SESAMm

Founded Year

2014Stage

Series B - II | AliveTotal Raised

$55.21MLast Raised

$37.37M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-106 points in the past 30 days

About SESAMm

SESAMm is an artificial intelligence company that specializes in the analysis of over 20 billion documents to generate insights for investment firms and corporations. The company's main offerings include real-time monitoring of ESG controversies, risk assessment, and the provision of ESG and positive impact scores. SESAMm's solutions are primarily utilized by the private equity, asset management, and corporate sectors. It was founded in 2014 and is based in Metz, France.

Loading...

SESAMm's Product Videos

ESPs containing SESAMm

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The generative AI — investment research market focuses on developing generative AI models specifically tailored for investment research and analysis. Generative AI models in this market are designed to generate investment insights, predict market movements, and automate research reports.

SESAMm named as Leader among 13 other companies, including AlphaSense, Boosted.ai, and Hebbia.

SESAMm's Products & Differentiators

TextReveal Alerts, Monitoring and Dashboards

SESAMm enables monitoring of sentiment on topics of interest, including ESG and SDG events on the web through its NLP platform. We analyze over 20 billion articles on 5 million companies daily in more than 100 languages. With flexible delivery methods, you can receive alerts via email, monitor portfolio-dedicated dashboards, or receive insights directly in your CRM.

Loading...

Research containing SESAMm

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SESAMm in 2 CB Insights research briefs, most recently on Oct 6, 2023.

Oct 6, 2023

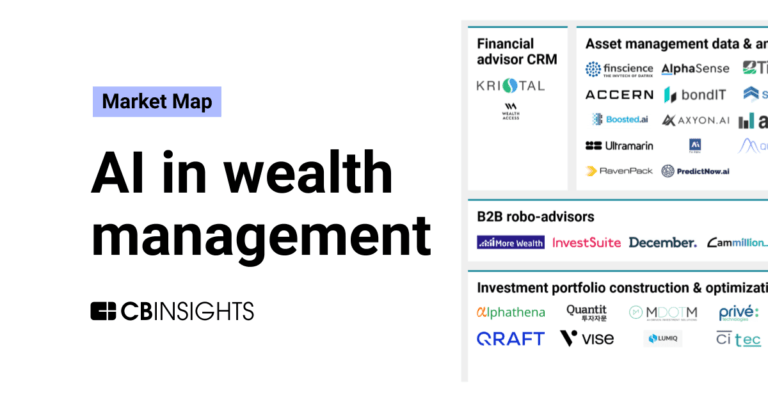

The AI in wealth management market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing SESAMm

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SESAMm is included in 6 Expert Collections, including Wealth Tech.

Wealth Tech

2,383 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,163 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Artificial Intelligence

10,027 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,699 items

Excludes US-based companies

Decarbonization Tech

2,372 items

Companies in the Decarbonization & ESG space, including those working on enterprise and cross-industry decarbonization and emissions monitoring solutions, as well as ESG monitoring and carbon accounting.

Fintech 100

100 items

Latest SESAMm News

Oct 23, 2024

auxmoney GmbH wins Financial Services Award at the Global FinTech Awards 2024 auxmoney GmbH has won the Financial Services Award at The Global FinTech Awards. auxmoney GmbH is at the forefront of digital lending in Europe, specialising in providing loans to consumers typically underserved by traditional banks. Its platform connects individual borrowers with institutional investors such as banks, insurance companies and funds. The company has processed over €100 billion in loans and served more than 250 million customers. At the heart of its innovation is auxmoney's commitment to financial inclusion, providing access to credit for groups often overlooked by mainstream financial institutions, including the self-employed, single parents and older borrowers. A key driver of auxmoney's success is its use of advanced scoring models and AI technologies. These innovations enable the company to automate over 80% of its loan processes, significantly reducing the need for manual intervention. This approach has allowed auxmoney to continue offering smaller loans—starting from 1,000 EUR—despite rising processing costs. Boudewijn Dierick, Managing Director and Yang Ge Buchan, Director of Customer Lifetime Value Management at auxmoney This is a stark contrast to traditional banks, which have been forced to increase its minimum loan amounts. With more than half of its loans approved instantly, auxmoney's fully digital process allows borrowers to secure financing within minutes. In addition to its focus on financial inclusion, auxmoney is a leader in responsible lending, adhering to principles of reliability, transparency and fairness. By using AI to enhance customer service and automate compliance with regulatory frameworks, the company ensures that borrowers receive clear, ethical and personalised service. auxmoney has also made strides in social finance, issuing four social bonds with a cumulative value of €1.825 billion to support lending to undeserved groups. Through its innovative lending platform, strong focus on automation and commitment to financial empowerment, auxmoney is not only addressing the needs of those excluded by traditional banking, but also shaping the future of responsible financial services. The awards Launched in 2024, The Global FinTech Awards 2024 debuted at FinTech LIVE London Global Summit 2024. Across 14 categories, the awards celebrated those companies, professionals and projects that consistently ensure that excellence and innovation lie at the forefront of their work. The awards set a benchmark for excellence across the industry and drive innovation in payment technology, digital banking, fraud verification and more. “It was an honour to spotlight such a wide range of incredible companies at the inaugural FinTech Awards,” said Glen White, CEO of BizClik, FinTech Magazine. “At a time where digital inclusion and easy access to finance is crucial for fostering economic growth, reducing poverty, and promoting social equity, it is important to celebrate the success of those in the fintech industry that are revolutionising traditional financial services through the integration of technology. auxmoney wins the Financial Services Award “To host the awards during FinTech LIVE London is an incredible moment for the sector to celebrate, we encourage many more companies to enter our awards for 2025. “Thanks to every company that entered - it's important that you stay focused, motivated and continuously innovate and I am excited to see so much more of Generative AI when we meet again in a year’s time. And a big congratulations to every company who entered, those that are highly commended and of course to our 14 winners – we appreciate your input more than you know.” The Financial Services Award The Financial Services Award recognises companies excelling in innovative, customer-centric financial solutions. Celebrates those driving financial literacy and empowering individuals. How does your financial services company demonstrate innovation and adaptability in response to changing market trends and customer needs? What measures does your company take to ensure regulatory compliance and ethical conduct in all financial operations? How does your financial services company prioritise customer satisfaction and engagement through personalised services and cutting-edge technology? Can you provide examples of how your company has achieved measurable success in driving financial literacy and empowering individuals to make informed financial decisions? Shortlisted companies included- Highly Commended: SESAMm & Moneyhub and Mercer SESAMm and Moneyhub are pioneering financial services through innovative technology, transforming how institutions and individuals navigate complex markets and manage their financial health. SESAMm specialises in AI-powered text analysis, providing clients with real-time insights drawn from over 25 billion articles across 100 languages. Its platform enables financial institutions to monitor market trends and ESG controversies, keeping pace with the industry's growing focus on sustainable investments. SESAMm’s standout technology includes real-time ESG portfolio monitoring and customisable sustainability scoring systems, which allow users to act on the latest developments in responsible investment. Its AI-driven tools also enhance compliance by detecting ethical breaches and ESG risks, helping institutions manage regulatory obligations. SESAMm’s impact on financial literacy is reflected in its ability to democratise access to complex data, allowing both institutional and individual investors to make informed, data-driven decisions. With recognitions such as the AIFintech100 and HedgeWeek’s Best AI Technology Provider award, SESAMm continues to lead the financial technology sector in innovation. Neil Perry, Stage Host and Group Broadcast Director at BizClik Moneyhub, on the other hand, has focused on personal financial management through its Open Finance platform. A notable partnership with Mercer has seen the development of Mercer Money, a white-labelled platform that consolidates users’ financial data, including retirement savings, day-to-day spending and pension information. The platform uses machine-learning-powered analytics to offer personalised financial nudges, helping users stay on track with their goals. This adaptability has led to high levels of user engagement, with a 40% increase in users logging in at least twice a week following a recent UX overhaul. Moneyhub’s Open Finance technology also empowers employees to make informed financial decisions, as demonstrated by a surge in additional pension contributions. Regulated by the FCA and adhering to ISO 27001 standards, Moneyhub’s data security measures ensure trust and compliance while promoting financial well-being across its user base. Both SESAMm and Moneyhub exemplify how cutting-edge technology and personalisation are shaping the future of financial services, from institutional ESG monitoring to individual financial wellness. The Global FinTech Awards 2024 Thanks to our esteemed panel of industry leaders who judged the awards: Stephen Roche, President and Co-Founder of Saphyre Nick Levy, Partner at IBM Consulting Daniel Yubi, Chief Executive Officer at Payable Jaideep Pawar, Founder & CEO of GRAMePAY Steve Suarez, External Advisor at Bain & Company Georgios Samakovitis, Professor of FinTech at University of Greenwich David Palmer, Blockchain Lead Vodafone Business IoT at Vodafone Business Russell Fisher, COO Admiral Pioneer at Admiral Group Jsmeet Narang, Chief Transformation Officer and Director of Financial Crime at Santander The full list of awards categories for 2024 is: Digital Banking Award Project of the Year Award Lifetime Achievement Award

SESAMm Frequently Asked Questions (FAQ)

When was SESAMm founded?

SESAMm was founded in 2014.

Where is SESAMm's headquarters?

SESAMm's headquarters is located at 11 Rempart Saint Thiebault, Metz.

What is SESAMm's latest funding round?

SESAMm's latest funding round is Series B - II.

How much did SESAMm raise?

SESAMm raised a total of $55.21M.

Who are the investors of SESAMm?

Investors of SESAMm include NewAlpha, Carlyle, AFG Partners, Elevator Ventures, Opera Tech Ventures and 17 more.

Who are SESAMm's competitors?

Competitors of SESAMm include Accern, AlphaSense, Auquan, Aisot Technologies, Wequity and 7 more.

What products does SESAMm offer?

SESAMm's products include TextReveal Alerts, Monitoring and Dashboards and 2 more.

Who are SESAMm's customers?

Customers of SESAMm include Crédit Mutuel Arkéa, Oddo Bhf, Raiffeisen Bank International and The Carlyle Group.

Loading...

Compare SESAMm to Competitors

Auquan provides AI agents for deep work in financial services, utilizing agentic AI to eliminate manual effort in complex, knowledge-intensive workflows. The company’s platform autonomously transforms unstructured data into structured insights, completing entire tasks in mission-critical processes including due diligence, ESG reporting, risk monitoring, and compliance. Auquan serves leading global financial institutions including private equity firms, asset managers, and insurers. The company was founded in 2018 and is based in London, United Kingdom.

Owlin provides external risk screening and monitoring within the risk management sector. The company offers a platform that uses AI and Natural Language Processing to screen and monitor third-party vendors, suppliers, and counterparties for financial and non-financial risks. The services include real-time alerts and insights through a customizable interface for risk managers across various industries. It was founded in 2012 and is based in Amsterdam, Netherlands.

RavenPack provides big data analytics in the financial services industry. The company offers products that analyze unstructured content to help financial professionals return, reduce risk, and increase efficiency. RavenPack primarily serves hedge funds, banks, and asset managers. It was founded in 2003 and is based in Malaga, Spain.

Yewno is a technology company that focuses on artificial intelligence and data analysis across various sectors. Its main offerings include the Yewno Knowledge Graph, which uses AI to analyze and connect structured and unstructured data. Yewno's technology is applied in Financial Services, Education, Publishing, Government, and Life Sciences. It was founded in 2015 and is based in Redwood City, California.

CityFALCON specializes in the transformation of unstructured financial content into structured data using machine learning, automation, and natural language processing. The company offers personalized financial data and analytics, delivering insights through website, mobile, application programming interface (API), voice, and chatbot platforms. Its services cater to a diverse range of clients, including retail investors, traders, and various enterprises, by providing tools for investment opportunity discovery, risk management, and due diligence. The company was founded in 2014 and is based in London, United Kingdom.

Briink specializes in artificial intelligence (AI) powered document analysis for environmental, social, and governance (ESG) teams within the sustainability and governance sector. The company offers solutions such as ESG questionnaire assistance, governance policy screening, and ESG data extraction and verification. It was founded in 2021 and is based in Berlin, Germany.

Loading...