Scalable Capital

Founded Year

2014Stage

Series E - II | AliveTotal Raised

$378.95MValuation

$0000Last Raised

$64.67M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+77 points in the past 30 days

About Scalable Capital

Scalable Capital is a financial technology company that specializes in digital wealth management and brokerage services. The company offers a platform for trading stocks, exchange-traded funds, and other financial instruments, as well as automated wealth management services using globally diversified exchange-traded fund portfolios. Scalable Capital primarily serves private individuals looking to invest and manage their assets. It was founded in 2014 and is based in Munich, Germany.

Loading...

Loading...

Research containing Scalable Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Scalable Capital in 1 CB Insights research brief, most recently on Jun 8, 2022.

Expert Collections containing Scalable Capital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Scalable Capital is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Wealth Tech

2,383 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Scalable Capital News

Apr 7, 2025

Kunden von Scalable und Trade Republic können zeitweise nicht auf Depots zugreifen Unruhe an Aktienmärkten: Kunden von Scalable und Trade Republic können zeitweise nicht auf Depots zugreifen Link kopiert! picture alliance / Eibner-Pressefoto | Eibner-Pressefoto/Jonas Lohrmann Donald Trumps angekündigte Zusatzzölle führen weltweit zu Kursstürzen an den Börsen und verunsichert Anleger. Zusätzlich konnten Kunden am Montagmorgen nicht auf ihre Depots bei den beiden Neobrokern Scalable Capital und Trade Republic zugreifen. Bei beiden Anbietern wurde stattdessen eine Meldung angezeigt, dass die Daten aktuell nicht geladen werden könnten. Die von US-Präsident Trump angekündigten Zusatzzölle führen weltweit zu Kursstürzen an den Börsen und verunsichern Anleger. Das betrifft auch die beiden Neobroker Scalable Capital und Trade Republic . Beide Anbieter hatten am Montagmorgen wohl technische Probleme. Kunden konnten nicht auf ihre Depots zugreifen, stattdessen wurde eine Meldung angezeigt, dass die Daten aktuell nicht geladen werden könnten. Lest auch

Scalable Capital Frequently Asked Questions (FAQ)

When was Scalable Capital founded?

Scalable Capital was founded in 2014.

Where is Scalable Capital's headquarters?

Scalable Capital's headquarters is located at Seitzstrasse 8e, Munich.

What is Scalable Capital's latest funding round?

Scalable Capital's latest funding round is Series E - II.

How much did Scalable Capital raise?

Scalable Capital raised a total of $378.95M.

Who are the investors of Scalable Capital?

Investors of Scalable Capital include HV Capital, Balderton Capital, BlackRock, Tengelmann Ventures, Tencent and 7 more.

Who are Scalable Capital's competitors?

Competitors of Scalable Capital include InvestSuite, Froots, Flink, Peaks, Wealthfront and 7 more.

Loading...

Compare Scalable Capital to Competitors

Plum is a smart money app that specializes in financial automation, investment services, and savings accounts. The company offers a range of products including automated saving tools, investment options such as stocks and funds, and personal finance management features. Plum primarily serves individuals looking to manage their personal finances more effectively. It was founded in 2016 and is based in London, United Kingdom.

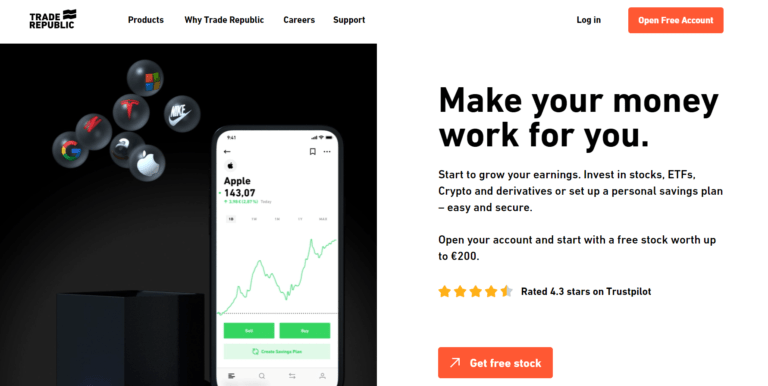

Trade Republic is a financial technology company that focuses on providing easy access to the stock markets and democratizing investment for individuals across Europe. The company offers services that allow users to invest, save, and spend, with a user-friendly platform designed to simplify the investment process for everyday people. Trade Republic primarily serves individual investors looking to engage with the capital markets. It was founded in 2015 and is based in Berlin, Germany.

Bitpanda focuses on providing an investment platform. The company offers investment options including stocks, cryptocurrencies, and precious metals, serving individuals with different investment budgets. It operates in the financial technology sector. The company was founded in 2014 and is based in Vienna, Austria.

Bitwala is a cryptocurrency investment platform operating within the fintech sector. The company offers services including buying, storing, and saving cryptocurrencies, instant euro transfers, biometric crypto storage, and payments with a Visa card. Bitwala serves individuals looking to incorporate cryptocurrency into their financial activities. Bitwala was formerly known as Nuri. It was founded in 2014 and is based in Berlin, Germany.

flatexDEGIRO operates one of the leading online brokerage platforms in Europe, focusing on financial technology and brokerage services. The company offers a range of brokerage services, including a self-developed brokerage platform that facilitates paperless customer transactions and provides white label banking technology to B2B customers. flatexDEGIRO primarily serves the financial services industry, offering technology solutions to both B2C and B2B segments. It is based in Frankfurt, Germany.

Vivid Money offers a mobile banking application and a digital investing platform. The company provides services such as payments, transfers, multi-currency accounts, spending reports, and bill splitting, as well as investment opportunities in stocks, exchange-traded funds (ETFs), precious metals, and a wide range of cryptocurrencies. Vivid Money caters to personal and business financial needs, offering cashback rewards and a stock rewards program. It was founded in 2020 and is based in Berlin, Germany.

Loading...