Pine Labs

Founded Year

1998Stage

Unattributed - IV | AliveTotal Raised

$1.127BValuation

$0000Last Raised

$50M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-17 points in the past 30 days

About Pine Labs

Pine Labs is a merchant platform that provides payment solutions across various business sectors. The company offers services, including in-store and online payment processing, customer loyalty programs, prepaid and gifting services, and analytics. Pine Labs serves sectors such as electronics, lifestyle, automobile, grocery, healthcare, and hospitality. It was founded in 1998 and is based in Noida, India.

Loading...

ESPs containing Pine Labs

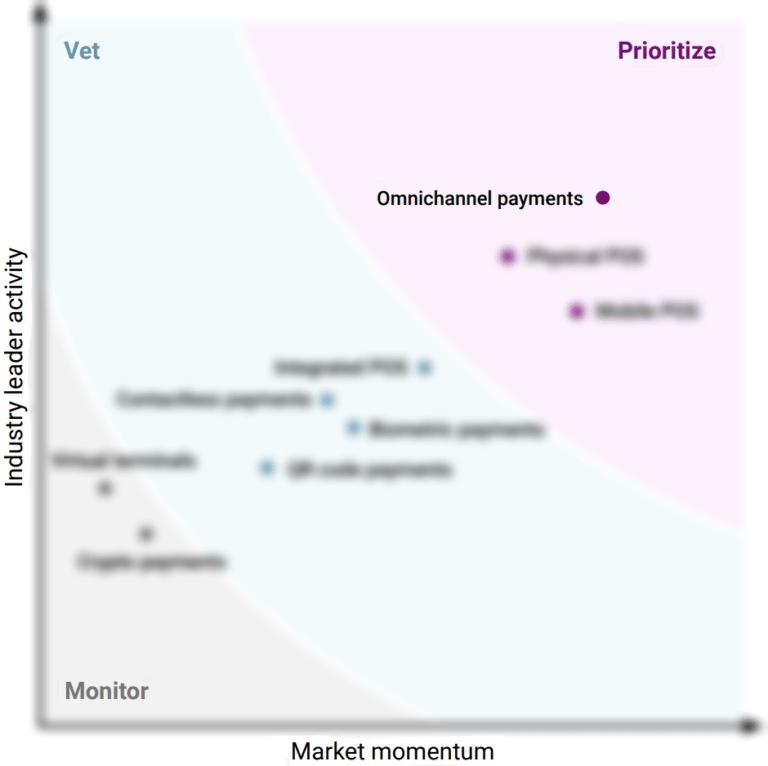

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

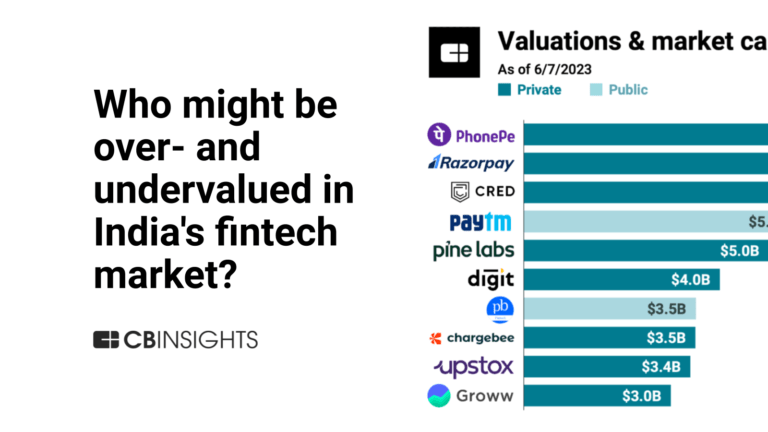

The omnichannel point-of-sale (POS) market, also called unified POS, provides integrated payment acceptance across digital and physical retail sales channels. These solutions provide the hardware and software to sync sales data, allowing for centralized transaction and inventory visibility. Some providers also offer customer service, shopper marketing, or sales analytics features. As more shopping…

Pine Labs named as Outperformer among 15 other companies, including Stripe, Fiserv, and Shopify.

Loading...

Research containing Pine Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Pine Labs in 4 CB Insights research briefs, most recently on Jun 14, 2023.

May 20, 2022 report

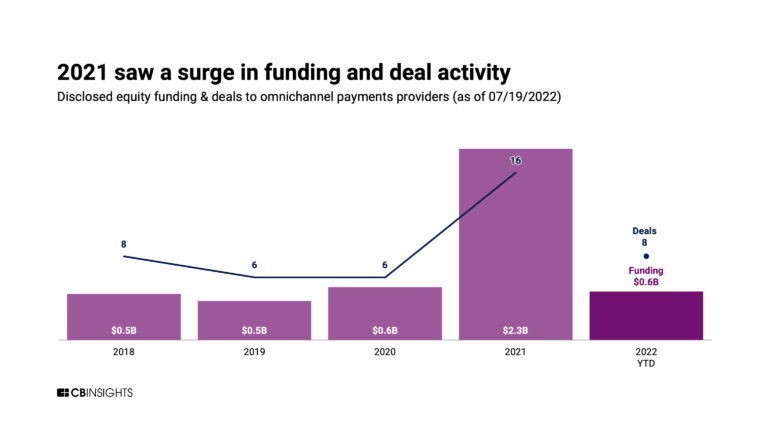

Why vendors are prioritizing omnichannel paymentsExpert Collections containing Pine Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pine Labs is included in 8 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,809 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,648 items

Payments

3,335 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,699 items

Excludes US-based companies

Latest Pine Labs News

Apr 13, 2025

SHARE SUMMARY With the IPO on the horizon, revenue diversification is a key focus for Urban Company, especially as it looks to sustain its growth momentum in the year ahead At the start of the year, we knew that the IPO momentum was going to be super strong among Indian startups. Some of the most noted companies in the country — PhonePe, Urban Company, OYO, Pine Labs, Zepto and others — are on the cusp of going public and naturally, there was a lot of confidence among investors about exits and maturity in the startup ecosystem. But in the past month or so, there is also a new wave of caution. Under the President Donald Trump administration in the US, global trade has been shaken to quite some extent, and markets are reacting every day to new developments and changes in trade tariffs. Many believe this is a temporary pain that should not deter the IPO parade in India, but it will have some impact on new IPOs. The first sign of this was perhaps on display this week as Urban Company finalised its plans for the IPO and received its board approval. But the final issue size might be well below previous expectations. For one, the next set of IPOs are likely to be much smaller than the ones we have seen in the past four years. More and more companies will be looking to take a rational approach to fundraising in this current environment, and companies with minimal exposure to global trade winds will be the ones that will cash in. Take for example, Urban Company, which was bullish about a mega IPO in late 2024 but has had to rejig its plans in the past two months. As we reported this week, the company’s board has approved raising up to INR 528 Cr (about $60 Mn) via a fresh issue in its IPO, in addition to an offer-for-sale component. Incidentally, earlier this year, when the startup converted into a public entity , reports suggested that Urban Company was planning to file its draft papers for an INR 3,000 Cr IPO ($300 Mn+) before the end of March. While that timeline has since changed, clearly, so has the company’s appetite for fundraise from public markets. It’s not just Urban Company — even EV maker Ather Energy is cutting its IPO size by at least $50 Mn (about INR 430 Cr) from its earlier target of $400 Mn (about INR 3,460 Cr) amid the ongoing volatility in the Indian and the global stock markets. The market turmoil might also result in Ather seeking a lower valuation for the IPO, however, as of now, Urban Company’s valuation for the IPO remains under wraps. The New Look Of Urban Company Founded in 2014 by Abhiraj Singh Bhal, Raghav Chandra and Varun Khaitan, Urban Company has been in the news recently for its quick commerce transition with the launch of InstaHelp to offer services in 15 minutes . Under it, the startup offers services such as cleaning, cooking, washing and more, connecting users to professionals in their area. Urban Company’s revenue model has changed quite a bit in the past two years. In fact, the revenue has nearly doubled since the end of FY22, and losses have come down significantly. It saw a near 30% increase in its revenue to INR 827 Cr in FY24 and narrowed its loss before tax to INR 93 Cr. RECOMMENDED FOR yOU 11th April, 2025 The company has gone beyond the commission-based model it started with. Today, it operates a marketplace for professionals and even these gig workers have to pay a subscription fee to remain on the platform. In addition to this, there is a commission charged on every job, plus of course revenue collected from consumers. With the IPO on the horizon, revenue from services is a key focus for Urban Company, along with revenue from products sold to professionals for fulfilling these services. But it’s also adding other pieces such as InstaHelp, its take on quick commerce and venturing into consumer brands. No Room For Loss-Making IPOs? “There is no real precedent for a model like Urban Company in the public markets. While most investors and institutions would be familiar with Zomato or Swiggy’s model, they may not quite be in sync with how Urban Company pulls off the operations and the many moving pieces,” said a Bengaluru-based VC fund partner. According to him, not having a counterpart in the market is often a disadvantage for companies looking to list, as most public markets investors like to have benchmarks for revenue and profitability. Even among the Indian listed companies and new-age tech stocks, there is no precedent for a model like Urban Company. This is undoubtedly a challenge for the company, similar to what Paytm faced when it listed, and it will have to spend considerable time and effort to convey the model to the investor base. The other big issue is sustaining profitability even as rules for gig work and part-time professionals change and evolve in the long run. The likes of Zomato and Swiggy have diversified quite a bit and while any changes in gig worker rules will naturally impact them severely, Urban Company is more heavily reliant on gig workers for revenue and business momentum. It is perhaps for this reason that Urban Company is reported to be mulling a D2C play, launching beauty, wellness, and personal care products for consumers, which could put it in the same league as Nykaa or Honasa, and therefore give investors a better view of its financial roadmap. The IPO size cut is a strong message that the public market investors are no longer willing to pay 10x or 20x revenue multiples for loss-making startups. Even though cofounder and CEO Bhal claimed that Urban Company hit profit before tax in the first quarter of FY25, long-term profitability will be key for the company as it hits the public markets trail. This is perhaps the biggest hurdle for Urban Company as it goes through the IPO litmus test. Stock In Focus: Honasa Honasa Consumer, the parent of Mamaearth, showed signs of resilience after opening the week at its 52-week low. The stock rebounded on Friday after four sessions of decline, gaining 5.72% on April 11, 2025, outperforming its sector. In terms of performance metrics, Honasa outperformed the retail sector by 5.35% this week, but it remains below the 5-day, 100-day, and 200-day moving averages, indicating that this may be a temporary bump for the stock. Incidentally, this past week, Honasa earned a victory in its lawsuit against RSM General Trading LLC in the UAE. A Dubai court ruled in favour of Honasa, overturning a previous ruling which ordered the company to pay AED 25 Mn as compensation. This court case has been an overhang on Honasa for the past year or so, and settling this would allow the company to press ahead with its international business. Over the past month, Honasa has seen a 7.38% gain in its stock price compared to the 1.68% bump for the overall Sensex. However, the Varun Alagh and Ghazal Alagh-led company’s year-to-date stock performance remains well below par at -8.82%, compared to the Sensex’s decline of -3.57%. Honasa was not the only major gainer this past week, as a host of new-age tech stocks bounced back after two weeks of pressure. Here’s a look at the top ten stocks last week: IPO Watch: Upcoming Issues & More Paytm Gets Domestic Boost: Domestic mutual funds increased their stake in Paytm to 13.11% in the fourth quarter from 11.2% in the Q3 FY25, primarily led by Nippon India Mutual Fund and Motilal Oswal Mutual Fund Wakefit Rises For IPO: Bengaluru-based D2C furniture and mattress startup Wakefit is reportedly looking to make a splash and aims to raise around INR 1,500-2,000 Cr (around $173-231 Mn) through a public offering later this year More’s IPO Roadmap: Amazon India backed supermarket retailer More Retail is planning to launch its initial public offering (IPO) next year as it looks to expand its network of supermarket stores in India and cater to the quick commerce boom Pine Labs’ Reverse Flip: Making another stride towards its IPO journey, fintech major Pine Labs has now secured the final approval from the National Company Law Tribunal (NCLT) to merge its Indian and Singapore entities and redomicile to India

Pine Labs Frequently Asked Questions (FAQ)

When was Pine Labs founded?

Pine Labs was founded in 1998.

Where is Pine Labs's headquarters?

Pine Labs's headquarters is located at Candor TechSpace, 4th & 5th Floor, Noida.

What is Pine Labs's latest funding round?

Pine Labs's latest funding round is Unattributed - IV.

How much did Pine Labs raise?

Pine Labs raised a total of $1.127B.

Who are the investors of Pine Labs?

Investors of Pine Labs include Vitruvian Partners, Alpha Wave Global, State Bank of India, Invesco, BlackRock and 24 more.

Who are Pine Labs's competitors?

Competitors of Pine Labs include Innoviti, ToneTag, Satispay, Klarna, Resal and 7 more.

Loading...

Compare Pine Labs to Competitors

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. It serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), platforms, marketplaces, and the creator economy. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

PayNearMe develops technology to facilitate the end-to-end customer payment experience. It offers a billing and payment platform. Its platform helps users pay with cash for a range of goods and services from companies in e-commerce, property management, consumer finance, and transportation, enabling businesses and government agencies as well as retail stores to digitize cash collection processes. PayNearMe was formerly known as Handle Financial. The company was founded in 2009 and is based in Santa Clara, California.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Previse specializes in accelerating B2B payments through data-driven solutions in the financial technology sector. The company offers services that enable instant invoice payments and supply chain payment optimization using artificial intelligence to assess invoices and facilitate early payments. Previse's solutions cater to large enterprises looking to improve their working capital efficiency and supplier payment processes. It was founded in 2016 and is based in London, England.

Loading...