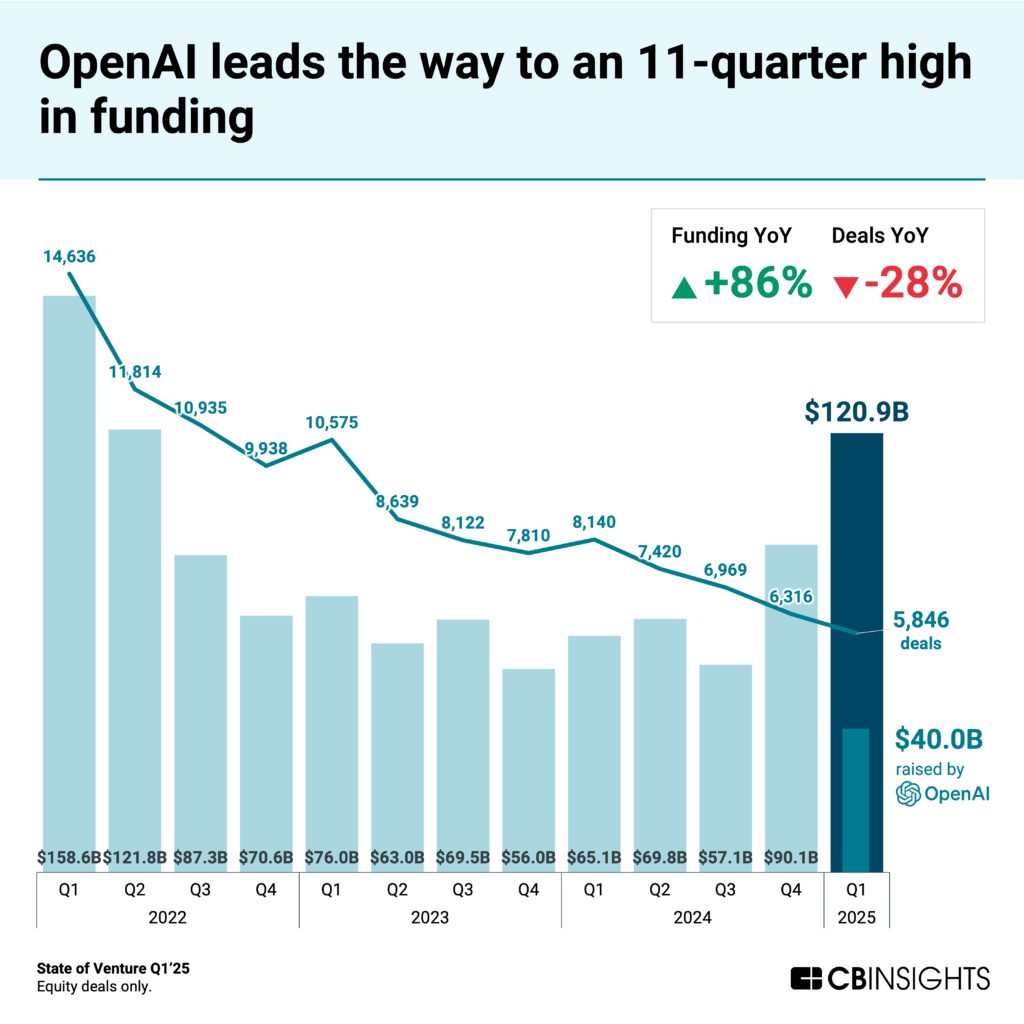

- Quarterly funding jumps to $121B, even as deal count keeps falling

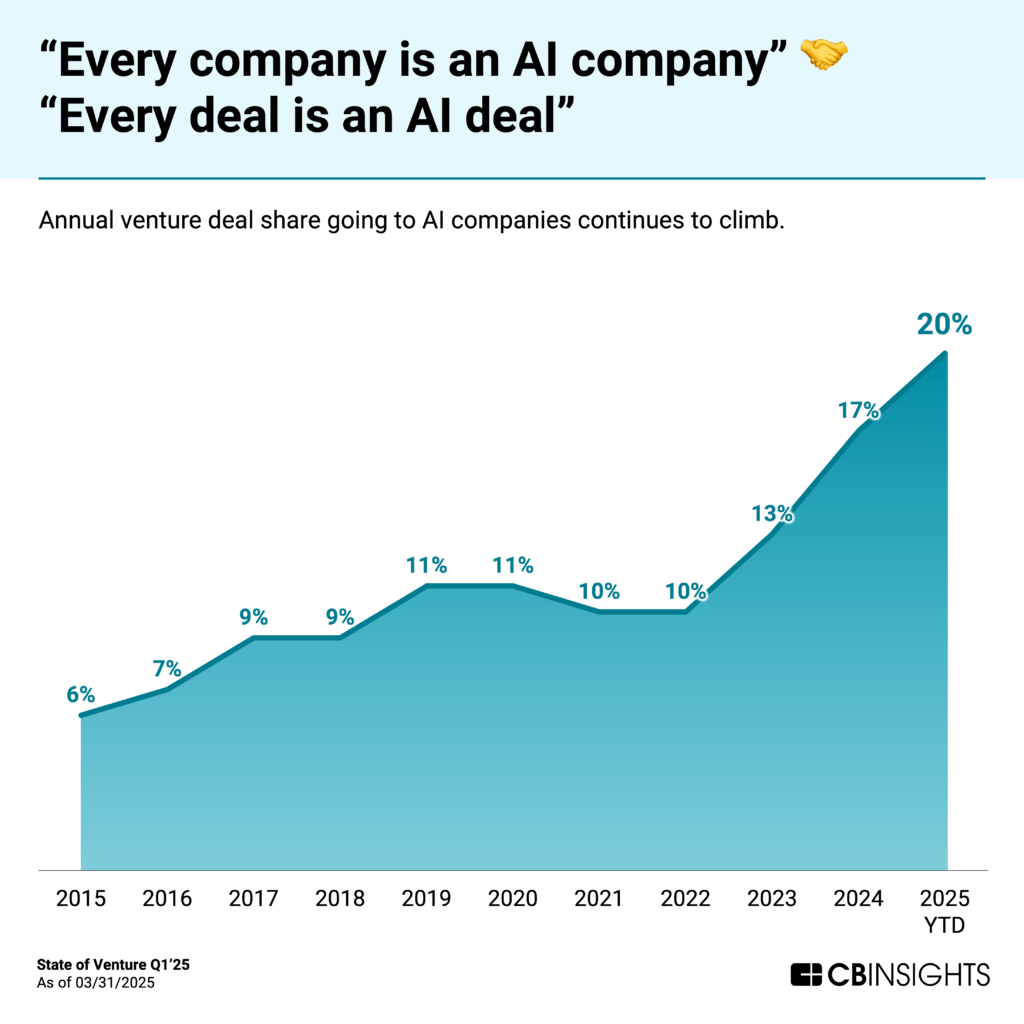

- AI now drives 1 in 5 global venture deals

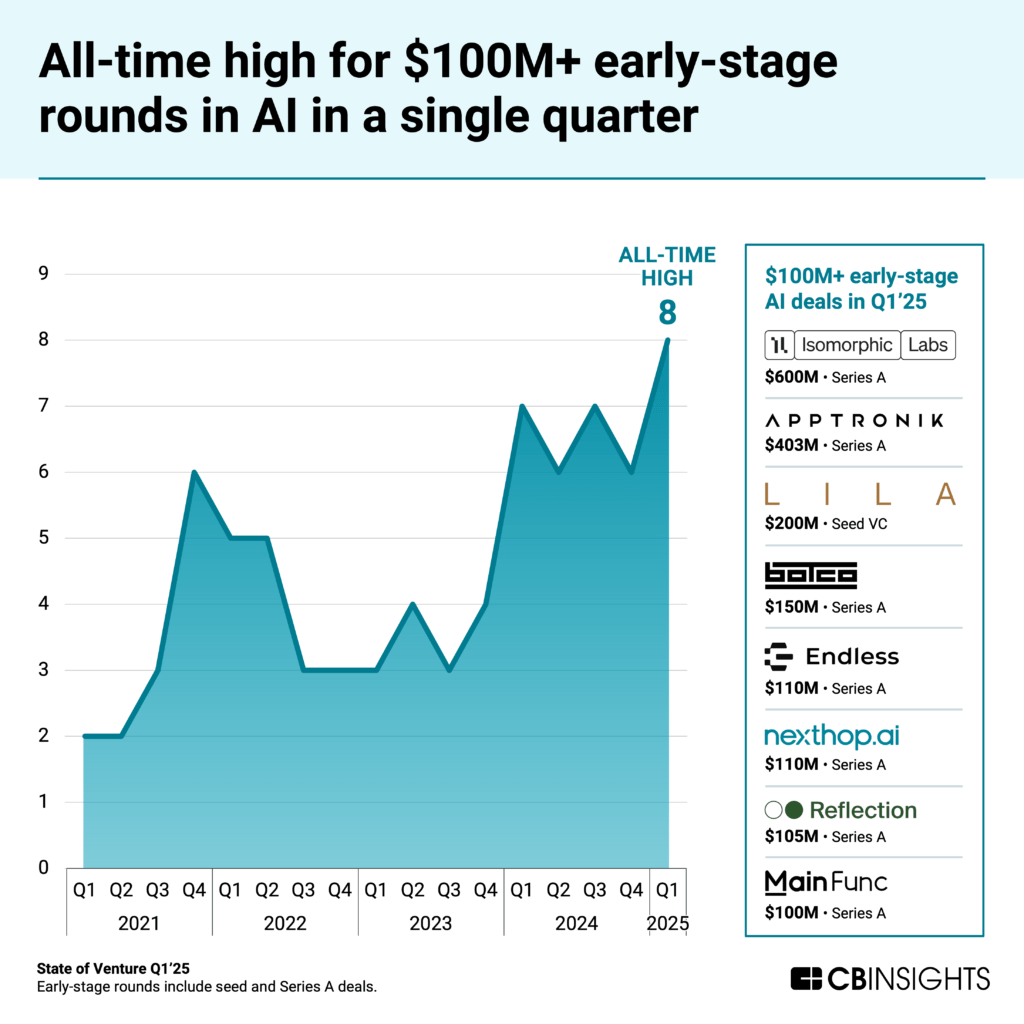

- Eight early-stage AI companies raise $100M+ mega-rounds

- Early-stage deal sizes pace at an all-time high

- Billion-dollar M&A exits hit a new quarterly record

We also outline the key trends shaping venture dealmaking for the rest of 2025 — from AI agent specialization and the voice AI boom to crypto’s rebound.

Let’s dive in.

Top stories in Q1’25

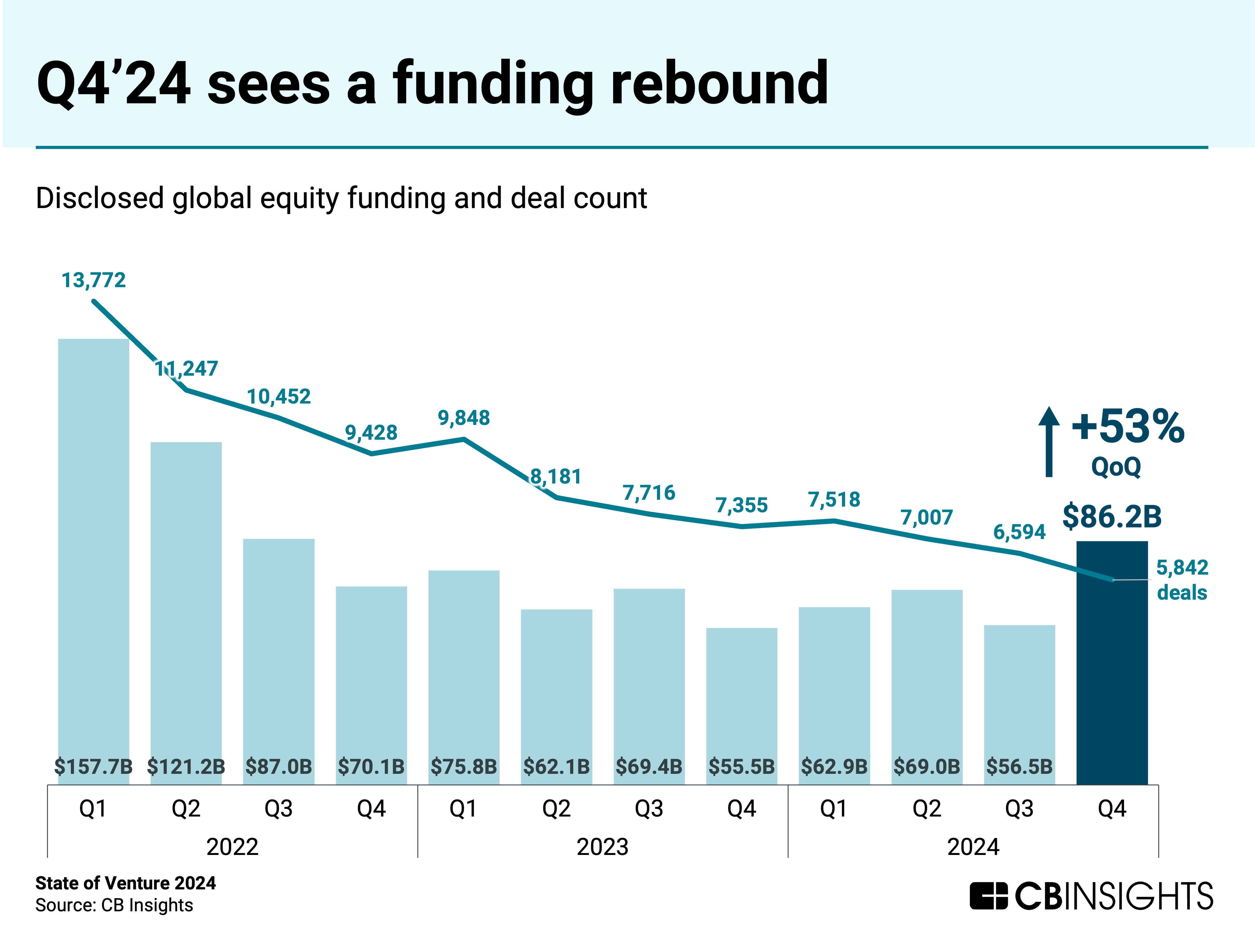

1. Quarterly funding jumps to $121B, even as deal count keeps falling

Q1’25 saw global venture funding rise to $121B — the highest quarterly total since Q2’22 — driven by OpenAI’s $40B raise, which values the company at $300B. This ties OpenAI with ByteDance as the second-highest-valued private company globally (behind SpaceX at $350B).

The OpenAI funding round — led by SoftBank and backed by Microsoft, Thrive Capital, and others — marks the largest private funding round in history. Even excluding this deal, total funding in Q1’25 would have reached $81B, still the second-highest quarterly figure since Q3’22.

However, global deal count slid for a fourth straight quarter, to 5,846 deals, down 7% QoQ and 28% YoY.

The stark contrast between soaring funding and declining deal count highlights growing capital concentration.

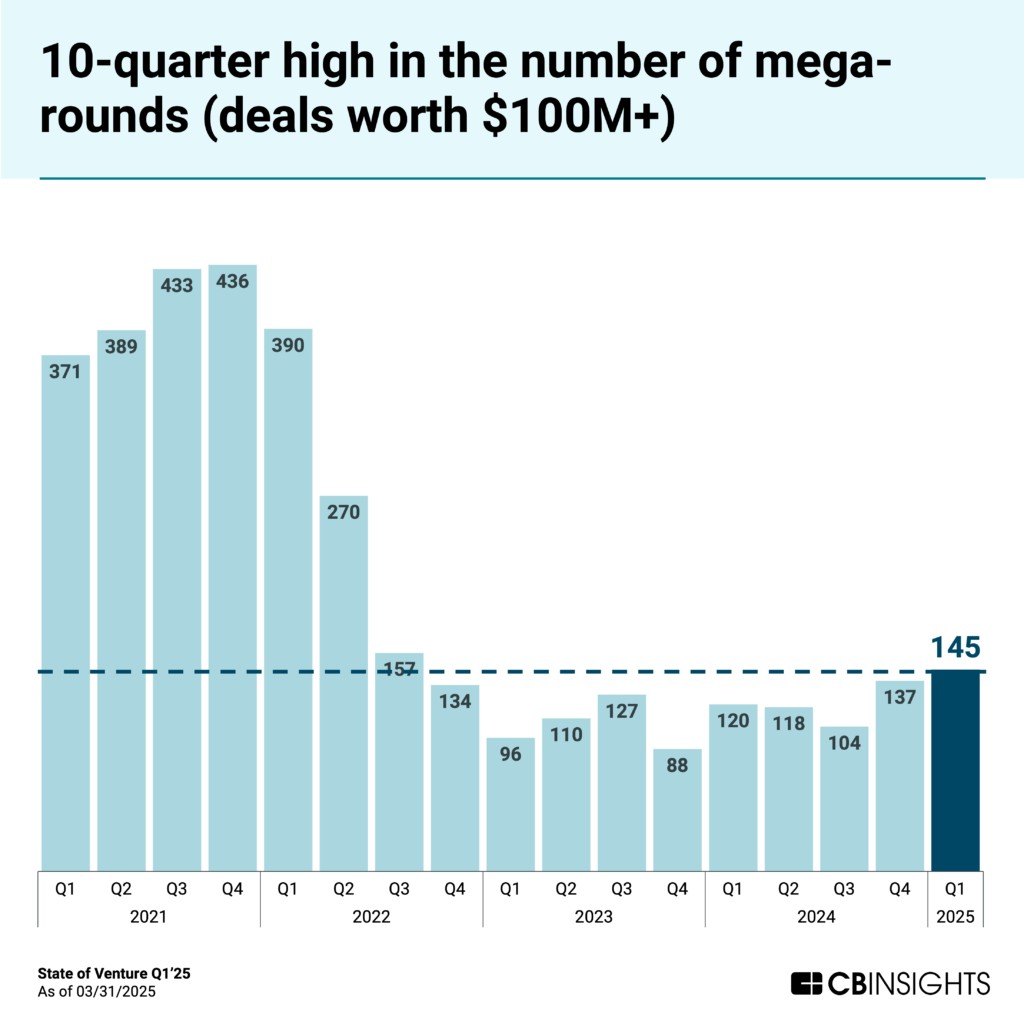

Mega-rounds (deals worth $100M+) accounted for 70% of all funding this quarter, up from 60% in Q4’24. A total of 145 mega-rounds closed in Q1’25 — the highest quarterly total since Q3’22, which saw 157.

While AI startups remain the primary beneficiaries of this capital concentration — grabbing more than half of the quarter’s funding — other sectors are showing resilience. Fintech funding increased 18% quarter-over-quarter to $10.3B, retail tech rose 18% to $6.5B, and digital health grew 47% to $5.3B.

2. AI now drives 1 in 5 venture deals

The influence of AI on venture capital continues to grow, with AI companies now capturing 20% of all venture deals globally — a new high, and up 2x since OpenAI’s launch of ChatGPT in 2022.

In absolute numbers, AI companies secured 1,134 deals in Q1’25 — a 7% decline from the previous quarter but still the fourth straight quarter with over 1,100 AI deals.

The composition of AI dealmaking is evolving. Early-stage deals (seed and Series A) made up 70% of all AI deals in Q1’25, down from 75% in full-year 2024. Correspondingly, late-stage deal share has increased from 6% to 9%, indicating market maturation as more AI companies progress to advanced funding stages.

The focus of AI dealmaking has also evolved. While infrastructure investments dominated the early AI boom, we’re now seeing greater emphasis on vertical solutions and application-layer platforms that address specific industry challenges. Notable exceptions exist in emerging categories like voice AI, where infrastructure still attracts significant investment.

Geographically, US-based AI companies secured 52% of global AI deals in Q1’25, while Asia and Europe grabbed 21% a piece.

3. Eight early-stage AI companies raise $100M+ mega-rounds

Q1’25 set a new record with 8 early-stage AI companies raising rounds of $100M or more. These 8 companies raised a combined $1.8B — with an average round size of $222M — highlighting investors’ willingness to place substantial bets on AI startups earlier than ever.

The companies represent a diverse range of AI applications:

- Isomorphic Laboratories: $600M for AI drug discovery, spun out of DeepMind

- Apptronik: $403M for humanoid robots

- Lila Sciences: $200M for scientific research automation

- The Bot Company: $150M for household robots

- Endless: $110M for AI-led Web3 developer tools

- Nexthop: $110M for cloud-native AI infrastructure

- Reflection AI: $105M for coding AI agents

- MainFunc: $100M for an agentic search engine

What unites these companies is their focus on specific industry or technical challenges — not general-purpose AI models. This same trend appears among late-stage players that raised deals in Q1’25, with companies emphasizing enterprise applications, vertical use cases, and infrastructure optimization.

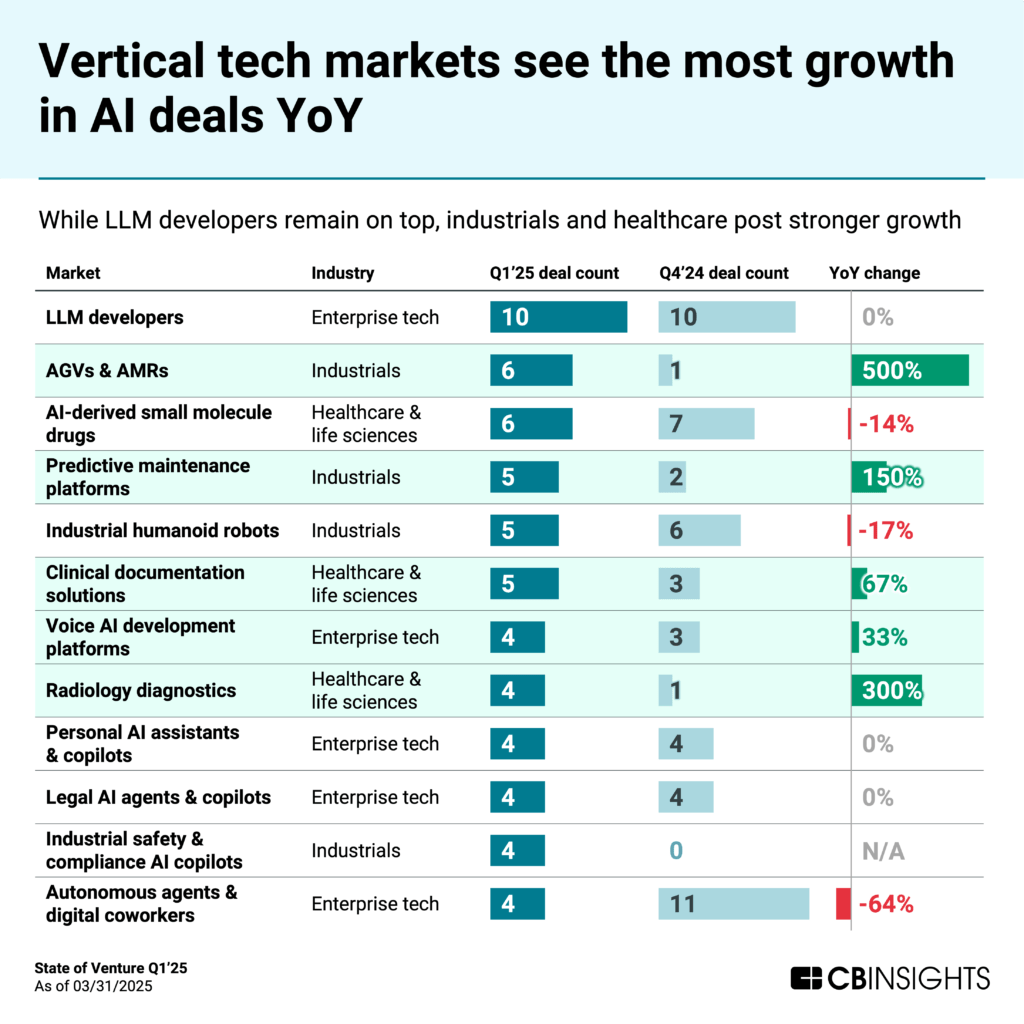

The shift from infrastructure to applications also plays out at the tech market level. Among the 1,400+ tech markets that CB Insights tracks, those in the below chart saw the greatest number of AI deals in Q1’25.

While LLM developers remain the top target for deals, they saw no growth in Q1’25 vs. Q1’24. On the other hand, vertical applications in industrials and healthcare — where AI is measurably improving automation — led in terms of YoY growth.

The top three vertical markets for AI deal growth in Q1’25 were automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), radiology diagnostics — particularly those focused on multiple imaging modalities — and clinical documentation solutions.

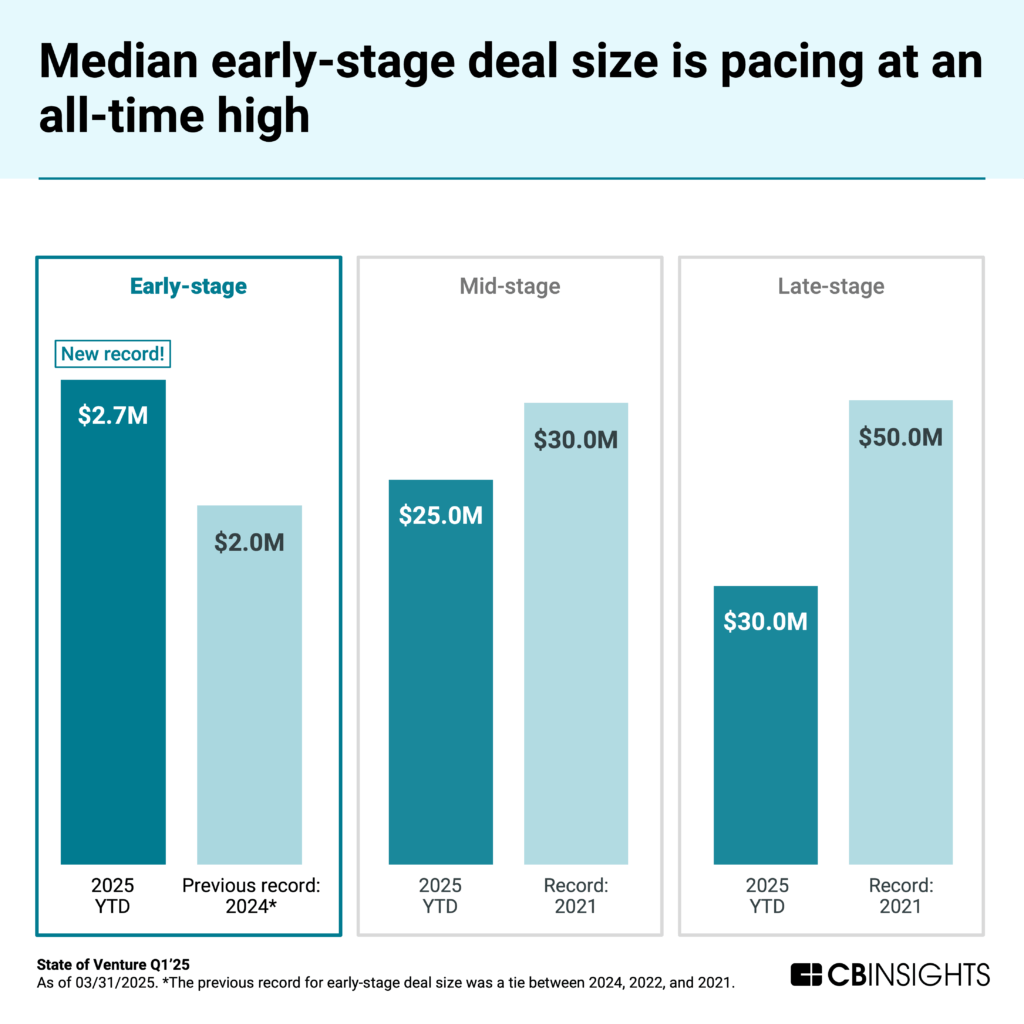

4. Early-stage deal sizes pace at an all-time high

The median early-stage deal size reached $2.7M in Q1’25, up from $2M in full-year 2024 — a 35% increase. This jump reflects both investors’ willingness to place larger bets on promising teams and the increased capital requirements for competitive AI development.

The increase is particularly notable against a backdrop of declining deal volume — investors are concentrating resources on fewer, more promising opportunities rather than spreading capital across a wide range of startups.

This environment creates both opportunities and challenges for founders. Well-positioned early-stage companies can secure larger initial rounds, but expectations for progress and growth are similarly elevated. The bar for follow-on funding will be higher for mid-stage rounds.

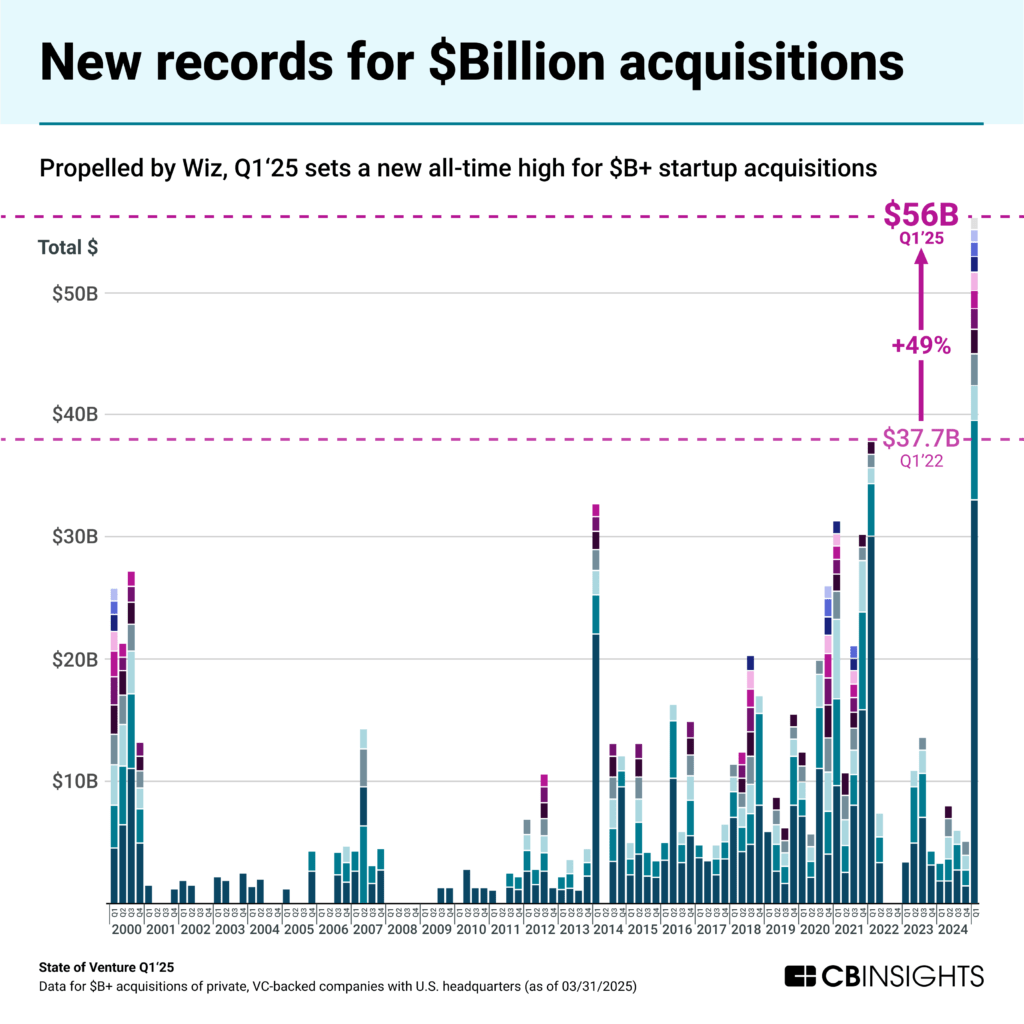

5. Billion-dollar M&A exits hit a new quarterly record

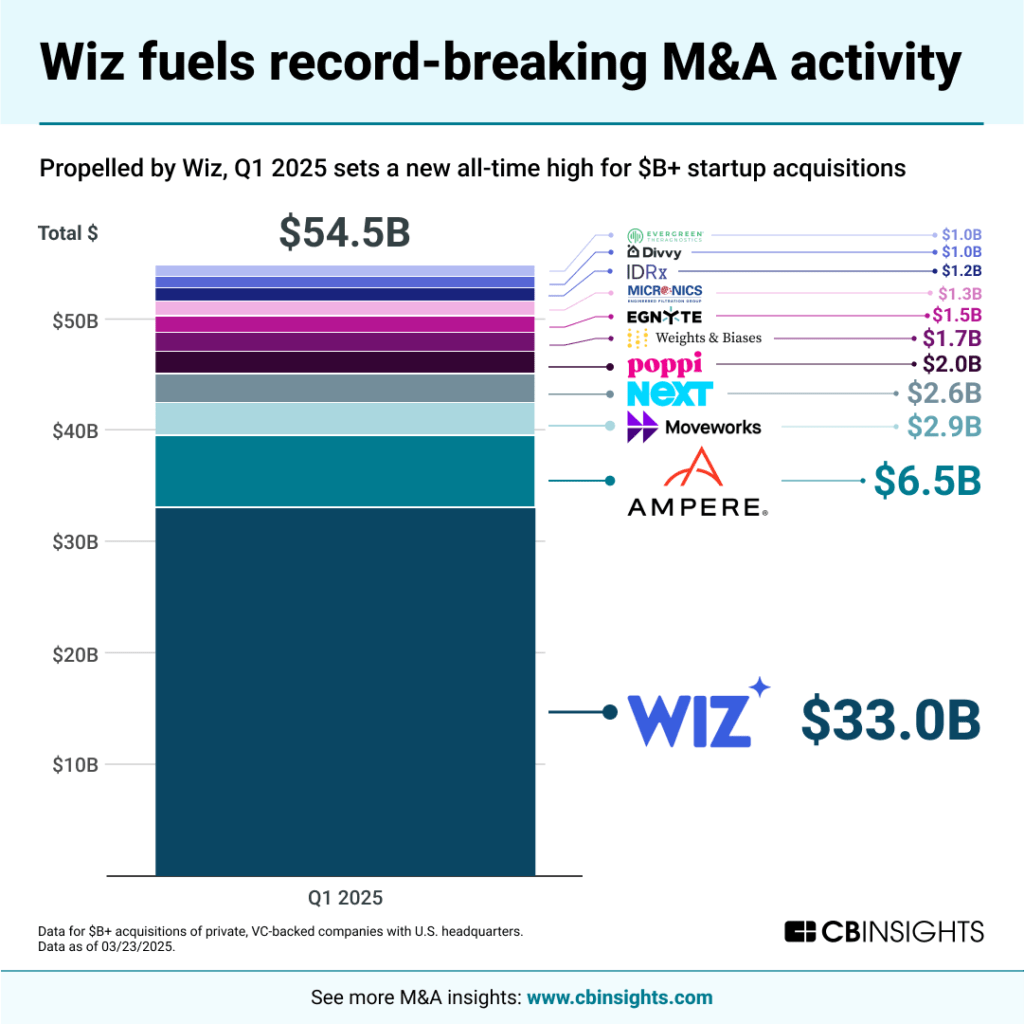

Q1’25 set a new record for billion-dollar M&A activity, with 12 VC-backed exits exceeding $1B in value, surpassing the previous high of 11 seen in both Q1’00 (dot-com bubble) and Q4’20 (peak ZIRP era). These 12 transactions had a combined value of $56B, driven primarily by Google‘s landmark acquisition of cloud security company Wiz.

The Wiz deal now stands as the most valuable M&A deal ever for a VC-backed private company, exceeding Meta‘s WhatsApp acquisition by more than $10B. It also marks Google’s largest acquisition to date — more than double the size of its Motorola Mobility purchase in 2012 — and sets a new record for cybersecurity exits, eclipsing Salesforce’s $28B acquisition of Splunk.

The Wiz deal highlights the growing focus among big tech companies on AI-driven cloud security as enterprises prioritize securing their expanding digital footprints.

It’s also part of a broader trend of high-profile unicorn exits that includes both IPOs (CoreWeave) and M&A transactions (Moveworks, Weights & Biases).

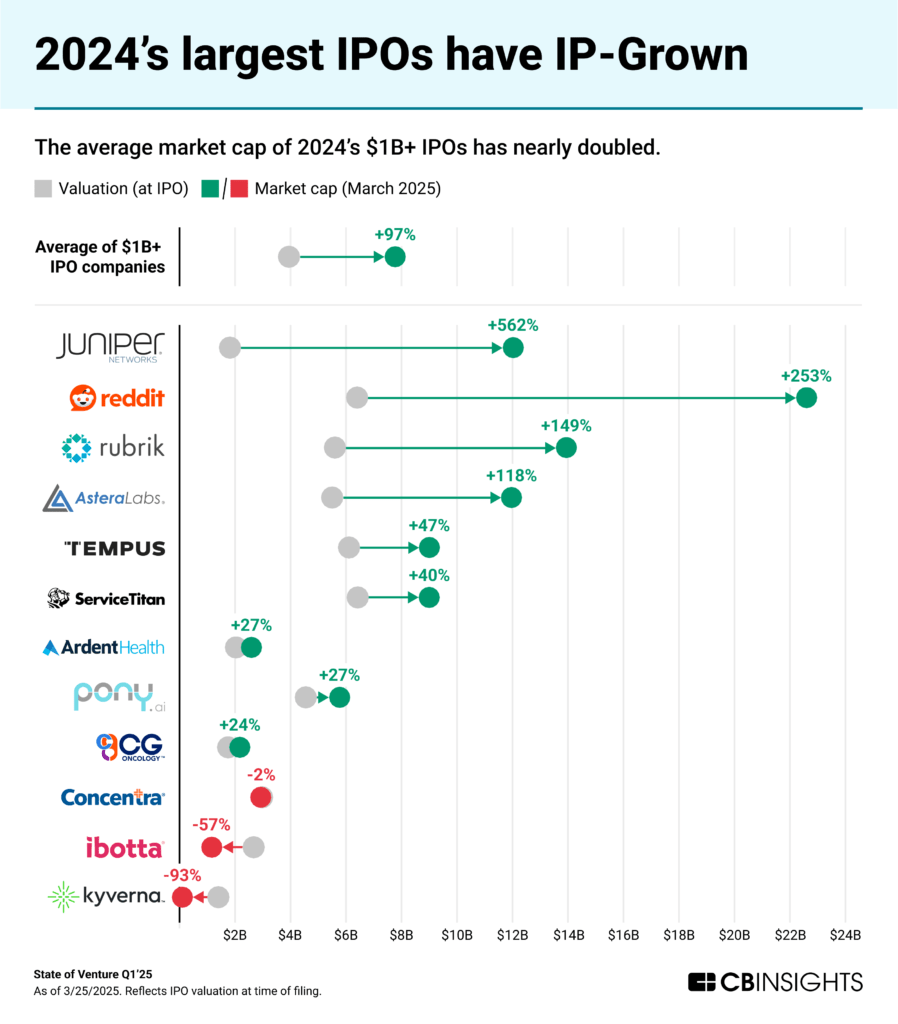

In fact, looking back to 2024, billion-dollar IPOs delivered strong returns — averaging a 97% increase in market cap post-listing. This bodes well for other IPO hopefuls looking to brave the public markets in the coming months.

Predictions for venture dealmaking in 2025

Below, we use signals from public-company earnings calls, startup financing trends, and business relationships to predict which trends will dominate venture activity through the rest of 2025.

AI agents “niche down” and gain enterprise buy-in

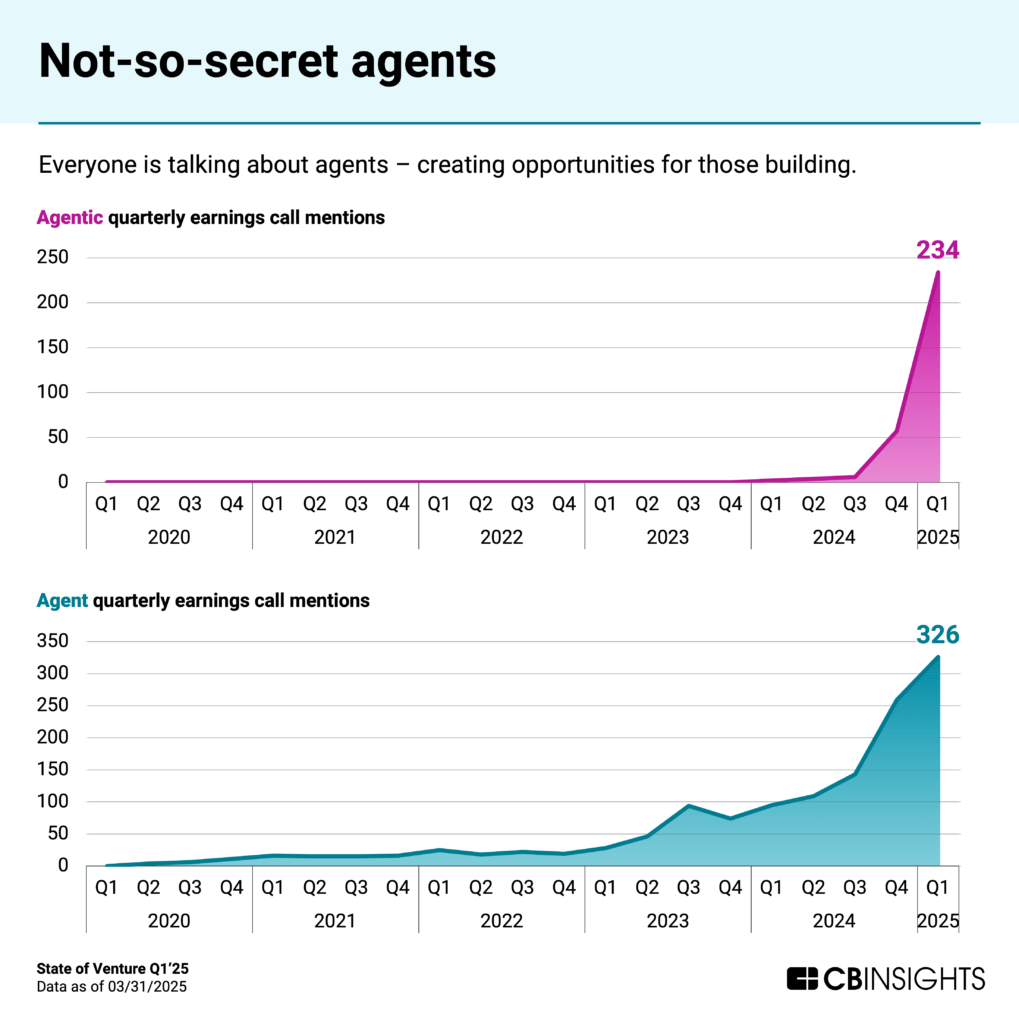

AI agents are transitioning from concept to commercial application. They’ve become a frequent topic on corporate earnings calls, and according to a December 2024 CB Insights survey, 63% of organizations said they are placing significant importance on AI agents over the next 12 months. All respondents reported at least experimenting with agents.

These LLM-based systems represent an evolution beyond copilots. They can autonomously handle complex tasks — from sales prospecting to compliance decision-making — with limited human input. The market is expanding rapidly, with CB Insights data showing that over half of companies in the space were founded since 2023.

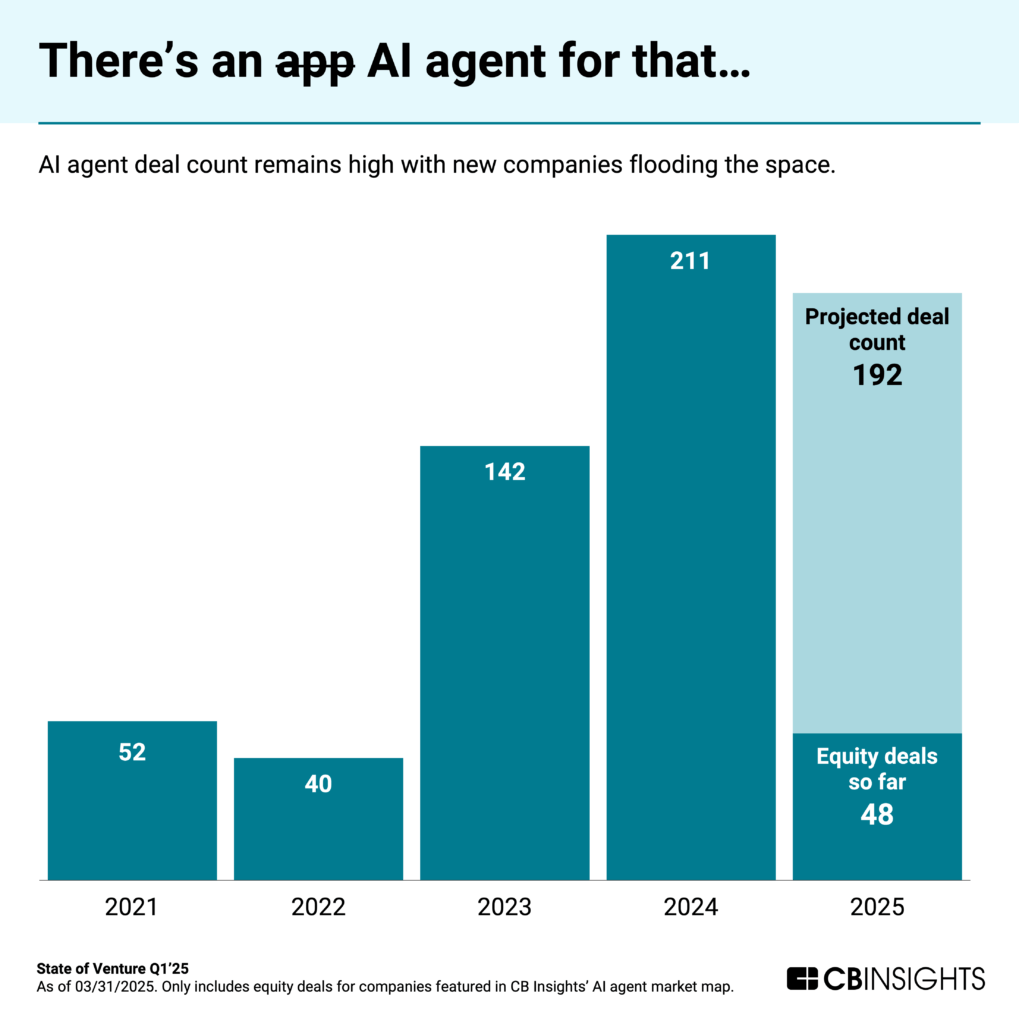

Investor interest is surging in parallel. AI agent startups saw more than 200 equity deals in 2024 — and activity is pacing toward similar levels this year.

Key investment themes emerging in the space include:

- Specialized agents for specific business functions (sales, legal, finance)

- Agent orchestration platforms that manage multiple agentic systems

- Safety and alignment tools for ensuring agent behaviors match human intentions

- Enterprise-grade agents with robust permissions and security frameworks

As agents become more capable and trustworthy, adoption will accelerate across industries.

Read more from our AI agent coverage:

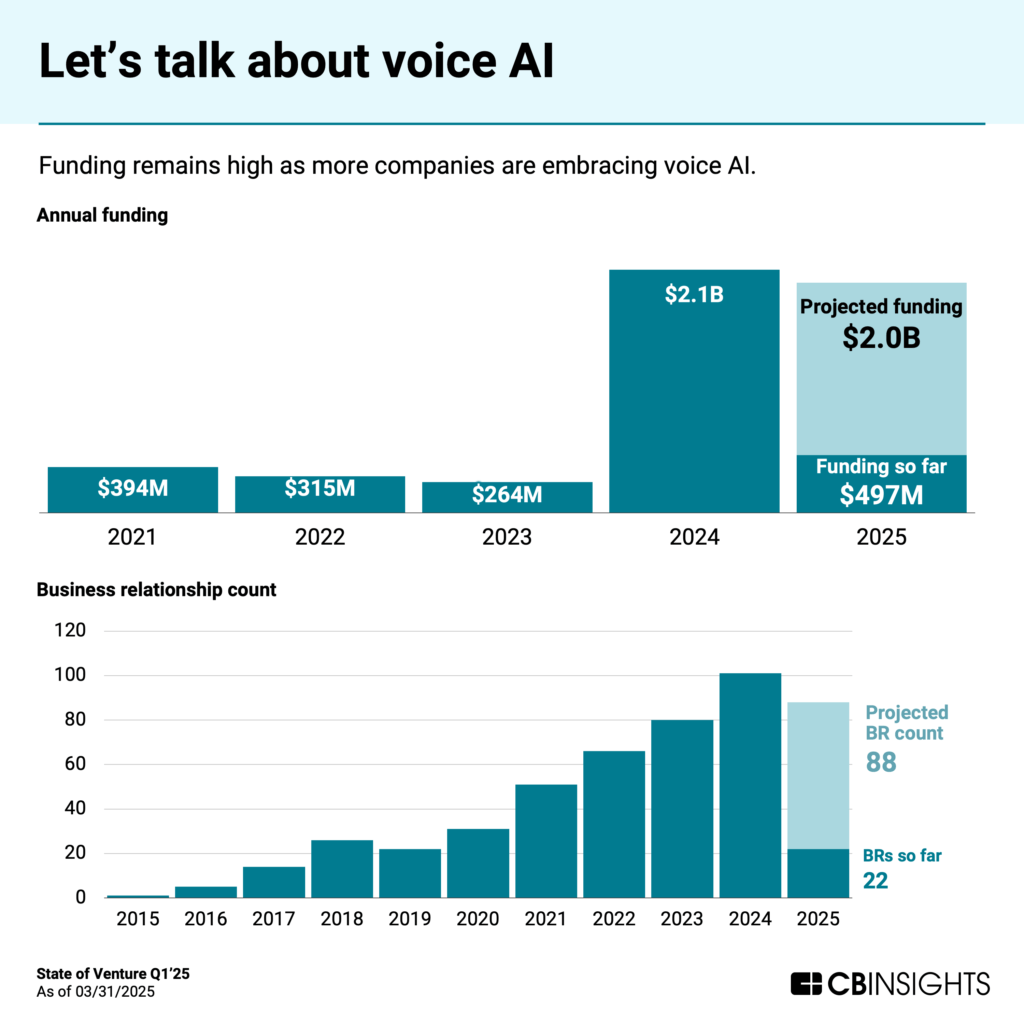

Voice AI takes off amid technical advances

Voice AI is undergoing a technical transformation as models shift toward processing audio directly — bypassing the text intermediation stage — and approaching human-like conversation latency of under 300ms.

This technical progress has fueled substantial investment, with voice AI solutions raising $2.1B in 2024 and nearly $500M in Q1’25.

One standout is ElevenLabs, which reached $100M in ARR just 3 years after its founding and raised a $180M round in January from investors including a16z, Salesforce Ventures, and Sequoia Capital.

Despite these promising signals, the voice AI market remains in early development. CB Insights data shows approximately 85% of companies in the space are at levels 1-3 on the Commercial Maturity scale. Nearly half are developing or validating their products, while 39% have just begun commercial distribution.

As voice interfaces become more natural and capable, we expect to see investment opportunities emerge in several areas:

- Domain-specific voice applications for industries like healthcare and legal

- Voice AI trained on local languages not typically covered by general-purpose AI systems

- Voice-first UI/UX for both consumer and enterprise applications

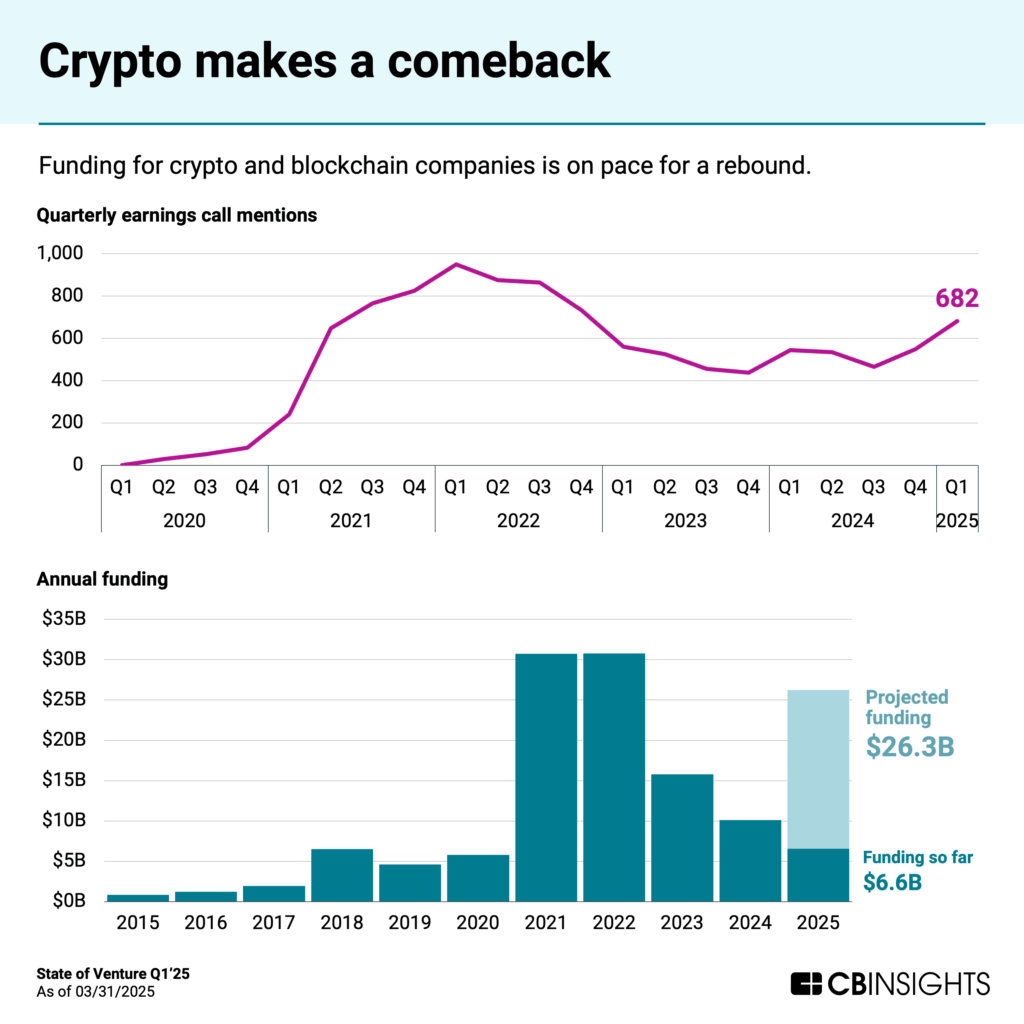

Crypto & blockchain rebound

After weathering a prolonged crypto winter, blockchain technologies are experiencing renewed institutional interest. Funding to crypto/blockchain companies reached $6.6B in Q1’25, putting the space on track to surpass $20B in annual funding. Earnings call mentions have climbed accordingly.

Several crypto companies now rank among the most likely IPO candidates, with platforms like Blockchain.com and Kraken showing IPO probabilities 64x higher than the average company tracked by CB Insights — a notable shift in public-market viability for the sector.

Another trend to watch is the growing institutional and government focus on stablecoins, as regulators develop frameworks to incorporate these digital assets into the traditional financial system.

Defense tech comes into focus

Military technology is entering a new era as investment shifts toward autonomous systems and AI-driven capabilities.

According to former Joint Chiefs of Staff Chairman General Mark Milley, smart machines and robotics could account for one-third of the US military presence within the next 15 years.

Funding to AI defense tech startups has already reached $1.5B this year — leading to a projected $6B by year-end. Last quarter saw earnings call discussion of defense reach an all-time high.

Much of this activity centers on multidomain operations (MDO) technologies — integrating systems across land, sea, air, space, and cyber — where AI is accelerating mission planning, threat detection, and battlefield connectivity. Major defense contractors are forming partnerships with AI startups to enhance battlefield management systems, mission planning capabilities, and integrated defense connectivity platforms.

As geopolitical tensions persist, defense tech investment is likely to continue growing, with particular focus on autonomous systems, AI-enhanced battlefield analytics, and advanced cybersecurity solutions for critical infrastructure.

Conclusion

The venture capital landscape in Q1’25 reflects key contrasts: record funding alongside declining deal count, significant early-stage deals vs. heightened expectations for follow-on capital, and a resurgence in billion-dollar exits despite broader market caution.

AI continues to influence capital allocation decisions across the venture ecosystem, but we’re seeing a shift from general infrastructure investments to specialized vertical applications and industry-specific solutions. Meanwhile, sectors beyond AI are showing resilience, with fintech, digital health, and retail tech all posting quarterly funding increases.

For investors, the data suggests maintaining a disciplined approach to AI investments while remaining alert to opportunities in adjacent sectors. The companies that successfully blend AI capabilities with sustainable business models will emerge as the defining ventures of this era.

For more insights on venture trends and emerging technologies, explore our related resources:

- The AI agent market map

- 7 tech M&A predictions for 2025

- State of AI Report: 6 trends shaping the landscape in 2025

- 15 tech trends to watch closely in 2025

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

The post State of Venture Q1’25 Report appeared first on CB Insights Research.

]]>The post Nvidia’s next big bet? Physical AI appeared first on CB Insights Research.

]]>M&A is back.

Below, we break down what’s driving the surge in deals, then zoom in on Nvidia’s latest purchase.

Buyers on the prowl

Q1’25 has already seen 11 $1B+ deals for VC-backed companies worth a combined $54.5B — blowing past quarters out of the water.

More than half of that value comes from Google’s $33B purchase of Wiz, the biggest VC-backed M&A exit of all time.

It’s not just tech startups — consumer & retail brands are getting snapped up too, like Pepsi’s $2B acquisition of Poppi.

But tech is leading the charge.

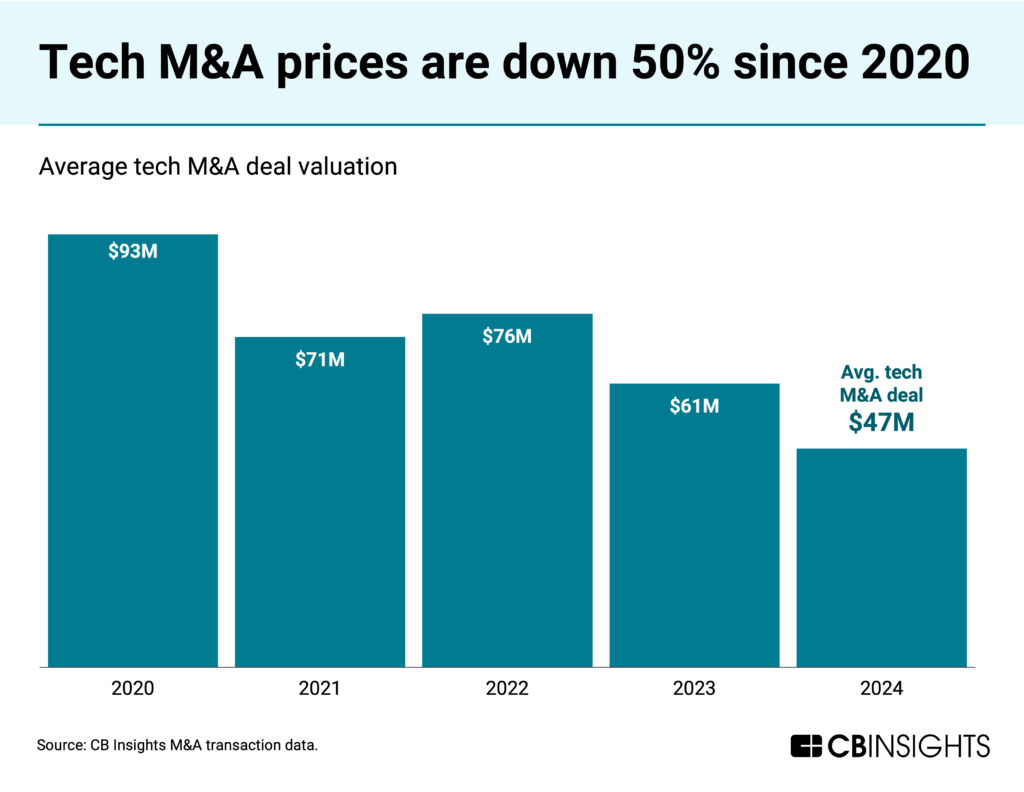

M&A activity in the sector rebounded 5% in 2024 and we expect it to gain more steam this year thanks to several factors:

-

- Less regulatory pressure: Big tech players like Google are betting on a friendlier dealmaking climate with Lina Khan out as head of the FTC.

- AI boom: Incumbents are anxious to get their hands on AI assets and infrastructure (see ServiceNow’s acquisition of MoveWorks and SoftBank’s acquisition of Ampere).

- Cheaper prices: Tech M&A valuations keep falling, encouraging strategic and financial buyers to get off the sidelines.

Nvidia’s M&A playbook

Among the Mag 7, Nvidia stands out for its aggressive acquisition strategy.

All told, Nvidia has snapped up 7 AI startups since 2021, with 4 of these in just the last year.

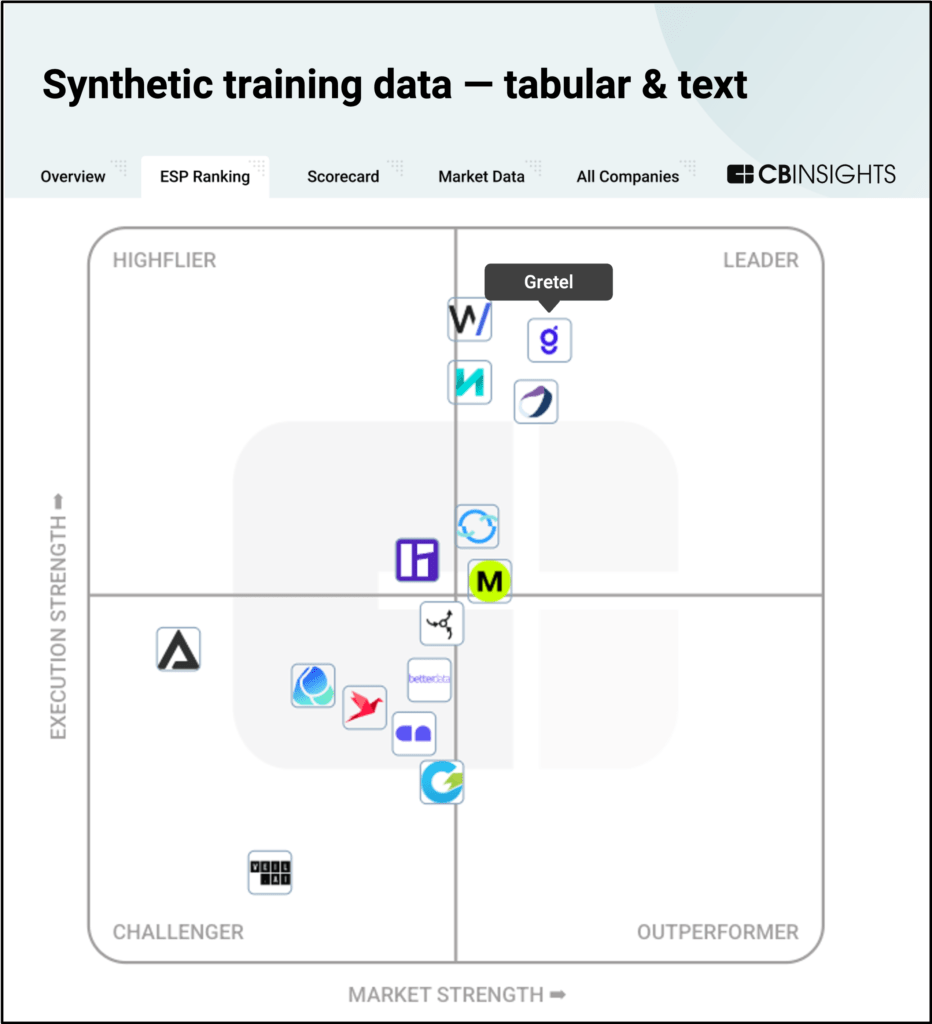

Last week it bought Gretel — reports place the exit valuation north of $320M (Gretel’s last disclosed valuation) but less than $1B.

Per CB Insights’ ESP ranking, Gretel is a leader in the synthetic training data market.

Source: CB Insights — ESP ranking of players in tabular and text-based synthetic training data

Synthetic data offers a potential solve to 3 issues in AI development:

- A diminishing pool of high-quality text data to train more advanced LLMs.

- The need to preserve privacy by using anonymized data, critical to AI adoption in industries like healthcare and finance.

- The absence of real-world data to train physical AI models on tasks like driving cars or piloting humanoid robots.

CBI customers can see our analysis of 50 synthetic data providers here.

By acquiring Gretel, Nvidia positions itself at the forefront of the synthetic data market and strengthens its position in emerging areas like physical AI.

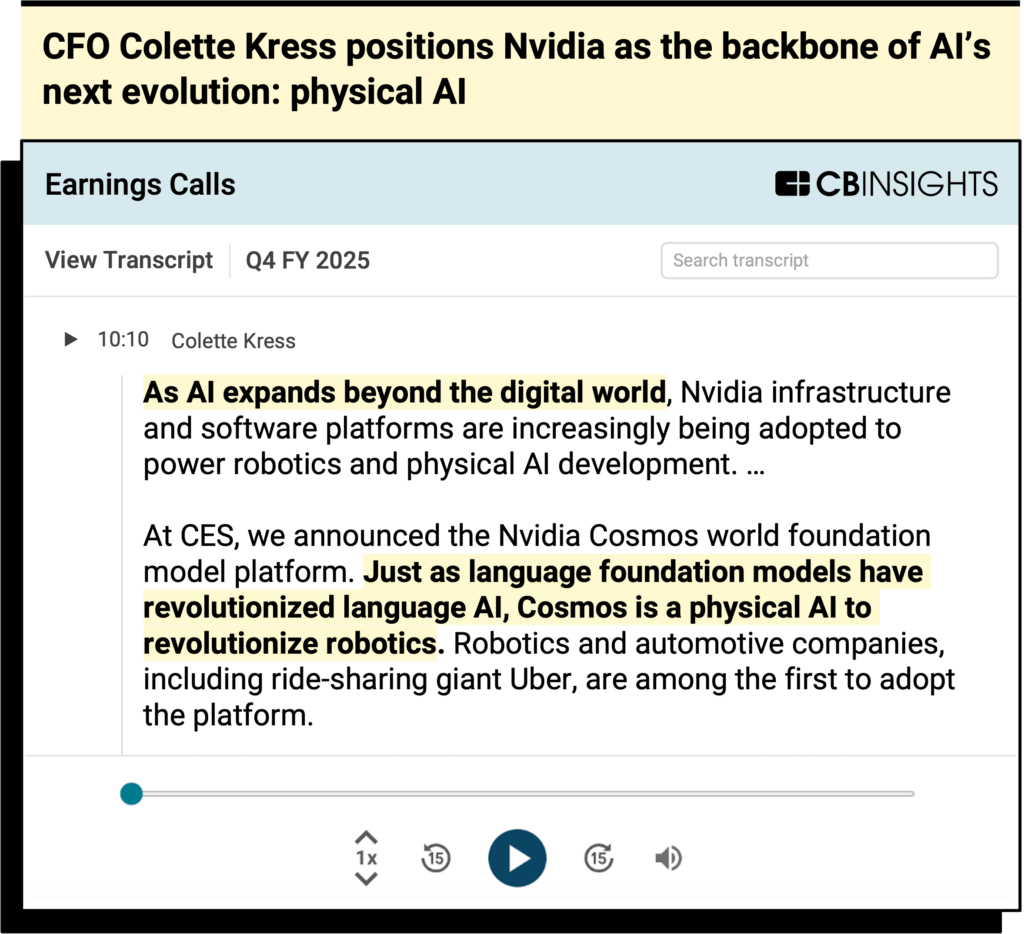

Nvidia sees the physical domain as the next evolution of AI, according to CB Insights’ earnings call transcripts.

Source: CB Insights — Nvidia Q4 FY 2025 earnings transcript

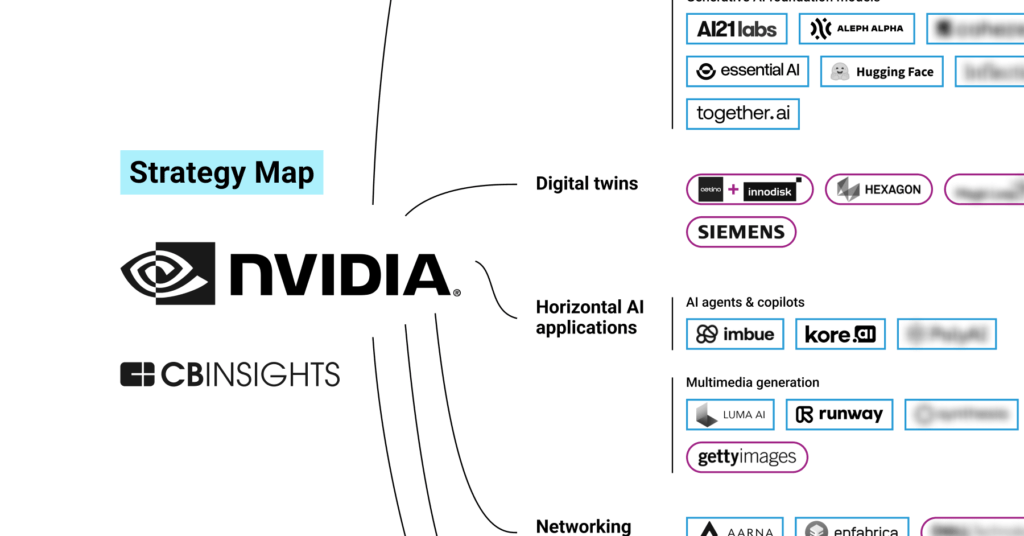

Back in June 2024, we wrote about how Nvidia is investing in and partnering with companies focused on industrial applications, like digital twins and robotics, which can rely on AI for simulation and training.

See where else the $3T company is targeting growth in our Nvidia strategy map.

Related research from CB Insights:

- Analyzing Nvidia’s growth strategy: How the chipmaker plans to usher in the next wave of AI

- State of Venture 2024 Report

- 7 tech M&A predictions for 2025

- Generative AI is accelerating the timeline for fully autonomous driving

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

The post Nvidia’s next big bet? Physical AI appeared first on CB Insights Research.

]]>The post 7 tech M&A predictions for 2025 appeared first on CB Insights Research.

]]>The AI boom has set the stage for a wave of tech M&A this year.

After 2 consecutive years of decline, tech M&A deals were up in 2024, with some of the largest deals centering on AI. AI companies have also bucked the general downward trend in exit valuations, instead seeing nearly double the median acquisition price from 2023 to 2024.

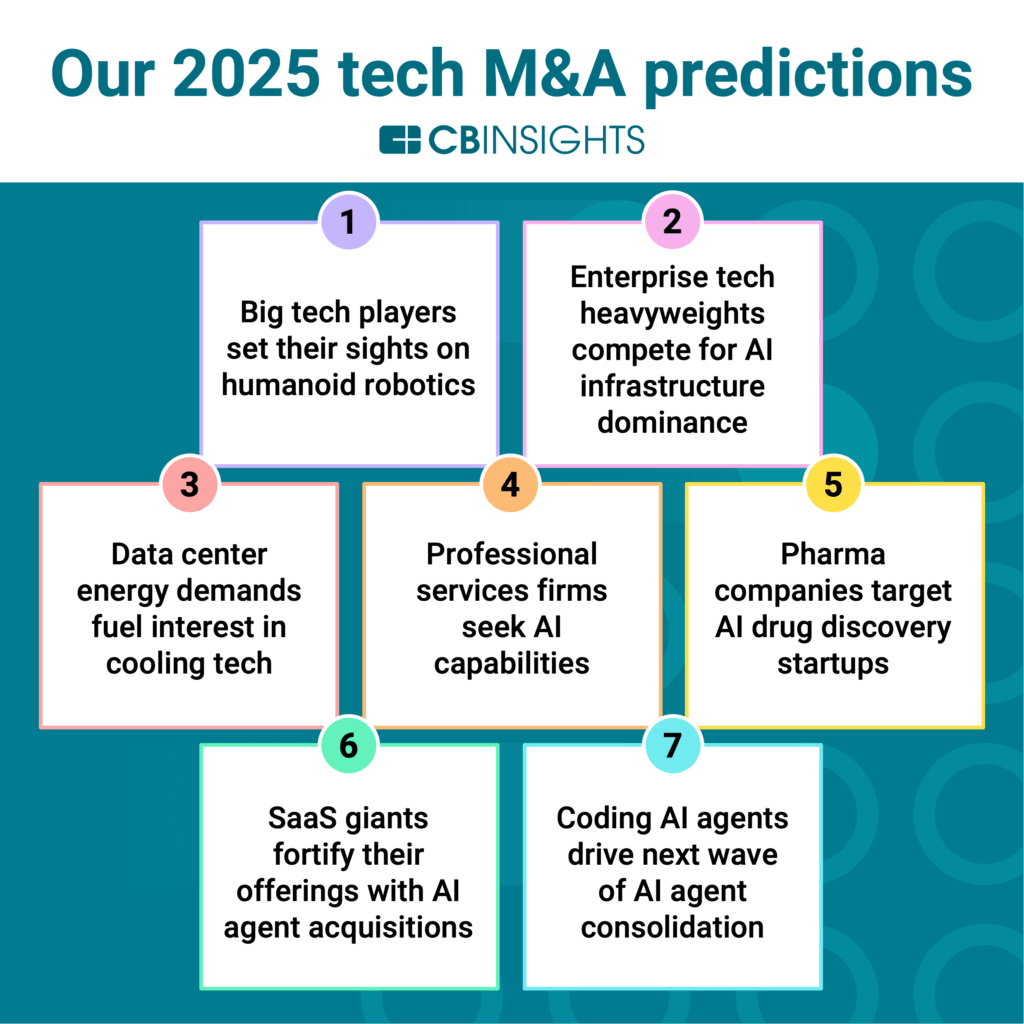

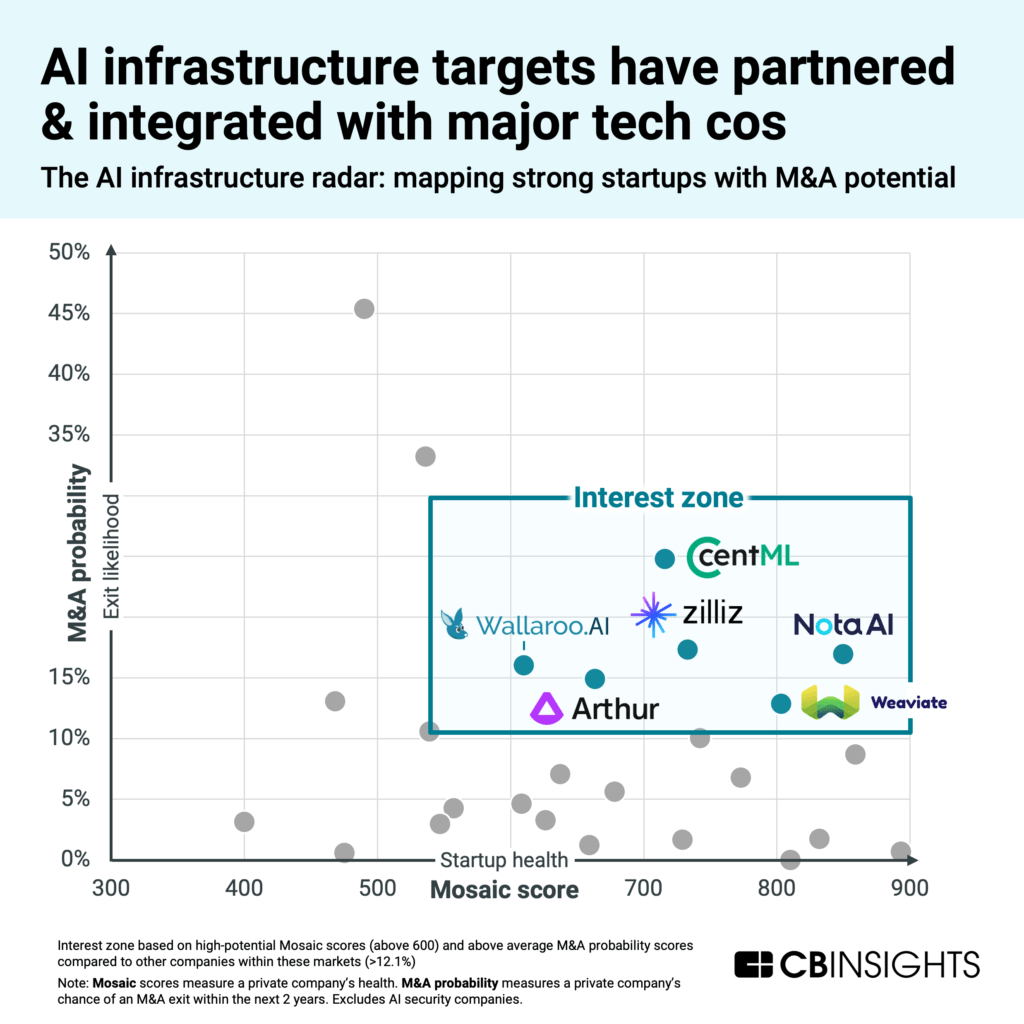

Using CB Insights’ predictive signals, such as Mosaic and M&A Probability, we’ve identified 7 AI-related areas where we expect to see M&A activity this year, as well as high-potential acquisition targets for each.

See highlights below, and download the full report for the rationale behind each prediction, as well as M&A target shortlists.

Tech M&A prediction highlights

- Big tech players set their sights on humanoid robotic: As physical AI takes off thanks to the rise of LLMs, humanoid robotics is becoming big tech’s next battlefield. Among high-potential acquisition targets, 1x stands out for its dual focus on industrial and consumer humanoids (just in January, it acquired Kind Humanoid to accelerate household robot development). This makes it a prime target for Meta, which recently announced plans to enter the consumer humanoid market.

- Enterprise tech heavyweights compete for AI infrastructure dominance: We’re already seeing strong signals from cash-rich companies such as Cisco and IBM, which are future-proofing their business models with AI investments. Hardware-aware AI optimization players CentML and Nota AI — which help accelerate AI model deployment while reducing compute costs — appear in our AI infrastructure acquisition target list. These companies have already shown quantifiable efficiency improvements as well as validation from Nvidia as a partner or investor.

Source: CB Insights advanced search. Data is dynamic (as of 2/27/2025).

- Data center energy demands fuel interest in cooling tech: Companies offering immersion and liquid cooling solutions enjoyed a funding rebound last year, attracting a combined $120M in fresh funding. Hypertec and Submer are high-potential acquisition targets in this space.

- Professional services firms seek AI capabilities: GenAI is coming for knowledge jobs — and leading professional services firms are buying AI capabilities to get ahead of it. One area where we see high M&A potential for professional services firms is to cater to clients’ responsible AI needs, with potential acquisition targets such as Lasso Security and HydroX AI.

- Pharma companies target AI drug discovery startups: AI drug discovery M&A is surging, with 12 deals in the sector since 2023. That M&A deal volume reflects both a maturing technology and growing urgency among pharma players to bring AI tech in-house.

- SaaS giants fortify their offerings with AI agent acquisitions: While some believe AI agents signal the death of SaaS companies, we anticipate SaaS leaders will acquire AI agent companies to avoid disruption. We’re already starting to see this happen with ServiceNow acquiring Moveworks for close to $3B in March 2025.

Source: CB Insights — ServiceNow Acquisition Insights

Source: CB Insights — ServiceNow Acquisition Insights

- Coding AI agents drive next wave of AI agent consolidation: Explosive growth, soaring valuations, a fractured AI agent landscape, and rising doubts about revenue defensibility make the coding AI agents market ripe for consolidation. While some players like Cursor look too expensive for an acquisition, we’ve identified Warp, Vidoc, and Bito as likely targets with high Mosaic scores and higher-than-average M&A Probabilities.

What is Mosaic?

Mosaic is CB Insights’ proprietary metric that measures the overall health and growth potential of private companies using non-traditional signals. Mosaic is widely used as a target company and market screener to identify high-potential emerging tech companies, typically defined as those with a score of 510 or higher.

What is M&A Probability?

M&A Probability is CB Insights’ proprietary signal that measures a private company’s chance of an M&A exit within the next 2 years. It is used to quickly screen and triangulate companies based on exit likelihood.

Combining both Mosaic Score and M&A Probability makes it easy to shortlist acquisition targets.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

The post 7 tech M&A predictions for 2025 appeared first on CB Insights Research.

]]>The post The AI agent market map appeared first on CB Insights Research.

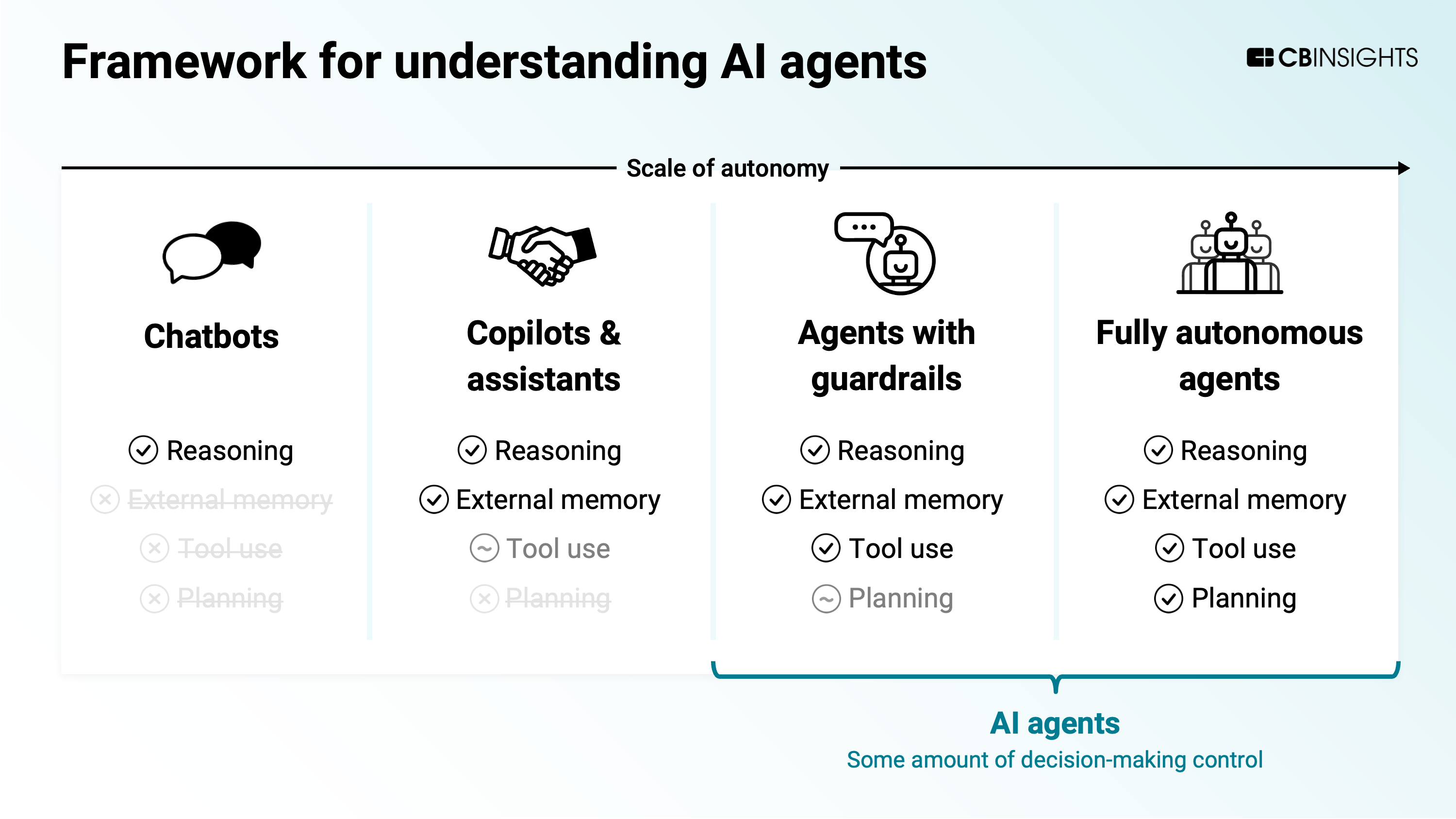

]]>While AI copilots have already made inroads across industries, the next evolution — autonomous agents with greater decision-making scope — is arriving quickly. AI agent startups raised $3.8B in 2024 (nearly tripling 2023’s total), and every big tech player is already developing AI agents or offering the tooling for them.

Implications for enterprises will be far-reaching, from altering workforce composition (with new hybrid teams of humans and AI agents) to maximizing operational efficiency through full automation of routine tasks.

Below we identify 170+ promising startups developing AI agent infrastructure and applications.

We selected companies for inclusion based on Mosaic health scores (500+) and/or funding recency (since 2022). We included private companies only and organized them according to their primary focus. This market map is not exhaustive of the space.

Want to be considered for future AI agent research? Brief our analysts to ensure we have the most up-to-date data on your company.

Outlook on AI agents

Fully autonomous agents remain limited due to issues pertaining to reliability, reasoning, and access. Most agent applications today operate with “guardrails” — within a constrained architecture where, for example, the LLM-based system follows a decision tree to complete tasks.

Agents featured on this map include some combination of the following components:

- Reasoning: Foundation models that enable complex reasoning, language understanding, and decision-making. These models evaluate information and form the cognitive core of the agent.

- Memory: Systems that store, organize, and retrieve both short-term contextual information and long-term knowledge.

- Tool use: Integration capabilities that allow agents to interact with external applications, APIs, databases, the internet, and other software.

- Planning: The agent’s architecture for breaking down complex tasks into more manageable steps, reflecting on performance, and adapting as necessary.

We expect more startups to move up the scale of autonomy as AI capabilities advance. Improvements in reasoning and memory will enable more sophisticated decision-making, adaptability, and task execution.

For example, in September 2024, legal AI startup Harvey announced that OpenAI’s o1 reasoning model, supplemented with domain-specific knowledge and data, was enabling it to build legal agents. The company, which raised $300M at a $3B valuation in February 2025, has doubled its sales force in the last 6 months, indicating rising market demand.

While the above market map highlights the private landscape (with a focus on enterprise applications), tech giants and incumbents are also launching agents. We predict big tech and leading LLM developers will own general-purpose AI agents, but there are many opportunities for smaller, specialized players.

Looking ahead, watch for new form factors outside of the copilot/chatbot interface that will push the boundaries of what an “agent” is. Early indications of this include “AI-native” workspaces — tools and platforms built from the ground up around AI capabilities, rather than layering AI features on top of a traditional product. For instance:

- Eve’s legal platform aims to automate aspects of the whole case lifecycle (from case intake to drafting).

- Hebbia’s Matrix product builds spreadsheets that mine information from files (in rows) and deliver answers to questions (in columns), proactively discovering, organizing, and surfacing data.

- With its Dia product, The Browser Company is exploring web browsing interfaces that can summarize content, automate repetitive web tasks, and even anticipate next actions.

Category overview

AI agent infrastructure

This segment covers companies building agent-specific infrastructure. (We excluded general genAI infrastructure markets like foundation models and vector databases from the map.)

Development tools

A diverse ecosystem of tools has emerged to support agents’ development. These range from memory frameworks like Letta that enable persistent, retrievable memory across interactions; to tools that allow agents to take action via integration (e.g., Composio), authentication (e.g., Anon), and browser automation (e.g., Browserbase).

Another set of companies is giving agents more utility across payments (which includes companies developing crypto wallets for agents as well as virtual cards) and voice (development platforms and tools for testing AI voice applications as well as speech models).

Meanwhile, demand for simplified, comprehensive deployment options is driving the rise of AI agent development platforms — the most crowded infrastructure market on our map.

LLM developers including Cohere (with its North AI workspace) and Mistral have launched their own agent development frameworks, while Amazon, Microsoft, Google, and Nvidia all offer AI agent development tooling. With many enterprises favoring established vendors due to lower risk, big tech companies have significant advantages here.

Trust & performance

Concerns around reliability and security have helped establish a market for agent evaluation & observability tools. Early-stage companies are targeting applications such as automated testing (e.g., Haize Labs) and performance tracking (e.g., Langfuse).

Multi-agent systems, where specialized sub-agents work together to complete tasks, also show promise in improving accuracy. Insight Partners-backed CrewAI’s multi-agent orchestration platform is reportedly already used by 40% of the Fortune 500.

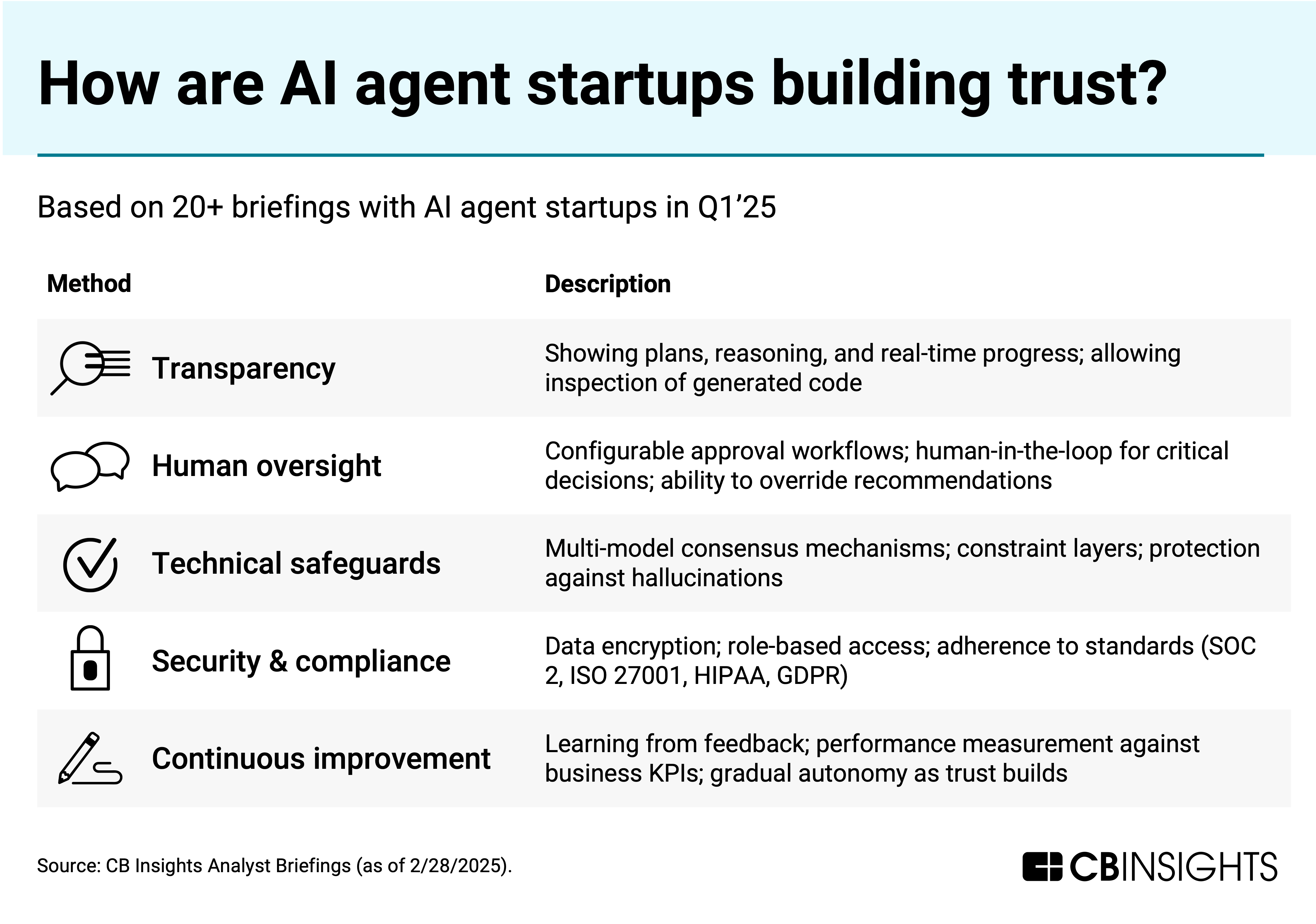

Vendors are also tackling reliability concerns directly. Based on our briefings with 20+ AI agent startups in Q1’25, companies are using 5 primary methods to build user trust:

- Transparency

- Human oversight

- Technical safeguards

- Security & compliance

- Continuous improvement

Horizontal applications & job functions

Horizontal AI agent startups make up nearly half of the map and overall landscape.

This segment primarily features startups targeting enterprises, with industry-agnostic applications across job functions like HR/recruiting, marketing, and security operations. Companies in the productivity & personal assistants market, including OpenAI with its Operator agent, are targeting consumers and employees directly.

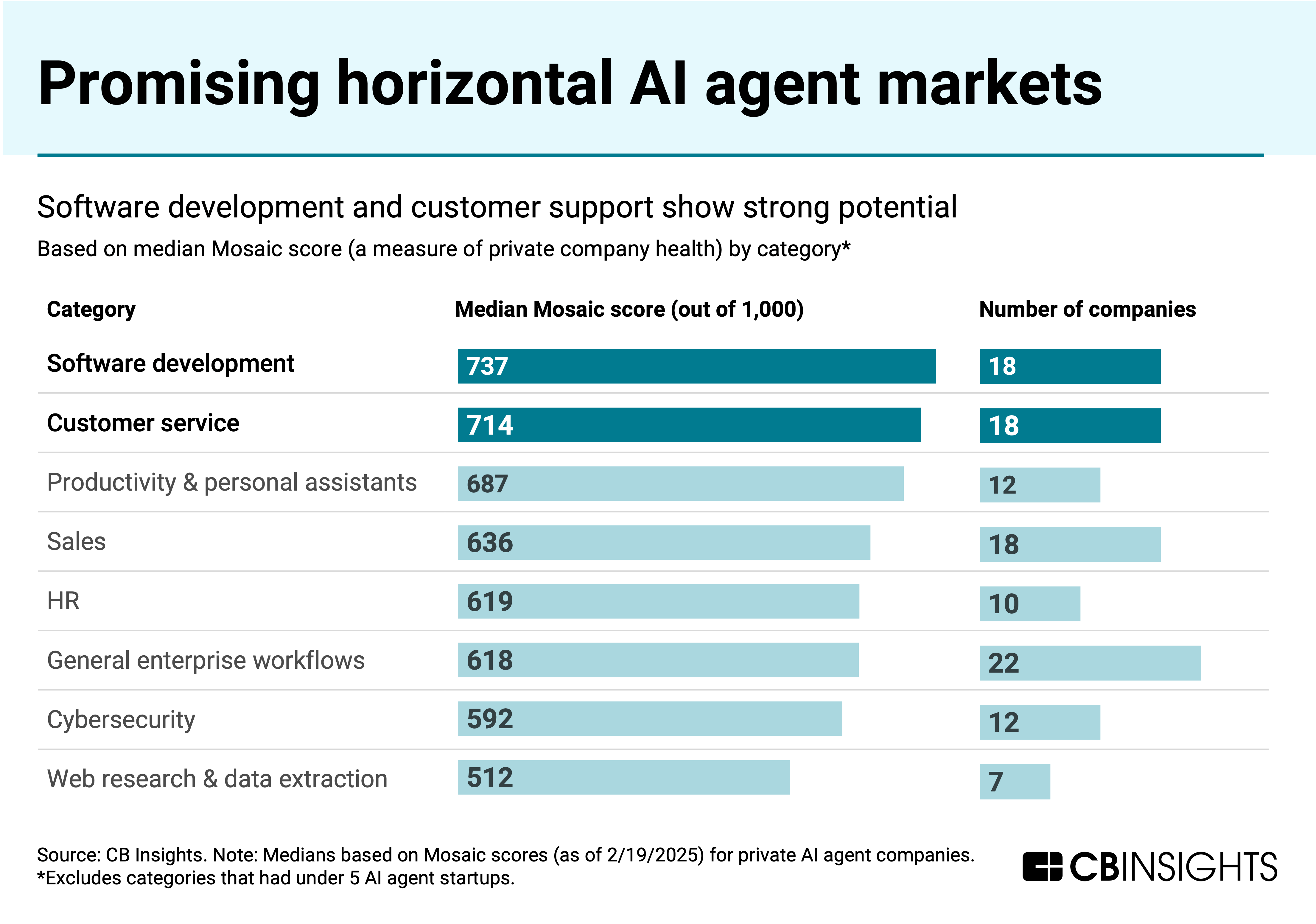

The AI agent markets with the most traction — based on companies’ median Mosaic health scores — are customer service and software development (which includes coding and code review & testing agents). These markets are also among the most crowded due to the value agents bring to well-defined workflows and testable environments.

We see this reflected in adoption, particularly at the customer service layer: Among 64 organizations surveyed by CB Insights in December 2024, two-thirds indicated they are using or will be using AI agents in customer support in the next 12 months.

Overall, horizontal AI agent applications are more commercially mature compared to the infrastructure and vertical segments, with over two-thirds of the market deploying or scaling their solutions based on CBI Commercial Maturity scores.

Vertical (industry-specific) applications

We expect increasing verticalization as startups carve out niches by solving industry-specific customer problems, especially in areas with strict regulatory scrutiny and data sensitivity.

This category features companies catering to industries including:

- Financial services & insurance: The most crowded vertical category on the map with 11 companies, startups here are targeting a variety of finserv workflows such as financial research (Boosted.ai and Wokelo), insurance sales & support (Alltius and Indemn), and wealth advisory prospecting & operations (Finny AI and Powder).

- Healthcare: Solutions in this market aim to reduce the volume of manual tasks for healthcare professionals across use cases like clinical documentation, revenue cycle operations, call centers, and virtual triage. Solutions from companies like Thoughtful AI (revenue cycle operations) and Hippocratic AI (staffing marketplace) are targeting end-to-end healthcare workflows.

- Industrials: These companies look to optimize processes and equipment — including control systems, robots, and other industrial machines — without relying on consistent human intervention. For example, Composabl launched an agent platform in May 2024 that uses LLMs to create skills and goals for agents that can control industrial equipment. Public companies like Palantir are also active in this space. Learn more in our industrial AI agents & copilots market map.

RELATED RESEARCH

- What’s next for AI agents? 4 trends to watch in 2025

- The enterprise AI agents & copilots market map

- The Multi-Agent AI Outlook

- Future of the workforce: How AI agents will transform enterprise workflows

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

The post The AI agent market map appeared first on CB Insights Research.

]]>The post The automated warehouse market map appeared first on CB Insights Research.

]]>Rather than full automation, the industry is embracing a more nuanced approach where technology augments human capabilities, creating hybrid workplaces where workers are upskilled to work alongside and manage robotic systems.

Today’s modular and scalable automation solutions enable incremental modernization, allowing logistics providers to start small, prove ROI, and gradually expand their automated operations while maintaining market adaptability.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post The automated warehouse market map appeared first on CB Insights Research.

]]>The post The wildfire tech market map appeared first on CB Insights Research.

]]>Companies are responding by developing solutions like fire surveillance drones to better monitor wildfires, as well as firefighting robots to minimize the severity when they occur. In fact, over 500 US fire departments have already deployed surveillance drones.

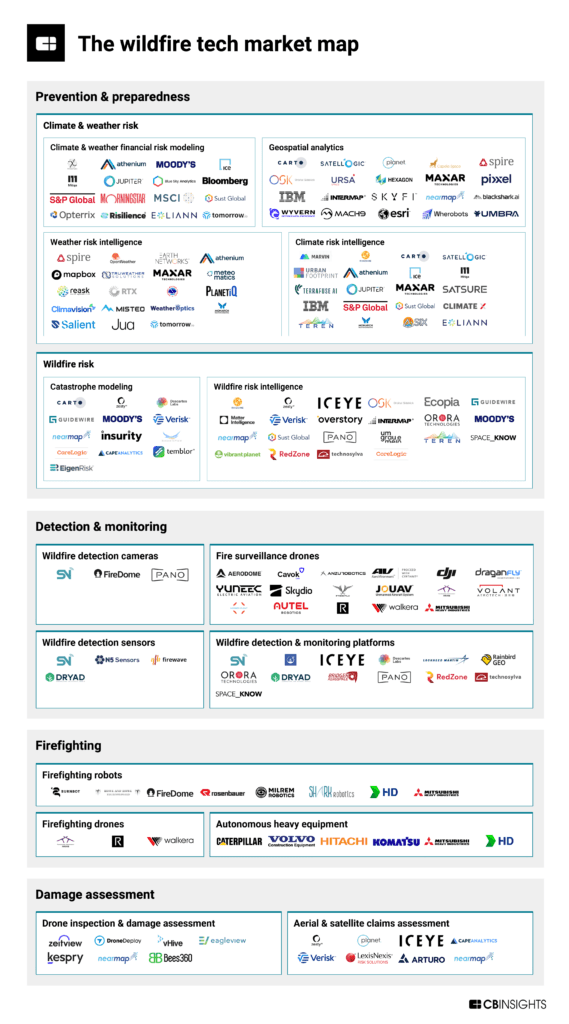

To help companies and governments understand the current wildfire tech landscape, we mapped 130 companies across 15 markets. We then organized tech markets by the wildfire lifecycle:

- Prevention & preparedness: Solutions in this category help forecast extreme weather events — including wildfires — and assess their damage potential. We break this category down into: 1) broader climate & weather risk; and 2) wildfire risk, which includes solutions specifically designed for wildfires.

- Detection & monitoring: These solutions use cameras, sensors, and analytics platforms to detect outbreaks early and track their progression to aid firefighting strategies.

- Firefighting: These technologies — such as drones and robots — support the suppression of wildfires or help create firebreaks to limit their spread.

- Damage assessment: This includes solutions to evaluate the destruction caused by wildfires after they occur.

Please click to enlarge.

To identify players for this market map, we included startups with a Mosaic score of 400 or greater and leading corporations developing wildfire tech. Categories are not mutually exclusive and are not intended to be exhaustive.

Market descriptions

Click the market links below for info on the leading companies, funding, and more.

Prevention & preparedness: Climate & weather risk

Climate & weather financial risk modeling focuses on quantifying the financial impacts of climate change and severe weather events, helping businesses forecast and mitigate monetary losses. Leading companies like Bloomberg and Morningstar serve many industries, from agriculture to insurance to government.

Featured companies:

Geospatial analytics analyzes and interprets geographic data (e.g., satellite imagery, GIS) for various industries, providing spatial insights and risk assessments. Startups in this market have raised a combined $508M since 2023 — the most funding of any market in this map.

Featured companies:

Weather risk intelligence emphasizes real-time weather monitoring and predictive modeling to reduce operational disruptions and manage day-to-day weather-related risks.

Featured companies:

Climate risk intelligence provides deeper analysis of long-term climate change hazards, guiding strategic decision-making and resilience planning for businesses and governments.

Featured companies:

Prevention & preparedness: Wildfire risk

Catastrophe modeling simulates large-scale natural disasters (e.g., hurricanes, earthquakes) to estimate potential losses, primarily for insurance and reinsurance purposes.

Featured companies:

Wildfire risk intelligence zeroes in on wildfire hazards with analytics and forecasting tools, helping organizations anticipate fire spread and prioritize mitigation. This market has the highest average company Mosaic health score (662 out of 1,000) among wildfire-specific tech markets.

Featured companies:

Detection & monitoring

Wildfire detection cameras use specialized imaging (thermal, infrared) to spot fire signatures early and relay alerts from fixed vantage points.

Wildfire detection sensors are ground-based devices that monitor environmental conditions (e.g., temperature, smoke) to detect potential fires in real time.

Fire surveillance drones provide aerial monitoring of wildfires using sensors like thermal imaging, enhancing situational awareness and firefighter safety. Companies in this market typically offer drones for a wider set of applications beyond wildfires. For example, Skydio, which has raised $400M since 2023, serves industries such as industrial inspection and defense, in addition to fire surveillance.

Featured companies:

Wildfire detection & monitoring platforms integrate satellite/aerial data, IoT sensors, and AI in a software platform to track and predict wildfire behavior at scale. ICEYE and Pano AI rank as leading startups here, offering solutions for enterprises and governments through platforms that use advanced imaging systems and AI models to predict potential wildfire locations and facilitate real-time detection and monitoring.

Featured companies:

Firefighting

Firefighting drones actively suppress fires by delivering water or fire-retardant agents, often equipped with thermal imaging to pinpoint hotspots. This is among the most nascent markets in the map, with 89% of deals since 2023 going to early-stage companies.

Firefighting robots are ground units equipped with sensors and suppression tools (e.g., water cannons), enabling safer and more efficient fire combat in hazardous areas.

Featured companies:

Autonomous heavy equipment encompasses self-operating machinery (e.g., bulldozers, loaders) used in construction, mining, or creating firebreaks, reducing human risk.

Featured companies:

Damage assessment

Drone inspection & damage assessment uses drones to capture high-resolution imagery of properties for quicker, more accurate insurance claims evaluations.

Aerial & satellite claims assessment leverages imagery from planes or satellites to evaluate property damage — often focused on large-scale or remote loss scenarios.

Featured companies:

RELATED RESOURCES FROM CB INSIGHTS:

- Weather risk intelligence funding surges as extreme weather events pile up

- Wildfires are causing insurers to leave markets. Can wildfire risk analytics reverse this trend?

- The Aerospace & Space Tech expert collection

- The Insurtech expert collection

- The satellite & geospatial tech market map

- The AI in defense tech market map

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

The post The wildfire tech market map appeared first on CB Insights Research.

]]>The post State of Climate Tech 2024 Report appeared first on CB Insights Research.

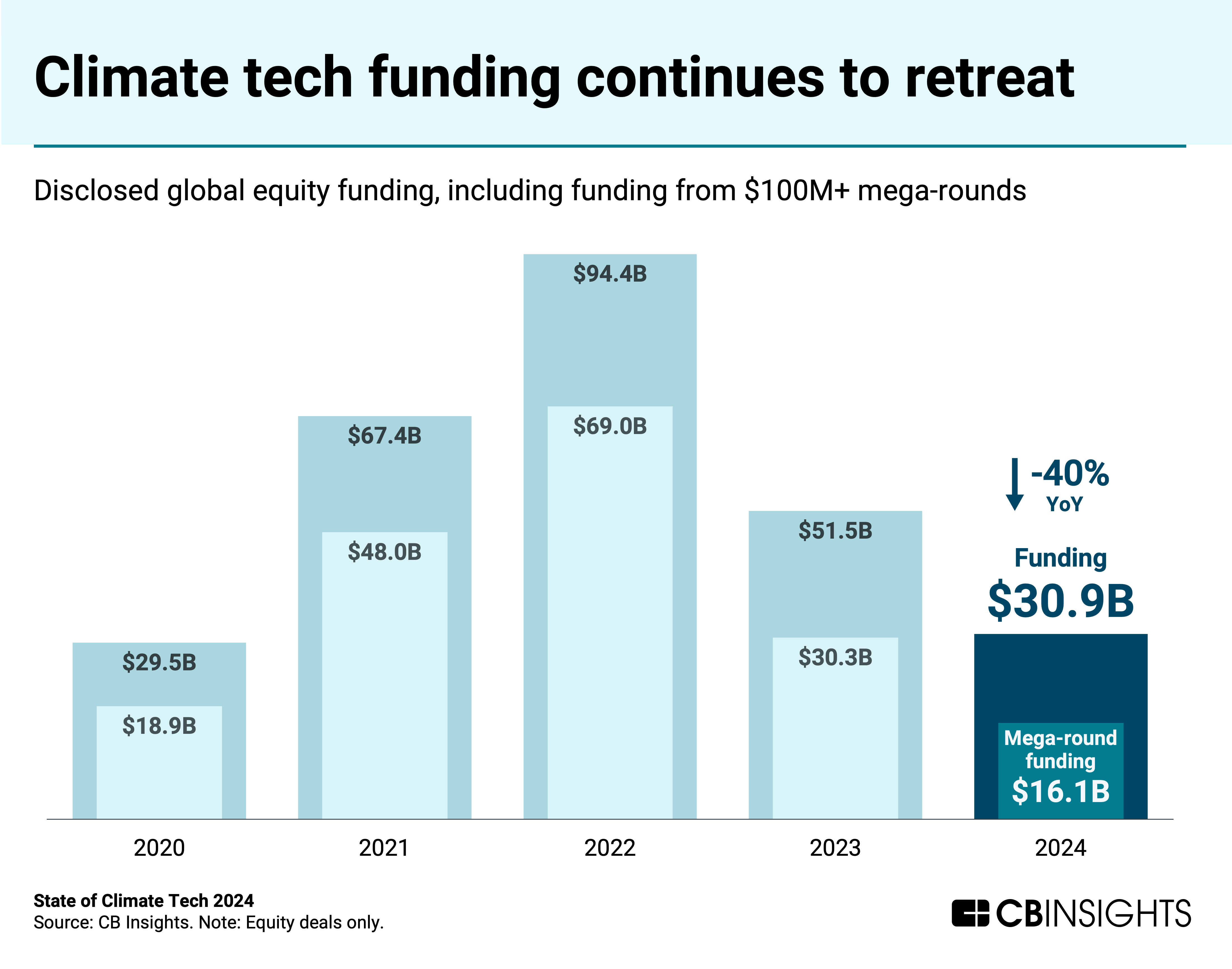

]]>A key factor in the slowdown was a sharp drop in funding from mega-rounds ($100M+ deals), which dropped 47% year-over-year (YoY) in 2024. This coincided with high-profile bankruptcies of established climate tech startups like battery manufacturer Northvolt.

However, this turbulence wasn’t limited to the private markets — public players like Lilium and Arrival also filed for insolvency/bankruptcy over the period, highlighting the commercialization challenges facing capital-intensive industries like climate tech.

Download the full report to access comprehensive data and charts on the evolving state of climate tech across sectors, geographies, and more.

Key takeaways from the report include:

- Climate tech investment activity continues to contract. Global climate tech funding fell for the second year straight in 2024, dropping by 40% YoY, with mega-round funding falling by 47%. However, the space still saw notable mega-rounds. This included deals to players modernizing the power grid, drawing participation from tech giants racing to secure clean energy for computing infrastructure.

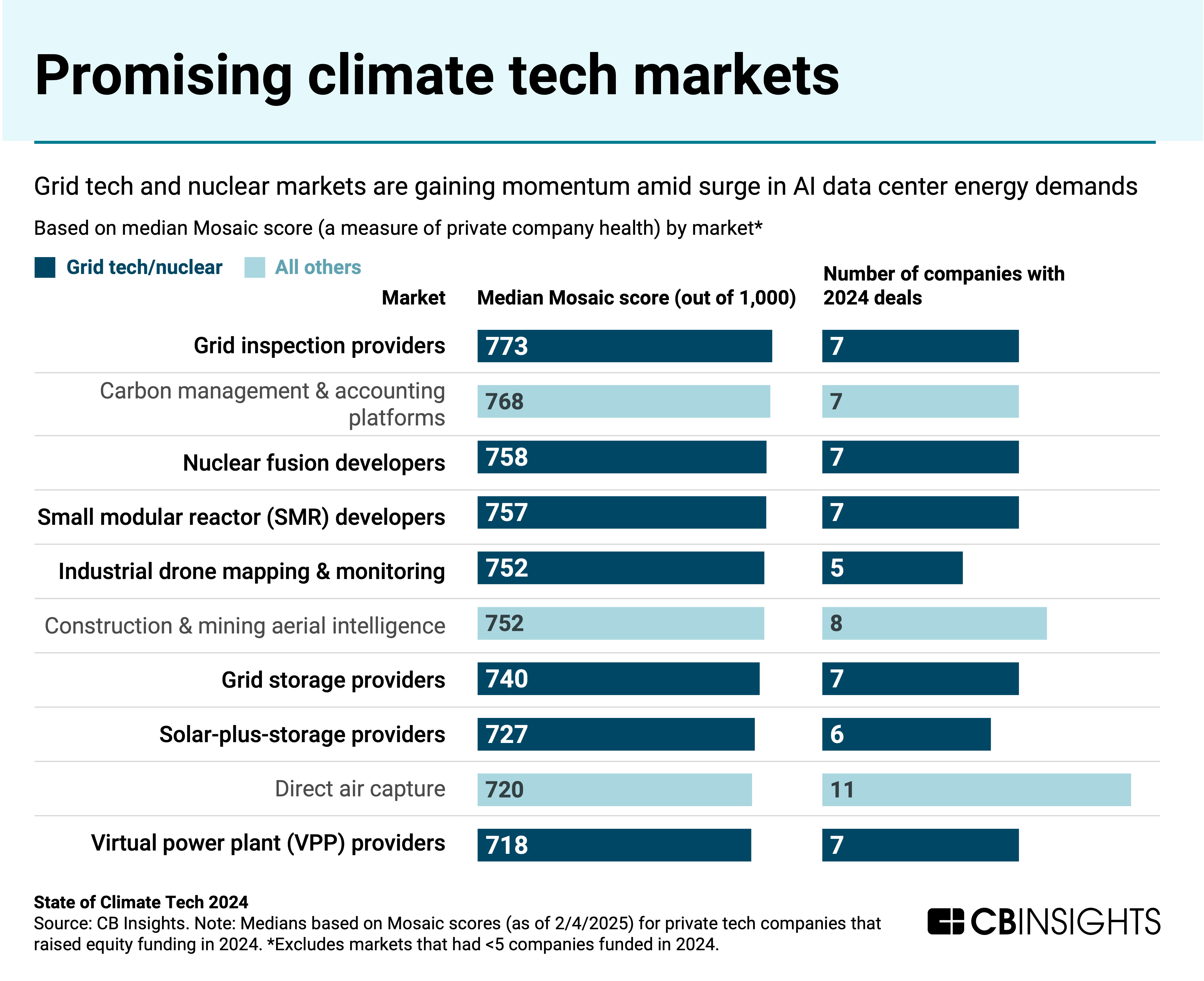

- Grid tech and nuclear are gaining momentum to meet AI’s energy needs. Within climate tech, markets targeting the grid and power generation show the strongest growth potential, according to CB Insights Mosaic startup health scores. This momentum is driven in part by the massive energy demands (and expected continued demand) of AI data centers.

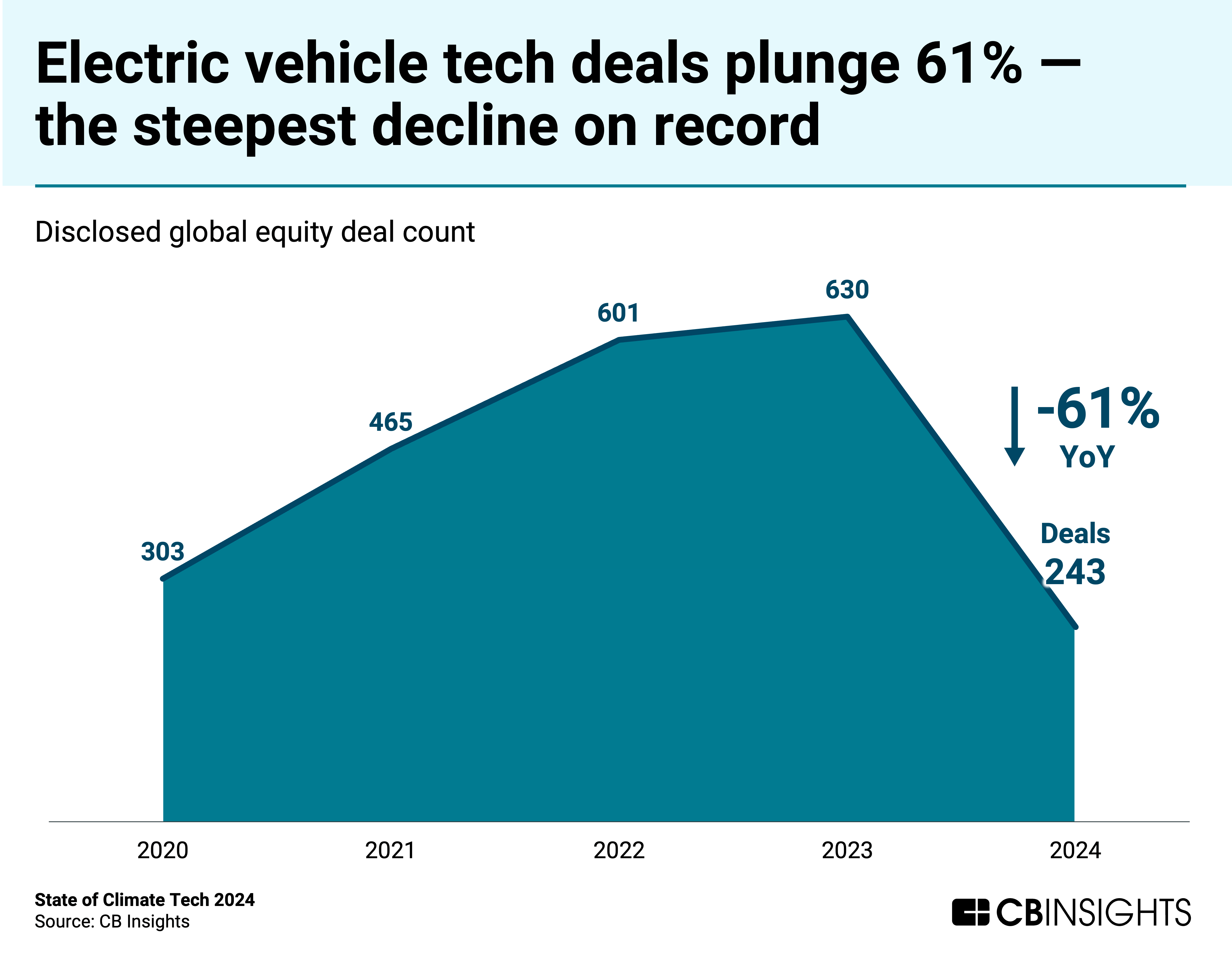

- Electric vehicle technology sees record pullback in deals. After years of steady growth, electric vehicle (EV) tech deal activity plunged 61% YoY in 2024 — its steepest decline on record. This points to broader challenges in the sector, like lower consumer demand for EVs and increased capital costs for scaling manufacturing operations.

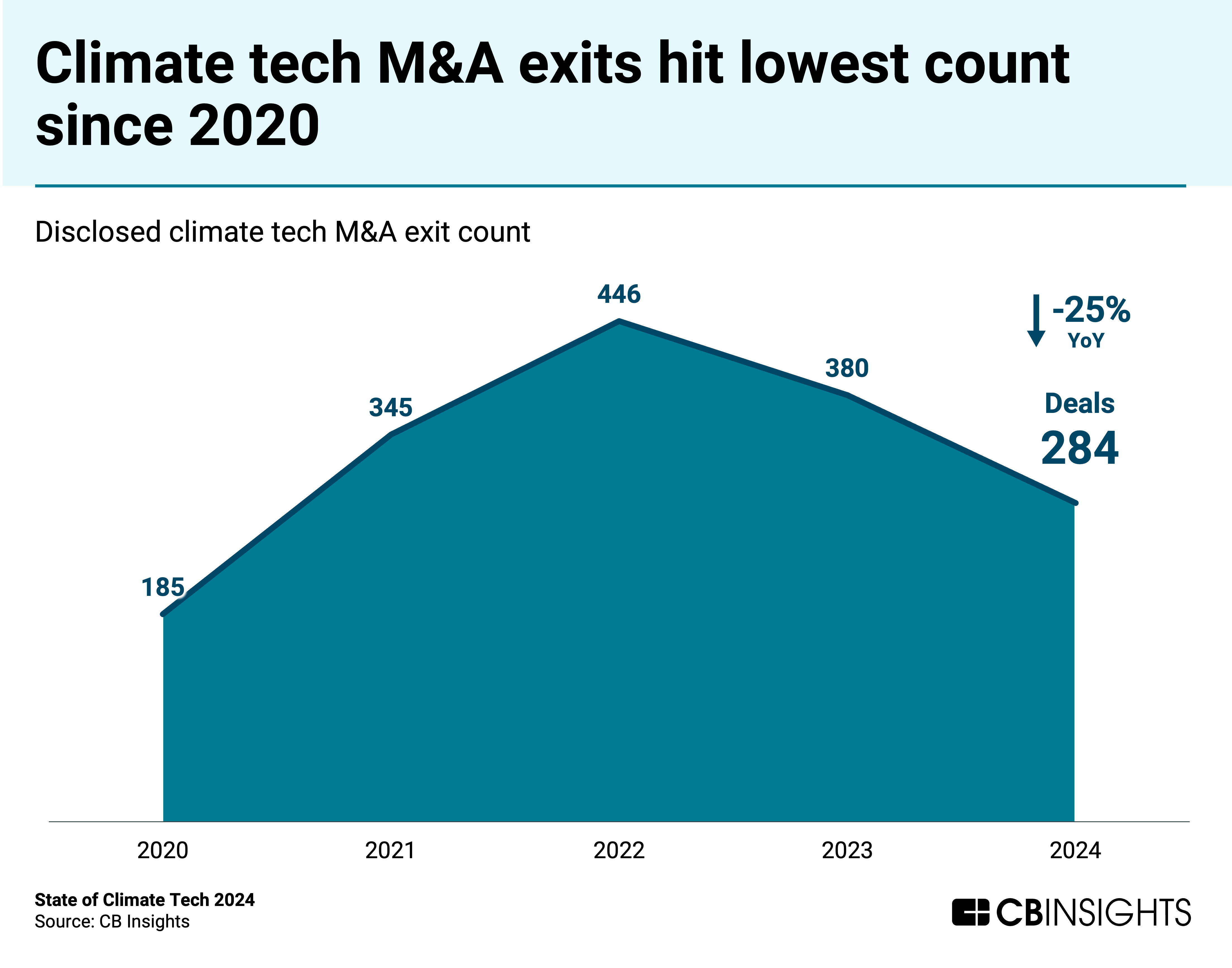

- Climate tech M&A exits decline once again. Climate tech M&A exits dropped by 25% YoY to hit 284, the lowest count since 2020. At the quarterly level, M&A exits steadily declined over the course of 2024, falling from 104 in Q1’24 to 39 in Q4’24. Growing skepticism around environmental, social, and governance (ESG) initiatives could be a contributing factor.

We dive into the trends below.

Climate tech investment activity continues to contract

Global climate tech funding dropped for a second consecutive year in 2024. It fell by 40% YoY, with mega-round funding falling by 47% over the same period.

The funding slowdown played out differently across the globe. US climate tech showed resilience YoY with relatively steady funding despite fewer deals. Meanwhile, other countries saw steep declines in climate tech dollars, with China experiencing the sharpest drop (-66% YoY).

Amid the overall funding decline, climate tech still saw several notable mega-rounds. This included deals in Q4’24 for companies modernizing the power grid:

- Crusoe secured $600M at a $2.8B valuation to support its efforts to use waste natural gas to power large-scale data centers

- X-energy received $500M as it works to build small modular reactors (SMRs) capable of generating more than 5 gigawatts of electricity by 2039

- Form Energy secured $405M to accelerate production of its iron-air batteries capable of 100-hour energy storage

Notably, some of these deals drew participation from big tech companies racing to secure clean energy for computing infrastructure. For example, Amazon (via the Climate Pledge Fund) invested in X-energy’s nuclear development, and Nvidia invested in Crusoe’s sustainable computing infrastructure, reflecting big tech’s interest in solutions that can help meet rising AI data center demands.

Grid tech and nuclear are gaining momentum to meet AI’s energy needs

Comparing median CB Insights Mosaic scores (a measure of private tech company health and growth potential on a 0–1,000 scale) for climate tech companies that raised equity funding in 2024 reveals the most promising markets in climate tech.

Grid tech and nuclear markets — covering technologies directly integrated into and operated by utilities to enhance power system reliability, flexibility, and clean energy integration — dominate the top 10 climate tech markets by median Mosaic score, highlighting their growth potential.

Surging energy demand from AI data centers is in part responsible for these markets’ momentum. For example, nuclear fusion and small modular reactors could provide continuous clean power generation, grid storage enables reliable renewable energy delivery, and virtual power plants help optimize massive power loads.

Electric vehicle technology sees record pullback in deals

Electric vehicle tech deals experienced their steepest decline on record in 2024, with deal count plunging 61% YoY to 243.

High-profile bankruptcies underscored the sector’s capital-intensive manufacturing challenges in 2024. Battery manufacturer Northvolt filed for bankruptcy a year after raising $1.2B, as it struggled to scale production efficiently. Electric van maker Arrival — which went public in 2021 at a $13B valuation — also filed for bankruptcy last year amid mounting production costs and the inability to raise funding.

Even the auto industry’s most prominent EV champions scaled back their electric ambitions throughout the year:

- GM delayed its Orion Assembly EV truck plant by 6 months and cut 2024 EV targets by 17%

- Toyota postponed US EV production to 2026

- Ford canceled plans to produce an all-electric three-row SUV, pivoting to a hybrid approach instead

- Volvo dropped its 2030 all-electric goal

Climate tech M&A exits decline once again

In 2024, climate tech M&A exits fell by 25% YoY to hit 284 — the lowest count since 2020.

At the quarterly level, M&A exits steadily declined over the course of 2024, falling from 104 in Q1’24 to 39 in Q4’24.

The decline in M&A activity coincided with key changes in market conditions, including the rise of economic headwinds, political uncertainty, and growing skepticism around environmental, social, and governance (ESG) initiatives.

For example, ESG tech markets collectively saw equity funding decline 54% YoY in 2024. On the corporate side, mentions of ESG in earnings calls have trended down since peaking in Q1’22.

As skepticism toward ESG initiatives grows, some companies appear to be placing lower priority on climate tech acquisitions that were previously considered strategic imperatives.

MORE CLIMATE TECH RESEARCH FROM CB INSIGHTS

- Data centers are reshaping nuclear development, driving billions in new power infrastructure investment

- Why fleet management leaders are racing to acquire next-gen telematics capabilities — and which M&A targets could be next

- The AI data center value chain: 12 high-momentum technologies powering the future of AI

- The top 25 utility companies by AI readiness

- Big Tech in Energy: How Amazon, Google, Microsoft, & Nvidia are advancing the global energy transition

- Sodium-ion batteries are poised for a breakout moment — energy players should prepare

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

The post State of Climate Tech 2024 Report appeared first on CB Insights Research.

]]>The post State of CVC 2024 Report appeared first on CB Insights Research.

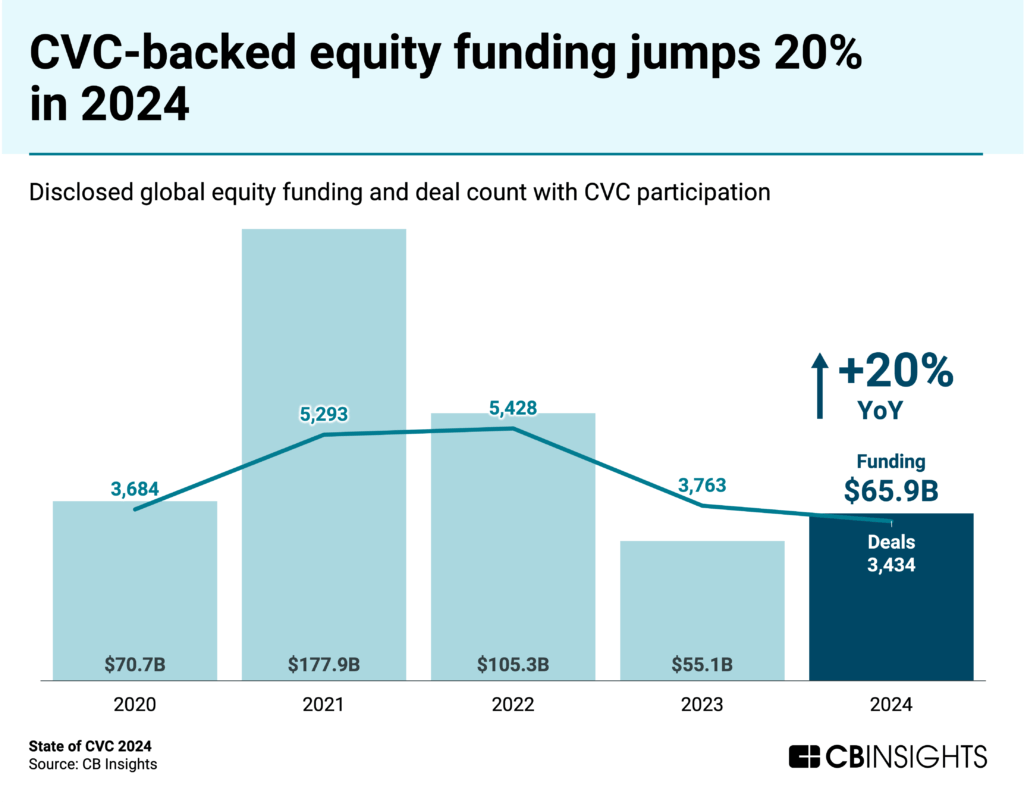

]]>However, global CVC deal count dropped to its lowest level since 2018 as CVCs become more selective.

Download the full report to access comprehensive data and charts on the evolving state of CVC across sectors, geographies, and more.

Key takeaways from the report include:

- CVC-backed funding grows, deal activity slows. Global CVC-backed funding increased 20% YoY to $65.9B, but deal count fell to 3,434, the lowest level since 2018. All major regions saw deal volume declines, with Europe dropping the most at 10% YoY.

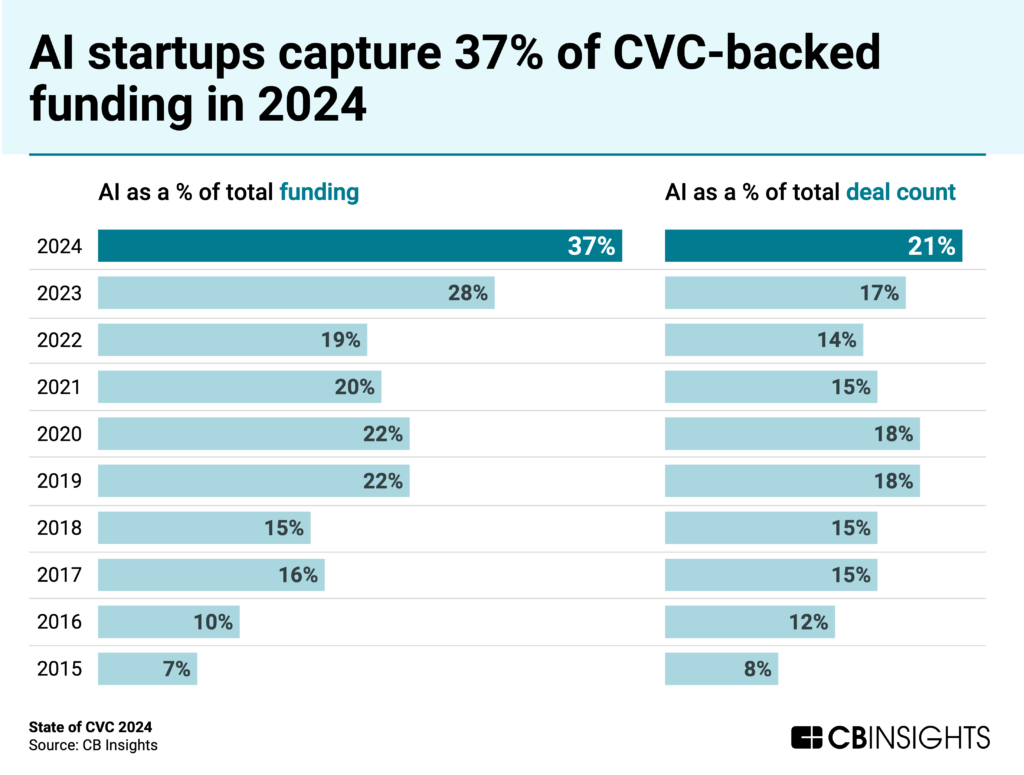

- CVCs are all in on AI. AI startups captured 37% of CVC-backed funding and 21% of deals in 2024 — both record highs. Counter to the broader decline in deals, CVCs ratcheted up AI dealmaking by 13% YoY as they race to secure footholds in the space before competitors gain an insurmountable edge.

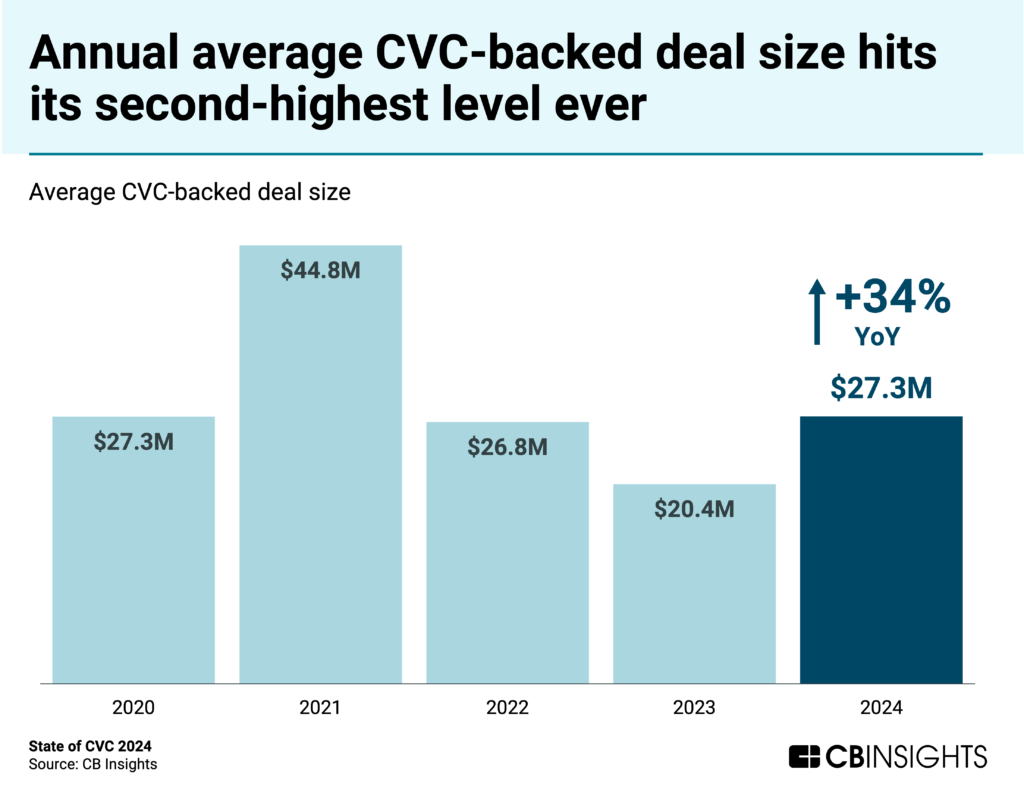

- The flight to quality continues. Among deals with CVC participation, the annual average deal size hit $27.3M in 2024, tied for the second highest ever. Amid fewer deals, CVCs are increasingly aggressive when they do decide to invest.

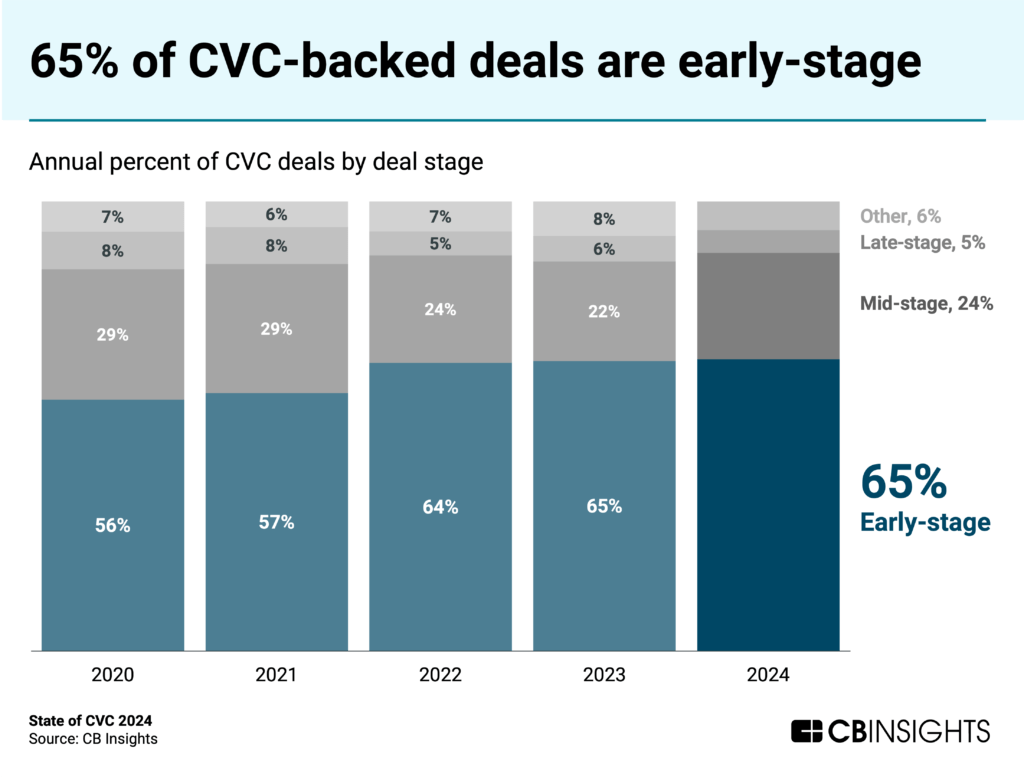

- Early-stage deals dominate. Early-stage rounds comprised 65% of 2024 CVC-backed deals, tied for the highest share in over a decade. Biotech startups made up half of the top 20 early-stage deals.

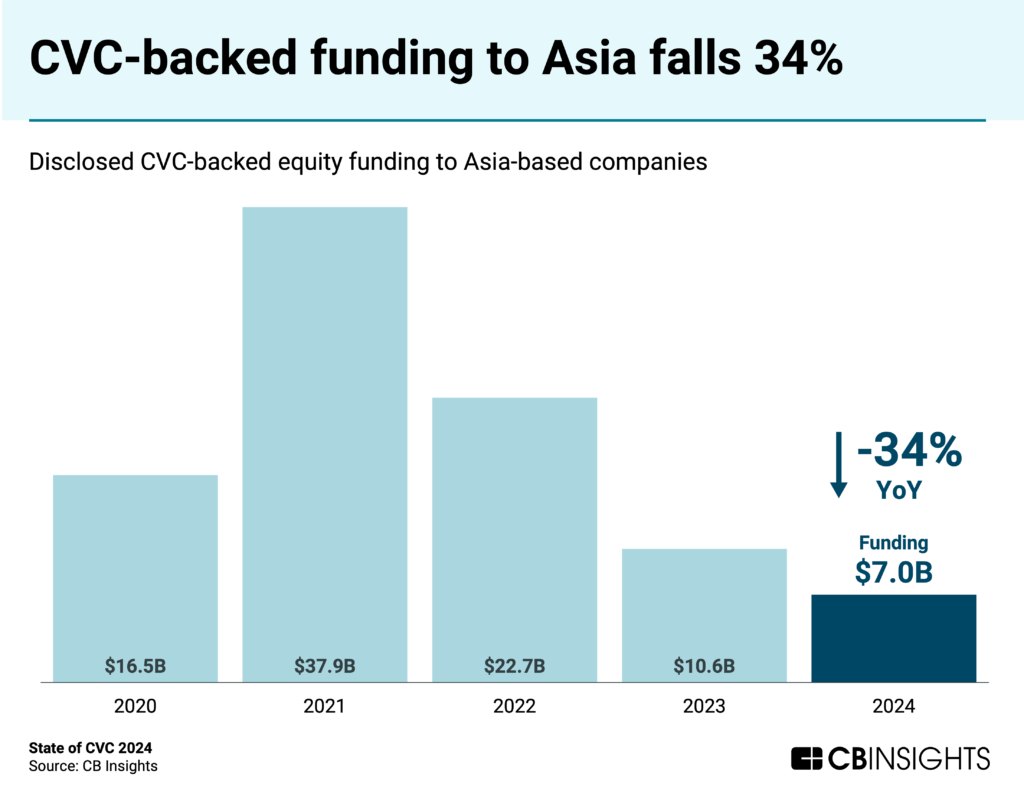

- CVC-backed funding plummets in Asia. In 2024, Asia’s CVC-backed funding dropped 34% YoY to $7B — the lowest level since 2016. China is leading the decline, with no quarter in 2024 exceeding $0.5B in funding. CVCs remain wary of investing in the country’s private sector.

We dive into the trends below.

CVC-backed funding grows, deal activity slows

Global CVC-backed funding reached $65.9B, a 20% YoY increase. The US was the main driver, increasing 39% YoY to $42.8B. Europe also saw CVC-backed funding grow 18% to $12.3B, while Asia declined 34% to $7B.

$100M+ mega-rounds also contributed to the rise, ticking up 21% YoY to 141 deals worth over $32B in funding.

Meanwhile, deal count continued its decline, as both annual (3,434 in 2024) and quarterly (806 in Q4’24) totals reached their lowest levels in 6 years.

Annual deal volume fell by at least 6% YoY across each major region — the US, Asia, and Europe — with Europe experiencing the largest decline at 10%.

However, Japan-based CVC deal volume remains near peak levels, suggesting a more resilient CVC culture compared to other nations. Two of the three most active CVCs in Q4’24 are based in Japan: Mitsubishi UFJ Capital (21 company investments) and SMBC Venture Capital (15).

CVCs are all in on AI

AI is driving CVC investment activity, much like the broader venture landscape. In 2024, AI startups captured 37% of CVC-backed funding and 21% of deals, both record highs.

In Q4’24, the biggest CVC-backed rounds went primarily to AI companies. These include:

- AI search startup Perplexity’s $500M Series C, backed by Nvidia’s NVentures

- Coding AI copilot Poolside’s $500M Series B, backed by the venture arms for Citigroup, HSBC, Capital One, LG, eBay, and Nvidia

- AI computing processor developer Lightmatter’s $400M Series D, backed by GV

CVCs are also investing in the energy companies powering the AI boom, such as Intersect Power, which raised the largest round at $800M (backed by GV).

Expect the trend to continue into 2025, as emerging AI markets mature further, such as AI agents & copilots for enterprise and industrial use cases; AI solutions for e-commerce, finance, and defense; and the computing hardware necessary to power these technologies.

The flight to quality continues

In 2024, the annual average deal size with CVC participation reached $27.3M, a 34% YoY increase and tied for the second highest level on record, exceeded only by the low-interest-rate environment of 2021.

Median deal size also increased, though only by 8% to $8.6M.

Even though the number of CVC-backed deals declined in 2024, the increase in average annual deal size reflects a focus on companies with strong growth prospects. CVCs are prioritizing quality and committing more funds to a select group of high-potential investments.

Early-stage deals dominate

Early-stage rounds (seed/angel and Series A) made up 65% of CVC-backed deals in 2024, tied for the highest recorded level in more than a decade.

In Q4’24, biotech companies were the early-stage fundraising leaders, accounting for 10 of the 20 largest early-stage deals. Biotech players City Therapeutics, Axonis, and Trace Neuroscience all raised $100M+ Series A rounds, with City Therapeutics and Axonis notably receiving investment from the venture arms of Regeneron and Merck, respectively.

Among all early-stage CVC-backed companies, the largest round went to Physical Intelligence, a startup focused on using AI to improve robots and other devices. Physical Intelligence raised a $400M Series A with investment from OpenAI Startup Fund.

CVC-backed funding plummets in Asia

Asia’s CVC-backed funding continued its downward trend in 2024, decreasing 34% YoY to $7B.

China was the main driver, with CVC-backed funding coming in at $0.5B or less every quarter in 2024. CVCs remain wary of investing in startups in the nation, which faces a variety of economic challenges, including a prolonged real estate slump, cautious consumer spending, strained government finances, and weakened private sector activity amid policy crackdowns.

In Japan, on the other hand, CVC activity remains robust. In 2024, funding with CVC participation ($1.7B) remained on par with the year prior, while deals (502) actually increased by 11%.

MORE VENTURE RESEARCH FROM CB INSIGHTS

The post State of CVC 2024 Report appeared first on CB Insights Research.

]]>The post State of AI Report: 6 trends shaping the landscape in 2025 appeared first on CB Insights Research.

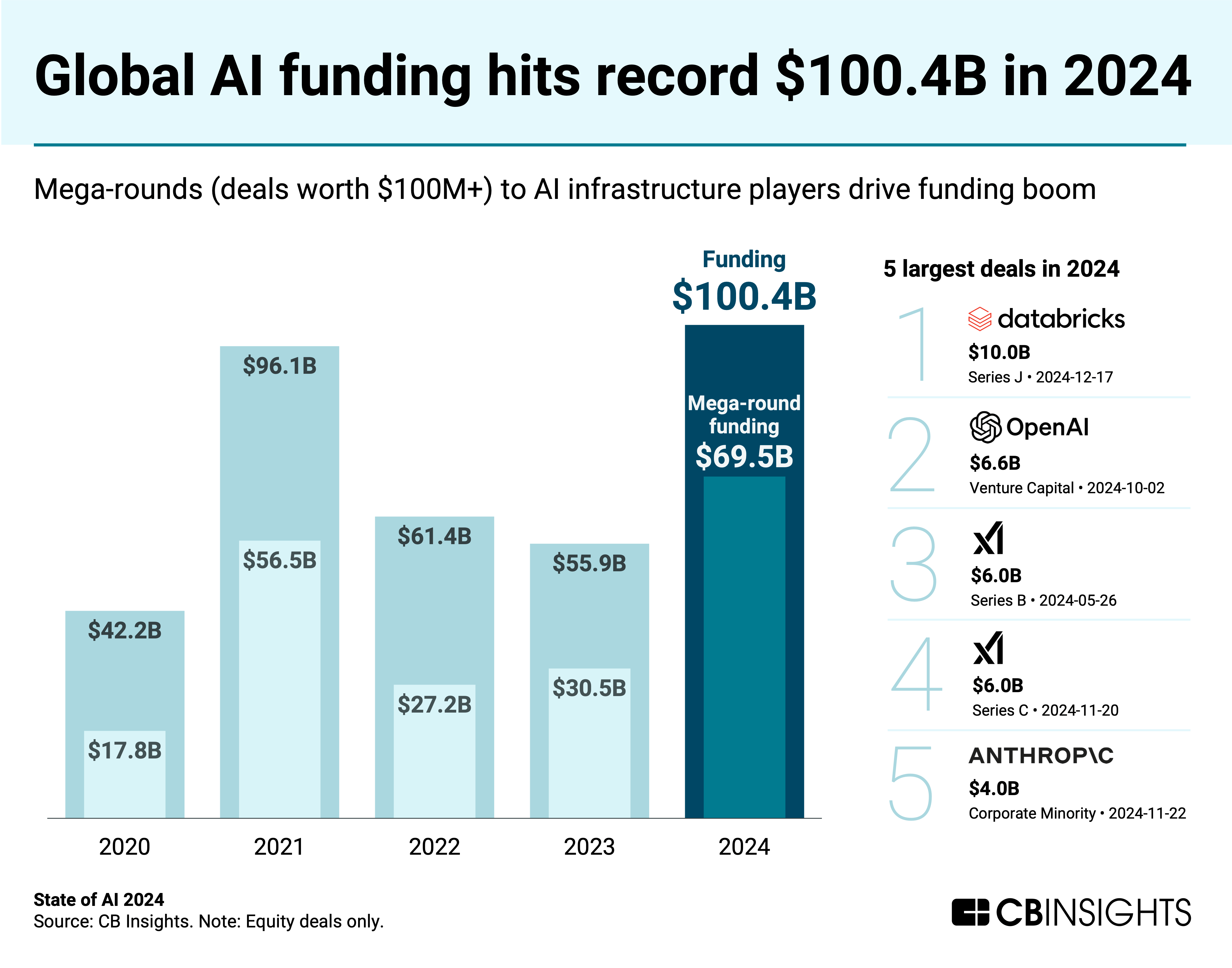

]]>Venture funding surged past the $100B mark for the first time as AI infrastructure players pulled in billion-dollar investments. A wave of M&A deals and rapidly scaling AI unicorns further underscored the tech’s momentum.

Download the full report to access comprehensive data and charts on the evolving state of AI across exits, top investors, geographies, and more.

Key takeaways include:

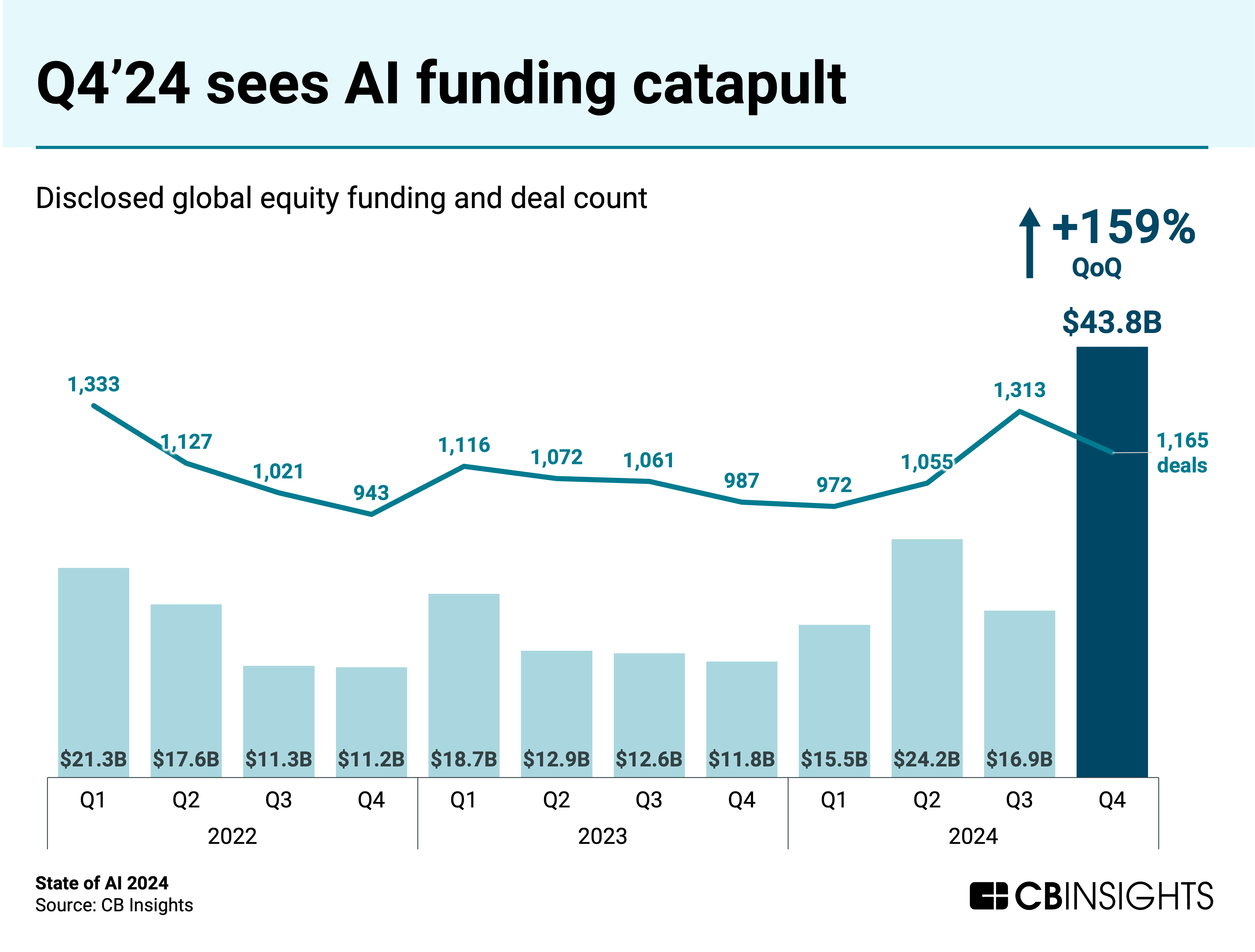

- Massive deals drive AI funding boom. AI funding hit a record $100.4B in 2024, with mega-rounds accounting for the largest share of funding we’ve tracked to date (69%) — reflecting the high costs of AI development. Quarterly funding surged to $43.8B in Q4’24, driven by billion-dollar investments in model and infrastructure players. At the same time, nearly 3 in 4 AI deals (74%) remain early-stage as investors look to get in on the ground floor of the AI opportunity.

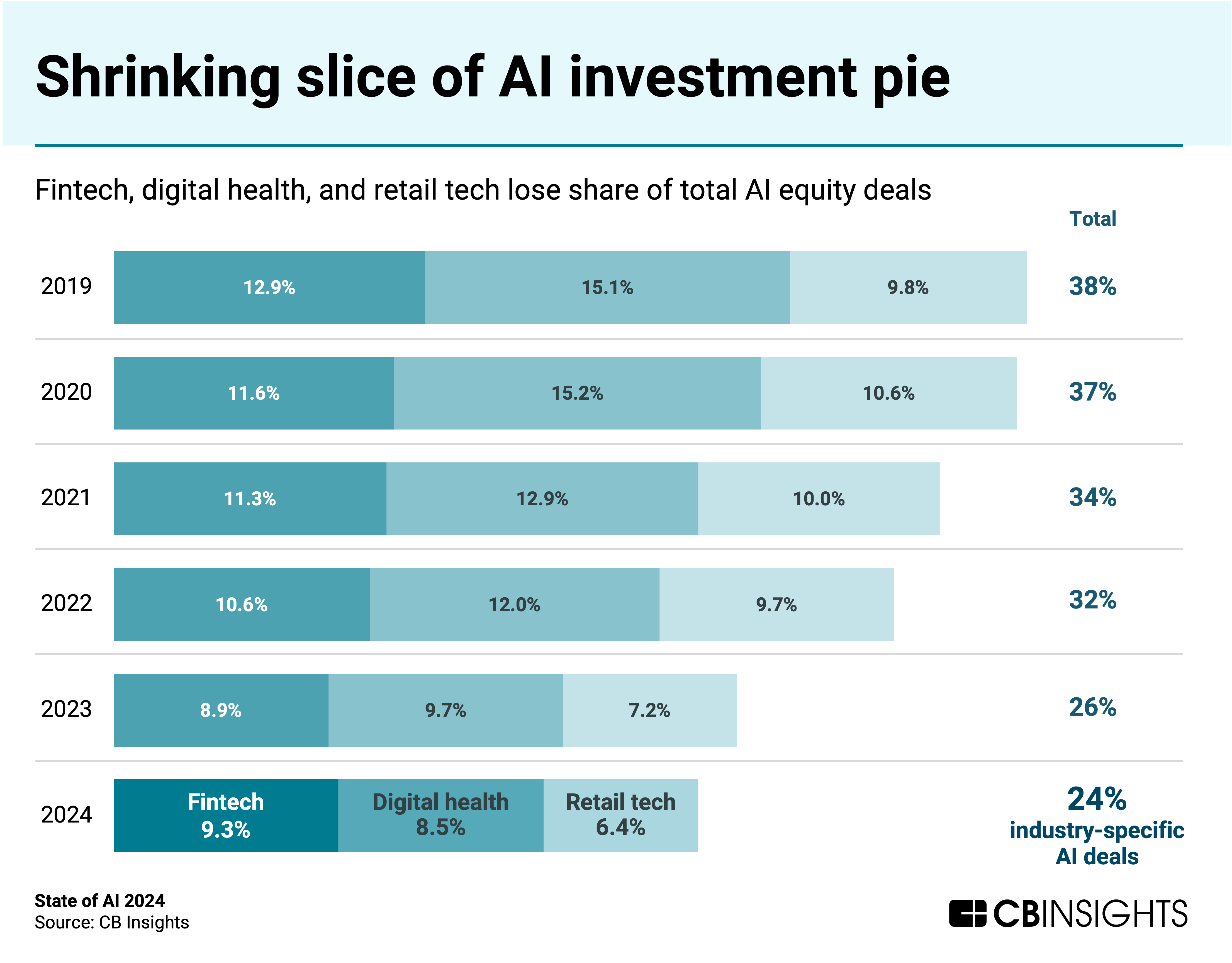

- Industry tech sectors lose ground in AI deals. Vertical tech areas like fintech, digital health, and retail tech are securing a smaller percentage of overall AI deals (declining from a collective 38% in 2019 to 24% in 2024). The data suggests that companies focused on infrastructure and horizontal AI applications are drawing greater investor interest amid generative AI’s rise.

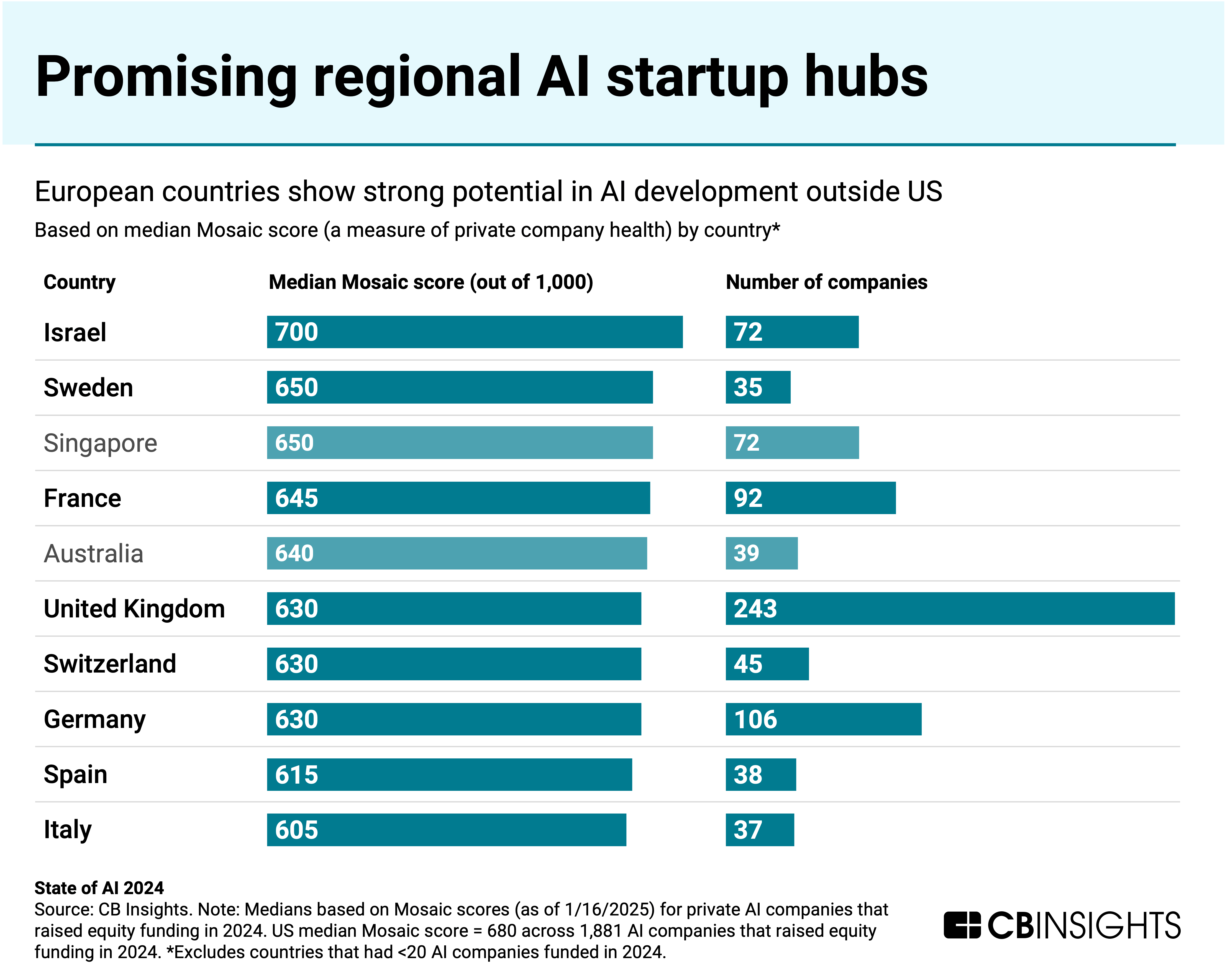

- Outside of the US, Europe fields high-potential AI startup regions. While the US dominated AI funding (76%) and deals (49%) in 2024, countries in Europe show strong potential in AI development based on CB Insights Mosaic startup health scores. Israel leads with the highest median Mosaic score (700) among AI companies raising funding.

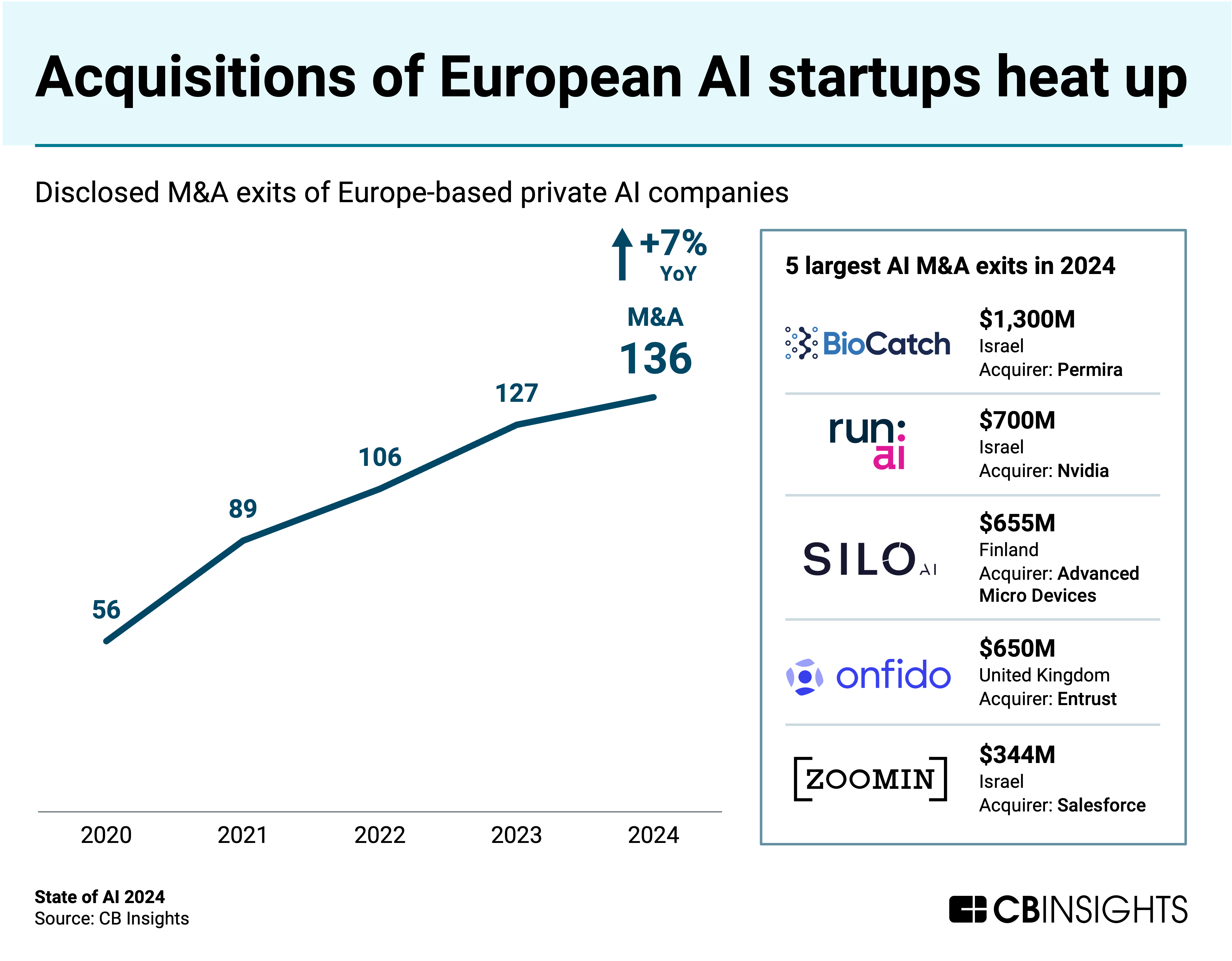

- AI M&A activity maintains momentum. The AI acquisition wave remained strong in 2024, with 384 exits nearly matching 2023’s record of 397. Europe-based startups represented over a third of M&A activity, cementing a 4-year streak of rising acquisitions among the region’s startups.

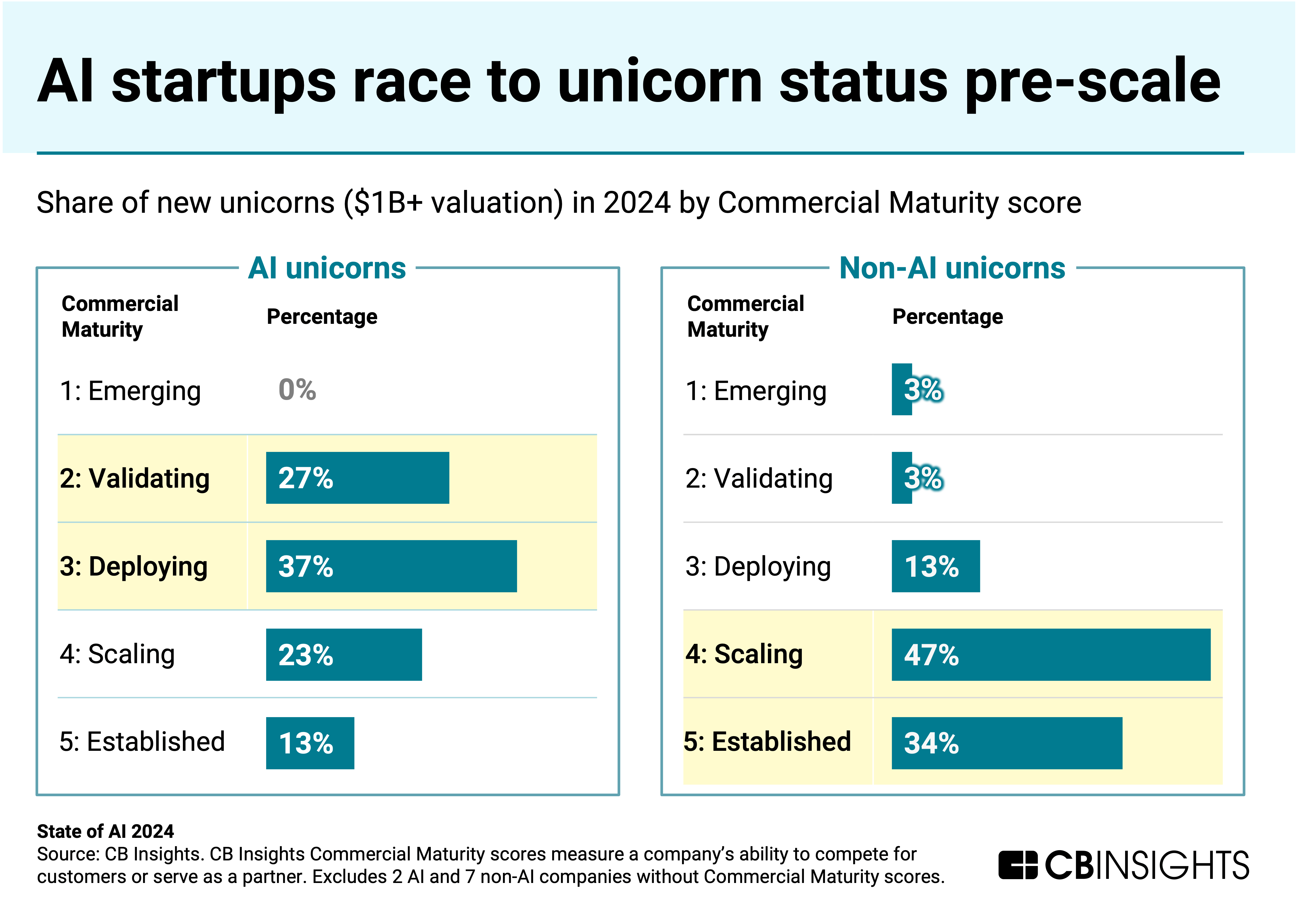

- AI startups race to $1B+ valuations despite early market maturity. The 32 new AI unicorns in 2024 represented nearly half of all new unicorns. However, AI unicorns haven’t built as robust of a commercial network as non-AI unicorns, per CB Insights Commercial Maturity scores, indicating their valuations are based more on potential than proven business models at this stage.

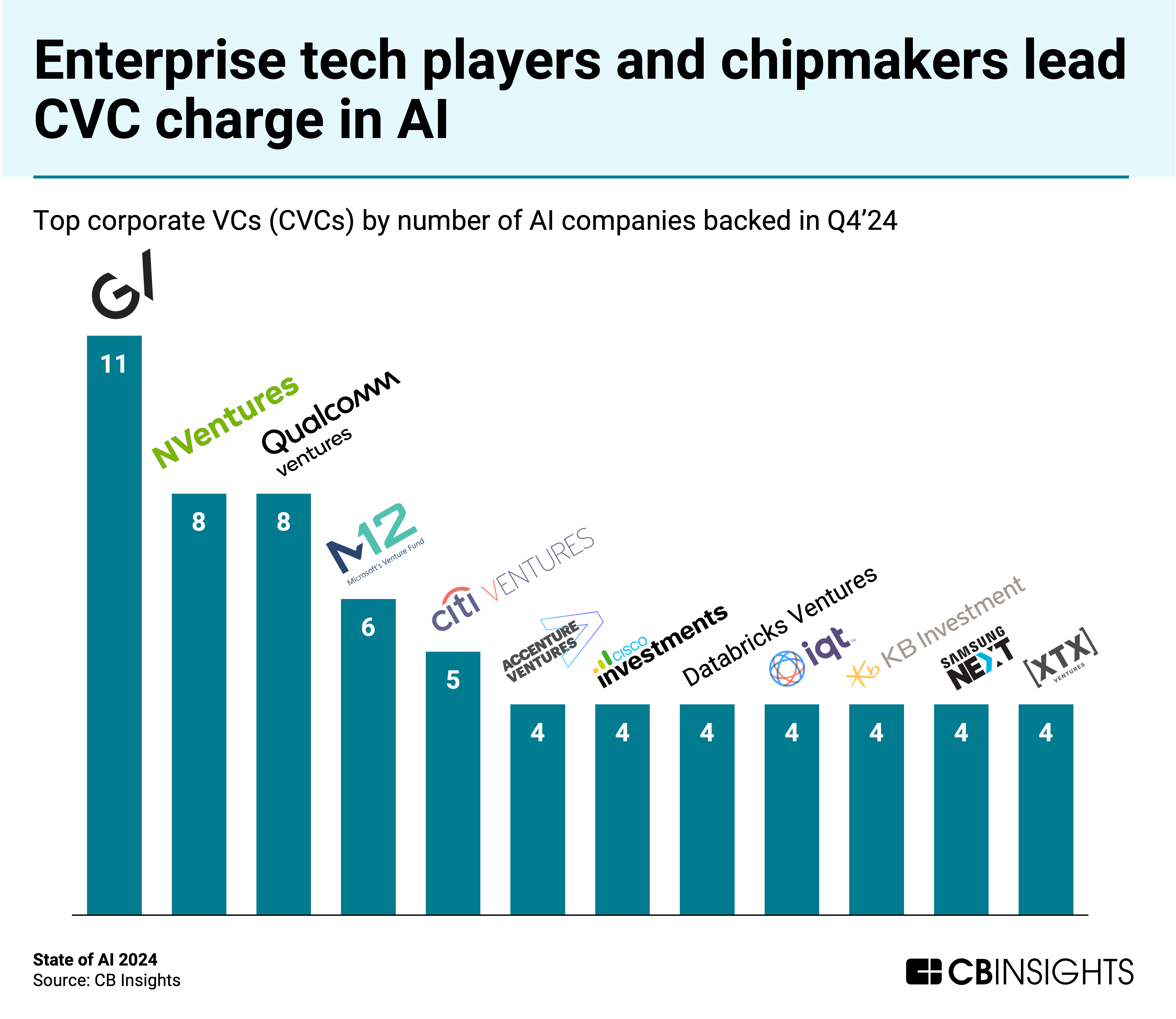

- Tech leaders embed themselves deeper in the AI ecosystem. Major tech companies and chipmakers led corporate VC activity in AI during Q4’24, with Google (GV), Nvidia (NVentures), Qualcomm (Qualcomm Ventures), and Microsoft (M12) being the most active investors. This reflects the strategic importance of securing access to promising startups while providing them with essential technical infrastructure.

We dive into the trends below.

For more on key shifts in the AI landscape in 2025, check out this report on the implications of DeepSeek’s rise.

Massive deals drive AI funding boom

Globally, private AI companies raised a record $100.4B in 2024. At the quarterly level, funding soared to a record $43.8B in Q4’24, or over 2.5x the prior quarter’s total.

The funding increase is largely explained by a wave of massive deals: mega-rounds ($100M+ deals) accounted for 80% of Q4’24 dollars and 69% of AI funding in 2024 overall.

The year featured 13 $1B+ deals, the majority of which went to AI model and infrastructure players. OpenAI, xAI, and Anthropic raised 4 out of the 5 largest rounds in 2024 as they burned through cash to fund the development of frontier models.

Overall, the concentration of funding in mega-rounds reflects the high costs of AI development across hardware, staffing, and energy needs — and widespread investor enthusiasm around the AI opportunity.

But that opportunity isn’t limited to the largest players: nearly 3 in 4 AI deals (74%) were early-stage in 2024. The share of early-stage AI deals has trended upward since 2021 (67%) as investors look to ride the next major wave of value creation in tech.

Industry tech sectors lose ground in AI deals

Major tech sectors — fintech, digital health, and retail tech — are making up a smaller percentage of AI deals.

While the overall annual AI deal count has stayed steady above 4,000 since 2021, dealmaking in sectors like digital health and fintech has declined to multi-year lows. So, even as AI companies make up a greater share of the deals that do happen in these industries, the gains haven’t been enough to register in the broader AI landscape.

The data suggests that, amid generative AI’s ascendancy, AI companies targeting infrastructure and horizontal applications are drawing a greater share of deals.

With billions of dollars flowing to the model/infra layer as well, investors appear to be betting that the economic benefits of the latest AI boom will accrue to the builders.

Outside of the US, Europe fields high-potential AI startup regions

Although US-based companies captured 76% of AI funding in 2024, deal activity was more distributed across the globe. US AI startups accounted for 49% of deals, followed by Asia (23.2%) and Europe (22.9%).

Comparing median CB Insights Mosaic scores (a measure of private tech company health and growth potential on a 0–1,000 scale) for AI companies that raised equity funding in 2024 highlights promising regional hubs.

European countries dominate the top 10 countries by Mosaic score (outside of the US). Israel, which has a strong technical talent pool and established startup culture, leads the pack with a median Mosaic score of 700.

Overall activity on the continent is dominated by early-stage deals, which accounted for 81% of deals to Europe-based startups in 2024, a 7-year high.

The European Union indicated in November that scaling startups is a top priority, pointing to the importance of increased late-stage private investment in remaining competitive on the global stage.

AI M&A activity maintains momentum

The AI M&A wave is in full force, with 2024’s 384 exits nearly reaching the previous year’s record-high 397.

Acquisitions of Europe-based startups accounted for over a third of AI M&A activity in 2024. Among the global regions we track, Europe is the only one that has seen annual AI acquisitions climb for 4 consecutive years. Although the US did see a bigger uptick YoY (16%) in 2024, posting 188 deals.

In Europe, UK-based AI startups led activity in 2024, with 32 M&A deals, followed by Germany (18), France (16), and Israel (12).

Major US tech companies, including Nvidia, Advanced Micro Devices, and Salesforce, participated in some of the largest M&A deals of the year as they embedded AI across their offerings.

AI startups race to $1B+ valuations despite early market maturity

AI now dominates new unicorn creation. The 32 new AI unicorns in 2024 accounted for nearly half of all companies passing the $1B+ valuation threshold during the year.

These AI startups are hitting unicorn status with much smaller teams and at much faster rates than non-AI startups: 203 vs. 414 employees at the median, and 2 years vs. 9 years at the median.

These trends reflect the current AI hype — investors are placing big early bets on AI potential. Many of these unicorns are still proving out sustainable revenue models. We can see this clearly in CB Insights Commercial Maturity scores. More than half of the AI unicorns born in 2024 are at the validating/deploying stages of development, while non-AI new unicorns mostly had to get to at least the scaling stage before earning their unicorn status.

Tech leaders embed themselves deeper in the AI ecosystem

In Q4’24, the top corporate VCs in AI (by number of companies backed) were led by a string of notable names: Google (GV), Nvidia (NVentures), Qualcomm (Qualcomm Ventures), and Microsoft (M12).

As enterprises rush to harness AI’s potential, big tech, chipmakers, and other enterprise tech players are building their exposure to promising companies along the AI value chain.

Meanwhile, startups are linking up with these players to not only secure funding for capital-intensive AI development but also access critical cloud infrastructure and chips.

MORE AI RESEARCH FROM CB INSIGHTS

- What DeepSeek’s model releases mean for the future of AI

- Here’s how leading strategy teams are successfully driving generative AI adoption in their organizations

- The foundation model divide: Mapping the future of open vs. closed AI development

- 15 tech trends to watch closely in 2025

- Inside the AI drug discovery arms race: Record M&A activity, a biologics funding spree, and more

- The industrial AI agents & copilots market map

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

The post State of AI Report: 6 trends shaping the landscape in 2025 appeared first on CB Insights Research.

]]>The post Data centers are reshaping nuclear development, driving billions in new power infrastructure investment appeared first on CB Insights Research.

]]>US data center power consumption is projected to triple from 25GW in 2024 to over 80GW by 2030. Between 2023 and 2028, data centers could drive nearly half of US electricity growth.

Tech companies are increasingly exploring nuclear energy as a reliable, carbon-free power source to support AI’s exponential growth.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post Data centers are reshaping nuclear development, driving billions in new power infrastructure investment appeared first on CB Insights Research.

]]>The post Critical infrastructure is under attack: How operational technology (OT) security platforms are helping companies better prepare appeared first on CB Insights Research.

]]>These attacks can inflict damages costing billions of dollars. Since 2017, every critical infrastructure cyberattack causing an estimated $1B+ in damages has affected the healthcare sector in some capacity, highlighting its particular vulnerability to digital threats.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post Critical infrastructure is under attack: How operational technology (OT) security platforms are helping companies better prepare appeared first on CB Insights Research.

]]>The post State of Venture 2024 Report appeared first on CB Insights Research.

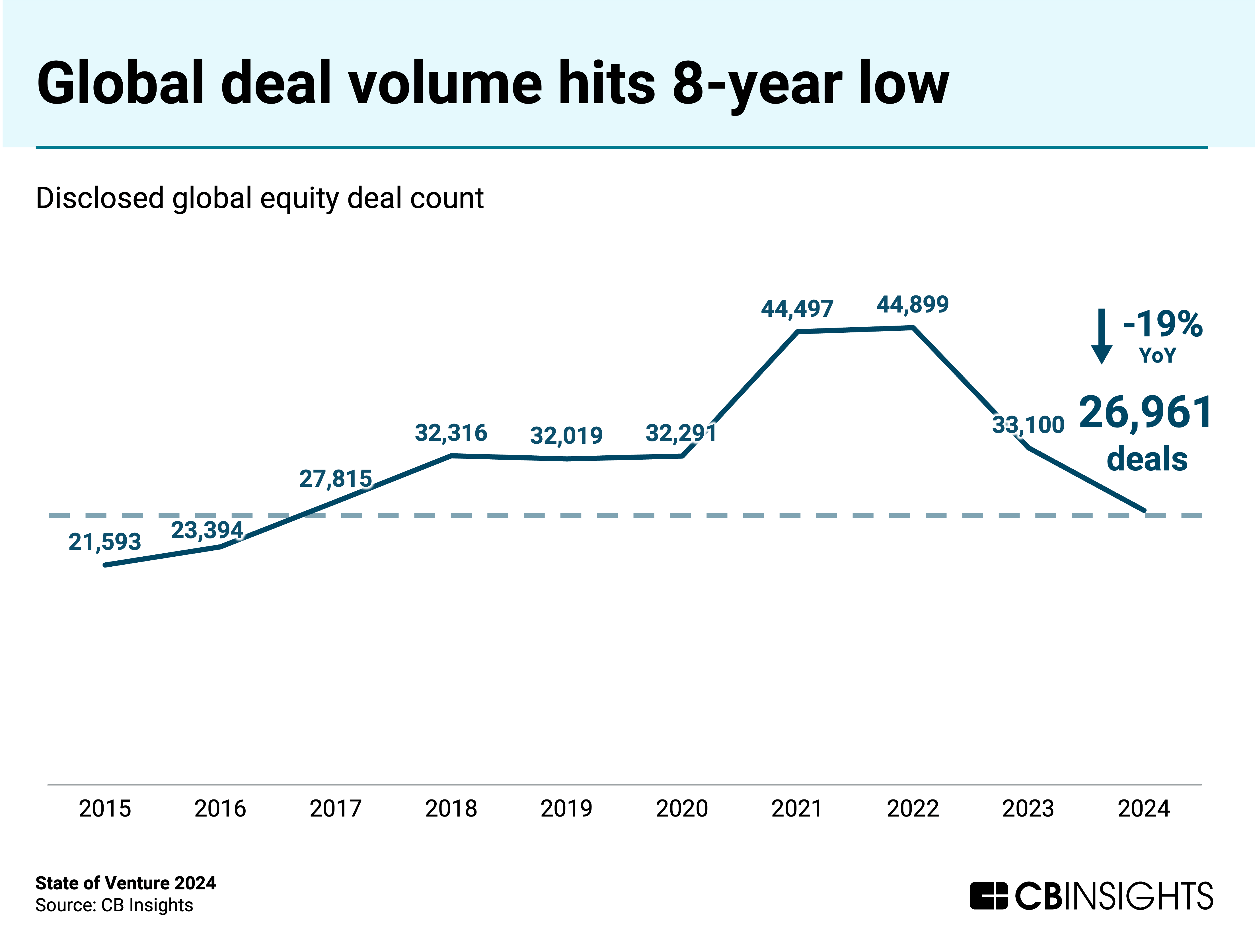

]]>But beyond the momentum building in AI, global deal activity plunged 19% YoY to its lowest level since 2016, creating both challenges and opportunities for investors and corporate strategists.

Download the full report to access comprehensive data and charts on the evolving state of venture across sectors, geographies, and more.

Key takeaways from the report include:

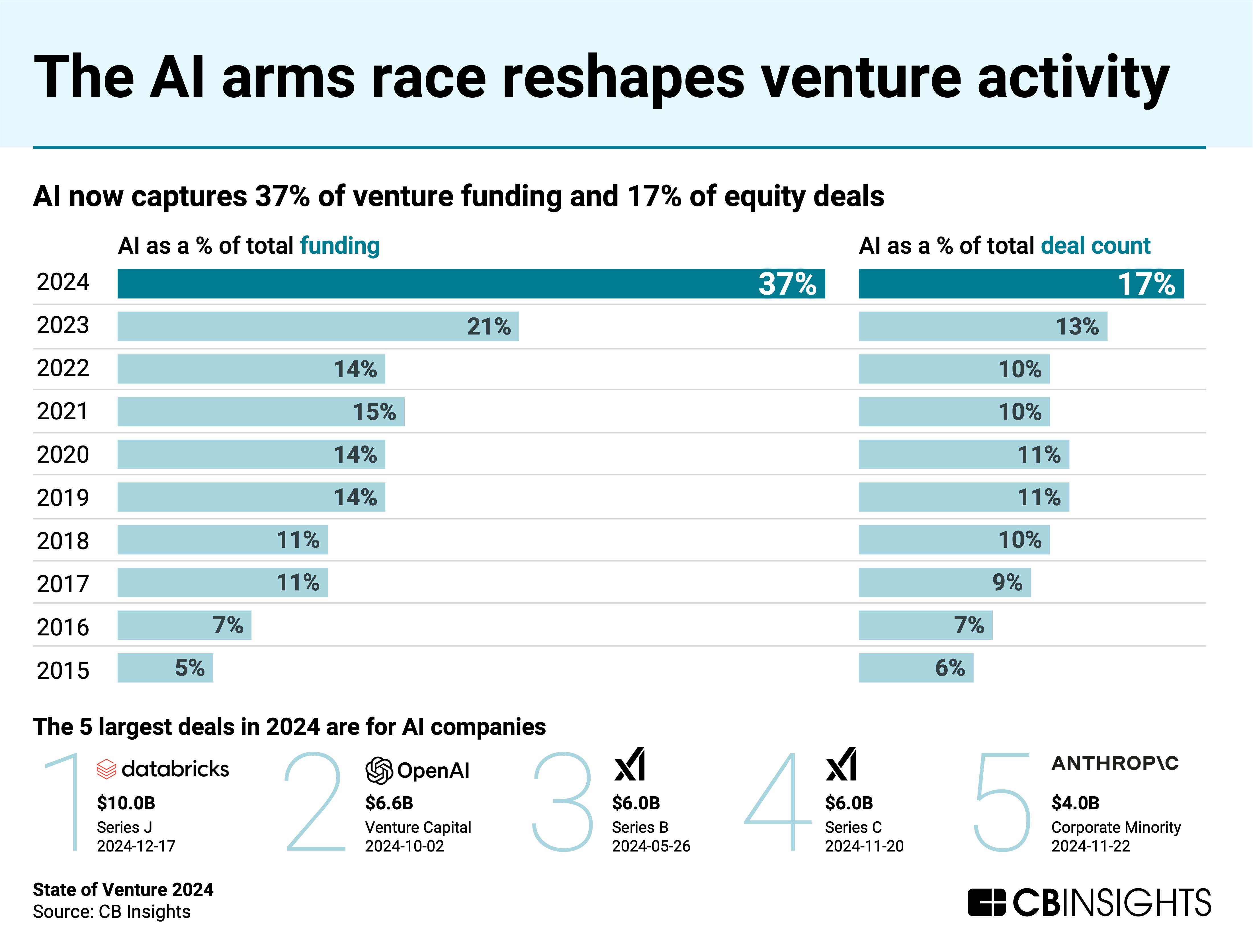

AI is eating VC. In 2024, AI represented 37% of venture funding and 17% of deals — both all-time highs. AI infrastructure players raised all of the top 5 venture deals of the year, with 4 closing in Q4’24 alone — driving a 2-year high in quarterly funding. With nearly 3 in 4 (74%) AI deals being early-stage in 2024, investors are staking out early claims to reap the rewards of the tech’s potential.

Aside from AI, venture dealmaking is in a drought. Globally, deal activity fell 19% YoY to 27K in 2024 — its lowest annual level since 2016. The drop was most pronounced in countries like China (-33% YoY), Canada (-27%), and Germany (-23%). However, several countries in Asia — Japan, India, and South Korea — have bucked the downward trend. Their resilience suggests attractive investment conditions.

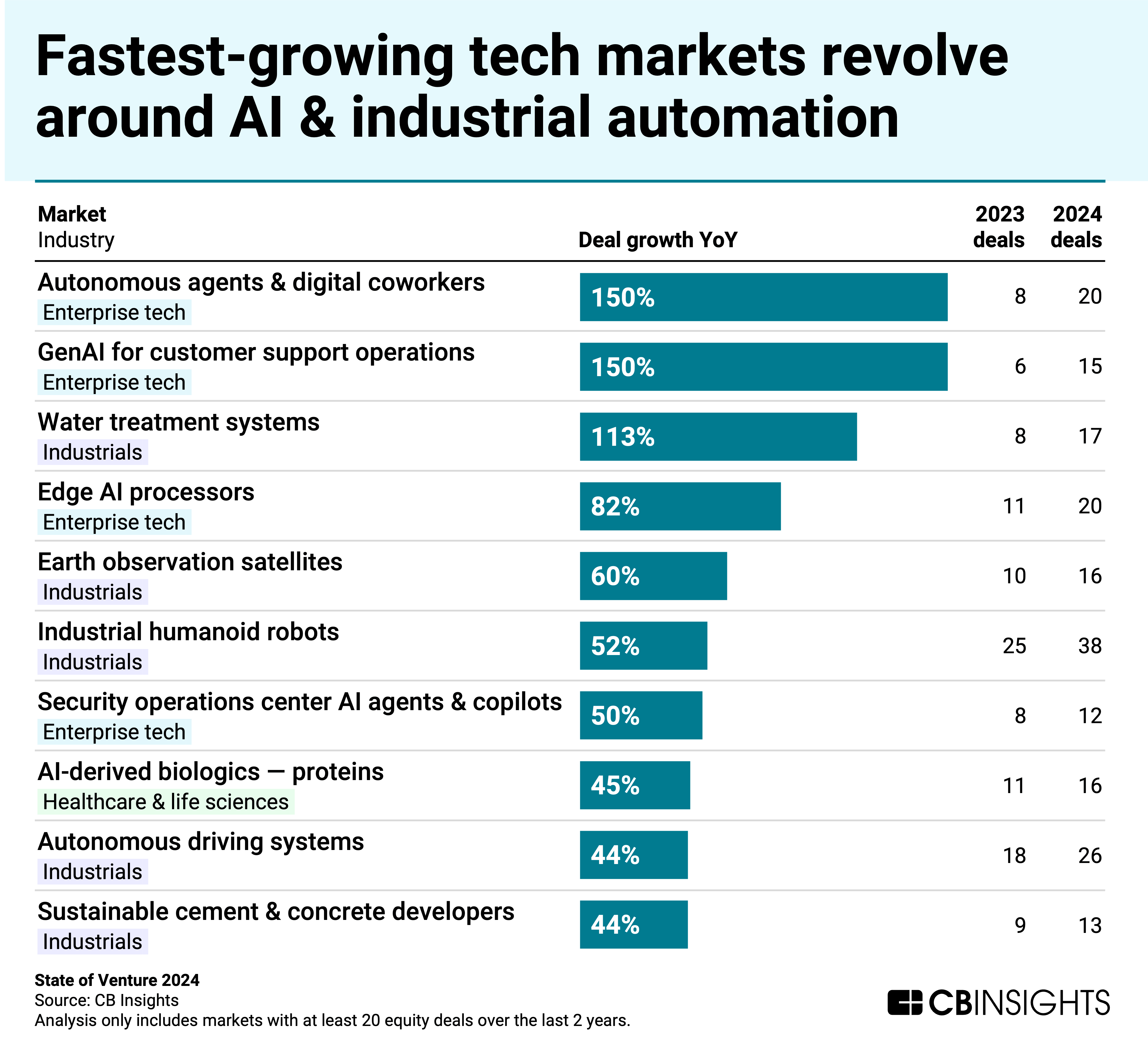

AI and industrial automation are common themes among the fastest-growing tech markets. Out of 1,400+ tech markets that CB Insights tracks, those with the highest rate of YoY deal growth include enterprise AI agents, genAI for customer support, industrial humanoid robots, and autonomous driving systems. Expect these technologies to continue maturing in 2025, increasing their disruptive potential.

Despite market uncertainty, early-stage valuations hit a record-high median of $25M in 2024. Investors are packing into early-stage rounds to ride the next major wave of value creation in tech, likely drawn by startups’ ability to now build products with less capital and fewer people thanks to AI tools and infrastructure. However, early-stage startups could face a reality check when they try to raise later-stage rounds if they have yet to prove they can sustain growth. Although mid- and late-stage deal valuations rebounded slightly vs. 2023, they remain muted compared to 2021 and 2022.

IPO timelines get delayed. From first funding to IPO, VC-backed companies that went public in 2024 waited a median of 7.5 years — 2 years longer than in 2022. Amid unfavorable market conditions, some late-stage players like Stripe and Databricks have resorted to raising additional equity funding or selling private shares in lieu of going public. This allows them to create liquidity for early investors and employees when the path to a public debut is rocky.

We dive into each trend below.

AI is eating VC

The 5 largest deals of the year all went to AI model and infrastructure players (led by Databricks’ $10B Series J, followed by a $6.6B round for OpenAI, two $6B rounds for xAI, and a $4B round for Anthropic). But the activity isn’t limited to the largest, most well-resourced AI players.

Across the board, AI companies are capturing a higher share of deal volume — nearly one in 5 deals (17%) now go to AI companies, almost triple the share from 2015 (6%). AI deal volume remained above 4,000 for the fourth year in a row.

The boom is providing tailwinds for every stage of the startup lifecycle, from early-stage companies — which take 3 out of 4 deals in AI — to startup exits. The AI M&A wave is in full force, with 2024’s 384 exits nearly rivaling the previous year’s record-high 397.

This trend will continue in 2025 as incumbents look to grab AI tech and talent and build end-to-end AI offerings. Get the full breakdown of what AI M&A means for corporate strategy in our Tech Trends 2025 report.

In Q4’24, the AI boom helped fuel a substantial rebound in global funding. The quarter’s funding tally reached $86.2B — a 2-year high, and an increase of 53% quarter-over-quarter (QoQ).

60% of that quarterly total, or $52B, came from mega-rounds (deals worth $100M+) — nearly tying Q1’21 (61%) for the highest share ever across venture.

At the same time, quarterly deal volume steadily declined throughout 2024, including slipping below 6,000 in Q4’24 for the first time since 2016.

Aside from AI, venture dealmaking is in a drought

Despite AI’s surge, most venture sectors face their worst dealmaking drought in nearly a decade, forcing investors to adjust their strategies. Many investors are taking a more selective and risk-off approach right now as they wait out macroeconomic volatility and geopolitical tensions.

Among major dealmaking countries and regions (those seeing 500+ deals per year), the slump was most pronounced in China (-33% YoY drop in deals), Canada (-27%), and Germany (-23%).

However, several countries in Asia bucked the trend and notched slim YoY gains: Japan (+2%), India (+1%), and South Korea (+1%). These countries have invested heavily in developing their startup ecosystems and may be benefiting indirectly from investors diverting funds away from China.

AI and industrial automation are common themes among the fastest-growing tech markets

AI and industrial automation are at the center of some of the fastest-growing markets in tech.

We filtered CB Insights’ 1,400+ tech markets for those with at least 20 equity deals over the last 2 years, then singled out those with the strongest deal growth YoY in 2024.

The enterprise tech and industrials sectors dominate, comprising 9 of the top 10 tech markets. Advancements in generative AI are fueling much of the activity in areas like humanoid robots and autonomous driving systems. Investors are also backing tech companies improving industrial processes like water treatment and purification, with deals to the market more than doubling YoY.

The enterprise tech and industrials sectors are also seeing a wave of hiring, as they lead in YoY headcount growth among all sectors. Industrials markets saw an average of 11% headcount growth last year, followed by enterprise tech markets with 10%.

Financial services and the consumer & retail industries are noticeably absent from the top 10 fastest-growing markets. Given the tough venture landscape, emerging technologies in these areas face an uphill battle.

Early-stage deals are showing strength

Globally, early-stage dealmaking represents one of the most vibrant areas of venture right now, with median deal size and valuation reaching all-time highs in 2024.

The seed/angel and Series A stages remain resilient despite the broader downturn, in part because investors view them as a safe haven to ride out late-stage challenges like constricted exit opportunities and capital constraints. Deal sizes and valuations for the mid- and late stages rebounded slightly vs. 2023 but were muted when compared to the boom times of 2021 and 2022.

Corporate strategy and development teams seeking out early-stage opportunities can see 900+ high-potential startups here. To identify these players, we looked at the nearly 11,000 VC-backed startups that raised seed or Series A rounds in 2024, then filtered for those with the healthiest businesses (600+ Mosaic score) and strongest management teams (600+ Management Mosaic score).

IPO timelines get delayed

Most tech firms continue to shirk the IPO market. Some are still waiting for macroeconomic conditions to stabilize, while others prefer to focus on topline growth without having to deal with the financial scrutiny that comes with being a public company.

This is pushing back the timelines for IPO-ready companies even further.

From first funding to IPO, VC-backed companies that went public in 2024 waited a median of 7.5 years — 2 years longer than in 2022.

While Q4’24 saw an uptick in global IPOs, activity remains down vs. historical levels. In the current climate, many late-stage startups will likely opt instead to raise more private funding to sustain operations and pay out employees or early investors.

Related resources from CB Insights:

- Live briefing on venture trends for 2025

- All AI research from CBI

- 15 tech trends to watch closely in 2025

- Game Changers 2025: 9 technologies that will change the world

- $1B+ Market Map: The world’s 1,249 unicorn companies in one infographic

The post State of Venture 2024 Report appeared first on CB Insights Research.

]]>The post The industrial AI agents & copilots market map appeared first on CB Insights Research.

]]>While AI copilots — which work alongside humans to speed up their workflows — currently comprise 90% of company activity, the tech will serve as a stepping stone to more autonomous solutions in the coming years. Eventually, AI agents could manage entire industrial processes, shifting human roles from operational tasks to strategic oversight.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post The industrial AI agents & copilots market map appeared first on CB Insights Research.

]]>The post $1B+ Market Map: The world’s 1,249 unicorn companies in one infographic appeared first on CB Insights Research.

]]>But the overall slowdown only tells part of the story. Within this smaller pool of new billion-dollar companies, AI startups have come to dominate, comprising 44% of new unicorns this year — a 7x increase in share over the last decade.

Here’s what today’s unicorn landscape signals about the future of tech:

- AI dominates new unicorn creation — 2024 has seen 72 companies become unicorns, and 32 of these (44%) are AI startups. These AI players are reaching unicorn status far faster (median of 2 years) than non-AI companies (median of 9 years). As AI capabilities advance at a rapid pace — across domains from intelligent robotics to coding AI agents — corporations that delay AI adoption risk falling behind their competitors.

- Valuations are under pressure — Over one-third of the 1,200+ current unicorns haven’t raised funding since 2021, and over 100 of these companies were last valued at exactly $1B — meaning a down round would take their unicorn status away altogether. These represent potentially distressed assets that cash-rich incumbents and corporate development teams would want to snap up.

- Next in line for an exit — Among today’s unicorns, 110 stand out with IPO probabilities above 20% (anywhere from 31x to 64x that of the average company we track). Another 25 have equally high M&A probability scores, making them prime acquisition targets for incumbents looking to expand their tech and market reach.

Market map of billion-dollar startups

On paper, today’s unicorns are collectively worth over $4T.

However, it’s unlikely that many of these 1,200+ companies are worth as much as their latest valuation, given how dramatically the venture landscape has changed since the heady days of 2021/22. Since then, tighter capital markets have applied downward pressure on public and private tech company valuations alike.

Over one-third of current unicorns haven’t raised a funding round since 2021. If they were to raise in today’s climate, they’d likely face a valuation cut. That includes over 100 unicorns that were last valued at exactly $1B — meaning any valuation reduction would strip them of their unicorn status.

With venture funding at its lowest level since 2016/17, unicorns in need of cash are likely considering an exit. Some have been waiting years for the IPO market to open up so they can access capital and compensate employees without further diluting their business. Others will need to accept sales at discounted prices.

Unicorns most likely to exit via IPO or M&A

Per CB Insights’ Exit Probability scores — which measure a company’s likelihood to exit in the next 2 years, based on 70+ data points — a select cohort of unicorns emerges as the most likely candidates for IPO and M&A.

110 unicorns have a 20% or higher chance of IPO’ing in the next 2 years — anywhere from 31x to 64x the likelihood of the average company we track. Recent tech IPOs have performed well relative to the cold snap of 2022/23, particularly for companies benefiting from the AI boom. This will likely open the doors to other IPO hopefuls like Klarna, which is reportedly considering debuting as soon as H1’25.

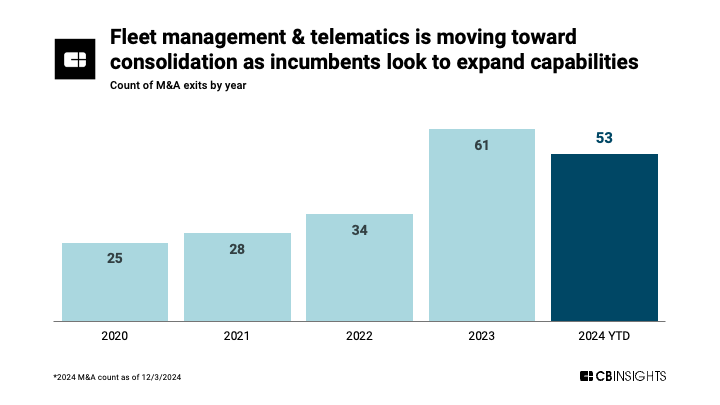

A smaller segment of unicorns has an M&A exit probability of 20%+ (from 2x to 5x the average). This includes unicorns like AI data company Tresata (38% M&A probability) and fleet management & telematics provider Radius (33%), both of which have faced headcount reductions over the last year.

These acquisition targets could offer incumbents a way to quickly add new tech and talent as well as expand their customer base and market reach.

AI has become a unicorn factory