Modern Treasury

Founded Year

2018Stage

Series C - II | AliveTotal Raised

$183.12MValuation

$0000Last Raised

$50M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-25 points in the past 30 days

About Modern Treasury

Modern Treasury specializes in payment operations and money movement solutions within the financial technology sector. The company offers APIs for real-time financial reconciliation, bank integrations, and AI-assisted money management. Modern Treasury's products are designed to serve finance teams, product teams, and engineering teams, enhancing payment processes and financial data management. It was founded in 2018 and is based in San Francisco, California.

Loading...

ESPs containing Modern Treasury

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The automated payments reconciliation market provides a streamlined and efficient solution for reconciling payments. Auto reconciliation refers to the automated process of matching incoming payments with corresponding invoices or transactions, eliminating the need for manual reconciliation efforts. By automating the reconciliation process, businesses can save time, reduce errors, and improve finan…

Modern Treasury named as Challenger among 15 other companies, including Stripe, Tipalti, and Flywire.

Modern Treasury's Products & Differentiators

Payments

For companies building money movement products, Payments provides a single API and web app to manage the entire cycle of money movement, from initiating and receiving payments to reconciliation and booking to the General Ledger. It lets customers manage multiple bank payment methods like ACH, Wire, RTP, SEPA, BACS, checks and any other method supported by their bank through one integration.

Loading...

Research containing Modern Treasury

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Modern Treasury in 6 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Modern Treasury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Modern Treasury is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

2,003 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,465 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

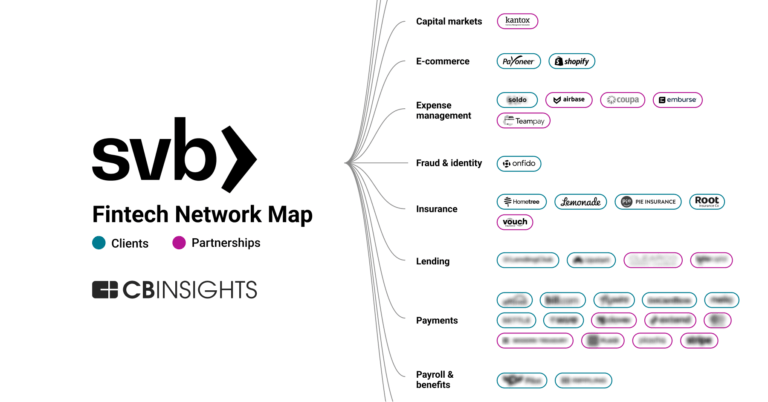

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Modern Treasury News

Mar 7, 2025

Outdated Payments Hold Companies Back While AP automation has become more widespread, manual and error-prone payment tasks continue to create hurdles for AP departments in 2025. Manual AP processes cause delays throughout the source-to-pay cycle. According to a new report from Modern Treasury , 68% of financial decision-makers say legacy payments infrastructure and procedures waste an enormous amount of time for their AP teams. Nearly 9 in 10 say they face problems with their current payment operations. Not coincidentally, 98% are still struggling with manual payment processes. 98% PYMNTS Intelligence data confirms that manual payment procedures are a prime source of AP delays. Forty-two percent of CFOs surveyed reported using manual processes for most or all of their payment execution , making it the most human-centered part of the entire source-to-pay cycle. This step was also the most significant source of AP delays, at 23%. In the face of continued economic uncertainty, the inefficiencies resulting from manual procedures and labor-intensive workflows have become unsustainable. The automation of routine tasks is no longer optional. Automation is having a profound impact on AP, with predictions suggesting that 80% of routine AP tasks will be automated within a few short years. This shift promises to reduce processing costs by an average of 29%. It will improve invoice processing turnaround times, enabling faster payment cycles and better cash flow management. Automated systems will also virtually eliminate errors in data entry and processing, reducing the need for time-consuming corrections. As routine tasks become automated, AP staff will be freed up to focus on more strategic activities, including data analysis, supplier relationship management and financial planning. By the end of 2025, AP team members could look — and think — a lot more like CFOs. AP Automation Takes Center Stage in 2025 Automation not only streamlines AP workflows but also allows finance teams to embrace their growing strategic role as drivers of overall performance by enhancing efficiency and productivity. End-to-end process automation optimizes productivity — and strategy-making. 67% of companies investing in payment operations over the last 12 to 18 months have focused on payments automation . AP departments are moving toward comprehensive automation solutions that cover the entire procure-to-pay cycle. This holistic approach includes such processes as automated invoice capture, data extraction, invoice matching and approval routing. The seamless integration of automation with enterprise resource planning (ERP) systems ensures real-time data synchronization across finance, procurement and other departments. This end-to-end automation not only streamlines operations but also provides unprecedented insights, enabling AP departments to evolve into strategic business partners. According to a recent survey, 67% of companies investing in payment operations over the last 12 to 18 months have focused on payments automation , making it the top payment investment. These investments are expected to drive significant improvements for firms, including faster and more accurate reconciliation (47%), increased revenue (45%), greater visibility into money movement (45%), quicker bank integration (39%) and enhanced customer experience (37%). Real-time payments optimize cash flow. The adoption of real-time payment systems alongside these automations is also gaining traction. More than half (56%) of respondents already utilize the RTP® network and the FedNow® Service real-time rails , while another 37% plan to adopt them within the next year. These immediate transactions provide firms with a more accurate picture of cash flow, eliminating the need for accounting teams to track in-process transactions on their balance sheets. The AI Revolution in AP As AP teams move from data entry to strategic advisory roles, AI is unlocking greater efficiency and real-time insights. The integration of AI into ERP systems allows AP teams to use predictive analytics to forecast cash flow, optimize working capital and anticipate payment trends. AI is becoming a driving force behind AP automation. The AP landscape is being reshaped by the rapid adoption of AI-driven automation technologies. According to research, a staggering 74% of AP departments were expected to be leveraging AI as they entered 2025. This widespread adoption is set to revolutionize AP processes in several ways. AI and machine learning are enabling unprecedented levels of automation — so-called hyper-automation — in invoice processing and payment management. They are also powering advanced analytics through deeper insights into spending patterns, supplier performance and payment trends, enabling more informed decision-making. 74% of AP departments were leveraging AI as they entered 2025. PYMNTS Intelligence research found that more than one-third of middle-market firms now utilize AI for at least half of their AP processes. Because of this, these businesses are 47% less likely to report high levels of operational uncertainty. This is a critical advantage, as they often operate with tighter margins and have greater sensitivity to cash flow disruptions than larger competitors. Firms implementing AI into AP report significant financial gains. According to one survey, AP automation was the most promising AI application for firms, achieving a 36% return on investment (ROI) over three years. This significant return is fueling enthusiasm for further AI investments, with 78% of organizations planning to increase their AI budgets in the near future. These firms leverage automation to reduce manual tasks, enhance compliance and improve error and fraud detection. The survey also reveals that 75% of CFOs believe AI empowers their teams to focus on more strategic activities, such as regulatory compliance and eInvoicing. However, despite recognizing AI’s potential to revolutionize financial operations, nearly one-third (31%) of organizations say they lack a clear strategic vision for AI implementation. This absence of direction, coupled with broader economic and geopolitical uncertainties, has made it challenging for 41% of finance leaders to prioritize AI investments effectively. Third-party payment providers place AI automation goals within reach. For organizations lacking such a strategy, third-party providers can make automation dreams a reality. AP solutions provider Stampli, for example, recently introduced a procure-to-pay solution that brings all procurement processes, including vendor pay, together in one workflow. The AI-powered platform automatically generates purchase orders in the user’s ERP system, enabling real-time budget tracking and validation while maintaining a complete audit trail across all activities. These features simplify accounting workloads and reduce the risk of AP errors. According to a press release, the procure-to-pay solution will be made available to Stampli’s AP automation customers in the first quarter of this year. 2025: A Year of Transformative Change for AP Automating AP processes converts traditionally cumbersome manual workflows into streamlined, efficient systems. By eliminating manual tasks such as data entry, invoice matching and approval routing, automation reduces processing times and errors while improving accuracy. This allows companies to process invoices faster, avoid late fees and capitalize on early payment discounts — ultimately strengthening cash flow management. Additionally, automation supports regulatory compliance by maintaining error-free records and facilitating audits. These efficiency gains free up finance teams to focus on strategic initiatives like financial planning and vendor relationship management, positioning businesses for long-term growth and operational excellence. The year 2025 marks a pivotal moment for AP departments. By embracing technological innovations, AP teams can transform from cost centers into value-driving entities within their organizations. The roadmap to success lies in the intelligent adoption of AI and automation technologies, coupled with a fresh focus on efficiency. As AP departments navigate these changes, they will play an increasingly crucial role in shaping the financial future of their companies. We’re witnessing a pivotal shift in the way accounts payable functions. As AP evolves from a back-office task into a strategic powerhouse, intelligent automation and AI are redefining its role — transforming routine processes into real-time, value-driven insights that enhance cash flow management and empower finance teams to drive business growth. Edenred Pay’s commitment is to equip organizations with solutions that streamline operations, reduce manual errors and unlock strategic opportunities. In 2025, AP is no longer a cost center. It’s the engine of operational excellence and innovation.” Alex Hoffmann About Edenred Pay, an Edenred Company, is a leader in invoice-to-pay automation and has extensive experience in the property management industry. Our integrated platform automates, optimizes and monetizes the entire invoice-to-pay cycle, from invoice receipt through payment reconciliation. And we connect buyers with suppliers, ERPs, banks, FinTechs and payment rails to improve efficiency, enhance visibility, mitigate the risk of payment fraud and deliver value to the enterprise. Visit www.edenredpay.com to learn more. PYMNTS Intelligence is a leading global data and analytics platform that uses proprietary data and methods to provide actionable insights on what’s now and what’s next in payments, commerce and the digital economy. Its team of data scientists include leading economists, econometricians, survey experts, financial analysts and marketing scientists with deep experience in the application of data to the issues that define the future of the digital transformation of the global economy. This multilingual team has conducted original data collection and analysis in more than three dozen global markets for some of the world’s leading publicly traded and privately held firms. The PYMNTS Intelligence team that produced this Tracker: John Gaffney, Chief Content Officer Andrew Rathkopf, Senior Writer Joe Ehrbar, Content Editor We are interested in your feedback on this report. If you have questions or comments, or if you would like to subscribe to this report, please email us at feedback@pymnts.com. Disclaimer The Invoice-to-Pay Automation Tracker® Series may be updated periodically. While reasonable efforts are made to keep the content accurate and up to date, PYMNTS MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, REGARDING THE CORRECTNESS, ACCURACY, COMPLETENESS, ADEQUACY, OR RELIABILITY OF OR THE USE OF OR RESULTS THAT MAY BE GENERATED FROM THE USE OF THE INFORMATION OR THAT THE CONTENT WILL SATISFY YOUR REQUIREMENTS OR EXPECTATIONS. THE CONTENT IS PROVIDED “AS IS” AND ON AN “AS AVAILABLE” BASIS. YOU EXPRESSLY AGREE THAT YOUR USE OF THE CONTENT IS AT YOUR SOLE RISK. PYMNTS SHALL HAVE NO LIABILITY FOR ANY INTERRUPTIONS IN THE CONTENT THAT IS PROVIDED AND DISCLAIMS ALL WARRANTIES WITH REGARD TO THE CONTENT, INCLUDING THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE, AND NONINFRINGEMENT AND TITLE. SOME JURISDICTIONS DO NOT ALLOW THE EXCLUSION OF CERTAIN WARRANTIES, AND, IN SUCH CASES, THE STATED EXCLUSIONS DO NOT APPLY. PYMNTS RESERVES THE RIGHT AND SHOULD NOT BE LIABLE SHOULD IT EXERCISE ITS RIGHT TO MODIFY, INTERRUPT, OR DISCONTINUE THE AVAILABILITY OF THE CONTENT OR ANY COMPONENT OF IT WITH OR WITHOUT NOTICE. PYMNTS SHALL NOT BE LIABLE FOR ANY DAMAGES WHATSOEVER, AND, IN PARTICULAR, SHALL NOT BE LIABLE FOR ANY SPECIAL, INDIRECT, CONSEQUENTIAL, OR INCIDENTAL DAMAGES, OR DAMAGES FOR LOST PROFITS, LOSS OF REVENUE, OR LOSS OF USE, ARISING OUT OF OR RELATED TO THE CONTENT, WHETHER SUCH DAMAGES ARISE IN CONTRACT, NEGLIGENCE, TORT, UNDER STATUTE, IN EQUITY, AT LAW, OR OTHERWISE, EVEN IF PYMNTS HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES. SOME JURISDICTIONS DO NOT ALLOW FOR THE LIMITATION OR EXCLUSION OF LIABILITY FOR INCIDENTAL OR CONSEQUENTIAL DAMAGES, AND IN SUCH CASES SOME OF THE ABOVE LIMITATIONS DO NOT APPLY. THE ABOVE DISCLAIMERS AND LIMITATIONS ARE PROVIDED BY PYMNTS AND ITS PARENTS, AFFILIATED AND RELATED COMPANIES, CONTRACTORS, AND SPONSORS, AND EACH OF ITS RESPECTIVE DIRECTORS, OFFICERS, MEMBERS, EMPLOYEES, AGENTS, CONTENT COMPONENT PROVIDERS, LICENSORS, AND ADVISERS. Components of the content original to and the compilation produced by PYMNTS is the property of PYMNTS and cannot be reproduced without its prior written permission. The Invoice-to-Pay Automation Tracker® Series is a registered trademark of What’s Next Media & Analytics, LLC (“PYMNTS”).

Modern Treasury Frequently Asked Questions (FAQ)

When was Modern Treasury founded?

Modern Treasury was founded in 2018.

Where is Modern Treasury's headquarters?

Modern Treasury's headquarters is located at 77 Geary Street, San Francisco.

What is Modern Treasury's latest funding round?

Modern Treasury's latest funding round is Series C - II.

How much did Modern Treasury raise?

Modern Treasury raised a total of $183.12M.

Who are the investors of Modern Treasury?

Investors of Modern Treasury include Benchmark, Altimeter Capital, Quiet Capital, NewView Capital, Mischief and 10 more.

Who are Modern Treasury's competitors?

Competitors of Modern Treasury include Nilus, Numeral, Fennech Financial, WhenThen, Ledge and 7 more.

What products does Modern Treasury offer?

Modern Treasury's products include Payments and 4 more.

Who are Modern Treasury's customers?

Customers of Modern Treasury include Pipe, Settle and Trip Actions.

Loading...

Compare Modern Treasury to Competitors

Atlar specializes in financial management for modern finance teams operating within the financial technology sector. The company offers a platform that manages cash, processes payments, and integrates with ERP systems to provide real-time financial data and analytics. Atlar's platform serves various sectors, including finance, treasury, and product teams within mid-market and enterprise organizations. Atlar was formerly known as Avantir. It was founded in 2022 and is based in Stockholm, Sweden.

Moov is a payment processing platform that operates within the financial technology sector, providing services that enable businesses to accept, store, send, and spend money. The company offers card and bank payment acceptance, virtual card issuance, instant payouts, and financial data synchronization. Moov serves sectors such as digital banking, construction, fundraising platforms, loan servicing, small businesses, and transport. It was founded in 2018 and is based in Cedar Falls, Iowa.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Sila operates as a financial technology company that focuses on providing a payment platform. The company offers a range of services including fast money transfers, identity verification, fraud prevention, and bank account linking. Its services are primarily targeted towards the fintech industry. It was founded in 2018 and is based in Portland, Oregon.

Orum focuses on financial services technology, providing solutions for fast and reliable payments. The company offers a platform for payment orchestration and instant bank account verification, aiming to optimize money movement and improve business transactions. Orum's services are utilized by various sectors, including insurance, marketplaces, brokerage firms, and creator platforms. It was founded in 2019 and is based in New York, New York.

Trovata specializes in automating cash management processes within the financial technology sector. The company provides solutions for cash flow analysis, cash reporting, cash forecasting, cash positioning, transaction search, and payments, aimed at simplifying financial data aggregation and enhancing decision-making for businesses. Trovata's platform serves various sectors within the economy, including treasury, finance, accounting, and the C-suite, by offering a modern approach to managing cash operations and strategic insights. It was founded in 2016 and is based in Solana Beach, California.

Loading...