PolicyGenius

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$276.05MRevenue

$0000About PolicyGenius

PolicyGenius is an online insurance platform. The company provides a place to shop online for life, long-term disability, renters, and pet insurance through its quoting engines that offer comparisons of tailored policies. It was formerly known as KnowltOwl. The company was founded in 2014 and is based in New York, New York. In April 2023, PolicyGenius was acquired by Zinnia. The terms of the transaction were not disclosed.

Loading...

ESPs containing PolicyGenius

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech producers — auto market comprises insurtech agents, brokers, distributors, and other intermediaries that provide automotive insurance. Customer experience initiatives — particularly those focused on improving the ease of insurance sales and policy management for insureds — are often a focus of these companies. This market excludes managing general agents.

PolicyGenius named as Highflier among 15 other companies, including Qover, Insurify, and PolicyStreet.

PolicyGenius's Products & Differentiators

Life Insurance

Life insurance is an affordable way to provide financial support to the people you love after you die.

Loading...

Research containing PolicyGenius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned PolicyGenius in 6 CB Insights research briefs, most recently on Mar 29, 2024.

Feb 23, 2024

The B2C US insurtech market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023

Aug 8, 2023 report

State of Insurtech Q2’23 ReportExpert Collections containing PolicyGenius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

PolicyGenius is included in 4 Expert Collections, including Fintech 100.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

3,304 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,465 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest PolicyGenius News

Feb 6, 2025

Roughly 4 out of 5 American adults don't know what an annuity is Roughly 4 out of 5 American adults don’t know what an annuity is In an uncertain economy fueled by high interest rates, annuities are more popular than ever. Last year, annuity sales soared to a record-high $385.4 billion in the U.S., a whopping 23% increase over the year before. However, roughly four out of five American adults (79%) still struggle to identify the correct definition of an annuity, according to the 2024 Policygenius Annuities Literacy Survey. Key findings: Only 19% of American adults are able to identify the correct definition of an annuity. Less than three in 10 (28%) American adults with four-year college degrees are able to identify the correct definition of an annuity. Over a third of American adults (35%) don’t know when buying an annuity could benefit them. Only 5% of American adults are able to both identify the correct definition of an annuity and accurately indicate at what age using an annuity could benefit them. Policygenius Many Americans Are Confused About Annuities—and Other Financial Tools Annuities are insurance contracts that provide a guaranteed stream of income, most often for life. Many people use annuities to offset the risk of outliving their savings, or to supplement their income later in life, usually after they retire. But unlike other financial products that have also become popular in recent years, such as credit card rewards and even cryptocurrency , annuities are complex — it can be hard to pick the right contract without the guidance of a financial advisor. Just 16% of Americans aged 35 to 54 were able to correctly define an annuity. Older adults were more likely to know what an annuity is, but only one in four Americans aged 55 and up identified the correct definition in the survey. Further, college-educated Americans are twice as likely to know how an annuity works than participants with a lower level of education (29% of those with a four-year degree or more vs. 14% of those with some college or less), according to the survey. Still, almost three in 10 (29%) with four-year degrees or more were able to identify the correct definition of an annuity — compared to 14% with some college or a two-year degree, or less. These results suggest annuities aren’t the only financial tool that American adults are confused about. Roughly one in three (34%) U.S. adults mistook annuity contracts for other products like IRAs, 401(k) plans, or even life insurance policies. In fact, 14% of all respondents matched an annuity to the definition of a Roth IRA. Further, 9% of all respondents matched an annuity to the definition of a 401(k) plan. And 17% and 13% of adults with a postgraduate degree matched the definition of an annuity to a Roth IRA or 401(k), respectively. Annuities Can Be a Good Financial Fit at Any Age, But Most Americans Aren’t Aware While annuities are often used to complement a retirement strategy, an annuity can be beneficial at any age, depending on the individual’s financial situation and goals. However, only about one in five (21%) U.S. adults knew this, and about 35% of respondents weren’t sure when using an annuity could be beneficial. Education level didn’t make much of a difference here — participants with four years of college education or graduate studies were only about 20% more likely than participants with a lower level of education to know that annuities can be a good financial asset at any point in life. Policygenius Only 5% of American Adults Know How Annuities Work and That They Can Be Beneficial at Any Age Very few Americans were able to identify the correct definition of an annuity, as well as recognize that an annuity can be beneficial at any age. Roughly one in 10 of adults with a four-year (9%) or postgraduate (10%) degree were able to answer both questions correctly. “Annuities are fairly difficult because they’re so complex — you can’t even have the same advisor selling you multiple types of annuities” because some contracts, like variable annuities, are considered securities that involve SEC regulations, says Steven J. Lee, Ph.D, CFJ , and finance lecturer at Cal Poly Pomona, who was unsurprised at the findings from the Policygenius survey. They’re “a complex product that’s being sold in a very complex regulatory environment.” Policygenius Challenges in Categorizing and Educating Consumers on Annuities The push for more comprehensive personal finance education has increased in recent years. The Council for Economic Education cited that in 2024, two-thirds of states now include a personal finance class as a high school graduation requirement, up from 2022, when fewer than half of states had a similar guideline in place. Lee explains how, even at the college level, it’s difficult to categorize annuities in a personal finance curriculum due to their complexity. Do they go under investments? Budgeting? Retirement? Couple that with the fact that “there’s no streamlined education process” for financial advisors in the U.S., so “annuities are caught in the crosshairs” between different schools of thought within the financial advisor community, Lee says. For instance, Lee advises to be wary of Assets Under Management companies that denounce annuities because of the fees that come with them (often 1% or 1.5%, sometimes lower or higher depending on the specific type of contract). “But then when you look at the client statements for those firms, they’re charging 1% to 1.5% per year in fees a lot of times — it’s crazy.” This ongoing discourse makes it difficult to explain some financial products and services to consumers in a logical, clear way. After professionals reach a consensus on best practices for education on annuities, “now we need to figure out a way to transmit the knowledge to the public,” Lee says. How to Add an Annuity to Your Financial Plan Even once you have a basic understanding of what annuities are and how they work , “you need someone who is dedicated to the deep knowledge of the products specifically,” Lee explains. In terms of finding an agent or advisor you trust, Lee recommends first verifying their credentials with their state department of insurance and FINRA, depending on their advisory licenses. Then, if you’re considering purchasing an annuity, Lee recommends asking the following questions: What are the fees? What is the surrender charge? How long is my money tied up? What is the financial strength of the insurance company? Annuities are complex, but it’s worth doing your homework if they add value to your financial plan. “When used properly, in the right context, [annuities] are amazing,” Lee says. “They can be used to solve a lot of problems. They can also be weaponized to cause a lot of problems.” Most other financial products don’t have that kind of extreme spectrum, but annuities do, “just because that’s the nature of annuities and the nature of the regulatory landscape.” Methodology Policygenius commissioned YouGov to poll 2,353 Americans 18 or older. The survey was carried out online from April 25 through April 29, 2024. The results have been weighted to be representative of all U.S. adults. The average margin of error was +/- 2%. This story was produced by Policygenius and reviewed and distributed by Stacker.

PolicyGenius Frequently Asked Questions (FAQ)

When was PolicyGenius founded?

PolicyGenius was founded in 2014.

Where is PolicyGenius's headquarters?

PolicyGenius's headquarters is located at 32 Old Slip, 30th Floor, New York.

What is PolicyGenius's latest funding round?

PolicyGenius's latest funding round is Acquired.

How much did PolicyGenius raise?

PolicyGenius raised a total of $276.05M.

Who are the investors of PolicyGenius?

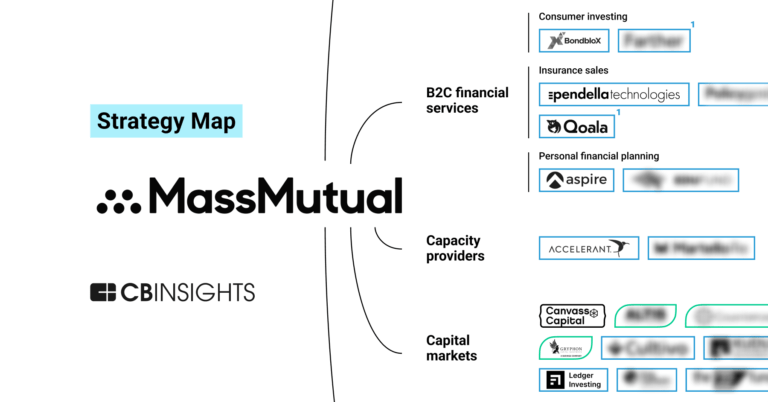

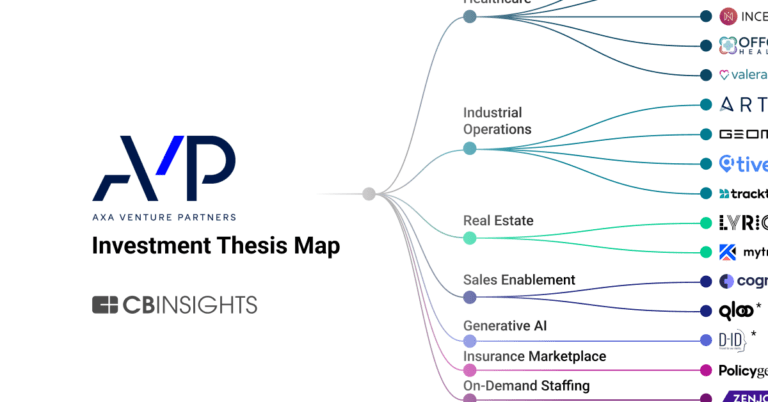

Investors of PolicyGenius include Zinnia, AVP, MassMutual Ventures, Norwest Venture Partners, KKR and 19 more.

Who are PolicyGenius's competitors?

Competitors of PolicyGenius include Next Insurance, NeueHealth, BIMA, Alan, Sixfold and 7 more.

What products does PolicyGenius offer?

PolicyGenius's products include Life Insurance and 2 more.

Loading...

Compare PolicyGenius to Competitors

Snapsheet specializes in insurance technology solutions. It enables a claim process starting with virtual estimations all the way to final repairs and payment by generating communication between consumers, shops, and carriers. The company offers a range of services, including appraisals, claims management, and payments, all aimed at managing the insurance claims process. It primarily serves the insurance industry. It was founded in 2011 and is based in Chicago, Illinois.

NeueHealth operates within the medical sector, providing care through its owned and affiliated clinics. It offers arrangements and tools for independent providers and medical groups, focusing on performance and population health. The company serves health consumers, providers, and payors in the healthcare industry. NeueHealth was formerly known as Bright Health Group Inc. It was founded in 2015 and is based in Minneapolis, Minnesota.

BIMA provides mobile-delivered insurance and health services in the financial services sector. The company offers a range of life, accident, and health insurance products that are registered and paid for via mobile technology, ensuring a paperless experience. BIMA primarily serves underserved communities through partnerships with mobile operators and microfinance institutions. It was founded in 2010 and is based in Singapore.

Alan focuses on providing health insurance services and preventive health solutions within the healthcare industry. The company offers health insurance plans, a healthcare system navigation tool through Alan Clinic, and mental well-being support with Alan Mind, designed to improve the health and productivity of individuals and corporate employees. Alan primarily serves diverse sectors, including tech startups, hospitality, the public sector, retail, and industrial businesses. It was founded in 2016 and is based in Paris, France.

Ladder provides term life insurance through a digital platform within the insurance industry. It offers affordable term life insurance policies with the flexibility to adjust coverage as the policyholder's life circumstances change. Its services are designed to be accessible online, with a paperless application process and tools like an insurance calculator to help customers determine their coverage needs. It was founded in 2015 and is based in Palo Alto, California.

HPOne operates within the healthcare sector, focusing on health insurance and Medicare plans. The company provides sales, marketing, and member outreach services to facilitate the management of Medicare and health insurance members. It was founded in 2006 and is based in Trumbull, Connecticut.

Loading...