KoBold Metals

Founded Year

2018Stage

Series C - II | AliveTotal Raised

$930.5MValuation

$0000Last Raised

$537M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+39 points in the past 30 days

About KoBold Metals

KoBold Metals focuses on mineral exploration using advanced technologies in the mining and metals sectors. The company utilizes artificial intelligence, comprehensive data aggregation, and geoscience to manage mineral discovery. It serves sectors that require critical minerals for clean energy technologies. It was founded in 2018 and is based in Berkeley, California.

Loading...

KoBold Metals's Product Videos

ESPs containing KoBold Metals

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Battery metal mining tech refers to the technology and processes used to extract metals such as lithium, cobalt, and nickel from the earth for use in batteries. This market is driven by the increasing demand for batteries in electric vehicles and renewable energy storage. Companies in this market focus on developing more efficient and sustainable mining methods to meet the growing demand for batte…

KoBold Metals named as Leader among 15 other companies, including Hydro Extrusions, Albemarle, and EnergyX.

KoBold Metals's Products & Differentiators

Machine Prospector

KoBold Metals’ Machine Prospector® is a proprietary system integrating machine learning, data processing, and artificial intelligence to revolutionize mineral exploration. It systematically reduces uncertainties by analyzing vast geoscientific datasets, enabling precise identification of mineral-rich areas. This approach transforms exploration into a repeatable science, enhancing efficiency and success rates.

Loading...

Research containing KoBold Metals

Get data-driven expert analysis from the CB Insights Intelligence Unit.

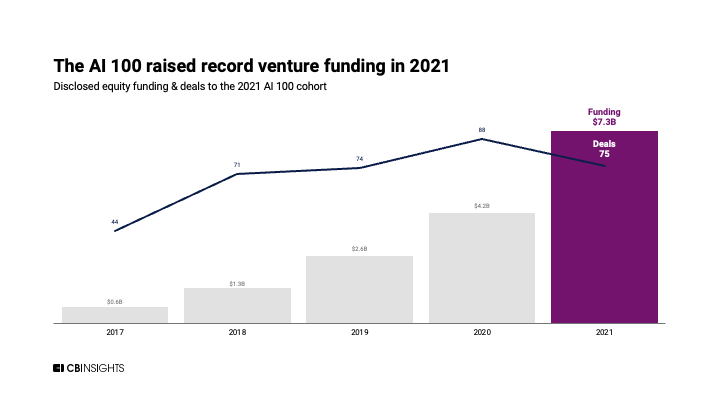

CB Insights Intelligence Analysts have mentioned KoBold Metals in 3 CB Insights research briefs, most recently on Apr 17, 2023.

Apr 11, 2022

The top 100 AI startups of 2021: Where are they now?Expert Collections containing KoBold Metals

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

KoBold Metals is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Energy Storage

5,350 items

Companies in the Energy Storage space, including those developing and manufacturing energy storage solutions such as lithium-ion batteries, solid-state batteries, and related software for battery management.

AI 100

100 items

Winners of CB Insights' 5th annual AI 100, a list of the 100 most promising private AI companies in the world.

Job Site Tech

925 items

Companies in the job site tech space, including technologies to improve industries such as construction, mining, process engineering, forestry, and fieldwork

AI 100 (2024)

100 items

Artificial Intelligence

7,221 items

KoBold Metals Patents

KoBold Metals has filed 40 patents.

The 3 most popular patent topics include:

- drilling technology

- petroleum production

- oil wells

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/16/2022 | 10/1/2024 | Particle experiments, Particle physics, Fermilab experiments, Mass spectrometry, Neutrino observatories | Grant |

Application Date | 2/16/2022 |

|---|---|

Grant Date | 10/1/2024 |

Title | |

Related Topics | Particle experiments, Particle physics, Fermilab experiments, Mass spectrometry, Neutrino observatories |

Status | Grant |

Latest KoBold Metals News

Apr 1, 2025

Mugglehead Investment Magazine Multiple parties have shown interest in the Roche Dure lithium deposit By 9 minutes ago Rio Tinto Group ( NYSE: RIO ) is looking to get into the Democratic Republic of Congo (DRC) to develop one of the largest hard rock lithium deposits in the world. The negotiations have been going on for the past few weeks, and include the company’s intent to turn the Roche Dure deposit into a lithium mine. The outcome of these talks remains uncertain as discussions are still in the early stages. The DRC aims to attract Western investment to counterbalance Chinese dominance in its mining industry. The country is also negotiating a minerals-for-security deal with the US to support its fight against regional insurgencies in its eastern provinces. Multiple parties have shown interest in the Roche Dure lithium deposit, which Australian company AVZ Minerals initially identified. As of May 2019, estimates place the deposit’s mineral resources at 400 million tonnes, containing 1.65 per cent lithium oxide, 715 parts per million (ppm) of tin, and 34 ppm of tantalum. Situated near the Manono lithium project in south-eastern Congo, the licence remains entangled in arbitration proceedings. AVZ Minerals initiated the dispute after the DRC Government revoked its rights and redistributed them, granting the northern section to Zijin Mining Group. In March, AVZ Minerals announced that an International Chamber of Commerce tribunal had issued a partial award, ordering DRC’s state-owned Cominière to pay €39.1 million (USD$42.4 million) plus interest for failing to comply with emergency orders over the Manono lithium project. Rio Tinto aims to establish itself in lithium market Rio Tinto’s talks with the DRC about developing the Roche Dure deposit highlight the company’s growing interest in battery metals, which are essential for the electric vehicle industry. The company aims to establish itself as a significant player in the lithium supply chain, unlike mining giants such as BHP and Glencore, which have approached the lithium market with more caution. Rio Tinto expanded its operations last year by acquiring Arcadium Lithium Plc ( NYSE: ALTM ) for USD$6.7 billion and developing assets in Serbia and Argentina. KoBold Metals, backed by investors such as Bill Gates and Jeff Bezos, has stated its intention to develop the deposit once legal disputes are resolved. Speculation suggests that KoBold and Rio Tinto may collaborate on the mine, though both companies are also considering independent involvement, according to the report. The discussions focus on the potential exploitation of Roche Dure, a site with ongoing legal disputes. Previously, the Australian company AVZ Minerals attempted to develop this lithium-rich area, but the Congolese government revoked its mining rights, triggering an ongoing arbitration process. Despite the current downturn, Rio Tinto has historically delivered strong returns for dividend seekers. The company has offered substantial payouts in the past, with dividend yields exceeding 10 per cent in 2019, 2021, and 2022. Currently, the yield sits at around 7 per cent, making Rio Tinto an appealing option for investors seeking stability. Investors are closely watching the developments at Roche Dure, as a successful negotiation between Rio Tinto and the DRC government could help revitalize the stock. The outcome of AVZ Minerals’ arbitration process will also play a crucial role in shaping the future of lithium mining in the region. .

KoBold Metals Frequently Asked Questions (FAQ)

When was KoBold Metals founded?

KoBold Metals was founded in 2018.

Where is KoBold Metals's headquarters?

KoBold Metals's headquarters is located at 64 Shattuck Square, Berkeley.

What is KoBold Metals's latest funding round?

KoBold Metals's latest funding round is Series C - II.

How much did KoBold Metals raise?

KoBold Metals raised a total of $930.5M.

Who are the investors of KoBold Metals?

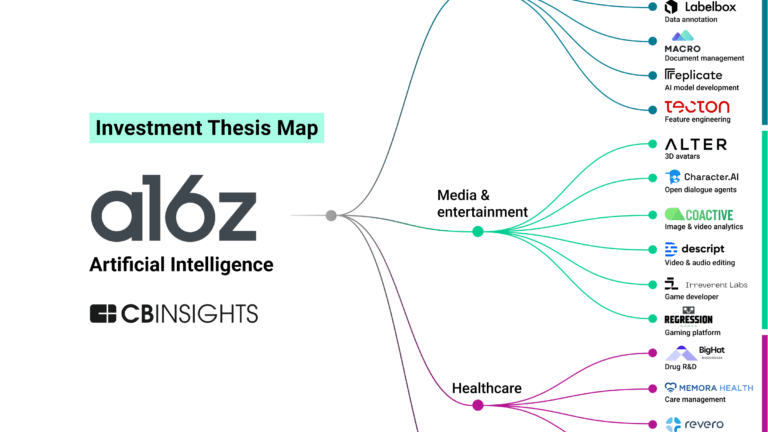

Investors of KoBold Metals include Andreessen Horowitz, Breakthrough Energy, T. Rowe Price, Bond, Durable Capital Partners and 14 more.

Who are KoBold Metals's competitors?

Competitors of KoBold Metals include Earth AI and 5 more.

What products does KoBold Metals offer?

KoBold Metals's products include Machine Prospector and 2 more.

Who are KoBold Metals's customers?

Customers of KoBold Metals include BHP and Rio Tinto.

Loading...

Compare KoBold Metals to Competitors

Torque Metals is a smart exploration company focused on the mining industry. They specialize in utilizing advanced geoscience and AI-powered techniques to identify and unlock high-value mineral deposits. The company primarily engages in the exploration of gold, lithium, and nickel through its various projects in Western Australia. It was founded in 2017 and is based in Subiaco, Western Australia.

Comstock Mining is a Nevada-based gold and silver mining company involved in the exploration and extraction of precious metals. The company's offerings include mineral exploration and extraction, utilizing technologies such as geophysics-based machine learning and satellite-captured hyperspectral data to enhance mineral discovery and extraction processes. Comstock Mining primarily serves the mining industry with a focus on improving the efficiency of mining operations. It was founded in 1999 and is based in Virginia City, Nevada.

Aruma Resources Limited is an ASX-listed company focused on the exploration and development of gold and lithium projects in the minerals exploration industry. The company's main activities include the systematic exploration of its portfolio to discover and develop high-grade mineral resources, with a particular emphasis on gold and lithium. Aruma Resources sells primarily to the mining and resources sector. It is based in West Perth, Western Australia.

Orosur Mining is a minerals development company focused on the exploration and development of precious and battery metals. The company's main offerings include the exploration and potential development of gold and battery metals assets, with a strategic exploration alliance in place for the Anzá gold exploration project in Colombia. Orosur Mining primarily serves the mining and metals sector, with a focus on investors interested in South American mineral exploration. It was founded in 1989 and is based in Toronto, Ontario.

Albion Technologies develops battery energy storage systems. It aims to allow surplus electrical energy to be stored near renewable power generation facilities such as solar or wind farms. It was formerly known as NewCo Centre. The company was founded in 2019 and is based in Bristol, United Kingdom.

InterGen is a developer, owner, and operator of power generation facilities in the energy sector. The company specializes in combined cycle gas and open cycle gas power generation. InterGen's assets contribute to renewable energy by providing power and balancing services. It was founded in 1995 and is based in Edinburgh, Scotland.

Loading...