Relativity Space

Founded Year

2016Stage

Angel | AliveTotal Raised

$1.405BMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-28 points in the past 30 days

About Relativity Space

Relativity Space operates a commercial launch company that focuses on the aerospace industry. The company specializes in providing launch services using reusable rockets and manages additive manufacturing to reduce vehicle complexity and production costs. Relativity Space primarily serves the space infrastructure sector with its launch capabilities. It was founded in 2016 and is based in Long Beach, California.

Loading...

ESPs containing Relativity Space

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The space launch systems (SLSs) market is a highly competitive and rapidly evolving space that focuses on providing launch solutions for space missions. It encompasses various companies and organizations that develop and operate launch vehicles capable of delivering payloads into space. These launch systems are designed to meet the specific requirements of different customers, including government…

Relativity Space named as Challenger among 15 other companies, including SpaceX, Boeing, and Northrop Grumman.

Loading...

Research containing Relativity Space

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Relativity Space in 3 CB Insights research briefs, most recently on May 4, 2023.

Jun 23, 2022 report

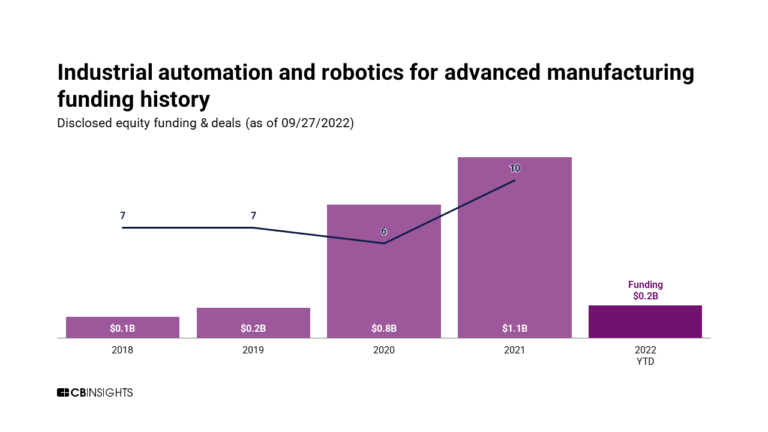

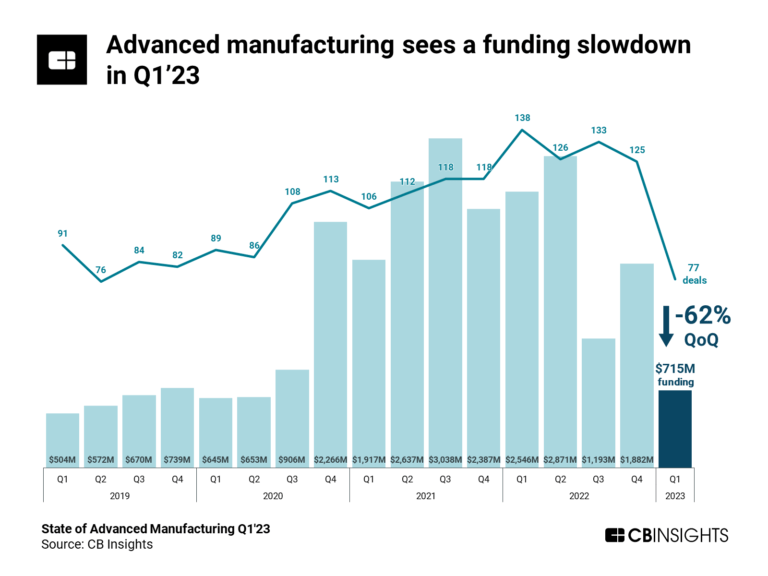

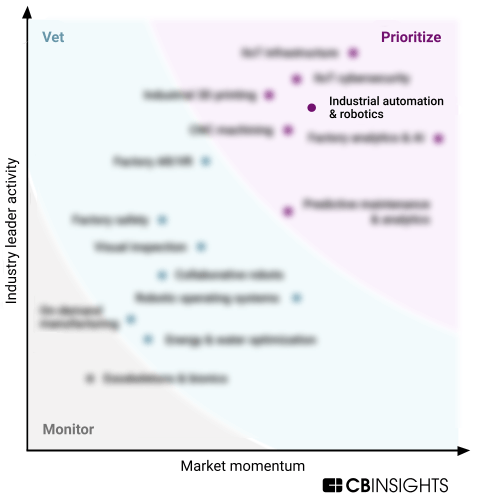

Why advanced manufacturers are prioritizing industrial automation & roboticsExpert Collections containing Relativity Space

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Relativity Space is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Game Changers 2018

70 items

Future Unicorns 2019

50 items

Advanced Manufacturing

6,609 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Aerospace & Space Tech

3,776 items

These companies provide a variety of solutions, ranging from industrial drones to electrical vertical takeoff vehicles, space launch systems to satellites, and everything in between

Defense Tech

1,021 items

Defense tech is a broad field that encompasses everything from weapons systems and equipment to geospatial intelligence and robotics. Company categorization is not mutually exclusive.

Relativity Space Patents

Relativity Space has filed 11 patents.

The 3 most popular patent topics include:

- welding

- 3d printing

- 3d printing processes

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/26/2019 | 2/16/2021 | Artificial neural networks, Machine learning, Classification algorithms, Sensors, Artificial intelligence | Grant |

Application Date | 11/26/2019 |

|---|---|

Grant Date | 2/16/2021 |

Title | |

Related Topics | Artificial neural networks, Machine learning, Classification algorithms, Sensors, Artificial intelligence |

Status | Grant |

Latest Relativity Space News

Apr 2, 2025

The State of Launch 2025 Sign Up You are now subscribed to our list. Be sure to add us to your contacts, so we don’t end up in your spam folder! The state of US launch is overwhelmingly the state of SpaceX. SpaceX accounted for a whopping 95% of the 145 US launches last year. The launch giant provides America’s only certified domestic crewed ride to the ISS. And that’s all without talking about Starship, the company’s mega launcher that holds NASA’s future Moon and Mars ambitions in its fins. Despite SpaceX’s dominance of the global launch industry, it’s far from the only player. Rocket Lab is hot on SpaceX’s heels, launching regular missions for military, civil, and commercial customers in the US and New Zealand. “There’s nobody else that’s demonstrating launch cadence and reliability other than SpaceX and us,” Rocket Lab founder and CEO Peter Beck told Payload. “And, not to say that there’s not other good providers, but they’re just not demonstrating launch cadence right now.” Many launch providers—in the US but also around the world—are working to overcome the technical (and high price tag) barriers to launch. They must do so to serve the growing space industry, which is looking for more rides to more orbits. “There’s a variety of needs in terms of the types of payloads and where they need to be launched to,” ULA’s Mark Peller, senior vice-president for the Vulcan program, told Payload. “It will require a diversity in the marketplace in terms of launch vehicle providers and the systems that they bring.” The race ahead won’t just be about going to space. Rather, it will be about which company can do it most often, without failures, while bringing in paychecks—and who will get left behind trying. Breaking the barrier: Launch is widely seen as the sexy part of the space industry. It’s also technologically difficult and capital intensive, with sky-high barriers to entry. After years of investment, winners (and losers) are emerging. As a result, you don’t see many new small launch companies founded nowadays. “Physics doesn’t care how much capital you’ve got. Poor engineering decisions don’t care how much capital you’ve got,” said Beck. “For a rocket company to come together to produce a product…and business that works is really, really hard.” Even if a new entrant can get together the money and talent required to cross the Kármán line, success also means bringing something different to the crowded market. ULA’s key consideration was customer flexibility—and differentiating itself from the crowd. “When we first set out to develop Vulcan, we were looking at the variety of missions required to support national security…” Peller told Payload. “That’s what we designed the system around. And, it turns out that can be a really good fit for other applications, as well for both civil and commercial.” Relativity Space’s Chief Revenue Officer Josh Brost said he looks for three things when it comes to whether a launch company will make it: Can reliably launch its mission. Has compelling economics. Delivers enough launch capacity for its business. “Everyone should reserve the right to be disrupted,” added Beck. “It’s just harder than it was before.” Growing pains: While the launch industry has lots of demand, companies also face challenges. A top concern for nearly every exec we spoke to? Supply chain fragility, with Beck citing it as the industry’s Achilles’ heel. “There can be very large projects for a number of years, and then just nothing for a number of years, so it creates a lot of fragility and lack of scale within this supply base,” said Beck. Launch site capacity is another area where supply is not meeting demand. Most US launches lift off from Florida’s space coast, creating congestion and scheduling conflicts. And, to worsen matters, more frequent launches stress local infrastructure. Officials floated a few solutions, including: More infrastructure investment from industry and government Better communication between government agencies and launch providers Increased collaboration among launch providers to take advantage of every opportunity to launch. Finally, companies have struggled with complex regulations — particularly delays in applying for the more streamlined Part 450 licensing process. While some firms have navigated the new process successfully, others are fighting for greater efficiency and predictability. “Any time there’s a big regulatory change, both sides—regulators and operators—need to learn how to operate efficiently in that space,” said Brost. Size matters: There’s no one-size-fits-all approach for launch. Rideshare missions offer cheaper rides to a set destination. Dedicated small launchers are more like Ubers, getting you exactly where you need to go. Heavy launch can lift lots of mass to orbit, one day enabling the building of infrastructure in space. On the smaller side of the launch spectrum, rideshare missions such as SpaceX’s Transporter series don’t make small-dedicated launches irrelevant—in fact, they do just the opposite. Small-lift vehicles like Rocket Lab’s Electron and Firefly’s Alpha play a crucial role in meeting specific demands that larger rockets can’t efficiently support. “We see Firefly as complementary to SpaceX,” Firefly’s Alpha Chief Engineer Jordi Paredes Garcia told Payload. “Like other transportation modes…, a small/medium/large model is critical to support the diverse needs of the launch market. Not everybody wants to ride the bus.” However, customers looking for heavy launch also want a robust, competitive market place in the 20-ton range. That’s why Relativity abandoned Terran-1 after its first launch and pivoted to build the larger Terran-R two years ago, according to Brost. “I think there are use cases where it can make sense to use smaller launch vehicles, but those are the more niche applications that don’t scale them the same kind of way,” said Brost. “What you’ll see is…customers who want to do their demo satellites on a small launcher and then deploy their constellation on a large launcher, as an example.” In the end, launching is all about one thing: economics. If a vehicle is too small, it could take dozens of launches to generate the same revenue and margin as a single heavy-lift launch. If a vehicle is too big, it may not have enough demand to completely fill rides. For ULA, the economics just didn’t add up for small-lift vehicles, so the firm stuck with the heavy-lift market. “The figure of merit we always look at is dollars per pound to orbit, or dollars per spacecraft. Those economics just get better as you go up to medium- and heavy-lift,” Peller told Payload. Reusability: Many startups are incorporating first-stage reusability as a tool to cut manufacturing costs (and time) and boost launch cadence—and with it, their profits. Second-stage reusability, however, remains a more nuanced conversation. According to Beck, it makes sense at a large scale like Starship, but not so much for the mediumlift category like Rocket Lab’s Neutron or SpaceX’s Falcon 9. “You notice that Elon never ever did a reusable second stage for a Falcon 9,” said Beck. “That’s because the economics make no sense to do that, but it does make sense on a very large launch vehicle.” For missions beyond LEO, reusability can take on a different form. Peller explained how flying back doesn’t make sense technically and economically for Vulcan. That is why ULA is developing “Smart Reuse”— a future Vulcan upgrade focused on non-propulsive, downrange recovery of just the first-stage engines. “We’re not using any fuel to support reuse, so all that fuel can be used to support the primary mission and deliver the most value to our customer downrange,” said Peller. “We’re recovering…just the engine module…the majority of the value of the booster.” The final word: Despite all of these challenges in navigating the industry, the officials we spoke to were optimistic about the opportunities for “a new era” of launch, in Brost’s words. “Things are changing in many ways…it’s a very dynamic business to be operating in right now, and a really exciting time,” said Peller. Share

Relativity Space Frequently Asked Questions (FAQ)

When was Relativity Space founded?

Relativity Space was founded in 2016.

Where is Relativity Space's headquarters?

Relativity Space's headquarters is located at 3500 East Burnett Street, Long Beach.

What is Relativity Space's latest funding round?

Relativity Space's latest funding round is Angel.

How much did Relativity Space raise?

Relativity Space raised a total of $1.405B.

Who are the investors of Relativity Space?

Investors of Relativity Space include Eric Schmidt, K5 Global Technology, Consus Asset Management, Hanwha Aerospace, NH Investment & Securities and 36 more.

Who are Relativity Space's competitors?

Competitors of Relativity Space include iSpace and 7 more.

Loading...

Compare Relativity Space to Competitors

Exos Aerospace specializes in suborbital space access and operates within the aerospace industry. The company provides launch services using reusable rockets and offers options for orbital transfer and space transportation, utilizing Type 5 carbon composite tanks. It serves sectors that require space access for scientific, educational, and exploratory purposes. It was founded in 2014 and is based in Greenville, Texas.

Orbital ATK is a company focused on aerospace and defense, providing systems and services for space-related applications. The company offers a range of products including space launch vehicles, satellite components, and missile defense systems. Orbital ATK serves various sectors including government and commercial space and defense markets. Orbital ATK was formerly known as Orbital ATK. It was founded in 2015 and is based in Dulles, Virginia. Orbital ATK operates as a subsidiary of Northrop Grumman.

SpaceX designs, manufactures, and launch rockets and spacecraft in the aerospace industry. Its offerings include launch services for payloads like satellites and cargo, as well as the development of spacecraft for human spaceflight. SpaceX serves sectors such as government space agencies and commercial satellite operators. It was founded in 2002 and is based in Hawthorne, California.

United Launch Alliance specializes in space launch services, providing reliable access to space with a focus on advanced rocket technology. The company offers a range of rockets, including the next-generation Vulcan, as well as the Atlas V, Delta IV, and Delta II, which are designed to deliver payloads into orbit with precision and reliability. United Launch Alliance primarily serves the needs of commercial spaceflight, national defense, and scientific research sectors. It was founded in 2006 and is based in Englewood, Colorado.

Blue Origin specializes in aerospace and spaceflight services, focusing on controlling the cost of access to space. It designs and manufactures reusable rocket engines, launch vehicles, in-space systems, and lunar landers to facilitate space exploration and development. Its primary market includes government and commercial entities in the space exploration and satellite deployment sectors. It was founded in 2000 and is based in Kent, Washington.

Perigee Aerospace is an aerospace technology company that specializes in the development and deployment of space technology solutions. It manufactures orbital launch vehicles. Its vehicle is designed to lift small satellites into low-altitude and high-inclination orbits, which are useful for weather, remote sensing, and imaging satellites. It enables space researchers to send necessary payloads into the orbital atmosphere. The company was founded in 2018 and is based in Daejeon, South Korea.

Loading...