Sila

Founded Year

2011Stage

Series G | AliveTotal Raised

$1.406BLast Raised

$375M | 10 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+112 points in the past 30 days

About Sila

Sila focuses on battery materials within the energy sector. Its main offerings include nano-composite silicon anodes, which aim to improve the performance and energy density of lithium-ion batteries, used in industries such as automotive, consumer electronics, and cell manufacturing. Sila's products are designed as replacements for traditional graphite anodes. It was founded in 2011 and is based in Alameda, California.

Loading...

ESPs containing Sila

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Battery anode developers are companies that specialize in the research, development, and production of materials used in the anode component of batteries. These materials are crucial in the performance and efficiency of batteries, and battery anode developers work to improve their properties and reduce costs. The market is driven by the increasing demand for batteries in various applications, incl…

Sila named as Highflier among 15 other companies, including Amprius Technologies, Group14, and Novonix.

Loading...

Research containing Sila

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sila in 2 CB Insights research briefs, most recently on Aug 13, 2024.

Aug 13, 2024 report

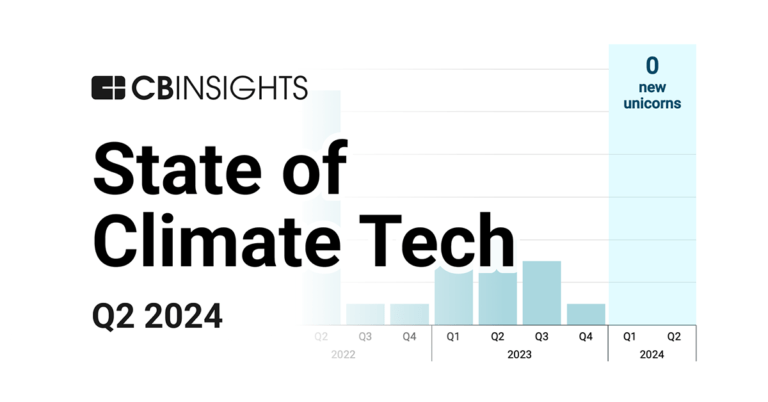

State of Climate Tech Q2’24 Report

Mar 12, 2024

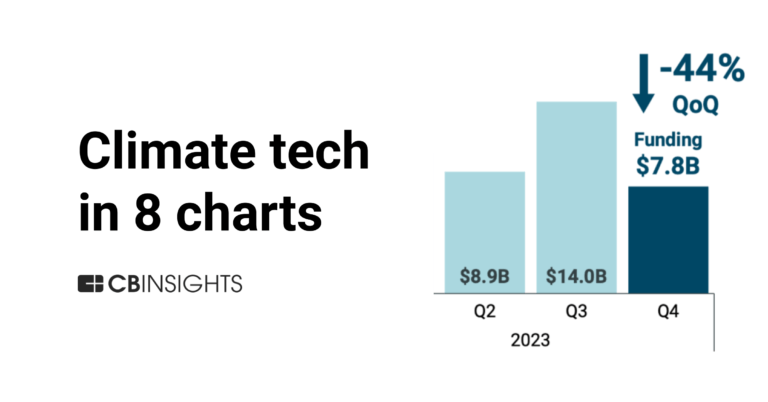

Climate tech in 8 charts: 2023Expert Collections containing Sila

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sila is included in 4 Expert Collections, including Auto Tech.

Auto Tech

3,978 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Unicorns- Billion Dollar Startups

1,270 items

Energy Storage

5,350 items

Companies in the Energy Storage space, including those developing and manufacturing energy storage solutions such as lithium-ion batteries, solid-state batteries, and related software for battery management.

Advanced Materials

1,412 items

Companies in the advanced materials space, including polymers, biomaterials, semiconductor materials, and more

Sila Patents

Sila has filed 137 patents.

The 3 most popular patent topics include:

- lithium-ion batteries

- rechargeable batteries

- energy storage

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/16/2023 | 4/1/2025 | Mass spectrometry, Ion source, Fluorides, Energy storage, Lithium-ion batteries | Grant |

Application Date | 8/16/2023 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Mass spectrometry, Ion source, Fluorides, Energy storage, Lithium-ion batteries |

Status | Grant |

Latest Sila News

Mar 10, 2025

Challenges and future outlook Key Factors Shaping Market Dynamics The market's rapid expansion is attributed to advancements in battery materials, increasing adoption of EVs, and the rising need for efficient energy storage solutions. However, high manufacturing costs and scalability challenges continue to pose hurdles. High Manufacturing Costs and Scalability Limitations One of the primary challenges faced by silicon anode battery manufacturers is the high cost of production. Silicon has a tendency to expand and contract during charge cycles, leading to structural degradation. Developing cost-effective solutions to counteract these effects remains a top priority for industry players. Additionally, the scalability of silicon anode battery production is still a work in progress. While laboratory tests have demonstrated promising results, large-scale manufacturing with consistent quality remains a challenge, necessitating continuous investment in R&D and process optimization. Growth in Electric Vehicles and Next-Generation Energy Storage The global EV market is one of the biggest drivers of silicon anode battery adoption. Automakers are increasingly integrating silicon-based anodes to improve battery performance, enabling longer driving ranges and faster charging times. Leading EV manufacturers are collaborating with battery technology firms to develop high-capacity energy storage solutions. Additionally, silicon anode batteries are gaining traction in grid-scale energy storage applications. As the world shifts toward renewable energy sources, efficient storage systems are required to stabilize power supply fluctuations, making silicon anode technology a key player in the sustainable energy transition. Browse Full Report Here: https://www.futuremarketinsights.com/reports/silicon-anode-battery-market Enhanced Energy Density Driving Market Growth Silicon anode batteries offer significantly higher energy density compared to traditional lithium-ion batteries, making them ideal for applications requiring compact, lightweight, and high-capacity energy solutions. This advantage is fueling adoption across various industries. Furthermore, advancements in nanotechnology and material science are helping improve battery longevity and reduce degradation, making silicon anode batteries a viable alternative for mainstream applications. "The Silicon Anode Battery Market is poised for a major breakthrough as technology advancements continue to address performance limitations. With the rise of electric vehicles, consumer electronics, and renewable energy integration, silicon anode technology is expected to play a critical role in the energy landscape of the future." opines Nikhil Kaitwade , Associate Vice President at Future Market Insights (FMI) Key Takeaways The Silicon Anode Battery Market is projected to reach USD 15.8 billion by 2035, growing at a CAGR of 13.7%. High energy density and extended battery life are driving adoption in EVs and energy storage applications. Manufacturing challenges, including silicon swelling and cost feasibility, remain key hurdles. Government incentives and clean energy initiatives are accelerating market growth. Key players are investing in R&D to enhance scalability and commercial viability. Advancements in Battery Technology to Propel Growth Battery technologies are important for delivering advanced performances in a wide range of applications including electric vehicles , consumer electronics, renewable energy, and industrial machinery. As battery applications are growing, it has become a top priority for key players to build their positions in the market and this has ushered in various developments. A vast number of next-generation technologies are under development, which has capability to serve large potential markets. Designers are keen on experimenting with different types of negative battery materials, which will act a better substitute to graphite anodes. Various anode chemistries are in action, such as silicon lithium or silicon graphite. These developments will fuel demand for silicon anode batteries. How are Partnerships among Manufacturers Providing Stimulus to Silicon Anode Battery Sales? The key players in the Silicon Anode Battery market are actively engaged in various forms of partnerships ranging from partnering with battery suppliers, chemical manufacturers, material suppliers, technical service providers, public associations or even automotive OEMs. These partnerships are creating new avenues for product development, its market positioning, improving the product value, its lifecycle, and easy deployment into the market. They are providing a stimulus in the Silicon Anode Battery market. How is Research & Development Enabling Growth? Some of the leading companies are investing in research and development activities to gain competitive advantage. Product development strategies and product positioning are adopted by suppliers to establish a stronger foothold in the market. They are partnering with technical service providers to gain technical expertise in the field. With companies around the world increasingly focusing on research initiatives, expansion is on the card. Silicon Swelling Issues Impacting Battery Longevity Silicon's tendency to expand during charge cycles presents a major challenge for battery stability. This swelling can cause material fractures, reducing battery efficiency and lifespan. Researchers are actively exploring composite materials and nanostructures to mitigate these issues. Innovations such as silicon-carbon composite anodes are showing promise in addressing swelling-related degradation, paving the way for more durable and reliable batteries. Start Exploring Now - Request Your Sample Report: https://www.futuremarketinsights.com/report-sample#5245502d47422d32313334 Rising Demand from EV and Consumer Electronics Sectors The consumer electronics industry is witnessing a surge in demand for compact, high-energy batteries, making silicon anodes an attractive choice. Smartphones, laptops, and wearable devices are increasingly benefiting from the enhanced performance of silicon anode batteries. Simultaneously, leading EV manufacturers are investing in silicon anode technology to extend battery life and reduce charging times, aligning with consumer expectations for better-performing electric vehicles. Silicon Anode Battery Market Key Players Amprius Technologies – Leading innovations in high-energy-density batteries for EVs and aerospace applications. Sila Nanotechnologies – Pioneering silicon anode material advancements to enhance battery performance. Enovix Corporation – Specializing in 3D silicon lithium-ion battery technology for next-gen applications. NexTech Batteries – Developing high-capacity energy storage solutions with a focus on durability. Enevate Corporation – Innovating fast-charging silicon battery technology for EVs and portable devices. Technological Advancements Aiming to Overcome Degradation Companies are exploring innovative solutions such as silicon nanowires and solid-state electrolytes to enhance battery stability. These advancements are helping mitigate degradation issues and improve long-term performance. Furthermore, ongoing research in graphene coatings and artificial intelligence-driven battery management systems is enhancing the reliability and efficiency of silicon anode technology. Regional Analysis Latin America: Emerging market with growing interest in renewable energy storage. Western & Eastern Europe: Leading in EV adoption and battery R&D. East Asia: Home to major battery manufacturers driving silicon anode innovations. South Asia & Pacific: Increasing investments in energy storage solutions. Middle East & Africa: Growing demand for off-grid energy storage systems. Latest Electrical & Heavy Machinery Reports: https://www.futuremarketinsights.com/industry-analysis/electrical-and-heavy-machinery Silicon Anode Battery Market Segmentation By Capacity: Explore FMI’s Extensive Coverage on Industrial Automation Domain: The global tower crane rental market sales are anticipated to grow at USD 12.8 billion in 2033, recording a CAGR of 5.8% from 2023 to 2033. The Truck Mounted Cranes Market sale is projected to grow from USD 2,751.1 million in 2025 to USD 4,243.6 million by 2035, registering a CAGR of 4.4% global sales of trigger sprayer market is anticipated to reach a value of USD 870.7 million by 2035. Sales are projected to rise at a CAGR of 4.2%. The bitumen sprayer market size is anticipated to reach a value of USD 1,404 million by 2034. Sales are projected to rise at a CAGR of 4% By 2033, the global market for size air quality monitoring equipment is expected to grow at a CAGR of 7.3% to reach a worth of USD 13.3 billion. global military battery market sales are likely to surge at 4.7% CAGR, taking the overall market valuation to USD 2.2 billion by 2033. global demand for Industrial Battery Chargers market is estimated to be worth USD 2,735.3 million in 2025 and is anticipated to reach a value of USD 6,184.4 million by 2035. The global Large Industrial Displays Market size garnering USD 5.2 billion in 2033, recording a CAGR of 6.4% from 2023 to 2033. About Future Market Insights (FMI): Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. FMI is headquartered in Dubai, and has delivery centers in the UK, U.S. and India. FMI's latest market research reports and market analysis help businesses navigate challenges and make critical decisions with confidence and clarity amidst breakneck competition. Our customized and syndicated market research reports deliver actionable insights that drive sustainable growth. A team of expert led analysts at FMI continuously tracks emerging trends and events in a broad range of industries to ensure that our clients prepare for the evolving needs of their consumers. Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise. Contact Us:

Sila Frequently Asked Questions (FAQ)

When was Sila founded?

Sila was founded in 2011.

Where is Sila's headquarters?

Sila's headquarters is located at 2470 Mariner Square Loop, Alameda.

What is Sila's latest funding round?

Sila's latest funding round is Series G.

How much did Sila raise?

Sila raised a total of $1.406B.

Who are the investors of Sila?

Investors of Sila include Bessemer Venture Partners, Sutter Hill Ventures, Coatue, Perry Creek Capital, U.S. Department of Energy and 13 more.

Who are Sila's competitors?

Competitors of Sila include CTNS, Polarium, NanoGraf, 3DC, Romeo Power and 7 more.

Loading...

Compare Sila to Competitors

Group14 specializes in advanced silicon battery technology within the energy storage sector. The company's main offering includes a patented silicon-carbon composite material, known as SCC55, which enhances rechargeable batteries by enabling them to charge more quickly and last longer than traditional lithium-ion batteries. It primarily serves sectors that require rechargeable batteries, such as the automotive, consumer electronics, and aviation industries. The company was founded in 2015 and is based in Woodinville, Washington.

Addionics specializes in battery technology within the energy sector. The company offers rechargeable batteries with an architecture applicable to current and emerging lithium-ion battery (LIB) technology. Addionics serves sectors that require advanced energy storage solutions, leveraging both hardware innovations in smart 3D current collectors and software-driven AI optimization for performance attributes. It was founded in 2017 and is based in London, United Kingdom.

EnPower operates as a battery company that focuses on advancing lithium-ion technology in the energy sector. The company specializes in developing multilayer electrode batteries that offer charging capabilities and enhanced cycle life without significant degradation. EnPower primarily serves markets that demand battery technology for applications such as electric mobility. EnPower was formerly known as Big Delta Systems. It was founded in 2014 and is based in Indianapolis, Indiana.

CTNS operates as a company involved in secondary battery technology within the energy sector. It offers services for the development, manufacturing, and management of secondary battery packs, focusing on energy storage and management solutions. It was founded in 2017 and is based in Changwon-si, South Korea.

Clarios specializes in the production of batteries for a variety of vehicles. The company manufactures batteries annually, including advanced low-voltage systems, lithium-ion, and smart batteries, catering to the automotive and commercial sectors. Its products are integral to powering vehicles with features such as heated seats and cutting-edge safety systems, as well as supporting heavy-duty and leisure vehicles. Clarios was formerly known as Johnson Controls Power Solutions. The company was founded in 2019 and is based in Glendale, Wisconsin.

Enevate Corporation develops silicon-dominant lithium-ion battery technology for the electric vehicle sector. The company provides solutions that support fast charging, energy density, low temperature performance, and safety for electric vehicles. Enevate's technology can be integrated into existing manufacturing facilities, which may lead to lower costs and a reduced CO2 footprint during battery production. Enevate was formerly known as Carbon Micro Battery Corporation. It was founded in 2005 and is based in Irvine, California.

Loading...