Mercury

Founded Year

2017Stage

Secondary Market | AliveTotal Raised

$450.93MValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+83 points in the past 30 days

About Mercury

Mercury operates as a financial technology company. It offers banking accounts, currency exchange, debit cards, and international wires with operational support in the form of team management, tool integration, relevant insights on business finances, and more to its customers. It was founded in 2017 and is based in San Francisco, California.

Loading...

Mercury's Product Videos

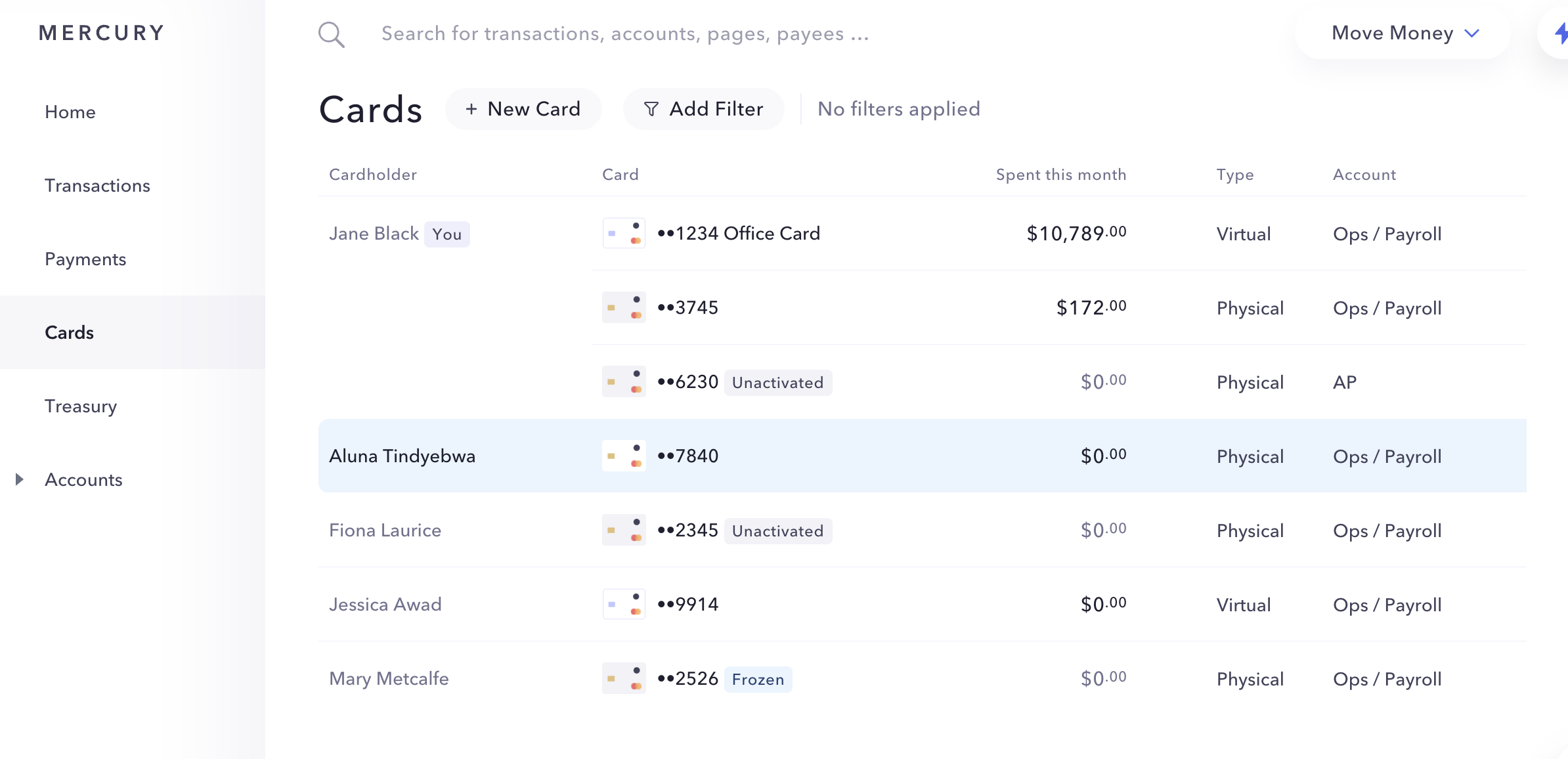

Mercury's Products & Differentiators

Business Checking Account

Designed with startups in mind, Mercury offers scalable digital tools — plus, every account provides read-write application programming interface access to truly customize your banking.

Loading...

Expert Collections containing Mercury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mercury is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,586 items

Future Unicorns 2019

50 items

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,112 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Mercury Patents

Mercury has filed 51 patents.

The 3 most popular patent topics include:

- videotelephony

- display devices

- electromagnetic radiation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/13/2023 | 3/4/2025 | Videotelephony, Teleconferencing, Association football forwards, Groupware, Qualitative research | Grant |

Application Date | 2/13/2023 |

|---|---|

Grant Date | 3/4/2025 |

Title | |

Related Topics | Videotelephony, Teleconferencing, Association football forwards, Groupware, Qualitative research |

Status | Grant |

Latest Mercury News

Apr 3, 2025

Banking Without Borders: How Lili is making US banking accessible to international SMBs A quarter into 2025, Lili, a small business banking platform, is exploring a more fluid approach to global expansion. Lili’s international move involves pulling entrepreneurs into the US SMB banking ecosystem, giving them a pathway to start and manage their businesses stateside. Sara Khairi | April 03, 2025 International growth is hard, and only a few succeed. One company that successfully managed to make its products accessible to an overseas client base is Mercury, which offers banking services to customers, primarily early-stage startups and tech companies. The fintech allows non-US entrepreneurs to open US business bank accounts remotely, provided their companies are formed and registered in specific jurisdictions , including the United States, U.S. Virgin Islands, British Virgin Islands, Cayman Islands, among a few others. A quarter into 2025, another relatively newer fintech has decided to test the waters of exploring a more fluid approach to global expansion: the small business (SMB) banking platform, Lili . Liran Zelkha, Lili’s Chief Technology Officer & Co-Founder Lili’s international move involves pulling entrepreneurs into the US SMB banking ecosystem, giving them a pathway to start and manage their businesses stateside. To make this possible, Lili has expanded Lili Connect — its embedded finance solution launched last year for US entrepreneurs — to eligible users outside the US. Non-US residents in Canada, the UK, Germany, and Spain can now use Lili Connect to set up businesses in the US. They also get a Lili Visa Debit Card without any foreign exchange or transaction fees. “This expansion allows entrepreneurs in select countries around the world to open a business checking account in the United States,” says Liran Zelkha, Lili’s Chief Technology Officer and Co-Founder. A closer look at Lili Connect: Lili Connect enables partner companies to integrate Lili’s banking, accounting, and tax management tools directly into their platforms. This integration allows the small business clients to manage their finances within a single interface. Lili isn’t a bank itself — it partners with FDIC-insured institutions to offer business checking accounts. “Lili Connect was created because small business owners are overwhelmed with managing their finances and keeping their bookkeeping up to date,” says Zelkha. Zelkha shares that both Lili Connect and its expansion to include US small businesses founded by non-resident accounts are part of the firm’s bigger goal – helping small business owners streamline operations, no matter where they are. “As a small business owner myself, one of my least favorite and most time-consuming activities was having to do my taxes and bookkeeping — that frustration was part of what eventually led my co-founder and me to the idea of Lili,” he notes. “Since then, we’ve made it a priority to tackle the real pain points small business owners face when deciding where and how to expand Lili’s offerings.” The rough ride for non-US resident SMB owners: For SMB owners outside the US who frequently sell to American customers or collaborate with US companies, payments pose the first major challenge. Transferring funds across borders comes at a steep price — payment gateways can eat up as much as 5% of their revenue, not to mention additional currency exchange fees, explains Zelkha. These costs not only shrink profit margins; they also put international entrepreneurs at a disadvantage compared to US-based businesses that aren’t burdened by such expenses. The most straightforward way to sidestep these fees is by opening a US bank account. However, for non-resident SMB owners, that’s easier said than done. Unlike personal bank accounts, some of which can often be opened online, business accounts typically require an in-person visit to a branch, followed by an approval process that can take anywhere from days to weeks. For entrepreneurs residing outside the US, this means a costly and time-consuming trip with no guaranteed outcome to access basic banking services. “This frustrating experience is all too common for non-resident small business owners looking to enter the US market, and this is something I have first-hand experience with,” says Zelkha. Recalling his personal experience from several years ago, he shared how his 74-year-old father faced the same hurdles when launching a nutrition supplement business in the US. Opening a business bank account became a big challenge, ultimately forcing his father to travel from overseas to the US, only to complete the process and get his business up and running. “His experience really stuck with me when we started thinking about how Lili could expand to serve even more customers and made me realize how much value we could bring,” shares Zelkha. “Lili Connect’s international expansion provides the exact solution that my dad could have used when he was getting his business up and running.” Lili Connect enables non-US residents to open a US business bank account remotely, given they submit the necessary verification details and fulfil certain criteria. Onboarding and compliance: For overseas SMB entrepreneurs, the Social Security Number (SSN) is a sticking point, which is vital in the US for income tracking, taxes, credit, and banking. So, how does Lili onboard international entrepreneurs without an SSN while staying compliant with US regulations? Zelkha outlines how Lili approaches this process: i) Gathering all the insights on the what, why, and how: First, Lili ensures that the small business applying for the account is legitimately established in the US. To do this, Lili asks an associated checklist of questions to understand the nature of the business, such as what it does, what it’s for, and how the bank account will be used. ii) Due diligence: Lili then compiles a list of business owners and cross-checks them with international databases. Because reliable and detailed records are required, Lili Connect is only available in select countries where thorough user verification can be ensured. “We also require scanned documents and extensive identifying information, just as we do for US residents,” says Zelkha. “We collect the necessary details and conduct an extensive verification process to ensure that only legitimate users gain access to our system. We’ve been highly successful at blocking bad actors and denying their account applications.” Adhering to the US tax rules: US tax planning and requirements are complicated for any local US small business owner and can be even harder to navigate for international entrepreneurs who are not familiar with its complexities. Zelkha notes that the worst-case scenario for any business is “thinking they earned $100,000 in a year, only to realize they owe $50,000 to the IRS because they didn’t fully understand their tax obligations.” This is where Lili’s product combination, integrating banking, payments, invoicing, and tax management into a single app, comes in. This product mix has also contributed to its growth and popularity over the past six years. By combining a checking account with AI-based accounting and tax preparation tools, Lili enables business owners, including self-employed freelancers, to smoothly integrate tax preparation into their financial management workflow. “Business owners have access to a built-in software stack that integrates banking, accounting, and tax tools that even someone with a limited financial background can use to manage every aspect of their business’s finances,” says Zellkha. “These tools are available whether you’re a US resident or not.” Credit-building: Credit building is a crucial factor in the US because it directly impacts financial opportunities for both consumers and businesses. Lili Connect enables non-resident entrepreneurs to build business credit through its partnership with Dun & Bradstreet, a US business data and analytics firm, says Zelkha. By opening a Lili business checking account via Dun & Bradstreet’s myD&B platform, customers can connect their financial data to D&B Credit Insights, making them eligible for business credit scores. Since Dun & Bradstreet operates worldwide, this feature is available to both US residents and non-residents using Lili. Expanding mindfully Navigating cross-border financial services involves many hurdles. Lili has had to work through issues such as: 1. Scaling: Expanding globally isn’t only about reaching new customers — it also requires complying with country-specific regulations, particularly in verifying foreign citizens’ personal information. Differences in postal code formats, state codes, and data privacy laws add layers of complexity, requiring strict regulatory alignment in each new market. 2. UX adjustments: Entering new markets also involves adapting the platform’s interface. Zelkha shares that Lili had to tweak input fields for different date formats, ensure UX translations were accurate, and tailor the user experience to fit local languages and cultural nuances. Auto-translation posed its additional challenge, requiring extensive testing to deliver a smooth user experience. 3. Marketing strategies: A one-size-fits-all marketing approach doesn’t work when expanding globally. Rolling out a multi-country marketing strategy was challenging for Lili. Given the varying approaches for each location, the expansion turned out to be time-consuming and resource-intensive. What was initially planned as a quick launch took weeks due to the need for localized strategies. The company initially launched Lili Connect in a limited capacity, partnering with a small group to test the waters. Only after proving its effectiveness did the company proceed with a full-scale launch, Zelkha explains. Lili’s approach, as Zelkha points out, is intentional — concentrating on select countries and markets with strong entrepreneurial presence, available compliance databases, and local partners that can support their marketing efforts. “We’re not just saying, ‘let’s expand to support 100 countries and see what happens.’ Instead, we’re building step by step — only expanding to a new country once we’re fully confident in our ability to support it,” Zelkha says. “Our priority is to be methodical and compliant rather than rushing into expansion, overextending ourselves, and ultimately running into operational challenges.” 0 comments on “Banking Without Borders: How Lili is making US banking accessible to international SMBs” You must be logged in the post a comment.

Mercury Frequently Asked Questions (FAQ)

When was Mercury founded?

Mercury was founded in 2017.

Where is Mercury's headquarters?

Mercury's headquarters is located at 660 Mission Street, San Francisco.

What is Mercury's latest funding round?

Mercury's latest funding round is Secondary Market.

How much did Mercury raise?

Mercury raised a total of $450.93M.

Who are the investors of Mercury?

Investors of Mercury include Andreessen Horowitz, Charles River Ventures, Coatue, Spark Capital, Sequoia Capital and 43 more.

Who are Mercury's competitors?

Competitors of Mercury include Jiko, Found, Grasshopper, Treasure, Nearside and 7 more.

What products does Mercury offer?

Mercury's products include Business Checking Account and 4 more.

Who are Mercury's customers?

Customers of Mercury include and undefined.

Loading...

Compare Mercury to Competitors

Novo develops a financial platform. It offers neo-banking facilities without traditional physical branch networks. It provides zero-balance accounts, business checking and debit card access, lending services, and more. The platform caters to small and medium enterprises (SMEs). Novo was formerly known as CLEAR Bank. The company was founded in 2016 and is based in Miami, Florida.

Lili focuses on providing business finance solutions. The company offers a range of services, including business banking, smart bookkeeping, invoice and payment management, and tax planning tools. It primarily serves the fintech industry. The company was founded in 2018 and is based in New York, New York.

Oxygen is a financial technology company. It offers services such as cashback rewards, virtual cards, early payroll access, and tools for business incorporation and invoicing. Oxygen primarily serves consumers, freelancers, solopreneurs, and small to medium-sized businesses with its financial products. It was founded in 2017 and is based in Princeton, New Jersey.

Bluevine is a financial technology company that specializes in providing business banking solutions. The company offers business checking accounts with high-yield interest, accounts payable automation, and extensive FDIC insurance, as well as business loans and credit cards designed to meet the needs of small businesses. Bluevine primarily serves the small business sector with its suite of financial products. It was founded in 2013 and is based in Jersey City, New Jersey.

Arival Bank is a digital banking platform operating in the financial technology sector. The company offers enterprise-level banking tools designed to simplify complex business banking needs, including multi-currency accounts, international payments, and advanced security measures. Arival Bank primarily serves tech startups, blockchain and web3 businesses, and digital SMEs. It was founded in 2017 and is based in Singapore.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Loading...