Starling Bank

Founded Year

2014Stage

Shareholder Liquidity | AliveTotal Raised

$905.62MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-60 points in the past 30 days

About Starling Bank

Starling Bank is a digital bank that focuses on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, United Kingdom.

Loading...

ESPs containing Starling Bank

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to modernize their services and expand their customer base through embedded banking and payment options. These providers offer APIs that enable businesses to integrate banking capabilities such as account opening, transaction processing, card issuance, payment rails, and compliance tools. BaaS solutions…

Starling Bank named as Challenger among 15 other companies, including Stripe, FIS, and Finastra.

Loading...

Research containing Starling Bank

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Starling Bank in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

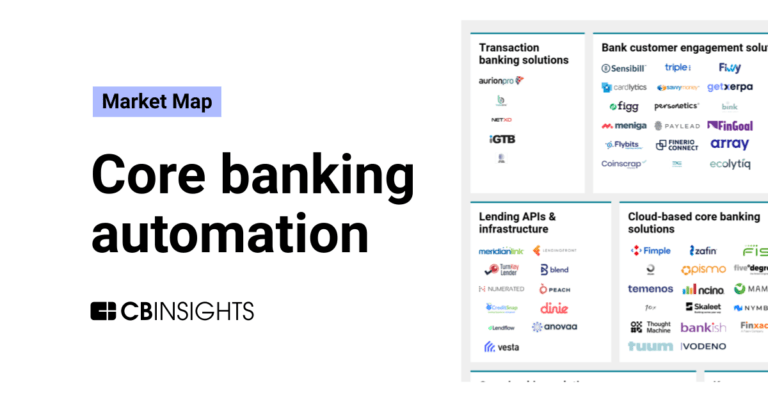

The core banking automation market map

Expert Collections containing Starling Bank

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Starling Bank is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,231 items

Fintech

13,699 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,112 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Starling Bank News

Mar 24, 2025

Analysis:Klarna IPO filing spurs hope of British fintech listings Search Analysis:Klarna IPO filing spurs hope of British fintech listings FILE PHOTO: A smartphone displays a Klarna logo in this illustration taken January 6, 2020. REUTERS/Dado Ruvic/Illustration/File Photo 24 Mar 2025 02:01PM Get bite-sized news via a new cards interface. Give it a try. Click here to return to FAST Tap here to return to FAST LONDON : Klarna's upcoming U.S. initial public offering could help unlock a pipeline of British fintech flotations after a barren period for new technology listings, investors, lawyers and an executive told Reuters. Stockholm-headquartered Klarna, best known for its buy-now pay-later products, publicly filed to float on the New York Stock Exchange earlier this month in its second attempt at listing on the public markets in four years. It had looked to IPO in 2021, after shooting from a valuation of $5.5 billion to $45.6 billion in three funding rounds. But investors soured on tech companies as interest rates rose and economies stuttered, and the company was forced to cut its valuation to $6.7 billion in a 2022 fundraising. Now it is back, and could be worth at least $15 billion in an IPO likely to be priced in the first half of April, one person with knowledge of the plans said. "Any successful IPO of a high-profile business in the sector will be a catalyst for others to look again at an IPO as a strategic option for growth and/or liquidity," said James Wootton, a partner at Linklaters, who advised money transfer company Wise on its 2021 listing in London. At the peak of a post-pandemic fundraising boom in 2021, 101 fintech companies raised $296.86 billion via IPOs on global stock markets, according to data from PitchBook, compiled for Reuters. But between 2022 and 2024, just 86 firms raised $32.76 billion via IPOs. Klarna's plans have fuelled hopes of a resurgence. "It’s quite clear that the market is looking to Klarna as a bellwether for future fintech IPOs, many of which are in a long pipeline," said Tim Levene, chief executive of London-listed fintech investment fund Augmentum. "We hope that Klarna is the first of many to list, which will prove a positive data point for the rest of the market." WAITING IN THE WINGS Challenger banks Monzo and Starling, as well as payments companies Zilch and Ebury, are among the fintech companies considering plans to list at some point in the future, sources close to the companies told Reuters. Zilch, which offers a competing buy-now pay-later product to Klarna, is currently aiming to float in 2026, Philip Belamant, its chief executive, told Reuters. "The Klarna IPO will be a significant moment for the fintech sector, and we'll be watching closely," he said, adding that a successful IPO could "set the stage for greater investor confidence in European fintechs going public". Ebury, a Spanish-founded payments company majority owned by Banco Santander, is gearing up for a London listing by June at the earliest, one person familiar with knowledge of its plans said. The company will likely seek a valuation of around 2 billion pounds ($2.6 billion), the person said, adding the timing would depend on market conditions. Ebury did not respond to a request for comment. Santander declined to comment. It has said in the past that listing Ebury was one of many alternatives for the business. Britain's Revolut has previously signalled its intention to list publicly. A spokesperson for the challenger bank, Britain's most highly-valued startup, declined to comment on specifics. "Our focus is not on if or when we IPO, but on continuing to expand the business, building new products, and providing better and cheaper services to serve our growing global customer base," the person said. Zopa, which is headquartered in London, has no firm timeline for an IPO, a spokesperson said. "We continue to plan towards an eventual IPO, preferably in the UK and can be ready in a short time, however we will wait for the right macroeconomic and market conditions," the spokesperson said. To be sure, many have raised money and can wait, and conditions are volatile, forcing some European companies to put IPOs on hold. "A lot of them (fintech companies) have the luxury of being able to choose their time,” said Patrick Evans, head of UK equity capital markets at Citi. The choice of the U.S. venue by Klarna is also likely to intensify debate over where these fast-growing companies should list. Monzo has discussed floating in Britain or the U.S. but has set no firm timeline or venue for an IPO, a person familiar with the company’s plans said. The London Stock Exchange has been making overtures to fintech companies including Zilch, one person familiar with the matter said. Zilch has yet to choose a venue, the person said. The London Stock Exchange Group declined to comment. ($1 = 0.7747 pounds)

Starling Bank Frequently Asked Questions (FAQ)

When was Starling Bank founded?

Starling Bank was founded in 2014.

Where is Starling Bank's headquarters?

Starling Bank's headquarters is located at 1 Duval Square, London.

What is Starling Bank's latest funding round?

Starling Bank's latest funding round is Shareholder Liquidity.

How much did Starling Bank raise?

Starling Bank raised a total of $905.62M.

Who are the investors of Starling Bank?

Investors of Starling Bank include Chrysalis Investments, Jupiter Asset Management, Railway Pension Trustee Co. Ltd., Qatar Investment Authority, Fidelity Investments and 11 more.

Who are Starling Bank's competitors?

Competitors of Starling Bank include Varo, Current, Allica Bank, Greengage, Tide and 7 more.

Loading...

Compare Starling Bank to Competitors

Monzo engages as a digital bank that operates in the financial services sector, offering various banking products and services through its mobile app. The company provides personal and business accounts, savings and investment options, and credit and loan products. Monzo primarily serves individual consumers and businesses. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Atom Bank is a financial institution that provides an online banking platform focusing on personal and business banking services. The company offers savings accounts, residential and commercial mortgages, and business loans. It primarily serves individuals looking for savings options and businesses seeking financing solutions. Atom Bank was founded in 2014 and is based in Durham, United Kingdom.

N26 is a digital bank that offers mobile banking services in the financial sector. The company provides a platform for personal finance management, enabling users to manage their money and conduct financial transactions. N26 primarily serves individual consumers. It was founded in 2013 and is based in Berlin, Germany.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Shawbrook Bank is a bank that focuses on savings, lending, and financial services. The company provides savings accounts and personal loans for individuals, as well as finance solutions for SMEs and real estate professionals. Shawbrook Bank was formerly known as Whiteaway Laidlaw Bank. It was founded in 2011 and is based in Brentwood, England.

Revolut operates as a financial technology company that focuses on providing digital banking services. The company offers products including personal finance management tools, multicurrency accounts, cryptocurrency and stock trading, insurance products, and financial analytics. Revolut primarily serves individuals seeking enhanced control and flexibility over their finances. It was founded in 2015 and is based in London, United Kingdom.

Loading...