Perfios

Founded Year

2008Stage

Series D - II | AliveTotal Raised

$443.18MValuation

$0000Last Raised

$80M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-40 points in the past 30 days

About Perfios

Perfios specializes in financial data analysis software and lending solutions within the fintech sector. The company offers a suite of products that facilitate real-time data extraction, risk analytics, and decisioning automation for financial institutions to make informed lending decisions. Perfios' solutions cater to various financial services, including consumer lending, small and medium enterprises lending, wealth management, and insurance, by providing tools for bank statement analysis, fraud checks, and credit underwriting automation. It was founded in 2008 and is based in Mumbai, India.

Loading...

Perfios's Product Videos

ESPs containing Perfios

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

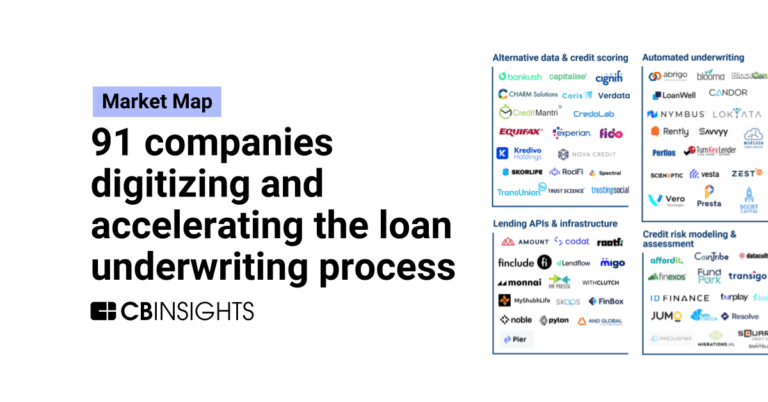

The loan underwriting market involves the process of evaluating and analyzing a borrower's creditworthiness to determine their eligibility for a loan. Technology vendors in this business-to-business market offer solutions that automate manual processes, reduce fraud rates, and provide data-driven insights for risk mitigation and decision-making. These solutions leverage technologies AI and Machine…

Perfios named as Highflier among 14 other companies, including Blend, Scienaptic, and Tavant.

Perfios's Products & Differentiators

Bank Statement Analyzer (Insights)

Analyze Bank Statements procured in any manner to derive detailed analysis on customer’s assets, liabilities, income & expenditure and check for both transactional and behavioral fraudulences at a 100% accuracy. Covers over 800 financial institutions and over 2000 different formats.

Loading...

Research containing Perfios

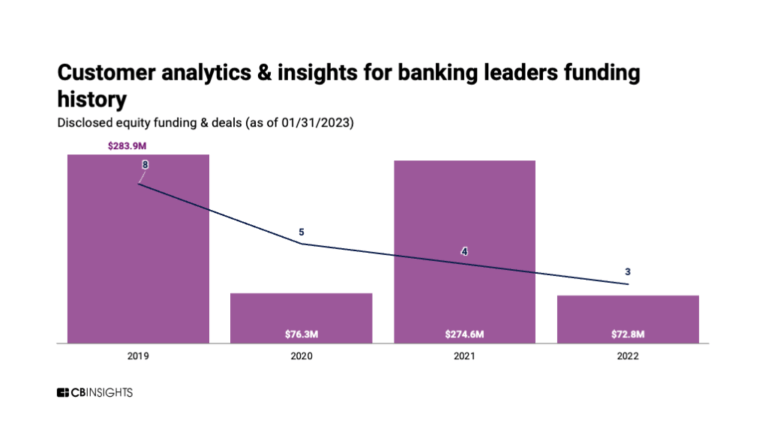

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Perfios in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Oct 18, 2023 report

State of Fintech Q3’23 ReportExpert Collections containing Perfios

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

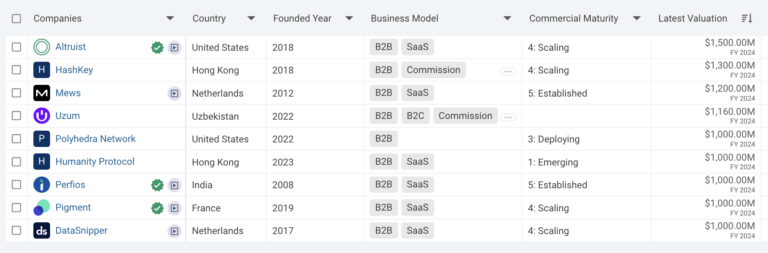

Perfios is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Wealth Tech

2,383 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,577 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,699 items

Excludes US-based companies

Latest Perfios News

Apr 3, 2025

Lenders say AI to fintech startups for debt collection SECTIONS By Rate Story Synopsis Lenders are now turning to AI-led models which can reduce the cost of each collection journey. This is opening a business opportunity for new-age startups to disrupt the traditional collections business. Recently, financial software services provider Perfios acquired CreditNirvana, a collections and debt management platform, to help banks and NBFCs streamline loan recovery, reduce delinquencies, and enhance portfolio performance. ETtech Signs of stress on unsecured consumer loans have seen lenders scouting for effective debt collection mechanisms through fintech startups . Several like Yubi-owned SpoctoX, Perfios-owned CreditNirvana, Rezolv and Credgenics are using advanced technology-led models to analyse large data sets to predict borrower behaviour, pre-empt defaults by closely monitoring transaction activity on the borrower’s account, and devise effective recovery means for the defaulters. Venture investors believe small ticket size loans, which have grown significantly over the last few years, cannot be collected via traditional routes that involve manual follow-ups, call centres, field agents, and legal notices. Lenders are now turning to AI-led models which can reduce the cost of each collection journey. This is opening a business opportunity for new-age startups to disrupt the traditional collections business. Recently, financial software services provider Perfios acquired CreditNirvana , a collections and debt management platform, to help banks and NBFCs streamline loan recovery, reduce delinquencies, and enhance portfolio performance. Live Events “Not a lot of innovations have happened in this (debt collection) space and not many people have gotten into it or figured out how to solve it. Also, not much technology has been used. So, there is ample scope and room to grow,” Sabyasachi Goswami, CEO of Perfios, told ET in an interaction. According to industry executives, AI-driven models are effective in analysing borrower behaviour, predicting repayment risks, and personalising collection strategies. These AI models can process large datasets to identify patterns in borrower behaviour and predict the likelihood of repayment, allowing banks and financial institutions to customise their recovery strategies accordingly. Also, AI algorithms help automate reminders, improve communication through SMS, email, or voice calls, and adjust the timing and content of collection messages. “The challenge with the current lending industry is that every lender has data in different silos and operations are run on multiple platforms with no scope of unified analytics. This approach was a smaller problem when the number of loans were much lesser, and the customer quality was higher,” said Mehta. Meanwhile, CredResolve, an AI-driven collections platform, raised $1.1 million in seed funding in March led by Unleash Capital Partners. According to data from intelligence platform Tracxn, venture capital firms have invested over $880 million in debt collection and resolution startups over the past three years. For venture capitalists, the key challenge is backing scalable solutions while ensuring compliance with India’s evolving financial regulations in the country. While AI offers better analytics and faster decision-making, industry executives acknowledge that it is not a quick fix. The sector is still in the early stages of technological transformation, and the long-term impact of AI-driven collections remains to be seen. "As lending activity grows, there is additional pressure on collections, which in turn affects the quality of assets on the balance sheets of banks and financial institutions. Consequently, more resources are being allocated to ensure the efficiency of the collections process," said Akshay Sharma, vice president, investments, at 3one4 Capital. Executives added that the growing demand for real-time data, predictive insights, and borrower-friendly repayment strategies is driving investment in both tech-driven and service-based approaches of debt resolution, making collections a rapidly evolving segment in India's fintech ecosystem. Read More News on

Perfios Frequently Asked Questions (FAQ)

When was Perfios founded?

Perfios was founded in 2008.

Where is Perfios's headquarters?

Perfios's headquarters is located at 111, Chandivali Road, Mumbai.

What is Perfios's latest funding round?

Perfios's latest funding round is Series D - II.

How much did Perfios raise?

Perfios raised a total of $443.18M.

Who are the investors of Perfios?

Investors of Perfios include Teachers' Venture Growth, Kedaara Capital, Stride Ventures, Visa Accelerator Program, Bessemer Venture Partners and 7 more.

Who are Perfios's competitors?

Competitors of Perfios include Plaid, Scienaptic, Bureau, AbleCredit, Fego and 7 more.

What products does Perfios offer?

Perfios's products include Bank Statement Analyzer (Insights) and 4 more.

Who are Perfios's customers?

Customers of Perfios include HDFC Bank Ltd, ICICI Bank Ltd, Zest Money, PNB Housing and Canara Bank.

Loading...

Compare Perfios to Competitors

MX operates within the financial services sector. It offers products for connecting, understanding, and utilizing financial data, including account aggregation, financial insights, and data enhancement services. MX serves financial institutions and financial technology companies, allowing them to provide money management experiences to consumers. MX was formerly known as MoneyDesktop. It was founded in 2010 and is based in Lehi, Utah.

MoneyThumb specializes in financial document conversion and analysis for the lending and accounting sectors. The company offers solutions that convert PDF bank statements into actionable financial data and assess creditworthiness using advanced analysis tools. MoneyThumb's products are designed to facilitate fraud detection, integrate with accounting systems, and support personal finance management by converting financial transaction data into various formats. It was founded in 2014 and is based in Encinitas, California.

Able specializes in AI-driven document management and process automation for the commercial lending sector. The company offers a platform that automates the collection and organization of borrower information, creates instant document checklists, and provides a collaborative workspace for all parties involved in a loan transaction. Able primarily serves the financial services industry, enhancing the efficiency of loan processing and document management. It was founded in 2020 and is based in San Francisco, California.

Underwrite.ai focuses on AI-driven credit risk modeling in the financial services industry. The company provides credit risk modeling that aims to improve the precision of lending decisions by using machine learning techniques. Underwrite.ai's services serve community banks, credit unions, and peer-to-peer lending platforms by offering AI models that assess the probability of default with a limited amount of borrower information. It is based in Boston, Massachusetts.

Vaultedge provides document processing services within the financial services sector. The company offers products that classify, extract, and validate data from structured and unstructured documents, as well as digital lending APIs for financial verification and credit appraisal. Vaultedge's solutions are applicable to the mortgage, insurance, and banking industries. It was founded in 2014 and is based in Dallas, Texas.

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Loading...