Climate tech funding hits a multi-year low alongside a sharp decline in M&A activity.

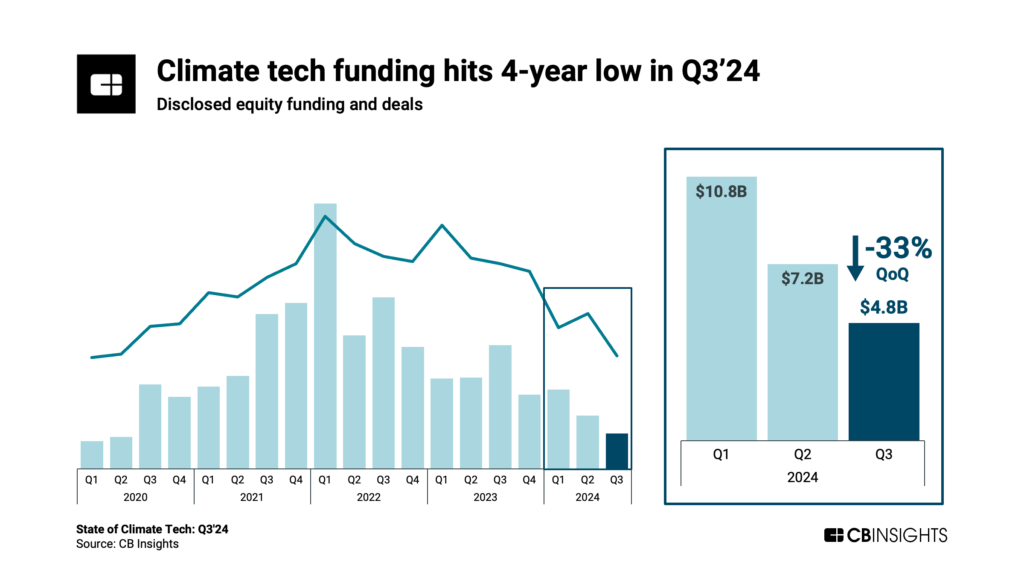

Q3’24 saw climate tech funding and deals reach their lowest points in 4 years.

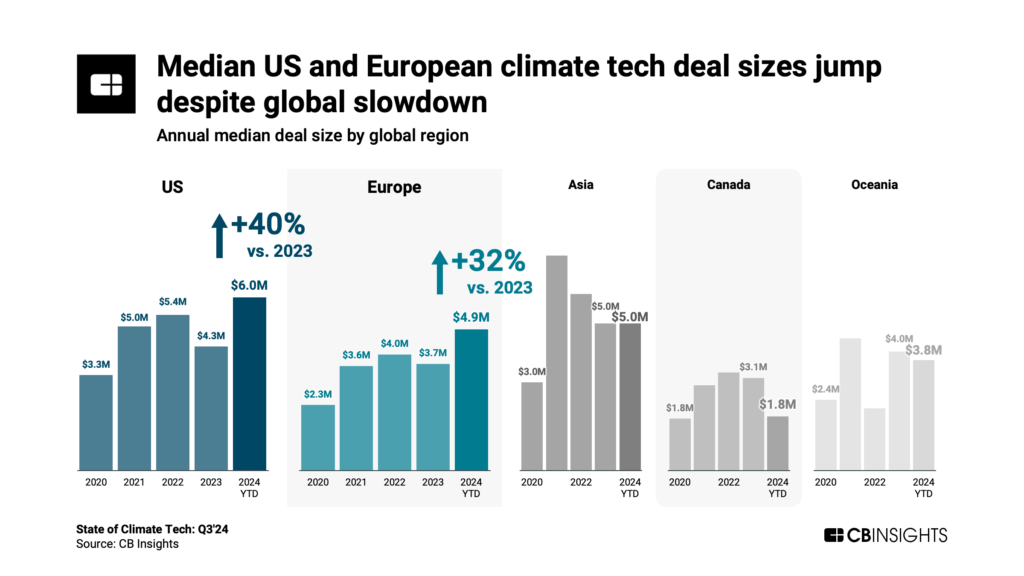

Despite the declines, global regions like the US and Europe have made gains in median deal sizes this year, and both the US and EU continue to provide government grants and loans to climate tech solutions. China, on the other hand, has rolled back some of its clean energy subsidies, and VC enthusiasm has waned in the country this year.

Globally, governments are focusing more on early-stage technologies that are ready for commercialization. Two prime examples in the US are nuclear fusion energy and direct air capture of CO2, both of which have received substantial funding from the US Department of Energy this year.

Download the full report to access comprehensive data and charts on the evolving state of climate tech across sectors, geographies, and more.

Below, we cover key shifts in Q3’24.

- Climate tech funding falls to $4.8B in Q3’24, marking the lowest point since Q2’20. Venture capital has shifted away from the sector as high interest rates impact climate tech’s capital-intensive projects and as investors pivot toward AI, which tends to feature more rapid developments and shorter commercialization timelines.

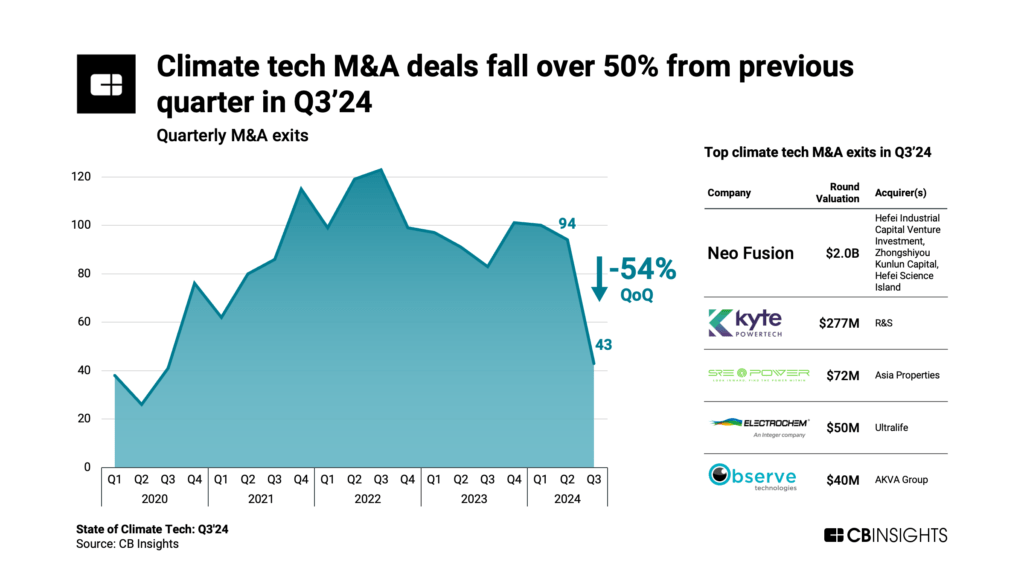

- M&A activity drops dramatically in Q3’24, with only 43 deals completed — a more than 50% decline from the previous quarter. While notable exits like Kyte Powertech ($277M valuation) and SRE Power ($72M) suggest a steady appetite for grid infrastructure solutions, the overall slowdown signals a more selective M&A environment, potentially limiting exit opportunities for highly valued climate tech companies.

- US and European deal sizes show resilience despite the slowdown in global funding. In the US, the median deal size has reached $6M in 2024 YTD (up from $4.3M in 2023), while Europe’s median deal size has grown to $4.9M (up from $3.7M in 2023), indicating sustained investor confidence in these markets.

- Despite declines in overall climate tech funding, companies commercializing solutions in carbon capture, utilization, and storage (CCUS) continue to secure significant capital, as demonstrated by Twelve‘s $200M Series C round in September. Twelve is using the funding to finish building its Washington state facility, where it will produce sustainable aviation fuel (SAF) that it claims can deliver up to 90% emissions reduction compared to conventional jet fuel.

Source: CB Insights — Twelve Funding Insights

- Electric vehicle technology funding reaches a critical low of $0.6B in Q3’24, marking its lowest point since early 2020. However, the sector still attracted notable deals, including 24M Technologies‘ $87M Series H round at a $1.3B valuation, pointing to selective investor appetite for more mature EV tech companies.

More energy resources from CB insights:

- 5 climate tech markets gaining momentum in 2024

- The grid tech market map: The companies tackling the growing need for reliable electricity

- The energy impact of generative AI: 3 technologies transforming the future of data centers

- Analyzing 15 oil & gas leaders’ tech priorities: Here’s where incumbents are buying, investing, and partnering

- Sodium-ion batteries are poised for a breakout moment — energy players should prepare

- Why energy giants should have green ammonia on their radar