Industry leaders like Intel are experiencing major losses due to decreasing chip demand on top of high capital investments, but some areas are still prime for growth.

Intel recently reported its largest quarterly loss in company history, showing a 133% year-over-year (YoY) decline in earnings per share in Q1’23. Quarterly revenue fell 36% YoY to $11.7B.

Although the loss was in part driven by an expensive, ongoing strategic transition, Intel highlighted a number of factors — such as decreasing PC demand and declining data center markets — that negatively impacted results and reflect headwinds in the semiconductor industry broadly.

Startups have been affected by the current downturn, with revenues and venture funding experiencing recent declines. However, there are several areas proving to be resilient to this change, including chips for AI, automotive, and quantum computing.

Below, we analyze private companies in the semiconductor market to assess what the future holds. We look at the following CB Insights data:

- Total funding

- Top-funded companies

- Valuations

- M&A

Total funding

The semiconductor industry is vast, encompassing electronic design developers, equipment manufacturers, foundries, fabless design firms, and more.

Funding for the space declined substantially in 2022, falling 18% from its 2021 peak of $19.9B. During Q1’23, funding reached $1.9B, a 57% decline quarter-over-quarter.

Top-funded companies

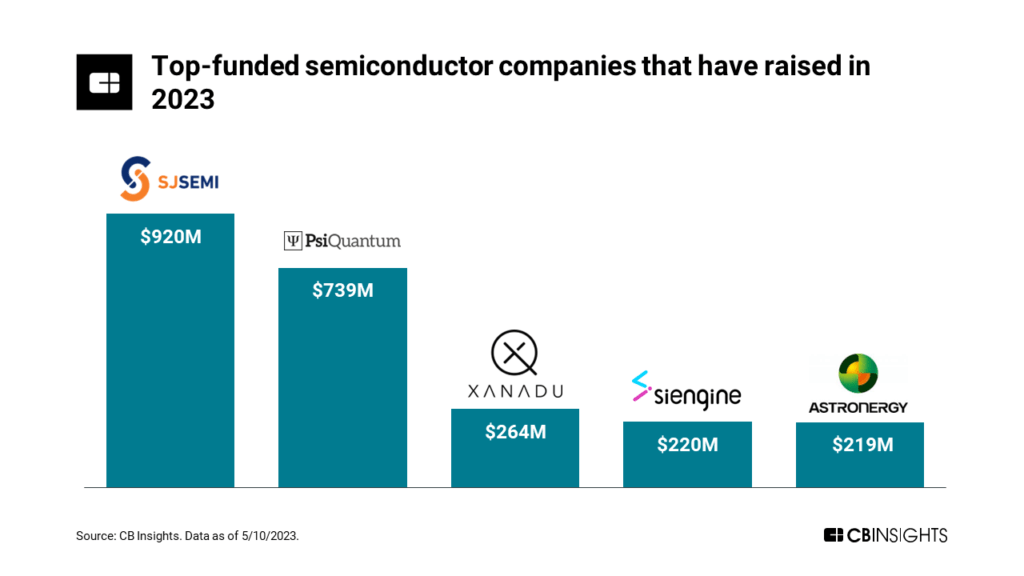

Among the companies that have raised in 2023 so far, SJ Semiconductor has received the most total funding, with $920M raised since launching in 2014. SJ is a pure-play foundry that focuses on fabricating chips designed by third parties.

The next top-funded companies that have attracted deals this year are PsiQuantum ($739M in total funding) and Xanadu ($264M). Both develop photonic quantum computing platforms, using particles of light to perform quantum operations and computations.

SiEngine ($220M), meanwhile, is a producer of automotive chips for applications like advanced driver assistance systems (ADAS), automotive microcontroller units (MCUs), and more.

Valuations

The highest valuations for companies that raised funding in 2023 are concentrated in sectors with significant growth, such as AI, automotive, and quantum.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.