Stori

Founded Year

2019Stage

Debt - III | AliveTotal Raised

$666.5MLast Raised

$107M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+41 points in the past 30 days

About Stori

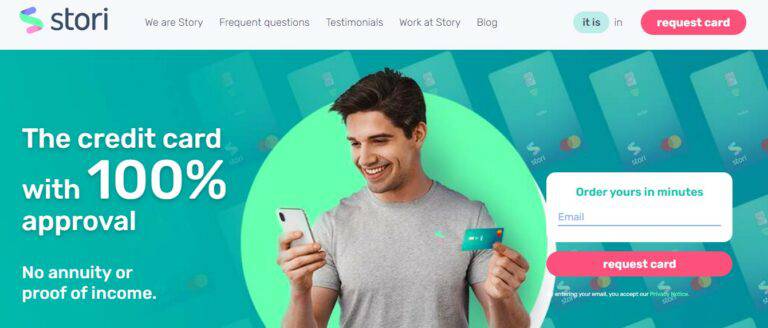

Stori is a financial technology company that focuses on providing credit access and financial services. The company offers credit cards with high approval rates and cashback rewards, as well as deposit accounts with competitive returns. Stori primarily serves the underbanked population in Latin America, offering financial products that aim to democratize credit access and enhance financial inclusion. It was founded in 2019 and is based in Mexico City, Mexico.

Loading...

Loading...

Research containing Stori

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stori in 1 CB Insights research brief, most recently on Jul 22, 2022.

Expert Collections containing Stori

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stori is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Digital Banking

1,112 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Latest Stori News

Apr 8, 2025

La cofundadora del unicornio y financiera popular Stori fue elegida presidenta para el periodo 2025-2027. Foto: Stori Por: La tarde de este lunes, la Asociación Mexicana de Sociedades Financieras Populares (AMS) nombró a Marlene Garayzar como su nueva presidenta para el periodo 2025-2027. Garayzar también es cofundadora del unicornio y financiera popular Stori. Durante la asamblea general de los asociados, también se designó a David Romero como vicepresidente de la Asociación para el mismo periodo. Romero es director general de Fincomún, la primera Sofipo en obtener autorización en México. En un comunicado, la AMS destacó que estas designaciones refuerzan los valores y compromisos de la asociación para impulsar cambios regulatorios en favor de los clientes, quienes demandan servicios financieros de calidad. Asimismo, subrayaron la importancia de mantener la cercanía con los usuarios y el espíritu social que caracteriza a las Sofipos, enfocados en elevar los niveles de inclusión financiera y brindar acceso a productos como crédito, ahorro, inversión y seguros a mexicanos actualmente desatendidos. “A través de una asociación proactiva, estratégica y unida, se dará continuidad a los cambios que abonen a la modernización del sector, fomenten la colaboración entre las Sofipos, mantengan su crecimiento sostenible y fortalezcan su posición dentro del ecosistema financiero, así como su papel clave en el desarrollo económico del país y el impacto positivo real en la vida de las personas”, señaló Garayzar. La figura de las Sofipos nació en México en el 2009, a partir de la Ley de Ahorro y Crédito Popular. Desde su origen, estas sociedades han tenido como objetivo acercar servicios financieros a quienes no tenían acceso a la banca tradicional. “Las Sofipos tenemos un fuerte compromiso con el desarrollo económico y social del país, por ello debemos mantener nuestros esfuerzos en impulsar la inclusión financiera, así como incorporar productos digitales en el portafolio de servicios ya disponible. Además de mantener la relación con las autoridades del sector, como lo hemos hecho desde la fundación de nuestra asociación”, afirmó Romero. Actualmente, las Sofipos atienden a casi 25 millones de personas en todo el país, a través de sucursales físicas y plataformas digitales. A enero del 2025, reportan activos por más de 181,000 millones de pesos y una cartera bruta cercana a los 64,000 millones de pesos. Te puede interesar

Stori Frequently Asked Questions (FAQ)

When was Stori founded?

Stori was founded in 2019.

Where is Stori's headquarters?

Stori's headquarters is located at 213 Juarez Colonia, Cuauhtemoc, Mexico City.

What is Stori's latest funding round?

Stori's latest funding round is Debt - III.

How much did Stori raise?

Stori raised a total of $666.5M.

Who are the investors of Stori?

Investors of Stori include Lightspeed Venture Partners, GIC, Tresalia Capital, General Catalyst, Goodwater Capital and 11 more.

Who are Stori's competitors?

Competitors of Stori include Uala, Aplazo, Vexi, C6 Bank, Klar and 7 more.

Loading...

Compare Stori to Competitors

Fondeadora is a financial technology company that provides personal and corporate banking solutions. The company offers a platform that allows users to open personal and business debit accounts and earn interest on their savings. Fondeadora primarily serves individuals and businesses seeking financial services. It was founded in 2011 and is based in Mexico City, Mexico.

Cuenca offers electronic funds payment accounts within the digital banking sector. Its services include easy account opening, SPEI bank transfers, bill payments, and 24/7 access to funds through a mobile app. Cuenca provides various account levels to meet different customer needs, from those making cash deposits to those receiving regular transfers. Cuenca was formerly known as Cuenca Health. It was founded in 2018 and is based in Mexico City, Mexico.

Banamex offers financial services to companies and individuals, including commercial banking and investment, insurance, and investment management. Banamex was formerly known as Citibanamex. It was founded in 1884 and is based in Santa Fe, Mexico.

Banco Original specializes in providing digital banking services for both individual and corporate clients. The bank offers a range of financial products, including online account opening, personalized credit solutions, and specialized services for the agribusiness sector. It caters to large enterprises and the agricultural industry with tailored financial services and support. It was founded in 2001 and is based in Sao Paulo, Brazil.

Finsus is a financial services company focused on providing digital solutions for savings, investment, and credit services. The company offers financial products including savings accounts, investment opportunities with interest rates, and credit schemes. Finsus serves individuals and businesses seeking financial services. It was founded in 2013 and is based in Benito Juarez, Mexico.

Prex is a financial technology company that offers digital banking services within the fintech sector. The company provides an international prepaid Mastercard, digital account management, real-time transaction alerts, foreign currency exchange, and the ability to send and receive money globally. Prex's services are aimed at individuals who utilize digital financial services. It was founded in 2015 and is based in Montevideo, Uruguay.

Loading...