LemFi

Founded Year

2020Stage

Series B | AliveTotal Raised

$86.86MLast Raised

$53M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+30 points in the past 30 days

About LemFi

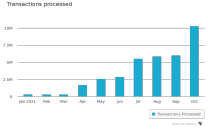

LemFi offers international payment solutions. It offers services such as international money transfers, multi-currency accounts, and cross-border card transactions. It serves the immigrant population, facilitating financial transactions across borders. It was formerly known as Lemonade Finance. It was founded in 2020 and is based in the United Kingdom.

Loading...

LemFi's Product Videos

ESPs containing LemFi

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The P2P (peer-to-peer) cross-border payments platforms market facilitates the direct transfer of funds between consumers located in different countries. Some providers specialize in remittances more broadly, while others target money movement between specific countries. Most offer accounts where users can hold their money as well.

LemFi named as Challenger among 15 other companies, including PayPal, Wise, and Remitly.

LemFi's Products & Differentiators

Digital Wallets

We provide users with wallets/accounts in both their country of origin (ie Ghana, NG, KE) as well as their country of residence (NA, Europe)

Loading...

Research containing LemFi

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned LemFi in 2 CB Insights research briefs, most recently on Dec 14, 2023.

Dec 14, 2023

Cross-border payments market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing LemFi

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

LemFi is included in 2 Expert Collections, including Payments.

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

100 items

Latest LemFi News

Apr 4, 2025

by April 4, 2025, 6:21 am As expected, the performance in March significantly impacted the overall numbers. In total, start-ups raised $460m in Q1 through $100k+ deals (excluding exits), which is only slightly below the Q1 2024 total of $486m, reflecting a 5% YoY decrease. However, it’s important to note that Q1 2024 itself was not a particularly strong quarter. In fact, Q1 2025 marks the second-lowest quarter for start-up funding since late 2020. Looking at the number of start-ups that raised at least $1m in Q1, there is a more positive outlook. With 52 such start-ups, this figure aligns with the 2023-2024 average. As expected, 83% of the funding went to the Big Four countries, with Kenya, Nigeria, and South Africa each attracting approximately $100m in funding (24%, 24%, and 22% of the total, respectively). Egypt followed with $61m (14%). Togo rounded out the top five, bolstered by Gozem’s $30m Series B funding round. Nearly half of the funding (46%) was raised by fintech start-ups ($53m for LemFi, $38m for Naked, etc. ), with energy (18%) and logistics & transportation (10%) following in terms of sectoral breakdown. Female CEOs secured just over 2% of the total funding ($10m), with the largest round being a $6.2m grant awarded to South African biotech company African Biologics. If grants are excluded, the proportion of funding raised by female CEOs in Q1 2025 drops to 0.7%. Ultimately, 79% of the funding went to either solo male founders (11%) or male-only founding teams (67%). Diverse founding teams received 20% of the total, which, while not ideal, is relatively strong compared to previous quarters. A mere 1% was allocated to solo female founders or female-only founding teams.

LemFi Frequently Asked Questions (FAQ)

When was LemFi founded?

LemFi was founded in 2020.

What is LemFi's latest funding round?

LemFi's latest funding round is Series B.

How much did LemFi raise?

LemFi raised a total of $86.86M.

Who are the investors of LemFi?

Investors of LemFi include Y Combinator, Left Lane, Endeavor Catalyst, Highland Europe, Palm Drive Capital and 9 more.

Who are LemFi's competitors?

Competitors of LemFi include Chipper Cash and 1 more.

What products does LemFi offer?

LemFi's products include Digital Wallets and 3 more.

Loading...

Compare LemFi to Competitors

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, United Kingdom.

KiaKiaFX is an online platform that allows users to buy and sell foreign exchange from their home or office via a computer, smartphone, or tablet. It specializes in foreign exchange (FX) transfers, FX intermediation, consulting, and more. The company was founded in 2017 and is based in London, United Kingdom.

Wave provides financial services and focuses on reinventing mobile money. It offers services such as depositing and withdrawing money, sending money to others, paying bills, and buying airtime, all primarily through a mobile application. It primarily serves the unbanked population. It was founded in 2017 and is based in Dakar, Senegal.

Travel Tao is a fintech company that provides currency exchange services for travelers. The company offers a currency exchange calculator and a currency tool that assists with currency conversion and calculation for travelers. Travel Tao serves the travel and tourism sector, addressing the financial needs of travelers. It was founded in 2018 and is based in Zhuhai, Guangdong.

First Digital Trade operates as a financial technology company providing digital banking and payment solutions. The company develops digital banking applications, issues credit cards, manages IBANs, and facilitates payments. They offer banking as a service and provide white label products. They integrate embedded finance and payment systems and technology. It was founded in 2021 and is based in Vilnius, Lithuania.

Narvi is a tech company that focuses on providing modern banking solutions, operating within the financial technology sector. The company offers dedicated business accounts that enable users to send and receive euro payments to and from over 100 countries worldwide, with features such as instant SEPA payments and global SWIFT wire transfers. Primarily, Narvi caters to global businesses, providing a banking platform that facilitates efficient international transactions. It was founded in 2021 and is based in Helsinki, Finland.

Loading...