Solaris

Founded Year

2016Stage

Series G | AliveTotal Raised

$693.83MLast Raised

$93.41M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+44 points in the past 30 days

About Solaris

Solaris is a technology company with a banking license that provides Banking-as-a-Service solutions in the financial services sector. The company offers a platform for businesses to integrate digital banking, payment services, and lending options into their products through APIs. Solaris serves sectors that require embedded finance solutions, including mobility, travel, and wealth management. Solaris was formerly known as Solarisbank. It was founded in 2016 and is based in Berlin, Germany.

Loading...

ESPs containing Solaris

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to modernize their services and expand their customer base through embedded banking and payment options. These providers offer APIs that enable businesses to integrate banking capabilities such as account opening, transaction processing, card issuance, payment rails, and compliance tools. BaaS solutions…

Solaris named as Leader among 15 other companies, including Stripe, FIS, and Finastra.

Solaris's Products & Differentiators

Digital Banking

White-labeled bank accounts

Loading...

Research containing Solaris

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Solaris in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Apr 18, 2024 report

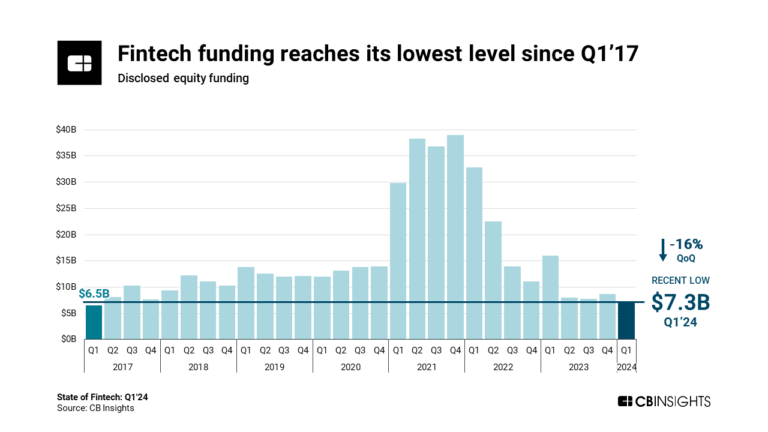

State of Fintech Q1’24 Report

Jan 4, 2024

The core banking automation market mapExpert Collections containing Solaris

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Solaris is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

747 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,380 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,699 items

Excludes US-based companies

Digital Banking

975 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Blockchain

125 items

Crypto payments refers to the use of cryptocurrency as a means of payment for goods and services. It also includes the use of fiat or other traditional payment methods to purchase cryptocurrency. This market includes cryptocurrency payments acceptance for merchants/retailers, cry

Solaris Patents

Solaris has filed 10 patents.

The 3 most popular patent topics include:

- hydraulic fracturing

- arm architecture

- drilling technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/7/2022 | 2/18/2025 | Sensors, Gibson electric guitars, Hydraulic fracturing, Gas technologies, Fluid dynamics | Grant |

Application Date | 4/7/2022 |

|---|---|

Grant Date | 2/18/2025 |

Title | |

Related Topics | Sensors, Gibson electric guitars, Hydraulic fracturing, Gas technologies, Fluid dynamics |

Status | Grant |

Latest Solaris News

Mar 25, 2025

By Gloria Methri Share SBI Group has officially completed the regulatory ownership control process to become the majority shareholder in Solaris , one of Europe’s leading embedded finance platforms. The investment, part of Solaris’s €140 million Series G funding round secured in February, reflects SBI’s commitment to driving innovation in embedded finance and supporting Solaris’s long-term growth and profitability. Yoshitaka Kitao, Representative Director, Chairman, President, and CEO of SBI Holdings (SBIHD), expressed confidence in Solaris’s future, saying, “We are incredibly proud to become the majority shareholder in Solaris. It’s an exciting time, and with our support, we believe the organisation is well positioned to lead Europe’s ever-growing embedded finance market.” Alongside this transition, Solaris has appointed Katharina Gehra to its supervisory board, replacing Burkhard Eckes. Gehra brings a wealth of financial expertise to Solaris. She currently serves on the supervisory boards of Fürstlich Castell’sche Bank and Boerse Stuttgart Group and co-edits the financial journal Der Aufsichtsrat. Her previous experience spans large banking institutions, consulting firms, and private equity. She holds an MSc in International Political Economy from the London School of Economics and Political Science. Gehra will join the existing Solaris supervisory board, which includes James Freis, Tomoyuki Nii, Masashi Okuyama, and Yasuhiro Fujiki. With SBI’s backing, Solaris aims to accelerate product innovation, expand its partnerships, and strengthen its role as a key FinTech infrastructure provider across Europe. This development marks an essential step in Solaris’s long-term strategy as it continues to innovate and drive embedded finance solutions across Europe. Previous Article

Solaris Frequently Asked Questions (FAQ)

When was Solaris founded?

Solaris was founded in 2016.

Where is Solaris's headquarters?

Solaris's headquarters is located at Cuvrystrasse 53, Berlin.

What is Solaris's latest funding round?

Solaris's latest funding round is Series G.

How much did Solaris raise?

Solaris raised a total of $693.83M.

Who are the investors of Solaris?

Investors of Solaris include SBI Group, Boerse Stuttgart, Yabeo Capital, BBVA, HV Capital and 20 more.

Who are Solaris's competitors?

Competitors of Solaris include Swan, Klarna, Codat, Nymbus, Vodeno and 7 more.

What products does Solaris offer?

Solaris's products include Digital Banking and 3 more.

Who are Solaris's customers?

Customers of Solaris include American Express and Vivid .

Loading...

Compare Solaris to Competitors

Railsr is a global embedded finance platform that operates within the financial services sector. The company provides financial services, including digital wallets, payment processing, and card issuance, all facilitated through API integration. Railsr's platform is designed to integrate into a brand's digital journey, offering rewards programs, loyalty points, and various types of cards. Railsr was formerly known as Railsbank. It was founded in 2016 and is based in London, United Kingdom.

Productfy is a platform that specializes in the embedding of financial products within various business sectors. The company offers a suite of services, including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Teller provides APIs for bank account connectivity within the financial technology sector. Its offerings include services that allow applications to connect with users' bank accounts for verifying ownership, checking balances, accessing transaction histories, and facilitating payments. The API supports a wide range of financial institutions. It was founded in 2014 and is based in London, United Kingdom.

ClearBank is a financial technology company that operates in the banking sector. The company provides a cloud-based API that enables financial institutions to offer their customers a fully regulated banking infrastructure and real-time clearing access. ClearBank primarily serves fintechs, crypto platforms, banks, and credit unions. ClearBank was formerly known as CB Infrastructure Limited. It was founded in 2014 and is based in Bristol, United Kingdom.

Modulr specializes in embedded payments within the financial technology sector. The company offers a platform that enables businesses to integrate payment processing, account management, and card issuance into their systems. Its services cater to a variety of sectors including travel, lending, merchant services, and investment management. The company was founded in 2015 and is based in London, United Kingdom.

Loading...