With the rise of EVs and AVs, fleet management solutions are expanding in scope to accommodate blended fleets. We break down what this means for fleet telematics & management companies, identifying who they should have on their radars to build out their capabilities.

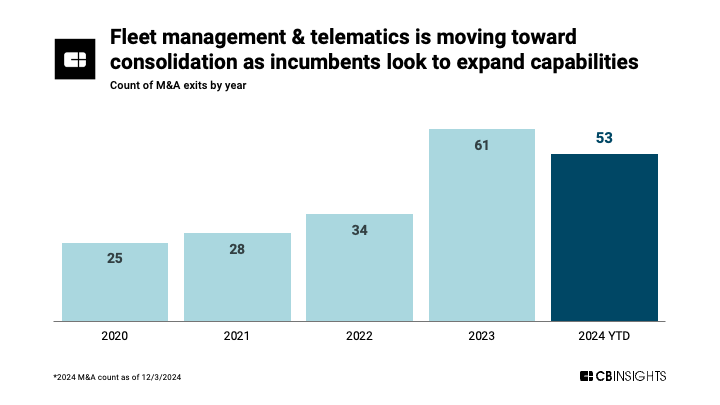

As major fleet owners like Amazon and Walmart invest billions to embrace electric and autonomous vehicles, it’s pushing fleet management leaders to make strategic acquisitions to better serve these blended fleets. In fact, annual M&A exit volume in the fleet management & telematics space has more than doubled since 2020.

Through M&A, leaders like PowerFleet and Element Fleet Management are layering on expanded capabilities that help fleet managers optimize for elements like charging schedules, battery range, autonomous routing efficiency, and maintenance cycles.

Source: CB Insights — fleet management & telematics M&A deals since 2020

In this brief, we use CB Insights data to unpack shifts in the market that fleet management companies can use to get ahead. Key takeaways include:

- Fleet management companies are turning to telematics M&A for growth opportunities. Among this year’s deals, two leading fleet management companies — PowerFleet and Element Fleet Management — have been particularly active, driving 3 strategic acquisitions as they look to expand their user bases and add new capabilities to their software offerings.

- Hardware-free telematics solutions are likely M&A targets for the next wave of consolidation. This tech offers faster deployment and lower costs for managing mixed fleets than hardware-based approaches. Motorq and Volteum stand out as potential acquisition targets due to their strategic business relationships and geographic reach.

Fleet management companies are turning to telematics M&A for growth opportunities

This year, 53 fleet management & telematics companies have exited via M&A, up 112% from 2020 levels. Most notably, established telematics players have used strategic acquisitions to expand their solutions and gain new customers.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.