We use CB Insights data to break down the AI trends highlighted at the conference that insurers should watch to stay ahead of competitors.

Among the 700 exhibitors and sponsors at ITC Vegas 2024 — an insurance conference focused on innovation and startups — a third had a clear AI focus, with genAI-powered insurance workflows drawing particular attention.

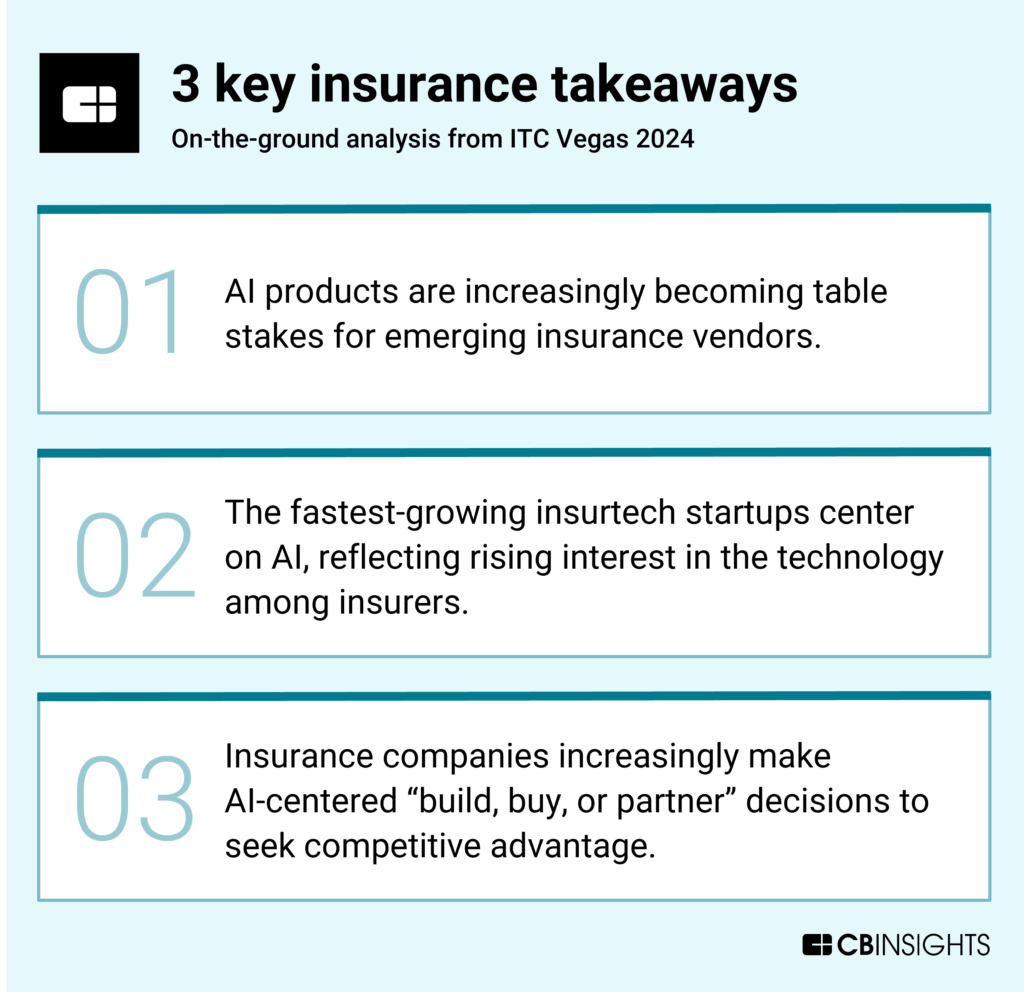

This AI focus reflects a new reality for insurers: Incumbents will need to move quickly to evaluate emerging AI products or risk being left behind by fast-moving competitors.

Below, we look at the key themes from the conference that insurers should pay attention to and use CB Insights data to dig into the underlying trends.

Our analysis centers on VC-backed private companies that were exhibitors or sponsors at ITC Vegas 2024, an insurance conference that took place from October 15 to 17.

1. AI products are increasingly becoming table stakes for emerging insurance vendors.

Established insurance companies — and their competitors — have an abundance of potential AI partners. The ITC Vegas expo floor reflected AI’s evolution from emerging technology to standard operations within insurance — from pre-seed startups like Alltius offering AI sales assistants to established players like Nearmap analyzing aerial data for underwriting with AI.

From an investment standpoint, AI capabilities are critical for startup differentiation in today’s selective dealmaking environment. This is underscored by AI startups exiting in nearly half the time of their non-AI-focused counterparts.

Among early-stage exhibitors and sponsors, 11 startups that offer AI products have raised early-stage deal sizes of at least $10M over the past year. These deals are notable as they far surpass the 2024 YTD median early-stage deal size of $2.1M across the global venture environment.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.