While global funding falls, M&A activity picks up in digital health.

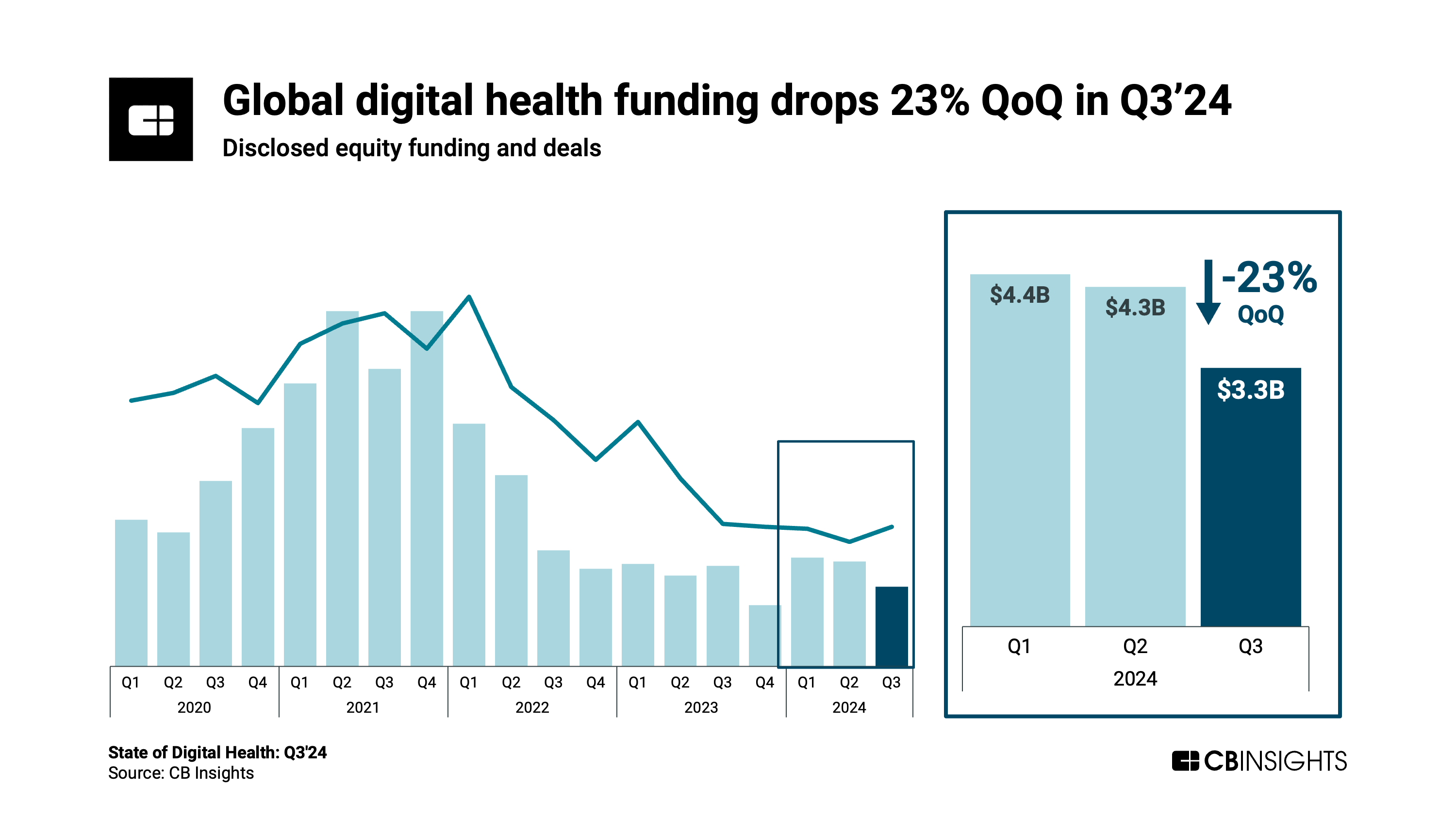

Despite a small bump in deals, digital health funding fell once again in Q3’24, hitting its second-lowest quarterly level since 2017.

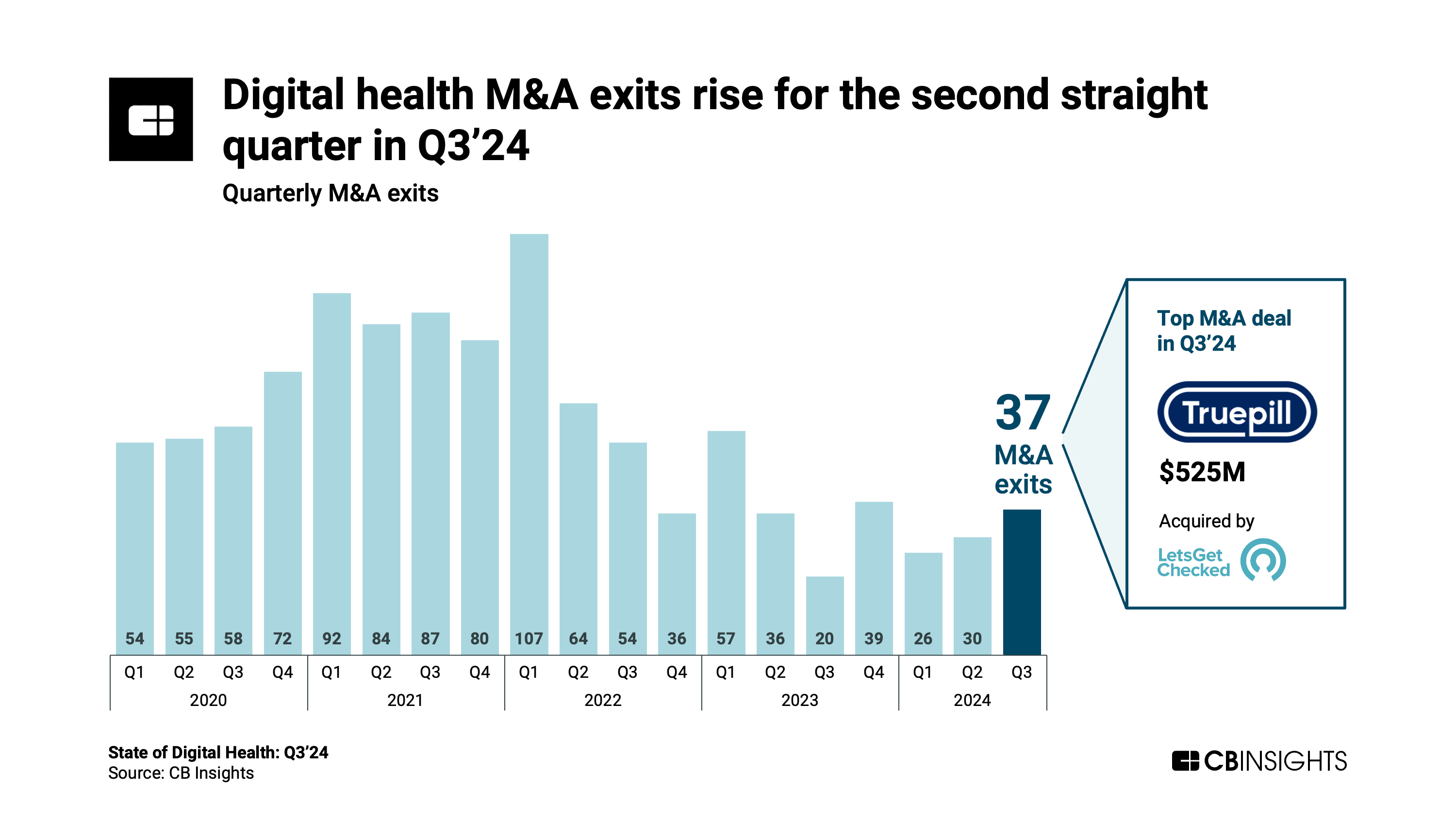

Meanwhile, M&A activity is on the rise, climbing for the second straight quarter in Q3’24.

Based on our deep dive in the full report, here is the TL;DR on the state of digital health:

- Global digital health funding drops 23% QoQ to hit $3.3B in Q3’24, marking the second-lowest quarterly funding level since 2017. This decline comes despite a slight uptick in deal count QoQ. However, the average deal size in 2024 YTD is $17.8M — a 51% increase from the full-year 2023 average of $11.8M. This jump in average deal size, amid a downturn in deals over the same period, reflects that investors are concentrating larger sums on fewer, later-stage ventures.

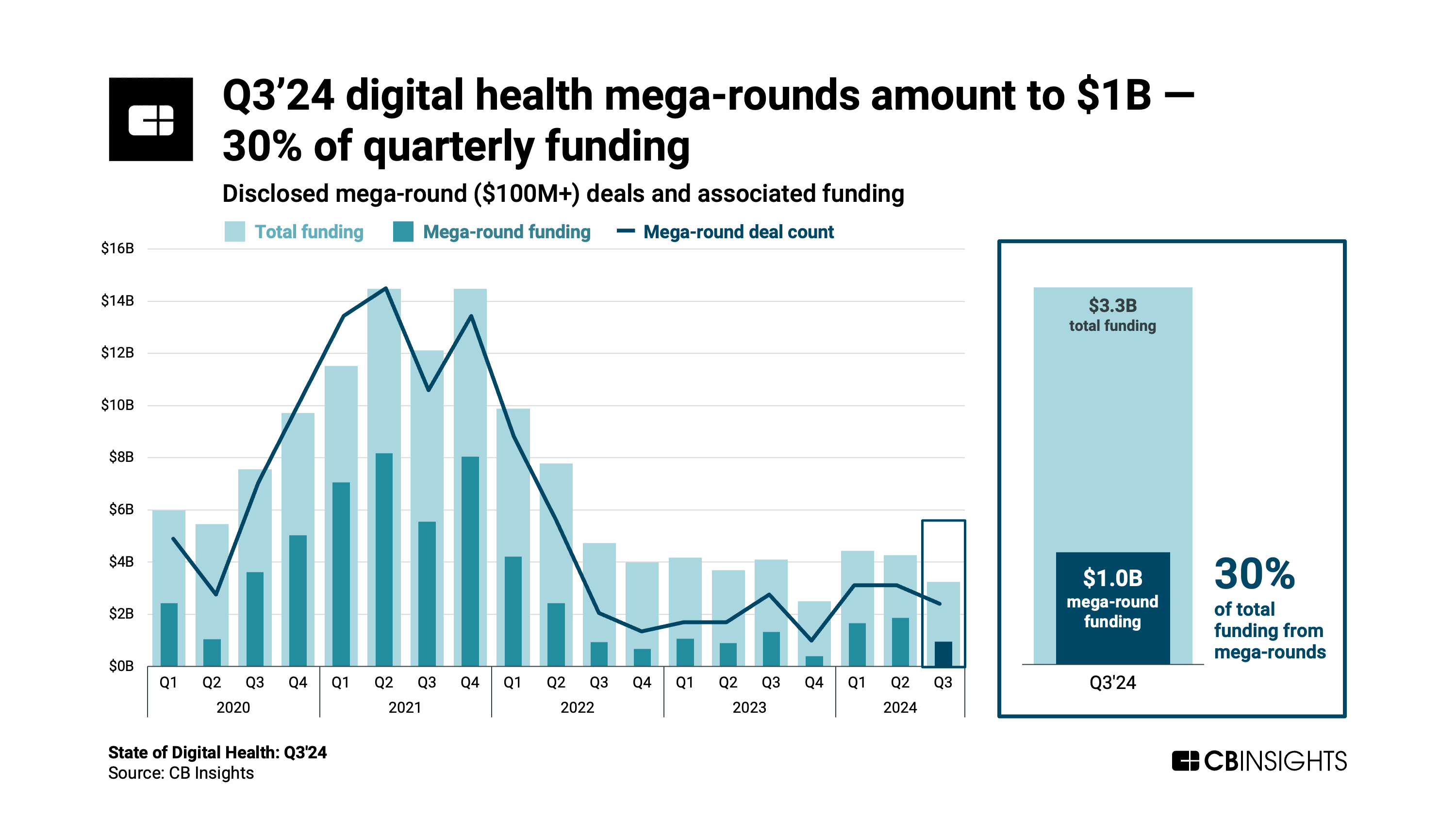

- Digital health mega-round deals ($100M+ deals) drop slightly in Q3’24, falling from 9 to 7 QoQ. Meanwhile, mega-round funding and share of total funding also declined QoQ, underscoring a more cautious investor approach. Mega-rounds accounted for 30% of total digital health funding in Q3 — down from 44% in Q2. Top Q3’24 mega-rounds (by round amount) included:

- Women’s health app Flo Health‘s $200M Series C

- Digital-first health insurance provider Alan‘s $193M Series F

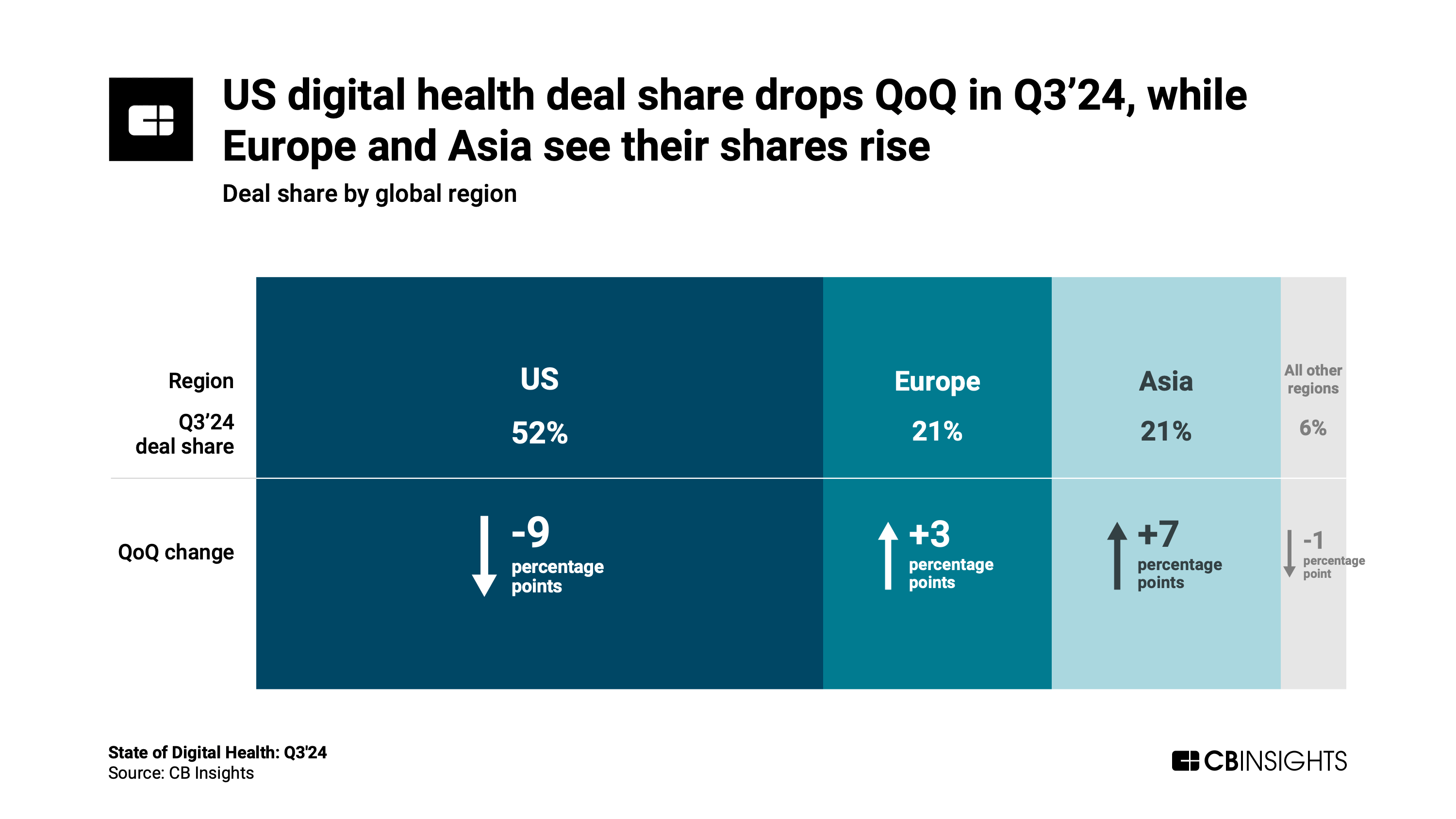

- The US accounts for 52% of digital health deals in Q3’24, down from 61% in Q2. Meanwhile, Europe and Asia both saw their deal shares rise to 21% in Q3. Asia experienced a greater jump in deal share, gaining 7 percentage points QoQ while Europe gained 3. This shift suggests growing investor interest in markets outside of traditional US hubs.

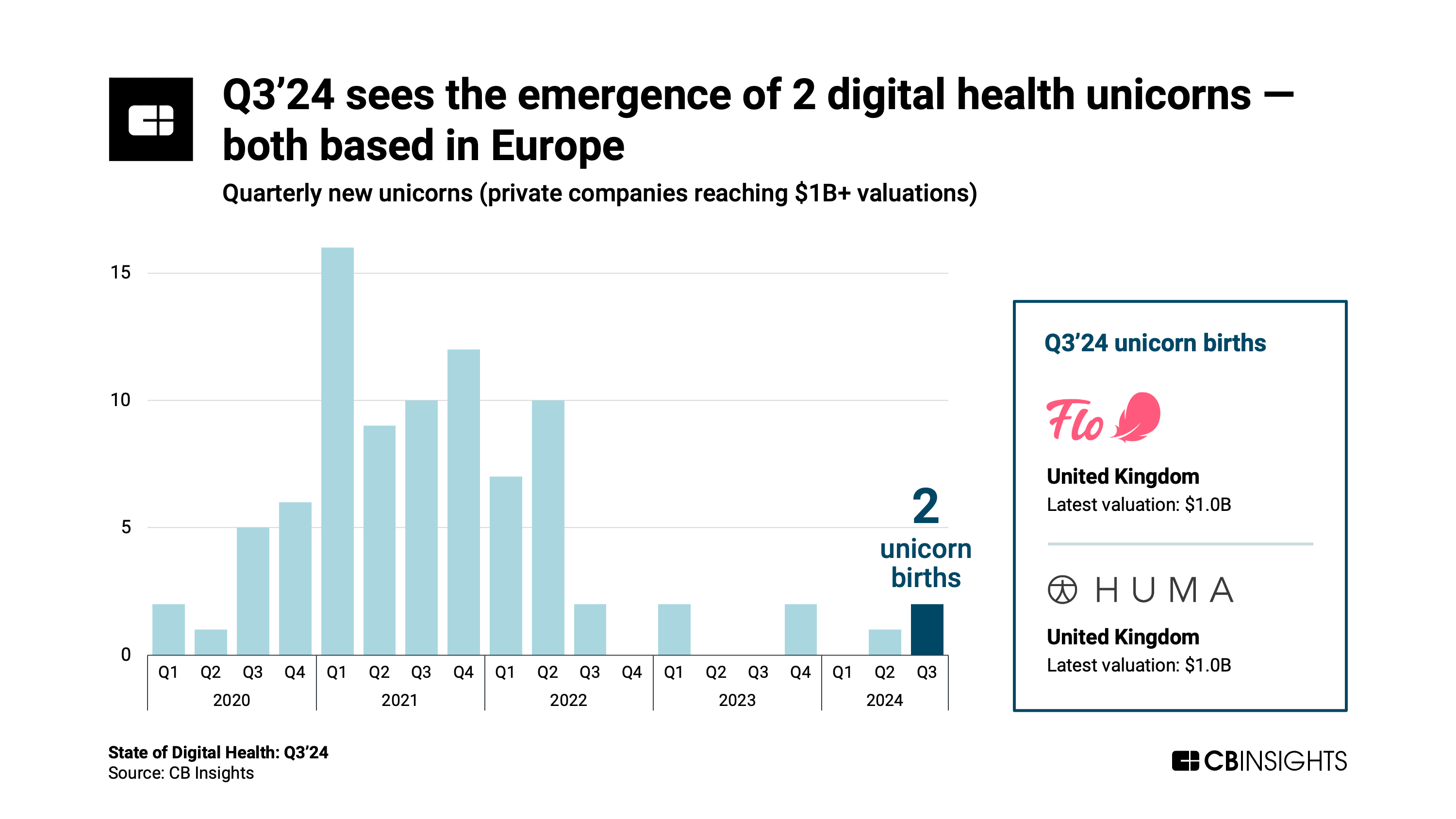

- Q3’24 sees the emergence of 2 new digital health unicorns — both based in Europe. The newest members of the digital health unicorn club are UK-based Flo Health, a women’s health app, and Huma, a remote patient monitoring platform. Against the backdrop of a broader downturn in new digital health unicorns, these births highlight Europe’s growing importance in the digital health landscape.

- Digital health M&A exits continue to climb in Q3’24, rising 23% QoQ to 37. This rising M&A appetite may be partly fueled by established companies seizing opportunities to scoop up innovative technologies amid a challenging funding environment for startups. The largest M&A deal in Q3’24 was LetsGetChecked’s $525M acquisition of digital pharmacy Truepill.

MORE DIGITAL HEALTH RESEARCH FROM CB INSIGHTS

- State of Digital Health Q2’24 Report

- Digital Health M&A: Every second acquisition in 2024 has been an AI company

- The $4.6B opportunity in healthcare: Ambient AI to target clinician burnout

- Analyzing Eli Lilly’s growth strategy: How the pharma giant is leveraging AI and pioneering a direct-to-patient approach

- Prioritizing clinical trials tech: How 16 tech-driven markets stack up across maturity and momentum