MoneyView

Founded Year

2014Stage

Series E - II | AliveTotal Raised

$185.45MValuation

$0000Last Raised

$4.65M | 7 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+48 points in the past 30 days

About MoneyView

MoneyView is a digital lending platform that specializes in providing personalized financial products and services. The company offers instant personal loans without collateral, credit tracking services, and tools for managing personal finances. MoneyView caters to individuals seeking quick financial solutions with minimal documentation and flexible repayment options. It was founded in 2014 and is based in Bengaluru, India.

Loading...

MoneyView's Product Videos

_thumbnail.png?w=3840)

_thumbnail.png?w=3840)

MoneyView's Products & Differentiators

Money View Loans

An instant personal loan app that helps provide customised personal loans in just a few minutes. The App uses data & external factors like bureau/liabilities to provide the max loan amount, tenure & ROI- All this with a 100% online, easy application process. The customers can find their eligibility in less than 2 minutes & proceed with the application.

Loading...

Research containing MoneyView

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned MoneyView in 1 CB Insights research brief, most recently on Oct 3, 2024.

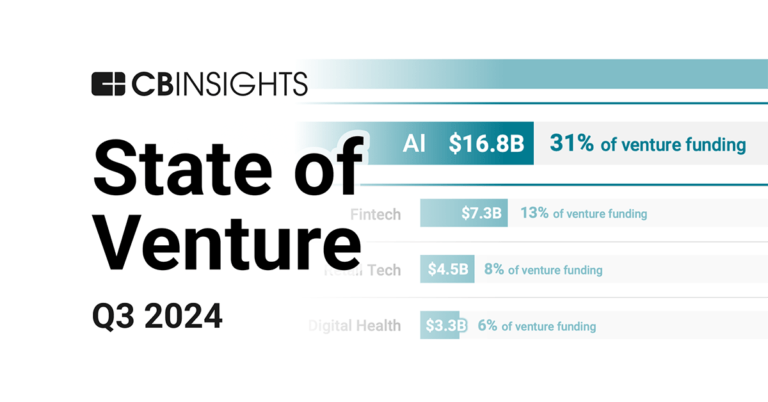

Oct 3, 2024 report

State of Venture Q3’24 ReportExpert Collections containing MoneyView

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

MoneyView is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Digital Lending

2,380 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest MoneyView News

Mar 19, 2025

Karnataka's startup ecosystem may have seen a dip in funding in 2024, but Bengaluru continues to cement its position as the nerve centre of India's tech innovation. According to data from Tracxn, tech startups in the state raised $3.7 billion in 2024 — a 24% decline from the $4.9 billion secured in 2023, and significantly lower than the $11.7 billion recorded in 2022. Early-stage investments showed resilience with a 10% year-on-year rise to $1.1 billion, indicating investor confidence in the next generation of companies. However, both seed-stage and late-stage funding took a hit, dropping 18% and 32% respectively. Despite the broader slowdown, Bengaluru alone accounted for almost all of Karnataka's funding activity, with Mysuru and Tiptur trailing far behind. Retail, enterprise applications, and transport and logistics emerged as the top three sectors attracting investor interest. and Meesho led the funding charts, raising $350 million and $275 million respectively. Other major deals included Rapido's $200 million funding round, pointing to continued optimism in mobility and e-commerce platforms. The city also saw the birth of six new unicorns — Krutrim, Perfios, Porter, Rapido, Ather Energy, and Money View — underlining Bengaluru's position as a breeding ground for billion-dollar companies. In fact, all unicorns minted in India this year have come from Bengaluru. The year wasn't without exits. Eight startups from Karnataka went public in 2024, including well-known names such as Swiggy, Ola Electric, and Digit Insurance. On the acquisition front, 49 deals were reported, with iBUS and Loyal Hospitality among the most high-profile buyouts. International and domestic investors continued to bet big on the region. , Elevation Capital, and Peak XV Partners dominated early-stage rounds, while SoftBank Vision Fund and other large global investors remained active in late-stage deals. While funding levels have tapered, industry experts believe that the correction could benefit startups in the long run by instilling greater capital discipline and focus on profitability. With government-backed initiatives like the Startup India Seed Fund Scheme and continued tax incentives for new businesses, Karnataka's tech ecosystem is expected to weather current headwinds and stay a dominant force in India's startup landscape.

MoneyView Frequently Asked Questions (FAQ)

When was MoneyView founded?

MoneyView was founded in 2014.

Where is MoneyView's headquarters?

MoneyView's headquarters is located at 3rd Floor, Survey No. 17, 1A, Outer Ring Road, Bengaluru.

What is MoneyView's latest funding round?

MoneyView's latest funding round is Series E - II.

How much did MoneyView raise?

MoneyView raised a total of $185.45M.

Who are the investors of MoneyView?

Investors of MoneyView include Accel, Nexus Ventures, Tiger Global Management, Rockstone Ventures, Evolvence India and 8 more.

Who are MoneyView's competitors?

Competitors of MoneyView include Tala and 6 more.

What products does MoneyView offer?

MoneyView's products include Money View Loans and 2 more.

Loading...

Compare MoneyView to Competitors

Simpl is a checkout network that specializes in providing a seamless online commerce experience for shoppers and enterprises within the digital payments industry. The company offers consumer payment solutions such as 1-tap checkout, pay after delivery, and interest-free installment payments, designed to simplify and secure the online shopping process. Simpl primarily serves the e-commerce industry by enabling merchants to offer these payment options to their customers. Simpl was formerly known as Get Simpl. It was founded in 2015 and is based in Bengaluru, India.

BharatPe provides financial services. It offers merchant discount rate (MDR) services and allows merchants to sign up and start receiving the funds in their respective bank accounts. It serves offline retailers and businesses. The company was founded in 2018 and is based in Gurgaon, India.

Kissht is a financial technology platform that provides personal and business loans. The company uses a digital loan process that requires no physical documentation, allowing for the disbursement of funds to customers' bank accounts. Kissht's services are aimed at consumers looking for financial solutions. It was founded in 2015 and is based in Mumbai, India.

Oriente operates as a financial technology (fintech) company. It provides identity-first digital solutions. The company offers services including artificial intelligence (AI) driven credit scoring, on-demand lending, and point-of-sale (POS) financing. It serves the fintech sector and utilizes big data analytics and machine learning to deliver financial services. It was founded in 2017 and is based in Hong Kong.

ShopSe is a financial technology company that focuses on consumer financing. The company offers a digital EMI marketplace where customers can make purchases and pay for them over time with flexible payment plans. It primarily serves the retail industry. It was founded in 2020 and is based in Mumbai, India.

SoLo Funds is a financial technology company specializing in community finance within the peer-to-peer lending sector. The company facilitates a platform where individuals can lend to and borrow from each other with terms they set themselves and offers a suite of banking services to support these transactions. SoLo Funds primarily serves individuals seeking alternative financial services and those from underserved communities. It was founded in 2018 and is based in Los Angeles, California.

Loading...