Traditional databases can't keep up with the rise of unstructured data and generative AI. Vector databases are emerging to meet the need.

By 2025, around 80% of generated data will be unstructured — ranging from images and videos to protein structures.

Vector databases provide enterprises with an easy way to store, search, and index unstructured data at a speed, scale, and efficiency that current relational (and non-relational) databases cannot offer.

This is particularly useful for “similarity searches” — e.g., surfacing images similar to an input image, suggesting similar videos, or personalizing e-commerce product recommendations. Vector databases are seeing emerging applications across industries, from drug discovery to anti-fraud and enterprise search.

While vector databases aren’t entirely new, the rapid rise of generative AI — fueled by OpenAI’s ChatGPT launch — has put them in the spotlight. The technology can make data more accessible for AI systems like large language models (LLMs), in turn making these models potentially more reliable.

Below, we’ll dive into:

- Vector database funding trends

- Most well-funded companies

- What’s next?

Vector database funding trends

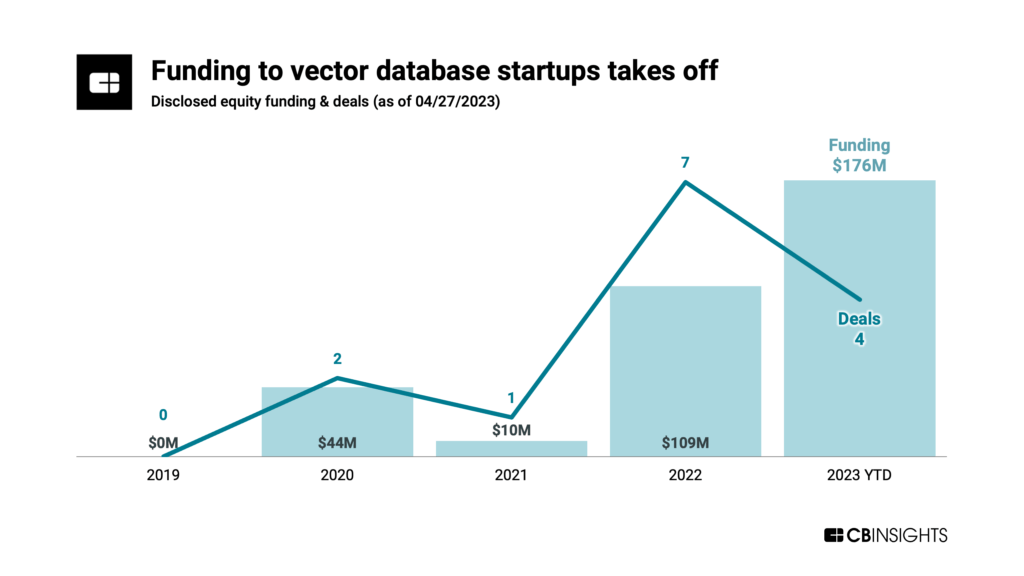

The vector database provider market is a nascent but growing one, with a number of vendors providing enterprise solutions.

This month alone, Pinecone ($100M Series B at a $750M valuation) and Weaviate ($50M Series B at a $200M valuation) have raised significant amounts of funding to scale their vector database and search capabilities.

Most well-funded companies

Pinecone’s $100M round, announced this week, makes it the most well-funded company in the space, bringing its total to $138M. Andreessen Horowitz, ICONIQ Growth, Menlo Ventures, and Wing Venture Capital participated in the round.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.