From in-home humanoids to autonomous labs, we highlight the growing opportunities in robotics markets for providers and other healthcare stakeholders.

The US healthcare industry faces a looming staffing crisis — projected shortages of over 139,000 physicians and 63,000 nurses by 2030 amid a rapidly aging population that will push up demand for healthcare services.

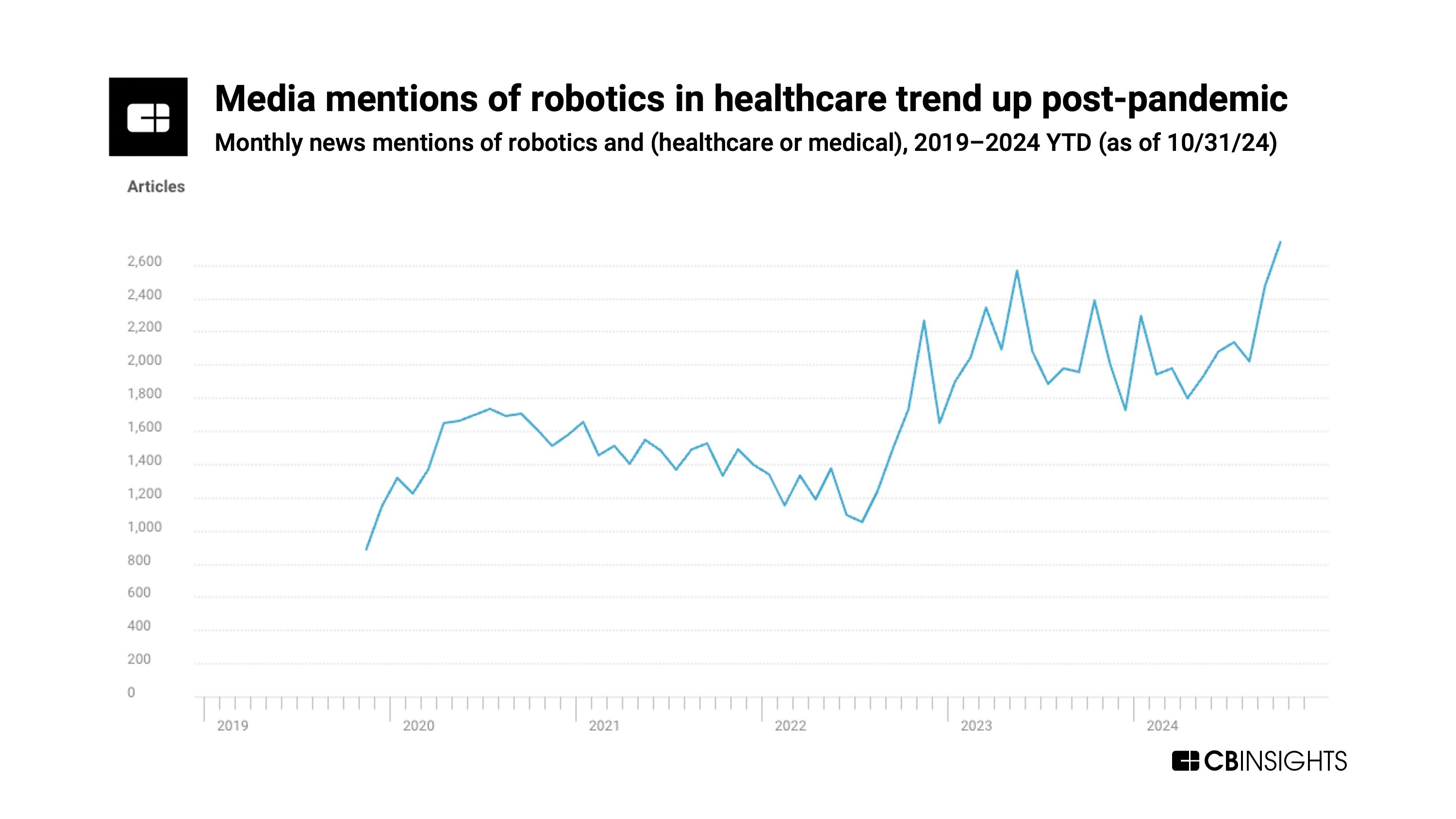

In response, robotics companies are seeing an opportunity to deploy their solutions across the healthcare industry — from automated medication dispensing to robotics-assisted physical therapy. Broader interest in the space is also rising, with healthcare robotics news mentions reaching a new high in October.

Source: CB Insights — news analysis tool

Using CB Insights data, we dug into recent deals, patents, and partnerships in robotics to identify areas that healthcare players should explore to improve efficiency and automation.

Here are 3 key takeaways from our analysis:

- Based on recent deals and startup momentum, healthcare providers should prioritize 4 key robotics markets — caregiving support, hospital operations and logistics, lab automation, and remote care delivery — to address staffing shortages and the needs of an aging population.

- Robots will enable aging at home, while reducing operational costs for providers. Solutions targeting these goals include everything from humanoid robots for household assistance to telepresence robotic systems for remote care delivery.

- Health systems are actively investing in robotics across a broad range of use cases. Mayo Clinic has made 3 robotics investments in 2024 YTD: Collaborative Robotics (collaborative robots), Clarapath (lab automation), and Bionaut Labs (drug delivery). Expect continued AI integration to enable an increasing number of diverse complex clinical tasks to be performed autonomously.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.