Paystand

Founded Year

2013Stage

Series D | AliveTotal Raised

$83MValuation

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-68 points in the past 30 days

About Paystand

Paystand specializes in business-to-business (B2B) payments, leveraging software as a service (SaaS) and blockchain technology within the financial services industry. The company offers a suite of products designed to automate and digitize the entire cash cycle, including accounts receivable and payment processing, while eliminating transaction fees. Its solutions cater to various sectors such as construction, food and beverage, insurance, manufacturing, medical suppliers, and environmental industries. It was founded in 2013 and is based in Scotts Valley, California.

Loading...

Paystand's Product Videos

ESPs containing Paystand

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The accounts receivable (AR) automation market streamlines invoicing and payment collection processes. Vendors provide APIs and software development kits that allow companies to embed accounts receivable functionalities into their enterprise resource planning software, customer relationship management systems, and other digital platforms. The tools allow automated invoicing, payment reminders and…

Paystand named as Challenger among 15 other companies, including FIS, Blackline, and Sage.

Paystand's Products & Differentiators

B2B Payment Network

Paystand’s B2B Payment Network is a robust payment portal supporting bank transfers, checks, and card payments. Bank-to-bank payments are free, offering fast, secure transfers that cut down processing fees. For businesses handling checks, the check scanning feature digitizes processing, speeding up funds availability. ACH payments streamline recurring transactions and payroll with a secure, cost-effective method. Card payments add flexibility, allowing businesses to accept Visa, Mastercard, and other major cards with security and fraud protection, ensuring fast, reliable transactions.

Loading...

Research containing Paystand

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Paystand in 5 CB Insights research briefs, most recently on Sep 6, 2024.

Aug 23, 2024

The B2B payments tech market map

Dec 14, 2023

Cross-border payments market map

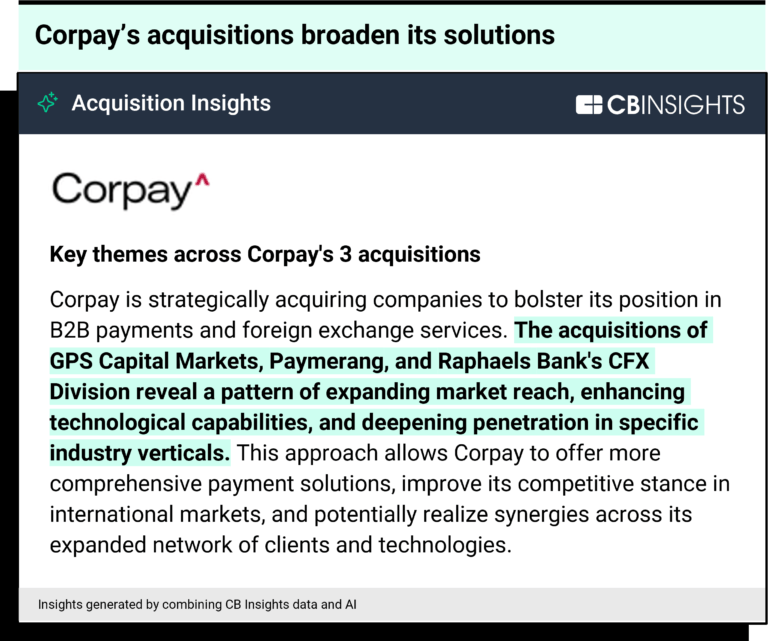

Oct 31, 2022 report

State of Blockchain Q3’22 ReportExpert Collections containing Paystand

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Paystand is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

8,944 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

SMB Fintech

2,003 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,465 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Paystand Patents

Paystand has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/28/2014 | Payment systems, Payment service providers, Mobile payments, Digital currencies, Online payments | Application |

Application Date | 3/28/2014 |

|---|---|

Grant Date | |

Title | |

Related Topics | Payment systems, Payment service providers, Mobile payments, Digital currencies, Online payments |

Status | Application |

Latest Paystand News

Jan 17, 2025

Share this post: Paystand , the global leader in blockchain-based payments and financial services, announces the opening of its new downtown Santa Cruz headquarters, offices formerly occupied by Google. The return to its Santa Cruz roots highlights the fintech firm’s long-time dedication to fostering economic growth in Santa Cruz, including working with local businesses to incentivize them to accept Bitcoin. Paystand’s Long-Time Santa Cruz Commitment The Jan. 13 ribbon-cutting event for the new headquarters highlighted Paystand’s commitment to Santa Cruz. Standing apart from the traditional and higher profile Silicon Valley just over the mountain, Santa Cruz incorporates a unique vibe that Paystand CEO Jeremy Almond has always cherished. When Almond was asked why he has resisted invitations to move to Silicon Valley, he responded: “Santa Cruz and its downtown have always been at the heart of Paystand’s origin story—it’s where we started on day one, and now we plan for it to remain our headquarters as we continue to grow. It embodies the bold and nonconformist spirit of Paystand.” “This new office symbolizes an investment in the community that has supported us from our beginnings. While we’re proud to anchor our vision and headquarters of our global operations in Santa Cruz, we’re also looking ahead to the future: our goal is to establish offices around the globe, driving innovation and building a decentralized financial ecosystem that empowers businesses worldwide. We are just at the start of what we’re working to achieve, and we couldn’t have picked a better place to call home,” Almond said. He continued, “With a thriving downtown and outdoor environment offering walkability and a beautiful seaside location, Santa Cruz is a fantastic place to work and to live. With UC Santa Cruz right nearby, we have an excellent source of talented engineers and creatives.” Almond came to the city in 2009 to begin work on a payments company, and it was there that he found some of his initial investors, including the Central Coast Angels. He also was in Santa Cruz when he won numerous local awards, including TECHie of the Year in 2018 and Titans of Tech in 2019. Very few venture-funded fintech companies have scaled to the impact that Paystand has. It recently completed two acquisitions (Yaydoo and Teampay). Over the past year, Paystand has also achieved a number of milestones, as it delivered new products to help finance teams better manage, control, and access their cash. These include: $14 billion in transactions approximately 1% of annual ACH annual payments went through Paystand the launch of Paystand.org, which promotes financial inclusion via blockchain and Bitcoin, focusing on underserved communities; partnering with 10 organizations in six countries and helping an estimated 40,000 individuals named to the Deloitte Technology Fast 500 List of Fastest Growing U.S. companies for the second year in a row as well as being listed on the Inc. 5000 Fastest Growing Companies for the fifth straight year People In This Post News Funding Funding Funding News

Paystand Frequently Asked Questions (FAQ)

When was Paystand founded?

Paystand was founded in 2013.

Where is Paystand's headquarters?

Paystand's headquarters is located at 1800 Green Hills Road, Scotts Valley.

What is Paystand's latest funding round?

Paystand's latest funding round is Series D.

How much did Paystand raise?

Paystand raised a total of $83M.

Who are the investors of Paystand?

Investors of Paystand include Commerce Ventures, NewView Capital, SB Opportunity Fund, King River Capital, Transform Capital and 20 more.

Who are Paystand's competitors?

Competitors of Paystand include Chargezoom, Melio, Stripe, CoreChain, notch and 7 more.

What products does Paystand offer?

Paystand's products include B2B Payment Network and 2 more.

Who are Paystand's customers?

Customers of Paystand include Covetous, Motorola Solutions, Thumbtack, Choozle and Allterra Solar.

Loading...

Compare Paystand to Competitors

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Billtrust provides accounts receivable automation and order-to-cash solutions within the financial services sector. The company offers services that improve the invoicing process, support multi-channel payments, and allow matching and posting for business-to-business transactions. Billtrust's solutions serve various industries, improving cash application and electronic handling of invoices and payments. It was founded in 2001 and is based in Hamilton, New Jersey.

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

Druo is a financial technology company that provides direct-to-account payment networks. The company offers services that allow businesses to debit or credit bank accounts or digital wallets. Druo serves the financial services sector with its payment solutions. It was founded in 2021 and is based in Miami, Florida.

PayNearMe develops technology to facilitate the end-to-end customer payment experience. It offers a billing and payment platform. Its platform helps users pay with cash for a range of goods and services from companies in e-commerce, property management, consumer finance, and transportation, enabling businesses and government agencies as well as retail stores to digitize cash collection processes. PayNearMe was formerly known as Handle Financial. The company was founded in 2009 and is based in Santa Clara, California.

Alternative specializes in B2B payments and checkout infrastructure for service-based businesses. The company offers solutions for processing customer payments, automating collections, and improving cash flow, without relying on overly technical language. Alternative's platform is designed to cater to the needs of managed service providers and business services, among others. It was founded in 2013 and is based in New York, New York.

Loading...