project44

Founded Year

2014Stage

Series F - II | AliveTotal Raised

$879.3MValuation

$0000Last Raised

$81.1M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+11 points in the past 30 days

About project44

project44 operates within the logistics and transportation industry, offering a platform that provides real-time tracking and management of shipments across multiple modes. The company's services cater to various sectors including automotive, chemical, food and beverage, manufacturing, life sciences, and retail. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

project44's Product Videos

ESPs containing project44

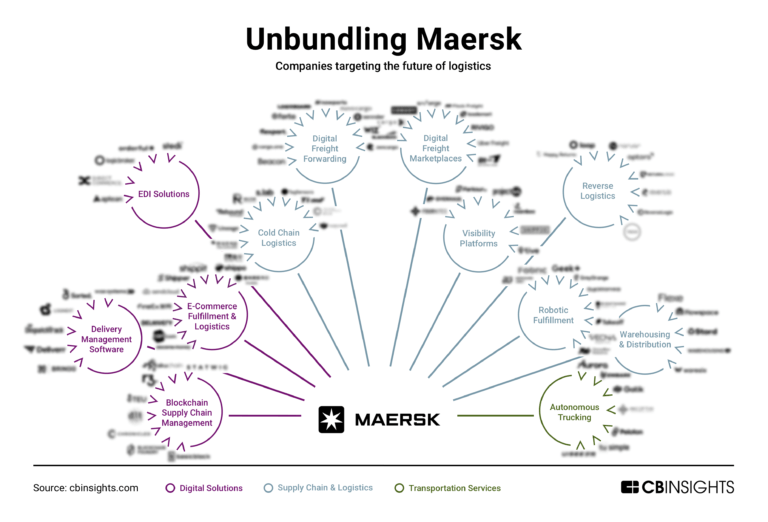

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The freight visibility platforms market, also referred to as the supply chain visibility platforms market, enables shippers and logistics service providers to gain real-time and predictive insight into their supply chain shipments across all modes of transport. The market offers end-to-end, multimodal visibility solutions that go beyond traditional track and trace solutions, as they can provide hi…

project44 named as Leader among 15 other companies, including FourKites, Shippeo, and Tive.

project44's Products & Differentiators

Truckload (FTL) Visibility

Increased visibility via real-time tracking for every truckload shipment in over 170 countries. Track by milestone, manage by exception with proactive notifications, and use enriched data and ML powered ETAs for the most accurate arrival, pickup, location, and delivery information.

Loading...

Research containing project44

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned project44 in 8 CB Insights research briefs, most recently on Feb 13, 2025.

Expert Collections containing project44

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

project44 is included in 4 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

7,009 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,270 items

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

project44 Patents

project44 has filed 14 patents.

The 3 most popular patent topics include:

- artificial intelligence

- machine learning

- natural language processing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/28/2022 | 1/16/2024 | Global Positioning System, Data management, Wireless locating, Social networking services, Geolocation | Grant |

Application Date | 6/28/2022 |

|---|---|

Grant Date | 1/16/2024 |

Title | |

Related Topics | Global Positioning System, Data management, Wireless locating, Social networking services, Geolocation |

Status | Grant |

Latest project44 News

Mar 25, 2025

Tenure as Postmaster General was marked by cost-cutting efforts, clashes with Congress. Ben Ames Ben Ames has spent 20 years as a journalist since starting out as a daily newspaper reporter in Pennsylvania in 1995. From 1999 forward, he has focused on business and technology reporting for a number of trade journals, beginning when he joined Design News and Modern Materials Handling magazines. Ames is author of the trail guide "Hiking Massachusetts" and is a graduate of the Columbia School of Journalism. AI Powered DeJoy has named a top lieutenant, Deputy Postmaster General Doug Tulino, to lead the 640,000-person agency until the Post Service Board of Governors name a permanent successor. Appointed by President Trump in 2020 near the end of his first term as President, DeJoy rose from a private sector job running a third-party logistics (3PL) firm called New Breed Logistics to take over a federal agency known for consistently losing money. He quickly launched a plan to improve USPS’ books through cost cuts and streamlined operations, and claimed incremental progress in that plan although the service has continued to post red ink in its quarterly earnings . DeJoy’s belt-tightening plan at USPS also led to frequent clashes with Congress over issues such as his early plan to replace its aging fleet with mostly gas-burning trucks instead of electric vehicles (EVs), frequent stamp rate hikes , and what some groups called an excessive focus on the agency’s profitability over its role as a public service. But DeJoy often said he enjoyed that combative tenure, and took pride in the steps he implemented to modernize the 250-year-old bureaucracy. In February, he informed the Postal Service Board of Governors of his plans to step down, and today he made it official. “While our management team and the men and women of the Postal Service have established the path toward financial sustainability and high operating performance – and we have instituted enormous beneficial change to what had been an adrift and moribund organization – much work remains that is necessary to sustain our positive trajectory,” DeJoy said in a release. “I am confident that Doug will continue our positive momentum during the period when the Governors undertake the important work of identifying and selecting the next Postmaster General. I also have no doubt that the entirety of the Postal Service will aggressively shape its future and become more efficient, capable, and competitive as it continuously changes and improves to best serve the American public.” In a separate announcement, the U.S. Postal Service Board of Governors announced it has retained the executive search firm Egon Zehnder to identify DeJoy’s successor, who will become the nation’s 76th Postmaster General. In a statement, the board said: “The Governors of the Postal Service expressed their appreciation for [DeJoy’s] transformational leadership during tumultuous times, which included a global pandemic and two presidential elections. As established by federal law, the selection of the Postmaster General rests with the Presidentially appointed and Senate confirmed members of the Board, who oversee the Postal Service as an independent establishment of the executive branch.” The Top 5 Feb 11, 2025 The growth of electric vehicles (EVs) is likely to stagnate in 2025 due to headwinds created by uncertainty about the future of federal EV incentives, possible tariffs on both EV and gasoline-powered vehicles, relaxed federal emissions and mileage standards, and ongoing challenges with the public charging network, according to a report from J.D. Power. Specifically, J.D. Power projects that total EV retail share will hold steady in 2025 at 9.1% of the market, or 1.2 million vehicles sold. Longer term, the new forecast calls for the EV market to reach 26% retail share by 2030, which is approximately half of the market share the Biden administration targeted in its climate agenda. A major reason for that flat result will be the Trump Administration’s intention to end the $7,500 federal Clean Vehicle Tax Credit, which has played a major role in incentivizing current EV owners to purchase or lease an EV, J.D. Power says. Even as EV manufacturers and consumers adjust to those new dynamics, the electric car market will continue to change under their feet. Whereas the early days of the EV market were defined by premium segment vehicles, that growth trend has now shifted to the mass market segment where franchise EV sales rose 58% in 2024, reaching a total of 376,000 units. That success came after mainstream franchise EV sales accounted for just 0.8% of total EV market share in 2021. In 2024, that number rose to 2.9%, as EVs from the likes of Chevrolet, Ford, Honda, Hyundai and Kia surged in popularity, the report said. This growth in the mass market segment—along with federal and state incentives—has also helped make EVs cheaper than comparable gas-powered vehicles, J.D. Power found. On average, at the end of 2024, the average cost of a battery-electric vehicle (BEV) was $44,400, which is $1,000 less than a comparable gas-powered vehicle, inclusive of hybrids and plugin hybrids. While that balance may change if federal tax incentives are removed, the trend toward EVs being a lower cost option has correlated with increases in sales, which will be an important factor for manufacturers to consider as they confront the current marketplace. Keep ReadingShow less Jan 10, 2025 Parcel carrier and logistics provider UPS Inc. has acquired the German company Frigo-Trans and its sister company BPL, which provide complex healthcare logistics solutions across Europe, the Atlanta-based firm said this week. According to UPS, the move extends its UPS Healthcare division’s ability to offer end-to-end capabilities for its customers, who increasingly need temperature-controlled and time-critical logistics solutions globally. UPS Healthcare has 17 million square feet of cGMP and GDP-compliant healthcare distribution space globally, supporting services such as inventory management, cold chain packaging and shipping, storage and fulfillment of medical devices, and lab and clinical trial logistics. More specifically, UPS Healthcare said that the acquisitions align with its broader mission to provide end-to-end logistics for temperature-sensitive healthcare products, including biologics, specialty pharmaceuticals, and personalized medicine. With 80% of pharmaceutical products in Europe requiring temperature-controlled transportation, investments like these ensure UPS Healthcare remains at the forefront of innovation in the $82 billion complex healthcare logistics market, the company said. Additionally, Frigo-Trans' presence in Germany —the world's fourth-largest healthcare manufacturing market—strengthens UPS's foothold and enhances its support for critical intra-Germany operations. Frigo-Trans’ network includes temperature-controlled warehousing ranging from cryopreservation (-196°C) to ambient (+15° to +25°C) as well as Pan-European cold chain transportation. And BPL provides logistics solutions including time-critical freight forwarding capabilities. Terms of the deal were not disclosed. But it fits into UPS' long term strategy to double its healthcare revenue from $10 billion in 2023 to $20 billion by 2026. To get there, it has also made previous acquisitions of companies like Bomi and MNX. And UPS recently expanded its temperature-controlled fleet in France, Italy, the Netherlands, and Hungary. "Healthcare customers increasingly demand precision, reliability, and adaptability—qualities that are critical for the future of biologics and personalized medicine. The Frigo-Trans and BPL acquisitions allow us to offer unmatched service across Europe, making logistics a competitive advantage for our pharma partners," says John Bolla, President, UPS Healthcare. Keep ReadingShow less Dec 05, 2024 As holiday shoppers blitz through the final weeks of the winter peak shopping season, a survey from the postal and shipping solutions provider Stamps.com shows that 40% of U.S. consumers are unaware of holiday shipping deadlines, leaving them at risk of running into last-minute scrambles, higher shipping costs, and packages arriving late. The survey also found a generational difference in holiday shipping deadline awareness, with 53% of Baby Boomers unaware of these cut-off dates, compared to just 32% of Millennials. Millennials are also more likely to prioritize guaranteed delivery, with 68% citing it as a key factor when choosing a shipping option this holiday season. Of those surveyed, 66% have experienced holiday shipping delays, with Gen Z reporting the highest rate of delays at 73%, compared to 49% of Baby Boomers. That statistical spread highlights a conclusion that younger generations are less tolerant of delays and prioritize fast and efficient shipping, researchers said. The data came from a study of 1,000 U.S. consumers conducted in October 2024 to understand their shopping habits and preferences. As they cope with that tight shipping window, a huge 83% of surveyed consumers are willing to pay extra for faster shipping to avoid the prospect of a late-arriving gift. This trend is especially strong among Gen Z, with 56% willing to pay up, compared to just 27% of Baby Boomers. “As the holiday season approaches, it’s crucial for consumers to be prepared and aware of shipping deadlines to ensure their gifts arrive on time,” Nick Spitzman, General Manager of Stamps.com, said in a release. ”Our survey highlights the significant portion of consumers who are unaware of these deadlines, particularly older generations. It’s essential for retailers and shipping carriers to provide clear and timely information about shipping deadlines to help consumers avoid last-minute stress and disappointment.” For best results, Stamps.com advises consumers to begin holiday shopping early and familiarize themselves with shipping deadlines across carriers. That is especially true with Thanksgiving falling later this year, meaning the holiday season is shorter and planning ahead is even more essential. According to Stamps.com, key shipping deadlines include: December 13, 2024: Last day for FedEx Ground Economy December 18, 2024: Last day for USPS Ground Advantage and First-Class Mail December 19, 2024: Last day for UPS 3 Day Select and USPS Priority Mail December 20, 2024: Last day for UPS 2nd Day Air December 21, 2024: Last day for USPS Priority Mail Express Note: UPS Ground dates may vary Keep ReadingShow less Dec 03, 2024 Retailers are deploying multiple carriers to deliver their packages, delivering lightning-fast delivery times this winter as peak season 2024 is off to the strongest start for e-commerce parcel handling since Covid-19, according to industry statistics from supply chain visibility platform provider Project44. That success comes as the last mile peak season ramps up, spanning November to January as the year’s highest annual volumes are driven by holiday shopping, returns, and events like Black Friday and Cyber Monday. Proejct44 measures retailers’ and e-tailers’ performance in managing that rush with a metric called “delivery time,” which comprises fulfillment time—from order placement to shipment readiness, including picking, packing, and upstream transit—and transit time, which is the journey from the warehouse to the customer. And in November 2024, the average delivery time was just 3.7 days—a 27% improvement from November 2023 and a 33% improvement from November 2022. That reduction shows a long-term trend where delivery times have decreased as online shopping grows and customer expectations rise, the report said. That move has been largely a reaction to Amazon’s standardization of 2-day shipping, which has reshaped the market, pushing companies to optimize processes and enhance satisfaction. Speed isn’t the only metric that matters, as customer satisfaction and retention also hinge on on-time performance—the accuracy of the initial ETA provided at order placement. Therefore, building and maintaining a healthy e-commerce customer base requires both delivery speed and delivery predictability, Project44 said. To deliver that performance—while mitigating shipping risks and increasing capacity—shippers increasingly use multiple carriers, the firm said. Counting by the average number of carriers used per account, carrier diversification has risen by two carriers per account since 2021, with a 5% increase between October and November 2024 as shippers expand their networks for peak season. According to Project44, this trend is fueled by the growing availability of smaller carriers like OnTrac, Deliver-it, and Veho, alongside established players such as UPS, FedEx, DHL, and USPS. To be sure, customers still file complaints about last-mile delivery performance, but complaints about delayed deliveries have dropped 8% since 2022 and are 1% lower than in 2023, Project44 said. The top complaints are: delivered but missing (28%), delayed (28%), carrier complaint (17%), damaged (14%), customer service (%), returned to sender (4%), and incorrect items delivered (4%). Keep ReadingShow less Oct 29, 2024 Having survived the demand surge of the pandemic and its aftermath, the parcel express market is undergoing an evolution of unprecedented proportions as the nation’s largest express carriers struggle to address multiple challenges—from a growing cast of new competitors, to rationalizing their networks and reining in surging costs, to dealing with flattening e-commerce volumes and a stubborn weakness in U.S. manufacturing and industrial output that’s putting a damper on parcel growth. Shippers have serious issues with the high cost of parcel service, exacerbated by a flurry of surcharges and changes implemented for this peak season, says Bart De Muynck, principal at strategic supply chain consulting firm Bart De Muynck LLC. “If you are doing high volumes in peak season, those increases mean tens of millions of dollars in extra parcel shipping costs,” he says. In response, shippers are diversifying their carrier bases and continuing to adjust and adapt their supply chain operating strategies, with a hard focus on how and when parcel shipments are delivered and by whom. “They’re looking at more regional providers for better rates and service,” De Muynck observes. “With new players coming into the market, especially in the last mile, that has created a lot more options for shippers.” That in itself is making parcel planning and management a much more difficult and complex endeavor, he adds. “And that means you need more technology to manage multiple providers effectively.” TURBULENT TIMES The parcel shipping market is undergoing an evolution that is fundamentally changing the structural foundation of the business, observes Satish Jindel, principal at ShipMatrix, a consulting firm that provides parcel data and analytics. “We are in the most turbulent time people have seen in the last 40 years,” he says. “The competition [that the major parcel carriers] are facing is unlike anything they have faced before. So they’re struggling to figure out who the competitors are, how [those competitors] will affect them, and how they need to respond.” Among the competitive challenges: the surging growth of Amazon’s own parcel and small-package delivery business, and competition from big retailers like Walmart, Costco, Home Depot, and Target, which have launched their own last-mile delivery services, fulfilling e-commerce orders directly from retail stores for delivery to local customers. Then there are crowdsourced last-mile delivery services like DoorDash and Roadie, which contract with drivers in their own vehicles to make local same-day deliveries for a wide range of businesses. And not to be forgotten are the regional parcel carriers like OnTrac (formerly LaserShip), which operate off lower cost bases and are expanding their coverage, as well as hyperlocal delivery firms that focus exclusively on an individual metro area. All these developments come in response to the demands of consumers who continue to fuel modest growth in retail spending—a consistent share of that, roughly 16%, represented by e-commerce sales—and the reality that short-distance home delivery of just about anything is here to stay. And that growth opportunity is enticing more players to jump into the BtoC last-mile market. TRADING DOWN Shippers and third-party logistics service providers (3PLs) are employing a laundry list of strategies and tactics as they try to rein in rising parcel shipping costs. At the same time, they are reworking the menu of e-commerce shipping options they offer to consumers, who are increasingly forgoing next-day delivery in favor of slower, deferred service if it will save them money—and help the environment. Micheal McDonagh is president of parcel services at 3PL AFS Logistics. He, for one, wonders how long the big parcel carriers can keep raising prices (and surcharges) before it becomes untenable and begins eroding their customer base. “The biggest thing for me with UPS and FedEx is how do they expect to keep customers, with the increases [and surcharges] they are [imposing]?” he says. “Their price increases are forcing shippers to look at other alternatives. Plus, they are generally less flexible about when they will take your parcels. They are more rigid with their cutoff times, and [their deadlines] are typically earlier than what some regional carriers will offer.” McDonagh estimates that with the large parcel carriers, parcel transport costs have increased 33% in the past five years. Such rate jumps are increasingly difficult for shippers to absorb, McDonagh says, especially when shippers typically set their budgets at the start of the year, only to get hit “in the last quarter [by] a raft of surcharges and zone changes they didn’t plan for.” That’s driving two trends among shippers and the 3PLs like AFS who manage freight and parcel transportation for their customers. “We are telling our customers to look at the U.S. Postal Service as an option,” McDonagh says. While the Postal Service may not be as quick, “[it is] cheaper,” he notes, adding that shippers are making that tradeoff to save money. He believes that the USPS is the nation’s largest parcel carrier, handling an estimated 6.6 billion packages annually. By his accounting, UPS handles 4.6 billion and FedEx 3.9 billion. The other trend is shippers “trading down” in service selection. “Shippers are reacting to the high cost of premium services and moving freight into the lower-cost … deferred ground services,” he notes. In addition, many retailers have curtailed the practice of offering free shipping for every e-commerce order, instead setting minimum order levels to qualify for free shipping or only offering free shipping for deferred two- or three-day service so the package can go via ground. For parcel carriers, this trend means that shipments moving via premium next-day service—which provide more revenue and higher margins—are being replaced with lower-revenue shipments. Shippers are also reimagining their shipping practices—instead of shipping small lots every day, they’re consolidating shipments and dropping them with carriers once or twice a week. That tactic helps the shipper negotiate lower rates with the carriers, who are not making as many stops to pick up parcels. “If you can mode-shift to slower services like the Postal Service or economy ground, you will save money,” says McDonagh. He also cites opportunities for shippers to reduce costs by examining how they package and box orders. Parcel shipments often arrive in a box that’s larger than necessary and contains excessive amounts of filler material. “How much are you paying to ship air, and what’s the cost of that unused space?” McDonagh asks. Among other things, the need to eliminate wasted space has led to the growth of automated packaging systems that will scan the product as it comes down the line and then custom build a box to that product’s dimensions. OFFERING CHOICES Chris Kina, senior director and analyst, logistics, customer fulfillment, and network design for the consulting and advisory firm Gartner, has spent 30 years as a logistics practitioner, working for Gillette, Procter & Gamble, and KB Toys before joining Gartner three years ago. In his conversations with logistics executives, Kina has detected a shift in strategies in response to today’s market. “We are seeing clients begin to look more and more at segmentation of their last-mile provider networks ... by region, by state, by metro area,” he says. “The question they are asking is, ‘Who can meet my service expectations at the lowest cost?’” It’s a trend driven by increasingly powerful, sophisticated, and capable technology platforms. These systems are designed to handle everything from order management and inventory visibility, to shipment and delivery route optimization, to shipment enroute visibility on the delivery side, to customer feedback. And virtually all communications between the shipper, delivery driver, and customer take place via smartphone. “These advanced technologies [and the real-time nature of their functionality] are the key to making it all work in this new environment,” he says. Bart De Muynck agrees with Kina’s observation, sharing one example of a new technology that’s rising to the challenge of a more complex and fragmented parcel market. De Muynck points to Shipium, a company launched by Amazon alum Jason Murray. According to De Muynck, Murray is building an Amazon-like platform for parcel optimization and carrier management—and is targeting as customers businesses that ship dozens to thousands of parcels a day from many locations. “It’s parcel optimization that provides for the most efficient allocation of freight from many locations across multiple carriers,” by examining the requirements of a shipment, then looking at the broader carrier network to find the best combination of service and price, he says. The platform also allows the shipper to model its parcel volumes against its carrier network to develop an optimized price/service tactical plan for shipping. “It is reducing [parcel shipping costs] by as much as 20%,” De Muynck adds. Gartner’s Kina also emphasizes how parcel shippers and managed transportation providers are deploying various tactical and strategic developments that add flexibility and options as shippers figure out the best delivery models for their business. Those include the use of small electric vans or bicycles for inner-city deliveries; locker systems at convenient retail sites, which serve as consolidated dropoff locations and customer pickup points, versus a truck making a residential stop; and cloud-based route optimization models and other tools, all of which “maximize the ability to select, manage, and deploy multiple forms of sources for delivery carriers,” Kina notes. Where is the market headed? In Kina’s view, “five years from now, the U.S. market will have more of a European flavor …. [It will be] much more fragmented around regional and local carriers, crowdsourcing [services], and technology solutions that help make deliveries of BtoB and BtoC shipments more efficient.” Another rising trend: Consumers, concerned about cost and sustainability, are seeking more choices, opting for deferred deliveries and consolidating their e-commerce purchases into a single large delivery on a designated day of the week—which Amazon is already doing. “Assuming everyone wants their shipment the next day is not a viable business strategy for any shipper,” Kina says. “Consumers will typically accept delivery in three days as long as you … are consistent with it. If they want expedited, they will [specify] that and often pay for it.” PLAYING THE LONG GAME Many sources interviewed for this story shared their intentions to move away from putting all their parcels in one or two big carrier buckets, instead seeking to diversify their carrier base to improve service, gain flexibility, and better control rising costs. Yet that’s not a strategy for everyone. “We play the long game,” says John Janson, vice president of global logistics at SanMar, the nation’s largest provider of branded promotional apparel. “We set a carefully crafted strategy and stick with it. We don’t put out a bid and change it from one year to the next. We develop and nurture strategic relationships with our core carriers, and we lean on those,” he says. SanMar, which ships almost exclusively to businesses, deploys a supply chain featuring 13 distribution centers across the U.S., which, during this year’s peak season, will ship over 100,000 packages nightly. UPS is SanMar’s principal parcel carrier. For Janson, one philosophy he’s never wavered from is being a shipper of choice. “I believe there is still currency around being a desired shipper, making our freight as attractive as possible to the carrier,” he emphasizes. “It’s easy when times are bad, but it pays dividends [when capacity is tight]. It’s an investment in our carrier partners and [in] ensuring we get the quality of service our customers demand.” He agrees with Jindel and others that in the parcel industry, “there is more dynamic change happening right now than at any time in recent history.” And the BtoC last-mile home delivery market—as opposed to the BtoB arena, where SanMar generally plays—is seeing the most significant change, he adds, noting that “there are some really interesting developments on the horizon.” He points to how Walmart has teamed up with The Home Depot on its “GoLocal” delivery-as-a-service business, giving Home Depot customers (and others) another option for same-day or next-day last-mile delivery. And as more retailers take Walmart up on its offer, that will help build more density in that network, reducing per-package costs and providing more revenue opportunity for the network’s delivery drivers. Then there is Amazon, which Janson notes is also offering third parties access to its logistics services and parcel delivery network. Essentially, Amazon’s pitch is “Let us deliver all your packages,” not just those generated as an Amazon reseller, he says. And while the pitch may sound enticing, Janson offers a word of caution. “Do you want Amazon to have access to all your final-mile delivery customers? And if you are using Amazon as a reseller and a logistics provider, how deep [do you really want that relationship to go]? I think it’s a risk.” Keep ReadingShow less

project44 Frequently Asked Questions (FAQ)

When was project44 founded?

project44 was founded in 2014.

Where is project44's headquarters?

project44's headquarters is located at 222, West Merchandise Mart Plaza, Chicago.

What is project44's latest funding round?

project44's latest funding round is Series F - II.

How much did project44 raise?

project44 raised a total of $879.3M.

Who are the investors of project44?

Investors of project44 include Emergence Capital, Chicago Ventures, 8VC, Omidyar Technology Ventures, Sozo Ventures and 20 more.

Who are project44's competitors?

Competitors of project44 include Pendulum, Shippeo, Overhaul, Tive, Portcast and 7 more.

What products does project44 offer?

project44's products include Truckload (FTL) Visibility and 3 more.

Who are project44's customers?

Customers of project44 include Bridgestone, ExxonMobil and Starbucks Corporation.

Loading...

Compare project44 to Competitors

FourKites specializes in supply chain intelligence and offers a platform that provides real-time visibility and execution across various transportation modes. The company's services include tracking multimodal shipments, optimizing inbound logistics, providing order lifecycle insights, managing inventory, and innovating yard logistics. FourKites serves a diverse range of sectors, including food and beverage, retail, consumer packaged goods, chemicals, oil and gas, manufacturing, and pharmaceuticals. It was founded in 2014 and is based in Chicago, Illinois.

Tive specializes in supply chain visibility solutions within the logistics and transportation sectors. The company offers products such as trackers and passive loggers that monitor the location and condition of shipments, including factors like temperature, humidity, and shock. It primarily serves industries such as food and beverage, high-value goods, life sciences, and transportation and logistics. It was founded in 2015 and is based in Charlestown, Massachusetts.

Shippeo provides multimodal transportation visibility within the supply chain industry. The company offers visibility solutions that include shipment tracking, carrier onboarding, and carbon emissions calculation, serving sectors such as automotive, consumer goods, and retail. It was founded in 2014 and is based in Paris, France.

Arviem specializes in providing real-time cargo tracking and monitoring services, focusing on enhancing supply chain visibility and security across various industries. The company offers solutions that enable accurate location and condition monitoring of shipments, utilizing sensor-based technology to ensure the integrity and quality of cargo during transit. Arviem's services cater to cargo owners, exporters, importers, and manufacturers, particularly those dealing with high-value, sensitive, or mission-critical goods. It was founded in 2008 and is based in Baar, Switzerland.

Flexport focuses on logistics and supply chain management. It offers services including customs brokerage, ocean and air freight, trucking, and fulfillment services. Flexport's platform enables businesses to manage their supply chain, covering aspects from order management to delivery, while also offering trade management and climate services. It was founded in 2013 and is based in San Francisco, California.

Vekia specializes in supply chain management solutions within the retail industry. The company offers predictive analytics and demand forecasting services powered by machine learning to optimize stock levels and automate inventory management. Vekia's solutions are designed to improve performance and efficiency for retailers by simplifying supply chain processes and enabling data-driven decision making. It was founded in 2008 and is based in Lille, France.

Loading...