Thought Machine

Founded Year

2014Stage

Series D - II | AliveTotal Raised

$508.05MValuation

$0000Last Raised

$106M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-16 points in the past 30 days

About Thought Machine

Thought Machine specializes in core banking software and operates within the financial technology sector. The company offers a cloud-native core banking platform, Vault Core, and a payment processing platform, Vault Payments, which enable banks to create and manage a wide range of financial products and payment schemes. Thought Machine's products are designed to provide banks with flexibility, control, and the ability to deploy on any cloud infrastructure. It was founded in 2014 and is based in London, United Kingdom.

Loading...

Thought Machine's Product Videos

ESPs containing Thought Machine

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

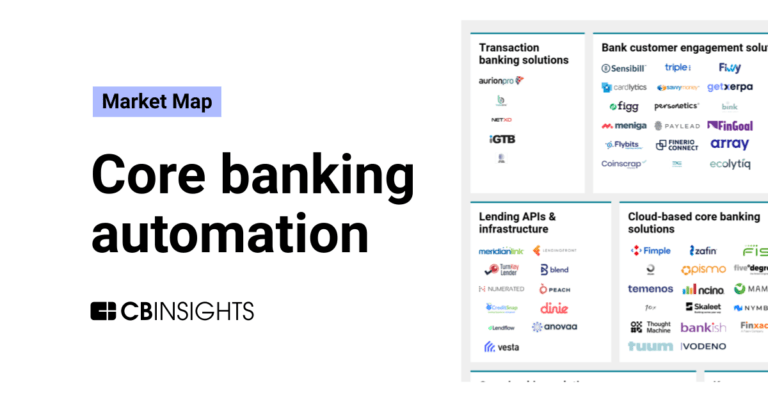

The cloud-based core banking solutions market offers financial institutions technology to modernize legacy systems and deliver personalized products and services. Vendors provide cloud-native platforms that are scalable, secure, and cost-effective. These solutions enable quick integration with other systems through APIs and microservices architecture. They allow consistent, easy updates to meet ch…

Thought Machine named as Outperformer among 15 other companies, including Oracle, Temenos, and Fiserv.

Thought Machine's Products & Differentiators

Vault Core

https://www.thoughtmachine.net/vault-core

Loading...

Research containing Thought Machine

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Thought Machine in 3 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Thought Machine

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Thought Machine is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Future Unicorns 2019

50 items

Fintech

13,699 items

Excludes US-based companies

Fintech 100

599 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,083 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Thought Machine News

Apr 3, 2025

The integrated solution is designed to streamline bank operations, reduce customer wait times, and improve the overall client experience. It leverages AI and advanced security features, such as biometrics, to meet the evolving needs of the financial industry. Banks adopting this solution will be able to offer “smart branches,” ensuring secure and customer-centric services, stated Unisys. Unisys vice president of solution management for Enterprise Computing Solutions Sean Tinney said: “Our integration with Vault Core is giving branch banking a turbo boost. Together, we’re not just upgrading the tech; we’re opening the door to a whole new way of doing branch banking. “Think of it as branch banking 2.0 – faster, smarter, and more secure – using AI and advanced security technology to help our clients stay ahead of the industry’s evolving needs and handle sensitive transactions securely.” Thought Machine’s Vault Core platform is a cloud-native core banking and payments technology that is used by various financial institutions worldwide. The platform is adopted by banks such as Intesa Sanpaolo, ING Bank Sląski and Lloyds Banking Group. Last month, Unisys introduced a Post-Quantum Cryptography (PQC) assessment as part of its cybersecurity portfolio, aiming to help organisations address future quantum threats. Unisys offers an inventory and analysis of an organisation’s cryptographic environment, identifying vulnerabilities and recommending security improvements.

Thought Machine Frequently Asked Questions (FAQ)

When was Thought Machine founded?

Thought Machine was founded in 2014.

Where is Thought Machine's headquarters?

Thought Machine's headquarters is located at 5 New Street Square, London.

What is Thought Machine's latest funding round?

Thought Machine's latest funding round is Series D - II.

How much did Thought Machine raise?

Thought Machine raised a total of $508.05M.

Who are the investors of Thought Machine?

Investors of Thought Machine include Lloyds Banking Group, Eurazeo, Intesa Sanpaolo, Temasek, J.P. Morgan Chase and 16 more.

Who are Thought Machine's competitors?

Competitors of Thought Machine include Fimple, Pismo, FintechOS, Tuum, 10x Banking and 7 more.

What products does Thought Machine offer?

Thought Machine's products include Vault Core and 1 more.

Who are Thought Machine's customers?

Customers of Thought Machine include Standard Chartered, JP Morgan, Intesa Sanpaolo and Atom Bank.

Loading...

Compare Thought Machine to Competitors

Tuum offers core banking solutions within the financial technology sector. The company's main offering is a modular core banking platform that allows banks to update their systems and adapt to the digital environment. The platform supports various business lines such as accounts, lending, payments, and cards, and is structured for integration and deployment of new banking services. Tuum was formerly known as Modularbank. It was founded in 2019 and is based in Tallinn, Estonia.

10x Banking provides cloud-native core banking solutions within the financial services sector. The company offers a platform that enables banks to create products using configuration and coding to support any programming language. 10x Banking primarily serves retail, SME, and corporate/commercial banking sectors, providing technology for digital transformation and operational efficiency. It was founded in 2016 and is based in London, England.

Finastra provides a range of financial services, treasury, lending, and banking software solutions. The company offers a wide range of services, including lending and corporate banking, payments, treasury and capital markets, universal banking, and investment management. It primarily serves the financial technology industry. It was founded in 2017 and is based in London, United Kingdom.

Ohpen is a Netherlands-based company that has built cloud-based core banking software, targeting any large financial services provider that administrates retail investment and savings accounts.

Nymbus operates in the financial services industry and provides alternatives to traditional banking business models. The company offers products and solutions designed to enable financial institutions of all sizes to grow and serve their customers without the need for core conversion. Nymbus primarily caters to banks and credit unions looking to launch digital banking services, create niche financial brands, or deploy core banking platforms. It was founded in 2015 and is based in Jacksonville, Florida.

Architecht provides information technology services to financial institutions within the fintech sector. The company offers banking platforms, including core banking systems, digital banking solutions, and investment banking technology, as well as supplementary products such as payment systems infrastructure, finance systems, and security solutions like multi-factor authentication. It was founded in 2015 and is based in Istanbul, Turkey.

Loading...