Standard AI

Founded Year

2017Stage

Unattributed VC - II | AliveTotal Raised

$236.32MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-69 points in the past 30 days

About Standard AI

Standard AI focuses on transforming the retail industry through artificial intelligence. The company offers a platform that uses artificial intelligence (AI)-powered cameras and deep algorithms to provide checkout-free shopping experiences, real-time reporting on shopper behavior, and insights into inventory and stocks. Its primary services are utilized in the retail sector. It was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Standard AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

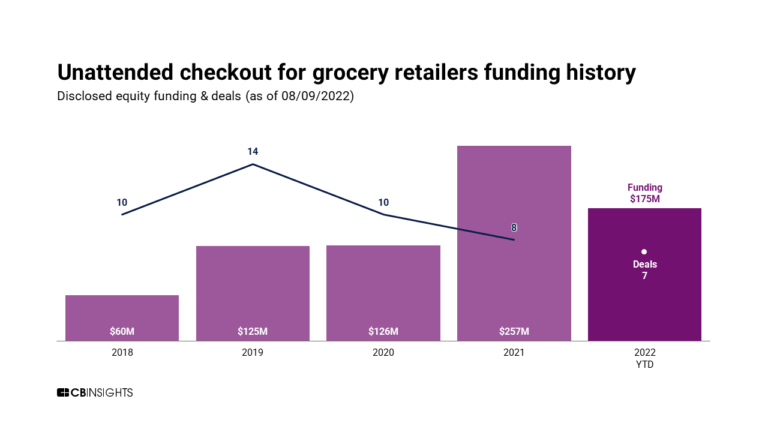

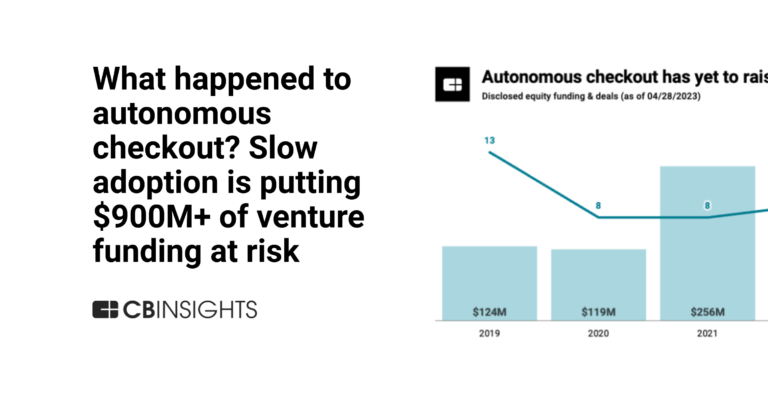

The unattended checkout market offers a range of solutions to retailers looking to provide unmanned point-of-sale and checkout technology. Solutions involve the deployment of kiosks, mobile applications, and computer vision technology to facilitate a seamless and contactless checkout experience for customers. This market is driven by the increasing demand for convenient and efficient shopping expe…

Standard AI named as Challenger among 14 other companies, including Amazon, AiFi, and MishiPay.

Standard AI's Products & Differentiators

Self-Checkout

Standard AI acquired Skip, the world leader in self checkout. The acquisition enables them to provide customers with self-checkout kiosks and cloud-based POS and integrations

Loading...

Research containing Standard AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Standard AI in 3 CB Insights research briefs, most recently on May 3, 2023.

Expert Collections containing Standard AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Standard AI is included in 12 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

2,161 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,270 items

Grocery Retail Tech

831 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Future Unicorns 2019

50 items

New Retail Formats

368 items

Tech-enabled, physical retail selling formats that reach beyond the walls of a traditional store.

Standard AI Patents

Standard AI has filed 108 patents.

The 3 most popular patent topics include:

- artificial intelligence

- chemical processes

- digestive system surgery

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/31/2022 | 4/1/2025 | Electrochemistry, Battery types, Energy storage, Lithium-ion batteries, Fuel cells | Grant |

Application Date | 5/31/2022 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Electrochemistry, Battery types, Energy storage, Lithium-ion batteries, Fuel cells |

Status | Grant |

Latest Standard AI News

Jan 7, 2025

Visual search, compliance issues, tech advancements lead list of 2025 predictions. Photo: Adobe Stock (AI generated) Jan. 7, 2025 While AI may be the dominant tech strategy, expanding its wings in 2025, it isn't the only trend retail and brand leaders expect to come into play with the retail customer experience. This year brought increasing news on how consumer behavior must be top of mind for retailers as well the consumer's steady and growing interest in visiting physical retail stores. There's also a slew of concerns on consumer minds, specifically data security and its use by retailers and brands. To dig deeper on what retail customer experience trends will play a bigger role next year, RetailCustomerExperience reached out via email to CEOs, tech leaders and brand leaders on their predictions. CX walking toward its own demise "CX as an industry is approaching an existential crisis — and 2025 may mark its death. Customer experience data is often left isolated within CX departments, when in reality, it should be serving the entire operation and the chosen business strategy. Customer insights need to be embedded in operational workflows, where actual change can be easily implemented. Operational managers and business development leaders need to own it, not a separate team isolated from the rest of the business. We've seen time and time again that CX budgets are among the first to be cut when ROI is hard to prove, so it may be time to rebrand or rethink the sector all together." — Miika Mäkitalo, CEO of HappyOrNot Visual search the new norm, foot traffic will rise "The concept of 'visual search' will be implemented by retailers across the country. While useful, text-based search isn't always accurate and can lead to disengagement from customers. With product discovery frequently taking place online or on social media, customers can now search with images of products they want and find them in-store. As consumers seek more engaging shopping experiences, foot traffic will increase for brick-and-mortar stores. With this rise, retailers will lean on in-store advertising as a revenue growth engine and method of captivating shoppers. The desire for authentic, hands-on interactions that make shopping more than just a transaction, coupled with the new opportunities for personalizing the in-store advertising experience with AI, will allow brick-and-mortar to compete more effectively with online shopping." — Angie Westbrock, CEO of retail-insights unicorn Standard AI Compliance challenges ahead, payment security "The deadline of March 31, 2025, where most new PCI-DSS 4.0 requirements become applicable have many merchants scrambling. Of most concern are new MFA requirements for all user access into CDE, as well as new e-commerce requirements (6.4.3, 11.6.1). The latter of which, due to the amount of confusion, has seen a massive push in the industry for the PCI SSC to provide additional guidance. Retail in-store payments will continue to see a rise in the use of digital wallets and payments utilizing services such as Google Pay, Apple Pay or Samsung Pay. The shift to digital wallets also signals the shift to tokenization, with significantly less merchant environments having access to actual credit card information." — Brent Johnson, chief information security officer, Bluefin Omnichannel innovation in play "In 2025, in-store advertising will improve customers' shopping experience with targeted activations that merge the best of in-store and digital. According to eMarketer, the majority (65.6%) of consumers said the availability of digital in-store retail media formats boosts how much they spend — with 37.9% saying they would spend a lot more in stores where the signage was available. We know retailers are in the early stage of using technology to create frictionless, omnichannel shopping experiences for customers. I expect retailers to lean into advertising that will add to the customer experience and bring digital targeting and measurement methods in-store. At Sam's Club, we have been making innovations in our Scan & Go app that uniquely enables members to check out on their phone. We recently added display ads to the Scan & Go experience to enhance the member shopping experience and help them discover items as they check out with Scan & Go. In just four weeks, a brand drove 88% incremental reach among unique members with an engagement rate 10x above benchmarks. Such omnichannel innovation enables advertisers to reach members at the point of conversion and may help drive incremental sales of associated or halo items. I predict other retailers will adapt their in-store ad experiences in similar ways." — Harvey Ma, SVP and general manager, Sam's Club Member Access Platform Advancements of retail tech "Technology has been helping to shape the retail sector for years, but in the next year we are going to see that impact soar as technology becomes more advanced than ever. Sometimes, the most significant changes stem from streamlining basic processes, like tracking point of sale activations. It's surprising that in 2025, we still hear brands say "we've lost our PoS!" — a situation that costs both time and money as they scramble to find or replace missing displays. While a start has been made with 21% of retailers starting using PoS software, there's still far to go. One of the key developments we can expect is the use of trace technology. Brands need to ensure their displays arrive at stores as planned. By integrating systems that monitor PoS locations, companies can prevent revenue loss from undelivered signage, which will help improve profit margins through guaranteed brand exposure. I also predict that sensors will become increasingly important for gathering consumer insights. By using sensors, brands can identify which displays attract the most attention from shoppers. This information will be invaluable for creating future PoS displays that are tailored to what resonates best with consumers. As these technologies take hold, we can look forward to more effective marketing strategies that truly connect with shoppers and drive sales." — Gail Van Dijk, global marketing director, Communisis Brand Deployment Transition to software-defined stores "Supercenters and grocery stores will become software-defined, each running computer vision and sophisticated AI algorithms at the edge. The transition will accelerate checkout, optimize merchandising and reduce shrink — the industry term for a product being lost or stolen. Each store will be connected to a headquarters AI network, using collective data to become a perpetual learning machine. Software-defined stores that continually learn from their own data will transform the shopping experience. Intelligent supply chains created using digital twins, generative AI, machine learning and AI-based solvers will drive billions of dollars in labor productivity and operational efficiencies. Digital twin simulations of stores and distribution centers will optimize layouts to increase in-store sales and accelerate throughput in distribution centers. Agentic robots working alongside associates will load and unload trucks, stock shelves and pack customer orders. Also, last-mile delivery will be enhanced with AI-based routing optimization solvers, allowing products to reach customers faster while reducing vehicle fuel costs." — Azita Martin, VP, retail, consumer-packaged goods and QSR, NVIDIA Hyper-personalization becomes the norm "We will begin to see more micro-personalization implementations on the retail side next year. For example, Walmart, the second-largest online retailer in the U.S., is already aggressively investing in their LLM "Wallaby" and announced the ambitious goal of creating custom Walmart.com homepages for every single shopper. And Google announced changes to Google Shopping, using AI to customize and personalize the results shoppers see to help them speed up and simplify their research for a given product. Finally, Amazon is including more AI-driven personalization efforts with their launch of their new AI Shopping Guides, which creates curated landing pages with product attributes, use cases, and recommendations for a shopper based on their search queries. With these and other launches on the horizon, 2025 promises to be the year every online shopper really starts experiencing their own shopping journey that's uniquely their own." — Michelle Wood, SVP of merchant business development, Wildfire Systems Big integration ahead "Integrating martech, ad tech, and retail tech will offer several key benefits: First, it allows for real-time optimization. For example, if a company sees a surge in demand for a product in one region, they can quickly adjust their ad spend and marketing efforts to capitalize on the trend. Second, a unified tech stack creates a more cohesive customer journey. Customers are no longer experiencing disconnected interactions with a brand — whether they're seeing an ad, browsing a website, or making an in-store purchase, the experience is consistent and personalized. Finally, companies benefit from enhanced analytics. By combining data from all three areas, businesses gain a more complete view of their customers, enabling deeper insights and more effective decision-making. — Mark Menell, partner, Silicon Foundry Going super, super seamless "This year, retailers made a big push towards creating more seamless checkout experiences within brick-and-mortar stores through things like Amazon Go and Walmart's Scan and Go. Both of these experiences are part of a larger trend towards eliminating shopping carts, long lines and all of the other friction that typically happens at checkout. Instead, these retailers are leading the charge towards enabling shoppers to make a purchase in the same moment that they discover an item. In the coming year, we'll see this trend take off in online shopping, too. Consumers are increasingly discovering products everywhere but on ecommerce sites —from social media to blog posts and marketing emails. But with every additional click or tap that's required to actually purchase these products, brands are losing shoppers' attention. This will change as brands lean into headless checkout to enable shoppers to make a purchase wherever they are." — Casey Gannon, VP of marketing and technology partnerships, Bold Commerce Conversational commerce beyond chatbots "In 2025, conversational commerce will continue to grow as a critical trend, changing how customers interact with e-commerce platforms. Advances in GenAI are driving this shift, moving beyond traditional chatbot interfaces to deliver more intuitive, conversation-driven shopping experiences. Research by the Boston Consulting Group highlights a key expectation among consumers: the most valued feature in GenAI-powered conversational commerce is its ability to address complex, product-related inquiries. This finding aligns closely with feedback from our own customers, demonstrating the significance of buyer education and knowledge discovery throughout their purchasing journey. Looking ahead, conversational commerce will likely evolve by integrating AI-powered systems within search frameworks, allowing for more nuanced, fast and informative interactions. This approach combines the strengths of traditional search with the interactivity of conversational tools, creating a seamless and rich product discovery experience." — Peter Curran, GM of commerce, Coveo

Standard AI Frequently Asked Questions (FAQ)

When was Standard AI founded?

Standard AI was founded in 2017.

Where is Standard AI's headquarters?

Standard AI's headquarters is located at 548 Market Street, San Francisco.

What is Standard AI's latest funding round?

Standard AI's latest funding round is Unattributed VC - II.

How much did Standard AI raise?

Standard AI raised a total of $236.32M.

Who are the investors of Standard AI?

Investors of Standard AI include Sergey Gordeev, Liquid 2 Ventures, Charles River Ventures, Initialized Capital, EQT Ventures and 12 more.

Who are Standard AI's competitors?

Competitors of Standard AI include VeriFone, Nomitri, PIXEVIA, Sensei, AiFi and 7 more.

What products does Standard AI offer?

Standard AI's products include Self-Checkout and 4 more.

Loading...

Compare Standard AI to Competitors

Trigo provides a computer vision company and operates in retail. It provides a retail automation platform that uses artificial intelligence to identify shopping items with high accuracy, enabling a seamless checkout process and providing valuable retail insights. It provides EasyOut for customer shopping and related services. It primarily sells to the grocery retail industry. Trigo was formerly known as Trigo Vision. It was founded in 2018 and is based in Ramat Gan, Israel.

Zippin specializes in checkout-free technology within the retail sector. The company provides an artificial intelligence-powered platform that uses machine learning and sensor fusion technology to enable purchases. It is primarily utilized by sports and entertainment venues, airports, train stations, convenience stores, college campuses, and healthcare organizations. Zippin was formerly known as Zyp. It was founded in 2018 and is based in San Francisco, California.

Inokyo specializes in autonomous checkout technology for the retail sector, aiming to streamline the shopping experience. Its main offerings include a system that tracks customers' virtual carts in real-time and allows for tap and go payments, eliminating the need for traditional checkout processes. Inokyo's solutions cater to a variety of store sizes and are designed to improve operational efficiency and provide valuable customer insights. It was founded in 2018 and is based in San Francisco, California.

AiFi specializes in autonomous retail technology and operates within the retail and technology sectors. The company offers computer vision solutions that enable retailers to implement frictionless shopping experiences without needing shelf sensors. It primarily sells to the retail industry, providing advanced analytics and AI (artificial intelligence)-powered checkout systems to enhance the shopping experience. The company was founded in 2016 and is based in Burlingame, California.

Mashgin specializes in AI-powered self-checkout systems within the retail automation sector. Its main product leverages 3D vision and deep learning algorithms to recognize items quickly and accurately, aiming to enhance the checkout process by reducing transaction times and increasing retailer revenue. Mashgin's technology is utilized across various sectors, including convenience stores, sports and entertainment venues, and business dining facilities. It was founded in 2014 and is based in Palo Alto, California.

SandStar operates in retail technology, focusing on AI solutions and data analytics. The company provides AI automated retail machines that use visual recognition and edge computing for self-service shopping experiences. SandStar's products aim to improve operational efficiency and profit margins for retail businesses. SandStar was formerly known as YI Tunnel. It was founded in 2016 and is based in Beijing, Beijing.

Loading...