Ramp

Founded Year

2019Stage

Secondary Market | AliveTotal Raised

$1.827BValuation

$0000Last Raised

$150M | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+36 points in the past 30 days

About Ramp

Ramp offers a financial operations platform that provides spend management services for businesses. It offers services including corporate cards, expense management, accounts payable solutions, and accounting automation. Its platform serves startups, small businesses, mid-market companies, and enterprises across sectors. It was founded in 2019 and is based in New York, New York.

Loading...

ESPs containing Ramp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The SaaS spend management software market provides platforms that help organizations monitor, control, and optimize their expenses on subscription-based software services. As businesses increasingly rely on diverse SaaS tools for various functions like CRM, analytics, and HR management, these solutions have become essential for financial governance. Vendors in this market offer capabilities includ…

Ramp named as Leader among 15 other companies, including SAP, Apptio, and Spendesk.

Ramp's Products & Differentiators

Ramp Card

Smart corporate cards - both physical and virtual - with embedded software controls.

Loading...

Research containing Ramp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ramp in 18 CB Insights research briefs, most recently on Oct 9, 2024.

Aug 23, 2024

The B2B payments tech market map

Oct 26, 2023

The CFO tech stack market map

Oct 18, 2023 report

State of Fintech Q3’23 Report

Oct 12, 2023

The procurement tech market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Ramp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ramp is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

2,003 items

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,466 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

599 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Ramp News

Apr 3, 2025

Plaid adia plano do IPO e levanta US$ 575 milhões em downround Fintech de open finance afirma que ainda não está pronta para oferta pública, mas esta deve ser sua última rodada antes do IPO Como rodada, Plaid deixa o IPO para depois | Foto: Canva A Plaid , fintech norte-americana que conecta contas bancárias a diferentes aplicações financeiras (de forma semelhante ao open banking no Brasil), estava há tempos na fila das empresas prontas para um IPO. No entanto, diante de um mercado desafiador, a fintech optou por outro caminho: levantou uma nova rodada de financiamento de US$ 575 milhões, a um valuation de US$ 6,1 bilhões. A rodada foi liderada por um grupo de novos investidores, incluindo Franklin Templeton, Fidelity e BlackRock . Investidores já existentes, como NEA e Ribbit Capital , também participaram. O acordo representa um downround significativo em relação à última rodada da Plaid , realizada em 2021, quando a empresa captou US$ 425 milhões com a Altimeter Capital e foi avaliada em US$ 13,4 bilhões. De acordo com o TechCrunch, um porta-voz da fintech reconheceu a desvalorização, mas a justificou como “apenas um reflexo da contração dos múltiplos em todo o mercado”, em razão das taxas de juros mais altas, que contrastam com o período de “vacas gordas” do Venture Capital. Por outro lado, o valuation da nova rodada já representa um aumento em relação à oferta feita pela Visa pela fintech em 2021, que foi de US$ 5,3 bilhões. No entanto, o negócio não foi adiante devido a questões regulatórias. Os recursos da rodada serão utilizados para oferecer liquidez à equipe atual por meio de uma oferta de recompra de ações para funcionários, além de cobrir a conversão de RSUs (restricted stock units) em ações, disse o CEO e cofundador Zach Perret (foto acima) em uma postagem no blog. Notícias Relacionadas Essa captação ocorre após o que o CEO descreveu como um “ano recorde em receita, um retorno às margens operacionais positivas e um aumento significativo nas empresas e mercados atendidos pela Plaid”. Ele não forneceu números exatos, mas afirmou que a receita cresceu mais de 25% em 2024 e que a empresa está se aproximando da “lucratividade sustentada”. Em uma carta aos acionistas, Zach ecreveu que novos produtos representaram mais de 20% da receita recorrente anual (ARR) da Plaid em 2024, “crescendo a uma taxa composta de 93% ao ano”. Apesar dos números positivos apresentados pelo CEO, a empresa destacou que ainda não está pronta para uma oferta pública de ações. No entanto, ele frisou que esta deve ser a última rodada da Plaid como empresa de capital fechado. “Um IPO está absolutamente no nosso caminho para os próximos anos. Não atribuímos um cronograma específico para isso”, disse o CEO. “Ainda temos muito trabalho interno a fazer. Não estamos prontos, e é por isso que não consideramos essa opção no momento.” A Plaid é mais uma entre várias empresas que estão optando por rodadas privadas de financiamento para permitir que funcionários vendam suas participações no mercado secundário. Ramp , DataBricks , OpenAI e Stripe também anunciaram captações secundárias para oferecer liquidez a alguns funcionários. A recente volatilidade das ações e o desempenho fraco dos IPOs recentes, incluindo o da CoreWeave na semana passada, esfriaram o apetite do mercado por novas aberturas de capital no setor de tecnologia. Compartilhar essa notícia

Ramp Frequently Asked Questions (FAQ)

When was Ramp founded?

Ramp was founded in 2019.

Where is Ramp's headquarters?

Ramp's headquarters is located at 28 West 23rd Street, New York.

What is Ramp's latest funding round?

Ramp's latest funding round is Secondary Market.

How much did Ramp raise?

Ramp raised a total of $1.827B.

Who are the investors of Ramp?

Investors of Ramp include Thrive Capital, Lux Capital, General Catalyst, Definition Capital, Khosla Ventures and 36 more.

Who are Ramp's competitors?

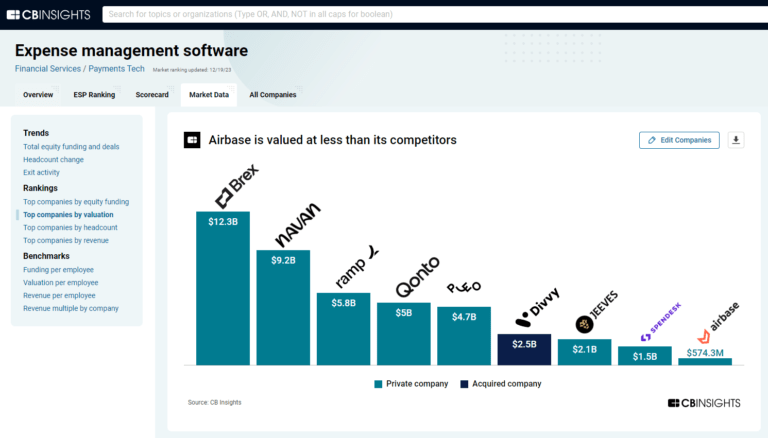

Competitors of Ramp include Center, Capital on Tap, Yokoy, Brex, Extend and 7 more.

What products does Ramp offer?

Ramp's products include Ramp Card and 4 more.

Who are Ramp's customers?

Customers of Ramp include Mode Analytics.

Loading...

Compare Ramp to Competitors

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Jeeves operates a financial platform providing payment and expense management solutions within the financial services industry. The company offers a suite of tools that streamline global finance operations, including multi-currency accounts, corporate card issuance, cross-border payments, and integrated expense management. Jeeves primarily serves businesses looking to manage their financial operations across multiple countries. It was founded in 2019 and is based in Orlando, Florida.

Spendesk provides financial management tools for businesses. The company offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. The company was founded in 2016 and is based in Paris, France.

Mesh focuses on travel and expense management for enterprises operating within the financial technology sector. The company offers a platform that provides solutions for travel management, spend management, and expense management, aiming to provide real-time visibility, control, and insights into all expenses. Mesh primarily serves modern global enterprises. It was founded in 2018 and is based in New York, New York.

Loading...