Marshmallow

Founded Year

2017Stage

Line of Credit | AliveTotal Raised

$135.46MLast Raised

$18.58M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+6 points in the past 30 days

About Marshmallow

Marshmallow is a financial services company that specializes in providing car insurance for newcomers to the UK. The company offers fully comprehensive coverage with a pricing model that takes into account a customer's driving experience from any country. Marshmallow primarily serves individuals who have recently moved to the UK and are seeking fair and inclusive car insurance options. It was founded in 2017 and is based in London, United Kingdom.

Loading...

ESPs containing Marshmallow

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — auto market comprises insurtech carriers that underwrite automotive insurance. As with established carriers, insurtech carriers will typically also be licensed by respective authorities and undergo review by rating agencies. The use of alternative data (such as from telematics sensors) is often central to proactive risk management and underwriting practices empl…

Marshmallow named as Challenger among 12 other companies, including Digit Insurance, Lemonade, and Branch.

Loading...

Research containing Marshmallow

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Marshmallow in 1 CB Insights research brief, most recently on Sep 7, 2022.

Expert Collections containing Marshmallow

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Marshmallow is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

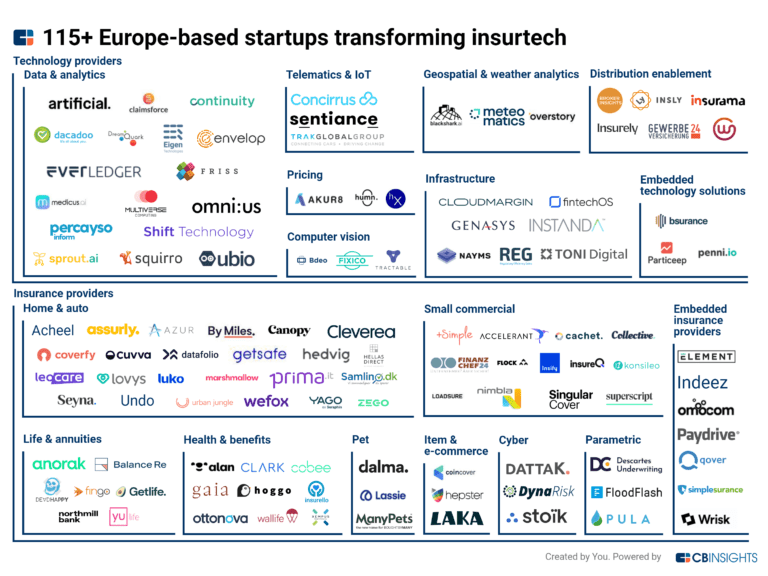

Insurtech

4,485 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,699 items

Excludes US-based companies

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Marshmallow Patents

Marshmallow has filed 1 patent.

The 3 most popular patent topics include:

- cloud infrastructure

- data management

- data modeling

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/20/2022 | Data modeling, Database management systems, Data management, Cloud infrastructure, Free software for cloud computing | Application |

Application Date | 10/20/2022 |

|---|---|

Grant Date | |

Title | |

Related Topics | Data modeling, Database management systems, Data management, Cloud infrastructure, Free software for cloud computing |

Status | Application |

Latest Marshmallow News

Mar 20, 2025

FinTech in London: Present and future, an analysis by Emils Kerimovs written by Sarah Dunsby 20th Mar 25 1:30 pm Financial Technology (FinTech) has been established in London, while the city maintains its premier position as a financial hub in the evolving financial sector. Emils Kerimovs conducts an analysis, which examines London’s FinTech sector at present times and forecasts its foreseeable developments. A dynamic ecosystem London’s diverse FinTech ecosystem encompasses a broad spectrum of specializations. Three companies, among others, such as Revolut, and Wise, and Monzo, established themselves in the payments and remittances sector by delivering faster services, while providing more affordable options. The retail banking industry faces disruption through user-focused digital challenger banks, having their services available exclusively through mobile apps, such as Starling and Atom Bank. The innovative InsurTech companies, Zego and Marshmallow, use customer data to create adjustable insurance solutions. According to Kerimovs, London happens to be one of the principal RegTech hubs in the world, and businesses, such as ComplyAdvantage and Onfido, implement AI to manage regulatory compliance. WealthTech firms, like Nutmeg, lead the way to investment equality by using technology, while the blockchain sector explores DeFi structures and their related uses. The business lending market gets new innovations through Funding Circle, as well as other companies. Key drivers of success London stands as a worldwide FinTech leader because multiple key components operate jointly. The financial center heritage of London enables the retention of substantial expert talent, as well as developed network systems, and advanced infrastructure. A thriving network of technology companies draws experienced developers, along with business owners, required for creative development. Businesses in London can leverage the FCA’s Regulatory Sandbox platform, as well as the UK’s pro-investment regulatory framework. According to Kerimovs, capital accessibility plays an essential part in FinTech success, and London maintains constant investment inflows from the industry. Governments expand the sector through tax benefits and plans to attract qualified staff. Open Banking data sharing requirements between British banks and third-party providers, initiated by the UK, has created substantial market competition and novel financial services. Navigating the challenges The FinTech sector, operating from London, deals with important obstacles, while achieving notable achievements. Brexit has created marketplace ambiguities, which affect both market entry protocols and the free cross-border flow of rights between nations. The recruitment of talented employees continues being an ongoing battle, due to powerful international recruitment battles and elevated living expenses in London. The sector faces three notable barriers, including complex regulations, and harmful cybersecurity risks, and fundamental challenges of business growth. According to Kerimovs, the funding pace declined in both 2022 and 2023, because of standard macroeconomic indicators. Conclusion Through the research conducted by Emils Kerimovs, it becomes clear that the London-based FinTech sector demonstrates strong resistance against challenges, and sustained innovation capabilities. This financial center has emerged as the leader of the global market, due to its specific mix of factors. The future points towards continuous growth, despite active challenges you may detect now. London maintains its position as a leader of finance future development, through technology innovation, alongside its supportive regulations, and deep workforce resources. Modern solutions, based on embedded finance, and AI, as well as sustainability advances, set the path for an outflow of increasingly impactful enhancements in finance. London needs direct intervention to tackle current recruitment issues, together with regulatory hurdles, and rising international competitive threats, to maintain its global leadership in financial technology. More Like This:

Marshmallow Frequently Asked Questions (FAQ)

When was Marshmallow founded?

Marshmallow was founded in 2017.

Where is Marshmallow's headquarters?

Marshmallow's headquarters is located at 66 City Road, London.

What is Marshmallow's latest funding round?

Marshmallow's latest funding round is Line of Credit.

How much did Marshmallow raise?

Marshmallow raised a total of $135.46M.

Who are the investors of Marshmallow?

Investors of Marshmallow include Triple Point Investment Management, Halo Business Angel Network, Passion Capital, Investec, SCOR and 8 more.

Who are Marshmallow's competitors?

Competitors of Marshmallow include Urban Jungle and 8 more.

Loading...

Compare Marshmallow to Competitors

RAC is a provider of motoring services that includes breakdown assistance and vehicle insurance. The company provides services such as roadside assistance, mobile mechanics, car and home insurance, and vehicle maintenance services. RAC provides tools for route planning and fuel price comparison. It was founded in 1897 and is based in Walsall, England.

Cuvva specializes in short-term car insurance, operating within the insurance industry. The company offers flexible insurance policies ranging from one hour to twenty-eight days, providing comprehensive coverage for drivers. Cuvva primarily serves individuals requiring temporary vehicle insurance, such as car sharers, learner drivers, and those needing immediate drive away insurance. It was founded in 2015 and is based in London, England.

Verti is a digital insurance provider specializing in offering online and telephonic insurance solutions within the insurance industry. The company provides a range of insurance products including coverage for automobiles, motorcycles, homes, and pets, designed to meet the diverse needs of its customers. Verti's insurance offerings are characterized by their innovative pricing models and the ability to personalize coverage to individual customer requirements. It was founded in 2011 and is based in Madrid, Spain.

Klinc provides an insurance platform for home, device, mobility, life, engine and more. It was founded in 2018 and is based in Barcelona, Spain.

Driverly is a company that focuses on providing flexible car insurance in the insurance industry. The company offers a unique car insurance service that uses artificial intelligence and machine learning techniques to determine insurance rates based on individual driving behavior, rather than demographic data. This service is offered through a monthly subscription model, with no cancellation fees, and includes the opportunity for customers to earn rewards for safe driving. It was founded in 2021 and is based in Cardiff, United Kingdom.

Locket is a SaaS platform focused on the insurance industry, offering solutions to prevent and reduce claims. The company provides tools and services designed to protect customers' assets and generate upsell and cross-sell opportunities. Locket's primary clientele includes insurance providers looking to integrate smart technology into their offerings. It was founded in 2020 and is based in London, England.

Loading...