Razor Group

Founded Year

2020Stage

Loan | AliveTotal Raised

$1.162BValuation

$0000Last Raised

$15M | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-54 points in the past 30 days

About Razor Group

Razor Group is a company focused on developing consumer products within the e-commerce sector. The company specializes in acquiring and integrating e-commerce businesses, utilizing its expertise in entrepreneurship, finance, and product development along with technology to improve brand potential and operational efficiency. It was founded in 2020 and is based in Berlin, Germany.

Loading...

Loading...

Research containing Razor Group

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Razor Group in 1 CB Insights research brief, most recently on May 11, 2023.

Expert Collections containing Razor Group

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Razor Group is included in 2 Expert Collections, including E-Commerce.

E-Commerce

11,245 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,270 items

Razor Group Patents

Razor Group has filed 60 patents.

The 3 most popular patent topics include:

- military trucks

- armoured personnel carriers

- cycle types

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/16/2022 | 3/4/2025 | Automotive transmission technologies, Gears, Engine technology, Mechanisms (engineering), Rotation | Grant |

Application Date | 6/16/2022 |

|---|---|

Grant Date | 3/4/2025 |

Title | |

Related Topics | Automotive transmission technologies, Gears, Engine technology, Mechanisms (engineering), Rotation |

Status | Grant |

Latest Razor Group News

Mar 14, 2025

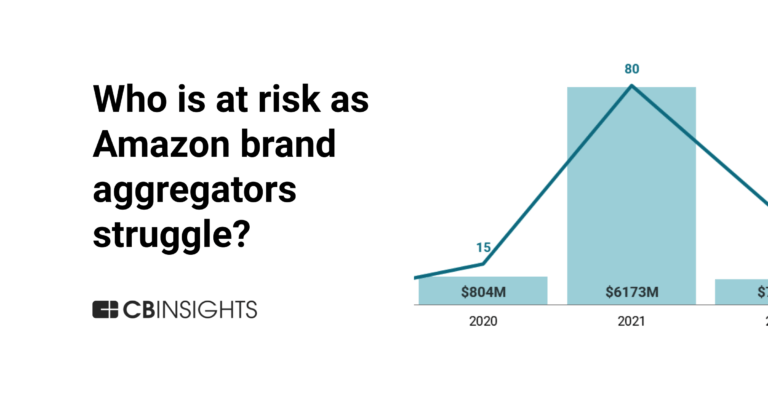

A total of $30 million in bridge financing has been granted to Razor over recent months by lenders such as Victory Park Capital Advisors as well as equity investors including Christian Angermayer’s Presight Capital Bloomberg Updated14 Mar 2025, 04:35 PM IST BlackRock and Victory Park joined Razor’s roster of lenders in May 2021. However, the investment has since soured with a BlackRock middle-market private credit fund downgraded to junk last week Investors including BlackRock Inc. have agreed to provide another loan of at least $15 million to Razor Group, according to people familiar with the matter, as the German e-commerce brand aggregator attempts to stave off a liquidity crunch. The relatively modest financing proposal indicates the severity of the cash squeeze at the Berlin-based firm that, according to Pitchbook data, has raised more than $1.3 billion in capital. It’s part of a turnaround effort that includes talks between Razor and fellow aggregator Infinite Commerce Inc. for a potential merger, the people said, asking not to identified because the process is confidential. A total of $30 million in bridge financing has been granted to Razor over recent months by lenders such as Victory Park Capital Advisors as well as equity investors including Christian Angermayer’s Presight Capital, the people added. The company is also working on a potential fundraising with existing shareholders, according to emails sent to investors in late February and seen by Bloomberg News. Communications show that Razor investors were contemplating a financing of at least $75 million alongside the M&A deal. Spokespeople for Razor, BlackRock and Presight Capital declined to comment on the proposed turnaround. Spokespeople for Victory Park and Infinite Commerce didn’t respond to requests for comment. E-Commerce Bet So-called Amazon aggregators buy up firms that sell products via online platforms, with the aim of saving costs on logistics and marketing by bundling brands under one roof. The boom in e-commerce during the pandemic encouraged investors to bet billions on these businesses, but falling consumer demand since the end of lockdown has seen a wave of restructuring across the sector — to the detriment of their investors. One of their main strategies for plugging holes in these aggregators’ balance sheets has been masterminding consolidation between the e-commerce conglomerates themselves. Infinite Commerce, the potential merger partner, is itself a combination of four brand aggregators that were merged with the help of Victory Park last year. Razor Group also acquired Perch — another BlackRock investment in the aggregator sector — last year. BlackRock and Victory Park joined Razor’s roster of lenders in May 2021, according to a statement at the time. However, the investment has since soured with a BlackRock middle-market private credit fund downgraded to junk last week, in part due to “credit challenges” stemming from brand aggregators. That included a $50.3 million unrealized loss on Razor as of Dec. 31. The publicly traded fund, BlackRock TCP Capital Corp., will “avoid meaningful concentrations in any one industry subsector, such as Amazon aggregators,” Chief Executive Officer Phil Tseng said on a Feb. 27 earnings call. The industry consolidation is fraught with tension between equity holders — who don’t want to take complete losses on their investments — and creditors, who are usually first to be paid in a liquidation but know they’ll only get pennies on the dollar. The hope is that with further acquisitions, Razor can aim for an initial public offering and offer something in return for all investors. Razor ran into issues with inventory, according to the emails from late last month. A delay in closing the purchase of Perch as well as liquidity constraints led to a pause in new orders, leading to periods when products were out of stock. Supply-chain issues also contributed to difficulties replenishing stock later, the messages show. This pressure on earnings eventually led Razor to breach the debt terms of a working capital facility, which then prompted Razor’s other lenders to allege a default on their own financing, according to the emails. This paved the way for discussions over a consensual solution, they show. BlackRock also was involved in the restructuring of SellerX, another German brand aggregator, and agreed to take a stake in the company as part of a debt-for-equity swap, Bloomberg previously reported. Another of its brand aggregator investments, Thrasio, emerged from Chapter 11 bankruptcy last year.

Razor Group Frequently Asked Questions (FAQ)

When was Razor Group founded?

Razor Group was founded in 2020.

Where is Razor Group's headquarters?

Razor Group's headquarters is located at Ritterstraße 16-18, Berlin.

What is Razor Group's latest funding round?

Razor Group's latest funding round is Loan.

How much did Razor Group raise?

Razor Group raised a total of $1.162B.

Who are the investors of Razor Group?

Investors of Razor Group include BlackRock, Presight Capital, Redalpine Venture Partners, Global Founders Capital, 468 Capital and 12 more.

Who are Razor Group's competitors?

Competitors of Razor Group include Evenflow, Heyday, Perch, Thrasio, unybrands and 7 more.

Loading...

Compare Razor Group to Competitors

SellerX is a company that acquires and scales Amazon businesses within the eCommerce sector. They assist entrepreneurs in selling their businesses and provide support in analytics, processes, and production. SellerX primarily serves the eCommerce industry and provides a pathway for business owners to transition to new ventures. It was founded in 2020 and is based in Berlin, Germany.

Thrasio specializes in the acquisition and growth of Amazon FBA businesses within the consumer goods industry. The company enhances and scales brands by leveraging data science to improve product ratings, reviews, and rankings and expands its reach across multiple retailers and marketplaces. Thrasio was formerly known as Thras.io. It was founded in 2018 and is based in Walpole, Massachusetts.

Rainforest serves as an e-commerce aggregator and brand builder that specializes in the acquisition and scaling of e-commerce brands, particularly in the home and mom-and-baby product sectors. The company offers a suite of services, including in-house marketing, product development, and brand development. Rainforest targets brands with a strong presence on Amazon FBA and seeks to expand them across new marketplaces and channels. It was founded in 2020 and is based in Singapore.

101 Commerce is a company that operates in the private label brand sector. The company acquires, invests in, and launches private label brands that utilize Amazon's FBA (Fulfilled by Amazon) services, enabling them to focus on product design and customer service. 101 Commerce uses technology, supply-chain efficiencies, and data-driven marketing to manage the brands. It was founded in 2018 and is based in Austin, Texas.

Forum Brands focuses on acquiring high-potential digital brands and transforming them into omnichannel leaders within the family, health and wellness, and pet product sectors. The company's main offerings include identifying promising brands, providing growth strategies, and managing brand development to enhance its presence across various sales channels. Forum Brands primarily serves the ecommerce industry, targeting brands that cater to family, health & wellness, and pet care markets. It was founded in 2020 and is based in New York, New York.

Boosted Commerce is a consumer product goods platform that specializes in the acquisition and growth of ecommerce businesses within the online retail sector. The company focuses on purchasing businesses from third-party sellers on platforms such as Amazon FBA and Shopify, and invests in the development of original products across various market verticals. Boosted Commerce primarily targets sellers in the ecommerce industry who are looking to exit their businesses. It was founded in 2020 and is based in Beverly Hills, California.

Loading...