Papa

Founded Year

2017Stage

Series D | AliveTotal Raised

$242.05MValuation

$0000Last Raised

$150M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+3 points in the past 30 days

About Papa

Papa offers companion care and support for older adults and families in the healthcare sector. It provides services such as transportation, assistance with daily tasks, and social support. Papa serves health plans, employers, and directly supports older adults and families. It was founded in 2017 and is based in Miami, Florida.

Loading...

Papa's Product Videos

ESPs containing Papa

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The caregiver benefits providers market focuses on delivering support to employees who are caregivers for family members, often facing challenges in managing their personal and professional responsibilities. Caregiver benefits providers offer a range of solutions such as flexible work arrangements, counseling services, respite care options, and access to information resources. These solutions can …

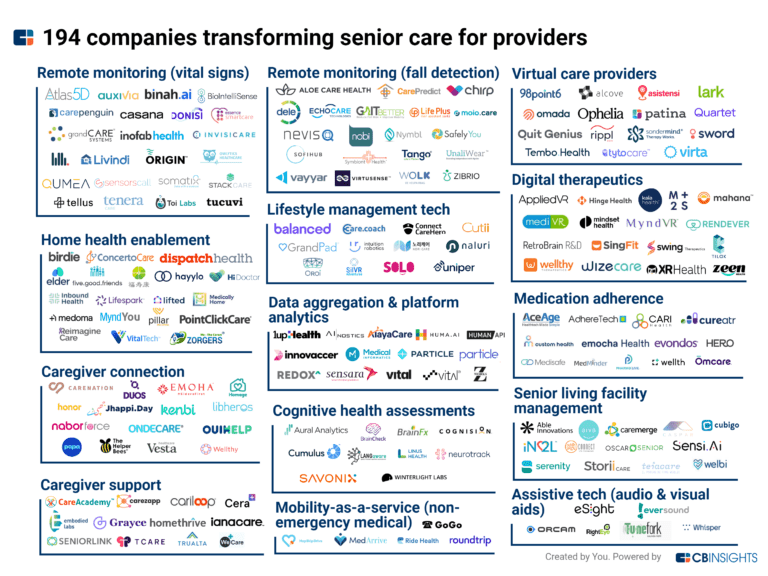

Papa named as Challenger among 9 other companies, including Bright Horizons, HomeThrive, and Wellthy.

Papa's Products & Differentiators

Health Plan-sponsored Companion Care

Non-medical in-home support and assistance

Loading...

Research containing Papa

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Papa in 5 CB Insights research briefs, most recently on Feb 1, 2023.

Expert Collections containing Papa

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Papa is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Conference Exhibitors

5,501 items

HLTH is a healthcare event bringing together startups and large companies from pharma, health insurance, business intelligence, and more to discuss the shifting landscape of healthcare

Value-Based Care & Population Health

1,136 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Digital Health

11,306 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Digital Health 50

150 items

The winners of the third annual CB Insights Digital Health 150.

Latest Papa News

Mar 20, 2025

billion by 2033, Growing at a CAGR of 8.67%: Market Strides Global Errand Services Market Size, Share & Trends Analysis Report By Service Type (Pick up / Drop off Service, Grocery Shopping, Pet Sitting, Car Cleaning & Servicing, Emergency & Healthcare Services), By Applications (City, Rural) By Region (North America, Europe, Asia-Pacific, Latin America, The Middle East and Africa) And Segment Forecasts, 2025 – 2033 March 20, 2025 08:55 ET Straits Research Private Limited - Garner Insights New York, United States, March 20, 2025 (GLOBE NEWSWIRE) -- As per the Latest Report by Market Strides, the global errand services market size was valued at USD 21.43 billion in 2024 and is estimated to reach USD 45.29 billion by 2033, growing at a CAGR of 8.67% during the forecast period (2025–2033). Errand services are professional solutions offered to individuals or businesses to manage everyday tasks that they may lack the time or resources to handle themselves. These tasks can range from grocery shopping and parcel delivery to pet care, prescription pickups, dry cleaning, and more. As part of the on-demand economy, errand services have become increasingly accessible via mobile apps and online platforms, enabling customers to easily schedule and tailor services to their needs. Businesses also use errand services to boost employee efficiency and improve customer satisfaction by delegating routine or time-intensive tasks. Download Free Sample Report PDF @ https://marketstrides.com/request-sample/errand-services-market Growing Work Commitments and Fast-Paced Urban Living Drive the Expansion of Errand Services The increasing demands of modern work schedules and the fast-paced nature of urban living are significantly fueling the growth of errand services. As professionals navigate long work hours, and remote or hybrid work arrangements, outsourcing tasks like grocery shopping, dry cleaning, and parcel deliveries has become essential to maintaining work-life balance. For instance, in October 2024, the average workweek for employees in the U.S. was 34.3 hours, according to Statista. Additionally, urbanization continues to rise, with 82.66% of the U.S. population living in urban areas as of 2020. The demand for app-based errand solutions, driven by the need for time efficiency and convenience, is expected to grow further as urban populations expand and lifestyles become increasingly hectic. Expansion of Specialized Individual Services Targets Specific Demographic Needs The growth of specialized individual services represents a significant opportunity in the global market. By addressing the unique needs of specific demographics, companies can enhance customer engagement and increase adoption of their services. One notable example is the rise of companionship and support services tailored to older adults. In April 2023, Papa, a senior care platform, expanded its Social Care Navigation program after a successful pilot. The program partners with health plans and care teams to provide both social and medical support. As of the latest data, over a quarter of Papa’s health plan clients are using this service, highlighting the growing demand for targeted, specialized errand solutions. This trend is shaping the future of market growth in the errand services sector. Regional Analysis North America dominates the global errand services market, driven by urbanization, high disposable incomes, and the widespread adoption of on-demand service platforms. The region's fast-paced lifestyle, particularly in major metropolitan areas like New York, Los Angeles, and Toronto, has fueled demand for time-saving services such as grocery delivery, home maintenance, and personal assistance. The gig economy plays a crucial role in this expansion, with platforms like TaskRabbit, Instacart, and DoorDash leading the way by offering flexible, app-based errand solutions. A notable example of this trend is the rapid growth of Instacart, which, by 2023, partnered with over 1,100 retailers, covering more than 80,000 stores across the U.S. and Canada, reflecting the rising consumer preference for outsourcing everyday tasks. Moreover, the rise of specialized services like Papa’s Social Care Navigation for senior citizens highlights the increasing need for targeted, demographic-specific errand solutions, further shaping the market's growth in the region. Key Highlights Based on service type, pick-up, and drop-off services dominate the global errand services market due to the growing demand for convenience in urban areas. In terms of market segment, the urban sector leads, driven by fast-paced lifestyles that create a strong need for outsourced convenience. North America holds a dominant position in the global errand services market, fueled by urbanization, high disposable incomes, and the widespread adoption of on-demand service platforms. Competitive Players Recent Developments November 2024– Taskrabbit acquired Dolly, an on-demand moving service based in Seattle. This move aims to enhance Taskrabbit's local moving and delivery capabilities, providing customers with a broader range of services. Despite the acquisition, both brands continue to operate separately. Segmentation Grocery Shopping

Papa Frequently Asked Questions (FAQ)

When was Papa founded?

Papa was founded in 2017.

Where is Papa's headquarters?

Papa's headquarters is located at 66 South West 6th Street, Miami.

What is Papa's latest funding round?

Papa's latest funding round is Series D.

How much did Papa raise?

Papa raised a total of $242.05M.

Who are the investors of Papa?

Investors of Papa include Initialized Capital, Canaan Partners, Tiger Global Management, TCG, Seven Seven Six and 12 more.

Who are Papa's competitors?

Competitors of Papa include BrightStar Care, Right at Home, Nui, Senior Helpers, Home Instead Senior Care and 7 more.

What products does Papa offer?

Papa's products include Health Plan-sponsored Companion Care and 1 more.

Who are Papa's customers?

Customers of Papa include Aetna, Elevance Health, Cigna and Molina Healthcare.

Loading...

Compare Papa to Competitors

Honor specializes in providing home care services for aging adults within the healthcare sector. The company offers non-medical assistance to older adults by professional care professionals, focusing on improving daily living and maintaining independence at home. Honor primarily serves the aging population and their families, leveraging technology to enhance the quality and delivery of home care services. Honor was formerly known as Sona Labs. It was founded in 2014 and is based in Omaha, Nebraska.

Bayshore HealthCare is a provider of home and community healthcare services in Canada. The company offers services including personal care, nursing, dementia care, therapy, and rehabilitation, as well as specialty pharmacy and patient support services. Bayshore serves individuals in need of home care, government-funded healthcare programs, and those requiring specialized medical assistance. It was founded in 1966 and is based in Mississauga, Canada.

Erin's Care is a licensed Home Care agency that aims to provide In-Home Care to the disabled and elderly community. The company's services assist with day to day living in the convenience of the clients own home.

Joshin focuses on providing support for neurodivergence and disability solutions. The company offers services such as virtual coaching, digital programs, and personalized navigation to help create inclusive and strong workplace cultures. It serves the corporate sector. It was founded in 2018 and is based in Saint Paul, Minnesota.

Help-Full is a community network that enables its members to request or offer help with various tasks and share skills. The platform allows individuals to participate in shared activities while using Time Tokens as a currency within the community. Help-Full serves individuals seeking support in daily tasks and those looking to share their hobbies with others. It is based in Oakland, California.

Signature In-Home Care provides in-home care services for seniors within the senior care industry. The company offers caregiving plans and adheres to ethical decision-making principles. They assist seniors who need help in their daily lives. It is based in Oxford, Alabama.

Loading...