Talkdesk

Founded Year

2011Stage

Series D | AliveTotal Raised

$504.77MValuation

$0000Last Raised

$230M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+18 points in the past 30 days

About Talkdesk

Talkdesk specializes in cloud contact center solutions and leverages AI and automation to enhance customer service across various industries. The company offers a suite of AI-powered products designed to improve customer experiences, operational efficiencies, and agent performance. Talkdesk's solutions cater to a range of sectors, including financial services, healthcare, retail, and more. It was founded in 2011 and is based in San Francisco, California.

Loading...

ESPs containing Talkdesk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The contact center-as-a-service (CCaaS) market offers cloud-based platforms that enable organizations to manage customer interactions across multiple channels. These solutions provide voice, messaging, video, and social media capabilities along with AI-powered features such as sentiment analysis, virtual agents, and predictive routing. CCaaS platforms include workforce optimization tools, analytic…

Talkdesk named as Outperformer among 15 other companies, including Zendesk, Amazon Web Services, and Cisco.

Loading...

Research containing Talkdesk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Talkdesk in 3 CB Insights research briefs, most recently on Oct 17, 2024.

Oct 17, 2024

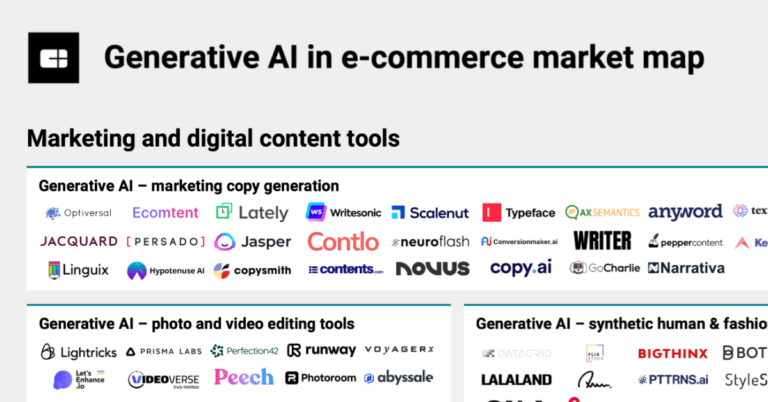

The generative AI for e-commerce market map

Expert Collections containing Talkdesk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Talkdesk is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Tech IPO Pipeline

568 items

Sales & Customer Service Tech

1,058 items

Companies offering technology-driven solutions for brands and retailers to enable customer service before, during, and after in-store and online shopping.

E-Commerce

217 items

Artificial Intelligence

7,632 items

NRF Big Show 2025: Exhibitors

959 items

Talkdesk Patents

Talkdesk has filed 225 patents.

The 3 most popular patent topics include:

- computer telephony integration

- outsourcing

- telemarketing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/29/2019 | 4/8/2025 | Computer telephony integration, Outsourcing, Telemarketing, Information technology management, Telecommunications equipment vendors | Grant |

Application Date | 10/29/2019 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Computer telephony integration, Outsourcing, Telemarketing, Information technology management, Telecommunications equipment vendors |

Status | Grant |

Latest Talkdesk News

Apr 4, 2025

Posted on NICE (US), Verint (US), Avaya (US), OpenText (Canada), Google (US), Vonage (US), Genesys (US), Calabrio (US), CallMiner (US), Almawave (Italy), Five9 (US), AWS (US), Qualtrics (US), Talkdesk (US), Alvaria (US), Castel Communications (US), VoiceBase (US), Intelligent Voice (UK), CallTrackingMetrics (US), 3CLogic (US). Speech Analytics Market by Offering (Software by Functionality & Deployment Mode & Services), Business Function (Sales & Marketing, HR), Channel (VOIP & Messaging Platforms, Webinars & Virtual Meetings), Vertical and Region – 2029. US Speech Analytics Market by Offering (Software by Functionality, Deployment Mode, and Services), Business Function (Sales & Marketing, HR), Channel (VOIP & Messaging Platforms, Webinars & Virtual Meetings), Vertical, and Region – Global Forecast to 2029, published by MarketsandMarkets, the US speech analytics market is projected to grow from USD 3.3 billion in 2024 to USD 7.3 billion by 2029, with a compound annual growth rate (CAGR) of 17.5% during the forecast period. The US speech analytics market is being driven by several key factors, including the growing need for seamless omnichannel integration, a stronger focus on tracking and optimizing agent performance, and the rising reliance on data analytics to boost customer retention and satisfaction. However, the high costs associated with extracting meaningful insights from transcribed voice data could limit market expansion. Emotion detection software functionality segment to register largest market size during the forecast period. The U.S. holds the largest market share for emotion detection software in speech analytics, driven by several key factors. The country is at the forefront of technological progress, with strong advancements in artificial intelligence and machine learning that improve the accuracy of emotion recognition. A thriving ecosystem of established tech firms and innovative startups fuels ongoing improvements in this field. Significant funding and partnerships between academia and industry also contribute to refining these tools. Businesses in the U.S. place a high priority on enhancing customer satisfaction and loyalty, using emotion detection to assess sentiments in conversations and adjust their services for better engagement. Supportive regulations for data-driven technologies further encourage adoption across sectors like healthcare, automotive, and entertainment. These elements solidify the U.S. as a major force in the worldwide expansion of emotion detection software. Services segment to witness higher CAGR during forecast period. The service segment of speech analytics is growing at the fastest rate in the U.S., fueled by rising demand for end-to-end support and implementation solutions. Businesses are realizing that successfully adopting speech analytics isn’t just about the technology itself it also hinges on customized consulting, employee training, and continuous system maintenance. Industries like healthcare and financial services are leading this trend, investing heavily in these services to refine customer engagement and streamline operations. Leading providers, including Verint Systems and NICE Systems, are scaling up their service portfolios to keep pace with market needs. By doing so, organizations maximize the value of speech analytics from sharper data-driven insights to smoother compliance management while ensuring the technology integrates effortlessly with current infrastructure. VOIP and messaging platforms to register for the highest market size during the forecast period. The VoIP and messaging platform segment has the highest market size in the U.S., driven by a surge in demand for reliable communication solutions. The rapid adoption of cloud-based technologies and the shift towards remote work have significantly influenced this growth. Major companies like RingCentral and Zoom are leading the market by providing innovative VoIP services that enhance connectivity and collaboration. The integration of advanced features, such as AI-driven analytics and real-time transcription, has further improved user experiences. Additionally, the expansion of 5G networks is enhancing service quality, making VoIP solutions more attractive for businesses seeking cost-effective communication alternatives. The increasing focus on enhancing customer experience with integration of AI and ML technologies has contributed to the growth of the US Speech Analytics market. Top Companies in the US Speech Analytics Market Key players in the US Speech Analytics market are NICE (US), Verint (US), Avaya (US), OpenText (Canada), Google (US), Vonage (US), Genesys (US), Calabrio (US), CallMiner (US), Almawave (Italy), Five9 (US), AWS (US), Qualtrics (US), Talkdesk (US), Alvaria (US), Castel Communications (US), VoiceBase (US), Intelligent Voice (UK), CallTrackingMetrics (US), 3CLogic (US), Sprinklr (US), Uniphore ( US), Enthu.ai (India), Deepgram (US), Gnani.ai (India), Observe.ai (US), Batvoice (France), Kwantics (India), Speech Village (UK), Salesken (US), Tethr (US), Gong (US), and Clari (US). Media Contact

Talkdesk Frequently Asked Questions (FAQ)

When was Talkdesk founded?

Talkdesk was founded in 2011.

Where is Talkdesk's headquarters?

Talkdesk's headquarters is located at 201 Spear Street, San Francisco.

What is Talkdesk's latest funding round?

Talkdesk's latest funding round is Series D.

How much did Talkdesk raise?

Talkdesk raised a total of $504.77M.

Who are the investors of Talkdesk?

Investors of Talkdesk include Viking Global Investors, Willoughby Capital, Top Tier Capital Partners, Franklin Venture Partners, Alpha Square Group and 16 more.

Who are Talkdesk's competitors?

Competitors of Talkdesk include Evolve IP, Sandra AI, Vocodia, LiveVox, Elemental Cognition and 7 more.

Loading...

Compare Talkdesk to Competitors

Sandra AI provides AI-driven call management solutions for the automotive industry. The company offers AI receptionists and sales assistants that automate customer interactions for car dealerships. These AI solutions include call management, lead capture, and customer support, integrating with dealership management systems (DMS) and customer relationship management (CRM) tools. It was founded in 2024 and is based in Paris, France.

Genesys operates within the customer experience and contact center solutions industry, focusing on artificial intelligence (AI) powered experience orchestration. The company provides a platform that allows organizations to manage customer interactions, utilizing automation and AI to improve experiences for both customers and employees. Genesys serves various sectors that need customer engagement and workforce management solutions, including banking, healthcare, retail, insurance, and government. It was founded in 1990 and is based in Menlo Park, California.

Bright Pattern provides omnichannel contact center technology, offering cloud-based solutions for customer service and communication. The company features a platform that integrates AI, CRM systems, and compliance management to support customer interactions across channels including voice, email, chat, and social media. Bright Pattern's solutions serve various sectors such as BPO, healthcare, insurance, retail, and education, with a focus on customer experience and agent productivity. It is based in San Bruno, California.

Avaya provides customer experience (CX) solutions, cloud collaboration, and contact center services across various sectors. The company offers products that facilitate customer interactions and employee engagement through communication and collaboration tools. It serves industries such as healthcare, education, financial services, media and entertainment, and government. Avaya was formerly known as Enterprise Networks Group. It was founded in 2000 and is based in Morristown, New Jersey.

3CLogic provides AI-powered contact center solutions within the customer experience and contact center industry. The company offers cloud platforms that integrate with CRM and customer service management systems. 3CLogic's solutions include self-service, agent automation, conversational AI, and sentiment analytics, designed for IT service desks, customer support, sales, and HR services teams. It was founded in 2005 and is based in Rockville, Maryland.

Talkmap specializes in conversational intelligence within the customer experience domain, transforming customer interactions into actionable insights. The company offers a platform that utilizes AI-powered machine learning and linguistics to analyze and visualize customer conversations in real-time, enabling improvements in customer experience and operational efficiency. Talkmap primarily serves sectors that require large-scale analysis of customer interactions, such as telecom, banking, financial services, insurance, retail, and healthcare. It was founded in 2017 and is based in Dallas, Texas.

Loading...