Mollie

Founded Year

2004Stage

Incubator/Accelerator | AliveTotal Raised

$934.32MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+47 points in the past 30 days

About Mollie

Mollie specializes in payment processing and money management for businesses. The company offers a suite of products that enable online and in-person payments, subscription management, fraud prevention, and financial reporting. It provides solutions that cater to the needs of businesses ranging from startups to enterprises, aiming to simplify the complexities of financial transactions and support business growth. The company was founded in 2004 and is based in Amsterdam, Netherlands.

Loading...

Loading...

Research containing Mollie

Get data-driven expert analysis from the CB Insights Intelligence Unit.

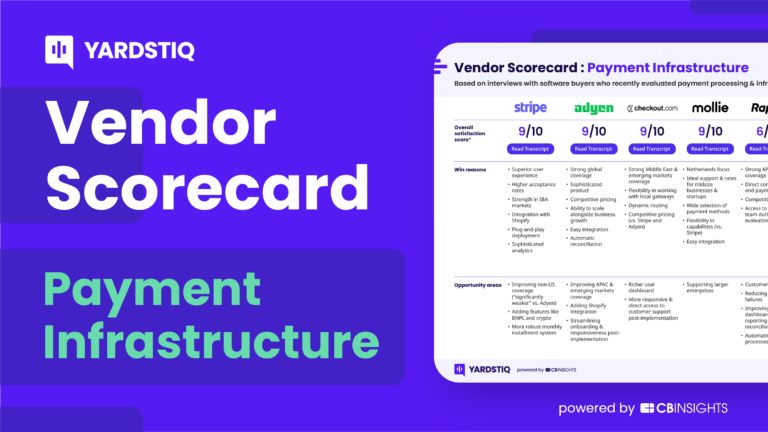

CB Insights Intelligence Analysts have mentioned Mollie in 5 CB Insights research briefs, most recently on Mar 3, 2023.

Sep 21, 2022 report

Top payment infrastructure companies — and why customers chose themExpert Collections containing Mollie

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mollie is included in 7 Expert Collections, including E-Commerce.

E-Commerce

11,462 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,648 items

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Mollie News

Apr 4, 2025

Friday 4 April 2025 13:56 CET | News Mollie has launched its services in Sweden, the first Nordic country the company has entered. Mollie’s platform consolidates payment solutions and financial management into one unified system designed to drive growth, simplify operations, and reduce costs. With its entry into the Swedish market, Mollie aims to support local businesses by providing a robust solution for managing both domestic and international transactions. Sweden is the eighth-largest ecommerce market in Europe, making it a strategic location for the company’s Nordic expansion. Mollie’s strategy for the Swedish market focuses on localising its offerings to better meet the needs of Swedish businesses. The platform supports a wide variety of payment methods, including popular local options such as Swish, as well as international payment solutions like Apple Pay, PayPal, Klarna, and others. Mollie has set up teams in Stockholm and Gothenburg to ensure better onboarding and customer support in Swedish, ensuring a smooth transition for businesses adopting the platform. Mollie’s platform is designed to support a broad range of payment methods, including credit cards, Swish, PayPal, Apple Pay, Google Pay, Klarna, and SEPA Direct Debit. It also offers advanced features like recurring payments, optimised checkout experiences, fraud prevention, and omnichannel solutions for both online and in-store transactions. Mollie supports all Nordic currencies and can easily integrate with ecommerce platforms like WooCommerce, providing a simple payment experience for businesses across the region. Fintech expansion in the Nordics The Nordic region has become an attractive hub for fintech expansion due to its high level of digital penetration and a population that is increasingly adopting digital financial solutions. According to Statista , over 80% of the Nordic population uses online banking services, and mobile payment adoption is exceptionally high. This strong digital infrastructure, paired with a tech-savvy population, has made the Nordics an ideal environment for fintech companies looking to expand their reach. As European fintech companies strive to tap into new markets with advanced digital payment and financial services, the Nordics offer a fertile ground for growth, driven by their innovation-oriented economy and digital-first mindset. The Nordic ecommerce market is another significant driver of fintech expansion in the region. The market has been growing consistently, with Sweden, Denmark, Finland, and Norway collectively making up one of Europe’s most dynamic ecommerce ecosystems. This growth in ecommerce is fostering a greater demand for simple payment solutions, which fintech companies are eager to fulfill. As the digital payments landscape evolves, fintech providers are capitalising on the region’s sophisticated infrastructure to offer integrated payment methods, improving the customer experience for businesses operating across multiple channels. By focusing on the Nordic market, fintech companies can tap into a lucrative, growing sector that demands efficient, secure, and localised payment solutions.

Mollie Frequently Asked Questions (FAQ)

When was Mollie founded?

Mollie was founded in 2004.

Where is Mollie's headquarters?

Mollie's headquarters is located at Keizersgracht 126, Amsterdam.

What is Mollie's latest funding round?

Mollie's latest funding round is Incubator/Accelerator.

How much did Mollie raise?

Mollie raised a total of $934.32M.

Who are the investors of Mollie?

Investors of Mollie include Leading European Tech Scaleups, Technology Crossover Ventures, EQT, HMI Capital, General Atlantic and 11 more.

Who are Mollie's competitors?

Competitors of Mollie include Payaut, Stripe, Hokodo, Vyne, Kody and 7 more.

Loading...

Compare Mollie to Competitors

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. It serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), platforms, marketplaces, and the creator economy. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Till Payments is a global fintech company that operates in the payments industry. The company provides a range of payment solutions, including online and in-person payment processing, as well as a consolidated platform for managing transactions and payment methods. Its services are primarily used by businesses across various sectors to streamline their payment systems. Till Payments was formerly known as SimplePay. It was founded in 2012 and is based in Macquarie Park, Australia.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Slice specializes in financial operating systems that provide a platform that redefines the concept of an operating system for money management within the financial technology sector. The company offers a product called MoneyOS, which allows businesses to collect and structure financial data from various sources into a comprehensive ledger, providing real-time financial visibility and automated control over suppliers, as well as the ability to execute financial strategies effectively. Slice's solutions are designed to serve a wide range of clients, including marketplaces, credit card issuers, banks, and other financial institutions. It was founded in 2020 and is based in Porto Alegre, Brazil.

Truust is a company that focuses on providing smart payment solutions in the fintech industry. It offers services such as facilitating online sales, crowdfunding, and managing money flows, with features like escrow payments, split payments, and digital wallets. The company primarily serves sectors such as ecommerce, crowdfunding platforms, and other fintech companies. It was founded in 2018 and is based in Barcelona, Spain.

Optty is a universal payments platform that specializes in the integration and orchestration of global payment methods and complimentary services across multiple sectors. The company offers a single API integration that allows access to a wide range of payment options, including buy now pay later (BNPL), digital wallets, card payments, gift cards, cryptocurrency, loyalty points, bank transfers, and peer-to-peer payments, simplifying transactions and promoting financial inclusivity. Optty primarily serves the e-commerce industry, providing solutions that cater to merchants, payment service providers, and financial institutions. It was founded in 2021 and is based in Singapore.

Loading...