Stord

Founded Year

2015Stage

Secondary Market | AliveTotal Raised

$321.14MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-30 points in the past 30 days

About Stord

Stord provides omnichannel fulfillment and shipping solutions within the logistics and supply chain industry. The company offers software tools, including order management and warehouse management systems, to assist with operations and the pre-purchase and post-delivery consumer experience. Stord serves direct-to-consumer (DTC) and business-to-business (B2B) sectors with a focus on health & beauty, nutrition & supplements, and apparel & accessories. It was founded in 2015 and is based in Union City, Georgia.

Loading...

ESPs containing Stord

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

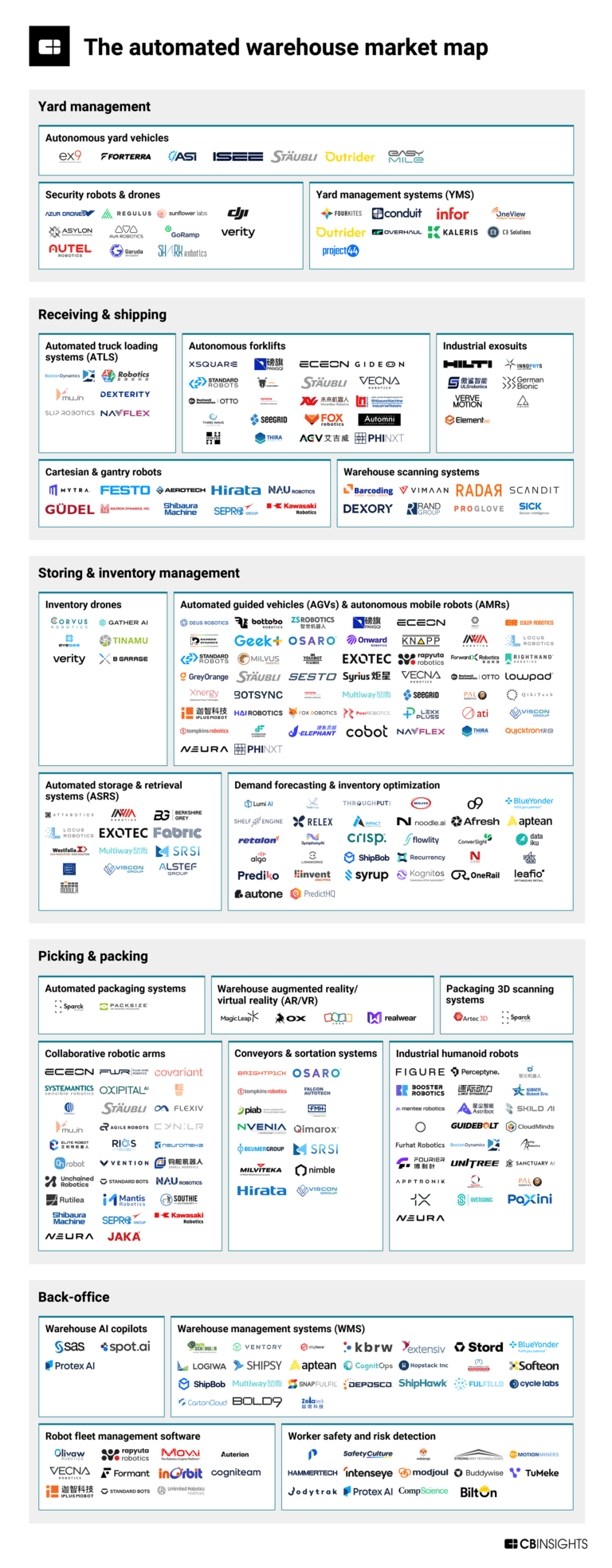

The warehouse management systems market aims to optimize and streamline warehouse operations. This technology typically involves using a centralized platform to manage inventory levels, track shipments, and coordinate resource allocation within the warehouse. Warehouse management systems can also integrate with other logistics technologies such as scanning devices and transportation management sys…

Stord named as Challenger among 15 other companies, including Oracle, SAP, and Manhattan Associates.

Loading...

Research containing Stord

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stord in 6 CB Insights research briefs, most recently on Feb 13, 2025.

Feb 13, 2025

The automated warehouse market map

Expert Collections containing Stord

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stord is included in 4 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

5,752 items

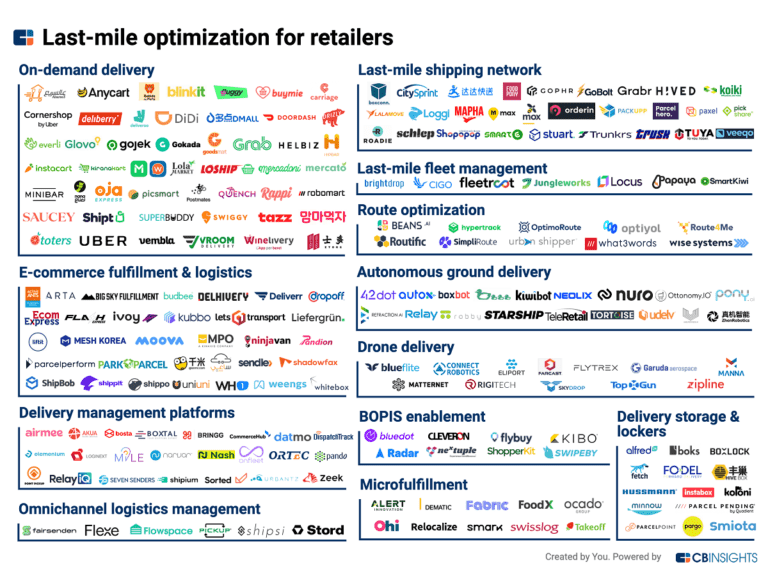

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,270 items

On-Demand

1,244 items

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Latest Stord News

Apr 8, 2025

The analyst's 'State of e-commerce logistics survey' analysis. A datasheet with all market sizing figures and forecasts will also be made available to all report purchasers. Despite Trump, global e-commerce logistics and e-fulfilment market expected to soar in 2025 Despite President Trump's intention to abolish the de minimis rules and impose tariffs on imports, the global E-commerce and E-fulfilment market is set to grow by 15.5% in 2025, according to the report. Following a post-COVID contraction in 2022, the market has regained its sharply upward trajectory, reporting double digit growth rates in the past two years. In 2024 the market was valued at €521.9bn ($569 bn), double the market value recorded just before the pandemic in 2019. The sharp increase suggests renewed consumer confidence, potentially driven by improved economic conditions, advancements in digital infrastructure, and the continued shift toward online shopping. In terms of regional performance, the Asia Pacific region has grown at a slightly faster rate than either North America or Europe; with 11% growth since 2020 compared to 10% for North America and 8% for Europe. M&A activity continues as larger groups seeking to capitalise on the e-commerce growth by acquiring smaller specialists. The report highlights recent e-commerce logistics acquisitions, examples of which are: DHL acquiring Inmar Supply Chain Solutions and Brandpath Group Stord acquiring Pitney Bowes fulfilment activities GLS acquiring e-Log Bpost acquiring Staci According to the senior report editor "Although President Trump's policies on trade and tariffs have introduced significant uncertainty into the market, the sector shows no signs of being blown off course. Consumer habits have transformed, and this will power domestic and cross-border e-commerce and e-fulfilment needs for years to come." Report Highlights The global e-commerce logistics market grew 13.6% year-on-year in 2024 to €521.9 bn. In 2024, the global e-commerce logistics market doubled the market value recorded just before the pandemic in 2019. Some inflationary pressures persisted in 2024, as y-o-y real growth came in at 9%. The North American e-commerce logistics market maintained its lead into 2024, albeit marginally. Asia Pacific came in at a close second. In 2024, eCommerce sales reached EUR 3.36 trillion, marking a strong 15% growth from the previous year. M&A activity continues as larger groups seek to capitalise on e-commerce growth by acquiring smaller specialists. Use the report to: Assess M&A opportunities: capture key investment and consolidation opportunities. Understand demand and growth forecasts: capitalise on key growth areas and emerging trends. Mitigate supply chain risk: increase resilience in volatile market conditions. Benchmark and optimise supply chain strategies: capture growth opportunities and gain competitive advantage. Key Topics Covered: 1.1 GLOBAL E-COMMERCE LOGISTICS MARKET SIZE 1.1.1 Global E-commerce Logistics Market by Region 1.1.2 Global Fulfilment and Last Mile E-commerce Logistics Market 1.1.3 Global Domestic and Cross-Border E-Commerce Logistics Market 1.2 Asia Pacific E-commerce Logistics Market 1.3 North America E-commerce Logistics Market 1.4 Europe E-commerce Logistics Market 2. E-COMMERCE LOGISTICS MARKET FORECAST 2.1 Global E-commerce Logistics Market Forecast 2.1.1 Global E-commerce Logistics Market Size Forecast by Region 2.1.2 Global E-commerce Logistics Market Size Forecast: Fulfilment and Last Mile 2.1.3 Global E-commerce Logistics Market Size Forecast: Domestic and Cross-Border 2.2 Asia Pacific E-commerce Logistics Market Forecast 2.2.1 Asia Pacific E-commerce Logistics Market Size Forecast by Country 2.2.2 Asia Pacific E-commerce Logistics Market Size Forecast: Fulfilment and Last Mile 2.2.3 Asia Pacific E-commerce Logistics Market Size Forecast: Domestic and Cross-Border 2.3 North America E-commerce Logistics Market Forecast 2.3.1 North America E-commerce Logistics Market Size Forecast by Country 2.3.2 North America E-commerce Logistics Market Size Forecast: Fulfilment and Last Mile 2.3.3 North America E-commerce Logistics Market Size Forecast: Domestic and Cross-Border 2.4 Europe E-commerce Logistics Market Forecast 2.4.1 Europe E-commerce Logistics Market Size Forecast by Country 2.3.2 Europe E-commerce Logistics Market Size Forecast: Fulfilment and Last Mile 2.4.3 Europe E-commerce Logistics Market Size Forecast: Domestic and Cross-Border 3. MARKET TRENDS Forecast Global E-commerce Sales

Stord Frequently Asked Questions (FAQ)

When was Stord founded?

Stord was founded in 2015.

Where is Stord's headquarters?

Stord's headquarters is located at 5195 Mason Road, Union City.

What is Stord's latest funding round?

Stord's latest funding round is Secondary Market.

How much did Stord raise?

Stord raised a total of $321.14M.

Who are the investors of Stord?

Investors of Stord include CrossWork, Allcargo Logistics, Northstar.vc, Dynamo VC, Susa Ventures and 26 more.

Who are Stord's competitors?

Competitors of Stord include Omnivio, Warehowz, Flexe, Waresix, SpaceFill and 7 more.

Loading...

Compare Stord to Competitors

Ohi focuses on enhancing e-commerce operations. It provides a platform that allows brands to position their inventory closer to their customers, facilitating unique post-purchase interactions through a delivery experience of less than two hours. The company primarily serves the e-commerce industry. It was founded in 2018 and is based in New York, New York.

Flexe focuses on omnichannel logistics. The company offers technology-powered logistics programs that help solve challenges in distribution, capacity, fulfillment, and same-day delivery. Its services primarily cater to the e-commerce and retail sectors. It was founded in 2013 and is based in Seattle, Washington.

Flowspace is an e-commerce logistics and fulfillment company that specializes in providing cloud-based software and services for brands. The company offers a suite of tools for inventory management, order management, and network optimization to streamline fulfillment operations. Flowspace primarily serves the e-commerce industry, enabling brands to meet customer expectations for fast and efficient delivery. It was founded in 2017 and is based in Los Angeles, California.

Warehowz specializes in on-demand warehousing within the logistics technology sector. The company offers a cloud-based platform that matches businesses seeking warehouse space with those that have available capacity, streamlining storage and fulfillment contracts and facilitating efficient inventory and shipment management. Warehowz primarily serves industries such as trucking & logistics, retail, e-commerce, and more, providing flexible warehousing solutions to a diverse range of sectors. It was founded in 2017 and is based in Richmond, Virginia.

Waresix is a logistics integrator that specializes in land transportation and integrated logistics services. The company offers a suite of services, including domestic freight handling, land transportation, and integrated warehouse and terminal logistics. Waresix primarily serves businesses requiring logistics and supply chain management solutions. It was founded in 2017 and is based in Jakarta Selatan, Indonesia.

Darkstore is a delivery fulfillment platform that provides eCommerce companies and brands with affordable, on-demand, last mile delivery. Retailers use Darkstore to fulfill their orders for 1-hour and same-day delivery and have them delivered ultra fast to customers by last mile delivery companies like Deliv, UberRUSH and others.

Loading...