Kraken

Founded Year

2011Stage

Unattributed VC - II | AliveTotal Raised

$20.07MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-46 points in the past 30 days

About Kraken

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Loading...

ESPs containing Kraken

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

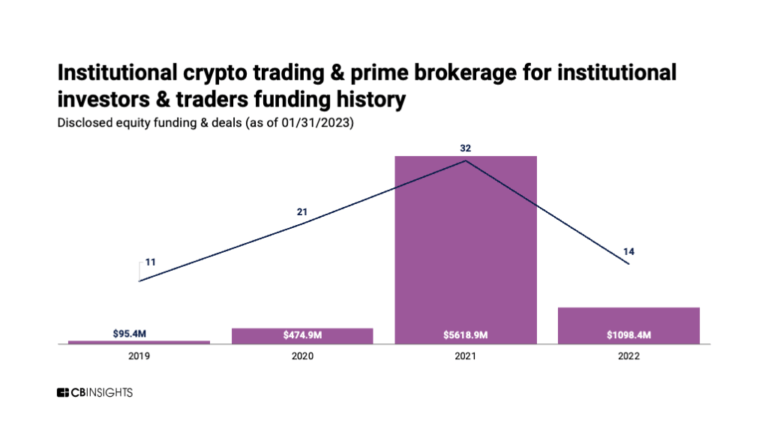

The institutional crypto trading & prime brokerage market is a complex and fragmented market that requires secure and reliable platforms to manage the operational complexity, security, and scale of trading cryptocurrencies. Vendors in this market offer built-in-house proprietary solutions that promise to combine prime brokerage, trade execution, and custody seamlessly. The market aims to unlock th…

Kraken named as Outperformer among 15 other companies, including Coinbase, BitGo, and HTX.

Loading...

Research containing Kraken

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kraken in 4 CB Insights research briefs, most recently on Apr 3, 2025.

Expert Collections containing Kraken

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Kraken is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

9,400 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Kraken Patents

Kraken has filed 27 patents.

The 3 most popular patent topics include:

- chemical processes

- industrial gases

- electric power distribution

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/27/2022 | 1/28/2025 | Automotive transmission technologies, Rotation, Engine technology, Gears, Mechanical power transmission | Grant |

Application Date | 10/27/2022 |

|---|---|

Grant Date | 1/28/2025 |

Title | |

Related Topics | Automotive transmission technologies, Rotation, Engine technology, Gears, Mechanical power transmission |

Status | Grant |

Latest Kraken News

Apr 13, 2025

How the crypto industry's political spending is paying off SECTIONS By Rate Story Synopsis Since President Donald Trump's inauguration, the Securities and Exchange Commission has dropped lawsuits against major crypto firms such as Coinbase and Kraken, lifting a legal cloud over the industry. An investor in crypto, Trump signed an executive order last month calling for the creation of a national crypto reserve -- a government stockpile containing bitcoin and other digital currencies. Reuters At the end of a three-hour hearing last month, Sen. Ruben Gallego, D-Ariz., sided with a group of Republicans in a hotly contested debate. He voted to advance the GENIUS Act, a bill backed by the cryptocurrency industry. "It's clear that digital assets are here to stay," Gallego said after the Senate Banking Committee hearing. Breaking from the committee's top Democrat, he called the bill a "step in the right direction." The vote, 18-6, was only preliminary, advancing a bill that will require approval from the full Senate. But in the crypto world, it was celebrated as a moment of vindication. Gallego is part of an increasingly influential cohort in Congress: beneficiaries of the crypto industry's largesse. During a tight Senate race last year, he was aided by $10 million from super political action committees financed by three large crypto companies, including the Coinbase digital currency exchange. The money funded ads that promoted Gallego's military service and support for border enforcement. Now, he and dozens of other lawmakers supported by the super PACs are taking steps in Congress to advance crypto priorities, handing a series of long-awaited victories to an industry with an extensive history of fraud and volatility. Live Events In the Senate, these legislators have thrown support behind the GENIUS Act, which would pave the way for businesses to issue stablecoins, a digital currency designed to maintain a price of $1. And in both chambers, they have voted to repeal a Biden-era rule that required crypto firms to report certain tax information to the IRS. Discover the stories of your interest An industry spending millions of dollars to influence Congress is hardly unusual. But crypto's political machine has stood out for the scale of its spending -- and the speed of the results. The industry has responded with glee. The spending is already "bearing fruit," said Josh Vlasto, a spokesperson for Fairshake, a super PAC that worked with two affiliated PACs to support pro-crypto congressional candidates. "This is a total sea change in terms of how Congress is approaching this industry." The crypto legislation is progressing just as US regulators roll back a yearslong enforcement campaign. Since President Donald Trump 's inauguration, the Securities and Exchange Commission has dropped lawsuits against major crypto firms such as Coinbase and Kraken , lifting a legal cloud over the industry. An investor in crypto, Trump signed an executive order last month calling for the creation of a national crypto reserve -- a government stockpile containing bitcoin and other digital currencies. The stablecoin legislation is poised to benefit Trump's business interests. At a crypto conference in March, he said stablecoins would "expand the dominance of the U.S. dollar" and called for "common-sense" legislation. A few days later, World Liberty Financial, a crypto firm that his family helped start, announced that it would begin selling a stablecoin called USD1. The stablecoin bill could go to the Senate floor for a vote in the coming weeks -- to the alarm of some Democrats who argue that Congress is giving the industry and Trump exactly what they want. The crypto industry has "spent a lot of money, and many of our members are beneficiaries," said Rep. Maxine Waters, D-Calif., the top Democrat on the House Financial Services Committee. "Many of them may not have taken the time to really examine what it is we're doing." Gallego was not a sponsor of the GENIUS Act, and he has said it requires fine-tuning. (The full name is the Guiding and Establishing National Innovation for U.S. Stablecoins Act.) But he has also defended the bill, saying it includes protections for consumers. "Senator Gallego believes it is important to have a seat at the table and work with colleagues on both sides," Jacques Petit, his spokesperson, said in a statement. "It remains the senator's priority to ensure proper guard rails are in place." In an interview, Sen. Kirsten Gillibrand, D-N.Y., who was a co-sponsor of the GENIUS Act, said crypto spending had no impact on the legislation. "If you made your decisions on what you're for based on who's giving you the most money, you would fail as a member of Congress," said Gillibrand, who was not funded by the crypto super PACs. During the Biden administration, the industry hired expensive lobbyists to push for federal legislation, without making much headway. The 2024 campaign was a turning point. A group of crypto executives and political strategists formed Fairshake and two affiliated super PACs, Defend American Jobs and Protect Progress, which spent more than $130 million to influence tight congressional races across the country. The spending was financed mostly by Coinbase, digital currency business Ripple and venture capital firm Andreessen Horowitz, which has financed more than 100 crypto startups. Candidates backed by the super PACs won 53 of 58 races. In Ohio, Defend American Jobs spent $40 million to support Bernie Moreno, a Republican crypto entrepreneur who unseated Sen. Sherrod Brown, the Democratic chair of the Banking Committee and an outspoken crypto critic. Protect Progress spent $10 million to help Elissa Slotkin, a Democrat, win a Senate seat in Michigan. And another $10 million from the super PACs boosted Gallego, who had spoken favorably about crypto in the past. The industry has since set out to convert those electoral victories into legislation. Executives at firms such as Coinbase, Ripple and Binance, a giant exchange that settled criminal charges with the U.S. government in 2023, have descended on Washington, meeting with lawmakers and posing for photographs on the steps of the U.S. Capitol. Their first priority is the bill laying out rules for stablecoins. The second is "market structure" legislation that would ensure most cryptocurrencies are not subject to enforcement lawsuits by the SEC, which conducted a crackdown during the Biden years. (STORY CAN END HERE. OPTIONAL MATERIAL FOLLOWS.) Many lawmakers backed by the crypto super PACs are positioned to advance those objectives. Moreno, Gallego and Sen. Jim Banks, R-Ind., who was supported by the PACs, serve on the Senate Banking Committee. Gallego is also the highest-ranking Democrat on a new Senate subcommittee devoted to crypto. A draft of the crypto market structure bill is still in the works. But a group of senators, including Tim Scott, R-S.C., who chairs the Banking Committee, introduced the GENIUS Act in February. In some ways, companies that issue stablecoins are similar to banks. The coins are supposed to be backed by assets that the issuer holds in reserve: If a firm sells 1 million stablecoins, it should have $1 million in a vault somewhere so customers can redeem the coins at any time. But over the years, crypto companies have been scrutinized for failing to maintain sufficient reserves. At the same time, stablecoins have become a useful tool for criminals looking to move money across borders. In theory, the GENIUS Act addresses those problems by outlining rules for stablecoin issuers. But in February, a coalition of consumer groups called the bill "a crypto industry wish list, not an adequate regulatory regime." They argued that the bill's requirements were too loose and would create major risks for customers. Even some crypto enthusiasts have expressed reservations. A provision in the GENIUS Act would allow overseas companies to get around some of its requirements. When the bill advanced out of the Senate Banking Committee, four Democrats other than Gallego, none of whom received support from Fairshake, also voted for it, along with Moreno, Banks and 11 Republicans who weren't backed by the crypto PACs. A similar bill, the STABLE Act, was introduced in the House last month, prompting Democrats to raise concerns that the new rules could benefit Trump's crypto business. "The president of the United States of America should not be using the power of the office to create business that will enrich himself," Waters said in an interview. But after a marathon hearing April 3, the House Financial Services Committee voted 32-17 to move the bill to the full chamber. The chair of that committee is Rep. French Hill, R-Ark. -- a longtime crypto supporter, a co-sponsor of the stablecoin bill and the beneficiary of $100,000 in spending by Fairshake. This article originally appeared in The New York Times. Read More News on

Kraken Frequently Asked Questions (FAQ)

When was Kraken founded?

Kraken was founded in 2011.

Where is Kraken's headquarters?

Kraken's headquarters is located at 100 Pine Street, Suite 1250, San Francisco.

What is Kraken's latest funding round?

Kraken's latest funding round is Unattributed VC - II.

How much did Kraken raise?

Kraken raised a total of $20.07M.

Who are the investors of Kraken?

Investors of Kraken include Bossa Invest, RIT Capital Partners, dedicated, Electric Capital, Ahimsa Capital and 19 more.

Who are Kraken's competitors?

Competitors of Kraken include BurjX, Bitpanda, Bitstamp, Circle, Binance.US and 7 more.

Loading...

Compare Kraken to Competitors

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Gemini is a cryptocurrency exchange and custodian that specializes in digital asset services. The company offers a platform for buying, selling, storing, and staking various cryptocurrencies, as well as trading cryptocurrency derivatives. Gemini serves a diverse market, including individual and institutional investors, fintechs, and banks. Gemini was formerly known as Gemini Trust Company. It was founded in 2015 and is based in New York, New York.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

Circle provides a financial technology solution for users to send and receive funds globally. It offers crypto treasury management solutions for businesses to manage digital assets. The company serves asset managers, financial technology companies, and financial institutions. It was founded in 2013 and is based in Boston, Massachusetts.

CoinDCX is a cryptocurrency investment platform that operates in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Loading...