Insurtech funding holds steady, buoyed by multiple $100M+ mega-rounds. We break down the global insurtech landscape to help leading insurers and investors understand emerging players and areas of activity.

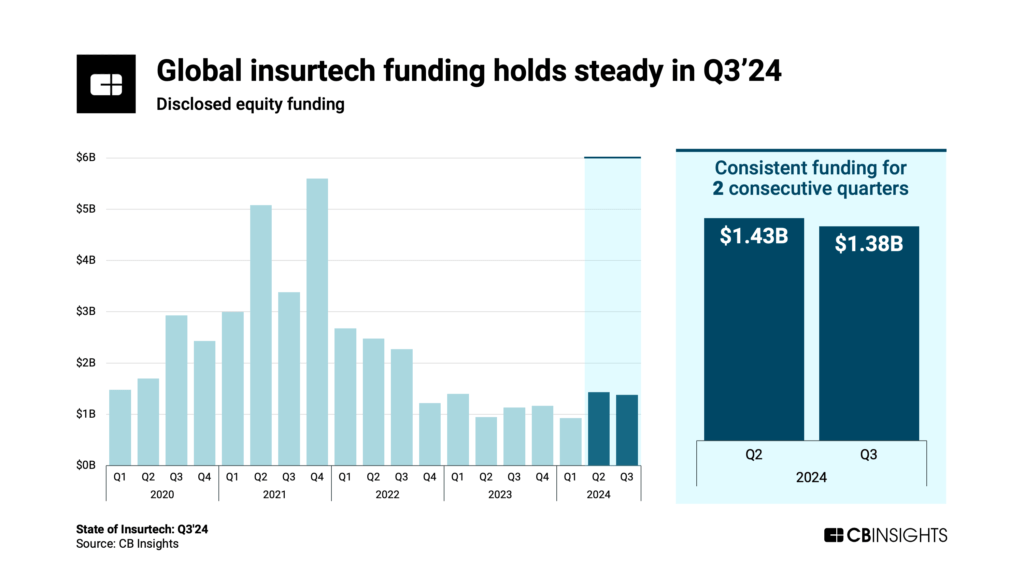

Global insurtech funding held steady at $1.4B for the second consecutive quarter in Q3’24. However, unlike the prior quarter, most of the funding came from just 5 mega-rounds (deals worth $100M+).

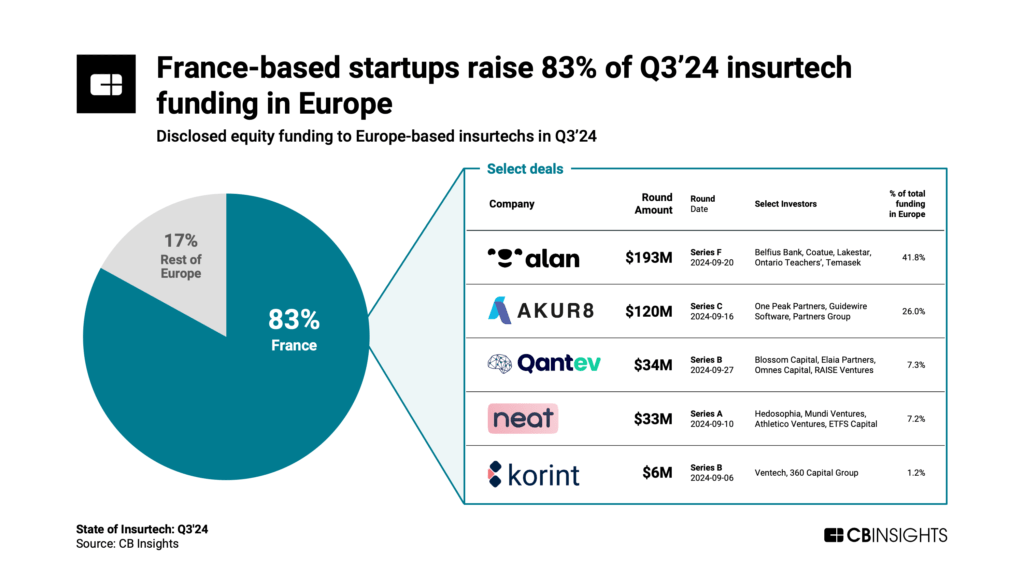

Q3’24 also saw the most selective dealmaking environment in years, although there were notable bright spots — in the early stages of funding, in the life & health insurance segment, and among France’s insurtechs.

Download the full report to access comprehensive data and charts on the evolving state of insurtech across sectors, geographies, and more.

Below, we cover key shifts in the landscape, including:

Quarterly insurtech funding holds mostly steady from Q2’24, at $1.4B. In Q3, the funding was evenly split across both P&C and life & health (L&H) segments — one of just 3 quarters since 2020 where L&H insurtechs have rivaled P&C for quarterly funding.

Insurtech fared better in Q3’24 than the broader venture environment, which saw funding decrease 20% quarter-over-quarter (QoQ). In fact, on a year-over-year basis, insurtech funding grew in Q3 by 27%.

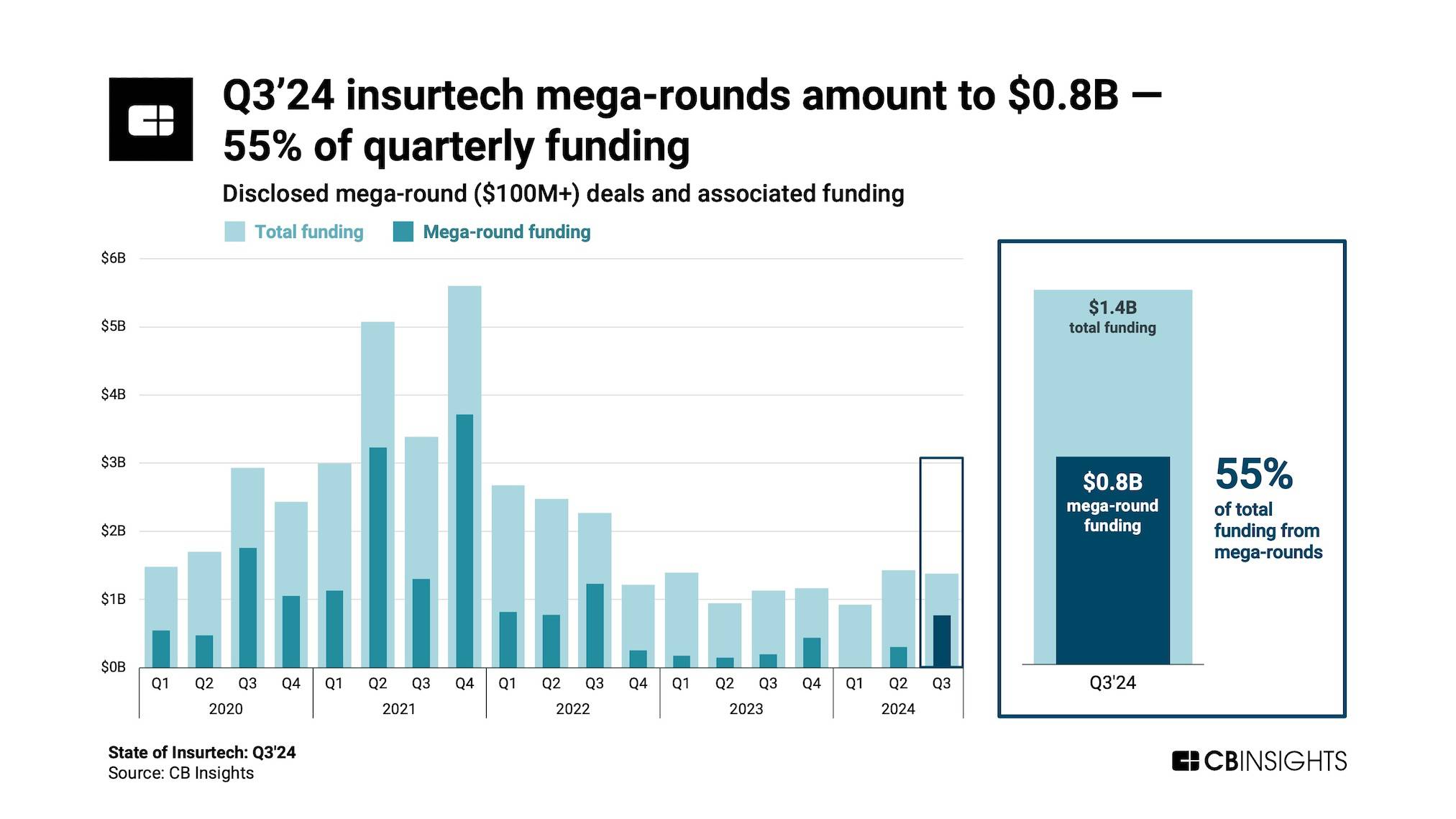

A majority of insurtech funding goes to $100M+ mega-round deals for the first time since Q3’22. Q3’24 saw mega-round funding and deals — $0.8B across 5 deals — surge to a 2-year high.

Altana AI, which offers a supply chain risk platform, raised the largest insurtech equity deal in 2024 so far ($200M Series C) from investors including Google Ventures and Salesforce Ventures. The deal valued Altana AI at $1B, making it the first new insurtech unicorn of 2024 so far. Insurtechs that offer Medicare Advantage plans raised 2 of the other mega-round deals, Devoted Health ($112M Series E) and Zing Health ($140M Series A).

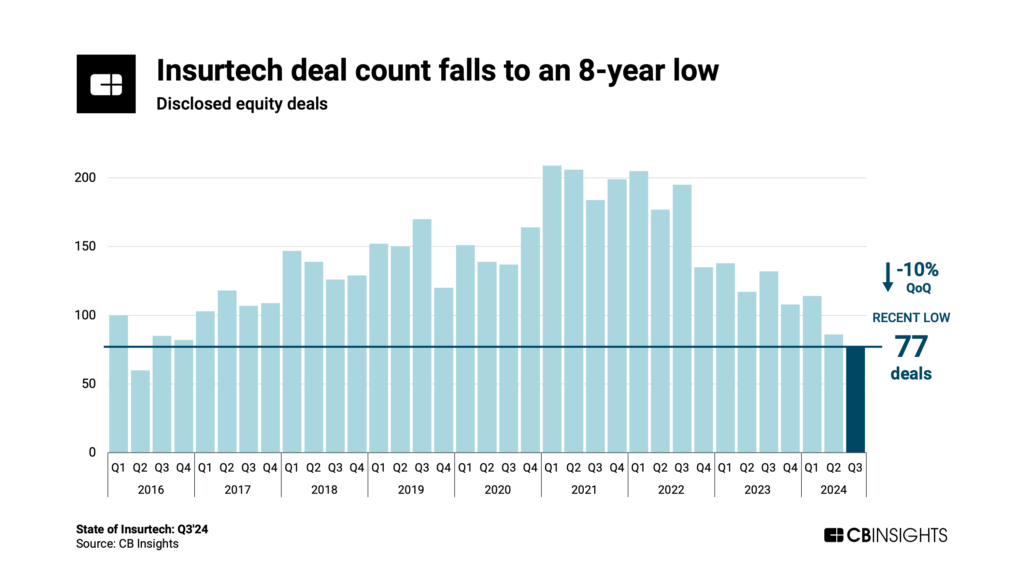

Insurtech deal count falls to an 8-year low. Q3’24 saw global insurtech deal count decline to 77, falling 10% QoQ and 42% YoY. Q2’16 was the last quarter to see fewer insurtech deals (60).

Even so, the drop is in line with a broader decline in venture dealmaking. Also, across insurtech and the broader venture environment, the percentage of deals by deal stage (i.e., early, mid-, late, or other) has been without drastic swings in recent years.

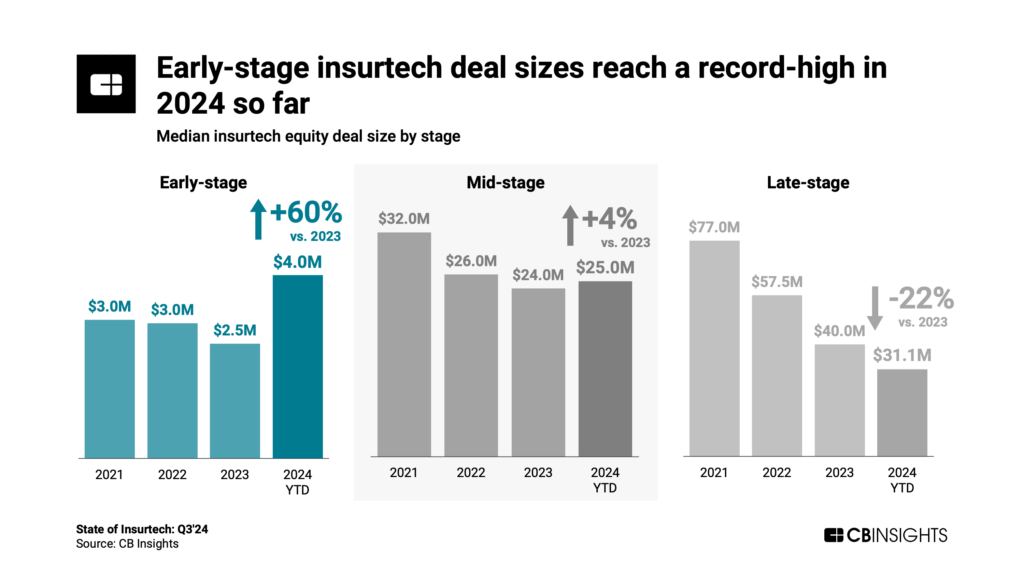

The median early-stage insurtech deal size has reached a record high, increasing from $2.5M in 2023 to $4M in 2024 so far. This signals that investors remain bullish on early-stage dealmaking despite the broader decline in funding and deals.

Comparatively, the median early-stage insurtech deal size only reached $3M in 2022 amid the venture funding boom.

Three of the 10 largest insurtech deals in Q3’24 were early-stage.

France-based insurtechs raise 83% of Europe’s insurtech funding in Q3. Five France-based insurtechs raised a combined $385M in Q3’24, including mega-round deals for health insurer Alan ($193M Series F) and pricing platform Akur8 ($120M Series C).

Globally, only insurtechs from France and the US appeared among the 10 largest insurtech deals of the quarter.

RELATED RESEARCH FROM CB INSIGHTS:

- State of Venture Q3’24 Report

- State of Insurtech Q2’24

- Insurtech 50: The most promising insurtech startups of 2024

- How genAI is reshaping the insurance value chain

- Game Changers 2025: 9 technologies that will change the world

- Tech Transforming the World: The Game Changers Roundtable (Webinar)