Sift

Founded Year

2011Stage

Secondary Market | AliveTotal Raised

$156.52MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-52 points in the past 30 days

About Sift

Sift operates in the fields of cybersecurity and financial technology. Its main offerings include a platform that uses machine learning and user identity verification to address fraud, including account takeover, payment fraud, and policy abuse. Sift serves sectors that require digital trust solutions, such as e-commerce, fintech, and online marketplaces. Sift was formerly known as Sift Science. It was founded in 2011 and is based in San Francisco, California.

Loading...

ESPs containing Sift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

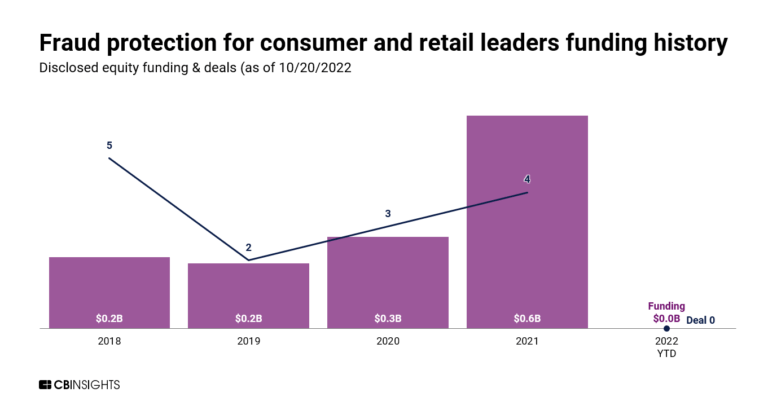

The device fingerprinting market, also referred to as device intelligence, offers customers a tool for identifying and authenticating devices accessing their systems or platforms. Device fingerprinting involves creating unique digital profiles based on various device attributes such as hardware, software, network configuration, and behavior patterns. This helps enhance security measures by detecti…

Sift named as Outperformer among 12 other companies, including Socure, Signifyd, and SEON.

Sift's Products & Differentiators

Payment Fraud

Sift’s Payment Fraud solution helps businesses detect and prevent fraudulent transactions. It detects and blocks risky transactions, shuts off fraudulent currency movement, and proactively prevents alternative payment abuse.

Loading...

Research containing Sift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sift in 6 CB Insights research briefs, most recently on Mar 14, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Aug 14, 2023

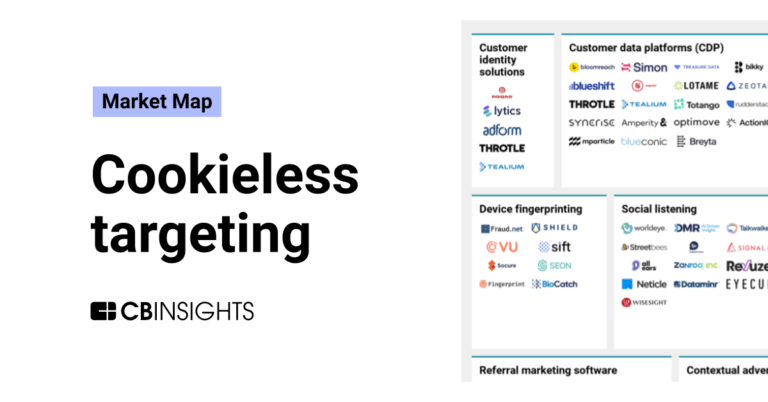

The cookieless targeting market map

Feb 27, 2023 report

Top fraud prevention companies — and why customers chose themExpert Collections containing Sift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sift is included in 12 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Regtech

1,721 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Digital Lending

2,483 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Sift Patents

Sift has filed 46 patents.

The 3 most popular patent topics include:

- machine learning

- social networking services

- computer security

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/29/2024 | 4/8/2025 | Machine learning, Association football forwards, Classification algorithms, Artificial neural networks, Trees (data structures) | Grant |

Application Date | 5/29/2024 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Machine learning, Association football forwards, Classification algorithms, Artificial neural networks, Trees (data structures) |

Status | Grant |

Latest Sift News

Apr 1, 2025

UK sees formation of data sharing fraud squad as easy access to tech democratizes fraud Apr 1, 2025, 1:34 pm EDT A common enemy can bring together unlikely allies, and right now the common enemy of banks, tech and telecoms firms is fraud. According to the UK Office for National Statistics, fraud accounts for around 41 per cent of all crimes in England and Wales, costing an estimated £6.8 billion (US$7.3 billion) each year. In the U.S., data breaches are having more severe consequences, and payment fraud is growing like a bad mold across the digital financial landscape. Injection attacks , deepfakes and other products of generative AI are getting easier to execute and distribute. The problem has become severe enough to force responses from both governments and the private sector. Supergroup of UK banks, tech and telecom firms bands together to fight fraud The Financial Times reports on a plan by some of the UK’s biggest companies to begin sharing live fraud data, in a united front against a fierce and fast-advancing foe. A joint statement from the coalition says that after a period of testing, it is transitioning to real-time exchange of fraud indicator data, such as suspicious URLs or unusual transaction activity. Signatories include Barclays, Lloyds, Santander, Nationwide, HSBC, NatWest and Monzo on the financial side, as well as tech giants Amazon , Google, Match Group and Meta, and telecoms groups BT and Three. Ruth Evans, chair of Stop Scams UK , a cross-sector umbrella group leading the initiative, says that “by making this pledge, our members are redoubling their efforts to create a safer environment for all businesses and consumers online.” The previous testing period in 2023 saw relatively little data exchanged compared to what is now possible. Stop Scams UK CEO Mark Tierney says the scheme has since changed “exponentially” with the implementation of automated systems that can process data much faster. Per the Times report, many are calling for a stronger government response to the fraud problem. Fraud minister Lord Hanson is developing a new fraud strategy that enables safe, speedy and effective exchange of data. TransUnion, Sift, BioCatch highlight scale of fraud in U.S. in new publications New reports from TransUnion and Sift lay out the scale of fraud in the U.S. TransUnion ’s H1 2025 Update to the State of Omnichannel Fraud Report shows that the severity of primary data breaches increased by 34 percent from a year earlier, with the primary U.S. Breach Risk Score (BRS) rising from 4.1 to 5.6 out of 10, and third party rising from 4.2 to 5.2. In a release, Steve Yin, global head of fraud at TransUnion, says that “breach severity is a leading indicator of future fraud. This year’s growth in severity means organizations must be even more diligent moving forward and work even harder to defend against the oncoming identity fraud attacks such as those in account creations, social engineering scams, and account takeovers.” The report identifies communities and gaming as industries seeing the highest rates of digital fraud globally. Communities, which encompasses online dating and forums, showed the highest rate of suspected digital fraud attempts, with nearly 12 percent of all attempted community transactions suspected to be fraudulent. Video gaming does not fare much better, at 11 percent, while online gambling and retail both come in at 8 percent. Everybody fraud now: easy access to data, tech makes fraud an easy side hustle Meanwhile, Sift ’s newly published Q1 2025 Digital Trust Index reveals what a release calls an “alarming trend in the democratization of payment fraud,” noting that “34 percent of consumers have seen offers to participate in payment fraud online – an 89 percent increase over 2024.” Once thought to be the purview of shady hacker types in hoodies, fraud is now not just a risk for individuals, but also a lure. “The democratization of fraud through the widespread availability of stolen payment information and validation tools – easily found and purchased online – is luring ordinary consumers into cybercrime ,” says Kevin Lee, SVP of customer experience, trust and safety at Sift. The trend is particularly concerning in that it appears to appeal to young people; per the report, “among those who personally participated in or know someone who has participated in payment fraud (23 percent of all surveyed consumers), 32 percent of Gen Z and 43 percent of Millennials admitted to personally participating in payment fraud schemes.” Industries that showed the highest attack rates include ticketing and reservations at 7.4 percent, social media at 5.2 percent, and transportation at 4.8 percent. A summary of the report on Sift’s website says “high-demand events, such as the Taylor Swift concerts, have forced ticketing platforms to process transactions more quickly to meet customer expectations, opening the door to more fraudulent activities. As a result, the ticketing industry saw an 85 percent rise in attempted payment fraud year-over-year.” Data from BioCatch shows young people just as vulnerable as the elderly BioCatch is not letting Europe off the fraud hook; its new report notes that France lost an estimated €4.5 (~US$4.8) billion to fraud in 2023. In a release, BioCatch Director of Global Fraud Intelligence Tom Peacock says “57 percent of French citizens say they’ve received scam messages and 13 percent report having fallen victim to a scam.” But the figure swells to 72 percent – with 16 percent falling victim – among those 35 and younger. Peacock notes that, “while many might find it tempting to stereotype the elderly as the most vulnerable targets for scammers, in France, data shows young people both receive more scam attempts and fall victim to those attempts more often than those from older generations.” Investment scams are also on the rise, having tripled over the last three years. Per the report, more than 3 percent of all French citizens – an estimated 22.7 million people – admitted to losing money to this type of scam. The long-term consequences can be damaging psychologically; BioCatch data shows that “six months after falling victim to a scam, some victims still log into their online banking accounts twice as frequently as they did before they lost any money, suggesting feelings of anxiety, mistrust and fear.” Feedzai takes a look at account takeover fraud A new report from Feedzai looks at account takeover fraud (ATO), which cost U.S. adults approximately $23 billion in 2023. ATO crime has risen steadily in recent years; per a release, data shows that bank accounts saw the most significant surge in ATO activity from 2021 to 2023, with a 10 percent rise. The report says global fraud losses are expected to reach $5 trillion, but several avenues for preventing ATO attempts are available, including behavioral biometrics, malware detection and device fingerprinting. NEC says face biometrics can stop fraud – if systems are good NEC likewise has things to say about fraud and how it impacts people. “People don’t think about security until it fails,” says a new post from the facial biometrics provider. “But what they remember is how the experience made them feel. If onboarding feels seamless, they stay. If transactions feel safe and smooth, they come back. If something feels off – or clunky – they look elsewhere. Experience builds trust – and trust is everything.” In NEC’s view, biometric technology can make all the difference, provided it’s done right. “Financial institutions globally are increasingly adopting facial biometrics, liveness detection, and AI-powered fraud prevention solutions to deliver secure digital ID experiences to customers,” it says, citing numbers from Research and Markets showing that the global biometrics market in financial services was valued at $5.9 billion in 2023 and is projected to reach $15.2 billion by 2030. As customers embrace biometrics, care must be taken to choose the right tools. High-quality, effective biometric solutions can, of course, significantly reduce fraud and enhance user experiences. But it’s not enough for firms to come in waving flags that say “ biometric authentication .” Not all biometrics are created equal: “low-quality implementations create more issues, such as increased false acceptances, frustrating false rejections, and exploitable security vulnerabilities.” Facial biometrics, says NEC, offer high identity assurance levels and are nearly impossible to counterfeit. “With NEC’s advanced facial biometric technology , financial institutions can securely verify digital IDs in real-time, covering everything from digital banking apps to high-value transactions and administrative access.” Related Posts

Sift Frequently Asked Questions (FAQ)

When was Sift founded?

Sift was founded in 2011.

Where is Sift's headquarters?

Sift's headquarters is located at 525 Market Street, San Francisco.

What is Sift's latest funding round?

Sift's latest funding round is Secondary Market.

How much did Sift raise?

Sift raised a total of $156.52M.

Who are the investors of Sift?

Investors of Sift include Fabrica Ventures, Union Square Ventures, Insight Partners, Stripes Group, Spark Capital and 18 more.

Who are Sift's competitors?

Competitors of Sift include Vesta, ClearSale, UrbanFox, Ravelin, Justt and 7 more.

What products does Sift offer?

Sift's products include Payment Fraud and 2 more.

Who are Sift's customers?

Customers of Sift include Atom Tickets, DoorDash, Paula's Choice, Uphold and Patreon.

Loading...

Compare Sift to Competitors

Signifyd provides e-commerce fraud protection and prevention services. The company offers services, including revenue protection, abuse prevention, and payment compliance, all aimed at maximizing conversion and eliminating fraud and consumer abuse. Its services primarily cater to the e-commerce industry. Signifyd was founded in 2011 and is based in San Jose, California.

Forter specializes in identity intelligence for digital commerce, focusing on fraud prevention and customer security across digital platforms. The company provides services including fraud management, payment optimization, chargeback recovery, identity protection, and abuse prevention, aimed at improving security and efficiency in online transactions. Forter's solutions are utilized by sectors within the digital commerce industry to support processes for businesses and consumers. Forter was formerly known as Ryzyco. It was founded in 2013 and is based in New York, New York.

BioCatch provides behavioral biometrics for the financial services industry, concentrating on fraud prevention. The company offers solutions that analyze online users' physical and cognitive digital behavior to protect against various forms of fraud and financial crime. BioCatch serves the banking and financial services sectors with its fraud detection and prevention services. It was founded in 2011 and is based in Tel Aviv, Israel.

Shield is a device-first risk AI platform that specializes in fraud prevention and risk intelligence within the digital business sector. The company offers solutions to identify and eliminate fraudulent activities through global standard device identification and actionable risk intelligence. Shield primarily serves industries such as ride-hailing, social media, e-commerce, digital banking, and gaming. Shield was formerly known as CashShield. It was founded in 2008 and is based in Singapore.

FUGU specializes in payment fraud prevention and operates within the financial technology sector. The company offers a suite of services that analyze transactions throughout the entire lifecycle, from pre-checkout to post-purchase, to identify and prevent various types of fraud, automate Know Your Customer (KYC) verifications, and manage chargebacks. FUGU's solutions are designed to reduce false declines, minimize operational costs, and provide a chargeback guarantee to online sellers and payment service providers. It was founded in 2017 and is based in Tel Aviv, Israel.

ComplyAdvantage offers artificial intelligence-driven solutions for fraud and anti-money laundering (AML) risk detection within the financial services industry. The company provides services including customer and company screening, ongoing monitoring, transaction and payment screening, and fraud detection. It serves sectors such as banking, cryptocurrency, insurance, lending, and wealth management. The company was founded in 2014 and is based in London, United Kingdom.

Loading...