Spendesk

Founded Year

2016Stage

Incubator/Accelerator | AliveTotal Raised

$300.34MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+96 points in the past 30 days

About Spendesk

Spendesk provides financial management tools for businesses. The company offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. The company was founded in 2016 and is based in Paris, France.

Loading...

ESPs containing Spendesk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

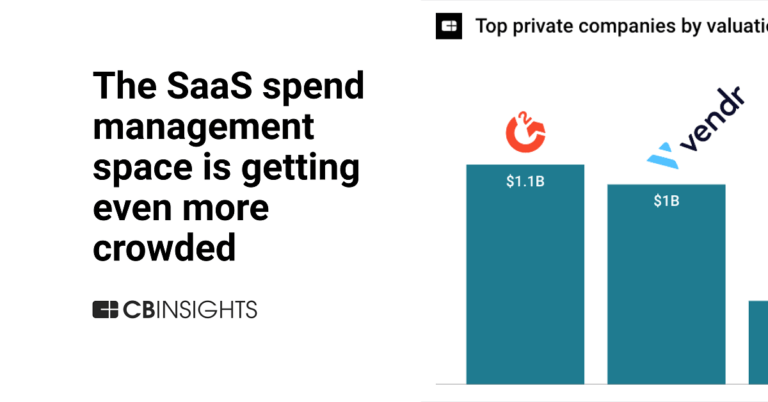

The SaaS spend management software market provides platforms that help organizations monitor, control, and optimize their expenses on subscription-based software services. As businesses increasingly rely on diverse SaaS tools for various functions like CRM, analytics, and HR management, these solutions have become essential for financial governance. Vendors in this market offer capabilities includ…

Spendesk named as Leader among 15 other companies, including SAP, Ramp, and Apptio.

Loading...

Research containing Spendesk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Spendesk in 8 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

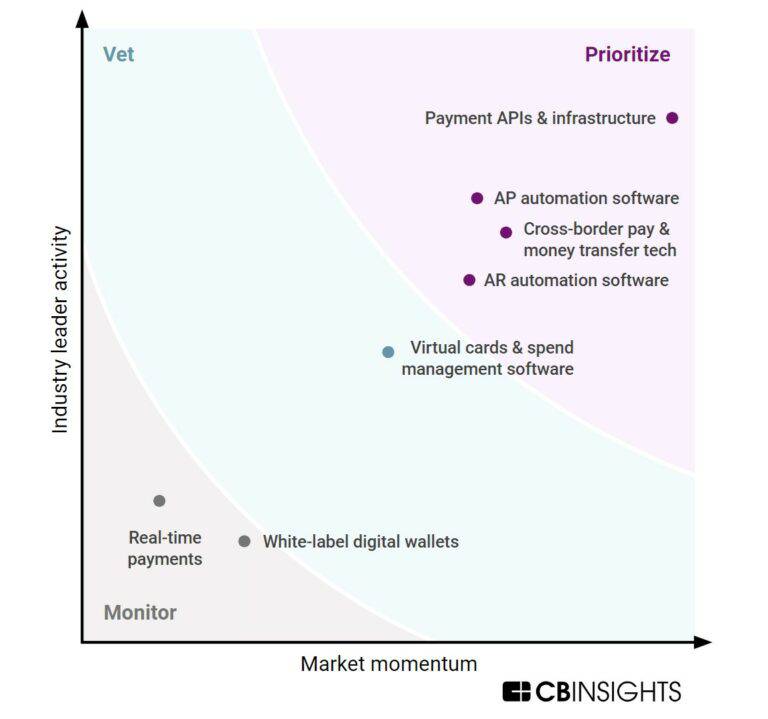

The B2B payments tech market map

Oct 26, 2023

The CFO tech stack market map

Oct 12, 2023

The procurement tech market map

Oct 25, 2022

The Transcript from Yardstiq: Toppling Salesforce

Oct 4, 2022

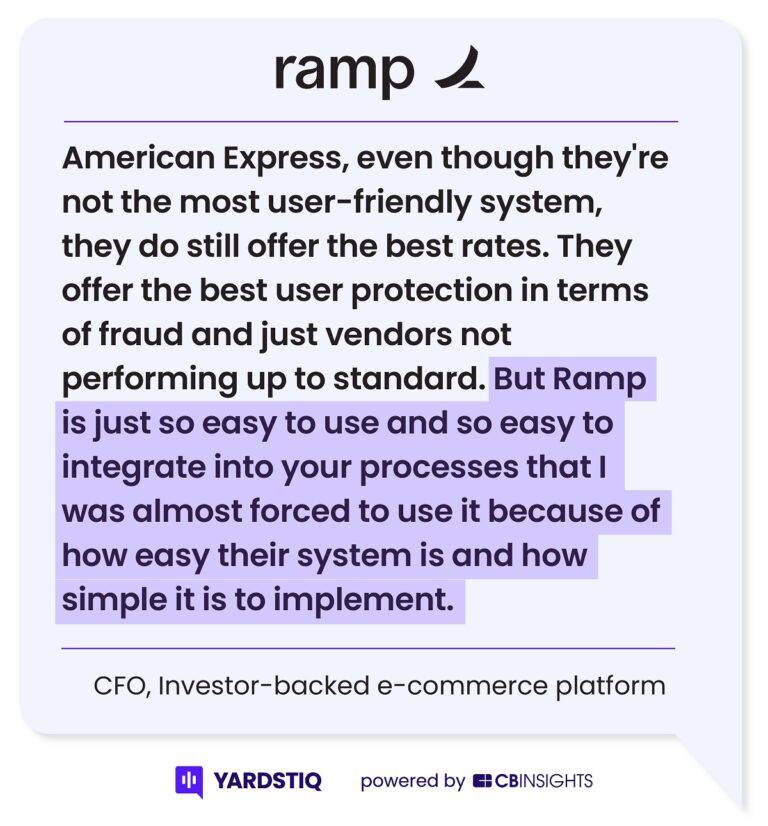

The Transcript from Yardstiq: Ramp vs. BrexExpert Collections containing Spendesk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Spendesk is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Spendesk News

Mar 20, 2025

Share this post: Spendesk , the leading spend management and procurement platform for mid-market companies, today announces its partnership with Wise Platform , Wise’s global payments infrastructure for banks and enterprises, to provide international payments. This strategic partnership introduces international payments capabilities to Spendesk’s platform, allowing customers based in the European Economic Area and the United Kingdom to make cross-border transactions quickly, securely and at low-cost in 30 currencies, supporting invoice payments and expense reimbursements. Starting today, customers can sign up to the waiting list with the feature expected to go live within the next few weeks. This also builds upon Spendesk’s recent announcements of the launch of Spendesk Financial Services , Spendesk’s regulated payment institution, and its pioneering Procure-to-Pay solution . This partnership marks yet another milestone as Spendesk continues to pioneer the landscape of modern spend management, this time addressing one of the most challenging aspects of managing cross-border payments. With this new international payments feature, Spendesk customers can now easily manage complex, multi-entity financial and cross-border operations through a single and unified dashboard. By combining spend management with fast, low-cost and transparent international payments in one cohesive solution, Spendesk eliminates inefficiencies and slow processing times that typically plague cross-border transactions, while providing real-time tracking of every payment directly from the dashboard. Key advantages of the new capabilities include: Global payment reach: Customers can send invoices and expenses in 30 currencies using the mid-market exchange rate1. Instant payments: Leveraging Wise’s global payment infrastructure for quicker international transfers. Over 60% of Wise’s transfers are settled instantly2 (in 20 seconds or less) and 95% are completed in under one day. Complete payment visibility: Real-time tracking of all international payments directly from the Spendesk dashboard, providing finance teams with full control and transparency. Multi-entity management: Seamless handling of complex corporate structures with centralised international payment management across different business entities. “This partnership with Wise Platform allows us to offer a comprehensive end-to-end payment solution for businesses operating worldwide,” said Stéphane Dehaies, CEO of Spendesk Financial Services. “Beyond gaining the ability to manage complex multi-entity operations with complete visibility over international payments, our clients now benefit from accelerated fund receipts and significant cost savings on their transactions, reinforcing our commitment to innovation.” Manuel Sandhofer, General Manager, EMEA at Wise Platform, commented: “We’re excited to partner with Spendesk to power a fast, seamless and unified international payments experience for their customers through Wise Platform. Spendesk has a strong vision to replace complicated and bureaucratic money movement and we’re thrilled to be working with them to make fast, cost-effective, transparent and easy international payments an integral part of their offering.” Spendesk will roll out the new international payments feature in the next few weeks. For more information or to request early access, please visit the waiting list . People In This Post News News News News News

Spendesk Frequently Asked Questions (FAQ)

When was Spendesk founded?

Spendesk was founded in 2016.

Where is Spendesk's headquarters?

Spendesk's headquarters is located at 51 rue de Londres, Paris.

What is Spendesk's latest funding round?

Spendesk's latest funding round is Incubator/Accelerator.

How much did Spendesk raise?

Spendesk raised a total of $300.34M.

Who are the investors of Spendesk?

Investors of Spendesk include Leading European Tech Scaleups, Index Ventures, Eight Roads Ventures, FundersClub, General Atlantic and 12 more.

Who are Spendesk's competitors?

Competitors of Spendesk include Yokoy, IPaidThat, Qonto, Pleo, Airbase and 7 more.

Loading...

Compare Spendesk to Competitors

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Ramp offers a financial operations platform that provides spend management services for businesses. It offers services including corporate cards, expense management, accounts payable solutions, and accounting automation. Its platform serves startups, small businesses, mid-market companies, and enterprises across sectors. It was founded in 2019 and is based in New York, New York.

Payhawk provides corporate spend management solutions within the financial technology sector. It offers a platform that includes corporate cards, expense management, accounts payable, and accounting software for business payments and financial control. Payhawk's services aim to automate expense reporting and reconciliation and provide visibility and control over company spending, while also integrating with existing financial systems. It was founded in 2018 and is based in London, United Kingdom.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Mooncard operates as a software-as-a-service (SaaS) company that focuses on business expenses and corporate spend management. The company offers smart payment cards linked to accounting and management software, which automate expense reports and simplify the daily lives of employees. It primarily serves companies of all sizes across various sectors. The company was founded in 2016 and is based in Paris, France.

Loading...