Plaid

Founded Year

2013Stage

Unattributed VC | AliveTotal Raised

$1.31BValuation

$0000Last Raised

$575M | 11 days agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-29 points in the past 30 days

About Plaid

Plaid connects users to financial data and services. The company provides products that link users' financial accounts to applications, verify identities, and support secure money movement. It was founded in 2013 and is based in San Francisco, California.

Loading...

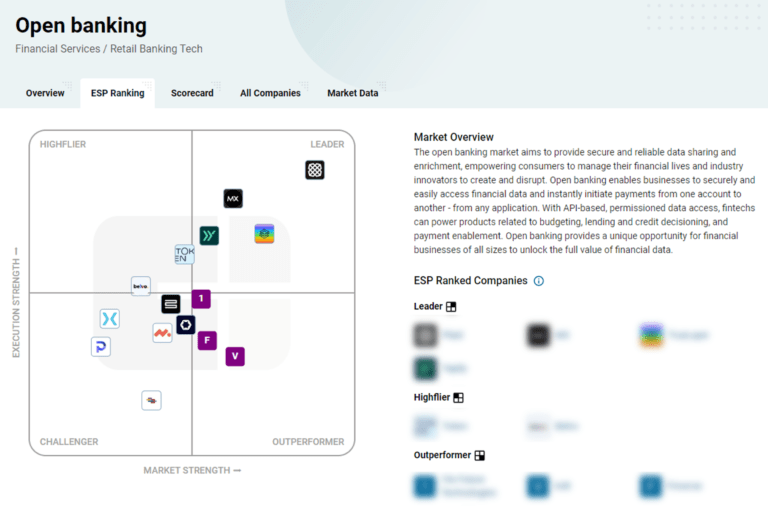

ESPs containing Plaid

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The lending APIs & infrastructure market provides end-to-end solutions for digital lending operations, including loan management systems, risk management tools, and compliance management capabilities. These platforms enable financial institutions to originate, process, and service loans through API-driven architecture that supports integration with existing systems. The market encompasses core ban…

Plaid named as Highflier among 15 other companies, including Fiserv, nCino, and Finastra.

Plaid's Products & Differentiators

Transacttions

Retrieve typically 24 months of transaction data, including enhanced geolocation, merchant, and category information. Stay up-to-date by receiving notifications via a webhook whenever there are new transactions associated with linked accounts.

Loading...

Research containing Plaid

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plaid in 14 CB Insights research briefs, most recently on Sep 27, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market map

Expert Collections containing Plaid

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Plaid is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Wealth Tech

2,383 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,483 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Tech IPO Pipeline

825 items

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Plaid Patents

Plaid has filed 70 patents.

The 3 most popular patent topics include:

- data management

- payment systems

- banking technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/16/2022 | 3/25/2025 | Data management, Computer network security, Computer security, Payment systems, Banking | Grant |

Application Date | 6/16/2022 |

|---|---|

Grant Date | 3/25/2025 |

Title | |

Related Topics | Data management, Computer network security, Computer security, Payment systems, Banking |

Status | Grant |

Latest Plaid News

Apr 3, 2025

4:00 AM PDT · April 3, 2025 Plaid , which connects bank accounts to financial applications, has sold about $575 million worth of common stock at a $6.1 billion post-money valuation, the fintech company confirmed to TechCrunch. The valuation is about less than half of the $13.4 billion that San Francisco-based Plaid was valued at when it raised a $425 million Series D in April 2021 in a round led by Altimeter Capital. A spokesperson acknowledged the decrease, saying it was “simply a reflection of the contraction of multiples across the market.” Indeed, higher interest rates have led to lower valuations for many startups that last raised at the top of the high cycle in 2021. Still, Plaid’s new valuation is about 15% higher than the $5.3 billion Visa was going to pay for the company before that acquisition deal fell apart in January of 2021 due to regulatory concerns. Plaid will not go public in 2025 but it is a milestone the company continues “to track towards,” according to the spokesperson. In October 2023, Plaid named former Expedia exec Eric Hart to serve as its new chief financial officer . The fact that it appeared to be eyeing an IPO — albeit with no timeline — drew attention. Today, the company maintains that it is “well-capitailized.” “Plaid’s business is in a great position and we’re optimistic about the opportunity ahead,” the spokesperson said. Franklin Templeton led the “oversubscribed” raise, which also included participation from new backers Fidelity Management and Research, BlackRock, and others in addition to existing investors NEA and Ribbit Capital. Plaid characterized the transaction as “not a Series E,” but rather a sale of common stock, which involves a company directly issuing new shares to raise capital. This is different from a secondary share sale, which occurs when existing shareholders sell their shares to other investors, without the company receiving any new capital. The proceeds of the round will be used to address employee tax withholding obligations related to the conversion of expiring RSUs ( restricted stock units ) to shares, and to offer some liquidity to its current team via an employee tender offer, CEO and co-founder Zach Perret (pictured above) said in a blog post. While the company did not break down how much capital exactly was going toward each initiative, a spokesperson told TechCrunch the majority of the secondary sale was going toward the conversion of the RSUs that will be expiring in the coming years. “We raised the capital to cover the RSU expiry issue and there is a small tender for employees, but it is not the entirety of the round,” the spokesperson said. Restricted stock units are typically issued to employees through a vesting schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time. This raise comes on the heels of what Perret described as a “record-setting year on revenue, a return to positive operating margins, and a meaningful increase in the companies and markets” Plaid serves. He didn’t provide hard revenue figures, saying that revenue grew over 25% in 2024 and that the company was approaching “sustained profitability.” In a shareholder letter viewed by TechCrunch, Perret also wrote that new products represented more than 20% of Plaid’s ARR in 2024, “compounding at 93% annually.” Founded in 2012, Plaid got its start as a company that connects consumer bank accounts to financial applications but has since been gradually expanding its offerings to also include lending, identity verification, credit reporting, anti-fraud, and payments. Being a multi-product company has led to traction beyond the traditional fintech customers it started out serving. President Jen Taylor told TechCrunch last June that enterprise and traditional financial institution growth was “starting to outpace the rest of its business.” Overall, Plaid saw “a big upswing in the number of enterprises ” it serves in 2024, Perret wrote in the shareholder letter. The company counts Citi, Robinhood, H&R Block, Invitation Homes, GoFundMe, Zillow, and Rocket as “key customers.” Perret also wrote: “Our goal is to build software that makes the financial system easier and better for everyone. Our products are the bedrock upon which many of the most well-known financial brands are built – companies like Affirm, Chime, Robinhood, and SoFi.” Plaid has raised about $1.3 billion in funding over its lifetime. Presently, it has 1,200 employees across the United States, Canada, the United Kingdom, and the EU. Topics

Plaid Frequently Asked Questions (FAQ)

When was Plaid founded?

Plaid was founded in 2013.

Where is Plaid's headquarters?

Plaid's headquarters is located at San Francisco.

What is Plaid's latest funding round?

Plaid's latest funding round is Unattributed VC.

How much did Plaid raise?

Plaid raised a total of $1.31B.

Who are the investors of Plaid?

Investors of Plaid include New Enterprise Associates, Ribbit Capital, BlackRock, Fidelity, Franklin Templeton and 27 more.

Who are Plaid's competitors?

Competitors of Plaid include Solaris, Finix, Nymbus, Bud, Aeropay and 7 more.

What products does Plaid offer?

Plaid's products include Transacttions and 4 more.

Loading...

Compare Plaid to Competitors

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Budget Insight focuses on open finance and embedded finance solutions. The company offers a range of services including instant money transfers, real-time revenue checking, automated bank identity verifications, and a platform for aggregating financial data from various institutions. Its services primarily cater to sectors such as banking, insurance, technology companies, and utilities. It was founded in 2012 and is based in Roubaix, France.

Railsr is a global embedded finance platform that operates within the financial services sector. The company provides financial services, including digital wallets, payment processing, and card issuance, all facilitated through API integration. Railsr's platform is designed to integrate into a brand's digital journey, offering rewards programs, loyalty points, and various types of cards. Railsr was formerly known as Railsbank. It was founded in 2016 and is based in London, United Kingdom.

TrueLayer is an open banking platform that specializes in the financial services industry. The company offers a suite of products that enable instant bank payments, fast and verified payouts, streamlined user onboarding, and variable recurring payments, all designed to facilitate safer and more efficient financial transactions. TrueLayer primarily serves sectors such as e-commerce, gaming, financial services, travel, and cryptocurrency markets. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, United Kingdom.

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Sila operates as a financial technology company that focuses on providing a payment platform. The company offers a range of services including fast money transfers, identity verification, fraud prevention, and bank account linking. Its services are primarily targeted towards the fintech industry. It was founded in 2018 and is based in Portland, Oregon.

Loading...