We examine what’s driving recent investment, partnership, and exit activity in the autonomous driving space to identify leaders and determine the market's direction.

Time has come for transportation and mobility players to revive their autonomous driving strategy and look for partnership and investment opportunities.

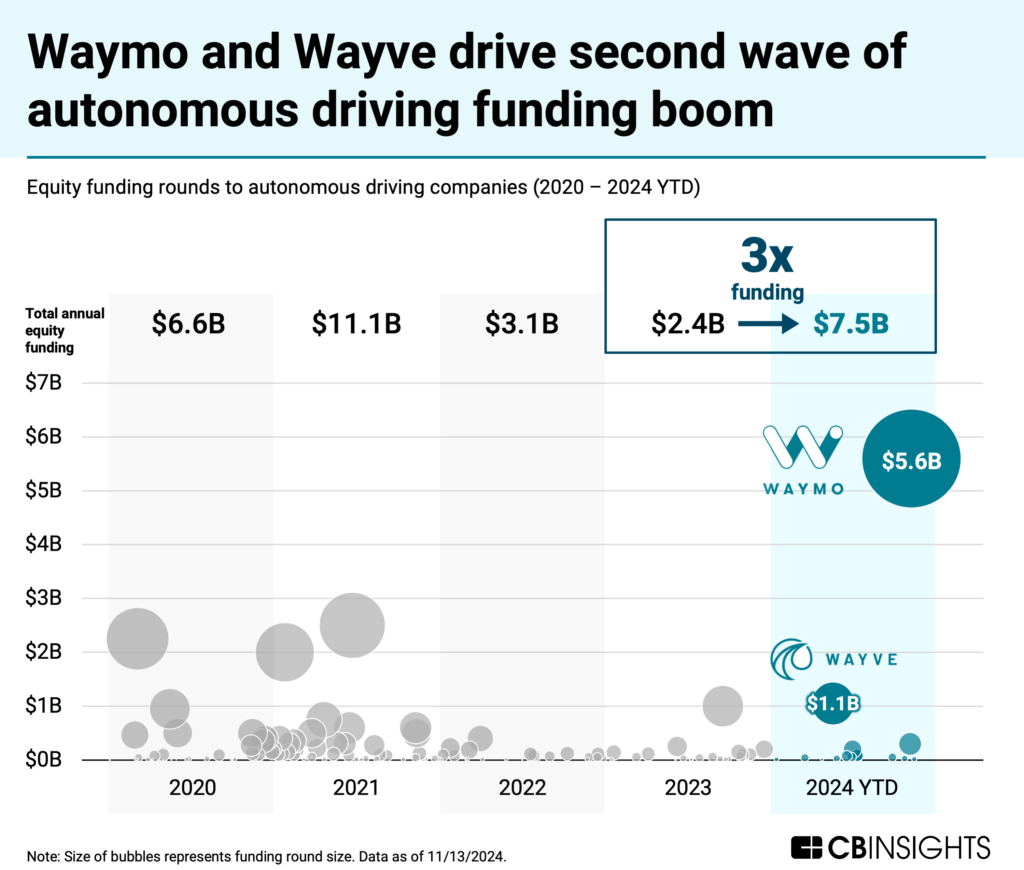

The AV space has seen equity funding triple this year to $7.5B, and robotaxi services are notching notable milestones — Waymo, for instance, recently hit 150K paid rides per week, 3x the volume from just 5 months prior.

Among key growth drivers, generative AI is helping remove hurdles to widespread adoption, while the potential for regulatory pullback may attract more investors in the year to come.

Source: CB Insights — advanced search for autonomous driving company funding as of 11/13/2024.

Source: CB Insights — advanced search for autonomous driving company funding as of 11/13/2024.

In this brief, we highlight potential approaches to tap into the autonomous driving opportunity — including partnering with self-driving stack developers, acquiring or investing in AV assets at attractive valuations, and supplying AV makers with the necessary components to scale.

Here are 4 key takeaways from our analysis:

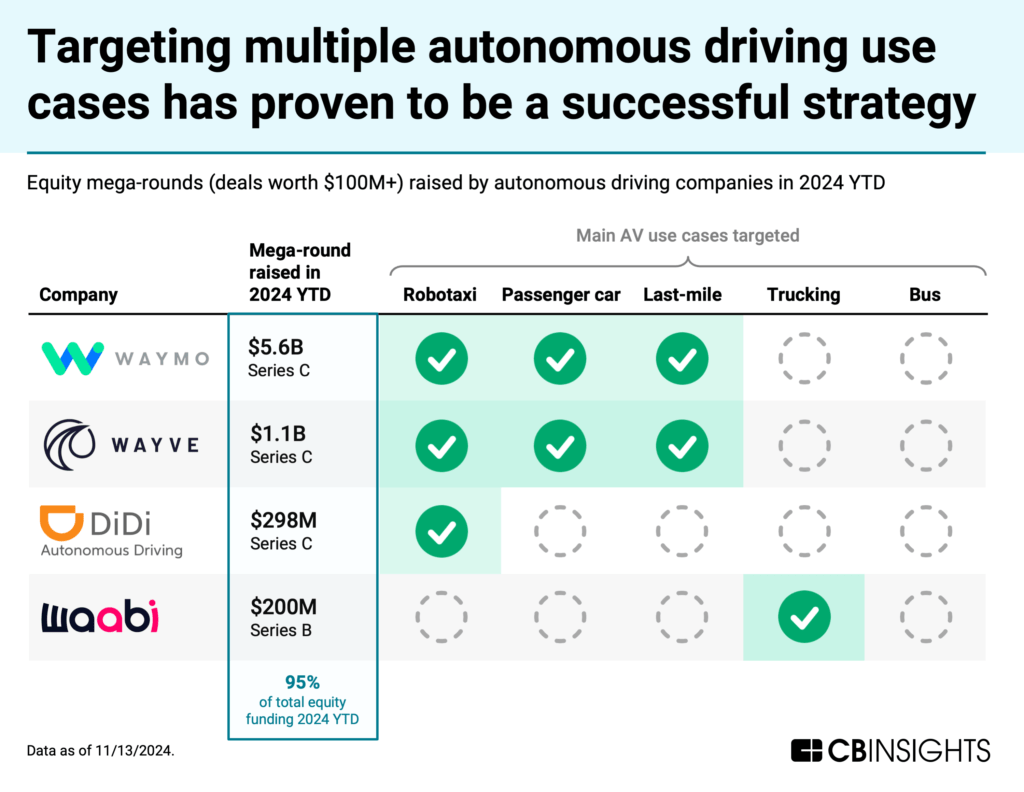

- Self-driving stack developers are best positioned for partnership in autonomous driving’s second wave: Waymo and Wayve have led this year’s funding rebound (combined ~90% of equity funding this year) as they make commercial gains and inch toward profitability. Both players are leveraging genAI to improve their self-driving systems and are opportunistically targeting multiple autonomous driving use cases.

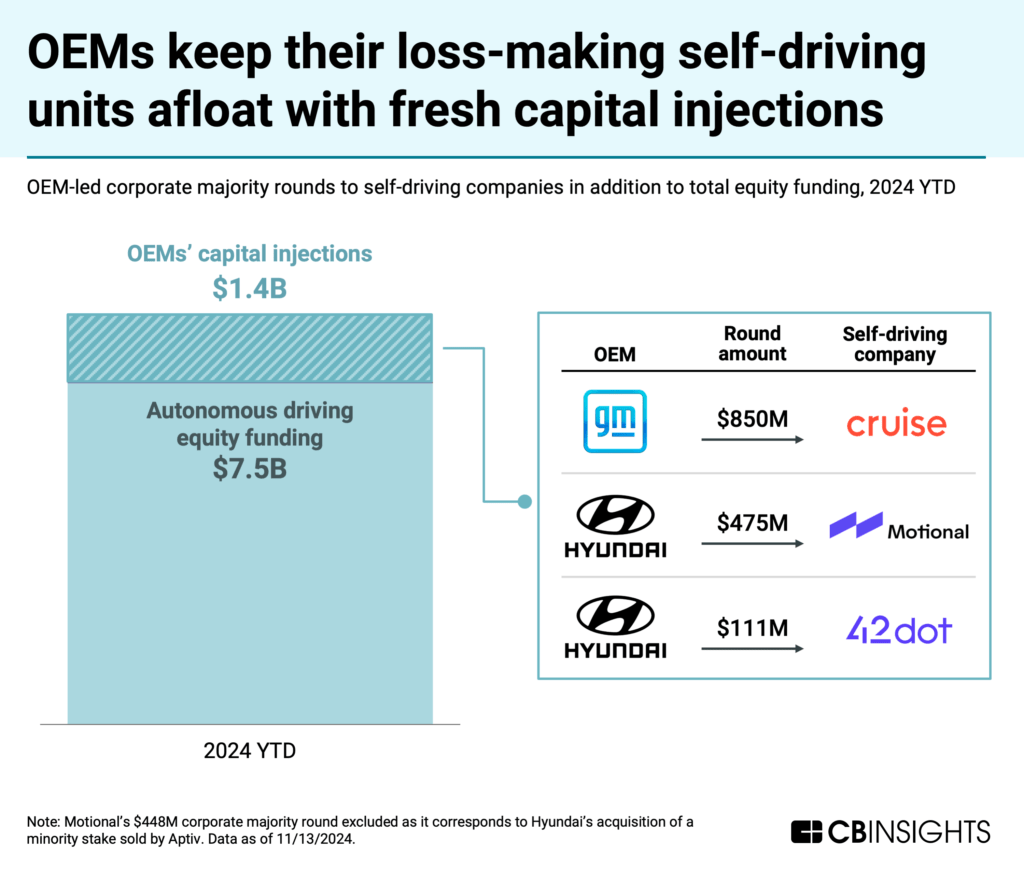

- OEMs are keeping their loss-making self-driving units afloat with fresh capital injections: Despite facing safety issues and commercialization delays, some OEMs view autonomous driving capabilities as strategically non-negotiable, with GM and Hyundai injecting a combined $1.4B in their self-driving units this year. At the same time, they may consider welcoming new financial backers to reduce their risk — creating opportunities for other OEMs to gain exposure to the space.

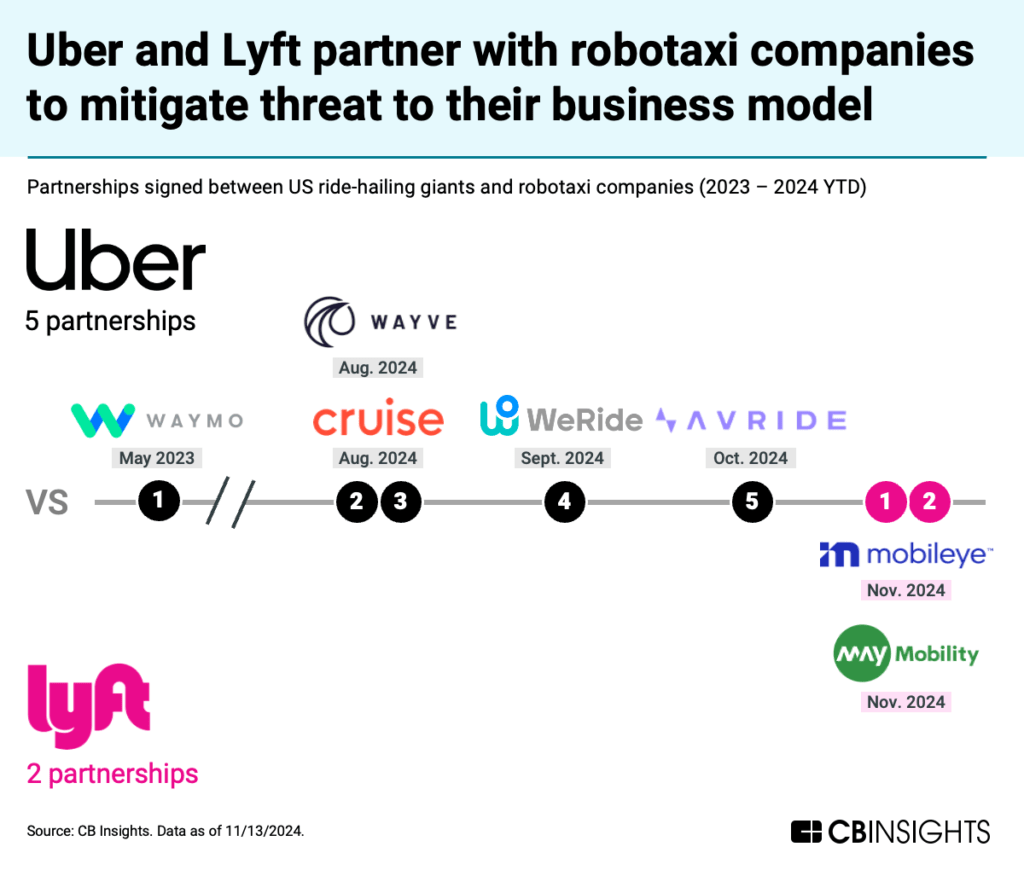

- Ride-hailing players can partner with robotaxi companies to mitigate the impact to their business model: Ride-hailing companies are pursuing multiple autonomous driving partnerships at once — Lyft and Uber, for example, have formed a combined 6 partnerships this year. In turn, robotaxi companies should target a similar multi-platform strategy to maximize market reach.

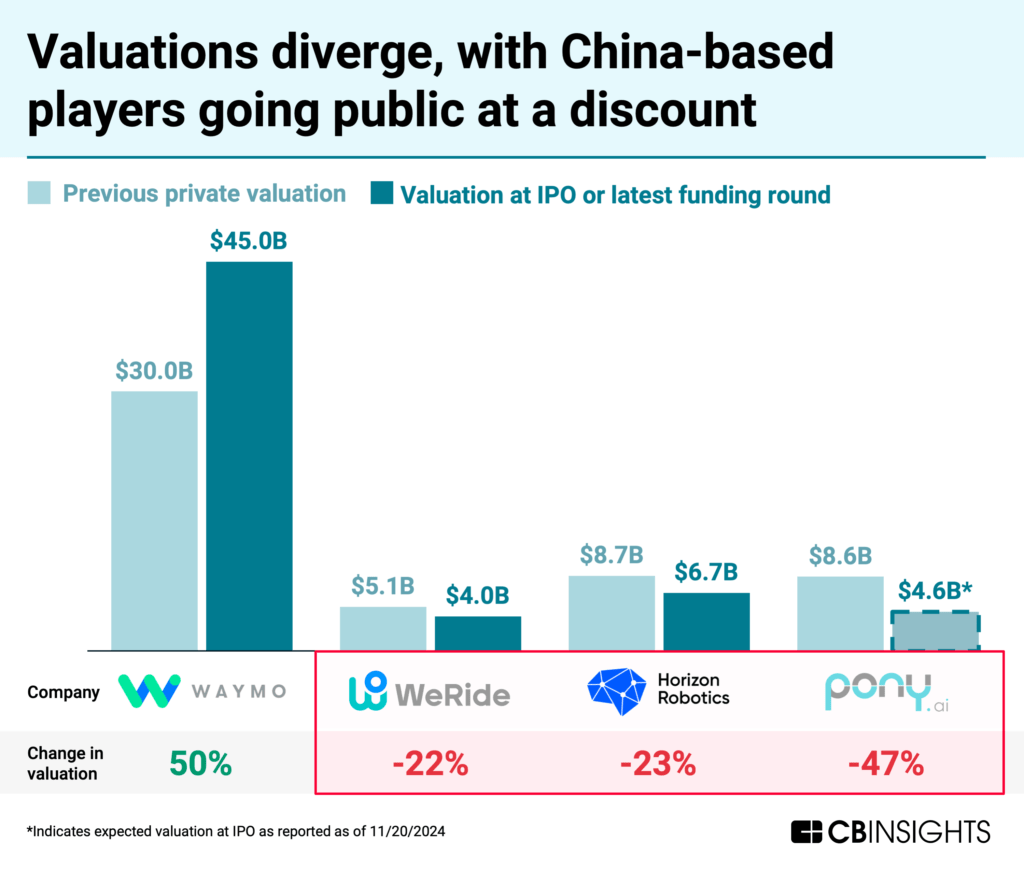

- In China, autonomous driving players have been pushed to go public at reduced valuations: Companies like WeRide and Horizon Robotics are debuting at prices discounted by 20% or more. The pressure these companies face to demonstrate near-term results represents an opportunity for OEMs and logistics companies to negotiate advantageous terms for strategic partnerships, investments, or even acquisitions.

We dive into each point below.

Self-driving stack developers are best positioned for partnership in autonomous driving’s second wave

After a 2-year funding winter, the autonomous driving space has attracted $7.5B in equity funding so far this year, a 3x YoY increase, driven by massive rounds to self-driving stack developers like Waymo ($5.6B Series C) and Wayve ($1.1B Series C).

Source: CB Insights — advanced search for autonomous driving mega-rounds in 2024 as of 11/13/2024.

Waymo hits key commercial milestones, leading US robotaxi rollout

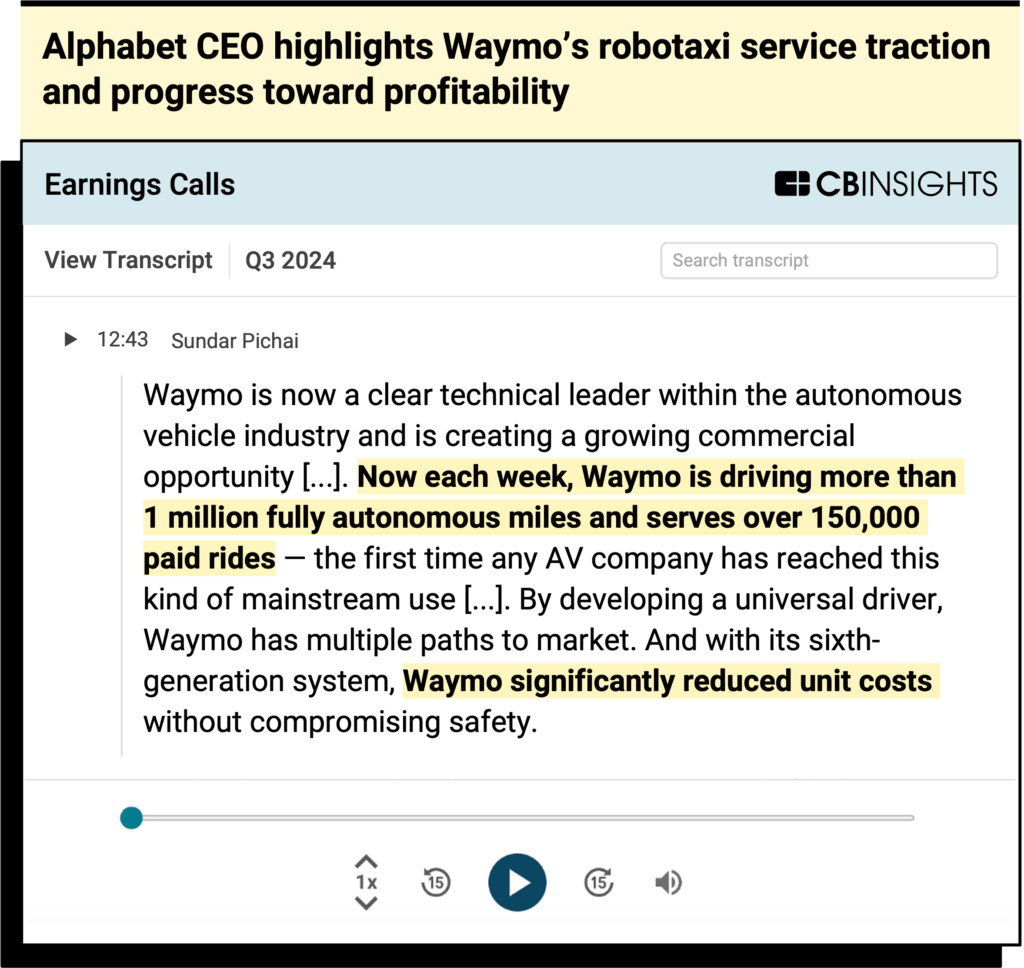

Waymo has been hitting significant milestones this year, tripling its number of weekly paid rides from 50K in May to 150K in October. It has emerged as a competitor to ride-hailing giants in a few US cities, although its volume pales in comparison to the ~5M weekly rides offered by the likes of Uber and Lyft in NYC alone.

Waymo has also made progress toward profitability, with Sundar Pichai, CEO of Waymo parent Alphabet, highlighting significant cost reduction during Alphabet’s Q3’24 earnings call.

This has helped give investors confidence that Waymo is well-positioned to lead the commercial rollout of robotaxis in the US. The company was valued at $45B in its latest round, up from $30B.

Source: CB Insights — Alphabet’s Q3’24 earnings call

GenAI increases hopes of full autonomy breakthrough

Advancements in genAI are also acting as a tailwind in the autonomous driving space, with hopes that this technology can accelerate the timeline for full autonomous driving by removing remaining hurdles — such as cost, explainability, and vehicle-passenger communication.

Both Waymo and Wayve are investing heavily in the use of genAI to improve their existing autonomous driving systems.

Wayve specifically is developing a self-learning end-to-end AI driving system similar to Tesla’s that could be used by any automaker and is financially backed by some of the biggest AI players such as Microsoft and Nvidia.

Self-driving stack developers target multiple autonomous driving use cases

The ability to target multiple autonomous driving use cases is another key strength of self-driving stack developers, allowing them to opportunistically pivot to focus on the most commercially promising ones. For example:

- Waymo reined in its investments in trucking use cases back in July 2023 to instead focus on robotaxis, where it saw more near-term commercial momentum. The company is now considering expanding into the personal car use case by licensing its technology.

- Wayve formed early partnerships with UK grocery retailers ASDA and Ocado, focused on home delivery of groceries. The company is now pushing deeper into robotaxis, partnering with Uber to roll out self-driving vehicles on the ride-hailing giant’s platform in the future.

Traction in the robotaxi space is driving other players to reconsider their AV strategy. For example, Elon Musk has increasingly framed Tesla as a robotaxi company — although the timing of the Tesla Cybercab launch remains uncertain.

Demonstrating a path to profitability will be key for robotaxi companies — including Waymo — to justify their outsized funding rounds, creating opportunities for OEMs and mobility players to help them scale or monetize their technology through licensing.

Their success also hinges on more municipalities and countries authorizing their operations, something that’s likely to take time unless regulations become less restrictive.

OEMs are keeping their loss-making self-driving units afloat with fresh capital injections

Despite mounting challenges such as safety issues and delayed commercialization, major OEMs such as General Motors (GM) and Hyundai have recalibrated their autonomous driving strategies while continuing to finance their subsidiary operations.

The sustained funding from OEMs amid setbacks reflects several strategic imperatives. For one, they’re still banking on the potential for returns on their significant existing investments, while also looking to position themselves competitively against tech-native OEMs such as Tesla and BYD.

Perhaps more importantly, it allows them to not miss out on the growth of the robotaxi industry by serving as suppliers of choice for vehicles and AV hardware — without bearing the full cost of software development. For example, Hyundai partnered with Waymo earlier this year to provide the robotaxi company with a fleet of vehicles equipped with autonomous tech.

Source: CB Insights — advanced search for corporate majority rounds in autonomous driving companies as of 11/13/2024.

GM provided its robotaxi unit Cruise an $850M lifeline despite safety incidents that forced the company to pause its service back in October 2023. The funding aims to bridge Cruise as it relaunches its service in select US cities, with the intent to charge for rides at the beginning of 2025.

Hyundai invested nearly $1B — including a $475M fresh capital injection — to gain 85% control of Motional, an autonomous driving JV between Hyundai and Aptiv. Aptiv’s stake reduction in the JV followed a strategic decision to cease further investment due to delayed commercialization.

Given the market pressures and challenges these units have faced, other OEMs may have an opportunity to gain exposure to the autonomous driving space by partnering with or investing in these units on favorable terms rather than trying to build the technology themselves.

Ride-hailing players can partner with robotaxi companies to mitigate the impact to their business model

The ride-hailing industry is undergoing a major shift as platforms rush to integrate AVs into their networks.

While these partnerships offer compelling near-term advantages, they also highlight the existential challenges facing traditional ride-hail business models in an autonomous future.

Source: CB Insights — business relationship data for Uber and Lyft as of 11/13/2024

Leading platforms such as Uber and Lyft — which sold their autonomous driving units in 2020 and 2021, respectively — are pursuing multiple parallel relationships with autonomous driving developers, suggesting both urgency and hedging strategies.

Between the two, Uber is currently leading the way with 5 partnerships since 2023, 4 of which have been signed since August this year. In September, the company announced an expansion of its partnership with Waymo, giving access to Waymo’s robotaxi through the Uber app in Austin and Atlanta (starting in 2025) in addition to Phoenix, where Uber users have been able to order a Waymo since October 2023.

These partnerships offer immediate operational benefits: reduced driver costs, improved service reliability, and the ability to better manage surge pricing.

However, they also expose how the current ride-hailing platform model faces disruption — that is, by helping autonomous driving companies build direct relationships with consumers and gain real-world miles to improve their autonomous operations. This creates a paradox where ride-hail companies are essentially helping to incubate their potential future competitors.

Looking forward, ride-hail companies face 3 distinct strategic paths:

- Partnership strategy: betting on becoming the dominant platform layer atop multiple autonomous driving systems providers

- Acquisition strategy: buying autonomous driving capabilities to maintain control of the full stack

- Potential acquisition target: positioning themselves to be acquired by autonomous driving companies seeking customer relationships and operational expertise

The choice between these paths will likely determine which companies survive the transition to autonomous mobility.

In China, autonomous driving players have been pushed to go public at reduced valuations

China is also seeing heightened activity in the autonomous driving space this year, including growing adoption of robotaxis. Baidu‘s Apollo Go service, for instance, averaged 75K fully driverless rides per week in Q2’24, up 26% YoY.

Chinese autonomous driving companies are also leading an exit wave through public listings, with Horizon Robotics and WeRide going public in October and Pony.ai, Momenta, and Minieye all recently filing to do the same. But they’re doing so at a discount to their last private valuations, reflecting limited access to private capital at a time of accelerating commercialization.

Source: CB Insights — advanced search for autonomous driving exits over time as of 11/13/2024 (excludes corporate majority deals)

Both Horizon Robotics and WeRide completed their IPOs at a more than 20% discount to their last private valuations, while Pony.ai is reportedly seeking a $4.6B IPO valuation, down from $8.6B just a year ago.

Private funding for China-based autonomous driving companies has dropped 90% since 2021, from $4B to less than $400M in 2024 YTD. The funding drought is pushing many of these companies to secure public funding or risk falling behind in the capital-intensive race to autonomy.

This funding crunch comes at a particularly critical time, as many players are accelerating their commercialization efforts and require capital to scale operations. As newly public companies face greater scrutiny over quarterly performance and profitability, they’re likely to prioritize near-term revenue generation over long-term technological development.

For transportation and mobility companies looking to expand in China, this creates opportunities to partner on advantageous terms with local players that need to show commercial progress.

This shift will also create an opening for well-funded private players like Waymo, which can maintain their focus on achieving full autonomy without the pressures of public market expectations.

Finally, the need for operational efficiency is likely to drive consolidation within the industry, as public companies seek cost synergies and combined market power to improve their financial metrics.

Looking ahead

Robotaxi adoption and genAI integration are already driving the next phase of the autonomous driving market’s evolution, pushing mobility players and OEMs to reassess their strategies after some had reduced their exposure to the space.

Although the success of robotaxi operations hinges on gaining regulatory approval in many more cities — which, in the US, may be accelerated under the incoming administration — expect to see a flurry of partnerships and strategic investments as automakers, autonomous driving hardware suppliers, and mobility platforms all vie to help robotaxi companies scale and get a share of the market.

As leaders such as Waymo race ahead, emerging autonomous driving companies will have to choose between accelerating the commercialization of their existing solutions or trying to outcompete winners on technological advancements (e.g., full driving autonomy, significantly cheaper autonomous driving systems, etc.).

Either strategy will likely require pooling resources, leading to consolidation in the space.

MORE AUTONOMOUS VEHICLE RESEARCH FROM CB INSIGHTS:

- Generative AI is accelerating the timeline for fully autonomous driving

- Autonomous driving systems market report

- Uber’s AV strategy: How the rideshare giant is redefining its core businesses in the age of autonomy

- Robotaxi market report