SumUp

Founded Year

2012Stage

Loan - III | AliveTotal Raised

$4.045BLast Raised

$1.608B | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+1 points in the past 30 days

About SumUp

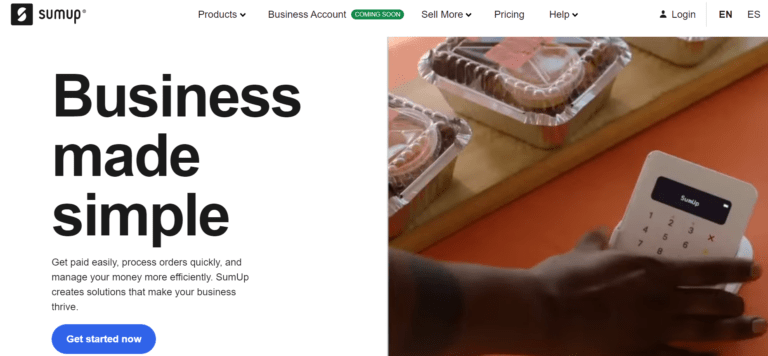

SumUp is a financial technology company that specializes in payment processing solutions and point-of-sale systems for small businesses. The company offers a range of products including mobile payment applications, card readers, and business bank accounts, designed to facilitate transactions and manage sales. SumUp's services cater to various sectors such as restaurants, salons, spas, and retail, providing tools for appointment management, loyalty rewards, and inventory management. SumUp was formerly known as Ka-Ching Payments. It was founded in 2012 and is based in Wilmington, Delaware.

Loading...

ESPs containing SumUp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual payment terminals market refers to a type of payment solution that allows merchants to accept payments through a web-based platform, without the need for a physical payment terminal. Virtual payment terminals are typically used by e-commerce businesses and other remote merchants who do not have a physical store or who need to accept payments from customers who are not present. The mark…

SumUp named as Challenger among 15 other companies, including Stripe, Fiserv, and Worldpay.

SumUp's Products & Differentiators

SumUp Solo Lite

Our card readers, like SOLO Lite, are also a major milestone. They’re portable, affordable, and designed for merchants who are always on the go. We’ve also developed business accounts that allow merchants to manage their finances, pay suppliers, and track income, all in one place.

Loading...

Research containing SumUp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SumUp in 7 CB Insights research briefs, most recently on Jan 18, 2024.

Jan 18, 2024 report

State of Fintech 2023 Report

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Sep 13, 2022

3 retail tech trends to watch in Q3’22Expert Collections containing SumUp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SumUp is included in 7 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,775 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,648 items

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SumUp Patents

SumUp has filed 9 patents.

The 3 most popular patent topics include:

- payment systems

- banking technology

- banks

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/24/2021 | 9/17/2024 | Payment systems, Banking technology, Banks, Interbank networks, Circulating currencies | Grant |

Application Date | 9/24/2021 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Payment systems, Banking technology, Banks, Interbank networks, Circulating currencies |

Status | Grant |

Latest SumUp News

Apr 3, 2025

SumUp Introduces Suite of New Solutions to Address Merchant Pain Points SumUp announced the launch of a wide range of new products and solutions at its annual event this week. The new offerings include a proprietary Tap to Pay on Android solution, an upgraded Business Account, as well as enhancements to its point of sale solution. London-based SumUp won Best of Show in its Finovate debut at FinovateEurope 2013. Ecommerce and payments platform SumUp took the occasion of its annual Beacon event to announce the launch of a range of new products designed to address a variety of merchant pain points. These solutions include an in-house Tap to Pay solution for Android, and a number of new features to its platform designed to help merchants of all sizes improve cash flow, efficiency, and customer engagement as they scale. “Each of the products we launched demonstrates how the SumUp product ecosystem has grown to cover the critical needs of businesses at each stage of operations, from micro businesses to established ones with complex operations and many employees,” SumUp Chief Product Officer Anna Kuriakose said. “We believe that SumUp’s integrated ecosystem—which brings together the different aspects of running a business—is incomparable in the value it delivers to our customers.” SumUp’s Tap to Pay on Android enables merchants to accept contactless payments directly from the thousands of phone brands and models that are not iPhones. The size and variety of the Android market, relative to iOS, has given Android a larger market share in EU countries in particular. SumUp’s proprietary Tap to Pay solution will provide a faster, more streamlined, and more reliable experience for merchants and consumers who have opted for Android. Further, SumUp’s solution features enhanced card detection, PIN entry to boost security at checkout, and delivers higher transaction success rates thanks to SumUp’s payment infrastructure and the absence of upfront costs. Tap to Pay is currently active in Europe and Brazil. The company plans to introduce the technology in Chile, Colombia, Peru, the US, and Australia “soon.” SumUp also unveiled a handful of new tools for merchants. These include enhancements to its SumUp Business Account. With SumUp’s new Business Account Plus, merchants will benefit from new features for multiple balances, as well as the ability to issue and track several cards and bulk transfers. The new Plus accounts are slated to go live across core markets later this month. Additionally, SumUp introduced an upgrade to its Point of Sale solution called POS Plus. Designed with retailers such as restaurants and beauty salons in mind, POS Plus offers features such as PIN-based employee profiles, one-tap promotions, kitchen order management, and the ability to flag out-of-stock items. POS Plus is expected to be introduced to select EU markets in April. Along with these new solutions, SumUp also announced the release of its new Solo Lite card reader, a new Kitchen Display System (KDS) to help streamline restaurant operations, and more. Founded in 2012, SumUp won Best of Show in its Finovate debut at FinovateEurope 2013 in London. In the years since then, the UK-based fintech has become the partner of more than four million merchants in 36 markets around the world. With 3,000+ employees in 20 offices globally, SumUp offers payment acceptance solutions, tools to help merchants better manage and save money, and innovative technologies to enhance order management and sales. Co-Founder Daniel Klein is SumUp’s CEO. Most recently, SumUp announced a partnership with FreedomPay to provide retail and hospitality businesses with a payment system with offline capabilities—including for remote merchants. The system will also feature the ability to access a payment processing service from a single provider, regardless of location. “At SumUp, we are dedicated to empowering merchants with payment solutions that are as straightforward as they are secure,” SumUp Commercial Lead Joey Oliver explained. “With FreedomPay as our partner, we’re advancing our commitment to making top-tier payment technology accessible and effective for every business.”

SumUp Frequently Asked Questions (FAQ)

When was SumUp founded?

SumUp was founded in 2012.

Where is SumUp's headquarters?

SumUp's headquarters is located at 1209 Orange St, Wilmington.

What is SumUp's latest funding round?

SumUp's latest funding round is Loan - III.

How much did SumUp raise?

SumUp raised a total of $4.045B.

Who are the investors of SumUp?

Investors of SumUp include Oaktree Capital Management, BlackRock, Vista Credit Partners, Goldman Sachs Asset Management, Apollo Global Management and 33 more.

Who are SumUp's competitors?

Competitors of SumUp include CloudWalk, Melio, Tide, Zoop, Clip and 7 more.

What products does SumUp offer?

SumUp's products include SumUp Solo Lite and 4 more.

Who are SumUp's customers?

Customers of SumUp include Deb Dobney-Cobb, Aidan Conway and Arlene Wedgbury.

Loading...

Compare SumUp to Competitors

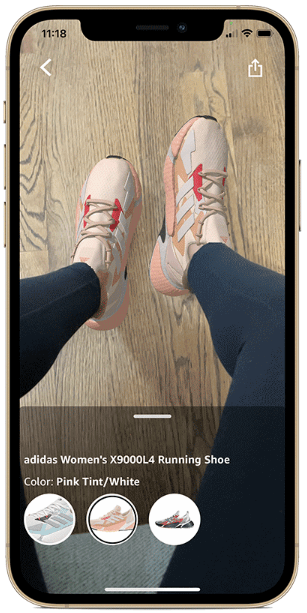

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Hash operates a financial technology platform. It enables companies to create and test payment and other financial solutions. It provides non-financial business-to-business (B2B) enterprises wishing to offer banking services with payment infrastructure. The company was founded in 2017 and is based in Sao Paulo, Brazil.

Ingenico is a company focused on payment acceptance and services within the financial technology sector. It offers a range of products including smart terminals, a cloud-based payments platform, and terminal management solutions. Ingenico also provides services such as advanced payment methods, buy now pay later options, digital receipts, and omnichannel services. It was founded in 1980 and is based in Suresnes, France.

NearPay provides payment infrastructure solutions within the fintech sector. The company offers a software development kit (SDK) that allows merchants to accept in-person NFC card payments. NearPay's services include transaction processes for businesses, offering purchase, refund, and reconciliation functionalities. It was founded in 2020 and is based in Riyadh, Saudi Arabia.

Mswipe offers mobile POS solutions that enable merchants to accept various card payments using compact, wireless devices without the need for a bank account or paper charge slips. Mswipe primarily caters to the needs of small enterprises with mainstream financial services and digital commerce. It was founded in 2011 and is based in Mumbai, India.

Loading...