Stripe

Founded Year

2010Stage

Valuation Change - III | AliveTotal Raised

$10.095BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-22 points in the past 30 days

About Stripe

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. It serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), platforms, marketplaces, and the creator economy. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Loading...

ESPs containing Stripe

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to modernize their services and expand their customer base through embedded banking and payment options. These providers offer APIs that enable businesses to integrate banking capabilities such as account opening, transaction processing, card issuance, payment rails, and compliance tools. BaaS solutions…

Stripe named as Leader among 15 other companies, including FIS, Finastra, and Solaris.

Loading...

Research containing Stripe

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stripe in 45 CB Insights research briefs, most recently on Apr 7, 2025.

Mar 6, 2025

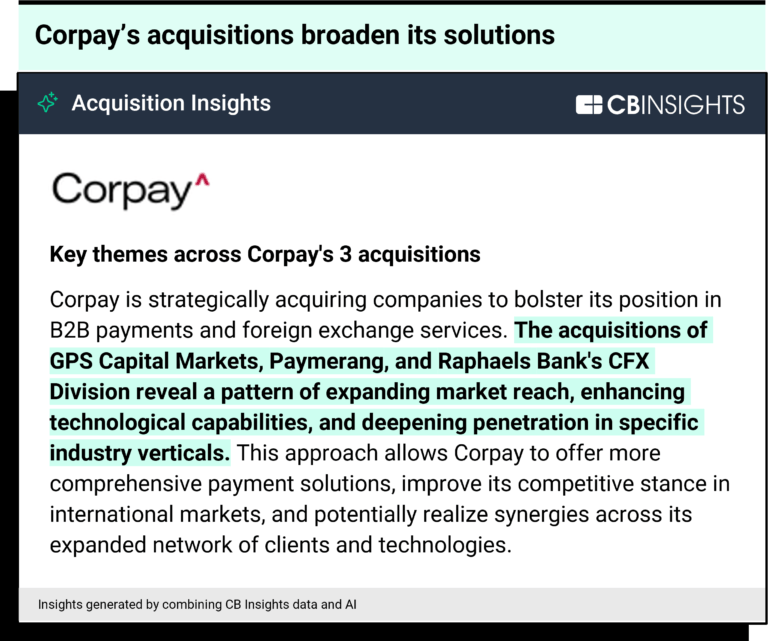

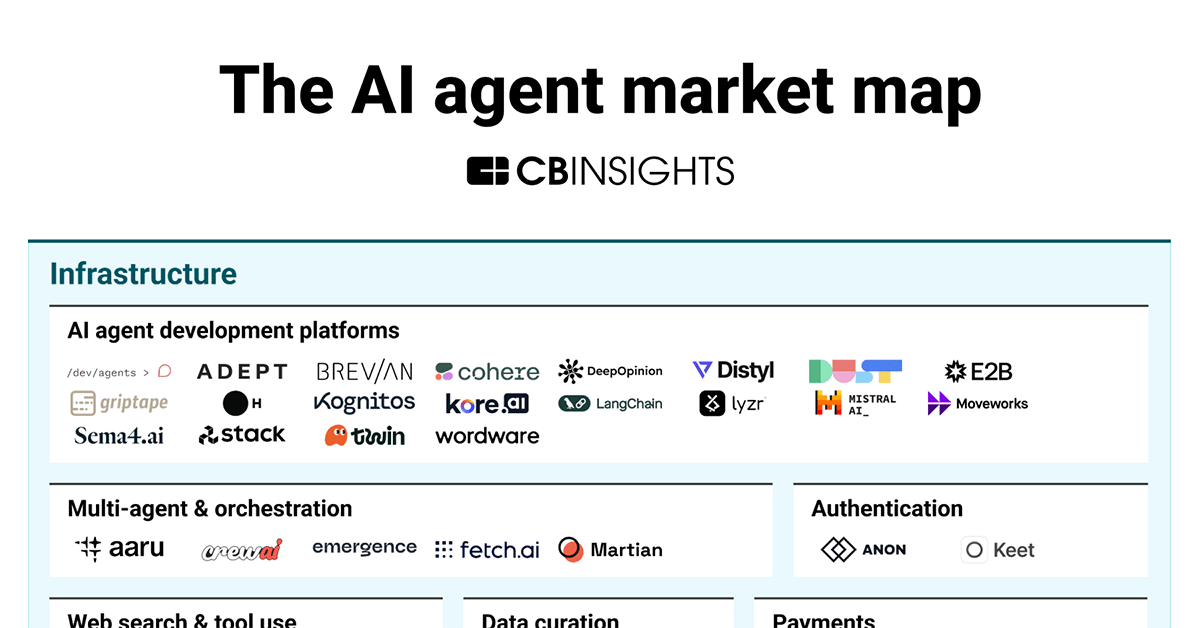

The AI agent market map

Jan 14, 2025 report

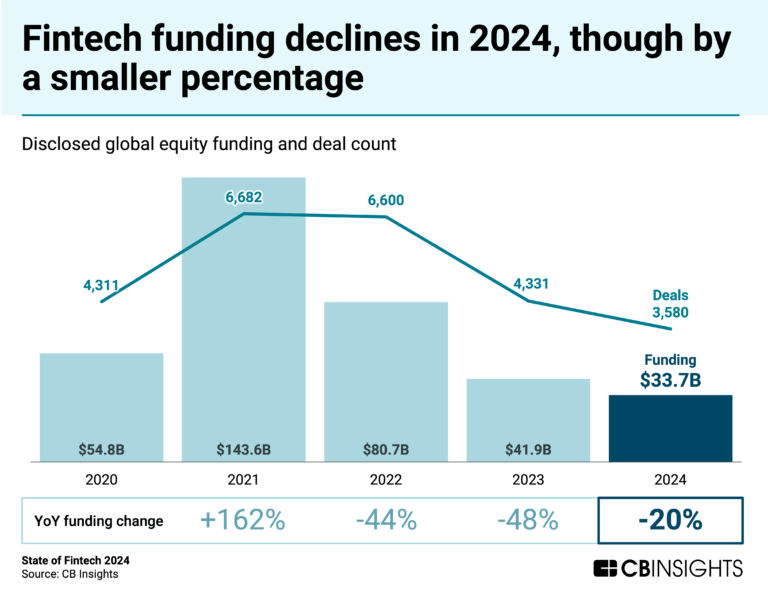

State of Fintech 2024 Report

Jan 7, 2025 report

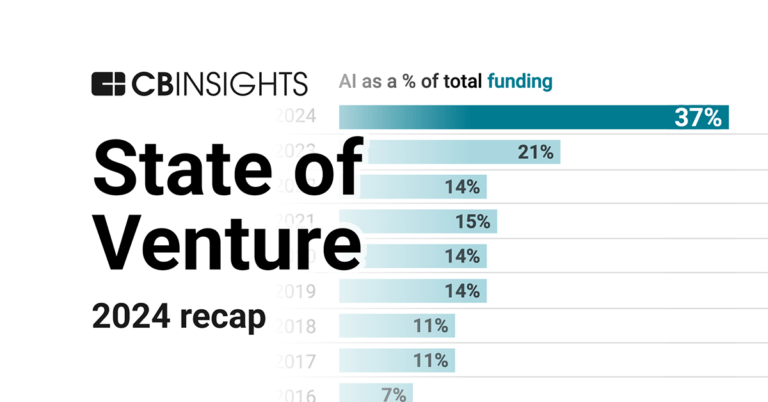

State of Venture 2024 Report

Oct 15, 2024 report

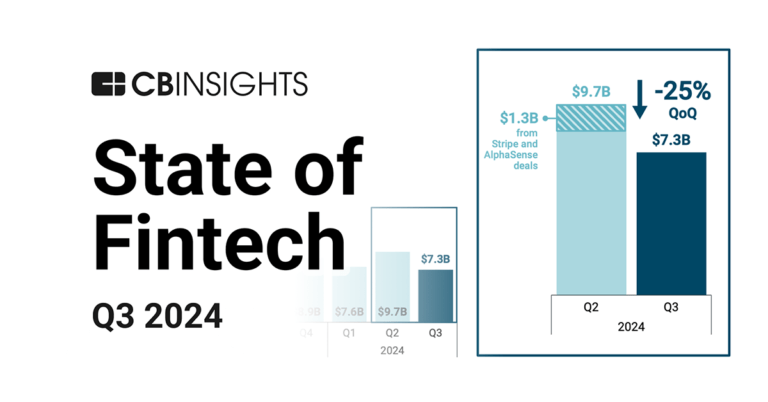

State of Fintech Q3’24 Report

Aug 23, 2024

The B2B payments tech market map

Jul 16, 2024 report

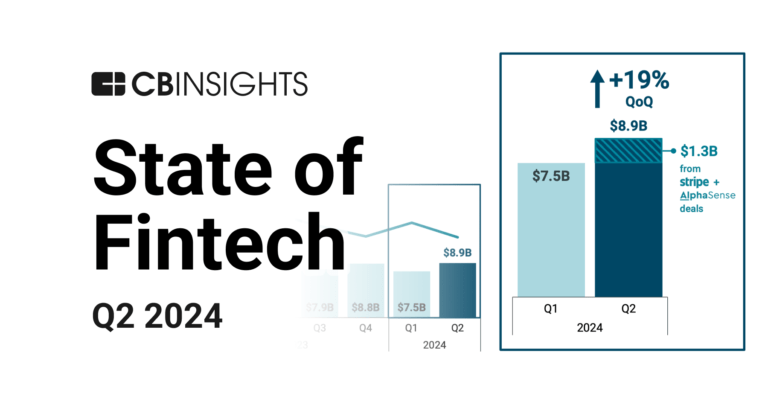

State of Fintech Q2’24 ReportExpert Collections containing Stripe

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stripe is included in 14 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

8,819 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

2,003 items

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Payments

3,136 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Stripe Patents

Stripe has filed 316 patents.

The 3 most popular patent topics include:

- payment systems

- payment service providers

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/29/2023 | 4/1/2025 | Grant |

Application Date | 11/29/2023 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | |

Status | Grant |

Latest Stripe News

Apr 9, 2025

Digital Finance First Digital’s business aspirations amid its conflict with Justin Sun illuminate the future of stablecoins. Published Vincent Chok, First Digital We’re headed into a ‘stablecoin summer’, practitioners say, with dozens of companies from Stripe to Fidelity launching or planning to launch crypto tokens that are pegged to a currency, asset or algorithm. A mini-crisis has exploded, however, involving the world’s third-largest fiat-backed stablecoin operator, First Digital, based in Hong Kong. Allegations of malfeasance briefly knocked the company’s US dollar-tracking coin, FDUSD, off its peg. FD’s coin has regained its footing, but the legal dispute continues, raising the question: if it’s this easy to upset the price of the number-three operator, what of the dozens of smaller fry in the market or coming our way? In other words, what has to happen to make stablecoins…stable? And: does the market need so many stablecoins? What differentiates them? And do these niche business models make sense of the coins trade thinly? These questions are important beyond specific uses. Stablecoins are simultaneously being used as payment tools, as capital-market funds, and as ‘narrow’ bank deposits that aren’t supposed to be on-lent (as would be the case in a fractional-reserve bank, ie as all commercial banks do today). This versatility, or confusion, puts stablecoins at the forefront of financial innovation today. But they need to engender trust, among fintechs, financial institutions, regulators, and retail and corporate users. Justin Sun vs FD First, the FD dispute. On April 3, Justin Sun, the wealthy founder of blockchain Tron, tweeted allegations that First Digital was insolvent and unable to meet client redemptions of FDUSD. Sun did not present any evidence, but his assertions knocked $130 million, or 9 percent, off the coin’s value. Stablecoins aren’t supposed to fluctuate in value against their fiat reference, so this was a serious impact. It also could be potentially damaging to Binance, the world’s largest crypto exchange, where FDUSD/USD is a popular trading pair; Binance holds more than $2 billion of customer deposits in FDUSD. Had the stablecoin’s nosedive continued, it could have threatened the exchange’s business. The de-pegging was short-lived, however, as FD founder Vincent Chok released statements affirming First Digital’s reserve is fully funded; he launched countersuits against Sun. Importantly, First Digital has since fulfilled all redemption requests. Its price soon rebounded; so far it remains steady, The dispute is complicated, involving an investment vehicle that Sun allegedly has exposure to, Techteryx, plus another stablecoin, TrueUSD, and Cayman-based commodity futures funds that may or may not be managing FD assets in illiquid exposures (First Digital denies this, while Sun has denied owning Techteryx, and Techteryx refuses to disclose its investors). Sun has also stated, without evidence, that FD’s behavior reflects loopholes in Hong Kong’s trust licensing process. Looking beyond the dispute DigFin’s sources conflict and we are not prepared to print what we’ve been told, particularly as some information was provided strictly on background. The purpose of this article is not to decode the conflict between Sun and Chok; that will be settled by their lawyers. Rather, it’s to shed light on what second-tier stablecoins might provide to the market, and how to think about their value. For, handily, Vincent Chok sat down with DigFin a few weeks before Sun launched his attack, and gave us a good look at the business’s ambitions. Chok’s team didn’t respond to our requests for a follow-up interview following l’affair Sun. Read more: The first thing to note is that the stablecoin market is dominated by two players, Tether (USDT), with a market cap of $143 billion, and Circle (USDC), with $59 billion. Both track the US dollar. There are two more stablecoins that rely on algorithms to calculate their value and are used in DeFi staking, Ethena USDe and Dai (each about $5.4 billion). However these are for pure crypto trading, whereas our focus is on fiat-backed stablecoins that have broader application, including for users that aren’t necessarily interested in crypto but are using stablecoins as payment tools. After Tether and Circle By that measure, FDUSD is third, at $2.5 billion. The market caps dwindle from there: PayPalUSD is fourth at $787 million. TrueUSD has $494 million, and Binance’s BUSD, living up to its nickname, is a busted flush at $58 million, after having reached $53 billion (with a B) just two years ago; regulatory problems. The market pattern is to have massive proportional drop-offs from one player to the next. In this environment, the stablecoin world is effectively Tether – itself operating outside of regulations – and Circle, which pitches itself as US-compliant even though there are as yet no laws in the US to regulate stablecoins (Congress is now writing these). In terms of structure and compliance, First Digital is structured similarly to Circle. It is a more recent entrant and perhaps lacks Circle’s funding and marketing chops, but it’s functionally similar. Chok told DigFin his first differentiator was to be based in Asia, which somehow makes FD more capable of serving customers in the region’s time zones. But Tether’s parent, Bitfinex, has a longstanding presence in Hong Kong, and Circle has operations in Hong Kong and Singapore. Chok also said FD has global ambitions. So it’s not clear to DigFin that geography matters. What else then might make FD more attractive, either to Tether’s maverick customer base or Circle’s more tradfi, buttoned-up users? Tradfi origins First Digital spun out of a trust company, Legacy Trust, to hold crypto reserves of blockchain companies. Chok considered launching his own stablecoin but there was no demand, until the aftermath of the 2021 FTX collapse, which happened to be followed by rapidly hikes in US interest rates. Suddenly crypto DeFi yields dried up while a stablecoin could return handsomely just sitting on US cash and cash equivalents: the one-to-one reserves meant to back a fiat stablecoin. FDUSD launched from within a Hong Kong Monetary Authority sandbox in 2023. Chok said launching a fiat-backed stablecoin in a regulated environment was not easy, suggesting even a modest market share could create a defensible business model. He cited the company’s licensed trust background as important to FD’s understanding of how to build within a regulated manner, including internal controls, reporting, and due diligence on third-party deposits. But making this successful means attracting liquidity. At one point, FDUSD had $4.4 billion of assets. It’s declined since amid greater competition and moderating US interest rates (the Justin Sun fracas hasn’t dented its AUM, so far). Making money The first billion dollars is key, as that allows the stablecoin operator to place a small amount of reserves in Treasuries (long-term US government bonds), and earn a yield above cash. Today the US Federal Reserve’s federal funds (short term) rate is 4.25 percent to 4.5 percent. Chok says FD remains profitable even if those rates fall to below 3.5 percent – or if the userbase scales up. The possibility of inflation in the US, due to Trump’s tariff policies, could force the Fed to increase interest rates, which would benefit stablecoin operators. Above a certain point they’re just banking free money. But attracting that liquidity will involve a race between expanding demand and the fragmentation of many new entrants. PayPal, which last year processed $1.7 trillion in payment volumes, has a tie-up with Visa and a global merchant base. That’s where it can try to push stablecoins. In February, Stripe, which last year processed $1.4 trillion of payment volume, acquired Bridge, a blockchain company, to launch its own stablecoin capability, again more of a complement to its existing finance operations than to disrupt the market. Stripe is also accepting payments in USDC and PayPal’s PYUSD. FD has been able to outpace these giants by serving Asia-based users, but that’s not a sustainable strategy. Chok says, however, that he is exploring use cases designed to support emerging markets. Emerging-market play Payments among these countries are fragmented: a Hongkonger pays with wallets like Octopus or AliPay, while a Malaysian might use Touch’n’Go. Within Southeast Asia, governments are working to enable these wallets to operate across borders, so the Hongkonger can still use Octopus while in Malaysia. These efforts are live but they are all bilateral, and so they are complex and not a full solution to fragmentation. But if all of these wallets leveraged a US dollar stablecoin, users could make payments across digital-wallet schemes. 2024 saw $2 trillion in stablecoin settlements (more than Visa), so there’s a genuine opportunity for embedding these tools in payments. DigFin is a little skeptical of that figure, noting Tether’s overweening size and the possibility that a portion of its payments are for money laundering and wash trading – possible given its unregulated nature, and Tether’s reported popularity among North Korean hackers, for example. But it’s fair to say stablecoin settlements are a rising trend. Stablecoin transactions are often cheaper than using Visa or Mastercard networks, depending on the user and the geographies. Businesses great and small could grow remittances by using stablecoins. Chok’s vision is not to launch lots of local-currency stablecoins, but to help regulators around the region figure out a licensing framework that won’t torpedo demand for their own currencies. In the most vulnerable countries, there’s already more demand for transacting via Tether than with the local currency, even in electronic form. Tether is difficult, if impossible, for national governments to police. Chok told DigFin: “We can mitigate these risks by suggesting governments partner with us so we can figure it out together.” The benefits to stablecoins in emerging markets is that they provide a better way to provide financial services to the unbanked. Traditional fintech’s promise of banking swathes of Asia’s poor hasn’t come true. Banks still don’t want to accept customers they calculate will cost them money to serve. Regulators need to balance this opportunity with the risk of scams or ensuring investor protection. Chok said there are longer-term ideas that regulators might consider. Yes, they need to consider worst-case scenarios such as a scam or cyber attack. But they also might see stablecoins as avenues to attract foreign investment into their local bonds, with stablecoins serving as the cash leg to tokenized asset trades. More than payments For FD, being native to the region may give it a foot in the door with Asian regulators. Then it tries to establish its bona fides: for example, by messaging that FDUSD does not bear a yield; it’s not a security. And by saying it follows strict KYC and AML rules. Most importantly is how it manages its reserves. Chok told DigFin the company engages in third-party attestations that its reserves are held in cash and cash equivalents in Hong Kong, Australia, the US, and Singapore, as well as some Treasuries. Finally, a stablecoin operator needs presence and market credibility. FDUSD is now listed on eight crypto exchanges and four DeFi platforms. Its most important partner is Binance, which embraced FDUSD after its native stablecoin lost traction. That kind of visibility gives FD’s team the chance to pitch its stablecoin to new use cases. It could also give it the ‘moat’ for its business: by focusing on banking rails, the operator hopes to stave off the raft of challengers that might lack its tradfi and compliance capabilities. Getting onto chains and protocols usually requires the coin operator to provide incentives to market makers. FD is no different. It has recently placed FDUSD on chains such as Sui and Solana, and this involves cost. Series B Chok told DigFin the company was looking to raise a Series B funding round of about $50 million. The proceeds will go to supporting FDUSD’s treasury operations as it expands its footprint, provide incentives to market makers, and open physical offices in markets where it wants to obtain licenses, not just in Asia but also in Canada, the UAE and the European Union. The Justin Sun controversy comes at a delicate time, as it could disrupt FD’s fund raising. For First Digital, it has been able to meet its redemptions and it has issued attestations of its reserves. The market seems to have accepted these, for now. For regulators, one line of questioning they should put to all stablecoin operators is transparency. Are attestations enough? A traditional audit is backward looking, but it is a complex, invasive investigation into the processes and procedures, not simply snapshotting a balance sheet. Secondly, they should consider what minimum size or other standards must be met to be licensed. The Sun-FD dispute raised the specter of the third-largest fiat-backed stablecoin losing its moorings. What best practices might mitigate against ‘stablecoin summer’ in 2025 devolving into banking runs and currency crises in 2026? Finally, authorities should also be creative about the ways they can use stablecoins to foster financial access and enhance their local bond and currency markets. Stablecoins are not just payment tools. They are funds and instruments of capital. That makes them potentially dangerous. It also makes them exciting.

Stripe Frequently Asked Questions (FAQ)

When was Stripe founded?

Stripe was founded in 2010.

Where is Stripe's headquarters?

Stripe's headquarters is located at 354 Oyster Point Boulevard, South San Francisco.

What is Stripe's latest funding round?

Stripe's latest funding round is Valuation Change - III.

How much did Stripe raise?

Stripe raised a total of $10.095B.

Who are the investors of Stripe?

Investors of Stripe include Sequoia Capital, General Catalyst, Andreessen Horowitz, Founders Fund, Thrive Capital and 42 more.

Who are Stripe's competitors?

Competitors of Stripe include Rapyd, Metronome, ToneTag, Swan, Highnote and 7 more.

Loading...

Compare Stripe to Competitors

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Pine Labs is a merchant platform that provides payment solutions across various business sectors. The company offers services, including in-store and online payment processing, customer loyalty programs, prepaid and gifting services, and analytics. Pine Labs serves sectors such as electronics, lifestyle, automobile, grocery, healthcare, and hospitality. It was founded in 1998 and is based in Noida, India.

Satispay focuses on simplifying payments through its mobile application within the digital payments industry. The company offers a platform for individuals to send and receive money, pay in stores and online, and save with features like cashback. It was founded in 2013 and is based in Luxembourg City, Luxembourg.

TouchBistro focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services, including front-of-house, back-of-house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. Its services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Canada.

Loading...