SpotOn

Founded Year

2017Stage

Series F | AliveTotal Raised

$900MValuation

$0000Last Raised

$300M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-54 points in the past 30 days

About SpotOn

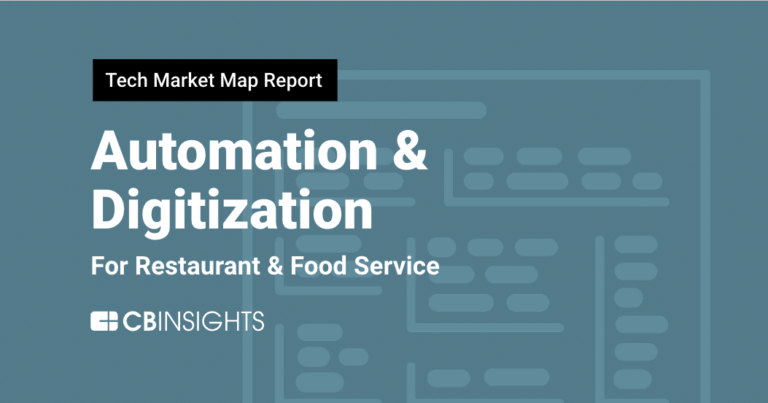

SpotOn provides payment processing and customer engagement tools. It brings together payment processing and a software solution to give merchants data and tools to market effectively to their customers. The platform offers comprehensive tools for small and medium-sized businesses (SMBs), including payments, marketing, reviews, analytics, and loyalty. It serves the financial technology sector. The company was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing SpotOn

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

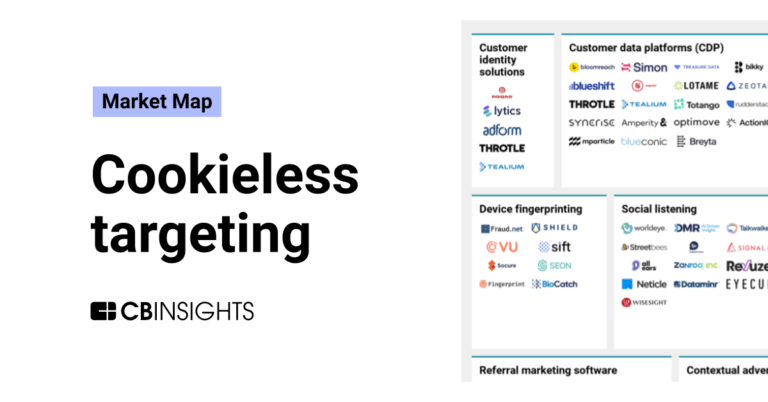

The loyalty management & analytics software market provides solutions and services related to the management, analysis, and optimization of customer loyalty programs. This market is driven by businesses seeking to enhance customer retention, engagement, and overall satisfaction through strategic loyalty initiatives. Loyalty management and analytics involve the use of technology, data analysis, and…

SpotOn named as Highflier among 15 other companies, including Salesforce, Antavo, and Amperity.

SpotOn's Products & Differentiators

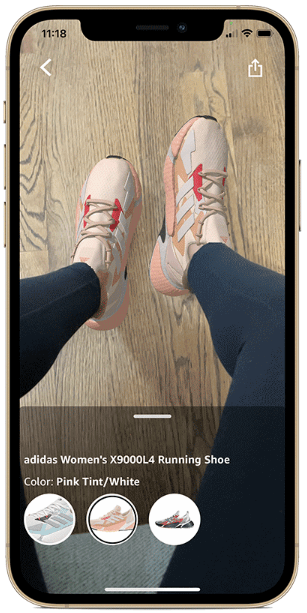

SpotOn Point of Sale

SpotOn Restaurant gives restaurant operators everything they need to drive profit point-by-point - from an intuitive point-of-sale with solutions for online ordering, reservations and labor management with software designed to improve efficiency and speed and hardware that offers flexibility and reliability.

Loading...

Research containing SpotOn

Get data-driven expert analysis from the CB Insights Intelligence Unit.

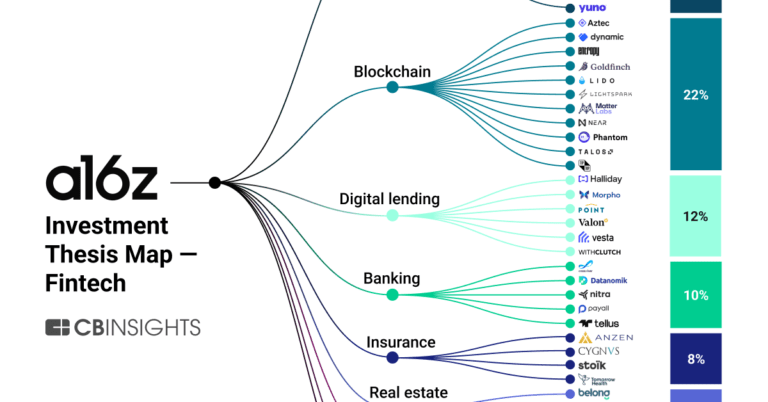

CB Insights Intelligence Analysts have mentioned SpotOn in 6 CB Insights research briefs, most recently on Aug 14, 2023.

Expert Collections containing SpotOn

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SpotOn is included in 9 Expert Collections, including Restaurant Tech.

Restaurant Tech

1,285 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, cloud kitchens, and more. On-demand food delivery services are excluded from this collection.

Store tech (In-store retail tech)

1,775 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,270 items

Loyalty & Rewards Tech

618 items

Startups allowing global brands and local shops alike to offer tech-enabled loyalty and rewards programs including loyalty software, AI-powered loyalty, blockchain-powered loyalty, and more.

SMB Fintech

1,586 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

SpotOn Patents

SpotOn has filed 16 patents.

The 3 most popular patent topics include:

- technical drawing

- broadcast engineering

- electronic device modeling

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/3/2024 | 2/11/2025 | Broadcast engineering, Radio electronics, Electronic device modeling, Technical drawing, Switches | Grant |

Application Date | 9/3/2024 |

|---|---|

Grant Date | 2/11/2025 |

Title | |

Related Topics | Broadcast engineering, Radio electronics, Electronic device modeling, Technical drawing, Switches |

Status | Grant |

Latest SpotOn News

Mar 7, 2025

businesses, today unveiled its 2025 Restaurant Business Report , revealing the financial challenges restaurant operators face and the opportunities to strengthen their businesses. While economic pressures persist, the report highlights that with the right tools and insights, operators can take control of their financial future in 2025 to strengthen profitability and position their businesses for long-term success. SpotOn worked with Penta to conduct a nationwide survey of 200 independent and chain restaurant operators to better understand the state of financial literacy among US operators in major markets including including Seattle San Francisco Los Angeles Dallas St. Louis Chicago New York Pittsburgh Washington DC Miami Denver , and Detroit Key Findings from the 2025 SpotOn Financial Literacy Report Economic Pressures Are Rising : 93% of operators are concerned about the impact of rising interest rates on their business, while nearly 1 in 3 worry about financial stability in 2025. Independent operators feel the squeeze the most. Financial Systems Need an Overhaul : While 99% of operators agree that strong financial management is critical, 84% say their current systems need improvement, and nearly half admit they should spend more time on financial tracking but struggle to do so. Data Gaps Hinder Pricing Strategies : 73% of operators lack full confidence in their pricing strategy, with most relying on gut instinct or competitor pricing instead of real-time cost analysis. Access to Capital Remains a Challenge : 66% of operators anticipate needing additional funding in 2025, yet fewer than 12% have explored POS-based lending, despite its potential to provide faster, more flexible capital. "Restaurant operators are some of the most resilient and resourceful business owners out there," said Kevin Bryla , Chief Marketing Officer of SpotOn. "This report isn't just about identifying challenges—it's about uncovering opportunities and leveling the playing field for independent restaurants. We as industry partners must provide better financial reporting and easier access to financial insights, enabling operators to navigate uncertainty with confidence while delivering incredible guest experiences." A Path Forward for Restaurants The report highlights key opportunities for restaurants to strengthen their financial future through better data access, automation, and smarter financial tools: Bridge the Data Gap : With real-time financial reporting and automation, restaurants can spend less time tracking numbers and more time running their business. SpotOn's Restaurant POS system integrates seamlessly to provide operators with the insights they need—when they need them. Streamline Financial Management : Integrating financial systems with payroll and accounting software reduces administrative burdens, freeing operators to focus on profitability. SpotOn's top-tier integrations streamline processes like payroll preparation, reduce manual tasks, and allow operators to focus more on strategic management and planning. Turn Pricing into a Growth Strategy : A smarter approach to menu pricing can boost revenue and profitability without compromising guest experience. SpotOn integrations with inventory partners like MarginEdge and Craftable can help operators fine-tune their pricing strategy in a way that accounts for costs while still appealing to consumers. Explore Easier Access to Capital : Traditional loans aren't the only option. POS-based lending solutions like SpotOn Capital give operators quick access to working capital, helping them invest in their business without the lengthy approval process. SpotOn's Report makes one thing clear: operators are ready to take control of their financial future, and the right technology partner can help. Whether it's improving financial visibility, making smarter pricing decisions, or unlocking new funding opportunities, restaurant owners have the power to turn today's challenges into tomorrow's success for a brighter financial future for all restaurants. The full report is available for download at www.spoton.com/report

SpotOn Frequently Asked Questions (FAQ)

When was SpotOn founded?

SpotOn was founded in 2017.

Where is SpotOn's headquarters?

SpotOn's headquarters is located at 100 California Street, San Francisco.

What is SpotOn's latest funding round?

SpotOn's latest funding round is Series F.

How much did SpotOn raise?

SpotOn raised a total of $900M.

Who are the investors of SpotOn?

Investors of SpotOn include Franklin Venture Partners, Dragoneer Investment Group, DST Global, Andreessen Horowitz, Mubadala Investment Company and 13 more.

Who are SpotOn's competitors?

Competitors of SpotOn include Izicap and 4 more.

What products does SpotOn offer?

SpotOn's products include SpotOn Point of Sale and 3 more.

Who are SpotOn's customers?

Customers of SpotOn include Trey Dyer, Kwango Lee, Marta Saint Louis, Benson Wang and Chuck Iverson.

Loading...

Compare SpotOn to Competitors

Foodics specializes in restaurant operations and payment technology, offering a suite of software solutions for the food and beverage industry. The company provides a cloud-based point of sale (POS) and restaurant management system designed to streamline operations, along with various tools for payment processing, order management, and customer engagement. Foodics' ecosystem includes solutions for self-ordering, table payments via QR codes, waiter performance apps, and kitchen display systems to enhance efficiency and profitability. It was founded in 2014 and is based in Riyadh, Saudi Arabia.

RoadSync is a digital payment platform in the logistics industry and provides solutions for payment processing. The company offers services such as RoadSync Checkout for various payment methods and RoadSync Driver for managing expenses, including warehouses, lumpers, repair and tow services, brokers, carriers, and drivers. RoadSync's solutions focus on transactions, cash flow, and operational control across the logistics supply chain. RoadSync was formerly known as MyLumper Corp. It was founded in 2015 and is based in Atlanta, Georgia.

Autobooks is a financial technology company that specializes in small business banking solutions within the financial services industry. The company offers integrated services such as online invoicing, digital payment acceptance, and comprehensive accounting and bookkeeping functionalities. Autobooks partners with banks and credit unions to provide these services seamlessly within existing online and mobile banking platforms. It was founded in 2015 and is based in Detroit, Michigan.

Computer Perfect specializes in retail point of sale solutions and operates within the technology sector, providing a suite of services that cater to retail businesses. Their main offerings include a cloud-based point of sale system that ensures fast transaction processing and real-time inventory management, along with e-commerce integration and digital marketing tools designed to enhance retail operations. The company's products are primarily utilized by various retail sectors such as wine and spirits stores, beauty supplies stores, and pet shops. It was founded in 1989 and is based in New Rochelle, New York.

eatOS is an AI-enabled restaurant management ecosystem operating within the food service industry. The company offers a suite of products designed to streamline restaurant operations, enhance customer service, and optimize payment processing. These products include cloud-based point of sale systems, kitchen display systems, self-service kiosks, handheld ordering devices, customer facing displays, and workforce management applications. It was founded in 2017 and is based in West Hollywood, California.

Prepaid Ventures is a processor of prepaid debit card solutions in the United States. Integrating cutting-edge technology and decades of financial experience, Prepaid Ventures offers solutions to businesses looking to grow. Solutions that can bridge the gap between traditional paper services and electronic payments while maintaining your current business structure. Prepaid Ventures can help merchants who look to give their consumers excellent debit card services and unrivaled customer support. Prepaid Ventures protects merchants by monitoring fraud and risk, and provides consistent and useful consultative services.

Loading...