Next Insurance

Founded Year

2016Stage

Acquired | AcquiredTotal Raised

$1.146BValuation

$0000About Next Insurance

Next Insurance provides insurance services, specifically for the needs of small businesses. It offers a range of insurance products, including general liability insurance, workers’ compensation insurance, professional liability insurance, commercial auto insurance, and commercial property insurance, among others. The company primarily serves sectors such as retail, food and beverage, construction, consulting, education, entertainment, fitness, financial services, real estate, and more. It was founded in 2016 and is based in Palo Alto, California. In March 2025, Next Insurance was acquired by ERGO Group.6B.

Loading...

ESPs containing Next Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — commercial lines property & casualty market comprises insurtech carriers that underwrite commercial property & casualty (P&C) insurance. These lines of business may include (but are not limited to) cyber, errors & omissions, general liability, property, and workers’ compensation. As with established carriers, insurtech carriers will typically also be licensed by…

Next Insurance named as Leader among 6 other companies, including Coalition, Cowbell Cyber, and At-Bay.

Next Insurance's Products & Differentiators

General Liability

General liability insurance, also known as commercial general liability (CGL), covers the risks that affect almost every business, no matter what your industry. It is the most common insurance for small businesses and self-employed professionals, and it’s typically the first policy purchased by new businesses.

Loading...

Research containing Next Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Next Insurance in 7 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

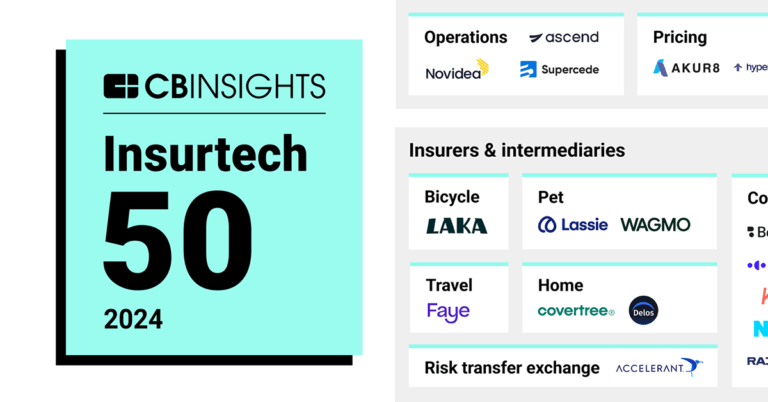

Insurtech 50: The most promising insurtech startups of 2024

Feb 23, 2024

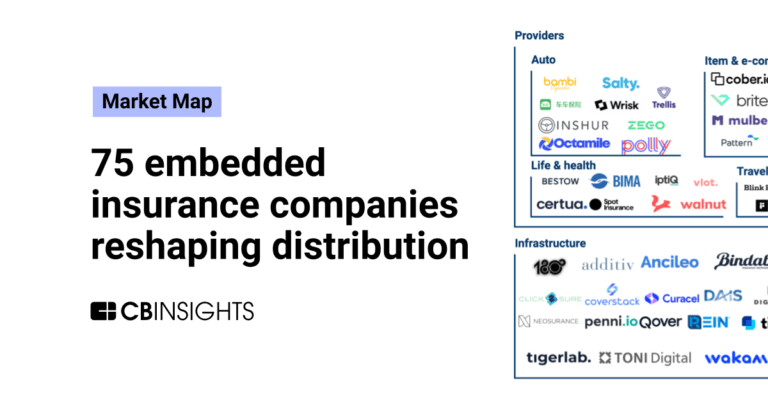

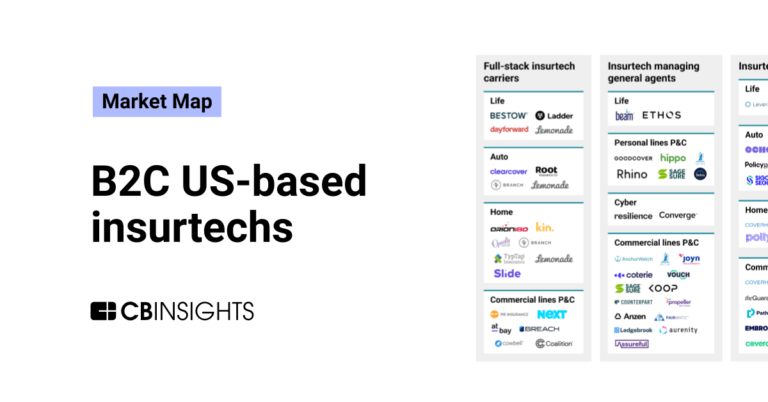

The B2C US insurtech market map

Feb 9, 2024 report

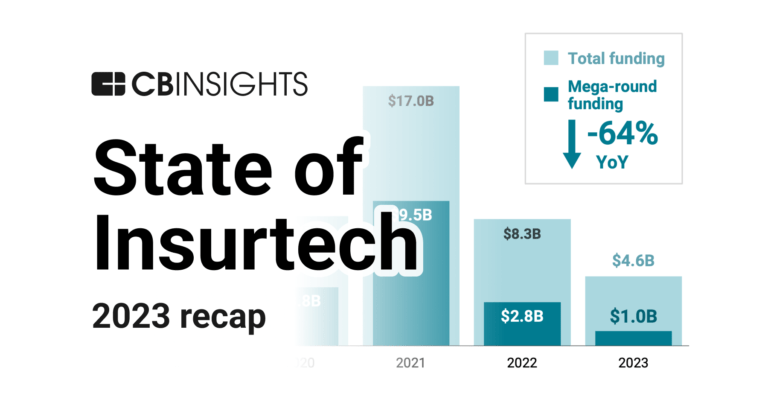

State of Insurtech 2023 Report

Oct 4, 2022 report

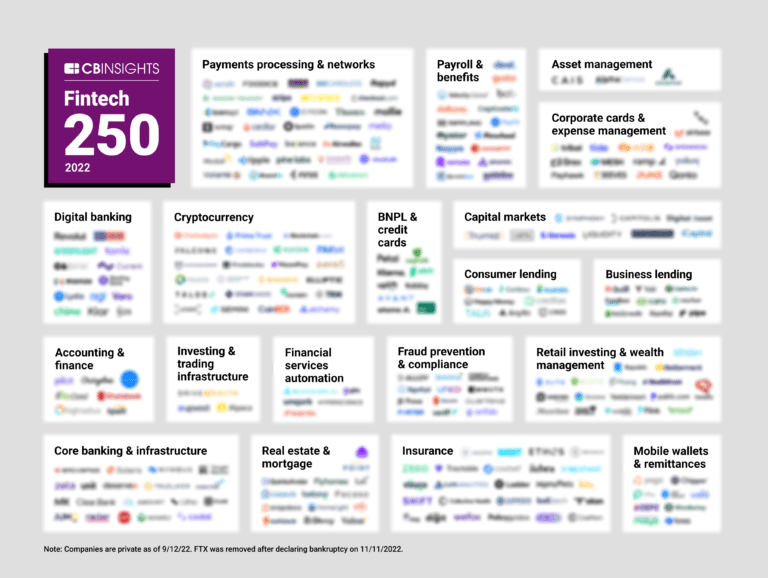

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Next Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Next Insurance is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,586 items

Insurtech

4,483 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Next Insurance News

Mar 27, 2025

L'agefi L’assurance est un poumon de l’économie européenne, selon France Assureurs Florence Lustman souligne que les assureurs sont des acteurs stratégiques tant du développement économique local que de la souveraineté européenne avec 20 milliards d’euros investis dans la défense. Publié le Un évènement L’AGEFI Plus d'articles du même thème Camille George Florence Lustman, présidente de la fédération, alerte sur la situation des complémentaires santé dont le résultat technique est pour la première fois déficitaire. Stéphanie Salti L’assureur espagnol va s’appuyer sur l’Espagne, les Etats-Unis et le Brésil pour développer et étendre au niveau mondial des cas d’utilisation d’une «intelligence artificielle humaniste». Camille George En se portant acquéreur du californien Next Insurance, le premier réassureur mondial donne un coup d’accélérateur à ses activités d’assurance directe à destination des petites et moyennes entreprises américaines. Sujets d'actualité 25 mars 2025 à 7:58 AM · PARTENARIAT PARTENARIAT PARTENARIAT A lire sur ... Irène Inchauspé Si le ralentissement semble conjoncturel outre-Atlantique, la crise économique est structurelle de l’autre côté de l’Oural, où le niveau stratosphérique des taux d'intérêt étouffe peu à peu la croissance, alors même que la population active diminue Buy European Jade Grandin de l'Eprevier La Commission européenne propose que les 150 milliards d’euros de prêts mis à disposition des 27 pour les achats militaires conjoints financent des équipements à 65% européens, avec une autonomie de conception Sandra Mathorel La filiale de la Caisse des dépôts met en vente plusieurs milliers de logements en zone tendue, espérant en tirer une jolie plus-value. L'objectif est de financer de la construction neuve

Next Insurance Frequently Asked Questions (FAQ)

When was Next Insurance founded?

Next Insurance was founded in 2016.

Where is Next Insurance's headquarters?

Next Insurance's headquarters is located at 975 California Avenue, Palo Alto.

What is Next Insurance's latest funding round?

Next Insurance's latest funding round is Acquired.

How much did Next Insurance raise?

Next Insurance raised a total of $1.146B.

Who are the investors of Next Insurance?

Investors of Next Insurance include ERGO Group, Allstate Strategic Ventures, Allianz X, Mitsui Sumitomo Insurance, Group 11 and 17 more.

Who are Next Insurance's competitors?

Competitors of Next Insurance include Vouch, Amwins, Thimble, Superscript, Pie Insurance and 7 more.

What products does Next Insurance offer?

Next Insurance's products include General Liability and 4 more.

Loading...

Compare Next Insurance to Competitors

Pie Insurance operates a platform for workers' compensation insurance. It matches price with risk across a broad spectrum of small business types that offer sustainable insurance to small business owners. The company was founded in 2017 and is based in Washington, District of Columbia.

AmTrust Financial Services is a multinational property and casualty insurance company with a focus on small commercial business insurance, specialty risk and extended warranty, and specialty middle-market property and casualty program insurance. The company offers a range of insurance products, including workers' compensation, business owners' policies, commercial packages, cyber insurance, and general liability. AmTrust serves various industries such as auto repair, contractors, financial institutions, healthcare, and retail, among others. It was founded in 1998 and is based in New York, New York.

Frontline Insurance provides home and commercial property insurance. The company offers insurance solutions focused on state-specific coverage options. Frontline Insurance serves coastal homeowners and commercial property owners in the Southeast United States. It was founded in 1998 and is based in Lake Mary, Florida.

State Farm Insurance provides various insurance and financial services. The company offers products such as auto, homeowners, and life insurance, along with financial services like investment planning and retirement savings. State Farm Insurance serves individual customers and small businesses with their insurance and financial needs. It was founded in 1922 and is based in Bloomington, Illinois.

Coterie Insurance specializes in providing small business insurance solutions within the insurance industry. The company offers a range of products, including business owner policies, general liability insurance, and professional liability insurance, all designed to meet the unique needs of small businesses. It primarily serves small businesses, agents, brokers, networks, aggregators, wholesalers, and digitally embedded partners. It was founded in 2018 and is based in Cincinnati, Ohio.

Galaxy Finco operates as a special-purpose entity. The Company was formed for the purpose of issuing debt securities, repaying existing credit facilities, refinancing indebtedness, and for acquisition purposes. The company was founded in 2013 and is based in Jersey, United Kingdom.

Loading...