Caribou

Founded Year

2016Stage

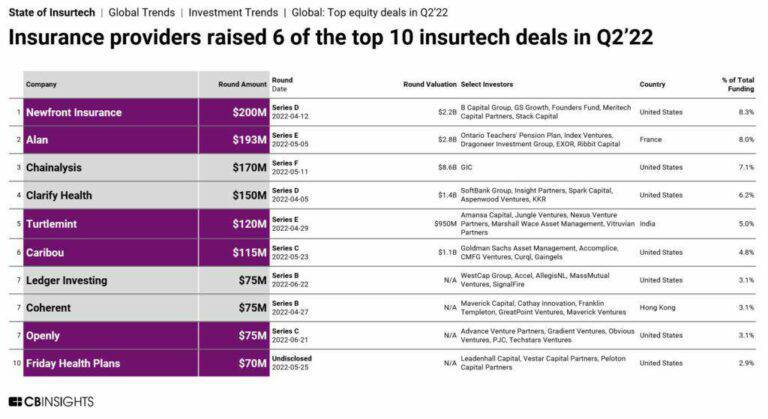

Series C | AliveTotal Raised

$193.64MValuation

$0000Last Raised

$115M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-37 points in the past 30 days

About Caribou

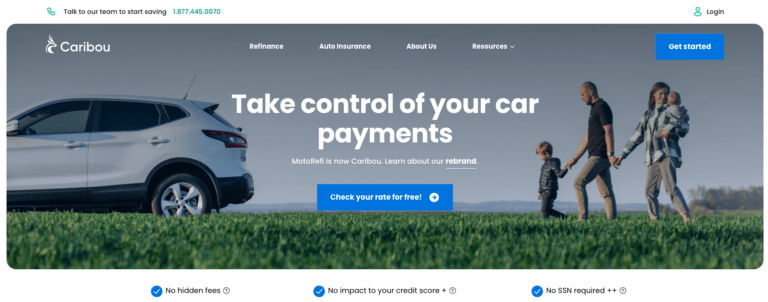

Caribou specializes in auto loan refinancing. The company provides a transparent loan process, allowing customers to access competitive rates and potentially reduce their monthly payments without impacting their credit score during pre-qualification. Caribou's primary clientele includes individuals seeking to refinance their existing auto loans for better terms. It was founded in 2016 and is based in Denver, Colorado.

Loading...

Loading...

Research containing Caribou

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Caribou in 4 CB Insights research briefs, most recently on Oct 10, 2022.

Expert Collections containing Caribou

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Caribou is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Digital Lending

2,380 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

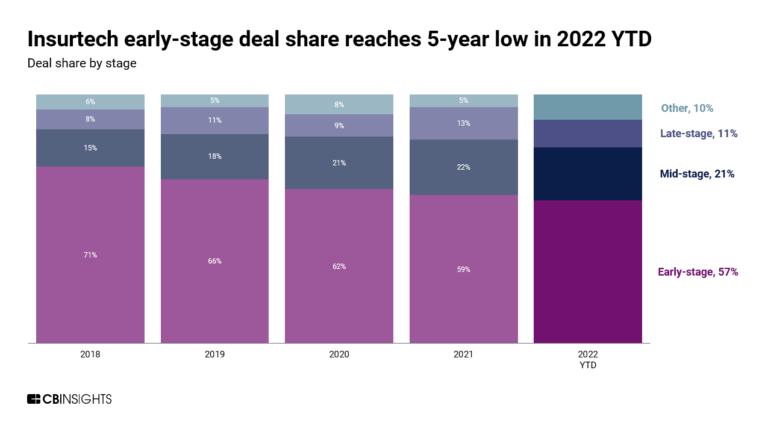

Insurtech

4,485 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Caribou News

Sep 28, 2024

Image Credits: Malte Mueller / Getty Images When the U.S. Feds cut interest rates by half a percentage point last week, it was a dash of good news for venture capitalists backing one particularly beleaguered class of startups: fintechs, especially those that rely on loans for cash flow to operate their businesses. These companies include corporate credit card providers like Ramp or Coast , which gives cards to fleet owners. The card companies make money on interchange rates, or transaction fees charged to the merchants. “But they have to front the money by getting a loan,” said Sheel Mohnot, co-founder and general partner at Better Tomorrow Ventures, a fintech-focused firm. “The terms of that loan just got better.” Affirm, a buy now, pay later (BNPL) company founded by famed PayPal mafia member Max Levchin, is a good case study. While Affirm is no longer a startup — having gone public in 2021 — when interest expenses rose, its stock price tanked, dropping from around $162 in October to hovering at under $50 a share since February 2022. BNPLs pay merchants the full amount up front; then they allow that customer to pay for the item over a couple of payments, often interest-free. Many BNPLs generate revenue primarily by charging merchants a fee for each transaction processed on their platform, not interest on the purchase. Their business model didn’t allow them to pass on the dramatically higher costs they incurred. “BNPLs were making money hand over fist when interest rates were zero,” Mohnot said. Counterintuitive as it may seem, lower rates are also good for fintechs that offer loans. Car loan refinancing company Caribou, for instance, falls into this bucket, predicts Chuckie Reddy, partner and head of growth investments at QED Investors. Caribou offers one- to two-year loans. “Their whole business is predicated on being able to take you from a higher rate to a lower rate,” he said. Now that Caribou’s funding costs are lower, they should be able to reduce what they charge borrowers. GoodLeap, a provider of solar panel loans, and Kiavi, a lender specializing in loans for “fix-and-flip” home investors, are other short-term lenders expected to benefit. Just like Caribou, they can potentially pass on some of their interest savings to customers, leading to a surge in loan origination volume, said Rudy Yang, fintech analyst at PitchBook. And no sector should be helped by lower interest rates as much as fintech startups taking on the mortgage loan industry. However, it could be some time before this recently beat-up space sees a resurgence. While the cut the Feds made was a biggie, interest rates are still high compared to the long ZIRP (zero interest rate policy) era that preceded it, when Fed rates were at near zero. The new Fed rates are in the 4.5% to 5% range now. So the loans available to consumers will still be a few percentage points higher than the base Fed rate. Should the Feds continue to cut rates, as many investors hope they will, then a lot of people who bought homes during the high-rate time will be looking for better deals. “The refinancing wave is going to be massive, but not tomorrow or over the next few months,” said Kamran Ansari, a venture partner at VC firm Headline. “It may not be worth it to refinance for half a percent, but if rates decrease by a percent or one and a half percent, then you will start to see a flood of refinances from everybody who was forced to bite the bullet on a mortgage at the higher rates over the last couple of years.” Ansari anticipates a significant rebound for mortgage fintechs like Rocket Mortage and Better.com , following a sluggish performance in recent years. After that, VC investor dollars will almost certainly flow. Ansari also predicted a surge in new mortgage tech startups if interest rates become more appealing. “Anytime you see a space that’s gone dormant for four or five years, there are probably opportunities for reinvention and updated algorithms, and now you can do AI-centric underwriting,” he said. More TechCrunch

Caribou Frequently Asked Questions (FAQ)

When was Caribou founded?

Caribou was founded in 2016.

Where is Caribou's headquarters?

Caribou's headquarters is located at 717 17th Street, Denver.

What is Caribou's latest funding round?

Caribou's latest funding round is Series C.

How much did Caribou raise?

Caribou raised a total of $193.64M.

Who are the investors of Caribou?

Investors of Caribou include TruStage Ventures, Accomplice, Motley Fool Ventures, Moderne Ventures, Gaingels and 12 more.

Who are Caribou's competitors?

Competitors of Caribou include Jerry and 6 more.

Loading...

Compare Caribou to Competitors

Jerry offers an AllCar app focused on simplifying car ownership through technology in the insurance and financial services sectors. The company offers a platform for comparing car insurance policies, refinancing car loans, estimating repair costs, and tracking driving habits. Jerry's services cater to individual car owners looking to manage their automotive expenses and maintenance. It was founded in 2017 and is based in Palo Alto, California.

The Zebra provides an online insurance comparison platform. Its product provides real-time rates and educational resources to inform consumers while at the same time helping them find the coverage, service level, and pricing to suit their needs. Its product simultaneously helps the insurance companies connect with their consumers too. The company was founded in 2012 and is based in Austin, Texas.

Squeeze is a licensed insurance agency that focuses on household bill optimization and savings within the insurance and mortgage sectors. The agency offers real-time quotes and automatic policy re-shopping for various types of insurance, aiming to find lower rates for customers without charging them fees. Squeeze primarily serves individuals looking to reduce their monthly expenses on auto, home, life, and other types of insurance. It was founded in 2015 and is based in Boca Raton, Florida.

Insurify is a digital insurance comparison platform that specializes in providing real-time quotes for auto, home, and life insurance policies. The company enables customers to compare insurance options from over 100 providers, including major carriers, to find the best rates and coverage. Insurify also offers expert guidance and support through licensed insurance agents, ensuring customers can make informed decisions about their insurance needs. Insurify was formerly known as Ensurify. It was founded in 2013 and is based in Cambridge, Massachusetts.

Otto Insurance specializes in comparing insurance rates and providing estimated quotes across multiple types of insurance policies. The company offers a platform for customers to receive insurance quotes for auto, home, life, and pet insurance, simplifying the process of finding cost-effective coverage. Otto Insurance primarily serves individuals seeking personal and commercial insurance solutions. It is based in Miami Beach, Florida.

SimplyIOA is a national insurance agency focused on personal insurance products within the insurance industry. The company offers a platform for comparing and purchasing various types of insurance, including home, auto, and life, as well as coverage for natural disasters and different types of vehicles. SimplyIOA primarily serves individuals seeking insurance solutions across multiple states. It was founded in 2019 and is based in Lake Mary, Florida.

Loading...