Shift Technology

Founded Year

2014Stage

Series D - II | AliveTotal Raised

$319.72MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-10 points in the past 30 days

About Shift Technology

Shift Technology specializes in AI decision-making solutions for the insurance industry. The company offers a suite of products that automate and optimize decisions in areas such as fraud detection, claims processing, and underwriting risk assessment. Its AI-driven tools are designed to enhance operational efficiency and improve the policyholder experience. It was founded in 2014 and is based in Paris, France.

Loading...

Shift Technology's Product Videos

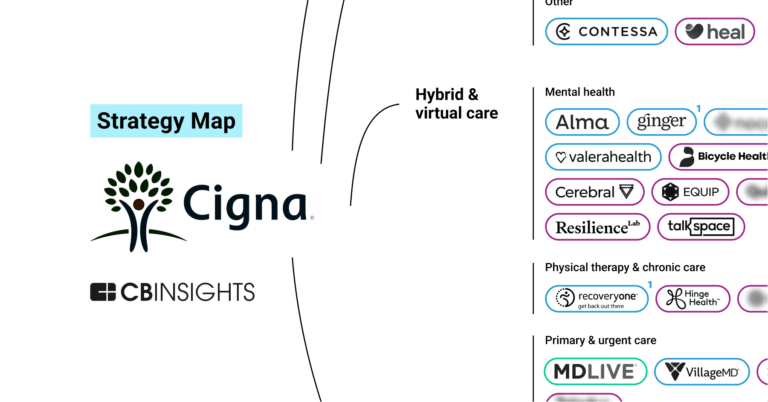

ESPs containing Shift Technology

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The fraud, waste, and abuse (FWA) detection platforms market refers to the use of technology to identify instances of fraud, waste, and abuse in the healthcare industry. These platforms use artificial intelligence to detect patterns that may indicate fraudulent activity. This can include billing for services that were not actually provided or billing for unnecessary services. The goal is to identi…

Shift Technology named as Leader among 7 other companies, including EvolutionIQ, 4L Data Intelligence, and Leapstack.

Shift Technology's Products & Differentiators

Shift Underwriting Risk

Mitigate premium leakage and policy fraud to enhance profitability

Loading...

Research containing Shift Technology

Get data-driven expert analysis from the CB Insights Intelligence Unit.

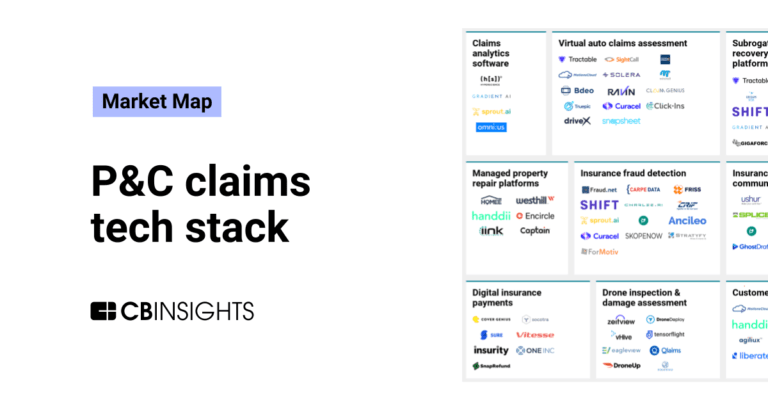

CB Insights Intelligence Analysts have mentioned Shift Technology in 5 CB Insights research briefs, most recently on Dec 18, 2023.

Dec 18, 2023

The P&C claims tech stack market map

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Shift Technology

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Shift Technology is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

AI 100

99 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

Insurtech

4,485 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

9,687 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Shift Technology News

Apr 2, 2025

News provided by Share this article IDN Delivers Actionable Fraud and Risk Insights From Shared Insurer Data BOSTON and PARIS, April 2, 2025 /PRNewswire/ -- Shift Technology , a provider of AI-powered decision optimization solutions for the global insurance industry, today introduced the Insurance Data Network (IDN). The network allows members to benefit from industry-wide intelligence made possible through the collaborative multi-carrier exchange of claims and related data. By participating, insurers gain valuable insights and analysis to enhance fraud detection and risk prevention throughout the entire claims lifecycle. IDN has rapidly gained acceptance within the industry and is now live and operational. Four of the top five U.S. property and casualty (P&C) insurers are contributing members, among many others. The network encompasses a substantial majority of U.S. auto and property claims across all 50 states, and its claims volume is growing quickly. In just the first few months, members have already identified millions of dollars in net new fraud schemes thanks to IDN's advanced fraud and risk detection capabilities. IDN allows insurers to get more value from their data and a better understanding of the forces impacting their business IDN offers significant advantages over legacy data-sharing models. First, IDN members retain full ownership and control of their data, ensuring it is never sold back to members or resold to third parties. Compared to traditional systems, IDN also provides a more comprehensive set of claims data and related intelligence in real-time, offering deeper context for fraud detection and risk assessment. Finally, Shift's AI-powered products are inherently designed to leverage diverse data sources. Intelligence from IDN enhances the performance of the Shift products customers already use. "IDN empowers insurers to get more value out of their data by providing a secure environment in which to share it and collaborate with other carriers," explained Jeremy Jawish, CEO and co-founder, Shift Technology. "Gaining a more complete understanding of the forces impacting their business and the industry as a whole, and to do so quickly and efficiently, is an amazing value proposition and a new way to harness the power of shared data." According to the Coalition Against Insurance Fraud , insurers record nearly $122 billion in P&C insurance losses annually due to fraud, with an estimated 10 percent of claims exhibiting signs of fraudulent activity. In this landscape, where the same fraud rings or providers affect multiple insurers, gaining greater visibility into these entities is essential. Early results from the IDN indicate that when cross-carrier data is analyzed, identified fraud networks have, on average, tripled in size. Participation in IDN provides insurers with valuable insights into claims on an industry-wide or region-specific basis. This information can uncover policyholders who have a history of suspicious behavior or proven fraud across multiple carriers. By understanding a claimant's interactions with various insurers, IDN members can expedite investigations and achieve better outcomes. "Insurers are continuously working to stay ahead of fraudsters as they recognize that their fraudulent activities extend beyond the scope of a single insurance company," explained Karlyn Carnahan, CPCU, head of insurance, North America, Celent. "Until recently, insurers had limited tools to understand behaviors of fraudsters beyond their own experiences. However, with this new ability to gain visibility, analyze, and extract insights from shared experiences across the industry, insurers have now regained control and power in fighting fraud." IDN enhances fraud and risk detection throughout the claims process. For instance, when a claim includes personal injury protection and bodily injury (PIP/BI), it can significantly increase costs and risks for insurers. Therefore, the ability to quickly and accurately assess the impact of these claims is crucial for effective management. Currently, claims handlers often face the daunting task of reviewing extensive demand packages and manually analyzing many pages of claims data to identify any relevant or actionable information. Membership in IDN allows insurers to automate this process. By leveraging data-driven insights, insurers can quickly determine if current or past PIP/BI claims involve providers—whether medical or legal—who are on the insurer's internal watchlist or have been sanctioned or suspended. This enables claims to be expedited to the Special Investigations Unit (SIU) or referred to medical management for further review. IDN provides members with accurate, actionable, automated, and secure insights derived from shared insurer data. Membership in IDN is designed to enhance an insurer's fraud detection and claims handling strategies, offering several key benefits, including: Accurate Data-Driven Insights: Through detailed data mapping and AI-powered entity resolution across carriers, IDN generates highly accurate insights and recommendations automatically integrated into the insurer's workflows and user interfaces. More Advanced Fraud and Risk Detection: By leveraging shared data, IDN enhances fraud and risk detection capabilities. This collaboration helps uncover fraud schemes and networks that affect the entire industry, leading to more effective prevention and response strategies. Actionable Claim History Intelligence: IDN allows claim handlers to swiftly identify cross-carrier patterns of suspicious and risky claim behavior in both past and current claims. Insurers can define and configure the relevance threshold for receiving loss history insights and information, ensuring that they receive the most pertinent intelligence for their needs. Proactive Automation, Context and Explainability: IDN proactively and automatically transforms data into actionable insights, delivering findings directly to users. This eliminates the need for manual search, matching and analysis, streamlining the claims process and enhancing efficiency. Data Ownership: IDN members retain ownership of their data and have full control over its usage. Member data is not sold to third-parties. Data Security and Privacy: The data of IDN members is safeguarded by industry-leading data security and privacy protocols. These protocols include strict compliance with established data security and privacy guidelines, ensuring the protection of sensitive information. "The insurance industry has long known that data, and the insights it can provide, are highly valuable and critical to long-term success," continued Jawish. "With the launch of IDN, insurers are changing the way they benefit from their own data. The ability to use shared data in new ways, to gain greater understanding of what's happening across the industry and have that knowledge and information at their fingertips is incredibly valuable." About Shift Technology Shift Technology delivers AI-powered decisioning solutions to benefit the global insurance industry and its customers. Our products enable the world's leading insurers to improve combined ratios by optimizing and automating critical decisions across the policy lifecycle. Shift solutions help mitigate fraud and risk, increase operational efficiency, and deliver superior customer experiences. Learn more at www.shift-technology.com . Contacts:

Shift Technology Frequently Asked Questions (FAQ)

When was Shift Technology founded?

Shift Technology was founded in 2014.

Where is Shift Technology's headquarters?

Shift Technology's headquarters is located at 2-14 rue Gerty Archimede, Paris.

What is Shift Technology's latest funding round?

Shift Technology's latest funding round is Series D - II.

How much did Shift Technology raise?

Shift Technology raised a total of $319.72M.

Who are the investors of Shift Technology?

Investors of Shift Technology include Guidewire, Iris Capital, Accel, General Catalyst, Bessemer Venture Partners and 10 more.

Who are Shift Technology's competitors?

Competitors of Shift Technology include Quantexa, Qantev, omni:us, Gradient AI, Sprout.ai and 7 more.

What products does Shift Technology offer?

Shift Technology's products include Shift Underwriting Risk and 2 more.

Who are Shift Technology's customers?

Customers of Shift Technology include Amica, Elephant, Central Insurance, Markerstudy and Direct Assurance.

Loading...

Compare Shift Technology to Competitors

FRISS focuses on risk assessment automation for property and casualty (P&C) insurance carriers. The company offers a platform that provides real-time analytics to understand and evaluate the inherent risks in customer interactions, aiming to enhance trust and efficiency in insurance processes. FRISS's solutions enable insurers to automate underwriting, accelerate claims processing, and conduct structured investigations into suspicious activities. It was founded in 2006 and is based in Mason, Ohio.

Carpe Data provides predictive data analytics and artificial intelligence solutions for the insurance industry. The company offers services for fraud detection, claims processing, and small commercial underwriting using data science techniques and AI. Carpe Data serves the insurance sector with products aimed at improving the efficiency and accuracy of claims and underwriting operations. It was founded in 2016 and is based in Santa Barbara, California.

Qantev specializes in AI-driven claims management for the health and life insurance sectors. Its main offerings include an automated claims platform that streamlines processing, detects fraud, waste, and abuse, and optimizes healthcare provider networks. It was founded in 2018 and is based in Paris, France.

Charlee.ai specializes in artificial intelligence and predictive analytics within the insurance sector. The company offers solutions that analyze claims and predict litigation and severity, utilizing natural language processing to enhance claims workflows and manage reserves effectively. Charlee.ai's predictive analytics solutions are tailored to the insurance industry, including personal, commercial, and workers' compensation sectors. Charlee.ai was formerly known as Infinilytics. It was founded in 2016 and is based in Pleasanton, California.

Tractable focuses on artificial intelligence in the automotive and property insurance sectors. The company provides solutions for damage appraisal, assisting in the assessment and protection of vehicles and homes. Tractable's technology aims to improve claims processes, from reporting to settlement, and to support the appraisal of automotive parts. It was founded in 2014 and is based in London, United Kingdom.

CLARA Analytics operates in the insurance sector, focusing on claims management. The company provides machine learning products that assist in claims processing by analyzing medical notes, bills, and other claim-related documents. It was founded in 2017 and is based in Sunnyvale, California.

Loading...