Upstox

Founded Year

2009Stage

Series C | AliveTotal Raised

$54MValuation

$0000Last Raised

$25M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-38 points in the past 30 days

About Upstox

Upstox is an online trading platform that specializes in stock market trading and investment services. The company offers a range of financial products, including demat and trading accounts, mutual funds, IPO applications, and tools for tax planning and investment calculations. Upstox provides a technology-driven trading experience with access to various markets such as equities, futures and options, commodities, and currencies. It was founded in 2009 and is based in Mumbai, India.

Loading...

Loading...

Research containing Upstox

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Upstox in 2 CB Insights research briefs, most recently on Jun 14, 2023.

Expert Collections containing Upstox

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

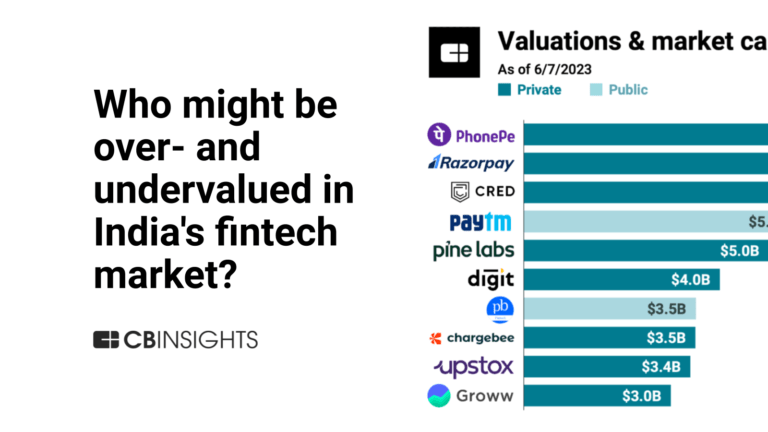

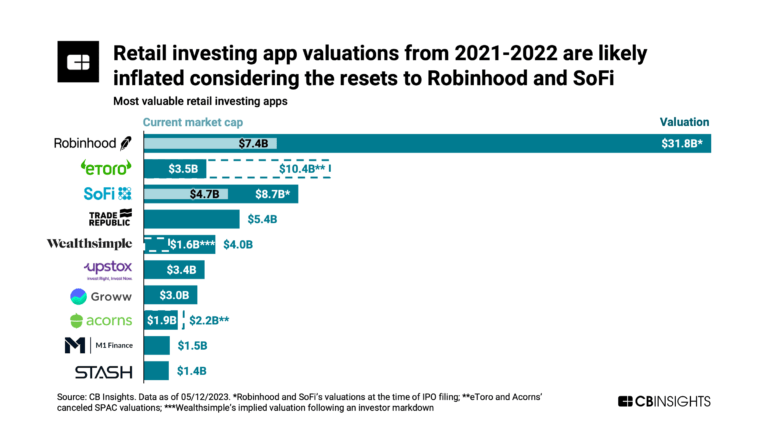

Upstox is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Wealth Tech

2,383 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

13,699 items

Excludes US-based companies

Latest Upstox News

Mar 11, 2025

This comes days after Zerodha cofounder and CEO Nithin Kamath said that the company is seeing degrowth in its business for the first time in 15 years. He estimated that there was a 30% decrease in activity across brokers. “Combined with the true-to-market circular, we are seeing degrowth in the business for the first time since we started 15 years ago,” Kamath said in a post on X. In line with his estimation, market leader Groww’s active user base also plunged by about 30% to 95.38 Lakh in February from 1.32 Cr at the end of January 2025, NSE data showed. Almost all brokerages were hit by the negative sentiment last month, with the cumulative active users of all platforms combined falling 19% to 4.08 Cr from 5.02 Cr in January. While third largest brokerage Angel One saw its user base contract 21% month-on-month (MoM) to 61.12 Lakh, Upstox’s active user base was dented by 3 Lakh to 25.17 Lakh. Paytm Money was an anomaly, with its active user base growing to 8.02 Lakh by the end of February from 6.91 Lakh in the previous month. The decrease in the number of active users comes at a time when the broader market has been on a downward trajectory for the last few months. While Sensex has slumped nearly 6% since January, Nifty 50 has fallen by a little over 5%. The uncertainty around US president Donald Trump’s tariff decisions, weak Q3 earnings of Indian companies, a recovery in the Chinese market, and a selling spree of foreign institutional investors (FIIs) are among the reasons for the fall in the market . As a result, about half of the 32 new-age tech stocks under Inc42’s coverage have plunged to fresh all-time lows in recent times. For instance, Ola Electric , MobiKwik , RateGain and Tracxn touched new lows during intraday trading today.

Upstox Frequently Asked Questions (FAQ)

When was Upstox founded?

Upstox was founded in 2009.

Where is Upstox's headquarters?

Upstox's headquarters is located at Senapati Bapat Marg, Dadar (West), Mumbai.

What is Upstox's latest funding round?

Upstox's latest funding round is Series C.

How much did Upstox raise?

Upstox raised a total of $54M.

Who are the investors of Upstox?

Investors of Upstox include Tiger Global Management, Kalaari Capital, Aragen, Ratan Tata and Reddy Ventures.

Who are Upstox's competitors?

Competitors of Upstox include Sharekhan, Nuvama Wealth Management, Anand Rathi Wealth Services, Paytm, 5paisa and 7 more.

Loading...

Compare Upstox to Competitors

HDFC Securities is a financial services provider that offers various investment products and services. The company provides online trading in equities, mutual funds, derivatives, currencies, and commodities, along with investment advisory and financial planning tools. HDFC Securities serves retail and institutional investors through its digital trading platforms. It was founded in 2000 and is based in Mumbai, India.

Zerodha is a financial services company specializing in discount broking and online stock trading. The company offers a platform for investing in stocks, derivatives, mutual funds, ETFs, and bonds with a transparent flat fee pricing model. Zerodha provides educational resources and a community for traders and investors. It was founded in 2010 and is based in Bengaluru, India.

Kotak Securities is a financial services company that focuses on online stock trading and investment across various asset classes. The company offers products including equities, mutual funds, futures and options, IPOs, and others, for individual and institutional clients. Kotak Securities serves retail investors and traders who manage their investments and trading activities through digital platforms. It was founded in 1994 and is based in Mumbai, India.

PredictRAM focuses on risk management in the financial domain. The company offers artificial intelligence-driven solutions for registered advisors and research analysts, providing insights and data-driven solutions for portfolio risk analysis. Its solutions include individual risk analysis, portfolio risk analysis, market event risk analysis, and risk mitigation strategies through customized exchange-traded fund (ETF). Primarily it serves the financial service sector. The company was founded in 2020 and is based in New Delhi, India.

Ventura operates as a brokerage firm. The company provides a complete array of financial products and services, as well as facilitates clients to trade in equity online. Ventura serves clients in India. It is based in Thane, India.

Groww is a financial services company specializing in investment and trading platforms. The company offers a range of services, including equity trading, direct mutual funds, and investment in US stocks, all through a user-friendly online platform. Groww provides tools for both systematic investment plans (SIPs) and lumpsum investments, as well as educational resources to empower investors. It was founded in 2016 and is based in Bengaluru, India.

Loading...