Payhawk

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$236.5MValuation

$0000Last Raised

$100M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-26 points in the past 30 days

About Payhawk

Payhawk provides corporate spend management solutions within the financial technology sector. It offers a platform that includes corporate cards, expense management, accounts payable, and accounting software for business payments and financial control. Payhawk's services aim to automate expense reporting and reconciliation and provide visibility and control over company spending, while also integrating with existing financial systems. It was founded in 2018 and is based in London, United Kingdom.

Loading...

Payhawk's Product Videos

ESPs containing Payhawk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

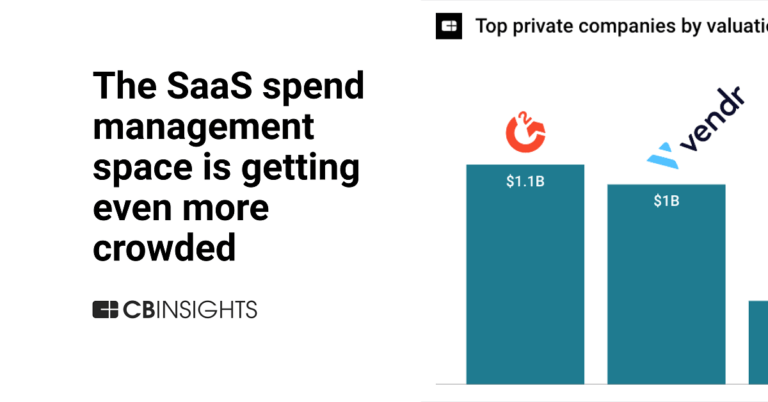

The spend management platforms market enables businesses to efficiently manage and control their expenditures through integrated software solutions, including virtual corporate cards, expense management systems, procurement software, and budget tracking tools. Vendors use APIs and cloud-based platforms to integrate these solutions into existing financial and operational systems, allowing for real-…

Payhawk named as Outperformer among 15 other companies, including Ramp, Coupa, and Pleo.

Payhawk's Products & Differentiators

Payhawk

• Integrated global solution for managing company spending • Corporate bank accounts in multiple currencies with dedicated IBANs • Global company cards • Mobile app for employees • Powerful and flexible software for the finance accounting team • Best-in-class direct integrations with ERP mean no manual data transfer (especially Xero and Oracle NetSuite)

Loading...

Research containing Payhawk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Payhawk in 10 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Oct 11, 2022

The Transcript from Yardstiq: Klarna vs. Afterpay

Oct 4, 2022

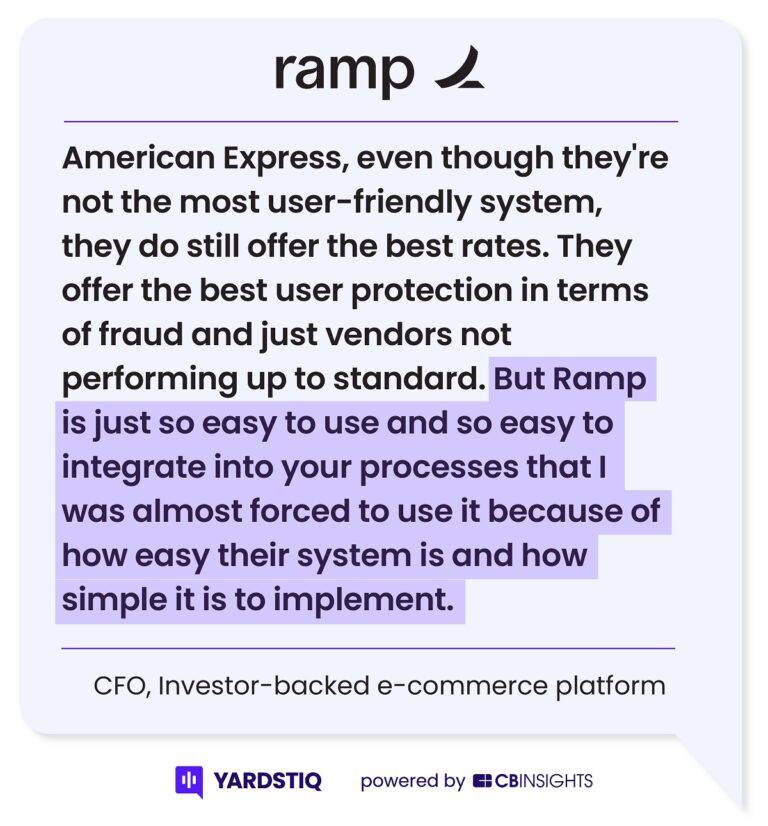

The Transcript from Yardstiq: Ramp vs. BrexExpert Collections containing Payhawk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Payhawk is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,648 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

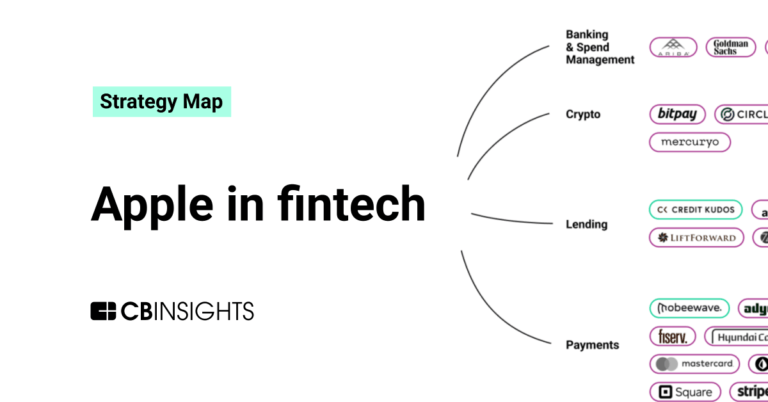

Fintech

13,699 items

Excludes US-based companies

Fintech 100

449 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech 100 (2024)

100 items

Latest Payhawk News

Apr 2, 2025

News provided by Share this article Share toX LONDON, April 2, 2025 /PRNewswire/ -- Payhawk, the leading spend management platform, today announced the launch of 'AI Office of the CFO,' a suite of specialised AI agents that solve finance's biggest AI challenge: drastically increasing finance teams' productivity while maintaining complete control over their operations. Image of Payhawk's "AI Office of the CFO" Spring 2025 Edition, showcasing smart automation for finance tasks like bookings, payments, and invoicing With its platform already managing companies' transactions, policies, workflows, and master data, Payhawk is uniquely positioned to build AI Agents that deliver practical value alongside the necessary controls. These new AI agents autonomously handle operational tasks with the same careful permissions as employees, enabling organisations to implement AI with confidence. While building its in-house agentic infrastructure, Payhawk has been leveraging early-access OpenAI models to refine its AI agent technology. The company is launching the suite with its Financial Controller Agent, which will take over the tedious tasks of chasing receipts, analysing expense documents, and spotting unusual spending patterns. This marks another milestone in Payhawk's journey to redefine financial operations, adding AI agents to its unified spend management platform. "Finance leaders know AI will have an impact on their operations, but until now, there hasn't been a clear and practical path forward," said Hristo Borisov, CEO of Payhawk. "We're not just adding AI features — we're creating a new category of purpose-built agents that transform finance operations by autonomously completing critical, time-consuming tasks." The AI Office of the CFO suite introduces agents that elevate key functions: The Financial Controller Agent eliminates the endless back-and-forth of expense reporting. Instead of managers chasing employees for missing receipts or checking expense reports line by line, the agent automatically collects documents, sends friendly reminders when something's missing, and flags any unusual purchases — freeing up time for more valuable work. The Procurement Agent turns complicated purchase requests into simple conversations. Employees just say what they need, and the agent guides them through company policies, gathers required approvals, and helps compare vendor options — replacing days of emails and form-filling with a smooth, guided process. The Travel Agent simplifies business travel by managing the entire process, from booking policy-compliant flights and hotels to capturing all related expenses. This eliminates manual coordination across departments or external agencies while ensuring compliance and complete documentation. The Payments Agent handles employee inquiries about transactions, reimbursements, and supplier payments, providing answers and investigating issues— tasks that previously took up the finance team's time unnecessarily. "What makes our approach unique is that we've built these AI agents on Payhawk's existing financial infrastructure," said Boyko Karadzov, CTO of Payhawk. "Our platform already handles global spend management through licensed payments, established approval workflows, granular spend controls, and system integrations — the exact foundation needed for secure, effective AI implementation in finance. Our vision is to offer all the capabilities of our web and mobile apps through natural conversation with AI, enabling users to work with Payhawk however they prefer." The AI agents integrate seamlessly into Payhawk's enterprise-grade secure infrastructure using established permissions, workflows, and audit trails. Finance teams will maintain the same visibility and control they need while gaining AI's benefits. This security-first foundation uniquely positions Payhawk to deliver AI that meets finance's fundamental need for control. ABOUT PAYHAWK Payhawk is a leading spend management platform that's transforming how global businesses handle company spending. By combining corporate cards with extensive proactive controls, employee expenses, accounts payable, and procure to pay processes in a single solution, Payhawk eliminates manual processes that slow companies down. Headquartered in London, with offices across Europe and New York, Payhawk is trusted by finance teams worldwide. Media contact :

Payhawk Frequently Asked Questions (FAQ)

When was Payhawk founded?

Payhawk was founded in 2018.

Where is Payhawk's headquarters?

Payhawk's headquarters is located at 53-64 Chancery Lane, London.

What is Payhawk's latest funding round?

Payhawk's latest funding round is Series B - II.

How much did Payhawk raise?

Payhawk raised a total of $236.5M.

Who are the investors of Payhawk?

Investors of Payhawk include Earlybird Venture, QED Investors, Greenoaks, Sprints Capital, Repeat and 12 more.

Who are Payhawk's competitors?

Competitors of Payhawk include Ramp, Yokoy, Brex, Spendesk, Pleo and 7 more.

What products does Payhawk offer?

Payhawk's products include Payhawk and 4 more.

Who are Payhawk's customers?

Customers of Payhawk include ATU, Luxair, Heroes, Payflow and Gtmhub.

Loading...

Compare Payhawk to Competitors

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Spendesk provides financial management tools for businesses. The company offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. The company was founded in 2016 and is based in Paris, France.

Moss is a company that provides spend management solutions within the financial technology sector. The company has a platform that allows businesses to manage expenses, handle month-end financial closing, and connect with existing human resources and accounting systems. Moss serves finance teams that require expense management tools. It was founded in 2019 and is based in Berlin, Germany.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Ramp is a financial operations platform that provides spend management services for businesses. The company offers a suite of services including corporate cards, expense management, accounts payable solutions, and accounting automation. Ramp's platform serves startups, small businesses, mid-market companies, and enterprises across various sectors. It was founded in 2019 and is based in New York, New York.

Loading...