The post State of Venture Q1’25 Report appeared first on CB Insights Research.

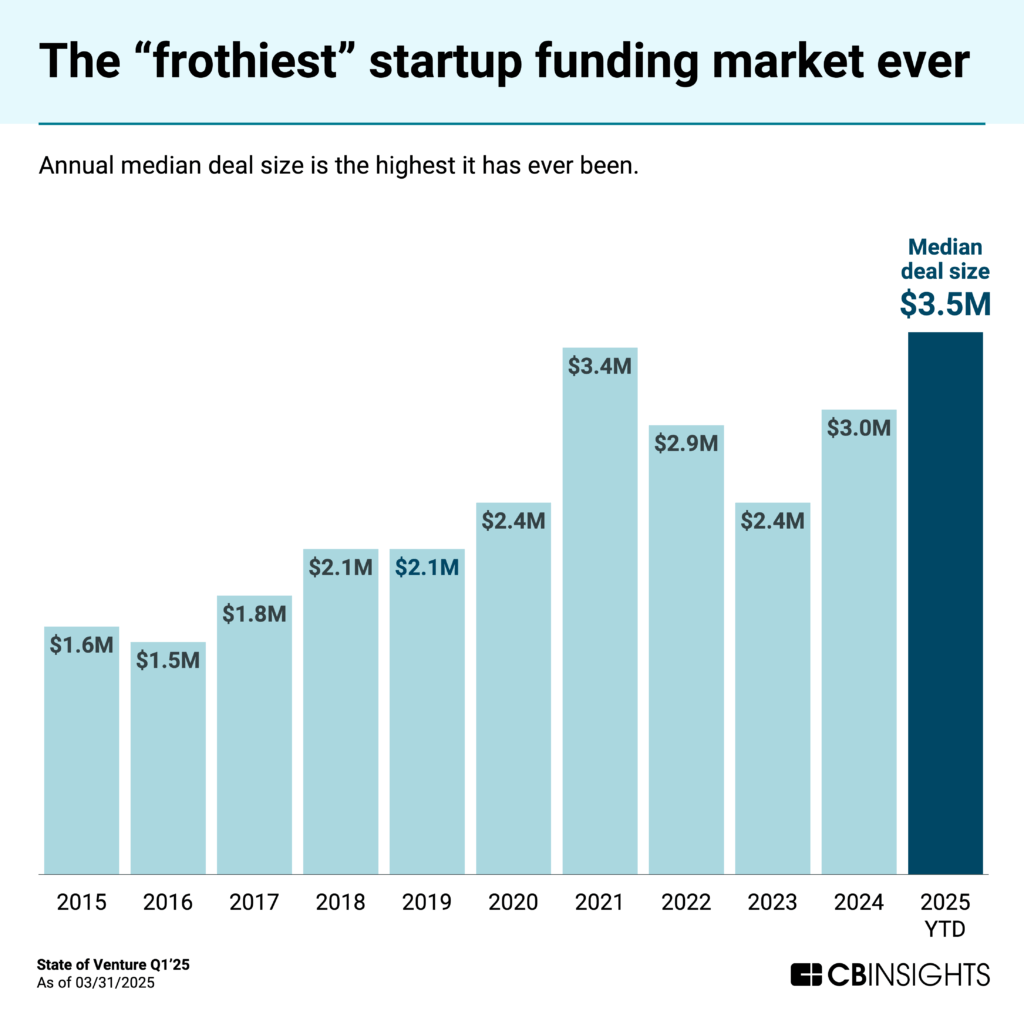

]]>Opportunities across stages and geographies have fueled growth in deal sizes globally. So far in 2025, the median deal size sits at a record $3.5M.

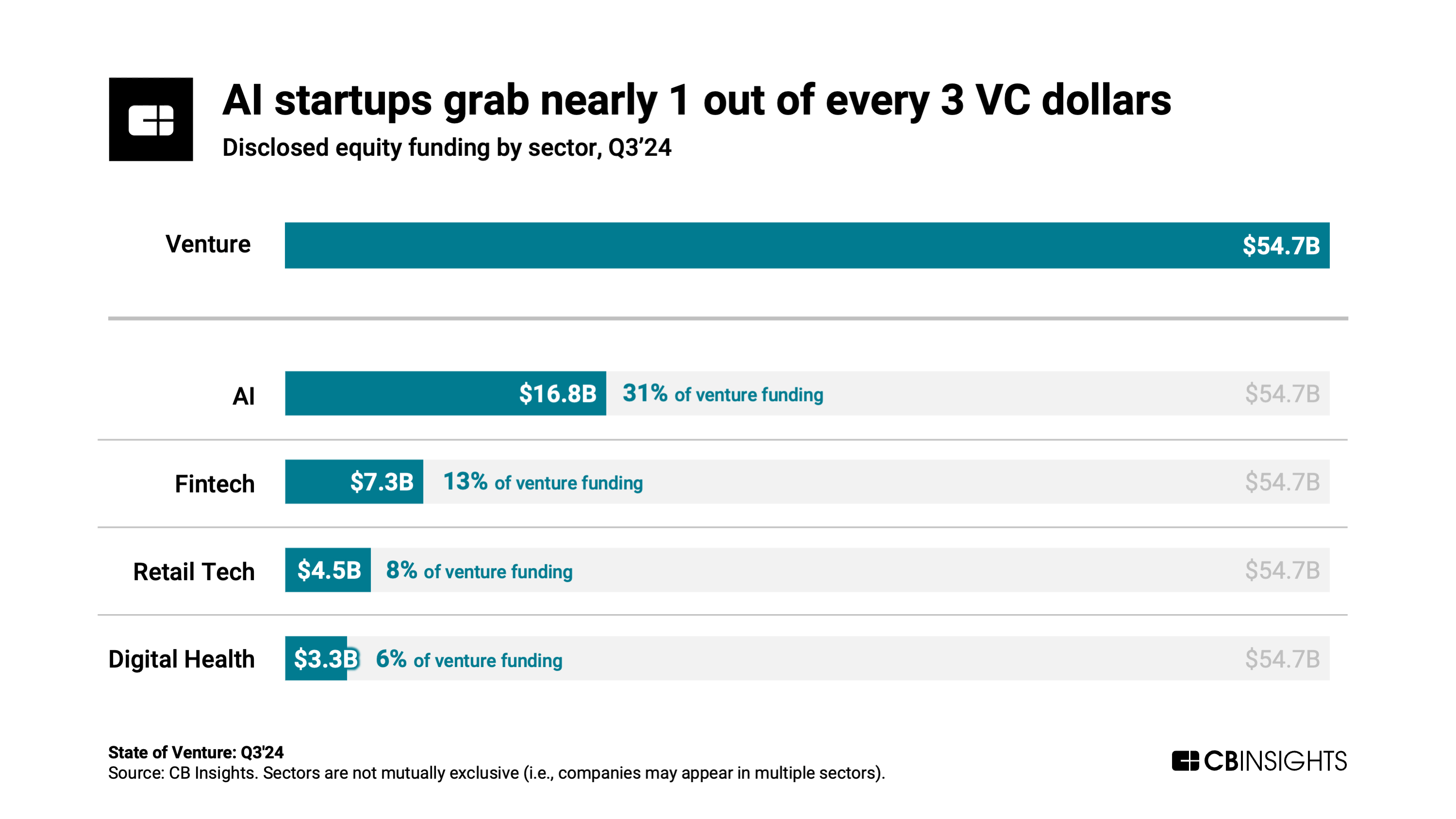

While AI continues to dominate headlines and venture activity, sectors like fintech, digital health, and retail tech all recorded quarterly funding increases as investors diversify beyond core AI infrastructure plays.

Download the full report to access comprehensive data and charts on the evolving state of venture across sectors, geographies, and more.

Below, we break down the top stories from this quarter’s report, including:

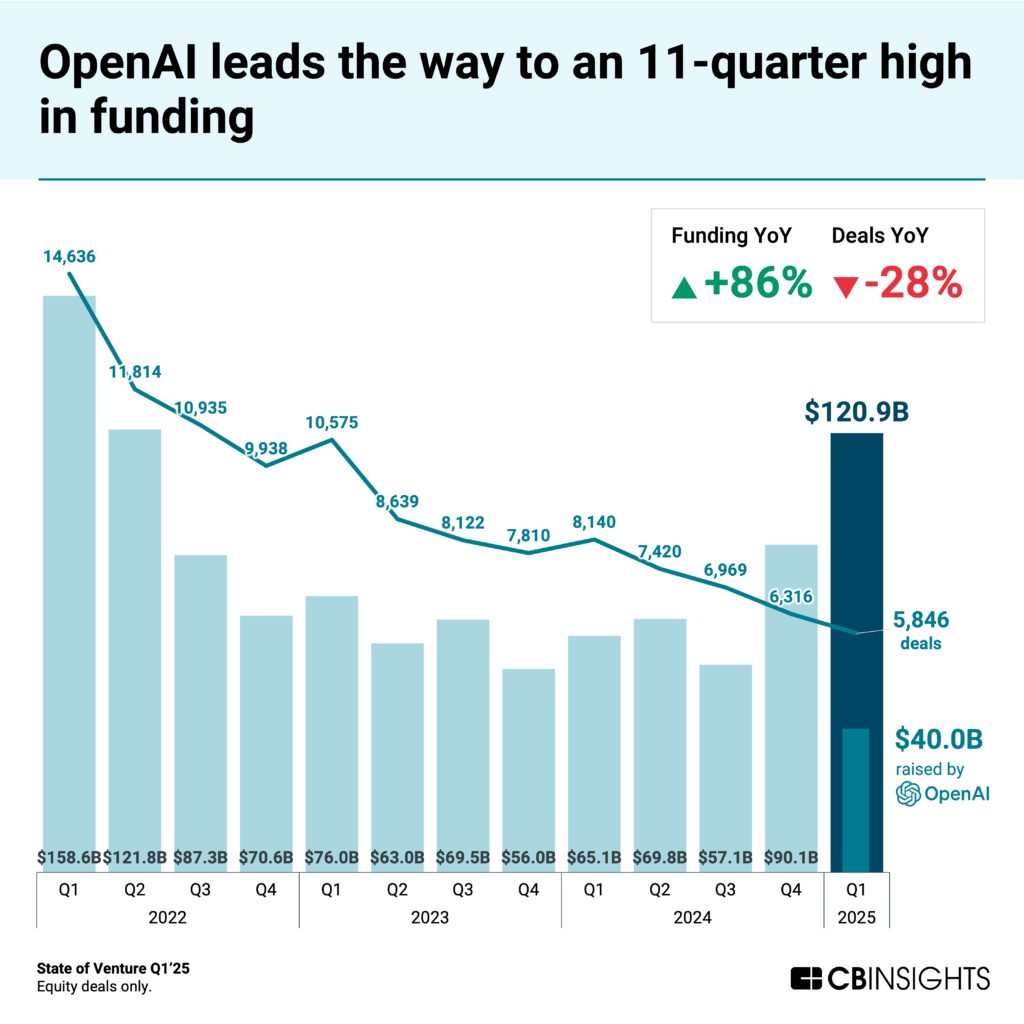

- Quarterly funding jumps to $121B, even as deal count keeps falling

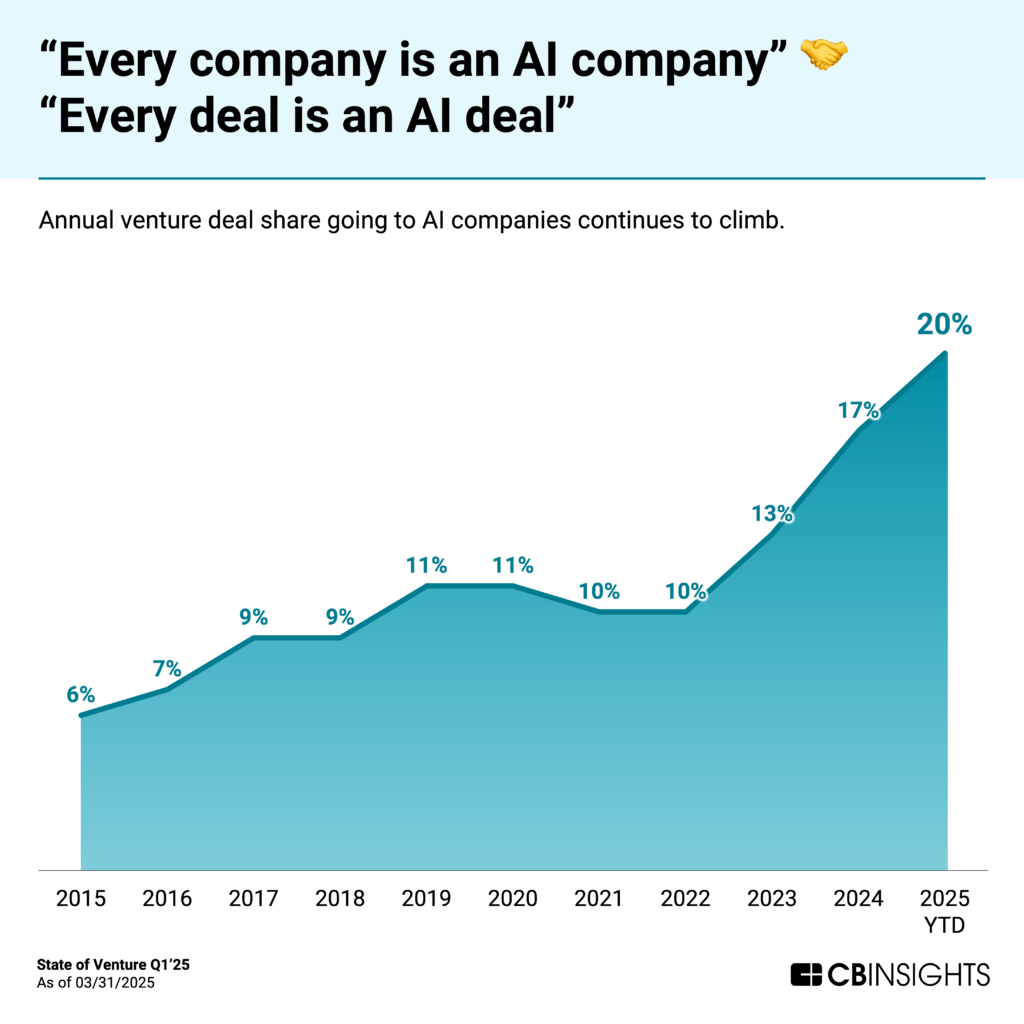

- AI now drives 1 in 5 global venture deals

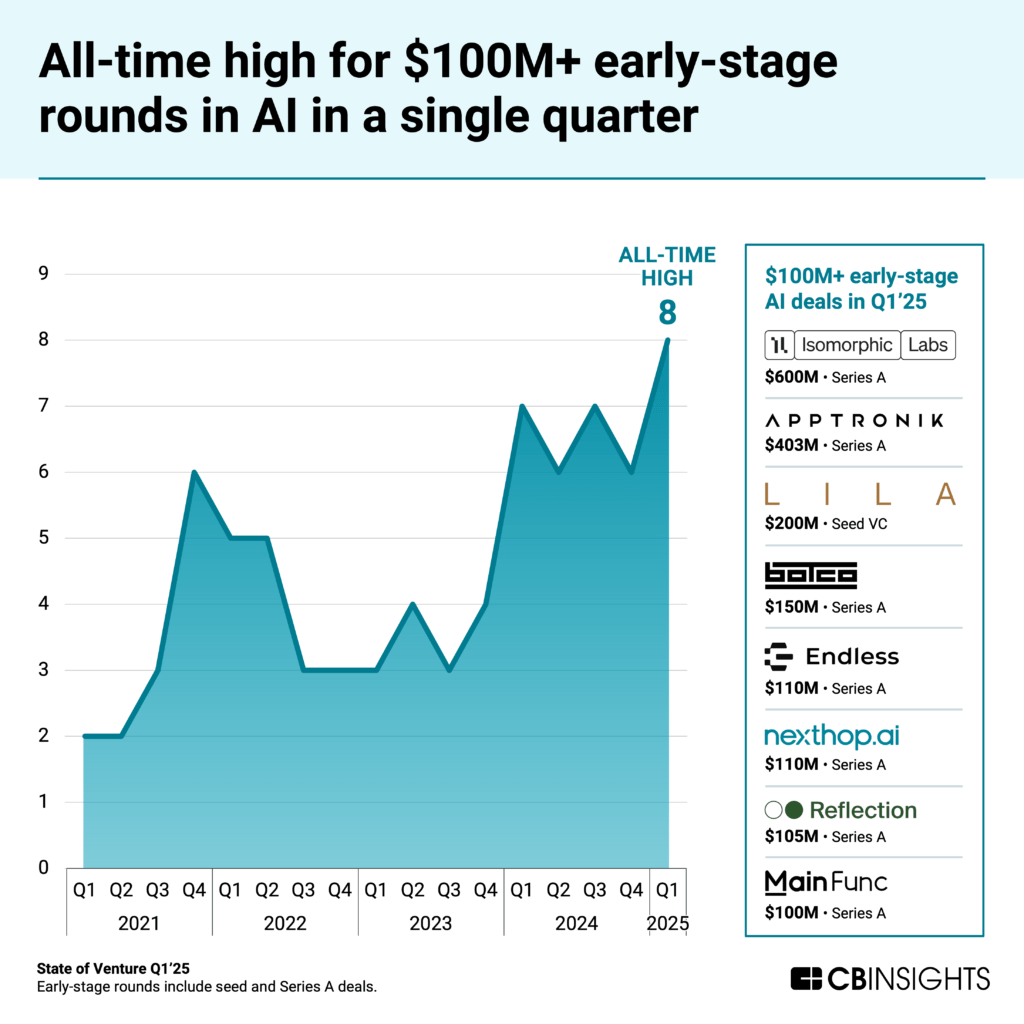

- Eight early-stage AI companies raise $100M+ mega-rounds

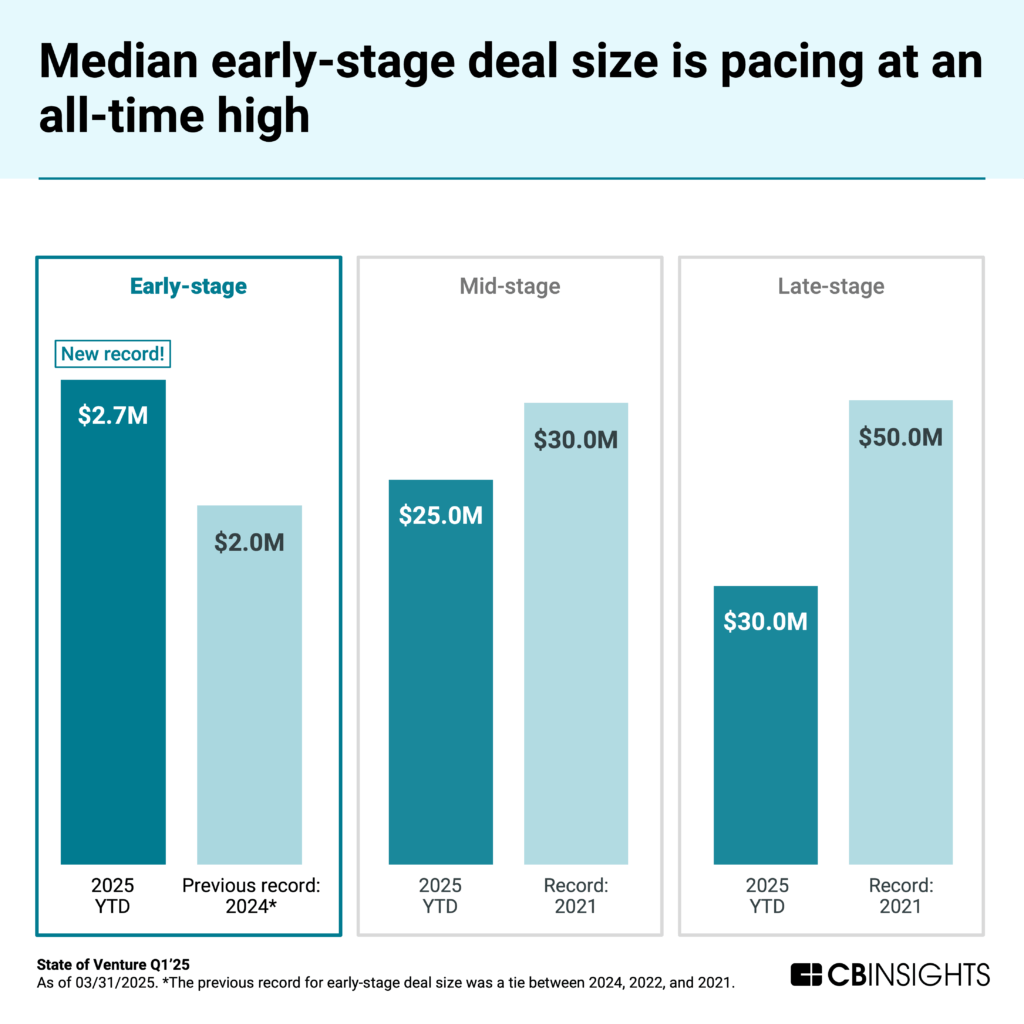

- Early-stage deal sizes pace at an all-time high

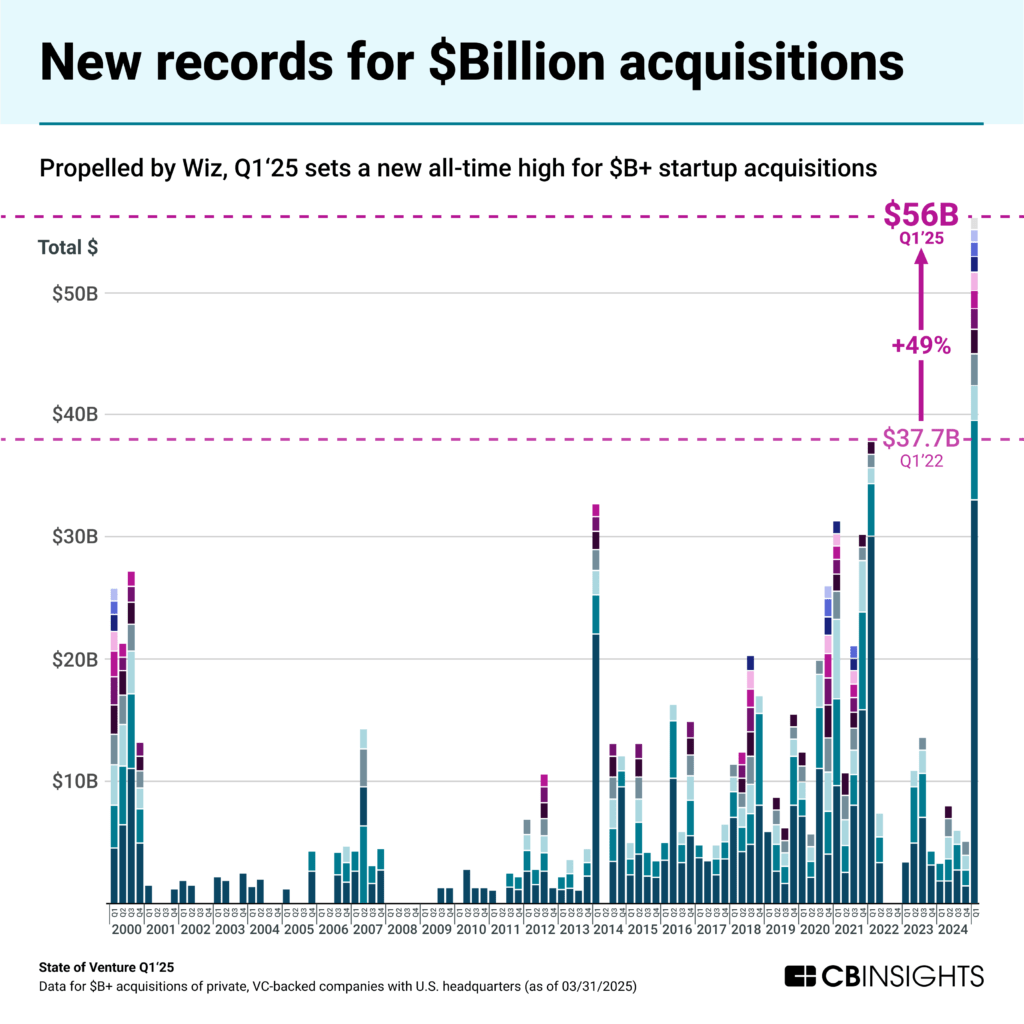

- Billion-dollar M&A exits hit a new quarterly record

We also outline the key trends shaping venture dealmaking for the rest of 2025 — from AI agent specialization and the voice AI boom to crypto’s rebound.

Let’s dive in.

Top stories in Q1’25

1. Quarterly funding jumps to $121B, even as deal count keeps falling

Q1’25 saw global venture funding rise to $121B — the highest quarterly total since Q2’22 — driven by OpenAI’s $40B raise, which values the company at $300B. This ties OpenAI with ByteDance as the second-highest-valued private company globally (behind SpaceX at $350B).

The OpenAI funding round — led by SoftBank and backed by Microsoft, Thrive Capital, and others — marks the largest private funding round in history. Even excluding this deal, total funding in Q1’25 would have reached $81B, still the second-highest quarterly figure since Q3’22.

However, global deal count slid for a fourth straight quarter, to 5,846 deals, down 7% QoQ and 28% YoY.

The stark contrast between soaring funding and declining deal count highlights growing capital concentration.

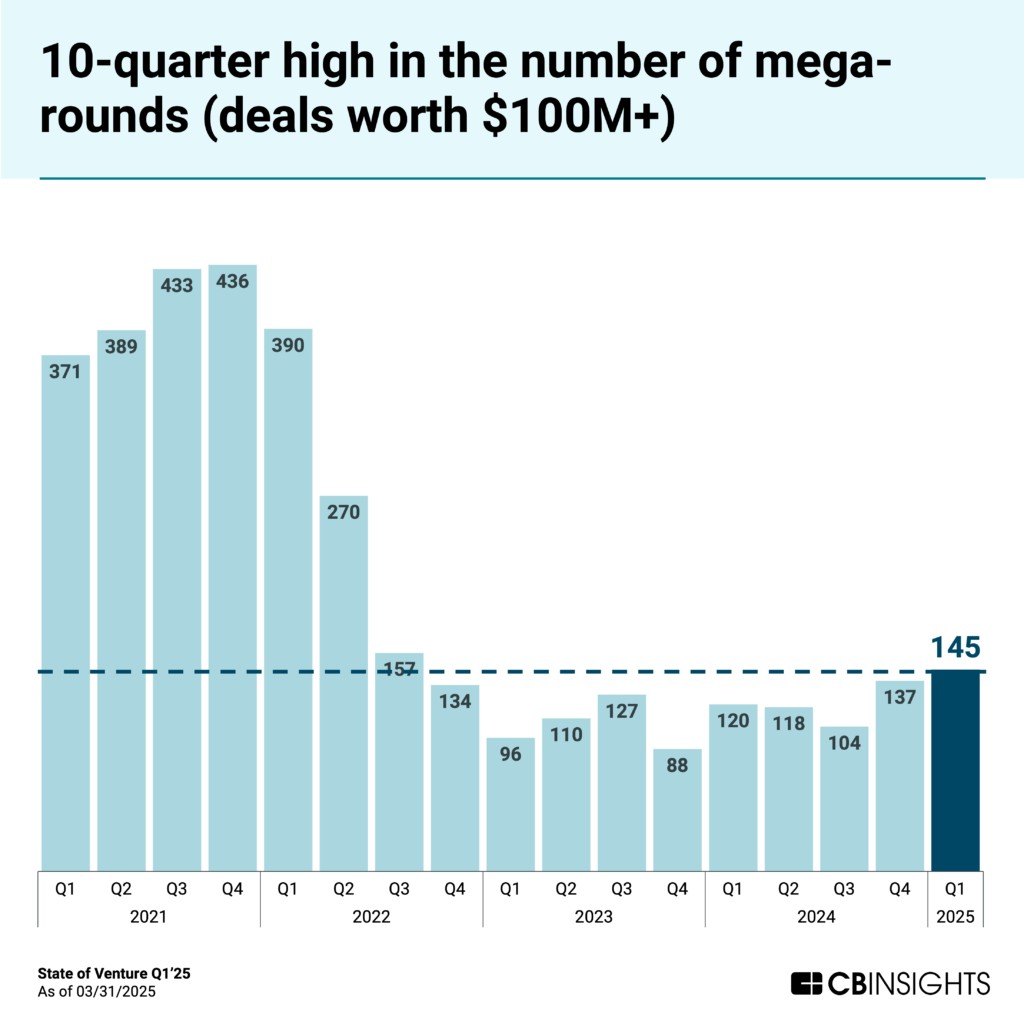

Mega-rounds (deals worth $100M+) accounted for 70% of all funding this quarter, up from 60% in Q4’24. A total of 145 mega-rounds closed in Q1’25 — the highest quarterly total since Q3’22, which saw 157.

While AI startups remain the primary beneficiaries of this capital concentration — grabbing more than half of the quarter’s funding — other sectors are showing resilience. Fintech funding increased 18% quarter-over-quarter to $10.3B, retail tech rose 18% to $6.5B, and digital health grew 47% to $5.3B.

2. AI now drives 1 in 5 venture deals

The influence of AI on venture capital continues to grow, with AI companies now capturing 20% of all venture deals globally — a new high, and up 2x since OpenAI’s launch of ChatGPT in 2022.

In absolute numbers, AI companies secured 1,134 deals in Q1’25 — a 7% decline from the previous quarter but still the fourth straight quarter with over 1,100 AI deals.

The composition of AI dealmaking is evolving. Early-stage deals (seed and Series A) made up 70% of all AI deals in Q1’25, down from 75% in full-year 2024. Correspondingly, late-stage deal share has increased from 6% to 9%, indicating market maturation as more AI companies progress to advanced funding stages.

The focus of AI dealmaking has also evolved. While infrastructure investments dominated the early AI boom, we’re now seeing greater emphasis on vertical solutions and application-layer platforms that address specific industry challenges. Notable exceptions exist in emerging categories like voice AI, where infrastructure still attracts significant investment.

Geographically, US-based AI companies secured 52% of global AI deals in Q1’25, while Asia and Europe grabbed 21% a piece.

3. Eight early-stage AI companies raise $100M+ mega-rounds

Q1’25 set a new record with 8 early-stage AI companies raising rounds of $100M or more. These 8 companies raised a combined $1.8B — with an average round size of $222M — highlighting investors’ willingness to place substantial bets on AI startups earlier than ever.

The companies represent a diverse range of AI applications:

- Isomorphic Laboratories: $600M for AI drug discovery, spun out of DeepMind

- Apptronik: $403M for humanoid robots

- Lila Sciences: $200M for scientific research automation

- The Bot Company: $150M for household robots

- Endless: $110M for AI-led Web3 developer tools

- Nexthop: $110M for cloud-native AI infrastructure

- Reflection AI: $105M for coding AI agents

- MainFunc: $100M for an agentic search engine

What unites these companies is their focus on specific industry or technical challenges — not general-purpose AI models. This same trend appears among late-stage players that raised deals in Q1’25, with companies emphasizing enterprise applications, vertical use cases, and infrastructure optimization.

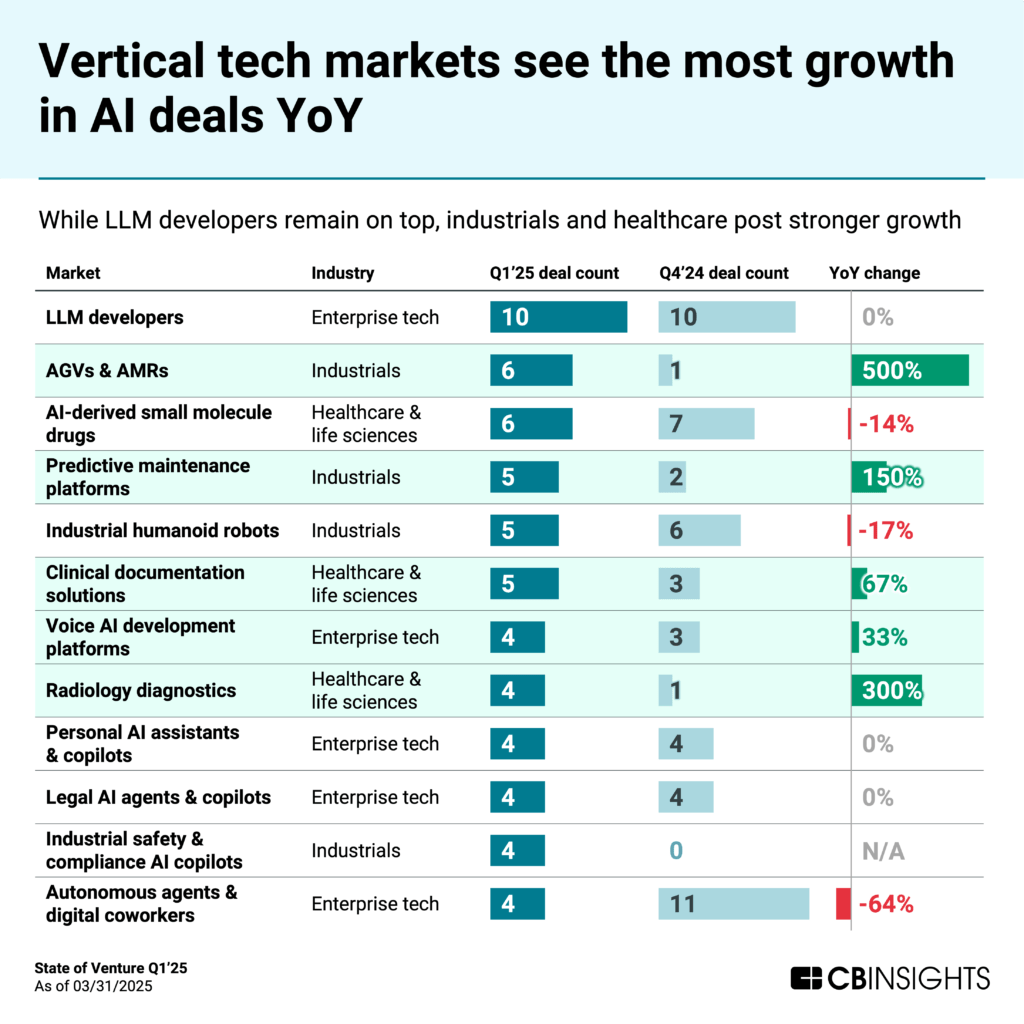

The shift from infrastructure to applications also plays out at the tech market level. Among the 1,400+ tech markets that CB Insights tracks, those in the below chart saw the greatest number of AI deals in Q1’25.

While LLM developers remain the top target for deals, they saw no growth in Q1’25 vs. Q1’24. On the other hand, vertical applications in industrials and healthcare — where AI is measurably improving automation — led in terms of YoY growth.

The top three vertical markets for AI deal growth in Q1’25 were automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), radiology diagnostics — particularly those focused on multiple imaging modalities — and clinical documentation solutions.

4. Early-stage deal sizes pace at an all-time high

The median early-stage deal size reached $2.7M in Q1’25, up from $2M in full-year 2024 — a 35% increase. This jump reflects both investors’ willingness to place larger bets on promising teams and the increased capital requirements for competitive AI development.

The increase is particularly notable against a backdrop of declining deal volume — investors are concentrating resources on fewer, more promising opportunities rather than spreading capital across a wide range of startups.

This environment creates both opportunities and challenges for founders. Well-positioned early-stage companies can secure larger initial rounds, but expectations for progress and growth are similarly elevated. The bar for follow-on funding will be higher for mid-stage rounds.

5. Billion-dollar M&A exits hit a new quarterly record

Q1’25 set a new record for billion-dollar M&A activity, with 12 VC-backed exits exceeding $1B in value, surpassing the previous high of 11 seen in both Q1’00 (dot-com bubble) and Q4’20 (peak ZIRP era). These 12 transactions had a combined value of $56B, driven primarily by Google‘s landmark acquisition of cloud security company Wiz.

The Wiz deal now stands as the most valuable M&A deal ever for a VC-backed private company, exceeding Meta‘s WhatsApp acquisition by more than $10B. It also marks Google’s largest acquisition to date — more than double the size of its Motorola Mobility purchase in 2012 — and sets a new record for cybersecurity exits, eclipsing Salesforce’s $28B acquisition of Splunk.

The Wiz deal highlights the growing focus among big tech companies on AI-driven cloud security as enterprises prioritize securing their expanding digital footprints.

It’s also part of a broader trend of high-profile unicorn exits that includes both IPOs (CoreWeave) and M&A transactions (Moveworks, Weights & Biases).

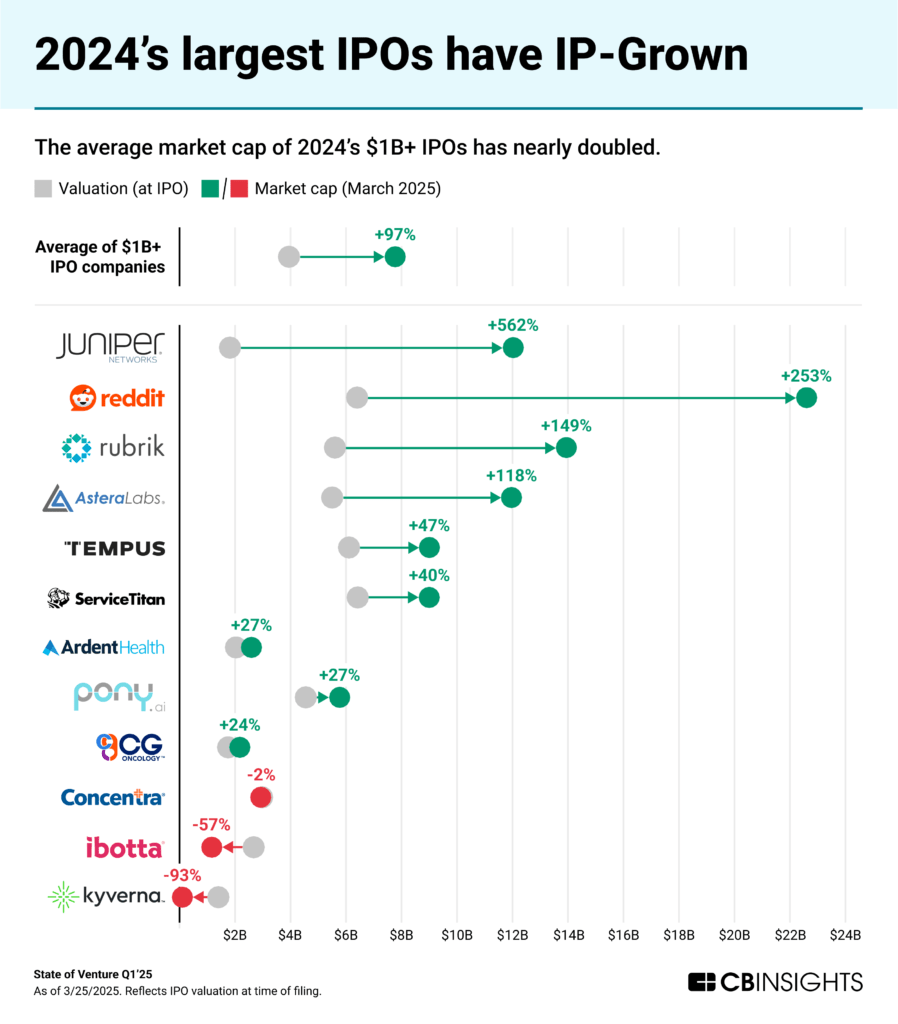

In fact, looking back to 2024, billion-dollar IPOs delivered strong returns — averaging a 97% increase in market cap post-listing. This bodes well for other IPO hopefuls looking to brave the public markets in the coming months.

Predictions for venture dealmaking in 2025

Below, we use signals from public-company earnings calls, startup financing trends, and business relationships to predict which trends will dominate venture activity through the rest of 2025.

AI agents “niche down” and gain enterprise buy-in

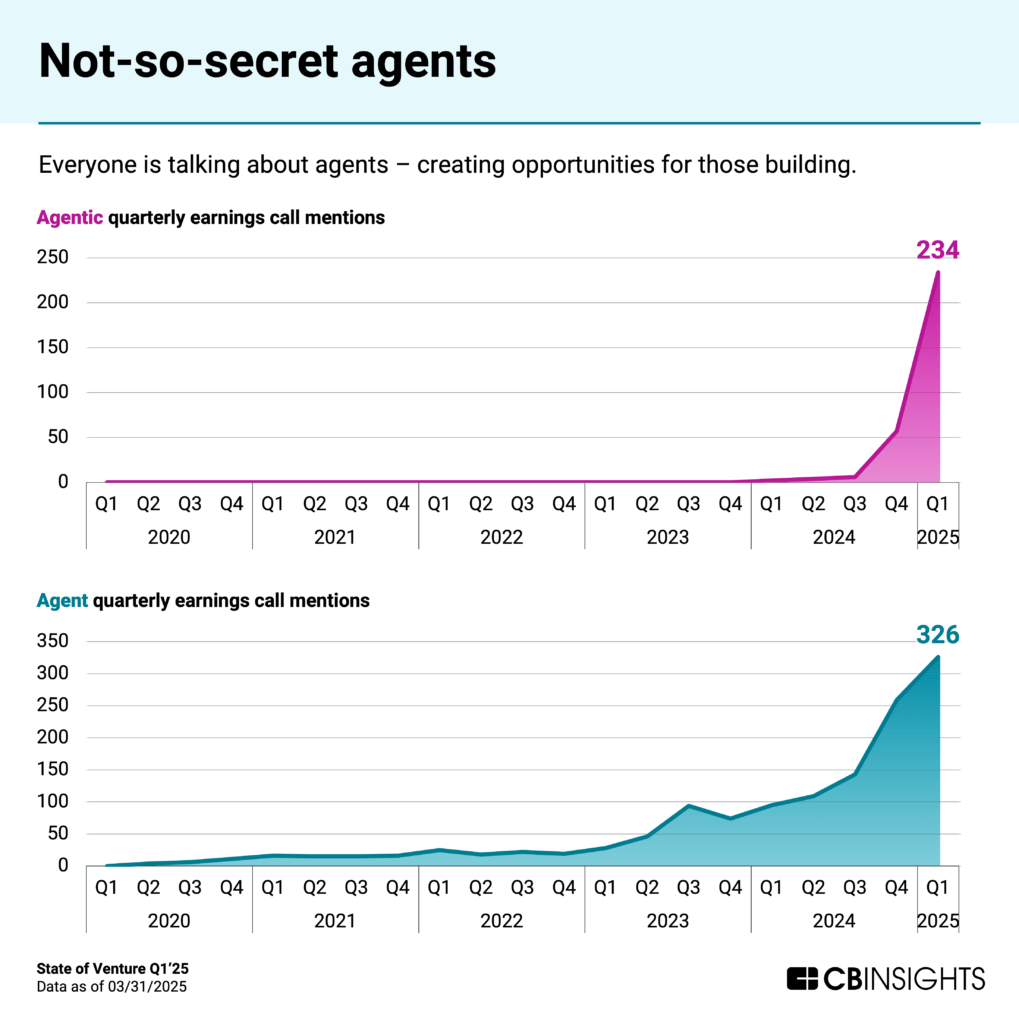

AI agents are transitioning from concept to commercial application. They’ve become a frequent topic on corporate earnings calls, and according to a December 2024 CB Insights survey, 63% of organizations said they are placing significant importance on AI agents over the next 12 months. All respondents reported at least experimenting with agents.

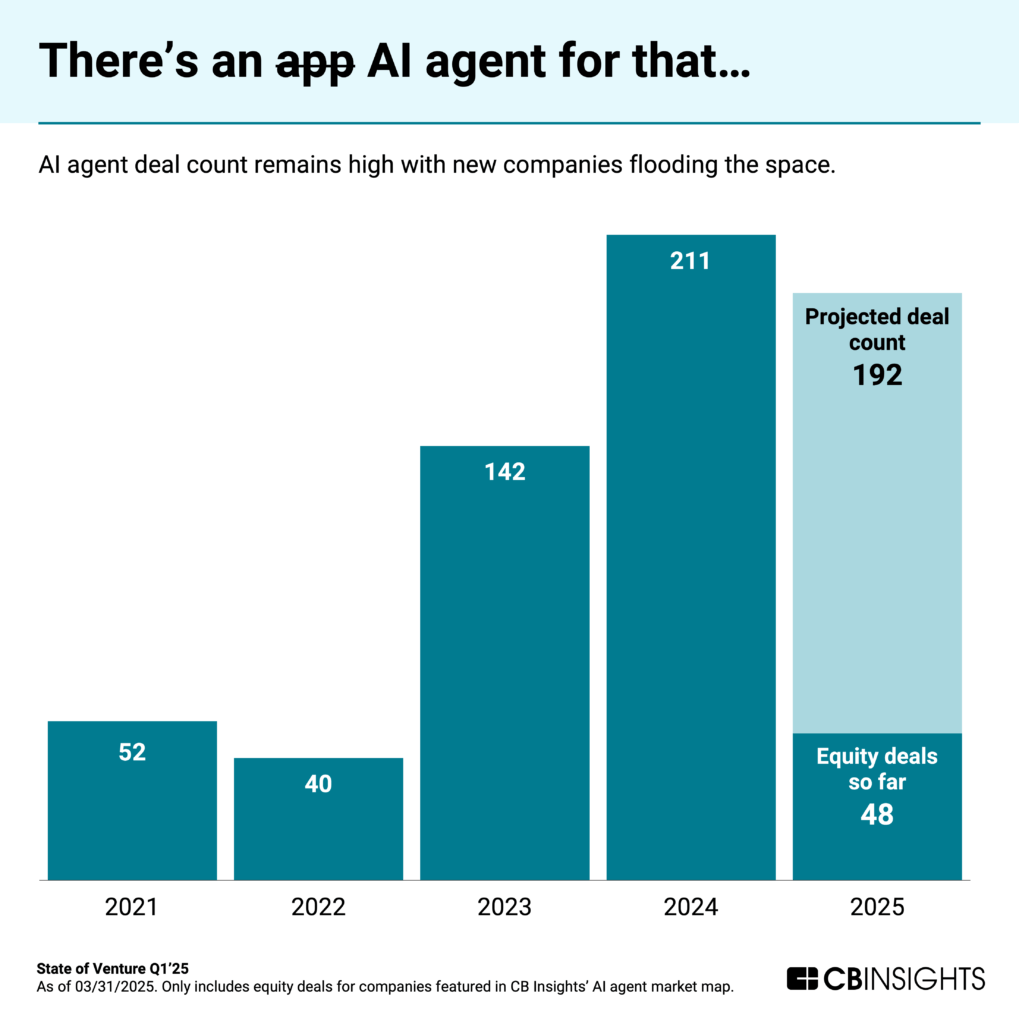

These LLM-based systems represent an evolution beyond copilots. They can autonomously handle complex tasks — from sales prospecting to compliance decision-making — with limited human input. The market is expanding rapidly, with CB Insights data showing that over half of companies in the space were founded since 2023.

Investor interest is surging in parallel. AI agent startups saw more than 200 equity deals in 2024 — and activity is pacing toward similar levels this year.

Key investment themes emerging in the space include:

- Specialized agents for specific business functions (sales, legal, finance)

- Agent orchestration platforms that manage multiple agentic systems

- Safety and alignment tools for ensuring agent behaviors match human intentions

- Enterprise-grade agents with robust permissions and security frameworks

As agents become more capable and trustworthy, adoption will accelerate across industries.

Read more from our AI agent coverage:

Voice AI takes off amid technical advances

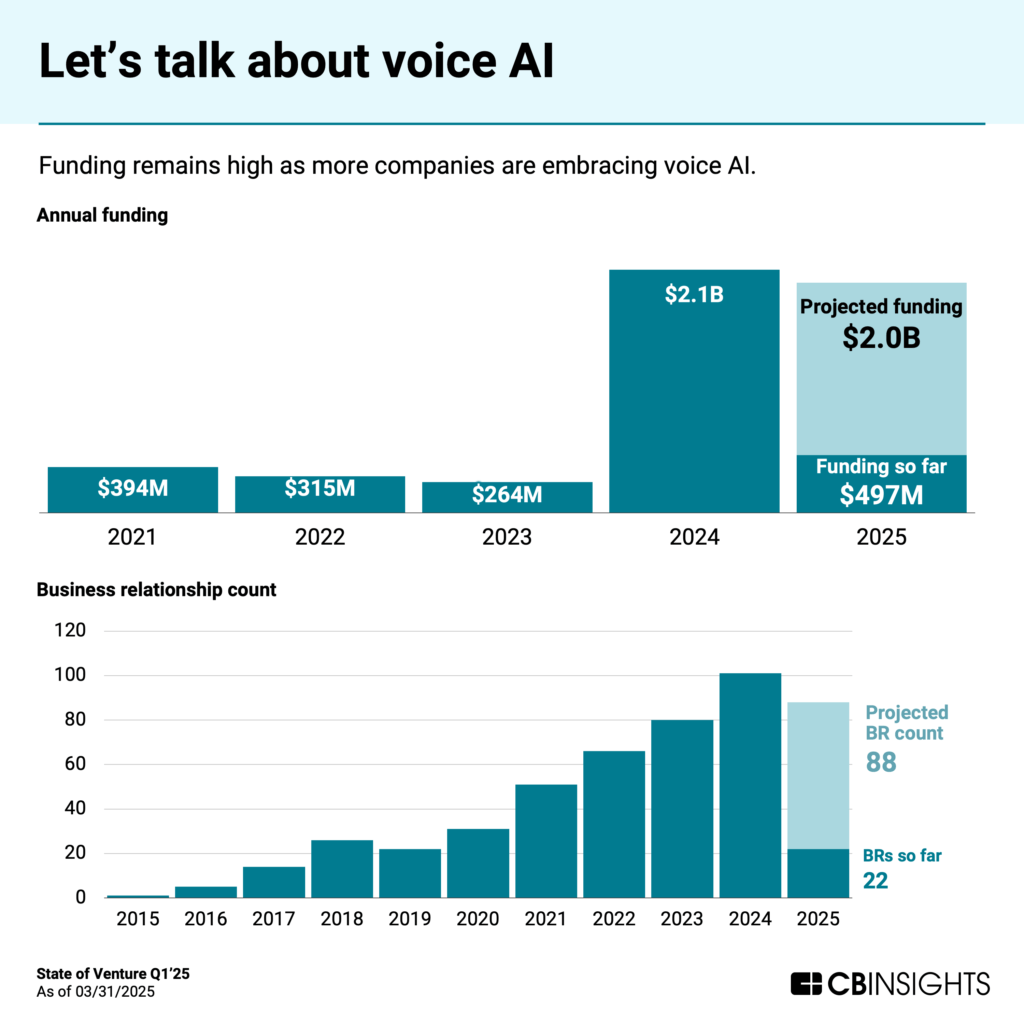

Voice AI is undergoing a technical transformation as models shift toward processing audio directly — bypassing the text intermediation stage — and approaching human-like conversation latency of under 300ms.

This technical progress has fueled substantial investment, with voice AI solutions raising $2.1B in 2024 and nearly $500M in Q1’25.

One standout is ElevenLabs, which reached $100M in ARR just 3 years after its founding and raised a $180M round in January from investors including a16z, Salesforce Ventures, and Sequoia Capital.

Despite these promising signals, the voice AI market remains in early development. CB Insights data shows approximately 85% of companies in the space are at levels 1-3 on the Commercial Maturity scale. Nearly half are developing or validating their products, while 39% have just begun commercial distribution.

As voice interfaces become more natural and capable, we expect to see investment opportunities emerge in several areas:

- Domain-specific voice applications for industries like healthcare and legal

- Voice AI trained on local languages not typically covered by general-purpose AI systems

- Voice-first UI/UX for both consumer and enterprise applications

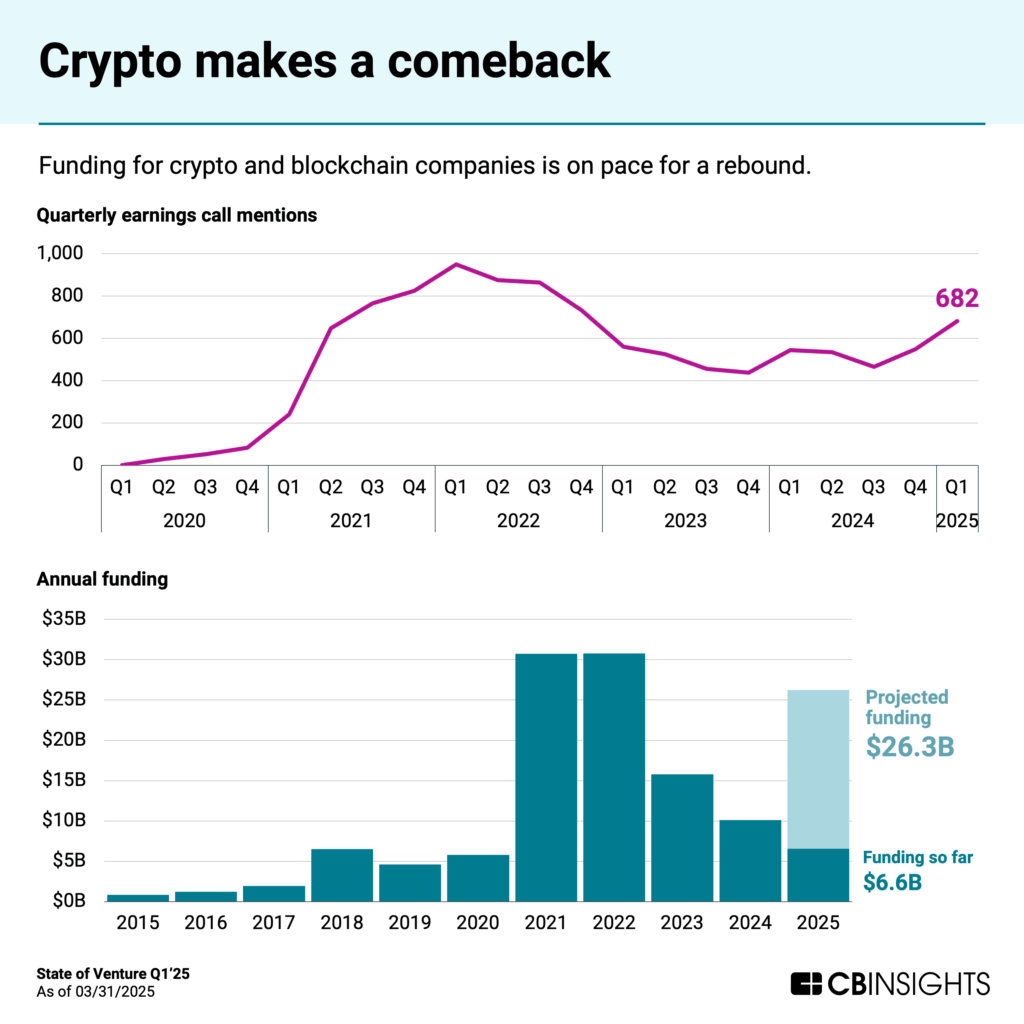

Crypto & blockchain rebound

After weathering a prolonged crypto winter, blockchain technologies are experiencing renewed institutional interest. Funding to crypto/blockchain companies reached $6.6B in Q1’25, putting the space on track to surpass $20B in annual funding. Earnings call mentions have climbed accordingly.

Several crypto companies now rank among the most likely IPO candidates, with platforms like Blockchain.com and Kraken showing IPO probabilities 64x higher than the average company tracked by CB Insights — a notable shift in public-market viability for the sector.

Another trend to watch is the growing institutional and government focus on stablecoins, as regulators develop frameworks to incorporate these digital assets into the traditional financial system.

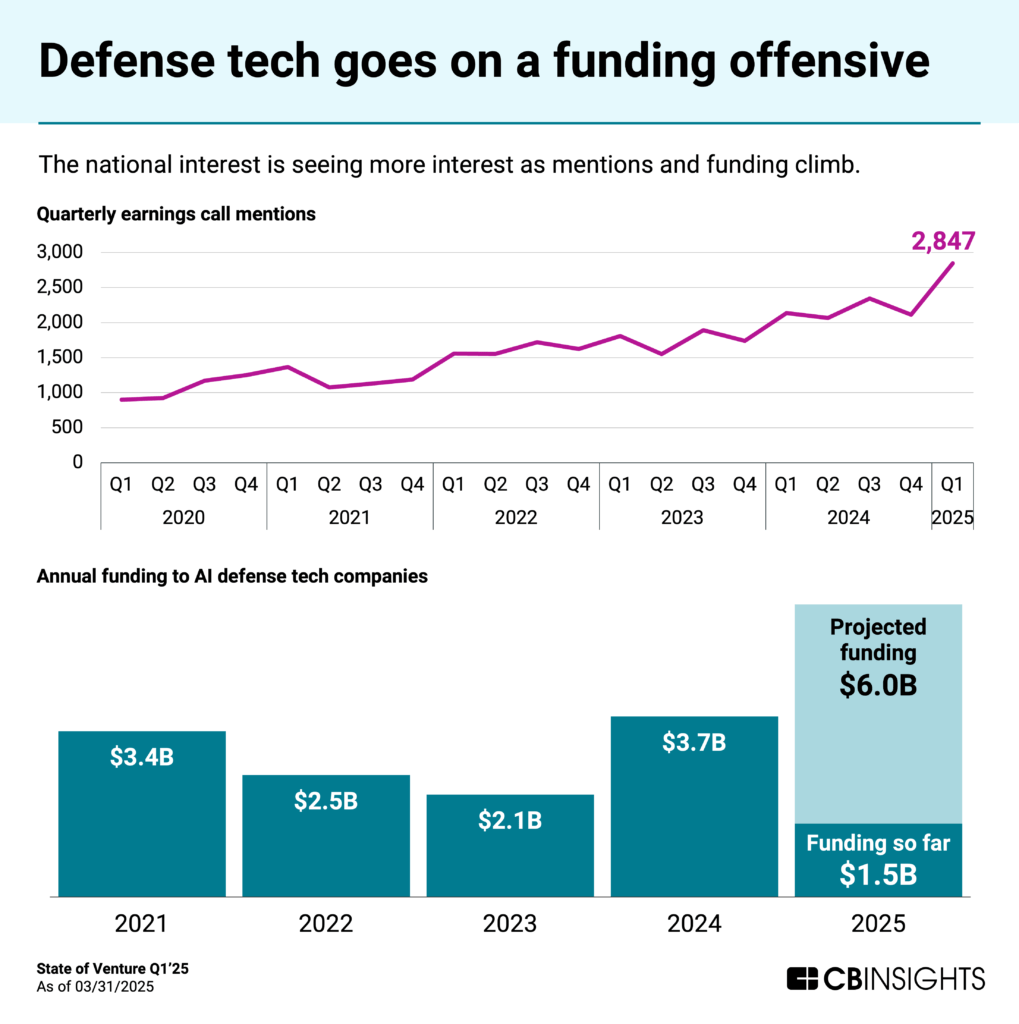

Defense tech comes into focus

Military technology is entering a new era as investment shifts toward autonomous systems and AI-driven capabilities.

According to former Joint Chiefs of Staff Chairman General Mark Milley, smart machines and robotics could account for one-third of the US military presence within the next 15 years.

Funding to AI defense tech startups has already reached $1.5B this year — leading to a projected $6B by year-end. Last quarter saw earnings call discussion of defense reach an all-time high.

Much of this activity centers on multidomain operations (MDO) technologies — integrating systems across land, sea, air, space, and cyber — where AI is accelerating mission planning, threat detection, and battlefield connectivity. Major defense contractors are forming partnerships with AI startups to enhance battlefield management systems, mission planning capabilities, and integrated defense connectivity platforms.

As geopolitical tensions persist, defense tech investment is likely to continue growing, with particular focus on autonomous systems, AI-enhanced battlefield analytics, and advanced cybersecurity solutions for critical infrastructure.

Conclusion

The venture capital landscape in Q1’25 reflects key contrasts: record funding alongside declining deal count, significant early-stage deals vs. heightened expectations for follow-on capital, and a resurgence in billion-dollar exits despite broader market caution.

AI continues to influence capital allocation decisions across the venture ecosystem, but we’re seeing a shift from general infrastructure investments to specialized vertical applications and industry-specific solutions. Meanwhile, sectors beyond AI are showing resilience, with fintech, digital health, and retail tech all posting quarterly funding increases.

For investors, the data suggests maintaining a disciplined approach to AI investments while remaining alert to opportunities in adjacent sectors. The companies that successfully blend AI capabilities with sustainable business models will emerge as the defining ventures of this era.

For more insights on venture trends and emerging technologies, explore our related resources:

- The AI agent market map

- 7 tech M&A predictions for 2025

- State of AI Report: 6 trends shaping the landscape in 2025

- 15 tech trends to watch closely in 2025

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

The post State of Venture Q1’25 Report appeared first on CB Insights Research.

]]>The post Zuckerberg vs. Altman: A showdown in social AI appeared first on CB Insights Research.

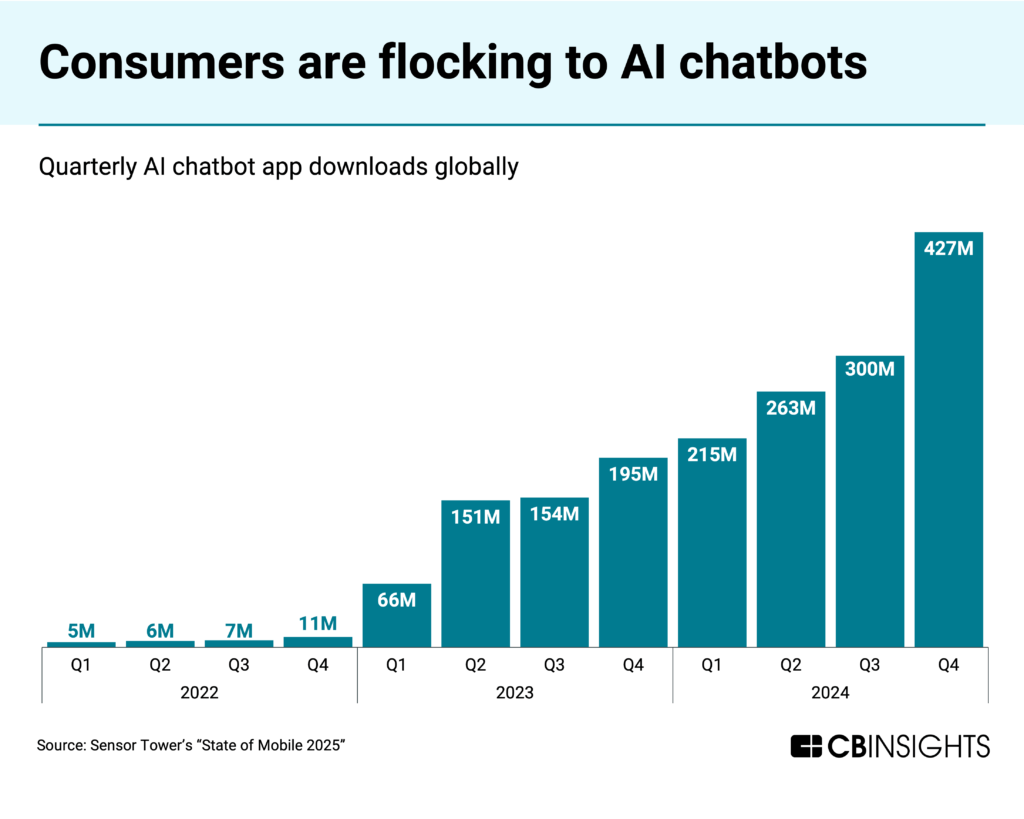

]]>AI chatbots saw a record 427M app downloads last quarter — up 42% vs. Q3.

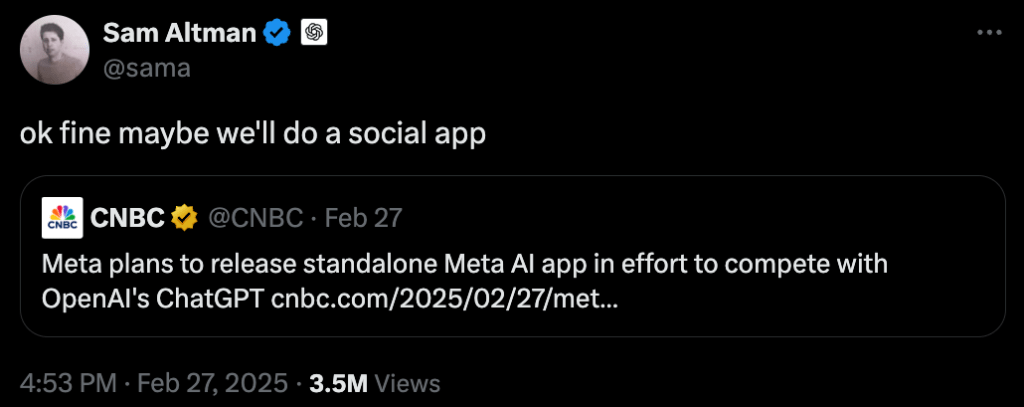

Now Meta wants in on the action.

The tech giant reportedly plans to spin Meta AI into a standalone app to compete with ChatGPT, Google’s Gemini, Perplexity, and other chatbot apps.

ChatGPT is still king with nearly a quarter of AI chatbot app downloads in 2024 and 400M weekly active users across platforms (not just mobile).

But Meta has a massive in-built user base, including ~700M people who already interact with Meta AI features each month across apps like Facebook and Instagram.

The battle for attention is on.

Source: X

One of the differentiators for social AI applications will be emotional intelligence — an area where OpenAI’s latest model, GPT-4.5, shows promise.

While many headlines have focused on the model’s eye-watering costs, one notable advance is its reported ability to interact with greater empathy (an area where Anthropic’s Claude has so far been superior).

This matters because the more natural AI sounds, the easier it will be for consumers to see it fitting into their lives.

It also makes AI even more formidable in both personal and business settings if the AI can be both higher IQ and EQ than most of us pesky ol’ humans.

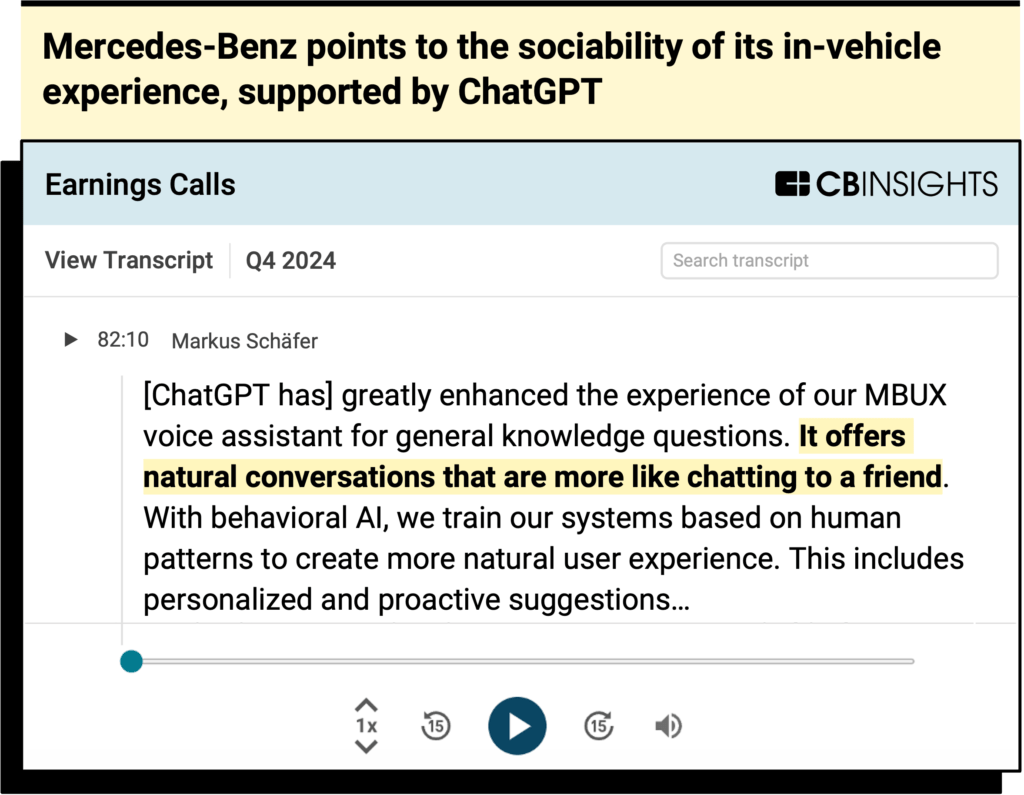

Businesses are catching on: More public cos are citing AI as a “friend” or “companion” on earnings calls in an effort to make B2C services more personal.

Mercedes-Benz, for instance, envisions drivers chatting with its MBUX voice assistant (which is built on ChatGPT) like a friend.

Source: CB Insights — Mercedes-Benz Q4’24 earnings call

Beyond emotional connection, AI developers are also making their chatbots more useful through agentic capabilities. This dual focus on both feeling and function will shape the competitive landscape moving forward.

While still constrained by reliability and access issues, web-browsing agents like OpenAI’s Operator signal a future where humans interact regularly with AI agents that take actions on their behalf.

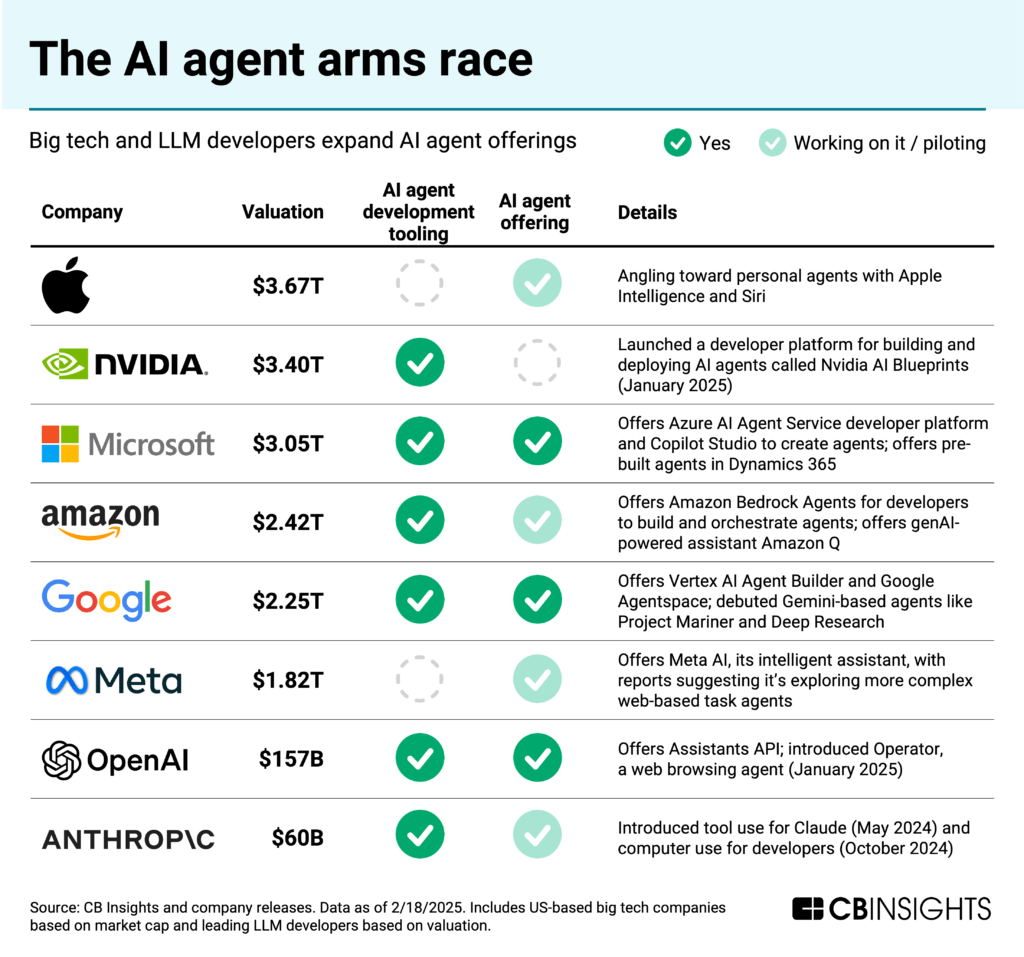

Already nearly every tech giant, plus leading LLM developers like OpenAI and Anthropic, have developed AI agents or are building out tools for others to develop them.

In a head-to-head matchup, OpenAI and Meta would bring distinct sets of advantages.

OpenAI has already built user habits with ChatGPT and is now layering agent capabilities on top. Meta must convince users its AI offering brings something meaningfully different.

But Meta’s experience in the social realm, combined with its existing algorithms, could give it an edge in creating AI that feels like it belongs in human conversations.

Watch for both companies to rapidly iterate on their consumer agent offerings in the coming months.

Related AI research from CB Insights:

- What’s next for AI agents? 4 trends to watch in 2025

- The future of the customer journey: AI agents take control of the buying process

- The foundation model divide: Mapping the future of open vs. closed AI development

- State of AI Report: 6 trends shaping the landscape in 2025

The post Zuckerberg vs. Altman: A showdown in social AI appeared first on CB Insights Research.

]]>The post AI and Web3 are leading the next wave of gaming innovation appeared first on CB Insights Research.

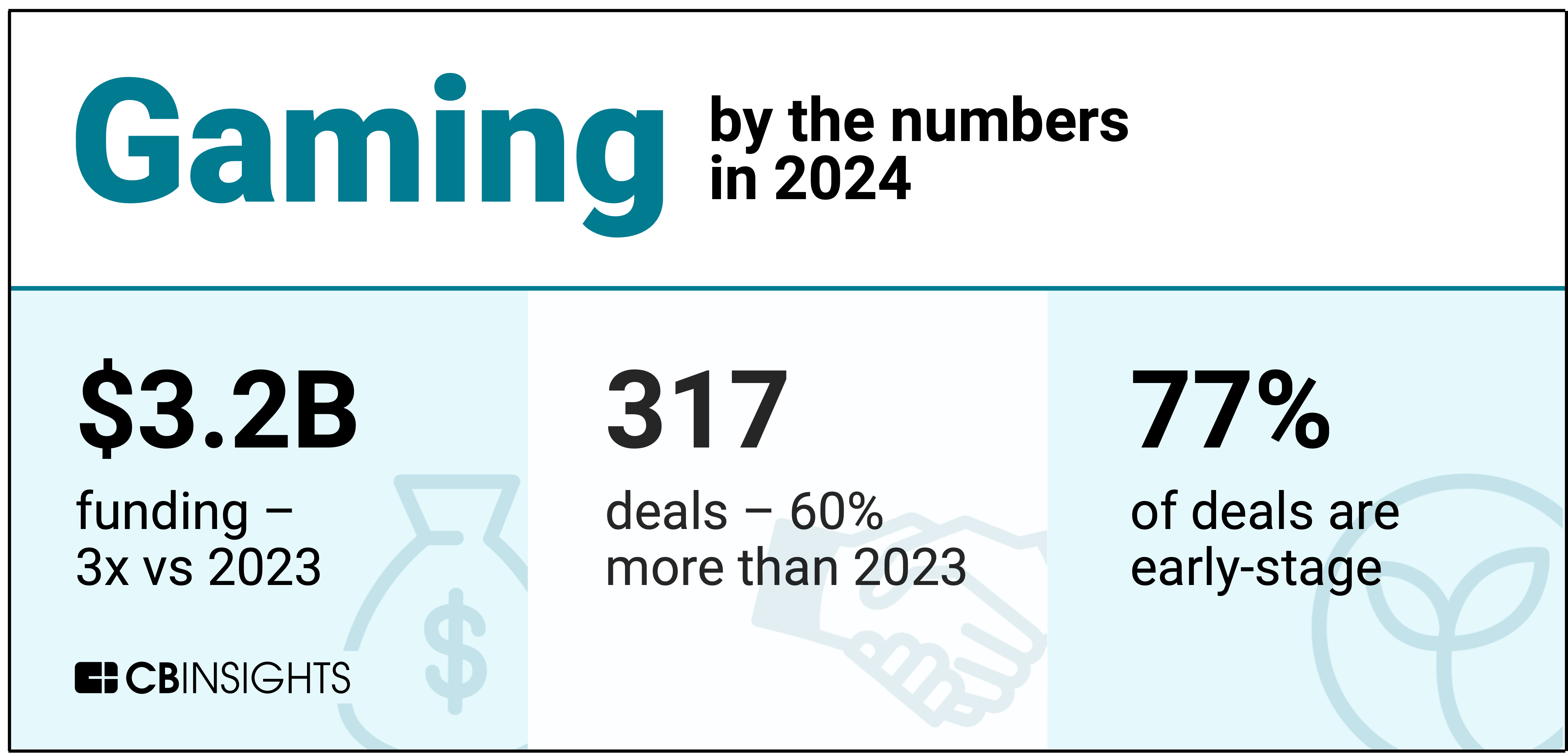

]]>But AI and blockchain solutions are driving innovation to create new revenue streams and stoke the existing ones. Early-stage deals in those spaces helped drive a rally in funding and dealmaking in gaming in 2024. Annual funding nearly tripled to $3.2B across 317 deals, with early-stage companies securing 77% of investments — up from 70% in 2023.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post AI and Web3 are leading the next wave of gaming innovation appeared first on CB Insights Research.

]]>The post State of CVC 2024 Report appeared first on CB Insights Research.

]]>However, global CVC deal count dropped to its lowest level since 2018 as CVCs become more selective.

Download the full report to access comprehensive data and charts on the evolving state of CVC across sectors, geographies, and more.

Key takeaways from the report include:

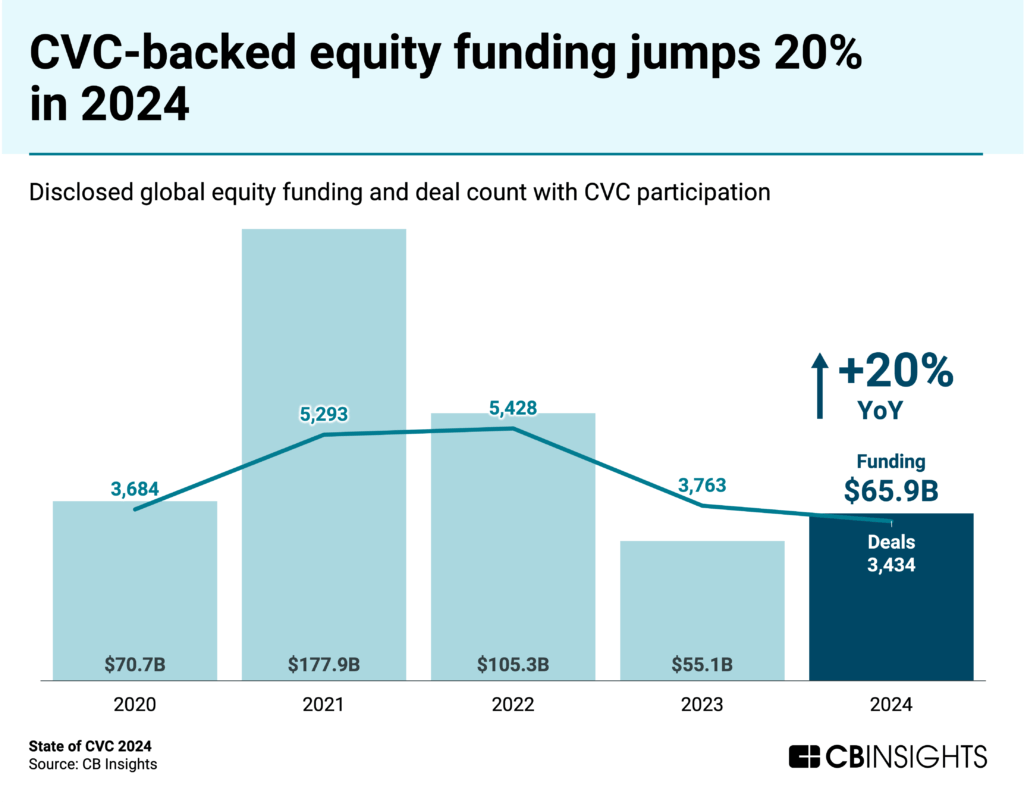

- CVC-backed funding grows, deal activity slows. Global CVC-backed funding increased 20% YoY to $65.9B, but deal count fell to 3,434, the lowest level since 2018. All major regions saw deal volume declines, with Europe dropping the most at 10% YoY.

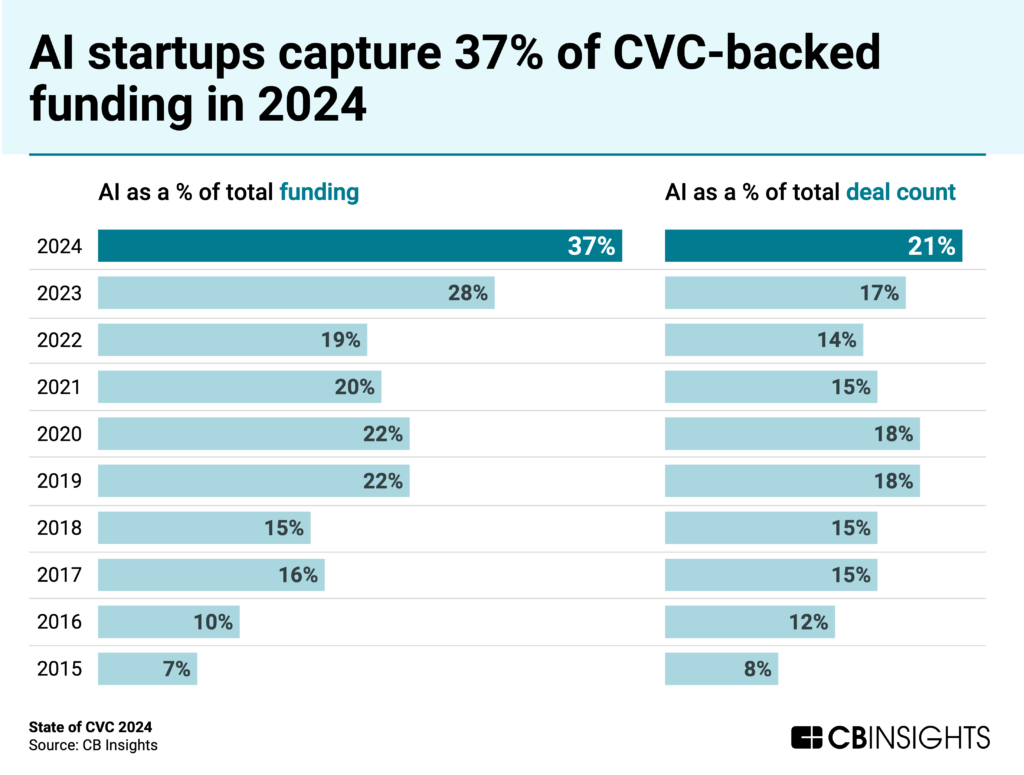

- CVCs are all in on AI. AI startups captured 37% of CVC-backed funding and 21% of deals in 2024 — both record highs. Counter to the broader decline in deals, CVCs ratcheted up AI dealmaking by 13% YoY as they race to secure footholds in the space before competitors gain an insurmountable edge.

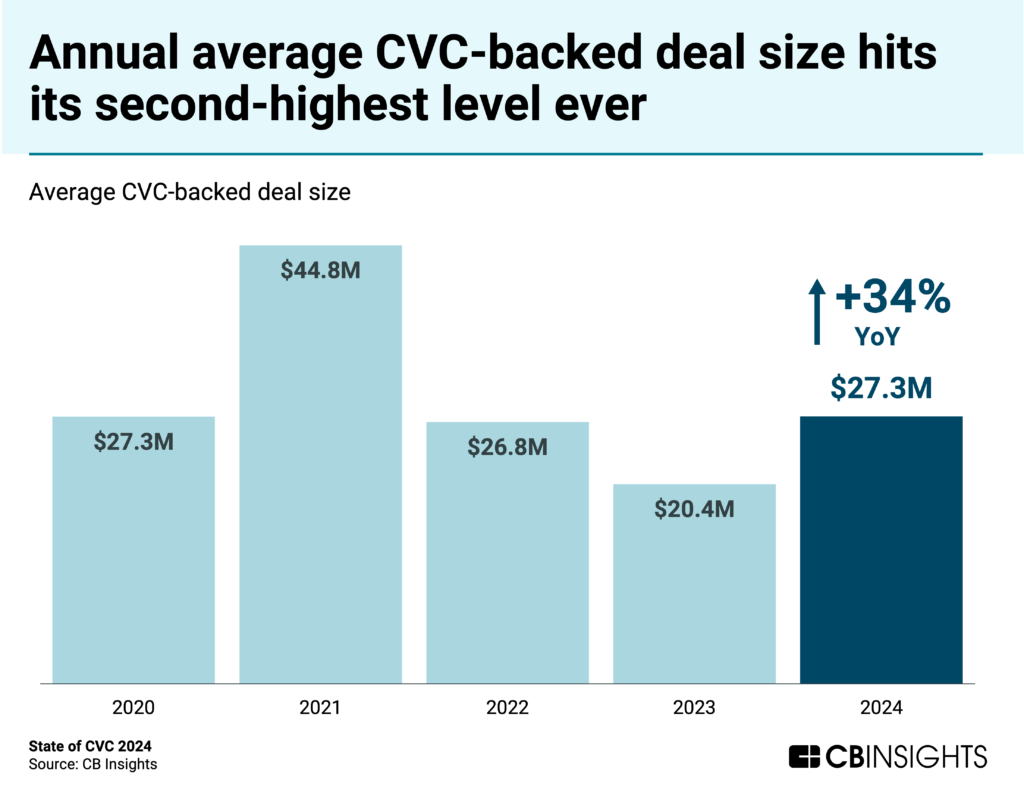

- The flight to quality continues. Among deals with CVC participation, the annual average deal size hit $27.3M in 2024, tied for the second highest ever. Amid fewer deals, CVCs are increasingly aggressive when they do decide to invest.

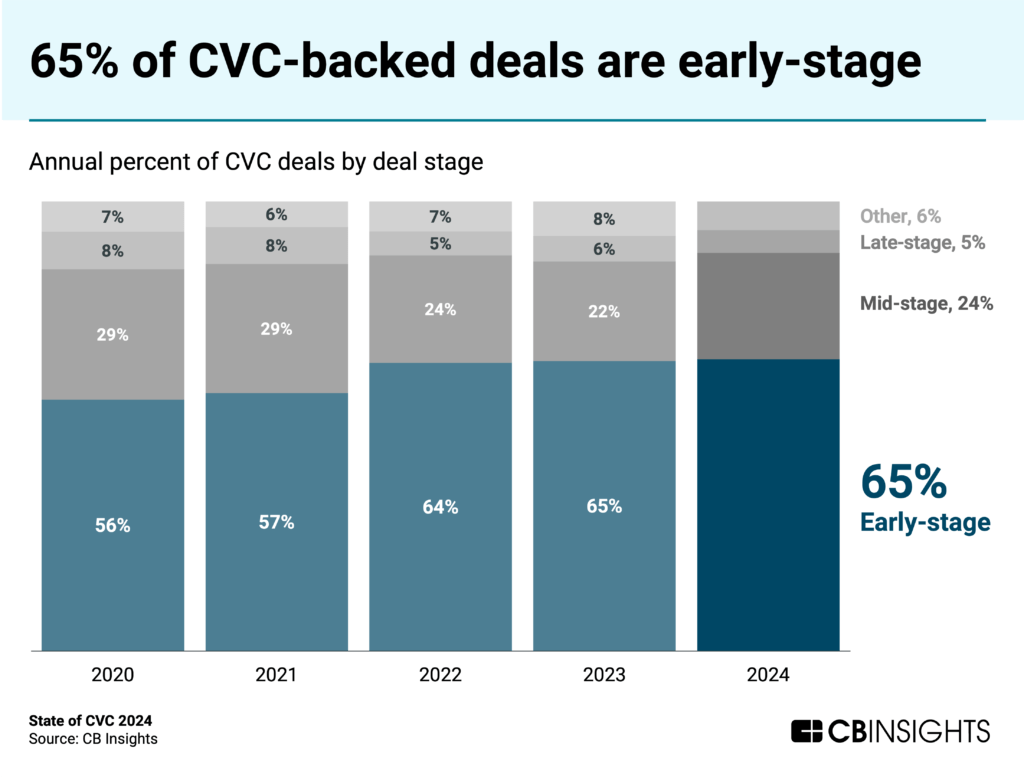

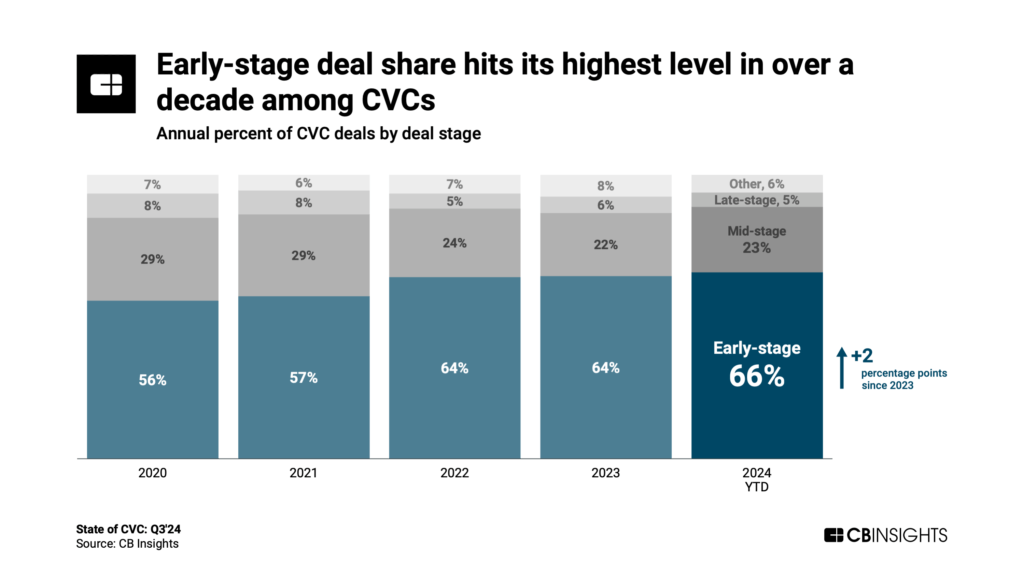

- Early-stage deals dominate. Early-stage rounds comprised 65% of 2024 CVC-backed deals, tied for the highest share in over a decade. Biotech startups made up half of the top 20 early-stage deals.

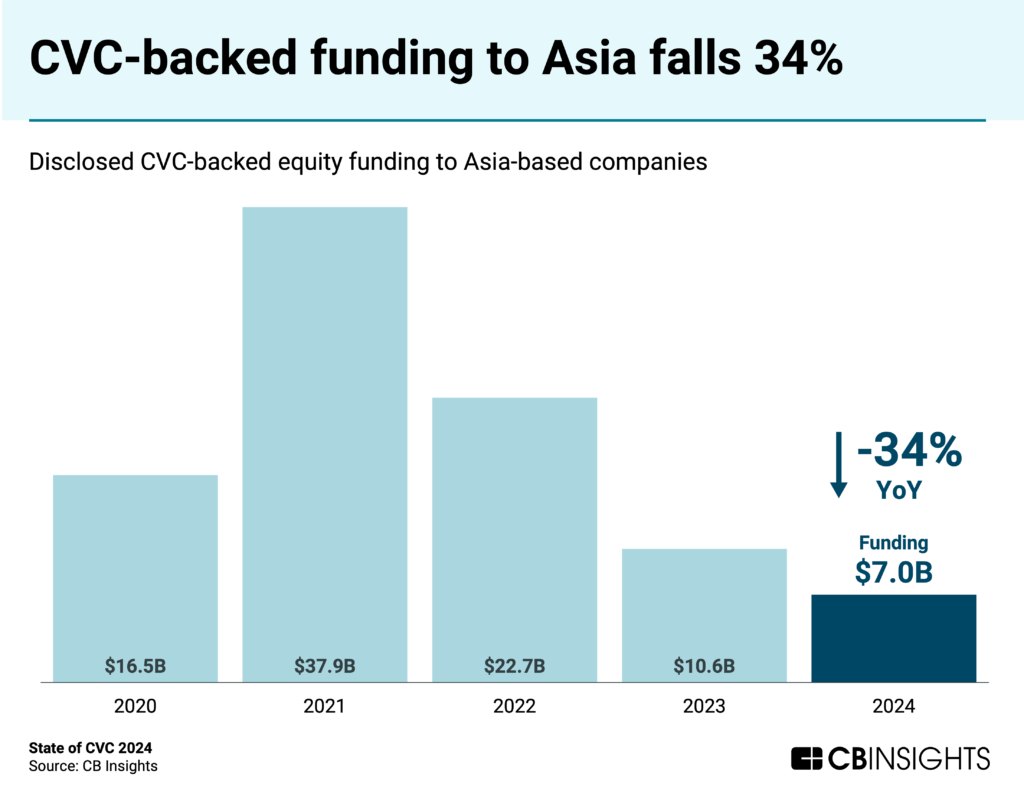

- CVC-backed funding plummets in Asia. In 2024, Asia’s CVC-backed funding dropped 34% YoY to $7B — the lowest level since 2016. China is leading the decline, with no quarter in 2024 exceeding $0.5B in funding. CVCs remain wary of investing in the country’s private sector.

We dive into the trends below.

CVC-backed funding grows, deal activity slows

Global CVC-backed funding reached $65.9B, a 20% YoY increase. The US was the main driver, increasing 39% YoY to $42.8B. Europe also saw CVC-backed funding grow 18% to $12.3B, while Asia declined 34% to $7B.

$100M+ mega-rounds also contributed to the rise, ticking up 21% YoY to 141 deals worth over $32B in funding.

Meanwhile, deal count continued its decline, as both annual (3,434 in 2024) and quarterly (806 in Q4’24) totals reached their lowest levels in 6 years.

Annual deal volume fell by at least 6% YoY across each major region — the US, Asia, and Europe — with Europe experiencing the largest decline at 10%.

However, Japan-based CVC deal volume remains near peak levels, suggesting a more resilient CVC culture compared to other nations. Two of the three most active CVCs in Q4’24 are based in Japan: Mitsubishi UFJ Capital (21 company investments) and SMBC Venture Capital (15).

CVCs are all in on AI

AI is driving CVC investment activity, much like the broader venture landscape. In 2024, AI startups captured 37% of CVC-backed funding and 21% of deals, both record highs.

In Q4’24, the biggest CVC-backed rounds went primarily to AI companies. These include:

- AI search startup Perplexity’s $500M Series C, backed by Nvidia’s NVentures

- Coding AI copilot Poolside’s $500M Series B, backed by the venture arms for Citigroup, HSBC, Capital One, LG, eBay, and Nvidia

- AI computing processor developer Lightmatter’s $400M Series D, backed by GV

CVCs are also investing in the energy companies powering the AI boom, such as Intersect Power, which raised the largest round at $800M (backed by GV).

Expect the trend to continue into 2025, as emerging AI markets mature further, such as AI agents & copilots for enterprise and industrial use cases; AI solutions for e-commerce, finance, and defense; and the computing hardware necessary to power these technologies.

The flight to quality continues

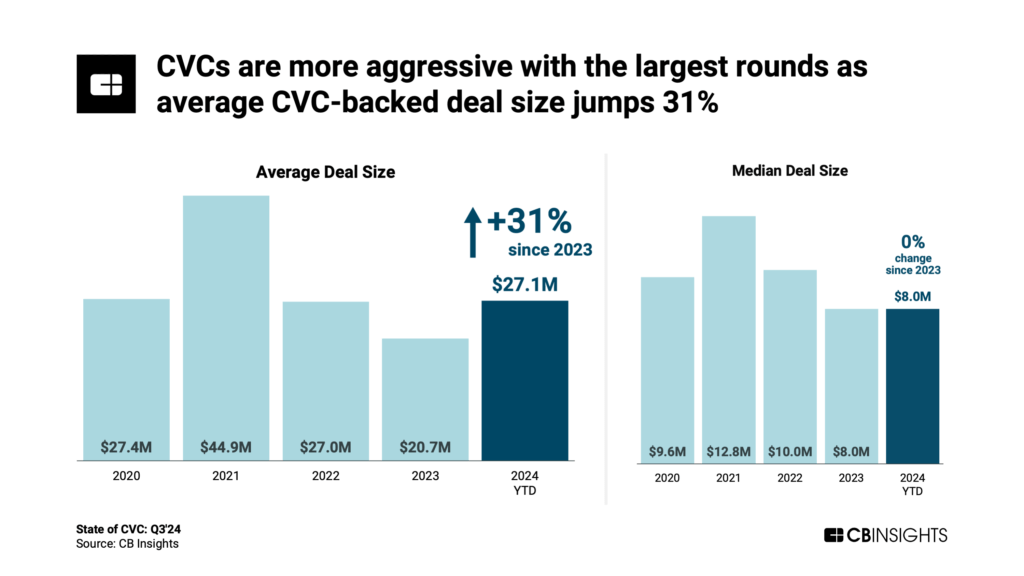

In 2024, the annual average deal size with CVC participation reached $27.3M, a 34% YoY increase and tied for the second highest level on record, exceeded only by the low-interest-rate environment of 2021.

Median deal size also increased, though only by 8% to $8.6M.

Even though the number of CVC-backed deals declined in 2024, the increase in average annual deal size reflects a focus on companies with strong growth prospects. CVCs are prioritizing quality and committing more funds to a select group of high-potential investments.

Early-stage deals dominate

Early-stage rounds (seed/angel and Series A) made up 65% of CVC-backed deals in 2024, tied for the highest recorded level in more than a decade.

In Q4’24, biotech companies were the early-stage fundraising leaders, accounting for 10 of the 20 largest early-stage deals. Biotech players City Therapeutics, Axonis, and Trace Neuroscience all raised $100M+ Series A rounds, with City Therapeutics and Axonis notably receiving investment from the venture arms of Regeneron and Merck, respectively.

Among all early-stage CVC-backed companies, the largest round went to Physical Intelligence, a startup focused on using AI to improve robots and other devices. Physical Intelligence raised a $400M Series A with investment from OpenAI Startup Fund.

CVC-backed funding plummets in Asia

Asia’s CVC-backed funding continued its downward trend in 2024, decreasing 34% YoY to $7B.

China was the main driver, with CVC-backed funding coming in at $0.5B or less every quarter in 2024. CVCs remain wary of investing in startups in the nation, which faces a variety of economic challenges, including a prolonged real estate slump, cautious consumer spending, strained government finances, and weakened private sector activity amid policy crackdowns.

In Japan, on the other hand, CVC activity remains robust. In 2024, funding with CVC participation ($1.7B) remained on par with the year prior, while deals (502) actually increased by 11%.

MORE VENTURE RESEARCH FROM CB INSIGHTS

The post State of CVC 2024 Report appeared first on CB Insights Research.

]]>The post State of AI Report: 6 trends shaping the landscape in 2025 appeared first on CB Insights Research.

]]>Venture funding surged past the $100B mark for the first time as AI infrastructure players pulled in billion-dollar investments. A wave of M&A deals and rapidly scaling AI unicorns further underscored the tech’s momentum.

Download the full report to access comprehensive data and charts on the evolving state of AI across exits, top investors, geographies, and more.

Key takeaways include:

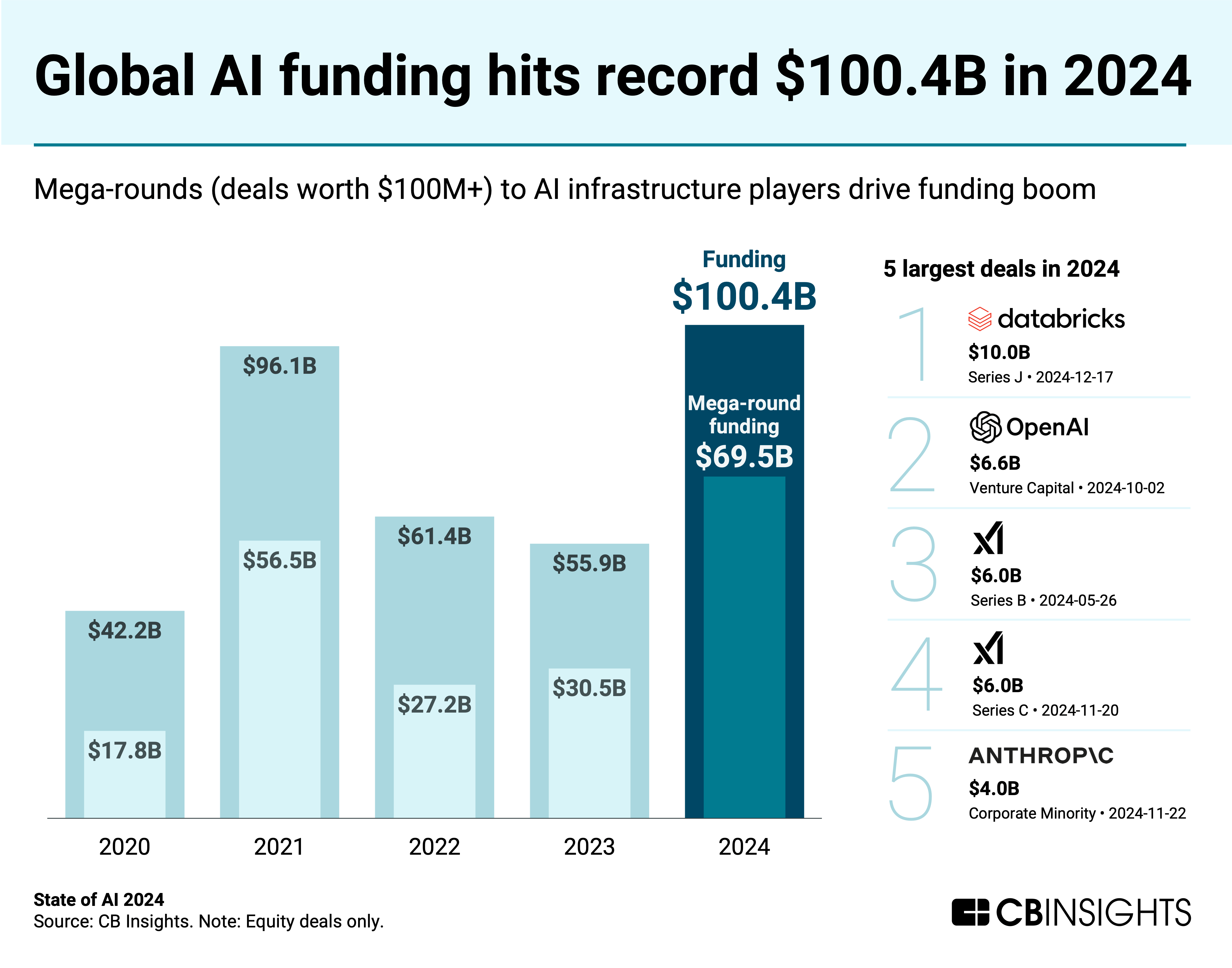

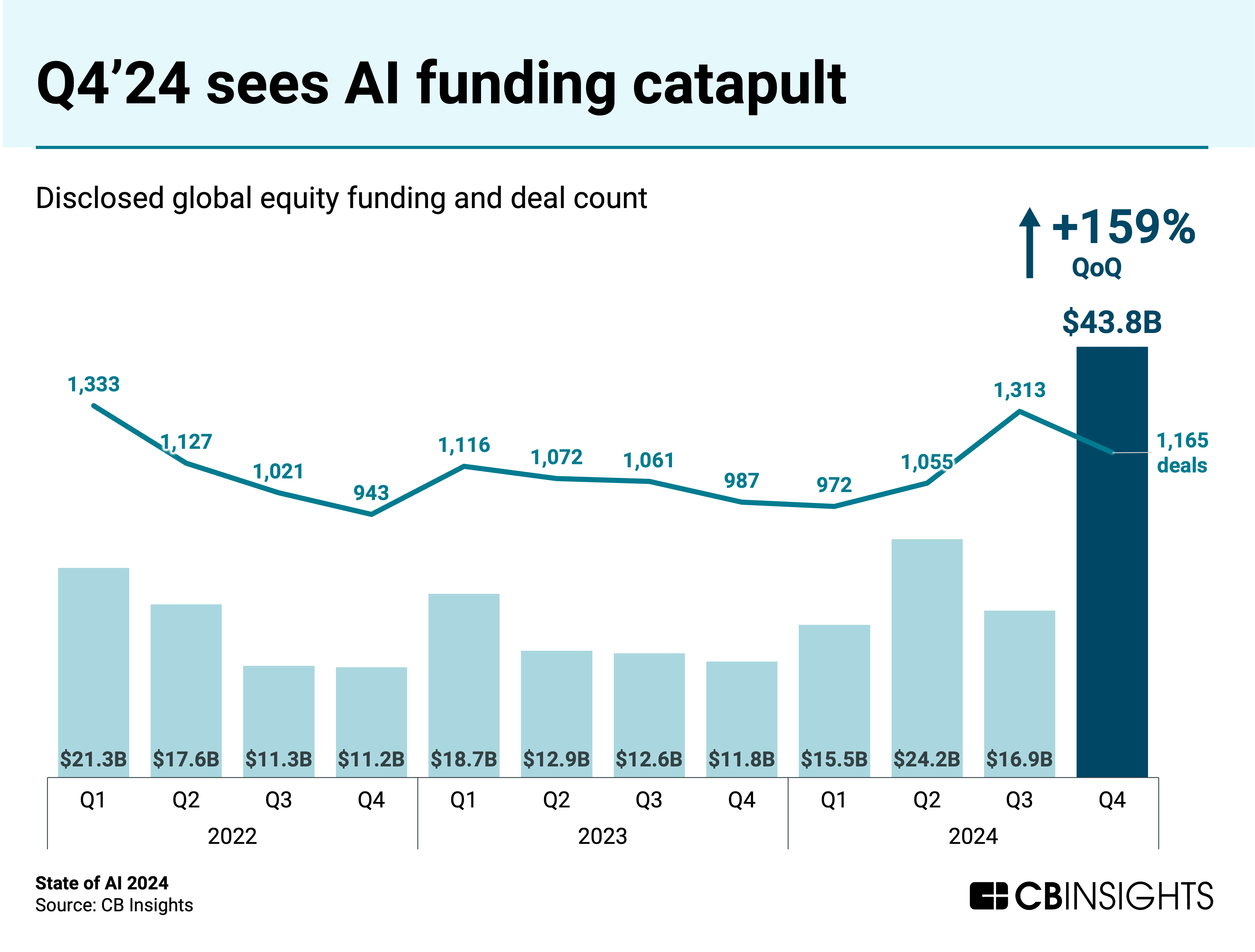

- Massive deals drive AI funding boom. AI funding hit a record $100.4B in 2024, with mega-rounds accounting for the largest share of funding we’ve tracked to date (69%) — reflecting the high costs of AI development. Quarterly funding surged to $43.8B in Q4’24, driven by billion-dollar investments in model and infrastructure players. At the same time, nearly 3 in 4 AI deals (74%) remain early-stage as investors look to get in on the ground floor of the AI opportunity.

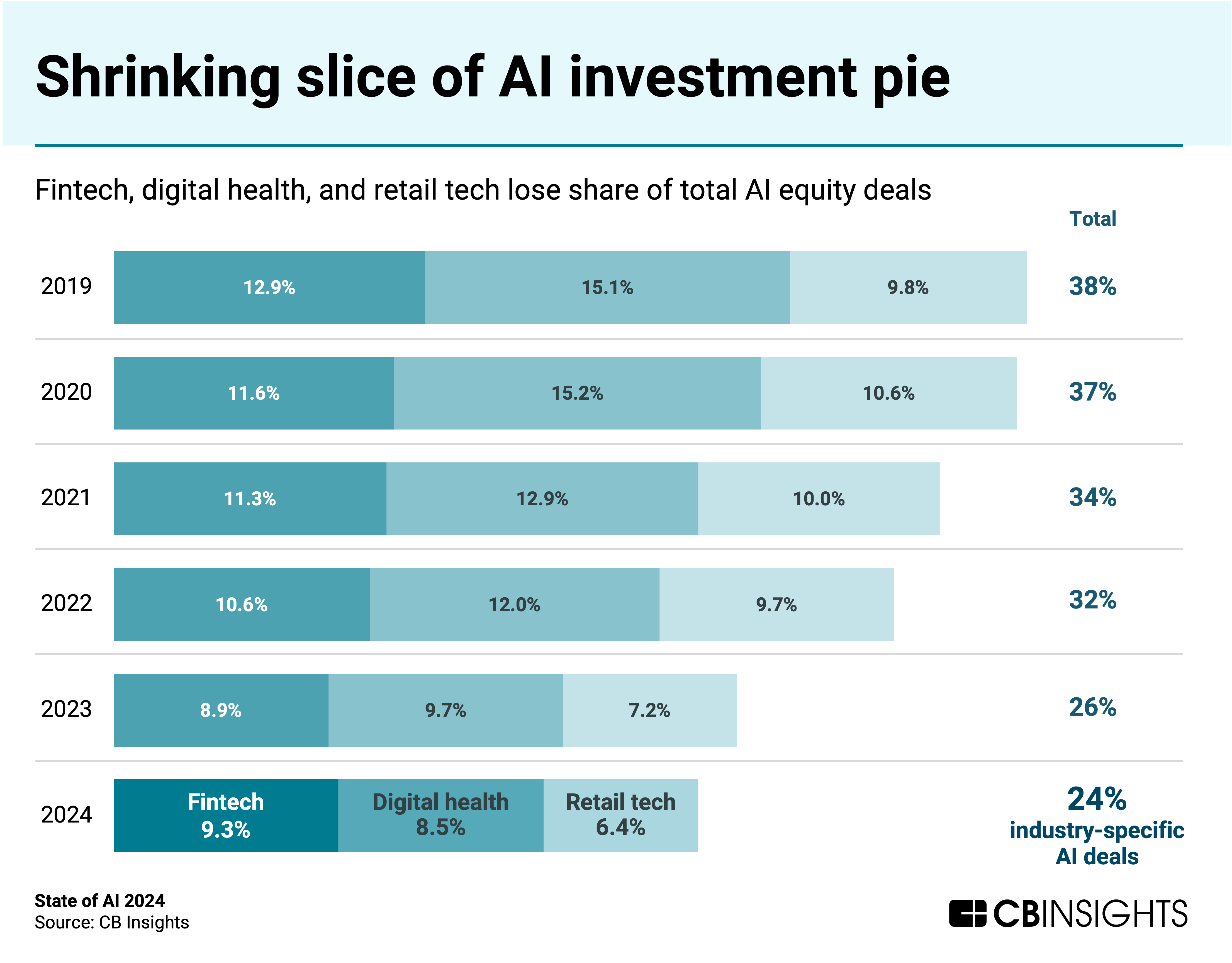

- Industry tech sectors lose ground in AI deals. Vertical tech areas like fintech, digital health, and retail tech are securing a smaller percentage of overall AI deals (declining from a collective 38% in 2019 to 24% in 2024). The data suggests that companies focused on infrastructure and horizontal AI applications are drawing greater investor interest amid generative AI’s rise.

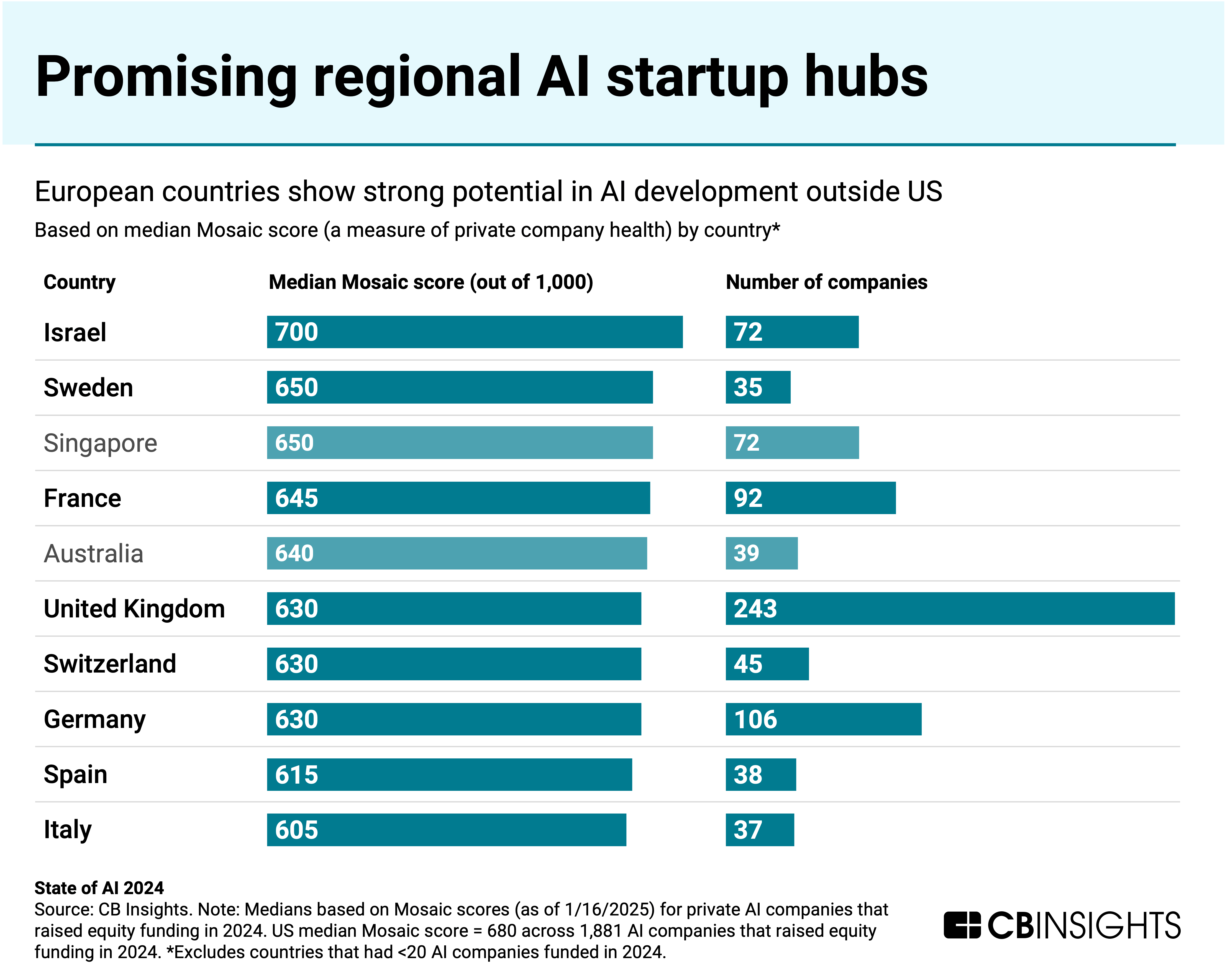

- Outside of the US, Europe fields high-potential AI startup regions. While the US dominated AI funding (76%) and deals (49%) in 2024, countries in Europe show strong potential in AI development based on CB Insights Mosaic startup health scores. Israel leads with the highest median Mosaic score (700) among AI companies raising funding.

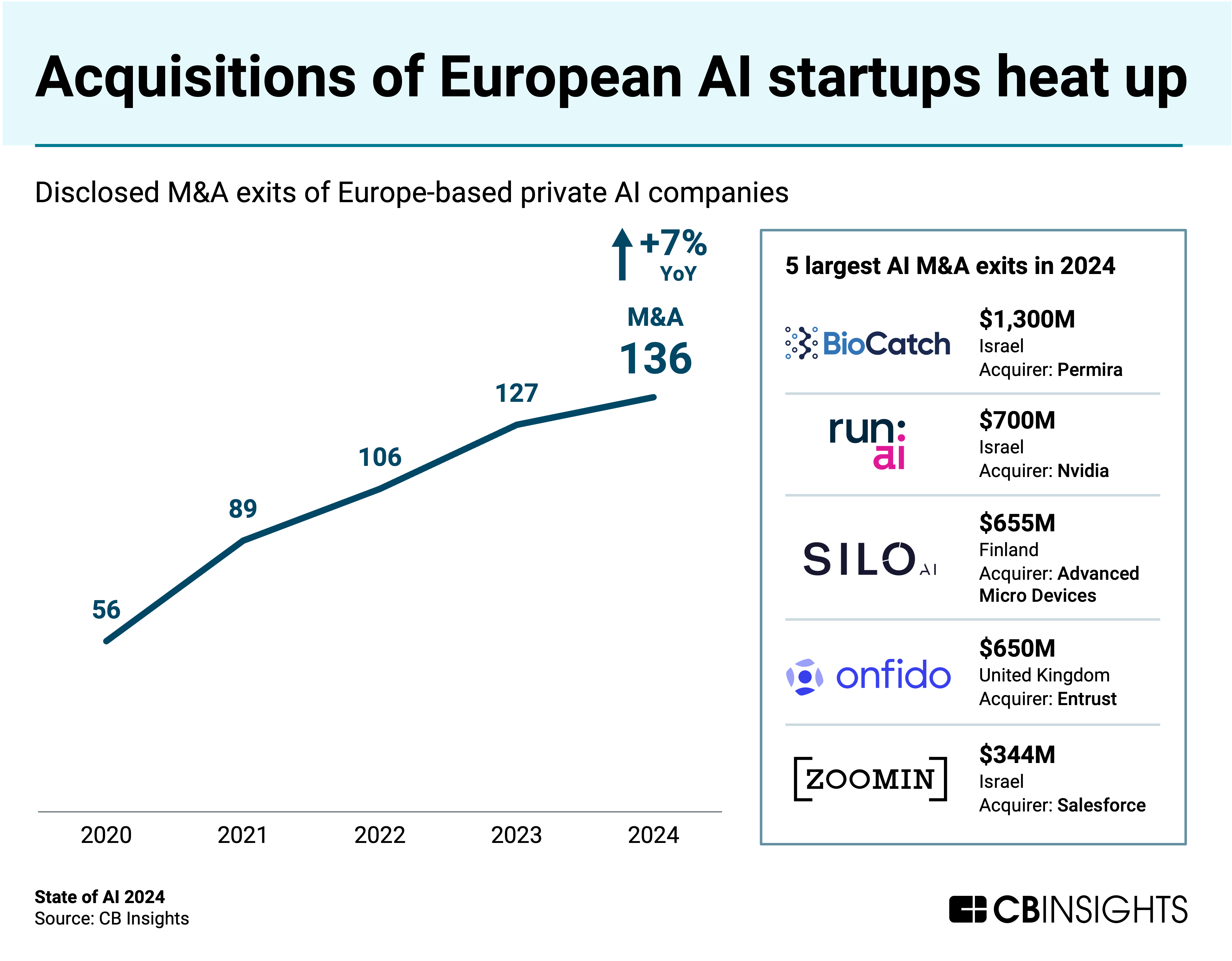

- AI M&A activity maintains momentum. The AI acquisition wave remained strong in 2024, with 384 exits nearly matching 2023’s record of 397. Europe-based startups represented over a third of M&A activity, cementing a 4-year streak of rising acquisitions among the region’s startups.

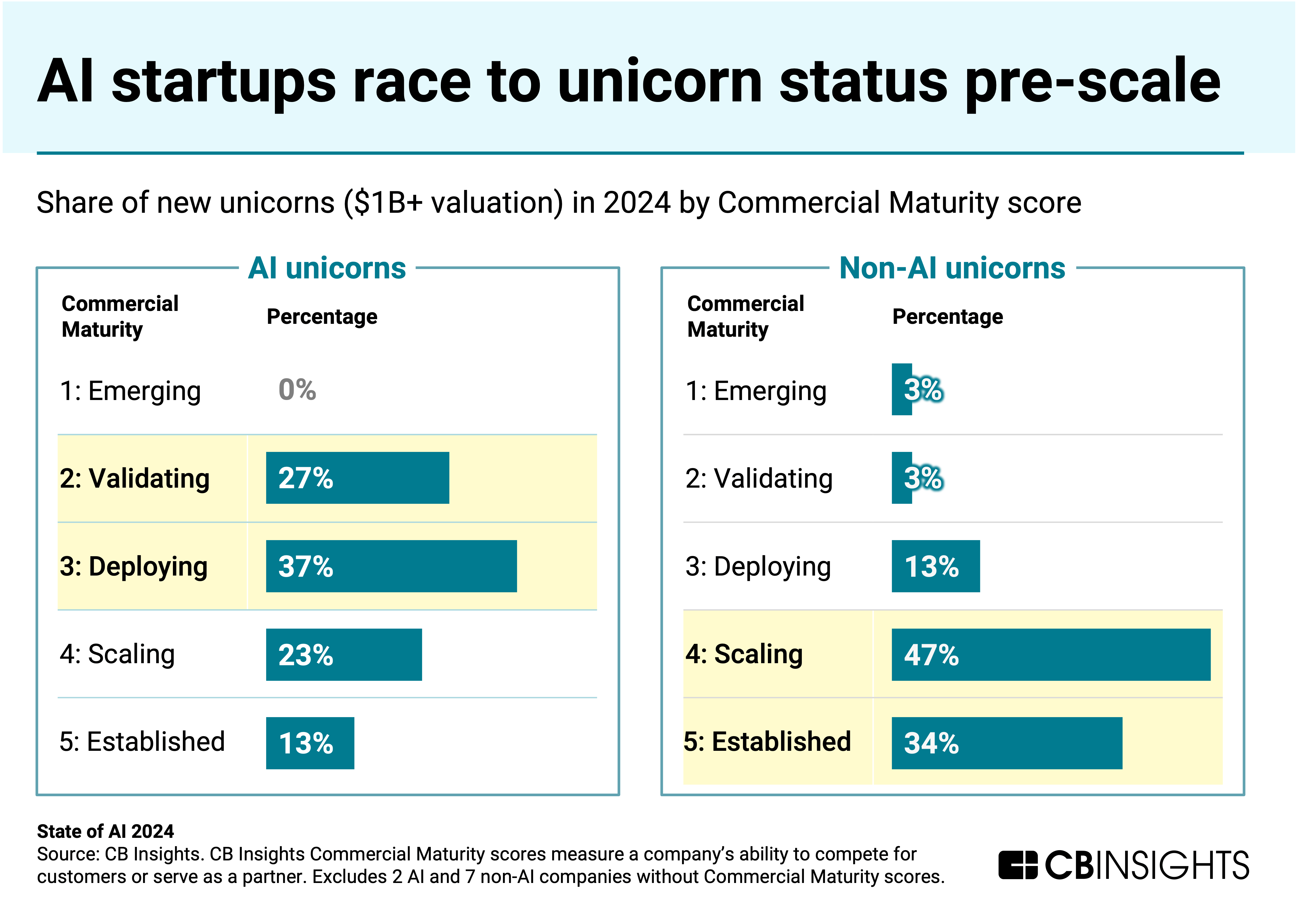

- AI startups race to $1B+ valuations despite early market maturity. The 32 new AI unicorns in 2024 represented nearly half of all new unicorns. However, AI unicorns haven’t built as robust of a commercial network as non-AI unicorns, per CB Insights Commercial Maturity scores, indicating their valuations are based more on potential than proven business models at this stage.

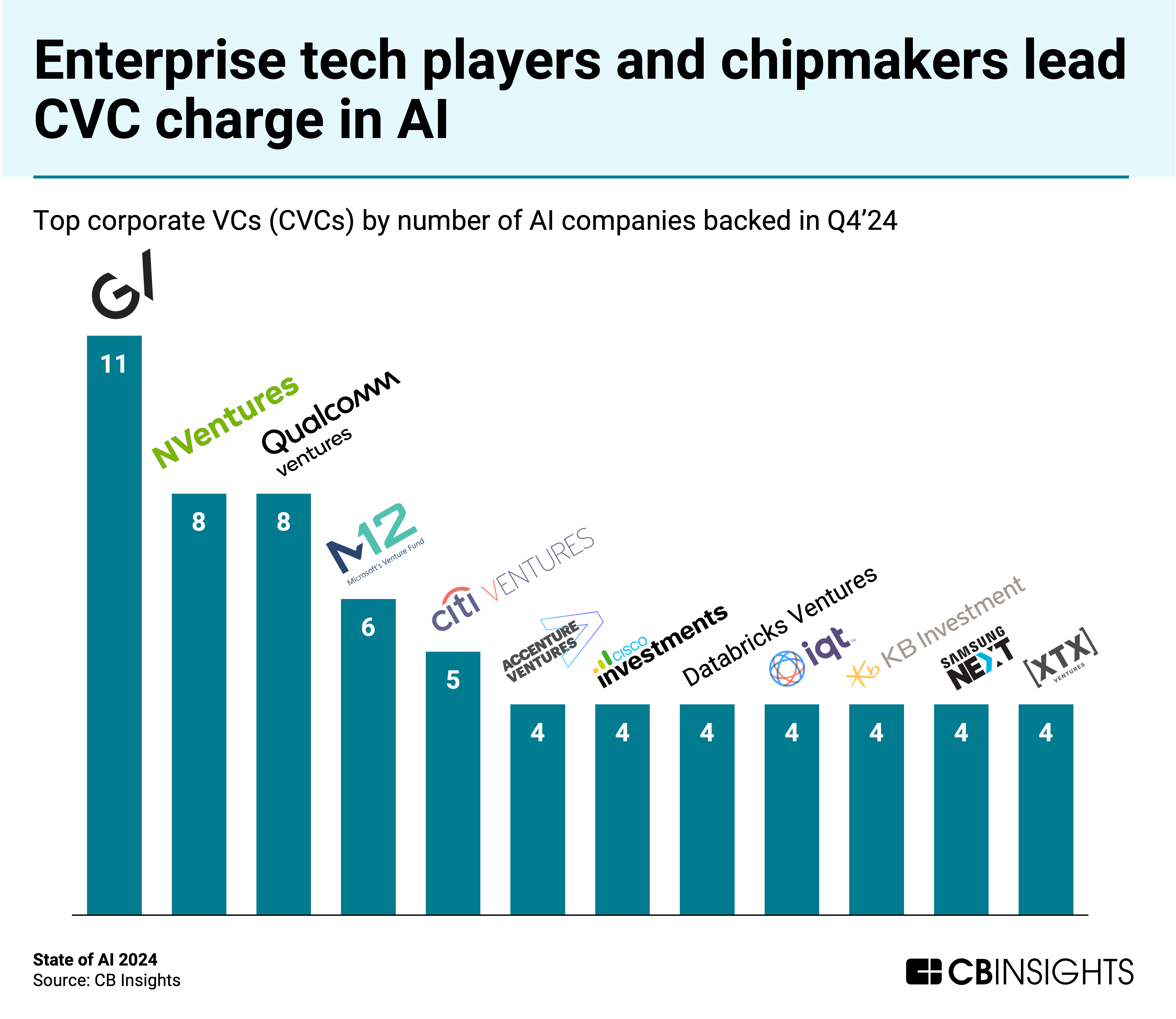

- Tech leaders embed themselves deeper in the AI ecosystem. Major tech companies and chipmakers led corporate VC activity in AI during Q4’24, with Google (GV), Nvidia (NVentures), Qualcomm (Qualcomm Ventures), and Microsoft (M12) being the most active investors. This reflects the strategic importance of securing access to promising startups while providing them with essential technical infrastructure.

We dive into the trends below.

For more on key shifts in the AI landscape in 2025, check out this report on the implications of DeepSeek’s rise.

Massive deals drive AI funding boom

Globally, private AI companies raised a record $100.4B in 2024. At the quarterly level, funding soared to a record $43.8B in Q4’24, or over 2.5x the prior quarter’s total.

The funding increase is largely explained by a wave of massive deals: mega-rounds ($100M+ deals) accounted for 80% of Q4’24 dollars and 69% of AI funding in 2024 overall.

The year featured 13 $1B+ deals, the majority of which went to AI model and infrastructure players. OpenAI, xAI, and Anthropic raised 4 out of the 5 largest rounds in 2024 as they burned through cash to fund the development of frontier models.

Overall, the concentration of funding in mega-rounds reflects the high costs of AI development across hardware, staffing, and energy needs — and widespread investor enthusiasm around the AI opportunity.

But that opportunity isn’t limited to the largest players: nearly 3 in 4 AI deals (74%) were early-stage in 2024. The share of early-stage AI deals has trended upward since 2021 (67%) as investors look to ride the next major wave of value creation in tech.

Industry tech sectors lose ground in AI deals

Major tech sectors — fintech, digital health, and retail tech — are making up a smaller percentage of AI deals.

While the overall annual AI deal count has stayed steady above 4,000 since 2021, dealmaking in sectors like digital health and fintech has declined to multi-year lows. So, even as AI companies make up a greater share of the deals that do happen in these industries, the gains haven’t been enough to register in the broader AI landscape.

The data suggests that, amid generative AI’s ascendancy, AI companies targeting infrastructure and horizontal applications are drawing a greater share of deals.

With billions of dollars flowing to the model/infra layer as well, investors appear to be betting that the economic benefits of the latest AI boom will accrue to the builders.

Outside of the US, Europe fields high-potential AI startup regions

Although US-based companies captured 76% of AI funding in 2024, deal activity was more distributed across the globe. US AI startups accounted for 49% of deals, followed by Asia (23.2%) and Europe (22.9%).

Comparing median CB Insights Mosaic scores (a measure of private tech company health and growth potential on a 0–1,000 scale) for AI companies that raised equity funding in 2024 highlights promising regional hubs.

European countries dominate the top 10 countries by Mosaic score (outside of the US). Israel, which has a strong technical talent pool and established startup culture, leads the pack with a median Mosaic score of 700.

Overall activity on the continent is dominated by early-stage deals, which accounted for 81% of deals to Europe-based startups in 2024, a 7-year high.

The European Union indicated in November that scaling startups is a top priority, pointing to the importance of increased late-stage private investment in remaining competitive on the global stage.

AI M&A activity maintains momentum

The AI M&A wave is in full force, with 2024’s 384 exits nearly reaching the previous year’s record-high 397.

Acquisitions of Europe-based startups accounted for over a third of AI M&A activity in 2024. Among the global regions we track, Europe is the only one that has seen annual AI acquisitions climb for 4 consecutive years. Although the US did see a bigger uptick YoY (16%) in 2024, posting 188 deals.

In Europe, UK-based AI startups led activity in 2024, with 32 M&A deals, followed by Germany (18), France (16), and Israel (12).

Major US tech companies, including Nvidia, Advanced Micro Devices, and Salesforce, participated in some of the largest M&A deals of the year as they embedded AI across their offerings.

AI startups race to $1B+ valuations despite early market maturity

AI now dominates new unicorn creation. The 32 new AI unicorns in 2024 accounted for nearly half of all companies passing the $1B+ valuation threshold during the year.

These AI startups are hitting unicorn status with much smaller teams and at much faster rates than non-AI startups: 203 vs. 414 employees at the median, and 2 years vs. 9 years at the median.

These trends reflect the current AI hype — investors are placing big early bets on AI potential. Many of these unicorns are still proving out sustainable revenue models. We can see this clearly in CB Insights Commercial Maturity scores. More than half of the AI unicorns born in 2024 are at the validating/deploying stages of development, while non-AI new unicorns mostly had to get to at least the scaling stage before earning their unicorn status.

Tech leaders embed themselves deeper in the AI ecosystem

In Q4’24, the top corporate VCs in AI (by number of companies backed) were led by a string of notable names: Google (GV), Nvidia (NVentures), Qualcomm (Qualcomm Ventures), and Microsoft (M12).

As enterprises rush to harness AI’s potential, big tech, chipmakers, and other enterprise tech players are building their exposure to promising companies along the AI value chain.

Meanwhile, startups are linking up with these players to not only secure funding for capital-intensive AI development but also access critical cloud infrastructure and chips.

MORE AI RESEARCH FROM CB INSIGHTS

- What DeepSeek’s model releases mean for the future of AI

- Here’s how leading strategy teams are successfully driving generative AI adoption in their organizations

- The foundation model divide: Mapping the future of open vs. closed AI development

- 15 tech trends to watch closely in 2025

- Inside the AI drug discovery arms race: Record M&A activity, a biologics funding spree, and more

- The industrial AI agents & copilots market map

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

The post State of AI Report: 6 trends shaping the landscape in 2025 appeared first on CB Insights Research.

]]>The post State of Venture 2024 Report appeared first on CB Insights Research.

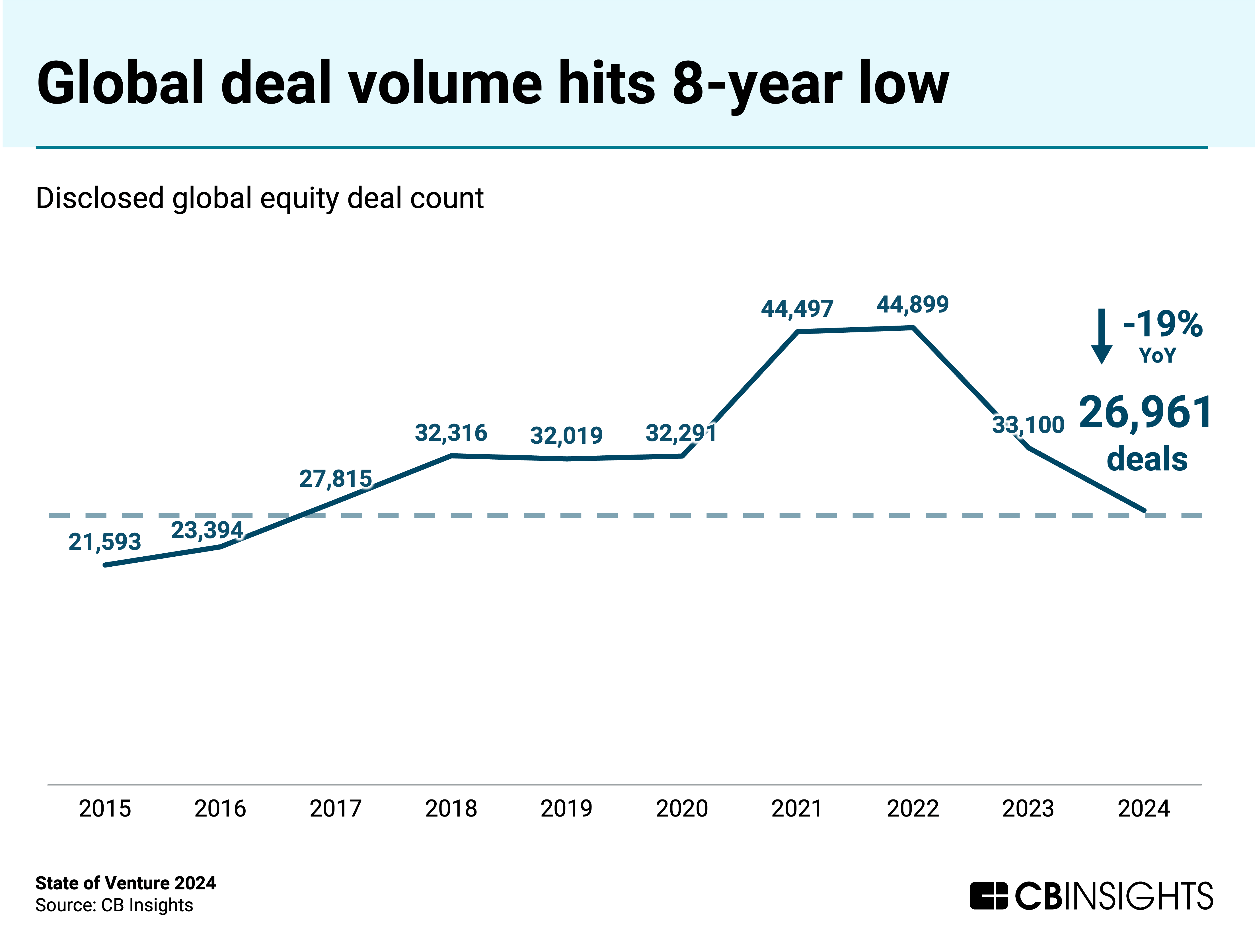

]]>But beyond the momentum building in AI, global deal activity plunged 19% YoY to its lowest level since 2016, creating both challenges and opportunities for investors and corporate strategists.

Download the full report to access comprehensive data and charts on the evolving state of venture across sectors, geographies, and more.

Key takeaways from the report include:

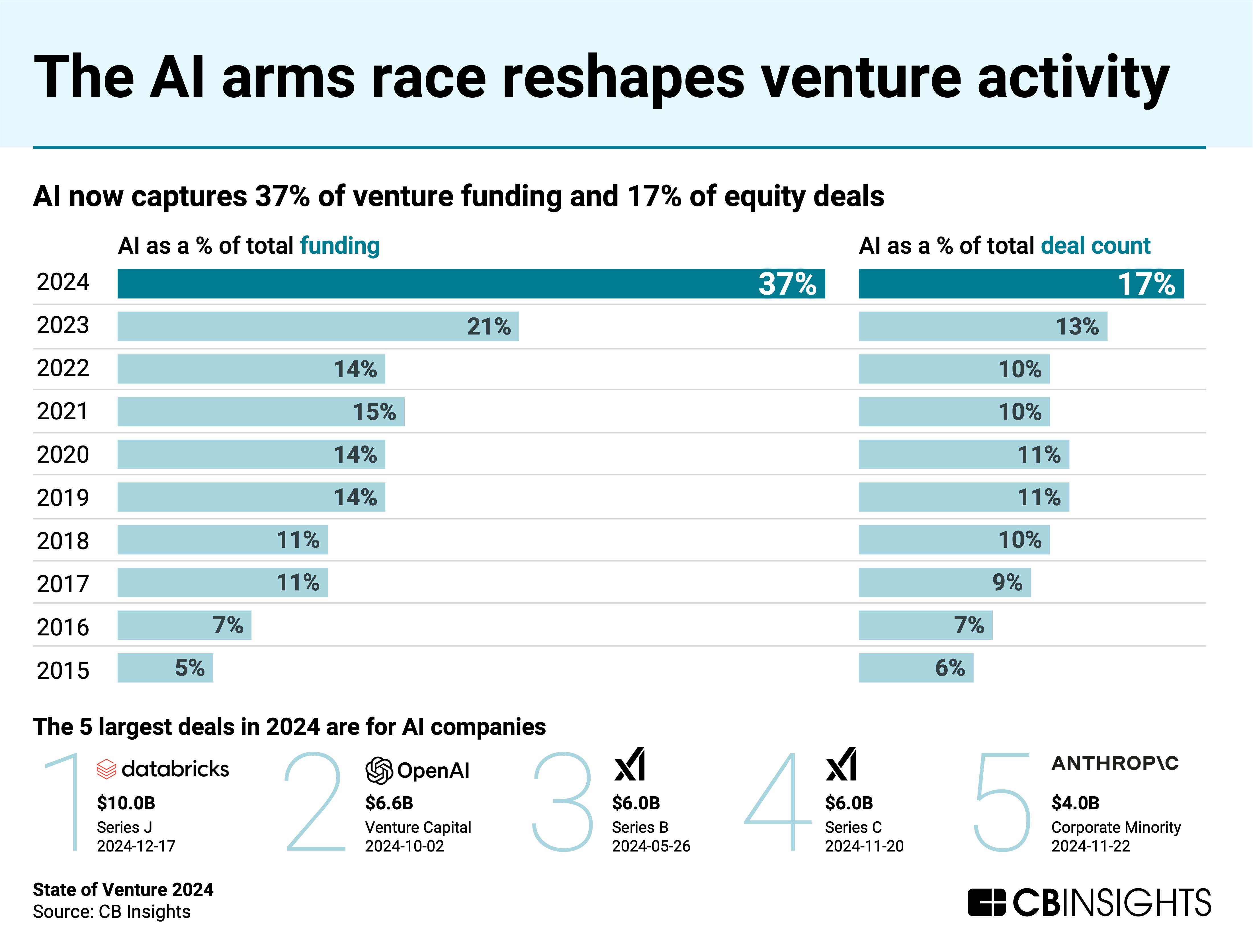

AI is eating VC. In 2024, AI represented 37% of venture funding and 17% of deals — both all-time highs. AI infrastructure players raised all of the top 5 venture deals of the year, with 4 closing in Q4’24 alone — driving a 2-year high in quarterly funding. With nearly 3 in 4 (74%) AI deals being early-stage in 2024, investors are staking out early claims to reap the rewards of the tech’s potential.

Aside from AI, venture dealmaking is in a drought. Globally, deal activity fell 19% YoY to 27K in 2024 — its lowest annual level since 2016. The drop was most pronounced in countries like China (-33% YoY), Canada (-27%), and Germany (-23%). However, several countries in Asia — Japan, India, and South Korea — have bucked the downward trend. Their resilience suggests attractive investment conditions.

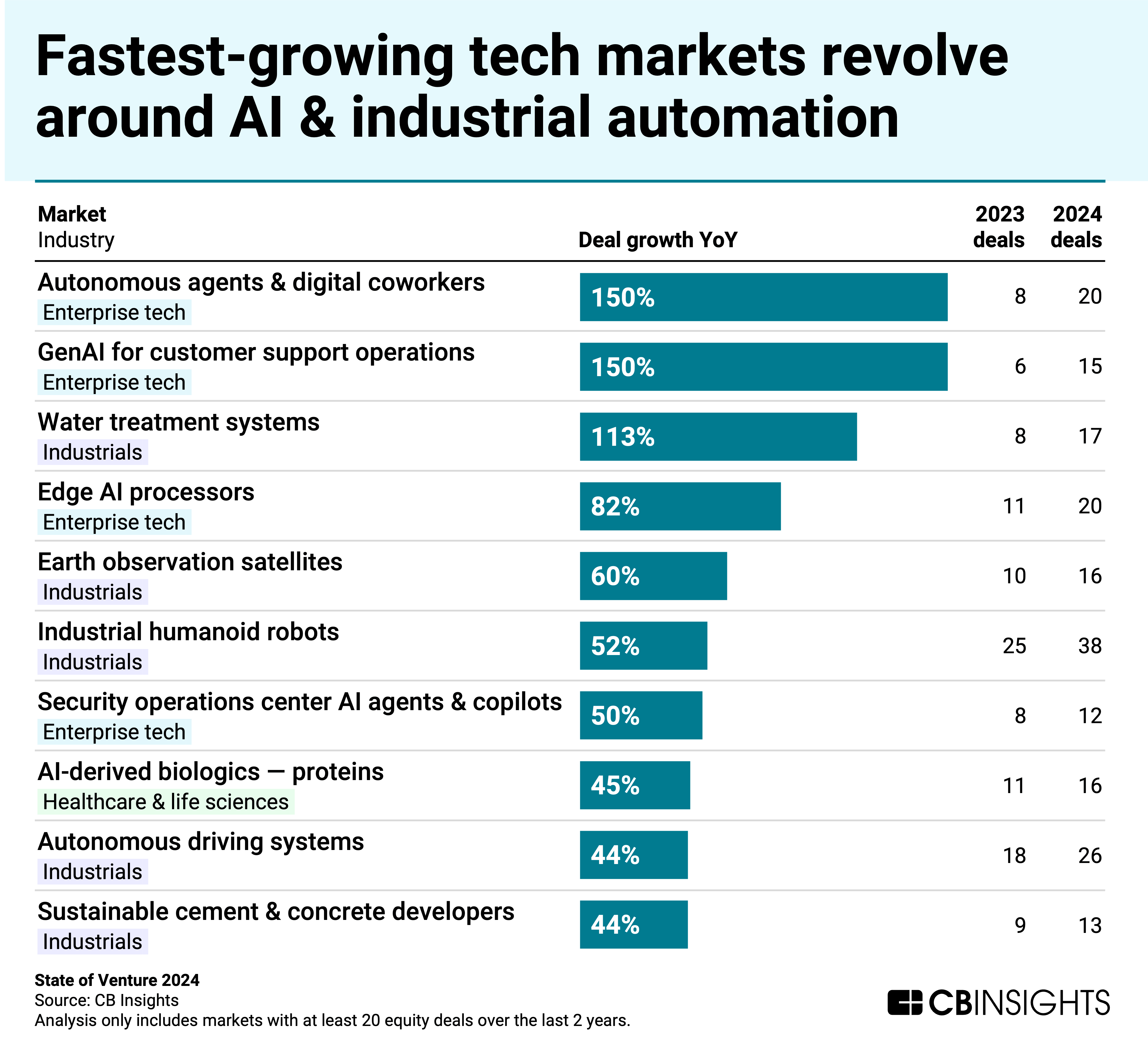

AI and industrial automation are common themes among the fastest-growing tech markets. Out of 1,400+ tech markets that CB Insights tracks, those with the highest rate of YoY deal growth include enterprise AI agents, genAI for customer support, industrial humanoid robots, and autonomous driving systems. Expect these technologies to continue maturing in 2025, increasing their disruptive potential.

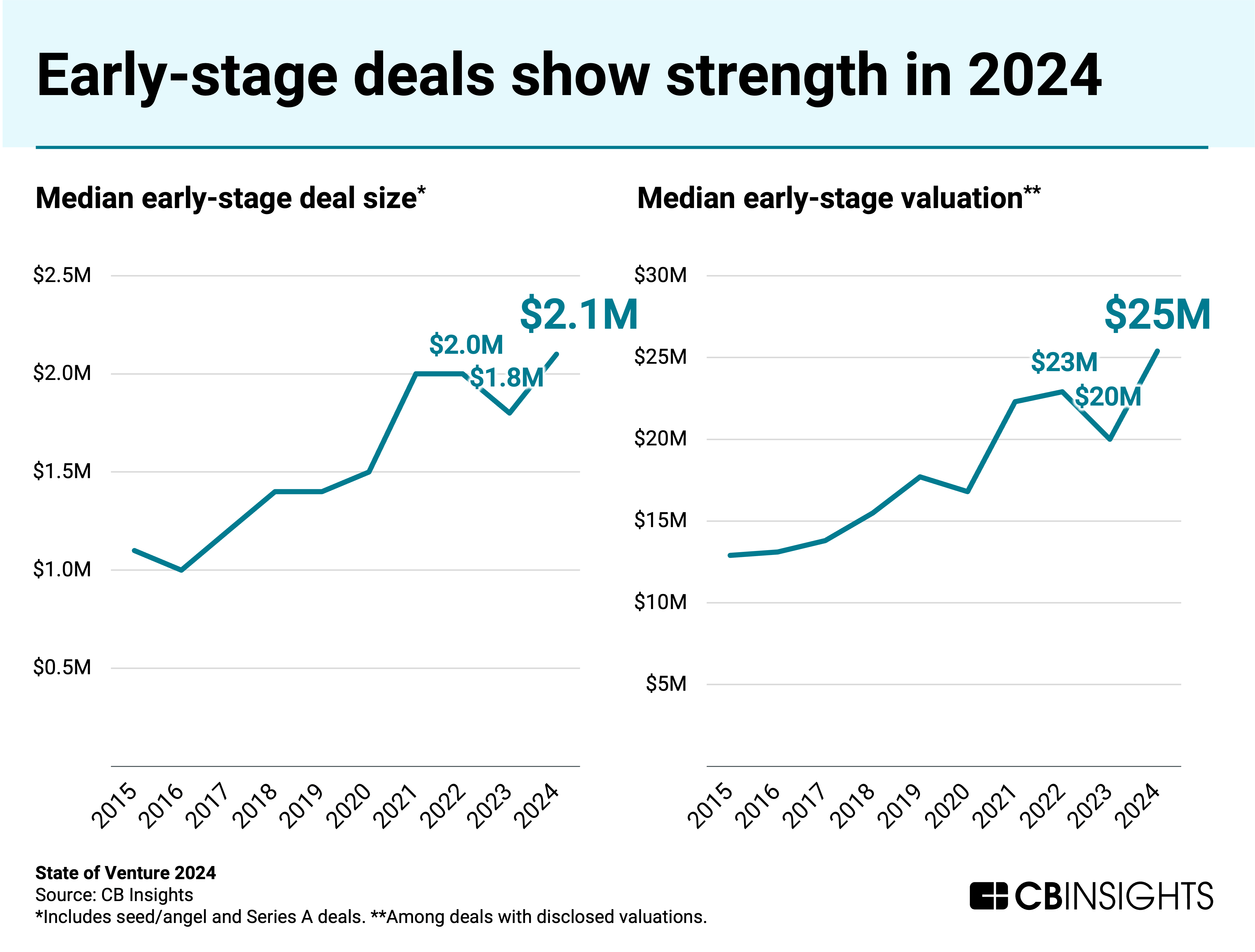

Despite market uncertainty, early-stage valuations hit a record-high median of $25M in 2024. Investors are packing into early-stage rounds to ride the next major wave of value creation in tech, likely drawn by startups’ ability to now build products with less capital and fewer people thanks to AI tools and infrastructure. However, early-stage startups could face a reality check when they try to raise later-stage rounds if they have yet to prove they can sustain growth. Although mid- and late-stage deal valuations rebounded slightly vs. 2023, they remain muted compared to 2021 and 2022.

IPO timelines get delayed. From first funding to IPO, VC-backed companies that went public in 2024 waited a median of 7.5 years — 2 years longer than in 2022. Amid unfavorable market conditions, some late-stage players like Stripe and Databricks have resorted to raising additional equity funding or selling private shares in lieu of going public. This allows them to create liquidity for early investors and employees when the path to a public debut is rocky.

We dive into each trend below.

AI is eating VC

The 5 largest deals of the year all went to AI model and infrastructure players (led by Databricks’ $10B Series J, followed by a $6.6B round for OpenAI, two $6B rounds for xAI, and a $4B round for Anthropic). But the activity isn’t limited to the largest, most well-resourced AI players.

Across the board, AI companies are capturing a higher share of deal volume — nearly one in 5 deals (17%) now go to AI companies, almost triple the share from 2015 (6%). AI deal volume remained above 4,000 for the fourth year in a row.

The boom is providing tailwinds for every stage of the startup lifecycle, from early-stage companies — which take 3 out of 4 deals in AI — to startup exits. The AI M&A wave is in full force, with 2024’s 384 exits nearly rivaling the previous year’s record-high 397.

This trend will continue in 2025 as incumbents look to grab AI tech and talent and build end-to-end AI offerings. Get the full breakdown of what AI M&A means for corporate strategy in our Tech Trends 2025 report.

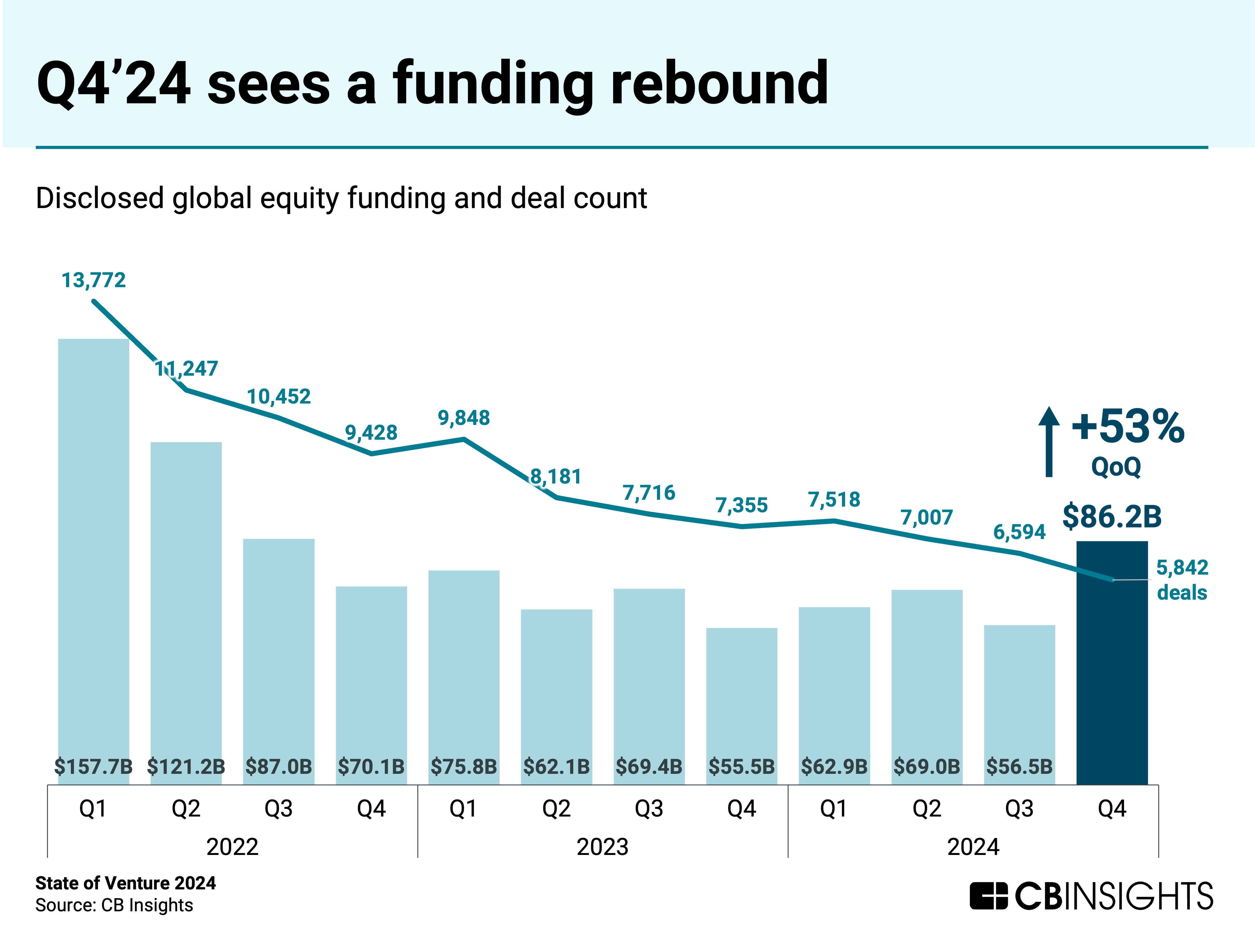

In Q4’24, the AI boom helped fuel a substantial rebound in global funding. The quarter’s funding tally reached $86.2B — a 2-year high, and an increase of 53% quarter-over-quarter (QoQ).

60% of that quarterly total, or $52B, came from mega-rounds (deals worth $100M+) — nearly tying Q1’21 (61%) for the highest share ever across venture.

At the same time, quarterly deal volume steadily declined throughout 2024, including slipping below 6,000 in Q4’24 for the first time since 2016.

Aside from AI, venture dealmaking is in a drought

Despite AI’s surge, most venture sectors face their worst dealmaking drought in nearly a decade, forcing investors to adjust their strategies. Many investors are taking a more selective and risk-off approach right now as they wait out macroeconomic volatility and geopolitical tensions.

Among major dealmaking countries and regions (those seeing 500+ deals per year), the slump was most pronounced in China (-33% YoY drop in deals), Canada (-27%), and Germany (-23%).

However, several countries in Asia bucked the trend and notched slim YoY gains: Japan (+2%), India (+1%), and South Korea (+1%). These countries have invested heavily in developing their startup ecosystems and may be benefiting indirectly from investors diverting funds away from China.

AI and industrial automation are common themes among the fastest-growing tech markets

AI and industrial automation are at the center of some of the fastest-growing markets in tech.

We filtered CB Insights’ 1,400+ tech markets for those with at least 20 equity deals over the last 2 years, then singled out those with the strongest deal growth YoY in 2024.

The enterprise tech and industrials sectors dominate, comprising 9 of the top 10 tech markets. Advancements in generative AI are fueling much of the activity in areas like humanoid robots and autonomous driving systems. Investors are also backing tech companies improving industrial processes like water treatment and purification, with deals to the market more than doubling YoY.

The enterprise tech and industrials sectors are also seeing a wave of hiring, as they lead in YoY headcount growth among all sectors. Industrials markets saw an average of 11% headcount growth last year, followed by enterprise tech markets with 10%.

Financial services and the consumer & retail industries are noticeably absent from the top 10 fastest-growing markets. Given the tough venture landscape, emerging technologies in these areas face an uphill battle.

Early-stage deals are showing strength

Globally, early-stage dealmaking represents one of the most vibrant areas of venture right now, with median deal size and valuation reaching all-time highs in 2024.

The seed/angel and Series A stages remain resilient despite the broader downturn, in part because investors view them as a safe haven to ride out late-stage challenges like constricted exit opportunities and capital constraints. Deal sizes and valuations for the mid- and late stages rebounded slightly vs. 2023 but were muted when compared to the boom times of 2021 and 2022.

Corporate strategy and development teams seeking out early-stage opportunities can see 900+ high-potential startups here. To identify these players, we looked at the nearly 11,000 VC-backed startups that raised seed or Series A rounds in 2024, then filtered for those with the healthiest businesses (600+ Mosaic score) and strongest management teams (600+ Management Mosaic score).

IPO timelines get delayed

Most tech firms continue to shirk the IPO market. Some are still waiting for macroeconomic conditions to stabilize, while others prefer to focus on topline growth without having to deal with the financial scrutiny that comes with being a public company.

This is pushing back the timelines for IPO-ready companies even further.

From first funding to IPO, VC-backed companies that went public in 2024 waited a median of 7.5 years — 2 years longer than in 2022.

While Q4’24 saw an uptick in global IPOs, activity remains down vs. historical levels. In the current climate, many late-stage startups will likely opt instead to raise more private funding to sustain operations and pay out employees or early investors.

Related resources from CB Insights:

- Live briefing on venture trends for 2025

- All AI research from CBI

- 15 tech trends to watch closely in 2025

- Game Changers 2025: 9 technologies that will change the world

- $1B+ Market Map: The world’s 1,249 unicorn companies in one infographic

The post State of Venture 2024 Report appeared first on CB Insights Research.

]]>The post $1B+ Market Map: The world’s 1,249 unicorn companies in one infographic appeared first on CB Insights Research.

]]>But the overall slowdown only tells part of the story. Within this smaller pool of new billion-dollar companies, AI startups have come to dominate, comprising 44% of new unicorns this year — a 7x increase in share over the last decade.

Here’s what today’s unicorn landscape signals about the future of tech:

- AI dominates new unicorn creation — 2024 has seen 72 companies become unicorns, and 32 of these (44%) are AI startups. These AI players are reaching unicorn status far faster (median of 2 years) than non-AI companies (median of 9 years). As AI capabilities advance at a rapid pace — across domains from intelligent robotics to coding AI agents — corporations that delay AI adoption risk falling behind their competitors.

- Valuations are under pressure — Over one-third of the 1,200+ current unicorns haven’t raised funding since 2021, and over 100 of these companies were last valued at exactly $1B — meaning a down round would take their unicorn status away altogether. These represent potentially distressed assets that cash-rich incumbents and corporate development teams would want to snap up.

- Next in line for an exit — Among today’s unicorns, 110 stand out with IPO probabilities above 20% (anywhere from 31x to 64x that of the average company we track). Another 25 have equally high M&A probability scores, making them prime acquisition targets for incumbents looking to expand their tech and market reach.

Market map of billion-dollar startups

On paper, today’s unicorns are collectively worth over $4T.

However, it’s unlikely that many of these 1,200+ companies are worth as much as their latest valuation, given how dramatically the venture landscape has changed since the heady days of 2021/22. Since then, tighter capital markets have applied downward pressure on public and private tech company valuations alike.

Over one-third of current unicorns haven’t raised a funding round since 2021. If they were to raise in today’s climate, they’d likely face a valuation cut. That includes over 100 unicorns that were last valued at exactly $1B — meaning any valuation reduction would strip them of their unicorn status.

With venture funding at its lowest level since 2016/17, unicorns in need of cash are likely considering an exit. Some have been waiting years for the IPO market to open up so they can access capital and compensate employees without further diluting their business. Others will need to accept sales at discounted prices.

Unicorns most likely to exit via IPO or M&A

Per CB Insights’ Exit Probability scores — which measure a company’s likelihood to exit in the next 2 years, based on 70+ data points — a select cohort of unicorns emerges as the most likely candidates for IPO and M&A.

110 unicorns have a 20% or higher chance of IPO’ing in the next 2 years — anywhere from 31x to 64x the likelihood of the average company we track. Recent tech IPOs have performed well relative to the cold snap of 2022/23, particularly for companies benefiting from the AI boom. This will likely open the doors to other IPO hopefuls like Klarna, which is reportedly considering debuting as soon as H1’25.

A smaller segment of unicorns has an M&A exit probability of 20%+ (from 2x to 5x the average). This includes unicorns like AI data company Tresata (38% M&A probability) and fleet management & telematics provider Radius (33%), both of which have faced headcount reductions over the last year.

These acquisition targets could offer incumbents a way to quickly add new tech and talent as well as expand their customer base and market reach.

AI has become a unicorn factory

The current AI boom is a driving force behind new unicorn creation.

In 2024 so far, 44% of new unicorns have been AI companies. This is by far the highest share that AI has seen over the past decade, representing over 7x growth during that time (from 6% in 2015).

What’s more, these AI startups are hitting unicorn status with 1) much smaller teams and 2) at much faster rates.

Among new unicorns in 2024, the median AI unicorn has just 203 employees and reached unicorn status in 2 years from its founding date. For comparison, the median non-AI company to become a unicorn did so with double the team size (414 employees) and a much longer life-span (9 years).

The size of these AI teams — and the speed with which they attain unicorn status — points to several underlying factors. For one, today’s AI startups may be able to do more with less — they can use their AI expertise to automate certain functions and scale faster with less staffing than a non-AI company.

But there’s a likely bigger factor at play: With the current pace of AI advances, alongside the sheer amount of AI hype, AI startups are able to earn investors’ attention earlier and with less to show for their business than non-AI companies. The AI opportunity means many of these startups can bank on fast revenue growth, though it’s unclear how sustainable that is — or when, if ever, that revenue will translate into profit.

Nevertheless, the breadth of the AI opportunity — across industries, business models, and audiences — means that there is still plenty of white space for these startups to carve out niches.

Among this year’s new unicorns, some of the smallest AI teams include:

- World Labs: 18 employees (founded 2024, valued at $1B)

- Skild AI: 19 employees (founded 2023, valued at $1.5B)

- Sakana AI: 34 employees (founded 2023, valued at $1.5B)

- Cognition AI: 49 employees (founded 2023, valued at $2B)

- Poolside: 75 employees (founded 2023, valued at $3B)

Notably, these startups point to several emerging areas of opportunity in AI:

Intelligent robotics and embodied AI — Both World Labs and Skild AI are working toward making AI systems that can better understand and interact with the physical world. This is also an area where OpenAI is getting involved, via investments in other unicorns like Figure and Physical Intelligence.

Coding AI agents & copilots — Cognition AI and Poolside both focus on automating software engineering. Equity funding to coding AI agents & copilots has exploded this year, nearly tripling to reach $1.8B.

RELATED RESEARCH FROM CB INSIGHTS:

- 15 tech trends to watch closely in 2025

- State of Venture Q3’24 Report

- Future of the workforce: How AI agents will transform enterprise workflows

- Future Tech Hotshots: 52 emerging tech startups that will have big, successful exits

The post $1B+ Market Map: The world’s 1,249 unicorn companies in one infographic appeared first on CB Insights Research.

]]>The post 15 tech trends to watch closely in 2025 appeared first on CB Insights Research.

]]>Our 2025 Tech Trends report provides a concrete roadmap for corporate leaders to navigate some of the most important technology shifts in the year ahead.

We include specific recommendations for action so that business leaders can get ahead of the next wave of value creation.

Here is a selection of key findings from the report:

- AI agents are given money to spend: AI agents’ utility is limited until they can make transactions seamlessly. A small group of tech players is building new infrastructure to make that happen.

- The future data center arrives: With data center power usage expected to more than double by 2026, big tech companies are morphing into energy innovators to support AI workloads. There’s a huge opportunity in improving data centers’ energy efficiency.

- Investment floodgates open for RNA therapeutics: RNA therapeutics developers are pioneering new ways to treat traditionally “undruggable” diseases, with a growing focus on neurodegenerative disorders like Alzheimer’s and Huntington’s diseases.

- AI M&A fuels the next wave of corporate strategy: AI’s share of corporate tech M&A has doubled since 2020. Tech incumbents like Nvidia, Salesforce, and Snowflake, as well as consultancies like Accenture, are rapidly acquiring AI startups to tap into enterprise demand.

- Disease management enters a new phase with AI: AI is improving care delivery across 3 key areas of disease management: precise symptom evaluation; testing/screening for earlier disease detection (including before symptoms even appear); and finding at-risk individuals in datasets of entire patient populations.

- Retail’s personalization imperative: Generative AI is unlocking 1:1 experiences across commerce touchpoints, with leaders like Target seeing a corresponding 3x boost in conversation rates. Personalization will become omnipresent in retailers’ offerings.

- And much more

Methodology

Our analysis relies on a wide range of CB Insights datasets, including financing and acquisition data, valuations, founding team and key people data, earnings transcripts, and more. We also leverage CB Insights’ proprietary scoring algorithms to measure business health (Mosaic) and maturity (Commercial Maturity), as well as the likelihood of acquisition (M&A Probability score). Throughout the report, we provide CB Insights customers with jumping-off points to dig deeper into the data behind the report.

The post 15 tech trends to watch closely in 2025 appeared first on CB Insights Research.

]]>The post The AI data center value chain: 12 high-momentum technologies powering the future of AI appeared first on CB Insights Research.

]]>This spending is creating opportunities for growth across the AI data center value chain.

Get the world’s best tech research in your inbox

Billionaires, CEOs, & leading investors all love the CB Insights newsletter

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post The AI data center value chain: 12 high-momentum technologies powering the future of AI appeared first on CB Insights Research.

]]>The post State of CVC Q3’24 Report appeared first on CB Insights Research.

]]>Despite these declines, $100M+ mega-rounds comprised 51% of total CVC-backed funding in Q3’24, a notable increase from a quarterly average of 37% in 2023. Meanwhile, two-thirds of CVC deals this year have gone to early-stage companies, highlighting a strategic shift toward more emerging opportunities, especially in AI.

Based on our deep dive in the full report, here is the TL;DR on the state of CVC:

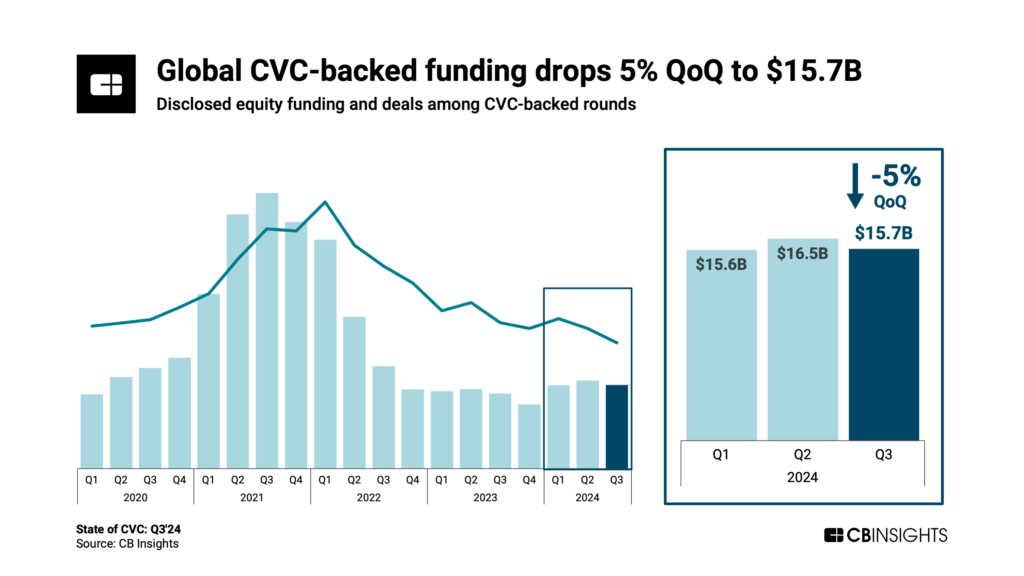

- Global CVC-backed funding drops 5% to $15.7B in Q3’24. Nevertheless, that figure is still the second-highest quarterly level since the beginning of 2023. Meanwhile, a 10% QoQ decline to 773 deals — the lowest total since 2018 — suggests that CVCs are increasingly selective, similar to the wider venture market.

- The average CVC-backed deal size has increased 31% so far this year to $27.1M, highlighting investors’ willingness to take risks when they find the right opportunity. However, the median deal size remains the same as last year at $8M, signaling that investors are only more aggressive regarding the largest deals.

- Funding to CVC-backed mega-rounds (deals worth $100M+) represents 51% of total funding in Q3’24. This percentage — roughly in line with the first 2 quarters of 2024 — is up significantly from an average of 37% in 2023, further suggesting that investors are currently willing to make large bets when they decide to invest.

- Early-stage rounds represent 66% of total CVC deal share this year, the highest level in over a decade. CVCs are increasingly focused on early-stage startups, likely driven by the record levels of AI funding and the fact that, across investor types, 72% of deals to AI companies this year are early-stage.

- CVC-backed funding in the US ticks up to $10.5B. Among major global regions, the US continued to lead in CVC-backed funding in Q3’24, followed by Europe at $2.6B and Asia at $1.3B. Within the US, defense tech provider Anduril raised the largest CVC-backed deal with its $1.5B Series F round (CVC investors include Franklin Venture Partners), followed by AI chip developer Groq with its $640M Series D round (backed by Samsung Catalyst).

MORE VENTURE RESEARCH FROM CB INSIGHTS

- State of CVC Q2’24 Report

- State of Venture Q3’24 Report

- State of Fintech Q3’24 Report

- State of Digital Health Q3’24 Report

The post State of CVC Q3’24 Report appeared first on CB Insights Research.

]]>The post State of AI Q3’24 Report appeared first on CB Insights Research.

]]>While AI deals in Q3’24 included massive $1B+ rounds to defense tech provider Anduril and AI lab Safe Superintelligence, global AI funding actually dropped by 29% QoQ. This was driven by a 77% decline in funding from $1B+ AI rounds QoQ.

Based on our deep dive in the full report, here is the TL;DR on the state of AI:

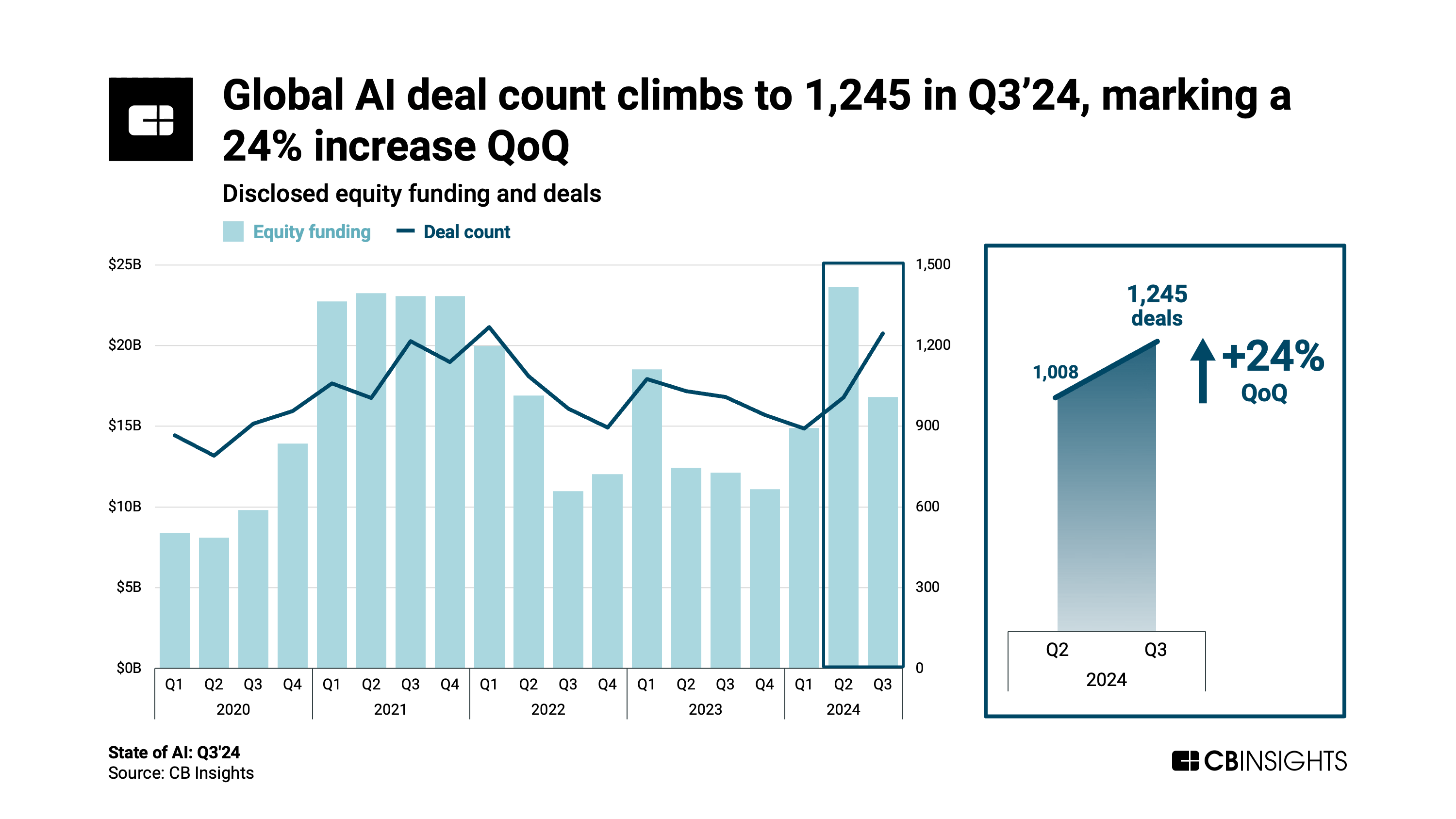

- Global AI deal count climbs 24% QoQ to reach 1,245 — its highest quarterly level since peaking in Q1’22. This bucked the trend in overall venture deals (-10% QoQ), signaling that investor interest in AI remains strong despite the broader cooling in venture markets. AI funding, on the other hand, fell by 29% QoQ to $16.8B, driven by a 77% decline in funding from $1B+ AI rounds QoQ.

- The average AI deal size is $23.5M in 2024 so far — up 28% vs. $18.4M in full-year 2023. This upward trend has been influenced by a rise in massive $1B+ deals, with AI startups drawing 9 of these deals in 2024 so far vs. 4 in full-year 2023. Top $1B+ rounds in 2024 YTD include:

These deals aren’t solely responsible for pushing up the average — the median AI deal size is up 9% in 2024 so far.

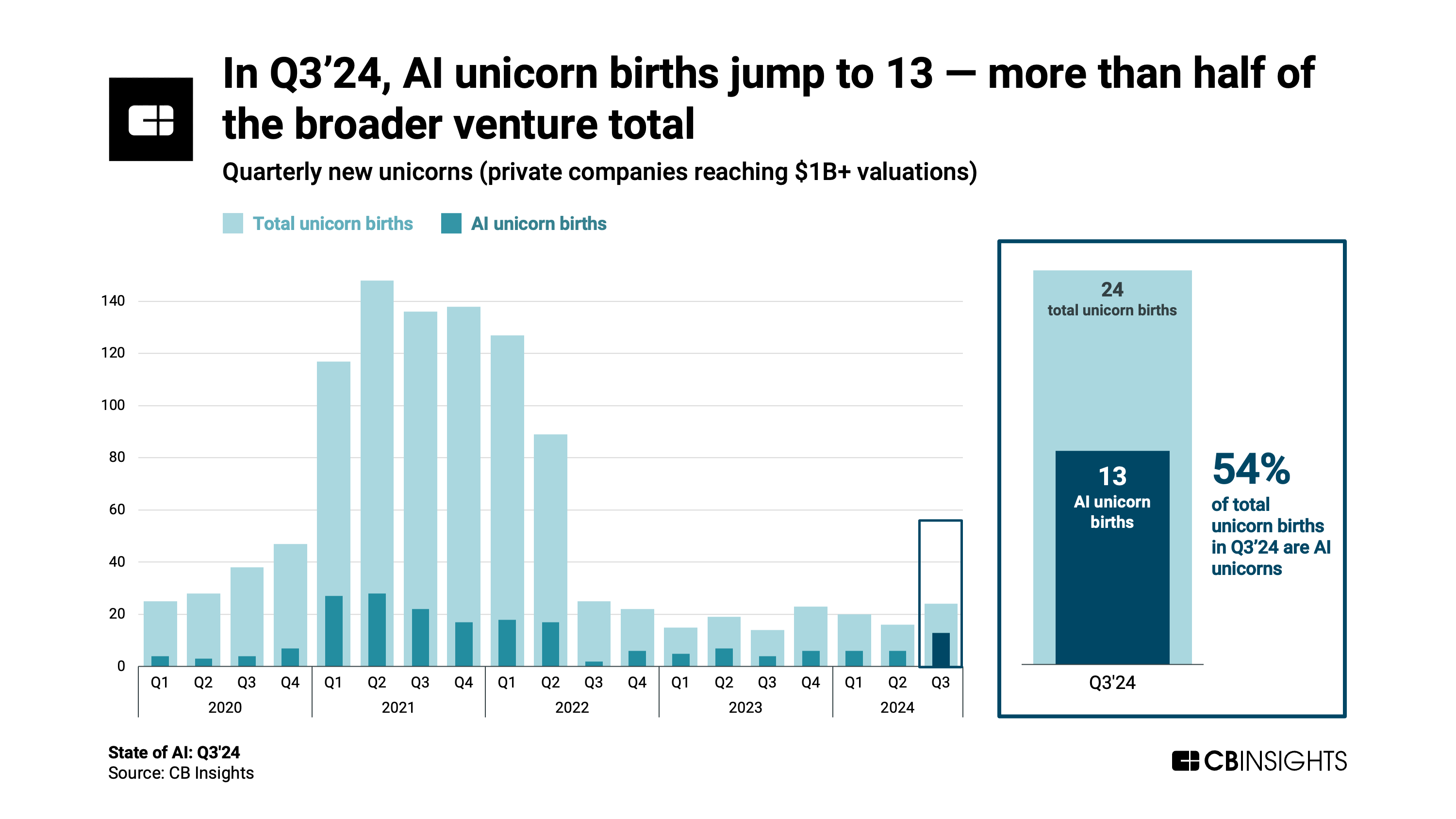

- AI unicorn births more than double QoQ to reach 13 — 54% of the broader venture total in Q3’24. Generative AI continues to be a key theme for new unicorns (private companies reaching $1B+ valuations). More than half of the AI unicorns born in Q3’24 are genAI startups, and they are working across a variety of areas — including AI for 3D environments (World Labs), code generation (Codeium), and legal workflow automation (Harvey).

Among new genAI unicorns in Q3’24, Safe Superintelligence — co-founded by OpenAI co-founder Ilya Sutskever — landed the most sizable valuation. The AI lab was valued at $5B after raising a $1B Series A round in September 2024.

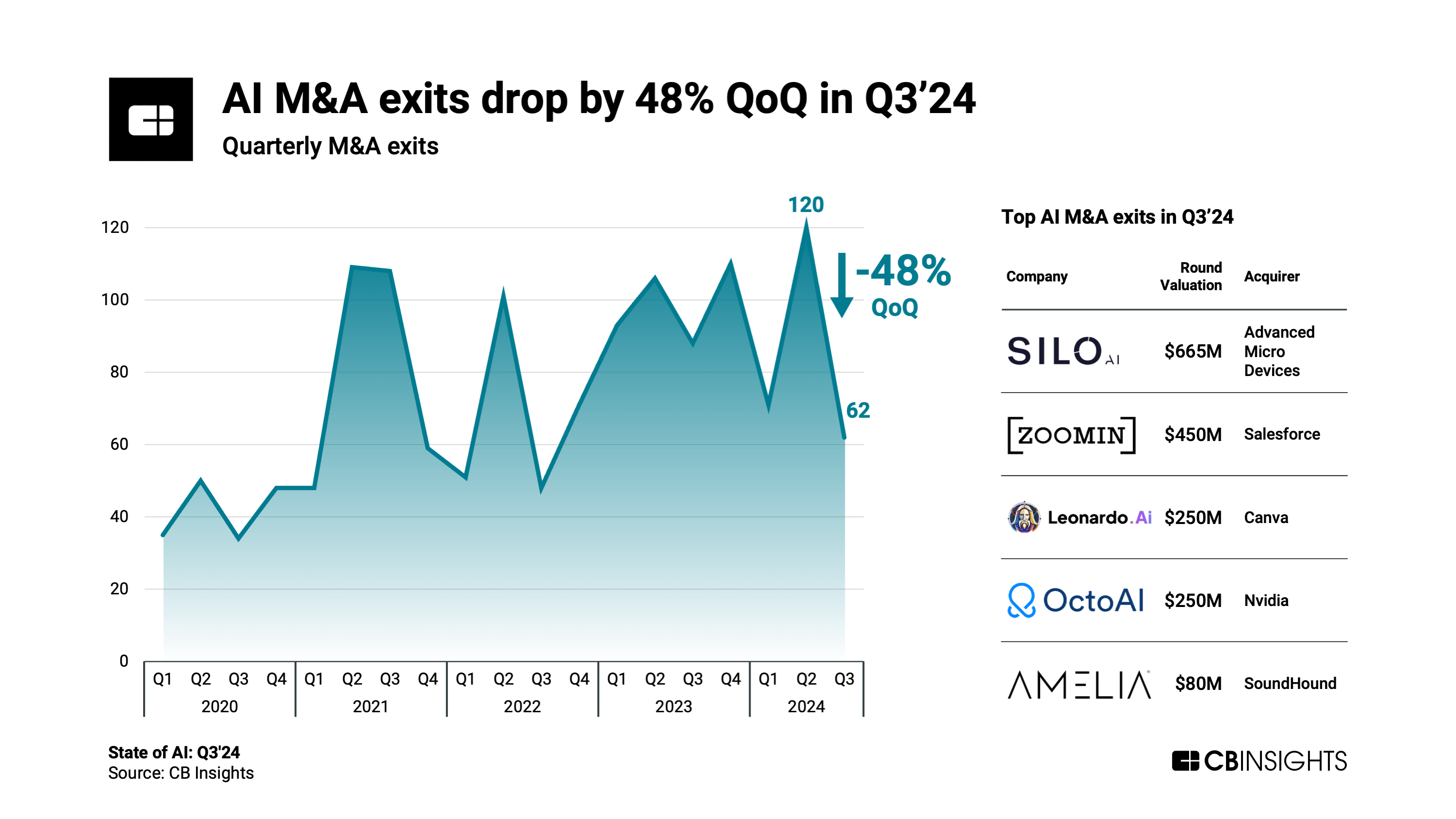

- AI M&A exits fall by 48% QoQ to hit 62 in Q3’24. The deals that did occur showcase how enterprises are strategically scooping up AI startups to improve their offerings and maintain a competitive edge. For example, the largest AI M&A deal in Q3’24 was AMD’s acquisition of AI lab Silo AI, which could help the semiconductor company enhance the development and deployment of AI models on its hardware. Meanwhile, Salesforce picked up unstructured data management startup Zoomin to support its AI agent offerings.

- Among major global regions, the US continues to lead in AI funding and deals. AI startups based in the US drew $11.4B across 566 deals in Q3’24, accounting for over two-thirds of global AI funding and 45% of global AI deals. Within the US, Silicon Valley still dominates AI funding and deals, but other metros are gaining ground. In Q3’24, Los Angeles and New York saw their AI deal counts rise QoQ while Silicon Valley watched its count drop for the second quarter straight.

ADDITIONAL AI RESEARCH FROM CB INSIGHTS:

- State of AI Q2’24 Report

- State of Venture Q3’24 Report

- Game Changers 2025: 9 technologies that will change the world

- The Multi-Agent AI Outlook: Here’s what you need to know about the next major development in genAI

- Analyzing a16z’s AI investment strategy: Where the firm sees opportunity amid the genAI rush

- The AI computing hardware market map

The post State of AI Q3’24 Report appeared first on CB Insights Research.

]]>The post Stripe, HubSpot, And JP Morgan Are Buying Audiences. Why Acquiring Media Companies And Communities Is About To Explode appeared first on CB Insights Research.

]]>Over the last month or so, JP Morgan has purchased 2 content/media assets. In early September 2021, it bought The Infatuation, a publisher that offers reviews and recommendations on restaurants in 50 cities across the USA and internationally.

And later in the month, it bought Frank, an online portal with content and tools that help students research and apply for financial aid. (Note: In April 2023, Frank was accused of defrauding JPMorgan, inflating the number of Frank customers before the sale.)

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post Stripe, HubSpot, And JP Morgan Are Buying Audiences. Why Acquiring Media Companies And Communities Is About To Explode appeared first on CB Insights Research.

]]>The post The generative AI for e-commerce market map appeared first on CB Insights Research.

]]>It’s driving value in both customer-facing experiences and back-end operations. This includes tackling challenges specific to digital retail, like personalizing product merchandising and forecasting inventory needs.

While customer service has been the dominant focus so far, more advanced use cases are on the horizon. These include multi-application orchestration through solutions like composable AI, which helps synchronize genAI tools across an organization’s e-commerce tech stack.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post The generative AI for e-commerce market map appeared first on CB Insights Research.

]]>The post State of Venture Q3’24 Report appeared first on CB Insights Research.

]]>In some ways venture has become less dramatic. The period of steep decline in funding that followed the dizzying heights of 2021 has given way to relatively moderate quarterly variations.

But even in a more sober fundraising environment, excitement over AI has become a major driving force for investors. One in every 3 VC dollars now goes to the tech. Silicon Valley, a major AI hub, is tightening its hold on investor cash. AI startups are exiting years faster than those working on other technologies.

As interest rates fall and the appetite for riskier assets increases, expect AI startups to be top of mind for an increasing number of investors in the months ahead.

Download the full report to access comprehensive data and charts on the evolving state of VC across sectors, geographies, and more.

Below, we cover key shifts in the landscape, including:

- Quarterly declines in global VC funding and deals

- AI startups grab 1 in 3 VC dollars

- Performance from recent tech IPOs

- Silicon Valley is only getting stronger

- New unicorns remain rare

- The US claims the bulk of AI innovation

- How global VC stacks up against economic output

- 76% of top deals go to B2B startups

- AI startups exit 6 years sooner than the rest of tech

Let’s dive in.

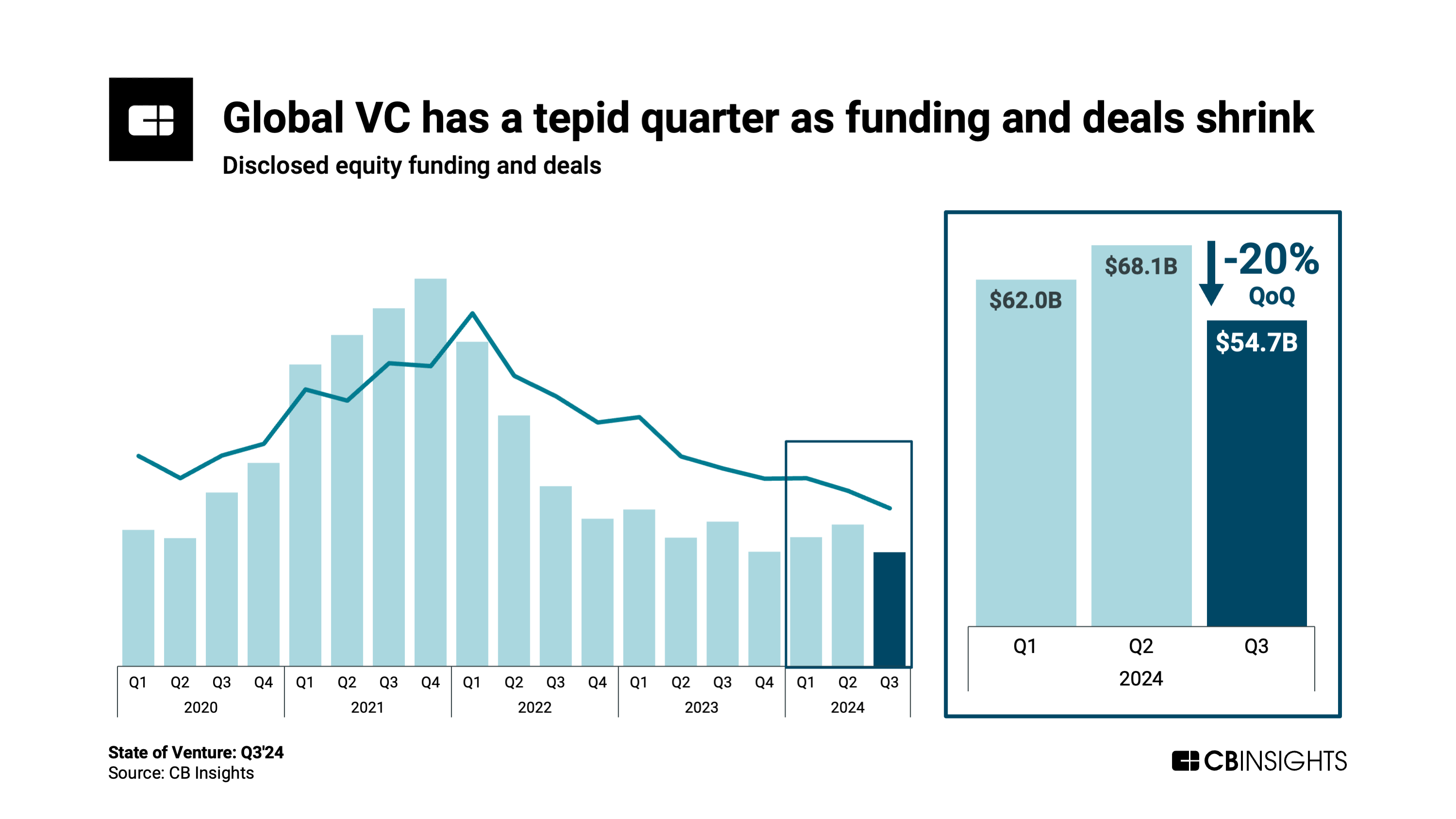

Topline figures paint a sobering picture for venture, as both global funding and deals ticked down quarter-over-quarter (QoQ). The quarterly levels place Q3’24 on par with where VC was in 2016/2017.

However, while deal volume has progressively declined, the size of deals that do happen has grown. In 2024 so far, the average deal clocks in at $13.9M (up from $12M in full-year 2023), while the median is worth $3M (up from 2023’s $2.5M).

The more cautious investment environment is likely driving a flight to quality as selective investors isolate the most promising ventures.

AI startups are capturing nearly a third (31%) of all venture funding right now — the second-highest share on record, following Q2’s 35%.

Within AI, a company’s age and stage don’t always correlate to the size of financing rounds. One of the largest rounds in Q3’24, for instance, was a mammoth $1B deal to Safe Superintelligence (SSI) — an early-stage startup founded in June by OpenAI co-founder Ilya Sutskever. The company has just 10 employees.

SSI’s deal is the 9th $1B+ AI equity round this year. Given their willingness to participate in such large rounds to so many companies, investors appear confident that a new tech giant will emerge from the space — and apparently have FOMO.

Yet despite investors’ bullishness, many of today’s fledgling AI startups will struggle to live up to lofty expectations, and some will ultimately fail. Even AI giants like OpenAI face the daunting task of keeping costs in control: the AI leader’s losses are expected to amount to $5B this year.

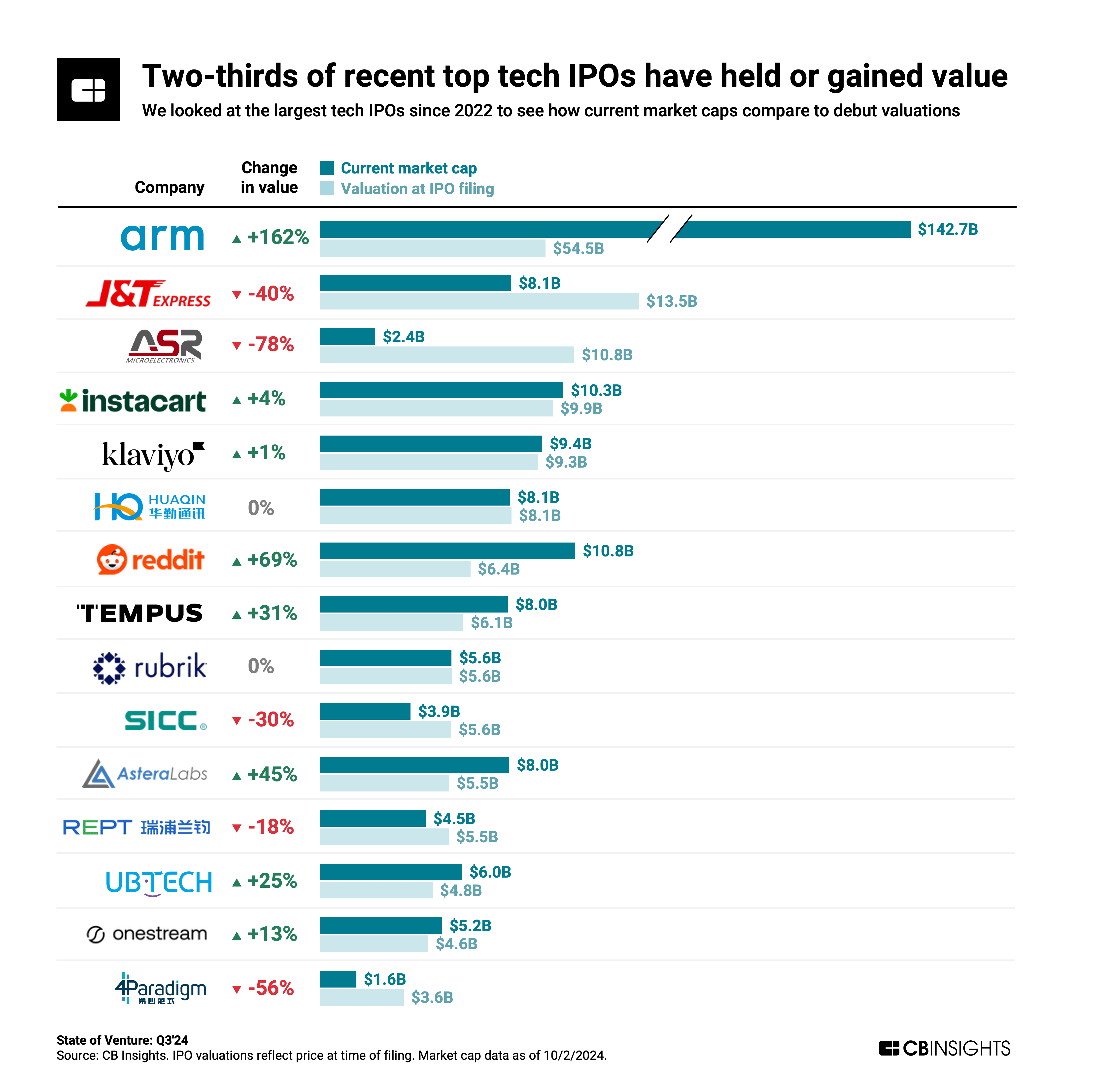

The AI boom is also giving recent public debuts a boost.

We analyzed 15 of the companies with the largest tech IPOs since 2022 to see whether they’ve gained or lost value since they filed to go public. The majority (10 out of 15) have either held steady or gained value as public players — a positive indicator for tech IPOs more broadly, which until recently were getting beaten down badly in the public markets. The fact that startups are able to maintain and even gain value as public companies will likely draw out other IPO-ready companies.

And AI is an important factor driving gains for several of these companies. For instance:

- Arm’s value has nearly tripled since it debuted late last year. The chip designer is a leader in CPUs for AI computing hardware, including providing the architecture for AI chip firms like Nvidia.

- Tempus is deploying AI across its precision medicine offerings, which has helped buoy its value by 31% since its IPO filing. (It legally changed its name from Tempus Labs to Tempus AI in early 2023.)

- Like Arm, Astera Labs, which offers AI infrastructure & connectivity hardware, has benefited from the swell in widespread adoption of AI. Its value has grown 45% since filing in March 2024.

It’s not universal — enterprise AI firm 4Paradigm, for instance, has seen its value slashed by over half since debuting. But this could be due more to geopolitical forces, as China-based 4Paradigm has faced an uphill battle in sustaining investor interest because of US restrictions. (4Paradigm was placed on a US export control list in early 2023.)

Another result of the AI explosion: Cash is concentrating in Silicon Valley, home to over a third of the US-based AI startups. In fact, the metro’s share of US venture funding — across sectors — has climbed to a recent high of 41% this year.

In Q3’24, Silicon Valley-based startups raised $10.5B — more than 2.5x that of New York ($3.9B), the second-ranked metro. LA and Boston follow, with $2.9B and $2.8B, respectively.

Notably, deal activity in Silicon Valley remains overwhelmingly early-stage — meaning it’s not just a handful of more established startups raising massive rounds. More than two-thirds of Silicon Valley’s deals this year are at the seed or Series A stages.

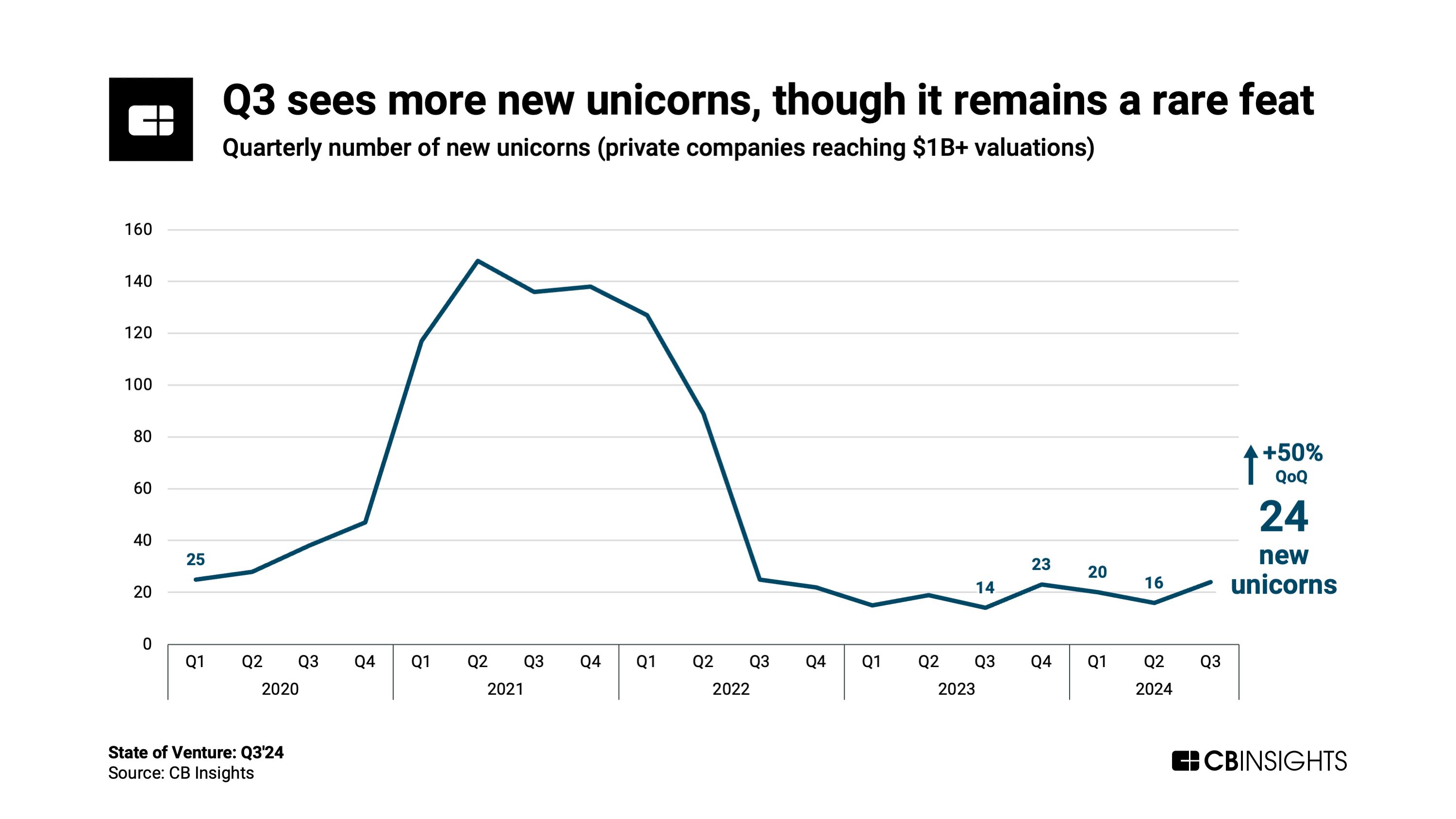

Newly minted billion-dollar startups remain few and far between. Q3’24 saw 24 startups reach that mark — a noticeable bump from the previous quarter’s 16, though a fraction of what we saw during the tech boom of 2021 and early 2022.

Valuations remain pressured at the later stages of investment, with many of the unicorns minted in years gone by likely worth less than $1B in reality. On the other hand, valuations are showing strength at the earlier stages. Among seed-stage startups, the median valuation for deals this year is $13.5M — the highest annual level on record.

There are a few common themes among the latest batch of new unicorns:

- AI is minting more unicorns than any other sector. More than half of the new unicorns in Q3’24 are AI companies. Among these, several are working to bring greater spatial awareness to AI systems, from Skild AI’s intelligent humanoid robotics to World Labs’ 3D world-building tools. Others are developing enterprise AI agents & copilots, like Harvey in the legal domain and Codeium in software engineering.

- India’s startups are climbing the ranks. The country contributed 3 of Q3’24’s new unicorns: Ather Energy, MoneyView, and Rapido. India ranks third globally for total unicorns after the US and China, and it had a strong funding quarter in Q3’24, with startups raising $4B — up 29% QoQ and 111% YoY.

- a16z and Sequoia are the most active investors in backing new unicorns. The investors each backed 4 of Q3’24’s freshly minted $1B+ companies. Andreessen Horowitz invested in Saronic Technologies, World Labs, Story Protocol, and Safe Superintelligence; while Sequoia Capital backed Skild AI, Harvey, Chainguard, and Safe Superintelligence.

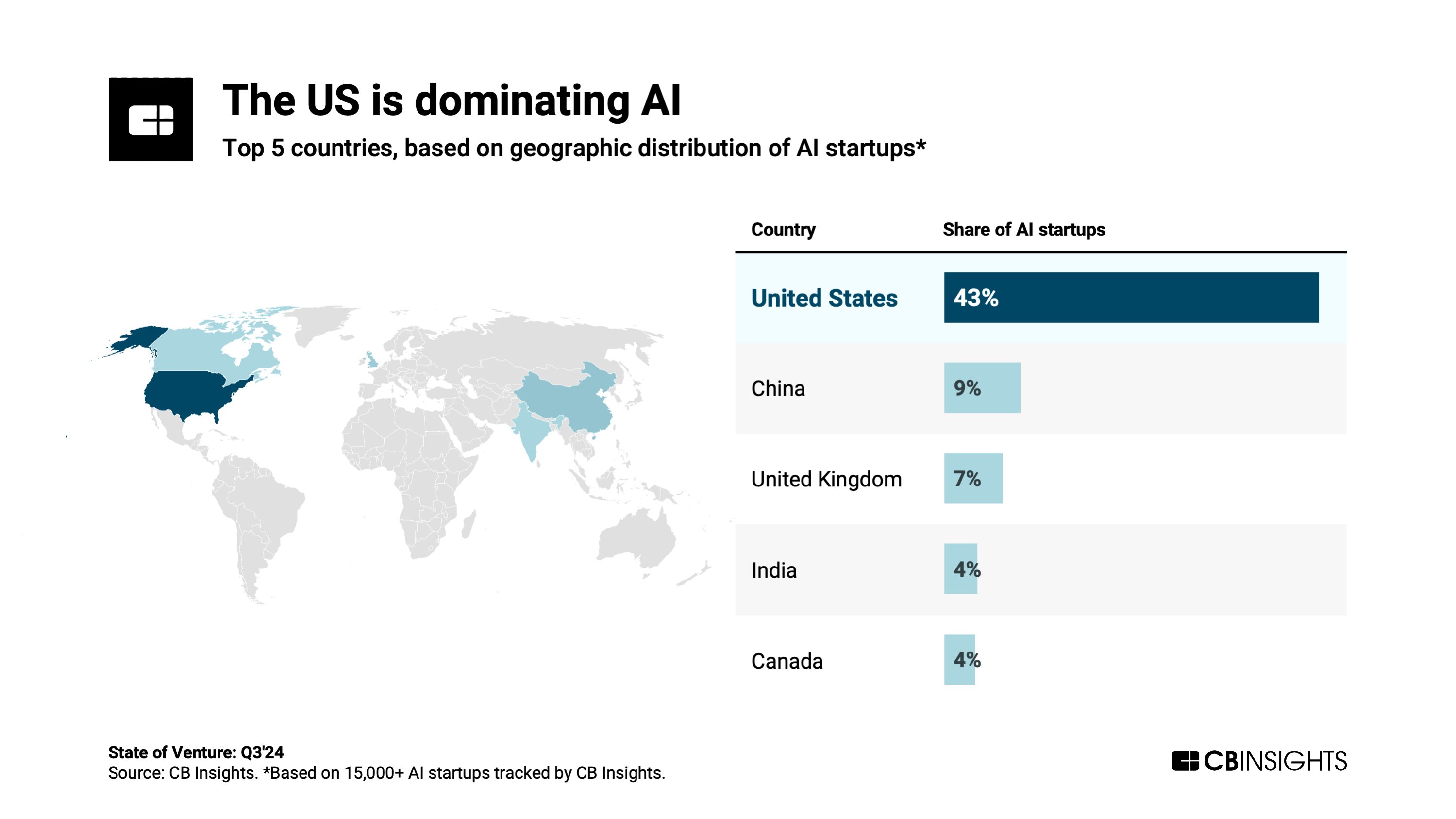

CB Insights tracks over 15,000 AI startups globally. And while 99 countries and regions around the world have at least 1 AI startup, the US is the undisputed leader in AI startup activity — and by a substantial margin.

43% of all AI startups are based in the country. The distant No. 2 and No. 3 countries are China (9% of AI startups) and the UK (7%).

While the US has long dominated the global venture scene when it comes to absolute funding and deal activity, several countries rank above the US in terms of the ratio of venture funding to GDP: the United Arab Emirates, Israel, and Singapore.

These 3 countries pace ahead of the US in terms of VC as a proportion of overall economic activity, suggesting they are punching above their weight in terms of fostering startup activity.

For instance, UAE-based startups have raised over $3B in funding over the last year (since 10/1/2023), and the country’s 2023 GDP came in at $504B. That represents $1 in VC to $158 in GDP (1/158) — a stronger ratio than any other country with at least $1B in annual venture funding.

Activity in the region has recently been fueled by AI firm G42, which raised a $1.5B round from Microsoft in April. (As part of the deal, G42 will use Microsoft’s Azure cloud offering, and Microsoft will also gain access to G42’s data centers.)

Israel and Singapore hold the No. 2 and 3 spots, with venture funding to GDP ratios of 1/166 and 1/198, respectively.

Right now, the venture capital industry is all in on B2B startups. Among the 100 largest deals in Q3’24, three-fourths went to startups that use a B2B business model (either exclusively or in combination with other models like B2C or B2G).

The B2B distribution model — particularly at the enterprise level — has gained appeal in recent years as a potentially more stable, recurring source of revenue for startups, especially during periods of volatile consumer spending.

The buzz around AI is translating to faster exit velocity for startups in the space. Breaking down all the exits that have taken place this year, it’s clear AI startups exit at a much faster rate — 6 years faster, to be exact. It takes the median AI company just 7 years to exit from the year it was founded, compared to 13 years for non-AI companies.

While this trend holds true for recent AI IPOs, it’s most commonly seen among M&A deals, which represent the vast majority of AI exits this year.

Corporations are among the top acquirers of AI startups, with many looking to gain an edge by rapidly adding novel AI tools to their product suites.

- Nvidia has acquired 3 AI startups this year: Deci and Run:ai, both in April; and OctoAI, just last week. All 3 operate at the infrastructure layer of AI development and signal Nvidia’s ambitions to expand across the AI software stack.

- Zendesk has acquired 2 customer service-focused players — Ultimate and Klaus — as it builds out its own AI agent offering to automate customer interactions.

- Salesforce has similarly pledged to go all in on AI agents. To this end, it acquired 2 AI startups last month: Tenyx and Zoomin.

Another driving factor is “acqui-hires,” where an acquirer purchases a startup primarily for its talent. We’ve seen this among some of the youngest AI startups to be acquired. For instance, SydeLabs and Laiyer, both founded in 2023, were acquired by Protect AI this year. In both cases, Protect AI absorbed the startups’ teams.

The post State of Venture Q3’24 Report appeared first on CB Insights Research.

]]>The post Future Tech Hotshots: 52 emerging tech startups that will have big, successful exits appeared first on CB Insights Research.

]]>The question is certainly top of mind for corporations getting to grips with emerging technology like generative AI — the answer could help identify future competitors, partners, new markets, or acquisition targets.

Using CB Insights’ proprietary data and metrics — including Exit Probability, Commercial Maturity, Mosaic, headcount, patents, and funding — we identified the 52 emerging players our data says are most likely to have an outsized influence in the next 5–10 years and have a strong exit.

Download the report to see:

- The full list of Future Tech Hotshots

- Key themes and industry analysis

- Methodology

MORE TOP COMPANY LISTS FROM CB INSIGHTS:

- Insurtech 50: The most promising insurtech startups of 2024

- AI 100: The most promising artificial intelligence startups of 2024

- The Digital Health 50: The most promising digital health companies of 2023

- Fintech 100: The most promising fintech startups of 2023

The post Future Tech Hotshots: 52 emerging tech startups that will have big, successful exits appeared first on CB Insights Research.

]]>